Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cam Enables Strategic

Caricato da

jonchkCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cam Enables Strategic

Caricato da

jonchkCopyright:

Formati disponibili

automation technology, inc.

________________________________________________________________________

Collaborative Asset Management enables Strategic MRO e-Procurement

Overview

Automation Technology, Inc. 150 Charcot Avenue San Jose, CA 95131 Tel: (408) 473-0200 Fax: (408) 473-0201 http://www.equiphealth.com

*Excerpts taken from AMR Research's February 2001 Manufacturing e-Business Report

-1

CAM enables Strategic MRO e-Procurement

Automation Technology, Inc.

Collaborative Asset Management (CAM) enables Strategic MRO e-Procurement

Summary

Strategic Maintenance Repair Operations (MRO) procurement is the high-risk, high-value category of MRO procurement that applies to highly engineered product OEMs. E-procurement applications that address tactical, spot-buy and high-volume MRO are not designed to handle the complexity and collaboration required for strategic MRO procurement. Collaborative Asset Management (CAM) opens the door to capturing the hidden value in strategic MRO. Original Equipment Manufacturers (OEMs) will be the driver behind CAM. As OEMs form strategic partnerships with their customers, the bundling of products and services will become the foundation of CAM, which will help build the differentiator against third party parts and service competitors.

Strategic MRO has not been Addressed

AMR Research's survey of over a dozen manufacturers in capital-intensive industries found that over 50% have comprehensive projects to reduce MRO procurement costs. However, as shown in Figure 1, none cover mission-critical, or strategic, MRO. More than half of the manufacturers have already outsourced the procurement of their non-strategic MRO procurement and/or made significant investments in e-procurement applications from vendors such as Ariba and Commerce One. Most of these projects target high-volume MRO items, such as office supplies and generic industrial MRO.

-2-

CAM enables Strategic MRO e-Procurement

Automation Technology, Inc.

Event or maintenance workflow-initiated MRO procurement is often driven by Enterprise Asset Management (EAM) systems from vendors such as MRO Software (formerly PSDI) or Datastream Systems. EAM-driven e-procurement implementations may include the procurement of missioncritical MRO items, such as OEM spare parts, but the approach is tactical, not strategic. Complex, mission-critical OEM products such as rotating equipment, mobile equipment, and automation equipment fall outside of existing procurement projects. Most manufacturers will negotiate volume-based buying contracts on a project-by-project basis. But once the products are installed, the approach becomes primarily tactical.

Unique Challenges in Strategic MRO Procurement

For strategic MRO, the decisions on what equipment to buy and which parts to stock are often made by project engineers at the time of plant design and construction. Once new capital equipment is operational, the emphasis shifts from procurement cost to keeping the plant running. The risk and complexity associated with managing installed assets often leads engineers and maintenance technicians to adhere to strict engineering standards and maintaining a large quantity of spare parts. The result is a tactical approach to strategic MRO management. In an attempt to reduce costs, manufacturers will explore opportunities to source strategic MRO parts from a non-OEM supplier. The decision requires both an extensive engineering review and a formal supplier selection process. However, the internal business process cost involved often limits the benefits gained from price reductions. Most significantly, the procurement department defers to the engineering department with regards to strategic MRO procurement, yet enterprise-wide strategic MRO procurement costs are often hidden from the engineering department.

Strategic MRO procurement is high-risk and high-value

Indirect, or MRO, procurement can be segmented into four categories according to the risk associated with product use and the opportunity for capturing value through business process improvements as illustrated in Figure 2. Spot-Buy MRO--These products are not usually planned purchases and their value is relatively low. Spot-buy MRO products are also low risk: they have no impact on manufacturing operations. Tactical MRO--These products are crucial to the operation but inherently present little opportunity for improvement. Relationships with suppliers are often fixed because of geography or existing fixed capital investments. High-Volume MRO--The procurement and inventory costs associated with these products can be reduced, but the products are not mission-critical. This is the low hanging fruit category of MRO procurement. Strategic MRO--This is where high risk and high potential value capture intersect. For strategic MRO, the consequences of using the wrong product or not having the right expertise could include costly unplanned downtime, damage to expensive equipment, personnel injury, and environmental damage. At the same time, strategic MRO procurement can help you reduce the total cost of asset ownership.

-3-

CAM enables Strategic MRO e-Procurement

Automation Technology, Inc.

Definition of Maintenance, Repair, and Operations MRO refers to any product or service that is procured and used to support the maintenance, repair, and operations of a manufacturing organization. It encompasses any material that is not a direct input into the final product. No distinction is made between supplies bought on expense and supplies bought under capital budgets; however, procurement made under major capital projects is not included. For example, a new pump to support the existing operation and paid for out of the capital budget is MRO, but significant new capital investment, such as a new operating unit, is not.

Complexity and collaboration required for strategic MRO procurement

The complexity inherent in strategic MRO forces manufacturers to work closely with equipment OEMs and third-party subject matter experts to maintain assets and make the best procurement decisions. None of the leading e-procurement products addresses strategic MRO complexity, much less the collaborative work process associated with it. Figure 3 illustrates the position of the most widely adopted e-procurement products in relation to product/process complexity. Corporate e-procurement vendors, such as Ariba, Commerce One, and RightWorks, provide buyers with applications for automating the procurement process. The applications also provide integration with internal business processes, content aggregation, and transaction-based punchout to external catalogs or Business-to-Business (B2B) marketplaces. Yet these applications do not attempt to address the complexity inherent in engineered products. Asset management system integration is the driver for adopting the e-procurement products of EAM vendors, including Datastream Systems, MRO Software, and SAP. The asset management vendors bring familiarity with industrial MRO and maintenance management systems to the MRO procurement process. However, collaborative business processes, such as vendor-assisted maintenance, fall outside their scope. MRO-centric B2B marketplaces and Web-enabled distributors are firmly rooted in catalog-based MRO procurement. They alternately compete and partner with the software vendors. For example, MRO Software worked with distributor Grainger on the latter's B2B marketplace.

-4-

CAM enables Strategic MRO e-Procurement

Automation Technology, Inc.

Collaborative asset management opens the door to capturing the hidden value in strategic MRO

The Internet enables real-time collaboration with business partners, including OEMs, and anytime/anywhere access to information. For capital-intensive industries it also makes possible a new approach to asset management and strategic MRO procurement: Collaborative Asset Management (CAM). Figure 4 illustrates how, short of complete maintenance outsourcing, CAM is the only approach that can deliver the benefits locked up in strategic MRO and the assets it supports. Business Process Improvement (BPI) and supplier rationalization projects have successfully delivered benefits, ranging from improving transaction efficiency to reducing prices to eliminating maverick buying for the spot buy and high-volume MRO categories. However, they do not adequately address the risk associated with strategic MRO. Stores outsourcing is an acceptable approach for soap, dope, and rope, and Vendor-Managed Inventory (VMI) works well for tactical MRO, such as industrial gases. Both approaches reduce working capital and procurement costs, but they have limited impact on total asset lifecycle costs. Current approaches fail to address the biggest opportunities hidden in strategic MRO: improving asset performance and reducing its complete lifecycle cost. By enabling real-time collaboration with external business partners, CAM can deliver these elusive benefits.

-5-

CAM enables Strategic MRO e-Procurement

Automation Technology, Inc.

OEM Product-service bundling becomes the foundation for CAM

Visionary OEMs are making the changes, such as bundling products and service, necessary to become their customers' strategic partners. They recognize that their customers no longer want to be equipment experts-they want the OEM to provide that service. Returning to Figure 4, the new Service-Level Agreements (SLAs) that bundle products and services can become the foundation for CAM.

Recommendations

The answer to the strategic MRO procurement challenge is CAM. Buyers: Evaluate your strategic MRO opportunities and include your OEMs in the evaluation process. OEMs: Create product-service offerings and take the lead in becoming your customers' strategic partner. All: Look beyond the standard MRO e-procurement products to software products and services that can support CAM

Conclusion

Strategic MRO procurement is the high-risk, high-value category of MRO procurement. E-procurement applications that address tactical, spot-buy and high-volume MRO are not designed to handle the complexity and collaboration required for strategic MRO procurement. Collaborative Asset Management (CAM) opens the door to capturing the hidden value in strategic MRO. Original Equipment Manufacturers (OEMs) will be the driver behind CAM. As OEMs form strategic partnerships with their customers, the bundling of products and services will become the foundation of CAM, which will help build the differentiator against third party parts and service competitors.

-6-

Potrebbero piacerti anche

- Pioneering Views: Pushing the Limits of Your C/ETRM - Volume 2Da EverandPioneering Views: Pushing the Limits of Your C/ETRM - Volume 2Nessuna valutazione finora

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationDa EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNessuna valutazione finora

- Gartner MQ On EAM For Delivery UtilitiesDocumento25 pagineGartner MQ On EAM For Delivery UtilitiesGnana ShekaranNessuna valutazione finora

- Best Practices For Implement 346916Documento13 pagineBest Practices For Implement 346916AndersonVieiraNessuna valutazione finora

- SCM Hero MotorCorp 11A 29ADocumento11 pagineSCM Hero MotorCorp 11A 29AArun MaithaniNessuna valutazione finora

- Brammer Efficient MRO Procurement ManagementDocumento6 pagineBrammer Efficient MRO Procurement ManagementFendi Mohamad ZainiNessuna valutazione finora

- Kaplan SawhneyDocumento10 pagineKaplan SawhneyMaxwell RejilNessuna valutazione finora

- Magic Quadrant For ECMDocumento31 pagineMagic Quadrant For ECMDavid LaskNessuna valutazione finora

- Course Mba - 2 Semester Subject Assignment MB0044 - Set 1Documento18 pagineCourse Mba - 2 Semester Subject Assignment MB0044 - Set 1kct_thomasNessuna valutazione finora

- Enhance PerformanceDocumento4 pagineEnhance PerformanceVivek VashisthaNessuna valutazione finora

- 10 Technology Best PracticesDocumento8 pagine10 Technology Best Practicesदीपक सैनीNessuna valutazione finora

- SCM Module 2 NotesDocumento7 pagineSCM Module 2 NotesRaveen MJNessuna valutazione finora

- Cots or In-House Tools in The Electrical DomainDocumento9 pagineCots or In-House Tools in The Electrical DomainMohamed Anas BenhebibiNessuna valutazione finora

- EAM For ManufacturingDocumento9 pagineEAM For Manufacturingmikcarh58Nessuna valutazione finora

- Ibm CompanyDocumento20 pagineIbm CompanyAnirud KumarNessuna valutazione finora

- BBA 506 GUIDE BOOK Smu 5th Sem BbaDocumento57 pagineBBA 506 GUIDE BOOK Smu 5th Sem BbalalsinghNessuna valutazione finora

- Customer Relationship Management (CRM) TechnologiesDocumento39 pagineCustomer Relationship Management (CRM) TechnologiesMrityunjay SaikiaNessuna valutazione finora

- Discussion ch16Documento3 pagineDiscussion ch16HoseaNessuna valutazione finora

- Project - 111312 - SCM in Automobile IndustryDocumento26 pagineProject - 111312 - SCM in Automobile IndustryIshan Datta100% (1)

- MRO - How A Robust MRO Strategy Becomes Your Profit CenterDocumento6 pagineMRO - How A Robust MRO Strategy Becomes Your Profit CenterFake ID100% (1)

- ERP Implementation in Steel IndustryDocumento8 pagineERP Implementation in Steel IndustryMukesh SinghNessuna valutazione finora

- Supply Chain Design & Planning.: By: Ohud AltalhiDocumento21 pagineSupply Chain Design & Planning.: By: Ohud AltalhiReef AlhuzaliNessuna valutazione finora

- Choosing The Best CRM For Your Organization: 2011 White PaperDocumento10 pagineChoosing The Best CRM For Your Organization: 2011 White Paperyadav123456Nessuna valutazione finora

- Udbhava May 2011Documento14 pagineUdbhava May 2011Rahul Singh ChoudharyNessuna valutazione finora

- Lesson 2Documento15 pagineLesson 2Pamela MorcillaNessuna valutazione finora

- Jaguar Land Rover Configuration Lifecycle Management WebDocumento4 pagineJaguar Land Rover Configuration Lifecycle Management WebStar Nair Rock0% (1)

- Thesis On Purchasing ManagementDocumento5 pagineThesis On Purchasing Managementfjnsf5yf100% (2)

- Ibm Maximo Transportation SolutionDocumento4 pagineIbm Maximo Transportation Solutionsherrybt2005Nessuna valutazione finora

- (EN) System Business FinalDocumento7 pagine(EN) System Business Finalmir makarim ahsanNessuna valutazione finora

- Presentation Slides Session 12 To 18 DT 7 Aug 2023Documento13 paginePresentation Slides Session 12 To 18 DT 7 Aug 2023Ankita SharmaNessuna valutazione finora

- Points To Consider - Maximo Versus SAPDocumento2 paginePoints To Consider - Maximo Versus SAPMaximo SupportNessuna valutazione finora

- Gartner - Magic Quadrant For IT Service Management Tools-2021Q1Documento23 pagineGartner - Magic Quadrant For IT Service Management Tools-2021Q1Guille LopezNessuna valutazione finora

- Gartner - APM Market TrendDocumento14 pagineGartner - APM Market TrendkarimmebsNessuna valutazione finora

- C (C CCCC CCDocumento7 pagineC (C CCCC CCAditya WaghNessuna valutazione finora

- Production & Operations ManagementDocumento11 pagineProduction & Operations ManagementDinesh Reghunath RNessuna valutazione finora

- Magic Quadrant For It Servic 260504Documento24 pagineMagic Quadrant For It Servic 260504knokturnal839Nessuna valutazione finora

- Practical Data Management A Smart Alternative To Product Lifecycle ManagementDocumento6 paginePractical Data Management A Smart Alternative To Product Lifecycle ManagementmindwriterNessuna valutazione finora

- Whitepaper: Credit: Rochelle Williams, ETC-USC, Via FlickrDocumento14 pagineWhitepaper: Credit: Rochelle Williams, ETC-USC, Via FlickrChandru ChristurajNessuna valutazione finora

- Explore and Understand Gartn 317886Documento23 pagineExplore and Understand Gartn 317886Leoncio ChávezNessuna valutazione finora

- Magic Quadrant For WarehouseDocumento25 pagineMagic Quadrant For WarehousePablo Plaza MuruaNessuna valutazione finora

- Market Guide For Retail Dist 352250Documento36 pagineMarket Guide For Retail Dist 352250AndersonVieiraNessuna valutazione finora

- Contents Page: Business PlanDocumento43 pagineContents Page: Business Plankasahun bedasoNessuna valutazione finora

- Wipro Visual Merchandising CaseDocumento3 pagineWipro Visual Merchandising CaseRaktimNessuna valutazione finora

- Maintenance, Repair and Operation (MRO) : Market Challenges and Cost Saving OpportunitiesDocumento12 pagineMaintenance, Repair and Operation (MRO) : Market Challenges and Cost Saving Opportunitiesfercba1Nessuna valutazione finora

- Production & Operations Management: Course: Master of Business Administration (MBA)Documento11 pagineProduction & Operations Management: Course: Master of Business Administration (MBA)Dinesh Reghunath RNessuna valutazione finora

- 4 Ways To Achieve MRO ReliabilityDocumento3 pagine4 Ways To Achieve MRO ReliabilityGiovani AmorinNessuna valutazione finora

- Capstone Headwaters ITG Robotics Report vFINAL2Documento10 pagineCapstone Headwaters ITG Robotics Report vFINAL2Ray CarpenterNessuna valutazione finora

- Matecconf Ispcime18 06013Documento8 pagineMatecconf Ispcime18 06013Abukhassym KhydyrbayevNessuna valutazione finora

- Chapter 3Documento2 pagineChapter 3Loverson Akhie MaguiweNessuna valutazione finora

- Understanding RPA - 2Documento6 pagineUnderstanding RPA - 2Dwaraki DNessuna valutazione finora

- Return of Invertmen For Transportation Management System - GartnerDocumento16 pagineReturn of Invertmen For Transportation Management System - GartnerDan AranmunNessuna valutazione finora

- PDF Chapter 18Documento3 paginePDF Chapter 18jaberalislamNessuna valutazione finora

- B2B Marketing Dec 2022Documento15 pagineB2B Marketing Dec 2022Rajni KumariNessuna valutazione finora

- THE MISSING TOOL For Maintenance & MRO Inventory ControlDocumento11 pagineTHE MISSING TOOL For Maintenance & MRO Inventory ControlLLNessuna valutazione finora

- A Sales Support System For Agents of The Machine Tool IndustryDocumento10 pagineA Sales Support System For Agents of The Machine Tool IndustryUma AnandNessuna valutazione finora

- MachineShop - AnswersDocumento5 pagineMachineShop - AnswersKatarína LuptákováNessuna valutazione finora

- 5 Factors To Consider For Effective Supply Chain OptimizationDocumento2 pagine5 Factors To Consider For Effective Supply Chain OptimizationCHANGAWA JUMA FONDO D192/20166/2020Nessuna valutazione finora

- Centralizing Procurement A Road Map For Oil and Gas CompaniesDocumento6 pagineCentralizing Procurement A Road Map For Oil and Gas CompaniescaviarNessuna valutazione finora

- Complete Semister 2nd 1 SetDocumento90 pagineComplete Semister 2nd 1 SetNavin JalwaniaNessuna valutazione finora

- Supply Chain ManagementDocumento14 pagineSupply Chain ManagementJoju JohnyNessuna valutazione finora

- Family Document 2007Documento27 pagineFamily Document 2007jonchkNessuna valutazione finora

- ACE Consultancy AgreementDocumento0 pagineACE Consultancy AgreementjonchkNessuna valutazione finora

- ACE Agreement 8: Adjudicator: ScotlandDocumento0 pagineACE Agreement 8: Adjudicator: ScotlandjonchkNessuna valutazione finora

- 2d260444 d275 406a 9f6b 36a1bc477870Documento0 pagine2d260444 d275 406a 9f6b 36a1bc477870jonchkNessuna valutazione finora

- 0cd8e051 b780 4f79 B73e b071cf461149Documento0 pagine0cd8e051 b780 4f79 B73e b071cf461149jonchkNessuna valutazione finora

- OtsmDocumento2 pagineOtsmjonchkNessuna valutazione finora

- 2bd70326 ddc7 4b35 8a55 d4147f1273f5Documento16 pagine2bd70326 ddc7 4b35 8a55 d4147f1273f5jonchkNessuna valutazione finora

- Nse Options Strategies Explanation With ExamplesDocumento60 pagineNse Options Strategies Explanation With ExamplesVatsal ShahNessuna valutazione finora

- Truchet Tilings and Their GeneralisationsDocumento9 pagineTruchet Tilings and Their GeneralisationsjonchkNessuna valutazione finora

- Visa SpenddataDocumento18 pagineVisa SpenddatajonchkNessuna valutazione finora

- 4da76f1f 2716 4a5e 9c24 B9e012c2fcd4Documento0 pagine4da76f1f 2716 4a5e 9c24 B9e012c2fcd4jonchkNessuna valutazione finora

- Spatial Realization of Escher's Impossible World SUGIHARADocumento5 pagineSpatial Realization of Escher's Impossible World SUGIHARAjonchkNessuna valutazione finora

- Fidic Silver Book OverviewDocumento14 pagineFidic Silver Book Overviewayaznpti100% (2)

- Pub in The History of Science 20005a5d - 87Documento6 paginePub in The History of Science 20005a5d - 87jonchkNessuna valutazione finora

- Category ManagementDocumento3 pagineCategory ManagementjonchkNessuna valutazione finora

- Categorisation and Category AnalysisDocumento9 pagineCategorisation and Category AnalysisjonchkNessuna valutazione finora

- Cause and Effect AnalysisDocumento8 pagineCause and Effect AnalysisjonchkNessuna valutazione finora

- Writing A Case AnalysisDocumento4 pagineWriting A Case AnalysisSameer SinghaniaNessuna valutazione finora

- Business Improvememts Workshop PlanDocumento5 pagineBusiness Improvememts Workshop PlanjonchkNessuna valutazione finora

- CENTCOM MRO Advantages Prime ContractorsDocumento4 pagineCENTCOM MRO Advantages Prime ContractorsjonchkNessuna valutazione finora

- Azure DevOps - User CreationDocumento68 pagineAzure DevOps - User CreationInge SmitNessuna valutazione finora

- Statistische Tabellen (Studenmund (2014) Using Econometrics. A Practical Guide, 6th Ed., P 539-553)Documento15 pagineStatistische Tabellen (Studenmund (2014) Using Econometrics. A Practical Guide, 6th Ed., P 539-553)Рус ПолешукNessuna valutazione finora

- Practical 3Documento3 paginePractical 3Naimish SorathiyaNessuna valutazione finora

- Pusk - Bkl-Permohonan DatabaseDocumento45 paginePusk - Bkl-Permohonan DatabaseSarjanaMudaNessuna valutazione finora

- EPANET Calibrator ManualDocumento8 pagineEPANET Calibrator ManualWesley AmorimNessuna valutazione finora

- Module 1 Web Systems and Technology 2Documento19 pagineModule 1 Web Systems and Technology 2Ron Marasigan100% (2)

- Britt Support Cat 9710Documento47 pagineBritt Support Cat 9710Jim SkoranskiNessuna valutazione finora

- Introduction Call FlowDocumento23 pagineIntroduction Call FlowmichaelsilvaNessuna valutazione finora

- Setup and Deployment in Visual Basic 2010Documento15 pagineSetup and Deployment in Visual Basic 2010meongkuNessuna valutazione finora

- Sample Swot For An InstitutionDocumento8 pagineSample Swot For An Institutionhashadsh100% (3)

- Basic Pencil ShadingDocumento2 pagineBasic Pencil ShadingNecronlord2Nessuna valutazione finora

- Punching Report - Unikl MsiDocumento9 paginePunching Report - Unikl MsiRudyee FaiezahNessuna valutazione finora

- M R410 eDocumento32 pagineM R410 eluck2007Nessuna valutazione finora

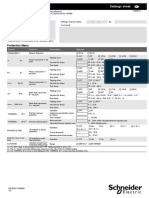

- VIP400 Settings Sheet NRJED311208ENDocumento2 pagineVIP400 Settings Sheet NRJED311208ENVăn NguyễnNessuna valutazione finora

- Control RoomDocumento24 pagineControl Roomsarsan nedumkuzhi maniNessuna valutazione finora

- Assignment 3Documento6 pagineAssignment 3Aayush MittalNessuna valutazione finora

- Sap MM PDFDocumento2 pagineSap MM PDFMurali TungaNessuna valutazione finora

- Introduction To IOTDocumento8 pagineIntroduction To IOTAKASH S RNessuna valutazione finora

- Moral and Legal IssuesDocumento22 pagineMoral and Legal IssuesManan MandannaNessuna valutazione finora

- Aman Choudhary BCA-1 C PracticalDocumento65 pagineAman Choudhary BCA-1 C PracticalPoras ChahandeNessuna valutazione finora

- Radio Network OptimizationDocumento18 pagineRadio Network OptimizationgpaulcalNessuna valutazione finora

- Bca 501Documento2 pagineBca 501api-3782519Nessuna valutazione finora

- ELABO Sensorics FundamentalsDocumento44 pagineELABO Sensorics FundamentalsItmi HidayatNessuna valutazione finora

- IPsec - GNS3Documento9 pagineIPsec - GNS3khoantdNessuna valutazione finora

- Formulae For Vendor RatingDocumento3 pagineFormulae For Vendor RatingMadhavan RamNessuna valutazione finora

- ByD DemoScript Project MGMTDocumento21 pagineByD DemoScript Project MGMTLakhbir SinghNessuna valutazione finora

- ESD Short Sleeve SmocksDocumento12 pagineESD Short Sleeve Smocksbeach_lover_1970Nessuna valutazione finora

- Unit 8: Future Outlook: Central Business Configuration For SAP S/4HANA CloudDocumento9 pagineUnit 8: Future Outlook: Central Business Configuration For SAP S/4HANA CloudKarina San MartinNessuna valutazione finora

- Unit 1 Real Numbers - Activities 1 (4º ESO)Documento3 pagineUnit 1 Real Numbers - Activities 1 (4º ESO)lumaromartinNessuna valutazione finora

- Robot Operating SystemDocumento11 pagineRobot Operating SystemAbdullah Abbas100% (1)