Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Stock Research Report For Indian Hotel

Caricato da

Sudipta BoseDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Stock Research Report For Indian Hotel

Caricato da

Sudipta BoseCopyright:

Formati disponibili

Result Update

August 4, 2010 Rating matrix

Rating Target Target Period Potential Upside : : : : Buy Rs. 118 12 months 17 %

Indian Hotels (INDHOT)

WHATS CHANGED

PRICE TARGET ............................................................................................. Unchanged

Rs. 101

EPS (FY11E) ................................................................... Changed from Rs 3.5 to Rs 2.9 Key Financials

(Rs Crore) Net Sales EBITDA Net Profit FY09 2,686.4 558.3 12.4 FY10 2516.5 393.6 -136.9 FY11E 3058.1 742.1 210.4 FY12E 3563.4 1006.9 354.5

EPS (FY12E) .................................................................................................. Unchanged RATING.......................................................................................................... Unchanged

Down but not out

IHCL came out with lower than expected Q1FY11 numbers. Revenue came at Rs 328.7 crore, against our expectation of Rs 352.1 crore for Q1FY11 (up 15.4% YoY, down 25.8% QoQ). Topline was impacted due to closure of the Heritage wing of the flagship Mumbai property and lower growth in occupancy and ARRs. Operating margins for the quarter improved by 413 bps to 16.2% YoY. However, the same remained below industry average of 29.5%. During the quarter, company earned extra ordinary income of Rs.4.3 crore through sale of hotel property as a result of which the company has been able to post net profit of Rs.3.3 crore for the quarter � Lower than expected results on account of subdued ARRs

Valuation summary

FY09 PE (x) Target PE (x) EV to EBITDA (x) Price to book (x) RoNW (%) RoCE (%) 586.4 685.1 19.7 2.2 0.4 4.7 FY10 NA NA 28.0 2.4 -6.4 2.6 FY11E 34.7 40.6 14.8 2.1 6.4 6.8 FY12E 20.6 24.1 10.9 1.7 10.7 9.8

Stock data

Market Capitalisation Debt Cash EV 52 week H/L Equity capital Face value MF Holding (%) RI Holding (%) Rs 7,306 crore Rs 4,461 crore Rs 750 crore Rs 11,017 crore 118/55 Rs 72.3 crore Rs.1.0 6.8 14.2

IHCLs average occupancy ratio stood at 64% in Q1FY2011 as against 52% in Q1FY2010 (though the same was below our expectation of 66% for the quarter). The ARR stood flat at ~Rs.8,010 in Q1FY2011 as against Rs.8,060 in Q1FY2010 (and below our expectation of ~Rs8,900 for the quarter). With flat ARRs and lower than expected occupancy levels, net sales grew by 15.4% YoY to Rs.328.7 crore as against our expected net sales of Rs.352.1 crore. � Operating margin improves, though remains below expectation With lower growth in operating expenses (10% YoY) compared to sales, operating margins for the quarter witnessed improvement of 413 basis points YoY to 16.2%. However, the same remained below our expectations on account lower sales growth.

Price movement

130 120 110 100 90 80 70 60 50 40 Aug-09 Apr-10 Nov-09 May-10 Mar-10 Sep-09 Dec-09 Jun-10 Jan-10 Oct-09 Feb-10 Jul-10 6000 5500 5000 4500 4000 3500 3000

Valuation

At CMP of Rs.101, the stock trades at 14.8x and 10.9x its FY11E and FY12E EV/EBITDA respectively. Despite the subdued performance for Q1FY11, we believe, the company would start witnessing gradual improvement in occupancy levels with the overall improvement in the macro economic environment. Considering this positive outlook, we value the stock at 12.0x (inline with its peers) its FY12E EV/EBITDA and maintain target price of Rs.118, with BUY rating on the stock. Exhibit 1: Performance Highlights

Rs. Crore Net Operating Income EBITDA EBITDA Margin (%) Depreciation Interest Net Profit EPS (Rs) Q1FY11 Q1FY10E 328.7 53.4 16.2 25.4 34.0 3.3 0.0 352.1 109.9 31.2 27.8 37.2 48.6 0.7 Q1FY09 284.9 34.5 12.1 25.1 37.6 16.4 0.2 Q4FY10 YoY Gr. (%) 443.3 143.5 32.4 27.9 33.3 59.9 0.8 15.4 54.7 +413 bps 1.5 -9.5 -79.7 -79.7 QoQ Gr. (%) -25.8 -62.8 -1612 bps -8.7 2.2 -94.4 -94.4

IHCL

NIFTY

Analysts name

Rashesh Shah rashes.shah@icicisecurities.com

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Indian Hotels (INDHOT)

Exhibit 2: Trends in foreign tourist arrivals (FTAs)

384 301 340 429 391 331 453 521 533 487 547 418 371 295 341 432 358 317 448 518 601 700 600 500 In 000's 400 300 200 100 0 Oct-08 Aug-09 Oct-09 Aug-08 Dec-08 Dec-09 Apr-08 Apr-09 Apr-10 Jun-09 Jun-08 Jun-10 62 53 Chennai 6,678 Chennai Feb-09 Feb-10 646 30 472 20 374 345 370 65 52 Kolkata 6,239 Kolkata 6595 10 0 -10 -20 -30 %

FTAs for the quarter declined by 30% QoQ due to seasonal impact while it grew by 8.1% compared to last year due to improvement global environment

Foreign tourists data

Source: Company, ICICIdirect.com Research

Growth

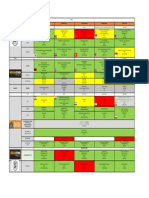

Exhibit 3: Trends in ARRs and Occupancy levels of key cities (Industry data) Average occupancy levels

70 65 60 55 50 45 40 35 30 Mumbai Delhi Bangalore Q1FY09 Goa Q1FY11 50 62 59 64 58 59 65 63

Mumbai, Kolkata and Chennai recorded highest growth in occupancy levels during this quarter while Goa reported marginal decline in average occupancy compared to the last year

Average Room rates (ARRs)

12,000 10,000 8,000

2,000 0 Mumbai Delhi Bangalore Q1FY09

Q1FY11

Source: Industry data, ICICIdirect.com Research

ICICIdirect.com | Equity Research

5,390

Delhi, Goa, Kolkata and Chennai reported marginal growth in ARRs while ARRs in Mumbai and Bangalore have declined compared to the last year.

9,520

9307

8,349

8898

9,622

6,000 4,000

491

7274

Goa

5743

Page 2

7482

Indian Hotels (INDHOT)

Exhibit 4: Quarterly trends in sales and net profits

456.6 437.9 443.3

376.9

367.8

418.2

500.0

37.6

16.4

11.9

100.0 -

50.7

The growth in sales for Q1FY11 has remained subdued compared to the last quarter due to closure of Taj Heritage wing, Mumbai and lower than expected growth in ARRs and occupancy levels

300.0 200.0 83.8 61.3

284.9

307.2

400.0

64.9

59.9

Q1FY09

Q2FY09

Q3FY09

Q4FY09

Q1FY10

Q2FY10

Q3FY10

Q4FY10

Q1FY11

Sales

Source: Company, ICICIdirect.com Research

Net profit

Exhibit 5: Trends in operating margins

40.0

Operating margins for the quarter witnessed improvement of 413 basis points YoY to 16.2%. However, the same remained below our expectations on account lower sales growth

35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Q1FY09 Q2FY09 31.0 24.4

36.2 27.9

34.5

32.4

16.6 12.1

16.2

Q3FY09

Q4FY09

Q1FY10

Q2FY10

Q3FY10

Q4FY10

Q1FY11

OPM (%)

Source: Company, ICICIdirect.com Research

Exhibit 6: New hotel launch for 2010-11 The company plans to add nearly 1,488 rooms to its total room portfolio this fiscal. The capital expenditure (capex) for ongoing projects is primarily done and with sufficient operating cash flow, we expect IHCL to bring down the debt and improve its balance sheet by the end of FY2012. Hotel projects

Hotel Name IHCL Taj Falaknuma Palace Vivanta by Taj Taj Group Taj Palace Vivanta by Taj Begumpet Fishcove Expansion Vivanta by Taj Ginger Hotels Management Contract Vivanta by Taj Vivanta by Taj Location Hyderabad Yeshvantpur Capetown Hyderabad Chennai Coorg 5 cities Bekal Srinagar Rooms Exp data 60 331 172 175 64 62 463 72 89 Ready for laun Feb-11 Launched Mar-11 Sep-10 Dec-10 2010-11 Oct-10 Dec-10

Source: Company, ICICIdirect.com Research

ICICIdirect.com | Equity Research

Page 3

3.3

328.7

Indian Hotels (INDHOT)

ICICIdirect.com Coverage Universe (Hotels)

IHCL FY09 Idirect Code MCap (Rs Cr) EIH FY09 Idirect Code MCap (Rs Cr) Hotel Leela FY09 Idirect Code MCap (Rs Cr) Taj GVK Hotels FY09 Idirect Code MCap (Rs Cr) Kamat Hotels FY09 Idirect Code MCap (Rs Cr) Viceroy Hotels FY09 Idirect Code MCap (Rs Cr) Royal Orchid FY09 Idirect Code MCap (Rs Cr) *EV/E - EV/EBITDA ROYORC 195.8 CMP Target 80.0 94.0 FY10 FY11E FY12E PALHEI 167.5 CMP Target 55.0 49.0 FY10 FY11E FY12E KAMHOT 162.7 CMP Target 118.0 132.0 FY10E FY11E FY12E TAJGVK 1009.5 CMP Target 162.0 186.0 FY10 FY11E FY12E HOTLEE 1889.1 CMP Target 49.0 55.0 FY10 FY11E FY12E EIH 4,518.9 CMP Target 127.0 128.0 FY10 FY11E FY12E INDHOT 7,306.3 CMP Target 101.0 118.0 FY10 FY11E FY12E Sales (Rs Cr} 2686.4 2516.5 3158.1 3702.1 Sales (Rs Cr} 1199.2 1038.3 1220.8 1379.5 Sales (Rs Cr} 459.8 436.2 558.7 691.1 Sales (Rs Cr} 238.2 229.1 270.9 318.6 Sales (Rs Cr} 123.1 107.8 131.9 168.3 Sales (Rs Cr} 103.0 93.9 122.3 157.6 Sales (Rs Cr} 140.2 120.4 141.2 203.8 EPS (Rs) 0.2 -2.7 2.9 4.9 EPS (Rs) 4.3 1.7 2.5 4.2 EPS (Rs) 3.8 1.1 2.0 3.0 EPS (Rs) 8.4 5.8 7.1 9.3 EPS (Rs) 4.1 -4.9 2.0 9.4 EPS (Rs) 1.6 0.3 1.1 2.2 EPS (Rs) 7.3 2.6 3.7 5.4 PE (x) 586.4 -37.0 34.7 20.6 PE (x) 29.4 75.3 51.3 30.2 PE (x) 12.8 45.1 24.8 16.6 PE (x) 19.3 28.0 22.8 17.5 PE (x) 28.7 NA 59.7 12.5 PE (x) 34.5 206.1 51.4 25.3 PE (x) 10.9 31.3 21.7 14.7 EV/E* (x) RoNW (%) 19.7 28.0 14.8 0.4 -6.4 6.4 RoCE (%) 4.7 2.6 6.8 9.8 RoCE (%) 13.8 7.2 10.1 12.2 RoCE (%) 4.7 1.6 3.1 4.4 RoCE (%) 14.4 10.5 9.8 12.8 RoCE (%) 5.2 5.6 6.4 7.6 RoCE (%) 2.1 1.7 2.3 3.0 RoCE (%) 7.9 2.8 4.1 5.0

Upside (%) 17%

10.9 10.7 EV/E* (x) RoNW (%) 13.7 20.0 17.6 13.7 26.6 34.1 21.5 16.6 11.1 13.1 11.5 9.3 15.3 18.0 12.5 9.5 25.1 27.1 19.8 15.3 6.4 12.8 12.5 10.4 12.0 4.8 6.7 11.9 7.5 2.0 3.3 4.9 19.5 12.4 13.2 17.2 10.1 NA 2.1 7.8 2.8 0.5 1.8 3.6 9.8 3.3 4.7 6.7

Upside (%) 1%

EV/E* (x) RoNW (%)

Upside (%) 12%

EV/E* (x) RoNW (%)

Upside (%) 15%

EV/E* (x) RoNW (%)

Upside (%) 12%

EV/E* (x) RoNW (%)

Upside (%) -11%

EV/E* (x) RoNW (%)

Upside (%) 18%

ICICIdirect.com | Equity Research

Page 4

Indian Hotels (INDHOT)

RATING RATIONALE

ICICIdirect endeavours to provide objective opinions and recommendations. ICICIdirect assigns ratings to its stocks according to their notional target price vs current market price and then categorises them as Outperformer, Performer, Hold, and Underperformer. The performance horizon is 2 years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: 20% or more; Buy: Between 10% and 20%; Add: Up to 10%; Reduce: Up to -10% Sell: -10% or more; Pankaj Pandey Head Research ICICIdirect.com Research Desk, ICICI Securities Limited, 7th Floor , Akruti Centre Point, MIDC Main Road, Marol Naka, Andheri (East) Mumbai 400 093 research@icicidirect.com ANALYST CERTIFICATION

We /I, Rashesh Shah CA, BCOM research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

pankaj.pandey@icicisecurities.com

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (ICICI Securities and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. ICICI Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of three months following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Rashesh Shah CA, BCOM research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Rashesh Shah CA, BCOM companies mentioned in the report. research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. This report has not been prepared by ICICI Securities, Inc. However, ICICI Securities, Inc. has reviewed the report and, in so far as it includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

ICICIdirect.com | Equity Research

Page 5

Potrebbero piacerti anche

- List of Hotel Property Management System That Siteminder IntegratesDocumento4 pagineList of Hotel Property Management System That Siteminder IntegratesKang DalikinNessuna valutazione finora

- Lemontree Hotels POM CaseDocumento18 pagineLemontree Hotels POM CasenikhilNessuna valutazione finora

- 360 Appraisal PDFDocumento3 pagine360 Appraisal PDFHammad MalikNessuna valutazione finora

- P&L COSDocumento128 pagineP&L COSNan-dei Guess'monNessuna valutazione finora

- About Human Resource Information Systems Report by Shaon JUDocumento42 pagineAbout Human Resource Information Systems Report by Shaon JUShoriful Islam ShaonNessuna valutazione finora

- Business Case For Sustainable HotelsDocumento44 pagineBusiness Case For Sustainable HotelsCARLOSNessuna valutazione finora

- Sunnxt AppDocumento8 pagineSunnxt ApppsiphoniphoneNessuna valutazione finora

- Bosch Home Appliances - Full - Range - CatalogueDocumento73 pagineBosch Home Appliances - Full - Range - CatalogueNam TranNessuna valutazione finora

- Hotel Industry Economic Assessment Destination Management Plan For The Inlay Lake RegionDocumento41 pagineHotel Industry Economic Assessment Destination Management Plan For The Inlay Lake RegionAyeChan AungNessuna valutazione finora

- Social Support List English VersionDocumento4 pagineSocial Support List English VersionRacasan RaulNessuna valutazione finora

- Yamaha Motor Co., LTD Is A Japanese Multinational Manufacturer of Motorcycles, MarineDocumento32 pagineYamaha Motor Co., LTD Is A Japanese Multinational Manufacturer of Motorcycles, Marinechenni senthurNessuna valutazione finora

- Group Report AccorHotelsDocumento17 pagineGroup Report AccorHotelsSoham Rashmi ChandakNessuna valutazione finora

- Serviced Apartments: Home Away From HomeDocumento6 pagineServiced Apartments: Home Away From Homelaksh81Nessuna valutazione finora

- Declaration FormatDocumento20 pagineDeclaration FormatlavyaNessuna valutazione finora

- 8-Principles of Management.: Staffing, Training & Development & Performance-AppraisalDocumento25 pagine8-Principles of Management.: Staffing, Training & Development & Performance-AppraisalDHRUMIL NEGANDHINessuna valutazione finora

- 11 Student Evaluation of InternshipDocumento2 pagine11 Student Evaluation of InternshipOidumas AziallaNessuna valutazione finora

- Min BDR Rawal (Internship Report)Documento46 pagineMin BDR Rawal (Internship Report)Gita Dahal100% (1)

- # (Article) Integrated Business Planning - A Roadmap To Linking S&OP and CPFR (2011)Documento10 pagine# (Article) Integrated Business Planning - A Roadmap To Linking S&OP and CPFR (2011)AbusamraMousaNessuna valutazione finora

- Handbook On Internal Control - Effective Monitoring Using Finacle MenusDocumento28 pagineHandbook On Internal Control - Effective Monitoring Using Finacle MenusnitishNessuna valutazione finora

- 6 PrensaDocumento44 pagine6 PrensaIng Eric Abimael SantanaNessuna valutazione finora

- Dividend Policy VeddantaDocumento14 pagineDividend Policy VeddantaVivek rathodNessuna valutazione finora

- Machine Design II (MCE325)Documento39 pagineMachine Design II (MCE325)Jeffrey EtimNessuna valutazione finora

- AmenitiesDocumento17 pagineAmenitiesAI GeneratorNessuna valutazione finora

- Nine Building Blocks of The Business ModelDocumento3 pagineNine Building Blocks of The Business ModelTobeFrankNessuna valutazione finora

- Module 3Documento57 pagineModule 3tafadzwa makuniNessuna valutazione finora

- Manash HRDocumento5 pagineManash HRkksingh007indiaNessuna valutazione finora

- Hotel PMS BrochureDocumento11 pagineHotel PMS BrochuremikeNessuna valutazione finora

- Cinnamon Hotels & Resorts - Annual Report 2021 2022Documento216 pagineCinnamon Hotels & Resorts - Annual Report 2021 2022John TrekNessuna valutazione finora

- Mostafa Mahmoud Soliman CV - March 2023Documento5 pagineMostafa Mahmoud Soliman CV - March 2023Mustafa Mahmoud MatarNessuna valutazione finora

- Hyperpure X Food ChainsDocumento11 pagineHyperpure X Food Chains2K18AE012 ARCHIT MITTALNessuna valutazione finora

- Industrial Training Report Divyanshu RawatDocumento93 pagineIndustrial Training Report Divyanshu RawatDIVYANSHU RAWATNessuna valutazione finora

- Strategy DevelopmentDocumento132 pagineStrategy DevelopmentNovalonNessuna valutazione finora

- Future of Qatar Lusail-FajerDocumento11 pagineFuture of Qatar Lusail-Fajerapi-639706569Nessuna valutazione finora

- Marriott International, Inc., 2015: My LabDocumento11 pagineMarriott International, Inc., 2015: My LabRoseNessuna valutazione finora

- Quick Guide To The Program DProDocumento32 pagineQuick Guide To The Program DProMayom MabuongNessuna valutazione finora

- BR - OpenLoop - PETs Playbook - English - Open LoopDocumento79 pagineBR - OpenLoop - PETs Playbook - English - Open LoopCleórbete SantosNessuna valutazione finora

- Human Resources Accounting and Profitability Evidence From Consumer Goods Companies in NigeriaDocumento9 pagineHuman Resources Accounting and Profitability Evidence From Consumer Goods Companies in NigeriaInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Polycab India Limited - XPLORE Internship Programme (XIP) : Forward Looking StatementsDocumento12 paginePolycab India Limited - XPLORE Internship Programme (XIP) : Forward Looking StatementsPankaj RawatNessuna valutazione finora

- Golden Lamian Franchise 1.1Documento28 pagineGolden Lamian Franchise 1.1Adrian KurniaNessuna valutazione finora

- Waiter WaitressDocumento2 pagineWaiter WaitressJohn Mardin ManlangitNessuna valutazione finora

- Helpdesk Portal - KEKA - Employees - 3jul2021Documento7 pagineHelpdesk Portal - KEKA - Employees - 3jul2021viswajaNessuna valutazione finora

- CVL KRA Operating Instructions NewDocumento19 pagineCVL KRA Operating Instructions NewPuru-the-braveNessuna valutazione finora

- Weekly Menu 1 CycleDocumento1 paginaWeekly Menu 1 CycleMichael ChanNessuna valutazione finora

- Working Capital Management in Icici PrudentialDocumento83 pagineWorking Capital Management in Icici PrudentialVipul TandonNessuna valutazione finora

- Annual Report of Falcon Tyre CompanyDocumento41 pagineAnnual Report of Falcon Tyre CompanyRaghavendra GowdaNessuna valutazione finora

- Novotel POM ReportDocumento13 pagineNovotel POM ReportRiya PandeyNessuna valutazione finora

- 01 - Press Pack-1 - 2 - OCTOBER 09 - Mazagan Beach Resort, El Jadida, Casablanca, MoroccoDocumento18 pagine01 - Press Pack-1 - 2 - OCTOBER 09 - Mazagan Beach Resort, El Jadida, Casablanca, MoroccoMazagan Beach ResortNessuna valutazione finora

- Planning of The BarDocumento7 paginePlanning of The BarVipul BhandariNessuna valutazione finora

- Support Terms and Service Level Agreements (SLA) of The OutSystems Software - OutSystemsDocumento8 pagineSupport Terms and Service Level Agreements (SLA) of The OutSystems Software - OutSystemssaracaro13Nessuna valutazione finora

- The TajDocumento40 pagineThe TajRishendra Singh RathourNessuna valutazione finora

- Proposal Zen Hospitality SolutionsDocumento22 pagineProposal Zen Hospitality SolutionsAstiwintari100% (1)

- The Easy Way To Perfect Results.: Introducing The New Generation of Built-In AppliancesDocumento55 pagineThe Easy Way To Perfect Results.: Introducing The New Generation of Built-In Appliancesshabeer7863Nessuna valutazione finora

- DoubleTree by HiltonDocumento2 pagineDoubleTree by HiltonNguyễn NgọcNessuna valutazione finora

- POCT CertificationDocumento8 paginePOCT CertificationNasheen NaidooNessuna valutazione finora

- Commercial Banks Unit VIDocumento34 pagineCommercial Banks Unit VIRN GamingNessuna valutazione finora

- Meluha The Fern PowaiDocumento84 pagineMeluha The Fern Powaishlok100% (1)

- E-Commerce Service Documentation: Release 0.1Documento51 pagineE-Commerce Service Documentation: Release 0.1prabhu kumarNessuna valutazione finora

- Hotel Site Inspection Checklist: Corporate Meeting or TrainingDocumento10 pagineHotel Site Inspection Checklist: Corporate Meeting or Trainingyihunsew betemariamNessuna valutazione finora

- Job Description For KPMGDocumento1 paginaJob Description For KPMGDulcet LyricsNessuna valutazione finora

- Kamat Hotels (KAMHOT) : Results InlineDocumento4 pagineKamat Hotels (KAMHOT) : Results InlinedidwaniasNessuna valutazione finora

- Jio Fibre Recharge 13 June 22Documento1 paginaJio Fibre Recharge 13 June 22Sudipta BoseNessuna valutazione finora

- Anushka - 2nd Sem Online Admission Payment Receipt - 11apr22Documento1 paginaAnushka - 2nd Sem Online Admission Payment Receipt - 11apr22Sudipta BoseNessuna valutazione finora

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 pagineIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Himanshu GuptaNessuna valutazione finora

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 pagineIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Himanshu GuptaNessuna valutazione finora

- February 2016 1455964034 133Documento3 pagineFebruary 2016 1455964034 133Sudipta BoseNessuna valutazione finora

- Case Study - Protyush Mukherjee - Management - Pre Mall Opening Transitions Management and Handover To Operations - Quest MallDocumento3 pagineCase Study - Protyush Mukherjee - Management - Pre Mall Opening Transitions Management and Handover To Operations - Quest MallSudipta BoseNessuna valutazione finora

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 pagineIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Himanshu GuptaNessuna valutazione finora

- 5 Multibagger For Coming 5 Years - 2018Documento3 pagine5 Multibagger For Coming 5 Years - 2018Sudipta BoseNessuna valutazione finora

- Astrology Atmakaraka RoleDocumento22 pagineAstrology Atmakaraka RoleSudipta BoseNessuna valutazione finora

- Electric Car BeneficiariesDocumento1 paginaElectric Car BeneficiariesSudipta BoseNessuna valutazione finora

- Transaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying OnlineDocumento1 paginaTransaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying Onlinebosudipta4796Nessuna valutazione finora

- Transaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying OnlineDocumento1 paginaTransaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying OnlineSudipta BoseNessuna valutazione finora

- Electric Car BeneficiariesDocumento1 paginaElectric Car BeneficiariesSudipta BoseNessuna valutazione finora

- 5 Multibagger For Coming 5 Years - 2018Documento3 pagine5 Multibagger For Coming 5 Years - 2018Sudipta BoseNessuna valutazione finora

- Transaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying OnlineDocumento1 paginaTransaction Successful Acknowledgement Slip: Thank You For Your Concern Towards The Environment by Paying OnlinePriyanko ChatterjeeNessuna valutazione finora

- What's New: Newly Added FeaturesDocumento5 pagineWhat's New: Newly Added FeaturesSudipta BoseNessuna valutazione finora

- KEATProX FeatureDocumento28 pagineKEATProX Featurevineetkrsingh0% (1)

- Payslip - Apr'10 MTSDocumento1 paginaPayslip - Apr'10 MTSSudipta BoseNessuna valutazione finora

- 5 Multibagger For Coming 5 Years - 2018Documento3 pagine5 Multibagger For Coming 5 Years - 2018Sudipta BoseNessuna valutazione finora

- Jack Straight From The GutDocumento7 pagineJack Straight From The Gutbosudipta4796100% (1)

- Amritsar Vaishnodevi Jammu KashmirDocumento1 paginaAmritsar Vaishnodevi Jammu KashmirSudipta BoseNessuna valutazione finora

- Payslip - Sept'10 SalaryDocumento1 paginaPayslip - Sept'10 SalarySudipta BoseNessuna valutazione finora

- CARD - For Personal UseDocumento1 paginaCARD - For Personal UseSudipta BoseNessuna valutazione finora

- The 7 Habits of Highly Effective PeopleDocumento5 pagineThe 7 Habits of Highly Effective PeopleSudipta BoseNessuna valutazione finora

- The Myths of InnovationDocumento5 pagineThe Myths of InnovationSudipta BoseNessuna valutazione finora

- If Life Is A Game, These Are The RulesDocumento5 pagineIf Life Is A Game, These Are The RulesSudipta Bose100% (1)

- If Life Is A Game, These Are The RulesDocumento5 pagineIf Life Is A Game, These Are The RulesSudipta Bose100% (1)

- Many Miles To GoDocumento5 pagineMany Miles To GoSudipta BoseNessuna valutazione finora

- Built To LastDocumento4 pagineBuilt To LastSudipta BoseNessuna valutazione finora

- Becoming A Person of InfluenceDocumento13 pagineBecoming A Person of InfluenceSudipta BoseNessuna valutazione finora

- HRBP ManualDocumento63 pagineHRBP ManualRAHUL DAM100% (2)

- Student Trading Guide - IntroductionDocumento39 pagineStudent Trading Guide - IntroductionB.R SinghNessuna valutazione finora

- 17 CompressedDocumento5 pagine17 CompressedAVISEK CHAUDHURINessuna valutazione finora

- 6 MHRM Sem VI MCQ Module 4Documento41 pagine6 MHRM Sem VI MCQ Module 4Nikita KukrejaNessuna valutazione finora

- IA Chapter4Documento56 pagineIA Chapter4Thuy Linh TranNessuna valutazione finora

- Monitoring of OHS Objectives & TargetsDocumento2 pagineMonitoring of OHS Objectives & TargetsNomaan MalikNessuna valutazione finora

- ACTBFAR Work Text - Chapter 13. - 2T1920 - FormattedDocumento7 pagineACTBFAR Work Text - Chapter 13. - 2T1920 - FormattednuggsNessuna valutazione finora

- Under Section 4 (1) (B) of Rti Act, 2005 APIIC - Right To Information Act, 2005Documento15 pagineUnder Section 4 (1) (B) of Rti Act, 2005 APIIC - Right To Information Act, 2005Sunil PhaniNessuna valutazione finora

- Case Study #9 - A RenovationDocumento6 pagineCase Study #9 - A RenovationAssignment HelpNessuna valutazione finora

- Eldho - GCC RecDocumento4 pagineEldho - GCC RecsherrymattNessuna valutazione finora

- 1) Match The Type of Accounting With The Skills RequiredDocumento3 pagine1) Match The Type of Accounting With The Skills RequiredThảo NhiNessuna valutazione finora

- Microeconomics Pindyck 8th Edition Test BankDocumento24 pagineMicroeconomics Pindyck 8th Edition Test BankIanSpencerjndex100% (38)

- Financial Statement 2020-21Documento7 pagineFinancial Statement 2020-21celiaNessuna valutazione finora

- Customer Satisfaction Review of LiteratureDocumento2 pagineCustomer Satisfaction Review of LiteratureNishaNessuna valutazione finora

- 2007 Full SpecbookDocumento1.080 pagine2007 Full SpecbookGuillermo LuchinNessuna valutazione finora

- The HR Service Delivery Model Canvas (LIVE)Documento2 pagineThe HR Service Delivery Model Canvas (LIVE)Mustafa KamalNessuna valutazione finora

- Reviewer FinalsDocumento16 pagineReviewer FinalsAngela Ricaplaza Reveral100% (2)

- Accounts Partnership ProjectDocumento24 pagineAccounts Partnership ProjectastrobhavikNessuna valutazione finora

- Importance of Customer Satisfaction, Retention, LoyaltyDocumento25 pagineImportance of Customer Satisfaction, Retention, LoyaltyAlma Agnas100% (1)

- Chapter 6 Homework QuestionsDocumento4 pagineChapter 6 Homework QuestionsAccount YanguNessuna valutazione finora

- Sayli Jadhav: ProfileDocumento2 pagineSayli Jadhav: ProfileTanishk SachdevaNessuna valutazione finora

- House Rent Receipt TemplateDocumento1 paginaHouse Rent Receipt TemplateGsk SkNessuna valutazione finora

- Ibm Assignment ON 1.global Division Structure, Matrix and Network StructureDocumento9 pagineIbm Assignment ON 1.global Division Structure, Matrix and Network StructureJagruc MahantNessuna valutazione finora

- Asahi Networks PhilsDocumento1 paginaAsahi Networks PhilsVincent Jave Garbilao GutierrezNessuna valutazione finora

- How Maker Movement Is Helping Startups and A New Breed of Entrepreneurs To Innovate New ProductsDocumento2 pagineHow Maker Movement Is Helping Startups and A New Breed of Entrepreneurs To Innovate New ProductsTushna ChokseyNessuna valutazione finora

- Lufthansa GroupDocumento2 pagineLufthansa GroupAnjanaNessuna valutazione finora

- Cornerstone - RDC (220617)Documento7 pagineCornerstone - RDC (220617)Oladamola OyabambiNessuna valutazione finora

- Intial Public OfferDocumento44 pagineIntial Public OffergudoNessuna valutazione finora

- DSC & AgilityDocumento35 pagineDSC & AgilityKavitha Reddy GurrralaNessuna valutazione finora

- Family Decision MakingDocumento9 pagineFamily Decision MakingHarshita srivastavaNessuna valutazione finora