Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Key Financial Ratios of Apple Finance

Caricato da

Shahid JavaidTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Key Financial Ratios of Apple Finance

Caricato da

Shahid JavaidCopyright:

Formati disponibili

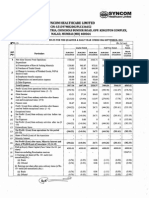

Key Financial Ratios of Apple Finance

Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

10

10

10

10

10

--

--

--

--

--

-0.24

-0.24

-0.24

0.04

0.27

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

0.02

0.32

Free Reserves Per Share (Rs)

--

--

-23.87

-17.6

-19.19

Bonus in Equity Capital

--

--

--

--

--

Operating Profit Margin(%)

--

--

-1,152.47

12.65

20,266.69

Profit Before Interest And Tax Margin(%)

--

--

-24.89

-0.39

660.79

Gross Profit Margin(%)

--

--

-1,344.87

-0.61

17,017.66

Cash Profit Margin(%)

--

--

72.15

-27.95

254.69

Adjusted Cash Margin(%)

10.16

20.83

72.15

-27.95

254.69

Net Profit Margin(%)

-6.18

9.86

80.9

318.14

44,345.57

Adjusted Net Profit Margin(%)

--

--

80.9

318.14

44,345.57

Return On Capital Employed(%)

--

--

17.8

3.2

4.34

Return On Net Worth(%)

--

--

19.66

42.78

704.51

-0.17

0.55

16.67

-4.9

2.04

Return on Assets Excluding Revaluations

4.67

4.68

4.65

3.74

2.14

Return on Assets Including Revaluations

4.67

4.68

4.65

3.74

2.14

-0.16

0.55

17.8

3.2

4.34

Current Ratio

2.82

2.87

2.57

3.3

1.59

Quick Ratio

2.51

2.55

2.25

2.98

1.48

Debt Equity Ratio

--

--

--

0.48

1.77

Long Term Debt Equity Ratio

--

--

--

0.48

1.77

Interest Cover

--

--

15.77

0.49

1.22

Total Debt to Owners Fund

--

--

--

0.48

1.77

Financial Charges Coverage Ratio

--

--

16.54

0.61

1.43

Financial Charges Coverage Ratio Post Tax

--

--

19.19

5.56

72.9

Inventory Turnover Ratio

--

--

0.05

--

--

Debtors Turnover Ratio

--

--

--

--

--

Investments Turnover Ratio

0.05

0.73

--

Fixed Assets Turnover Ratio

--

--

0.01

--

--

Total Assets Turnover Ratio

--

--

--

0.06

--

Asset Turnover Ratio

--

--

0.06

--

Average Raw Material Holding

--

--

--

--

--

Profitability Ratios

Adjusted Return on Net Worth(%)

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Debt Coverage Ratios

Management Efficiency Ratios

Average Finished Goods Held

--

--

--

--

--

3,984,312.35

4,139,575.11

36,894.51

3,593.24

820,663.09

Material Cost Composition

--

--

--

--

--

Imported Composition of Raw Materials Consumed

--

--

--

--

--

Selling Distribution Cost Composition

--

--

--

--

--

Expenses as Composition of Total Sales

--

--

--

--

--

Dividend Payout Ratio Net Profit

--

--

--

--

--

Dividend Payout Ratio Cash Profit

--

--

--

--

--

Number of Days In Working Capital

Profit & Loss Account Ratios

Cash Flow Indicator Ratios

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

Earnings Per Share

Book Value

Source : Dion Global Solutions Limited

--

100

100

100

100

100

100

100

100

100

--

--

--

1.04

43.71

Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

-0.02

0.03

0.91

1.6

15.07

4.67

4.68

4.65

3.74

2.14

Mar '08

Mar '07

Mar '06

Mar '05

Mar '04

10

10

10

10

10

--

--

--

--

--

-0.45

-0.27

-0.19

-0.17

0.15

0.04

0.03

0.02

0.53

-41.45

-40.69

-40.06

-39.69

-39.43

--

--

--

--

--

-32,199.50

-688.73

--

--

--

-1,428.68

-751.98

--

--

--

-35,340.34

-1,219.59

--

--

--

-1,983.46

-1,345.31

--

--

--

-1,983.46

-1,242.31

-833.21

-308.97

27.91

-2,165.59

-1,465.94

-1,033.62

-546.92

13.8

-2,165.59

-1,362.95

--

--

--

-1.06

-0.73

--

--

--

3.86

6.28

3.86

1.75

-0.39

--

--

--

--

--

-19.47

-10.09

-9.46

-15.06

-18.58

-19.47

-10.09

-9.46

-15.06

-18.58

-1.06

-1

-0.74

-0.94

0.21

0.66

0.14

0.15

0.11

0.11

0.58

0.56

0.57

0.59

0.64

--

--

--

--

--

--

--

--

--

--

-1.74

-1.25

--

--

--

--

--

--

--

--

-1.57

-1.04

-351.79

-99.89

63.15

-1.66

-1.25

-583.51

-110.13

73.26

--

0.07

0.06

0.08

0.36

--

0.01

0.01

0.01

0.14

--

0.09

0.05

--

--

--

--

--

--

0.01

--

--

--

--

--

--

0.01

--

--

--

--

--

--

--

-561,978.55 -20,224.27 -25,191.52 -37,729.25

--

--

--

-702.94

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

--

100

--

--

--

--

100

--

--

--

--

438

Mar '08

Mar '07

Mar '06

Mar '05

Mar '04

-0.75

-0.63

-0.37

-0.26

0.07

-19.47

-10.09

-9.46

-15.06

-18.58

Potrebbero piacerti anche

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Key Ratios of NTPCDocumento2 pagineKey Ratios of NTPCManinder BaggaNessuna valutazione finora

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDa EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento5 pagineBalance Sheet of Reliance IndustriesMukesh bariNessuna valutazione finora

- Archies Financial StatmentsDocumento5 pagineArchies Financial StatmentsShitiz JainNessuna valutazione finora

- Ratio Analysis of Suzlon EnergyDocumento3 pagineRatio Analysis of Suzlon EnergyBharat RajputNessuna valutazione finora

- Dabur India key financial ratios and profit & loss data for 5 yearsDocumento5 pagineDabur India key financial ratios and profit & loss data for 5 yearsHiren ShahNessuna valutazione finora

- Parle Product FinanciaDocumento14 pagineParle Product FinanciaAbinash Behera100% (1)

- Yes Bank: Key Financial RatiosDocumento8 pagineYes Bank: Key Financial Ratiosrky1992Nessuna valutazione finora

- GOLDEN CREST ANNUAL REPORT ANALYSISDocumento13 pagineGOLDEN CREST ANNUAL REPORT ANALYSISShivam JadhavNessuna valutazione finora

- Idea Cellular Key Financial Ratios Over 10 YearsDocumento12 pagineIdea Cellular Key Financial Ratios Over 10 YearsSumit MalikNessuna valutazione finora

- Key Financial Ratios of ACCDocumento2 pagineKey Financial Ratios of ACCcool_mani11Nessuna valutazione finora

- Airan RatioDocumento2 pagineAiran RatiomilanNessuna valutazione finora

- Financials of Canara BankDocumento14 pagineFinancials of Canara BankSattwik rathNessuna valutazione finora

- Balance Sheet of Reliance IndustriesDocumento7 pagineBalance Sheet of Reliance IndustriesNEHAAA26Nessuna valutazione finora

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsUday KumarNessuna valutazione finora

- Standalone Profit & Loss AccountDocumento5 pagineStandalone Profit & Loss AccountTarun BangaNessuna valutazione finora

- MBA FM - 3102 Security Analysis and Portfolio ManagementDocumento6 pagineMBA FM - 3102 Security Analysis and Portfolio ManagementAsh KoulNessuna valutazione finora

- Tata Motors RatiosDocumento2 pagineTata Motors RatiosRahul GargNessuna valutazione finora

- Operational & Financial RatiosDocumento3 pagineOperational & Financial RatiosAnonymous HAkNRaNessuna valutazione finora

- Balance Sheet of Adani Power: - in Rs. Cr.Documento7 pagineBalance Sheet of Adani Power: - in Rs. Cr.bpn89Nessuna valutazione finora

- Welcome To The Presentation SessionDocumento32 pagineWelcome To The Presentation SessionMoinul IslamNessuna valutazione finora

- Company Info - Print Financials PDFDocumento2 pagineCompany Info - Print Financials PDFgaurav khuleNessuna valutazione finora

- Airtel DividdendDocumento6 pagineAirtel DividdendRishab KatariaNessuna valutazione finora

- Analysis of key financial ratios for major Indian fertilizer companiesDocumento8 pagineAnalysis of key financial ratios for major Indian fertilizer companiesYash ShahNessuna valutazione finora

- Consoolidated Balance SheetDocumento31 pagineConsoolidated Balance SheetSunil ShawNessuna valutazione finora

- Hindalco Industries FY19-20 Financial ReportDocumento14 pagineHindalco Industries FY19-20 Financial ReportJaydeep SolankiNessuna valutazione finora

- Eps N LevrageDocumento7 pagineEps N LevrageShailesh SuranaNessuna valutazione finora

- Name: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialDocumento8 pagineName: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialAkash MehtaNessuna valutazione finora

- HPCL profit and loss analysis for FY20 and FY19Documento10 pagineHPCL profit and loss analysis for FY20 and FY19riyaNessuna valutazione finora

- Name: Akash Mehta BATCH: BBA 2016-2019 Subject: Financial Management-IiiDocumento6 pagineName: Akash Mehta BATCH: BBA 2016-2019 Subject: Financial Management-IiiAkash MehtaNessuna valutazione finora

- Unit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic ValueDocumento2 pagineUnit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic Valuedharshana.segaranNessuna valutazione finora

- Ratios From NetDocumento4 pagineRatios From NetAnushka RajaniNessuna valutazione finora

- Balance Sheet of Amara Raja BatteriesDocumento11 pagineBalance Sheet of Amara Raja Batteriesashishgrover80Nessuna valutazione finora

- Particulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012Documento4 pagineParticulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012saboorakheeNessuna valutazione finora

- Cash Flow of Cadbury India: - in Rs. Cr.Documento6 pagineCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNessuna valutazione finora

- Key Financial Ratios of Bajaj AutoDocumento6 pagineKey Financial Ratios of Bajaj Autohitman3886Nessuna valutazione finora

- Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Documento4 pagineBhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Shavya RastogiNessuna valutazione finora

- Attock Oil RefineryDocumento2 pagineAttock Oil RefineryOvais HussainNessuna valutazione finora

- SEx 11Documento32 pagineSEx 11Amir Madani60% (5)

- Tata Steel's Balance Sheet and Financial Ratios AnalysisDocumento12 pagineTata Steel's Balance Sheet and Financial Ratios AnalysisDhwani ShahNessuna valutazione finora

- Hindustan Unilever key financial ratios over 5 yearsDocumento6 pagineHindustan Unilever key financial ratios over 5 yearsMANIVISHVARJOON BOOMINATHANNessuna valutazione finora

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorDocumento7 paginePunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157Nessuna valutazione finora

- Cipla Financial RatiosDocumento2 pagineCipla Financial RatiosNEHA LALNessuna valutazione finora

- Investment VI FINC 404 Company ValuationDocumento52 pagineInvestment VI FINC 404 Company ValuationMohamed MadyNessuna valutazione finora

- Accounts - ComparisonDocumento24 pagineAccounts - ComparisonNirav HariaNessuna valutazione finora

- in Rs. Cr. - Key Financial Ratios of HDFC BankDocumento8 paginein Rs. Cr. - Key Financial Ratios of HDFC BankthodupunooripkNessuna valutazione finora

- Introduction To Business Finance (NEW)Documento7 pagineIntroduction To Business Finance (NEW)saadsidd22Nessuna valutazione finora

- Analysis of Financial Statements of BanksDocumento52 pagineAnalysis of Financial Statements of BanksNayan MistryNessuna valutazione finora

- Analysis of Financial Statements of BanksDocumento48 pagineAnalysis of Financial Statements of BanksNayan MistryNessuna valutazione finora

- in Rs. Cr.Documento19 paginein Rs. Cr.Ashish Kumar SharmaNessuna valutazione finora

- Aptech Equity Research: Key Financial FiguresDocumento7 pagineAptech Equity Research: Key Financial FiguresshashankNessuna valutazione finora

- Redco Textiles LimitedDocumento18 pagineRedco Textiles LimitedUmer FarooqNessuna valutazione finora

- Introduction To Business FinanceDocumento6 pagineIntroduction To Business Financesaadsidd22Nessuna valutazione finora

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Documento2 pagineAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNessuna valutazione finora

- Management AccountingDocumento8 pagineManagement AccountingParth MehtaNessuna valutazione finora

- Comparison - Ratios - Tyre - DistributionDocumento15 pagineComparison - Ratios - Tyre - DistributionParehjuiNessuna valutazione finora

- AnalysispdfDocumento15 pagineAnalysispdfMalevolent IncineratorNessuna valutazione finora

- BW Top 500Documento2 pagineBW Top 500Suneel KotteNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- EBS-HYD Complaint Record March 2015Documento1 paginaEBS-HYD Complaint Record March 2015Shahid JavaidNessuna valutazione finora

- OT Cards FormatDocumento2 pagineOT Cards FormatShahid JavaidNessuna valutazione finora

- TID Course Class TopicDocumento2 pagineTID Course Class TopicShahid JavaidNessuna valutazione finora

- Closing Marks 2013-14Documento1 paginaClosing Marks 2013-14Shahid JavaidNessuna valutazione finora

- Press ReleaseDocumento1 paginaPress ReleaseShahid JavaidNessuna valutazione finora

- Code of EthicsDocumento28 pagineCode of EthicsShahid Javaid100% (1)

- SirDocumento4 pagineSirShahid JavaidNessuna valutazione finora

- KKF Charity Approval Challan Challan Medical Bill: 20000 Expense Detail Total AmountDocumento2 pagineKKF Charity Approval Challan Challan Medical Bill: 20000 Expense Detail Total AmountShahid JavaidNessuna valutazione finora

- Report On Engro FoodsDocumento73 pagineReport On Engro FoodsRao Rashid100% (3)

- Marketing Analysis - CLV AnalysisDocumento18 pagineMarketing Analysis - CLV AnalysisShahid Javaid75% (4)

- Information Leaflet BSDocumento3 pagineInformation Leaflet BSShahid JavaidNessuna valutazione finora

- EvasionDocumento2 pagineEvasionDominik KotrwtsosNessuna valutazione finora

- Major Case Analysis MethodologyDocumento2 pagineMajor Case Analysis MethodologySundus AshrafNessuna valutazione finora

- Guidelines To Term ProjectDocumento8 pagineGuidelines To Term ProjectShahid JavaidNessuna valutazione finora

- Tax On Salary: Income Tax Law & CalculationDocumento7 pagineTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNessuna valutazione finora

- Budget 2012 FacDocumento25 pagineBudget 2012 FacShahid JavaidNessuna valutazione finora

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Documento7 pagineAllama Iqbal Open University, Islamabad (Department of Business Administration)Shahid JavaidNessuna valutazione finora

- Apple From The Ipod To The IpadDocumento13 pagineApple From The Ipod To The IpadSheeraz RashidNessuna valutazione finora

- Lawpresentation A121003200627 Phpapp02Documento34 pagineLawpresentation A121003200627 Phpapp02Mabroor AhmedNessuna valutazione finora

- Taxstructureofpakistan22 110113191019 Phpapp01Documento16 pagineTaxstructureofpakistan22 110113191019 Phpapp01Ankit SachdevNessuna valutazione finora

- Case Assignment # 1Documento8 pagineCase Assignment # 1shan0% (1)

- Three 8531Documento8 pagineThree 8531Shahid JavaidNessuna valutazione finora

- Key Ratios: Margins % of SalesDocumento4 pagineKey Ratios: Margins % of SalesShahid JavaidNessuna valutazione finora

- Three 8531Documento8 pagineThree 8531Shahid JavaidNessuna valutazione finora

- INCOME TAX ORDINANCE, 2001 AMENDED UPTO 30th June, 2013Documento24 pagineINCOME TAX ORDINANCE, 2001 AMENDED UPTO 30th June, 2013Yasir ShahzadNessuna valutazione finora

- Google+Gap FinalDocumento4 pagineGoogle+Gap FinalShahid JavaidNessuna valutazione finora

- Pakistan Salary Income Tax Calculator Tax Year 20141Documento3 paginePakistan Salary Income Tax Calculator Tax Year 20141Shahid JavaidNessuna valutazione finora

- Detailed Marketing Plan (For Idea)Documento22 pagineDetailed Marketing Plan (For Idea)Shahid JavaidNessuna valutazione finora

- APPLE 2010 CASE ANALYSIS PEST INDUSTRY FINANCESDocumento11 pagineAPPLE 2010 CASE ANALYSIS PEST INDUSTRY FINANCESShahid JavaidNessuna valutazione finora

- Gerald Asakeya KwameDocumento92 pagineGerald Asakeya Kwamekitderoger_391648570100% (1)

- Department of Labor: DekalbDocumento58 pagineDepartment of Labor: DekalbUSA_DepartmentOfLabor50% (2)

- Vietnam's Economic Development in The Period Since Doi MoiDocumento7 pagineVietnam's Economic Development in The Period Since Doi MoiNgọc LâmNessuna valutazione finora

- Varshaa D Offer Letter PDFDocumento11 pagineVarshaa D Offer Letter PDFKavitha RajaNessuna valutazione finora

- Heizer 10Documento45 pagineHeizer 10anushanNessuna valutazione finora

- Availability Based TariffDocumento24 pagineAvailability Based Tariffprati121Nessuna valutazione finora

- Dan Loeb Sony LetterDocumento4 pagineDan Loeb Sony LetterZerohedge100% (1)

- Subject: Fundamentals of Abm 1 Grade Level: Eleven Quarter: Three (2) Week: Two I. OBJECTIVES: at The End of The Lesson, Students Are Expected ToDocumento7 pagineSubject: Fundamentals of Abm 1 Grade Level: Eleven Quarter: Three (2) Week: Two I. OBJECTIVES: at The End of The Lesson, Students Are Expected ToRoz AdaNessuna valutazione finora

- Iare TKM Lecture NotesDocumento106 pagineIare TKM Lecture Notestazebachew birkuNessuna valutazione finora

- Why Renting Is Better Than BuyingDocumento4 pagineWhy Renting Is Better Than BuyingMonali MathurNessuna valutazione finora

- International Economics Theory and Policy 10th Edition Krugman Test BankDocumento26 pagineInternational Economics Theory and Policy 10th Edition Krugman Test BankMatthewRosarioksdf100% (51)

- Financial Management ObjectivesDocumento36 pagineFinancial Management ObjectiveschandoraNessuna valutazione finora

- MG 201 Assignment 1 s11145116Documento4 pagineMG 201 Assignment 1 s11145116sonam sonikaNessuna valutazione finora

- Permission MarketingDocumento35 paginePermission Marketingtattid67% (3)

- Furniture Industry in IndiaDocumento38 pagineFurniture Industry in IndiaCristiano Ronaldo100% (1)

- Principles of Economics 7th Edition Gregory Mankiw Solutions ManualDocumento25 paginePrinciples of Economics 7th Edition Gregory Mankiw Solutions ManualJacquelineHillqtbs100% (60)

- SWOT of Coca ColaDocumento4 pagineSWOT of Coca ColaYoongingNessuna valutazione finora

- Cannibalization: This Module Covers The Concepts of Cannibalization and Fair Share DrawDocumento12 pagineCannibalization: This Module Covers The Concepts of Cannibalization and Fair Share DrawVishal GargNessuna valutazione finora

- Republic Act No 9679 PAG IBIGDocumento17 pagineRepublic Act No 9679 PAG IBIGJnot VictoriknoxNessuna valutazione finora

- Photographed Baby Pay To Alipay Confirm The Receipt of GoodsDocumento2 paginePhotographed Baby Pay To Alipay Confirm The Receipt of Goodsroma kononovNessuna valutazione finora

- Latin American Journal of Central Banking: Andrés Arauz, Rodney Garratt, Diego F. Ramos FDocumento10 pagineLatin American Journal of Central Banking: Andrés Arauz, Rodney Garratt, Diego F. Ramos FHasfi YakobNessuna valutazione finora

- Solution To Worksheet - Modified-2Documento25 pagineSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANessuna valutazione finora

- Retail Technology Management: Presented by Kumar Gaurav Harshit KumarDocumento19 pagineRetail Technology Management: Presented by Kumar Gaurav Harshit KumarKumar GauravNessuna valutazione finora

- K21u 1229Documento4 pagineK21u 1229muneermkd1234Nessuna valutazione finora

- HRMS Full NoteDocumento53 pagineHRMS Full NoteDipendra Khadka100% (1)

- Housing Delivery Process & Government AgenciesDocumento29 pagineHousing Delivery Process & Government AgenciesPsy Giel Va-ayNessuna valutazione finora

- Qdoc - Tips - Carter Cleaning Company Case HRMDocumento7 pagineQdoc - Tips - Carter Cleaning Company Case HRMYến VyNessuna valutazione finora

- ANNUAL Report Sardar Chemical 2014Documento44 pagineANNUAL Report Sardar Chemical 2014Shabana KhanNessuna valutazione finora

- CH 6 Reverse Logistics PresentationDocumento27 pagineCH 6 Reverse Logistics PresentationSiddhesh KolgaonkarNessuna valutazione finora

- Quiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDocumento2 pagineQuiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDianeNessuna valutazione finora

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Strategic Value Chain Analysis for Investors and ManagersDa EverandStrategic Value Chain Analysis for Investors and ManagersNessuna valutazione finora

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)