Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

My View On Organovo (Over-) Valuation

Caricato da

UnemonTitolo originale

Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

My View On Organovo (Over-) Valuation

Caricato da

UnemonCopyright:

My view on how much Organovo (ONVO) is really worth?

- A tentative valuation attempt using Inpsheros technology! -76% downside risk

/hey dont trust me Im probably wrong as always/

Organovo Holdings, Inc., a public company valued approximately of USD 700m, develops threedimensional (3D) bio printing technology for creating functional human tissues on demand for research and medical applications. The companys 3D NovoGen bio printing technology works across various tissue and cell types, and allows for the placement of cells in desired pattern. InSphero AG, a privately held Swiss based Company, is a leading supplier of organotypic, biological in vitro 3D micro tissues for highly predictive drug testing. The company currently counts all of the top ten global pharmaceutical and cosmetics companies as customers and is helping them to implement its patented micro tissue technology in their development work-flow.

InSphero 3D Insight Micro tissues enable more biologically relevant in vitro applications in efficacy (e.g. in oncology) and toxicology, including long-term and inflammation-mediated toxicity

models in the pipeline. InSphero's 3D micro tissues are more predictive, last longer and are more affordable than conventional cell-based models. (http://www.insphero.com/company)

As the CEO pointed out during the recent (Dec. 5, 2013) presentation, Investors should not expect ONVO to start Printing Organs. He described ONVOs potential market as follows:

N EM

testing. A broad portfolio of tumor and liver micro tissues is available, with additional toxicology

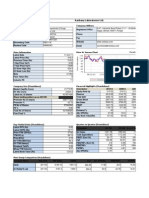

The slide above, gives more details about the revenue potential disclosed by the Company in the 11/20/2013 PR.

Under such a definition of the Market ONVO intends to enter in, Cyprotex (Listed on the LSE) should also be included as a potential competitor. Cyprotex in collaboration with InSphero is co-marketing and providing services related to InSphero's proprietary 3D InsightTM rat and human liver micro tissue technologies. Other micro tissue services are expected to follow as the uptake of 3D cells for Toxicology testing gathers pace.

How much did Recently Private Equity Investors Value Insphero AG? My best Guess.

1. Inshpero AG secured its first (Series A) Financing in August 2010

Zurich, Switzerland, August 6, 2010 InSphero AG, a supplier of novel 3D cell-based assays for efficacy testing and toxicology, announced it has secured CHF1,800,000 financing (approx. USD

22'058 1 new shares were issued at a nominal value of CHF 1.00 / share. (02/Aug/2010 Link)

The Company issued 22,058 shares in exchange of approx. USD 2,000,000 in capital. (Price per share: approx. USD 90.00 per share)

August 2010 Financing Round Implied Company Valuation: USD 10,985,220

2. Inshpero AG secured its second (Series B) Financing in June 2013

Successfully closed a financing round of CHF 2000000 last month (approx. 2200000 USD). This series B financing was (13/June/2013 Link)

05/July/2013, the Company's Capital (nominal) was increased by CHF 24,470 (from CHF 208'694). 24,470 new shares were issued at a nominal value of CHF 1.00 / share. (05/July/2013 Link)

Key assumption: all the shares issued were used in the Financing Transaction. If this assumption is falsified, then the entire results could be jeopardized! However, it is highly unlikely to conduct a round of financing for less than 5% of the value of the Company (in the Start-Up world).

N EM

02/Aug/2010, the Company's Capital (nominal) was increased by CHF 22'058 (from CHF 100,000).

2,000,000) led by Redalpine Venture Partners. (06/Aug/2010 Link)

The company issued 24,470 shares in exchange of approx. USD 2,200,000 in capital. (Price per share = approx. USD 90.00 per share) August 2010 Financing Round Implied Company Valuation: USD 20,984,7602

To introduce a certain degree of flexibility (thus correcting for possible Errors) we use an Implied Company Value of USD 32.50m (instead of the calculated USD 21m)

Assuming Insphero AG has zero debts and zero Cash, the resulting Enterprise Value (EV) would be USD 32.50m.

ONVOs EV is USD 645m! More than 19.84 times higher than Insphero EV (USD 32.50m)

Furthermore, if you were to consider that -

Insphero counts all of the top ten global pharmaceutical and cosmetics companies as customers, Inspheros tissues and technology is already used/studied by Pfizer and Roche the shelf life of Insphero 3D liver Micro-Tissues (hum.) is 60 days vs. 40 days of ONVO liver tissues Insphero has almost same number of workers of ONVO (25)

. you will have a hard time to justify ONVOs current Market Capitalization!

ONVO and Insphero are two very similar companies (IMO, Insphero is a little bit ahead of ONVO from a technological and executional point of view / see September 2013 Insphero Presentation). The two Companies do however have two complete different valuations!

Private Equity (PE) Redalpine valued Insphero AG at USD 32.50m in June 2013 during the last financing round, while Irrational Retail investors are currently valuing ONVO at a whopping USD 645m EV! (A 1884 % premium / assuming ONVO and Insphero are similar companies)

Well, sorry guys but I do trust more to Private Equity Experts rather than to Irrational Markets Participants! Dont you?

2 It is highly unlikely to conduct a round of financing for less than 5% of the value of the Company (in the Start-Up world). It follows that we believe with a high degree of certainty that the total Value of Insphero (as of June 2013) was not higher than USD. For our analysis we used the resulting average of USD 32.50m

N EM

Insphero is already generating revenue / selling the tissues,

Does the Fact that ONVO is a public traded Company, and does therefore offer its shareholders a degree of liquidity on their investments, justify a 1884% Premium!? Not so sure about that!

Assuming that: 1. Private Equity (PE) investors entered into Insphero at a bargain-price (estimating the FV of Insphero at USD 65m approx. 100% higher) 2. A 34% Market Liquidity DISCOUNT 3

It follows that the Market Value (=EV) of A listed Insphero would be approximately USD 98m

EV of ONVI is currently USD 645m (6.58 times higher)

Based on Insphero AG valuation, ONVO should have a Market Cap of USD 151M (EV+ net cash)

The Market Cap of Cyprotex is GBP 17.65m (= USD 28.77m)

Do your math!

The Silber regression does provide us with a sense of how different the discount will be for a rm with small revenues versus one with large revenues. For More Details see Slides 32-33 of this Presentation

N EM

ONVO, at current Prices (USD 9.02), is 331% Overvalued!

-76.83% downside risk form here!

Comparing Organovo to Cyprotex (Listed on the LSE)

Corresponding to a Price per Share (PPS) of USD 2.09

SOME ADDITIONAL INFORMATION ABUOUT INSPHERO

N EM

U N EM O N

Complete Inspheros presentation: Here

N EM

Potrebbero piacerti anche

- Multifocal Intraocular Lenses: The Art and the PracticeDa EverandMultifocal Intraocular Lenses: The Art and the PracticeJorge L. AlióNessuna valutazione finora

- Polymedicure TIADocumento28 paginePolymedicure TIAProton CongoNessuna valutazione finora

- Disruptive Procurement: Winning in a Digital WorldDa EverandDisruptive Procurement: Winning in a Digital WorldNessuna valutazione finora

- AxoGen Initiation Report Outlines 45% Revenue Growth and $5 Price TargetDocumento28 pagineAxoGen Initiation Report Outlines 45% Revenue Growth and $5 Price TargetTao LevyNessuna valutazione finora

- Adxs Update q4f10-2Documento20 pagineAdxs Update q4f10-2jaxstrawNessuna valutazione finora

- Pharma Industry Demand and Supply AnalysisDocumento19 paginePharma Industry Demand and Supply AnalysisYatendra VarmaNessuna valutazione finora

- Market Outlook 17.11.11Documento3 pagineMarket Outlook 17.11.11Angel BrokingNessuna valutazione finora

- Ranbaxy Laboratories LTDDocumento23 pagineRanbaxy Laboratories LTDk_m892001Nessuna valutazione finora

- A Review of Stock Prediction Using Various Machine Learning TechniquesDocumento8 pagineA Review of Stock Prediction Using Various Machine Learning TechniquesIJRASETPublicationsNessuna valutazione finora

- Systematic Value Investing Does It Really WorkDocumento16 pagineSystematic Value Investing Does It Really WorkJUDS1234567Nessuna valutazione finora

- Determination of Optimal Portfolio by Using Tangency Portfolio and Sharpe RatioDocumento7 pagineDetermination of Optimal Portfolio by Using Tangency Portfolio and Sharpe RatiowoelfertNessuna valutazione finora

- Investment Proposal ExampleDocumento30 pagineInvestment Proposal ExampleMd TowkikNessuna valutazione finora

- Portfolio Optimization Analysis With Markowitz Quadratic Mean-Variance ModelDocumento7 paginePortfolio Optimization Analysis With Markowitz Quadratic Mean-Variance ModelKrishna JoshiNessuna valutazione finora

- Analyzing Oxyglobin pricing and launch strategyDocumento8 pagineAnalyzing Oxyglobin pricing and launch strategyRajagopal PuttapartiNessuna valutazione finora

- Aurinia Pharmaceuticals Inc.: Eyeing A New OpportunityDocumento5 pagineAurinia Pharmaceuticals Inc.: Eyeing A New OpportunitySusan LaskoNessuna valutazione finora

- Indiabulls Securities LTD: DerivativesDocumento12 pagineIndiabulls Securities LTD: DerivativesMOHAMMED KHAYYUMNessuna valutazione finora

- Description: Voice MorphingDocumento26 pagineDescription: Voice MorphingmahendranvijayNessuna valutazione finora

- Comparing Mutual Funds and ULIPs: An Analysis of Investor PerceptionsDocumento8 pagineComparing Mutual Funds and ULIPs: An Analysis of Investor PerceptionsindradelhiNessuna valutazione finora

- Ca Cia 1.aDocumento12 pagineCa Cia 1.asarayuNessuna valutazione finora

- People and Technology: A History ofDocumento64 paginePeople and Technology: A History ofshtempelNessuna valutazione finora

- Midcap healthcare stock with 47% profit growthDocumento16 pagineMidcap healthcare stock with 47% profit growthPradeep MagudeswaranNessuna valutazione finora

- Assignment 1Documento7 pagineAssignment 1mariyaNessuna valutazione finora

- Project Report On Sanitary Napkin Manufacturing Unit (Biodegradable) Cap: 12 Lac No / Day (Miscellaneous Products)Documento10 pagineProject Report On Sanitary Napkin Manufacturing Unit (Biodegradable) Cap: 12 Lac No / Day (Miscellaneous Products)Sachin SharmaNessuna valutazione finora

- Business Plan FinalDocumento24 pagineBusiness Plan Finalapi-592787087Nessuna valutazione finora

- Inogen CitronDocumento8 pagineInogen CitronAnonymous Ht0MIJNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento4 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Trauma Care - Medical Devices - Blue Ocean - Developing Countries - Value For Money Segmentation ReportDocumento116 pagineTrauma Care - Medical Devices - Blue Ocean - Developing Countries - Value For Money Segmentation ReportEinsteinAlbertKesiNessuna valutazione finora

- Market AnalysisDocumento6 pagineMarket AnalysisMohamed AhmedNessuna valutazione finora

- Pharmaceutical Industry - M&AsDocumento18 paginePharmaceutical Industry - M&AsMeet KanwalNessuna valutazione finora

- Stock Exchange - Mishthi JaggiDocumento7 pagineStock Exchange - Mishthi Jaggisjaggi.hideNessuna valutazione finora

- Herd BehaviorDocumento14 pagineHerd BehaviorMarii KhanNessuna valutazione finora

- An Empirical Study On IPO Underpricing of The Shanghai A Share MarketDocumento5 pagineAn Empirical Study On IPO Underpricing of The Shanghai A Share MarketKurapati VenkatkrishnaNessuna valutazione finora

- Eyewear Industry: Visions Are ChangingDocumento53 pagineEyewear Industry: Visions Are ChangingSagar BhagdevNessuna valutazione finora

- Arnott Why Cap-Weighted Indexing Is FlawedDocumento21 pagineArnott Why Cap-Weighted Indexing Is Flawedambasyapare1Nessuna valutazione finora

- MphasisDocumento4 pagineMphasisAngel BrokingNessuna valutazione finora

- Stonegate: Visualant Incorporated (OTCBB: VSUL)Documento20 pagineStonegate: Visualant Incorporated (OTCBB: VSUL)Dan TrangNessuna valutazione finora

- Window Dressing in Mutual FundsDocumento30 pagineWindow Dressing in Mutual FundsMahmood GiliNessuna valutazione finora

- Endogene A09tp - Pitch DeckDocumento29 pagineEndogene A09tp - Pitch DeckJatan MudgalNessuna valutazione finora

- Thesis Stock MarketDocumento6 pagineThesis Stock MarketBuyCheapPapersSavannah100% (2)

- Form Print Ortho 500Documento6 pagineForm Print Ortho 500Kushagra VarmaNessuna valutazione finora

- The Effect of Peer IPOs on Price InformativenessDocumento62 pagineThe Effect of Peer IPOs on Price InformativenessDuyên LêNessuna valutazione finora

- Relationship between shareholders’ wealth and debt levels of Nigerian firmsDocumento7 pagineRelationship between shareholders’ wealth and debt levels of Nigerian firmssilentwattpadreaderNessuna valutazione finora

- Buffer Stock Saving and Household Response To IncomeDocumento41 pagineBuffer Stock Saving and Household Response To IncomeRyan Yu SyuenNessuna valutazione finora

- 18-06-2021-1624020528-7-Ijfm-3. Ijfm (Foc - Dec 2020) - Selective Diversification Does The Capital Asset Pricing Model Capture EffectsDocumento6 pagine18-06-2021-1624020528-7-Ijfm-3. Ijfm (Foc - Dec 2020) - Selective Diversification Does The Capital Asset Pricing Model Capture Effectsiaset123Nessuna valutazione finora

- Participatory Innovation Lessons From Breeding Cooperatives2016Documento7 pagineParticipatory Innovation Lessons From Breeding Cooperatives2016rengabNessuna valutazione finora

- Jurnal ManajemenDocumento10 pagineJurnal ManajemenadrianNessuna valutazione finora

- Unit 1 - Introduction (International Finance)Documento8 pagineUnit 1 - Introduction (International Finance)undesastreordenadoNessuna valutazione finora

- Source All Overview enDocumento28 pagineSource All Overview enFaridNessuna valutazione finora

- Retail Investors' Percption On Financial Derivatives in IndiaDocumento18 pagineRetail Investors' Percption On Financial Derivatives in IndiaprashantkumbhaniNessuna valutazione finora

- China Bronchoscopes Market Outlook To 2020: On8 Sept 2014Documento7 pagineChina Bronchoscopes Market Outlook To 2020: On8 Sept 2014api-258620453Nessuna valutazione finora

- Ubc Circle Thesis SubmissionDocumento4 pagineUbc Circle Thesis Submissionandrealeehartford100% (2)

- Monte Carlo Simulation of Reliance Stock Price ForecastingDocumento17 pagineMonte Carlo Simulation of Reliance Stock Price ForecastingSandeep DhupalNessuna valutazione finora

- Portfolio Construction TechniquesDocumento11 paginePortfolio Construction TechniquesArthur KingNessuna valutazione finora

- Corporate Profile of Olympus GroupDocumento18 pagineCorporate Profile of Olympus GroupTanveer TusharNessuna valutazione finora

- DerivativesDocumento9 pagineDerivativesrududu duduNessuna valutazione finora

- Train Product Specialist For URIT-910 Electrolyte AnalyzerDocumento7 pagineTrain Product Specialist For URIT-910 Electrolyte AnalyzerErwin TecsonNessuna valutazione finora

- Dzexams 3as Anglais 1135875Documento9 pagineDzexams 3as Anglais 1135875netseven00007Nessuna valutazione finora

- Thesis Fulltext01Documento81 pagineThesis Fulltext01Chandra manandharNessuna valutazione finora

- 19 StateDocumento7 pagine19 StateAshish V MeshramNessuna valutazione finora

- EJMCM - Volume 7 - Issue 8 - Pages 2286-2305Documento20 pagineEJMCM - Volume 7 - Issue 8 - Pages 2286-2305Ritik RajNessuna valutazione finora

- VLTC - Market EuphoryDocumento2 pagineVLTC - Market EuphoryUnemon0% (1)

- 保定天威英利新能源有限公司2011年度第一期中期票据第四次持有人会议之法律意见书Documento8 pagine保定天威英利新能源有限公司2011年度第一期中期票据第四次持有人会议之法律意见书UnemonNessuna valutazione finora

- YY PresentationsDocumento51 pagineYY PresentationsUnemonNessuna valutazione finora

- The Catalyst: LOI For The Sale of FL Mobile and Showself With 20 B-Days Negotiations DeadlineDocumento7 pagineThe Catalyst: LOI For The Sale of FL Mobile and Showself With 20 B-Days Negotiations DeadlineUnemonNessuna valutazione finora

- YY Research NotesDocumento39 pagineYY Research NotesUnemonNessuna valutazione finora

- WBAI Scraping ScriptDocumento3 pagineWBAI Scraping ScriptUnemonNessuna valutazione finora

- Biojax Blog 2Documento2 pagineBiojax Blog 2UnemonNessuna valutazione finora

- BIOJAX The Main ATHX Pumper Revealed.Documento4 pagineBIOJAX The Main ATHX Pumper Revealed.UnemonNessuna valutazione finora

- Onvo Competitors PDFDocumento1 paginaOnvo Competitors PDFUnemonNessuna valutazione finora

- CERS Notes v00Documento7 pagineCERS Notes v00UnemonNessuna valutazione finora

- The Investigation Results of FAB 5C MachinesDocumento5 pagineThe Investigation Results of FAB 5C MachinesUnemonNessuna valutazione finora

- LLEN: Supplement BriefingDocumento9 pagineLLEN: Supplement BriefingUnemonNessuna valutazione finora

- Xoma PDFDocumento4 pagineXoma PDFUnemonNessuna valutazione finora

- PPHM Preferred PDFDocumento2 paginePPHM Preferred PDFUnemonNessuna valutazione finora

- 01/10/2014 - Antitrust Lawsuit Against Questcor in California - Complaint DocumentDocumento27 pagine01/10/2014 - Antitrust Lawsuit Against Questcor in California - Complaint DocumentUnemonNessuna valutazione finora

- LongWei Petroleum - Overstating Its Inventories.Documento19 pagineLongWei Petroleum - Overstating Its Inventories.UnemonNessuna valutazione finora

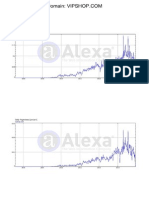

- VIPS Domains Alexa StatisticsDocumento10 pagineVIPS Domains Alexa StatisticsUnemonNessuna valutazione finora

- Organovo PfizerMy Thoughts On Organovo, Inc. (NYSE: ONVO) - Pfizer (NYSE: PFE) Partnership.Documento3 pagineOrganovo PfizerMy Thoughts On Organovo, Inc. (NYSE: ONVO) - Pfizer (NYSE: PFE) Partnership.UnemonNessuna valutazione finora

- Onvo 20130315 10K 20121231Documento92 pagineOnvo 20130315 10K 20121231UnemonNessuna valutazione finora

- Organovo CFO Incredible Track RecordDocumento3 pagineOrganovo CFO Incredible Track RecordUnemonNessuna valutazione finora

- Mobile services bill breakdownDocumento3 pagineMobile services bill breakdownTuttu P.hNessuna valutazione finora

- Schwab Charitable Fund 2008 990Documento879 pagineSchwab Charitable Fund 2008 990TheSceneOfTheCrimeNessuna valutazione finora

- 10-09-22 SACCO Automation ReportDocumento88 pagine10-09-22 SACCO Automation ReportTomBiko100% (1)

- Why Organizations Should Collect Accurate Financial RecordsDocumento16 pagineWhy Organizations Should Collect Accurate Financial Recordsyevhen100% (4)

- CITI Bank Interview Insights for EMA ProgramDocumento30 pagineCITI Bank Interview Insights for EMA ProgramRajNessuna valutazione finora

- HSC Commerce March 2018 Board Question Paper SPDocumento2 pagineHSC Commerce March 2018 Board Question Paper SPAnushka VishwakarmaNessuna valutazione finora

- IGNOU MBA Project ManagemntDocumento27 pagineIGNOU MBA Project ManagemntAmit SharmaNessuna valutazione finora

- Big Bank Business: The Ethics and Social Responsibility of The Finance IndustryDocumento2 pagineBig Bank Business: The Ethics and Social Responsibility of The Finance IndustryFaculty of the ProfessionsNessuna valutazione finora

- Swot Analysis in Bancassurance.Documento50 pagineSwot Analysis in Bancassurance.Parag More100% (2)

- Value Investors Group PDFDocumento11 pagineValue Investors Group PDFnit111100% (1)

- ProblemDocumento1 paginaProblemGemmie Barsobia100% (2)

- Advantages & DisAdvantages of DBFO PFI or PPPs PDFDocumento12 pagineAdvantages & DisAdvantages of DBFO PFI or PPPs PDFwhyoNessuna valutazione finora

- Deed of Sale of Motor VehicleDocumento7 pagineDeed of Sale of Motor VehicleMarc CalderonNessuna valutazione finora

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Documento7 pagineACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- PAS 7 Statement of Cash FlowsDocumento14 paginePAS 7 Statement of Cash FlowsBritnys NimNessuna valutazione finora

- IFC Vs Imperial TextileDocumento2 pagineIFC Vs Imperial TextileClarisse Ann MirandaNessuna valutazione finora

- Revised Nekepte 2Documento18 pagineRevised Nekepte 2theodrosbaby100% (1)

- Advocates of Til vs. BSPDocumento3 pagineAdvocates of Til vs. BSPIrene RamiloNessuna valutazione finora

- 4DCA Sep11 - Regner v. Amtrust Bank - Reversed - Mortgagors Did Not Receive Notice of SaleDocumento3 pagine4DCA Sep11 - Regner v. Amtrust Bank - Reversed - Mortgagors Did Not Receive Notice of Salewinstons23110% (1)

- Inflation & Unemploy Ment: Lecturer: Pn. Azizah Isa 1Documento50 pagineInflation & Unemploy Ment: Lecturer: Pn. Azizah Isa 1hariprem26100% (1)

- Golf Course Valuation TrendsDocumento3 pagineGolf Course Valuation TrendsSarahNessuna valutazione finora

- 1.deped Provident Form 2023Documento6 pagine1.deped Provident Form 2023BTS EDITSNessuna valutazione finora

- 6 Economics of International TradeDocumento29 pagine6 Economics of International TradeSenthil Kumar KNessuna valutazione finora

- ACC 211 Week 10-12Documento24 pagineACC 211 Week 10-12idontcaree123312Nessuna valutazione finora

- What Is CARPDocumento33 pagineWhat Is CARPWorstWitch TalaNessuna valutazione finora

- TX 1102 Deductions from Gross Income Itemized and Special DeductionsDocumento10 pagineTX 1102 Deductions from Gross Income Itemized and Special DeductionsJulz0% (1)

- Loan Statement SummaryDocumento2 pagineLoan Statement SummaryNewsletter Online Technical supportNessuna valutazione finora

- A Simple FTP Model For A Commercial BankDocumento80 pagineA Simple FTP Model For A Commercial BankMaratAyaibergenovNessuna valutazione finora

- Balance SheetDocumento28 pagineBalance SheetrimaNessuna valutazione finora

- PWC Financing Guide 122022Documento382 paginePWC Financing Guide 122022M Tariqul Islam Mishu100% (1)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsDa EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsValutazione: 5 su 5 stelle5/5 (2)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDa Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurValutazione: 4 su 5 stelle4/5 (2)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryDa EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryValutazione: 4 su 5 stelle4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDa EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeValutazione: 4.5 su 5 stelle4.5/5 (85)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDa EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNessuna valutazione finora

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Da EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Valutazione: 5 su 5 stelle5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeDa EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeValutazione: 4.5 su 5 stelle4.5/5 (30)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDa EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedValutazione: 4.5 su 5 stelle4.5/5 (38)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDa EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelValutazione: 5 su 5 stelle5/5 (51)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsDa EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsValutazione: 4 su 5 stelle4/5 (6)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDa EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureValutazione: 4.5 su 5 stelle4.5/5 (100)

- Without a Doubt: How to Go from Underrated to UnbeatableDa EverandWithout a Doubt: How to Go from Underrated to UnbeatableValutazione: 4 su 5 stelle4/5 (23)

- Transformed: Moving to the Product Operating ModelDa EverandTransformed: Moving to the Product Operating ModelValutazione: 4 su 5 stelle4/5 (1)

- Anything You Want: 40 lessons for a new kind of entrepreneurDa EverandAnything You Want: 40 lessons for a new kind of entrepreneurValutazione: 5 su 5 stelle5/5 (46)

- Your Next Five Moves: Master the Art of Business StrategyDa EverandYour Next Five Moves: Master the Art of Business StrategyValutazione: 5 su 5 stelle5/5 (795)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldDa Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldValutazione: 5 su 5 stelle5/5 (19)

- Invention: A Life of Learning Through FailureDa EverandInvention: A Life of Learning Through FailureValutazione: 4.5 su 5 stelle4.5/5 (28)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesDa EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesValutazione: 4.5 su 5 stelle4.5/5 (99)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesDa EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesValutazione: 5 su 5 stelle5/5 (21)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceDa EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceValutazione: 5 su 5 stelle5/5 (363)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursDa EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (23)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouDa EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouValutazione: 5 su 5 stelle5/5 (1)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizDa EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizValutazione: 4.5 su 5 stelle4.5/5 (112)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDa EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsValutazione: 5 su 5 stelle5/5 (48)

- Summary of The 33 Strategies of War by Robert GreeneDa EverandSummary of The 33 Strategies of War by Robert GreeneValutazione: 3.5 su 5 stelle3.5/5 (20)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andDa EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andValutazione: 4.5 su 5 stelle4.5/5 (708)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeDa EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeValutazione: 5 su 5 stelle5/5 (22)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessDa EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessValutazione: 4.5 su 5 stelle4.5/5 (407)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIDa EverandAI Money Machine: Unlock the Secrets to Making Money Online with AINessuna valutazione finora