Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Make or Buy Analysis

Caricato da

MaryCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Make or Buy Analysis

Caricato da

MaryCopyright:

Formati disponibili

Make or Buy Analysis

Introduction:

Lawrence Company manufacture simple tablets for the marketplace. Here is a list of their products parts:

Camera Module Processor NAND & DRAM PCB WI FI & GPS Baseband

Display and glass Touch Sensor Battery Pack Sensors and Connectors Enclosure

Lawrence Company is faced with the decision to either make or buy the camera module for their tablets. They have asks you as their accountant to look at the numbers to give them factual financial advice on which would be the best course of action on this matter. They have cost for manufacturing for the cameras as $8.00 per unit or they believe they can purchase them in the marketplace for $7.00 per unit.

Here is the web-link to the presentation for this Analysis: http://prezi.com/siw3g1ad1kwd/make-or-buy-analysis/

MJC

Make or Buy Analysis

Practice Problem:

Here is Lawrence Companys manufacturing data for the cameras:

Manufacturing Data Direct Materials 60,000 Direct Labor 70,000 Variable manufacturing overhead 50,000 Fixed manufacturing costs 70,000 Total manufacturing costs 250,000 Total cost per unit (250,000 31,250) 8.00

After reviewing the manufacturing cost Lawrence Company determines that only 15,000 of the fixed cost would be eliminated by purchasing the cameras. They have found a retailer that would sell them the same quality of camera for $7.00 per unit.

Instructions:

Create a make or buy analysis for Lawrence Company. Explain why or why not they should make or buy the Cameras. What if they could use the freed up space now use to product the cameras generate $30,000 more in income?

MJC

Make or Buy Analysis

Answer:

Buy without an Opportunity Cost Make Direct Materials Direct Labor Variable manufacturing cost Fixed manufacturing cost Purchases price Total cost 60,000 70,000 50,000 70,000 0 250,000 Buy with an Opportunity Cost Make Direct Materials Direct Labor Variable manufacturing cost Fixed manufacturing cost Purchases price Total cost Opportunity cost Total cost 60,000 70,000 50,000 70,000 0 250,000 30,000 280,000 Buy 0 0 0 55,000 218,750 273,750 273,750 Net Income Increase or Decrease 60,000 70,000 50,000 15,000 (218,750) (23,750) 6,250 Buy 0 0 0 55,000 218,750 273,750 Net Income Increase or Decrease 60,000 70,000 50,000 15,000 (218,750) (23,750)

Calculations:

Without any opportunity cost:

Make cost will be the same as those given by the company. Buy will be: Fixed manufacturing cost: $70,000 15,000 = 55,000 Purchases price for the cameras: 31,250 cameras X the $7.00 per unit = $218,750 total purchase price. Decrease in Net income: Buy price of $273,750 Make price of $250,000 = (23,750) loss of income.

MJC

Make or Buy Analysis

With an opportunity cost: Generate more income: The Opportunity cost is added to the manufacturing cost: $250,000 + 30,000 = 280,000 new manufacturing cost with opportunity cost factored in to the process. Result: $280,000 273,750 = 6,250 increase in profit

Results:

The results of this analysis is that without an opportunity cost Lawrence Company should continue to manufacture the cameras because they would loss $23, 750 in net income if they purchased them. However, if they would manage to produce $30,000 more in income for the freed up space then they should buy the cameras because it would result in an increase of net income by $6,250.

MJC

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

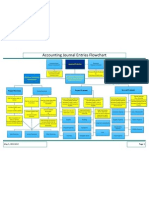

- Accounting Journal Entries Flowchart PDFDocumento1 paginaAccounting Journal Entries Flowchart PDFMary75% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Account ClassificationDocumento2 pagineAccount ClassificationMary96% (23)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Analysis of Financial Statements RatiosDocumento2 pagineAnalysis of Financial Statements RatiosMaryNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Oracle InventoryDocumento207 pagineOracle InventorySandeep Sharma100% (1)

- Adjusting Entries For Bank ReconciliationDocumento1 paginaAdjusting Entries For Bank ReconciliationMaryNessuna valutazione finora

- VT-2 Codes and StandardsDocumento29 pagineVT-2 Codes and StandardsMirza Safeer Ahmad100% (1)

- Cost of Goods Manufactured ScheduleDocumento4 pagineCost of Goods Manufactured ScheduleMary82% (11)

- Journal Entry Format PDFDocumento1 paginaJournal Entry Format PDFMaryNessuna valutazione finora

- Basic Impact of Everyday Journal Entries On The Income StatementDocumento2 pagineBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Walt Disney SustainabilityDocumento23 pagineWalt Disney Sustainabilitysourobhdas.007Nessuna valutazione finora

- Cash Flows Statement Indirect MethodDocumento2 pagineCash Flows Statement Indirect MethodMary100% (1)

- Financial StatementsDocumento1 paginaFinancial StatementsMary100% (4)

- Registration Under GSTDocumento9 pagineRegistration Under GSTSaleemNessuna valutazione finora

- Ak - Keu (Problem)Documento51 pagineAk - Keu (Problem)RAMA100% (9)

- Marketing Cas StudyDocumento4 pagineMarketing Cas StudyRejitha RamanNessuna valutazione finora

- C-TPAT Partner Appl2Documento7 pagineC-TPAT Partner Appl2Cheo HitchensNessuna valutazione finora

- 1 MW BrochureDocumento4 pagine1 MW BrochureJose VicenteNessuna valutazione finora

- Horizontal Analysis of A Balance SheetDocumento3 pagineHorizontal Analysis of A Balance SheetMary100% (6)

- Group4 Report - Managerial EconomicsDocumento37 pagineGroup4 Report - Managerial EconomicsThuyDuongNessuna valutazione finora

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocumento2 pagineBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Diagram of Accounting EquationDocumento1 paginaDiagram of Accounting EquationMary100% (3)

- End of The Year Adjustment For Allowance For Doubtful AccountsDocumento1 paginaEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- ARCS Method of MotivationDocumento1 paginaARCS Method of MotivationMaryNessuna valutazione finora

- Circle of LifeDocumento1 paginaCircle of LifeMaryNessuna valutazione finora

- Continue or Eliminate AnalysisDocumento3 pagineContinue or Eliminate AnalysisMaryNessuna valutazione finora

- Kirkpatrick + ModelDocumento1 paginaKirkpatrick + ModelMaryNessuna valutazione finora

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocumento1 paginaCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNessuna valutazione finora

- Scaffolding MethodDocumento1 paginaScaffolding MethodMaryNessuna valutazione finora

- Materials Variance FormulasDocumento2 pagineMaterials Variance FormulasMary100% (1)

- Partial Income Statement For Manufacturing CompanyDocumento1 paginaPartial Income Statement For Manufacturing CompanyMary50% (2)

- Chunking Method DiagramDocumento1 paginaChunking Method DiagramMaryNessuna valutazione finora

- Calendars For Sales TermsDocumento2 pagineCalendars For Sales TermsMaryNessuna valutazione finora

- Labor Variance FormulasDocumento2 pagineLabor Variance FormulasMaryNessuna valutazione finora

- General Ledger PageDocumento2 pagineGeneral Ledger PageMaryNessuna valutazione finora

- Gross Profit Section of Income Statement-Periodic SystemDocumento3 pagineGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Periodic Inventory Valuation MethodsDocumento10 paginePeriodic Inventory Valuation MethodsMary100% (1)

- General Ledger 4 ColmDocumento2 pagineGeneral Ledger 4 ColmMaryNessuna valutazione finora

- How To Create Corporation WorksheetDocumento4 pagineHow To Create Corporation WorksheetMaryNessuna valutazione finora

- Analyzes of A Business TransactionDocumento13 pagineAnalyzes of A Business TransactionMary100% (1)

- Television Quality AssuranceDocumento4 pagineTelevision Quality AssurancepartibanNessuna valutazione finora

- How To Make An Advance Payment?Documento6 pagineHow To Make An Advance Payment?Renzo SantiagoNessuna valutazione finora

- MM 2011Documento4 pagineMM 2011Ak LandNessuna valutazione finora

- Oakley v. TMart - ComplaintDocumento22 pagineOakley v. TMart - ComplaintSarah BursteinNessuna valutazione finora

- Appendix 2.1 First Screen Part 1: Strength of Business IdeaDocumento4 pagineAppendix 2.1 First Screen Part 1: Strength of Business IdeaMohammad ArslaanNessuna valutazione finora

- Liquidity GapsDocumento18 pagineLiquidity Gapsjessicashergill100% (1)

- DBF - JAIIB (Indian PSU Banks)Documento10 pagineDBF - JAIIB (Indian PSU Banks)UkanyaNessuna valutazione finora

- China-Pakistan Economic Corridor Power ProjectsDocumento9 pagineChina-Pakistan Economic Corridor Power ProjectsMuhammad Hasnain YousafNessuna valutazione finora

- Property Surveyor CVDocumento2 pagineProperty Surveyor CVMike KelleyNessuna valutazione finora

- A Research Study On Customer Preference Choclate in Comparison From Traditional SweetsDocumento8 pagineA Research Study On Customer Preference Choclate in Comparison From Traditional Sweetsgudia2020Nessuna valutazione finora

- Blue DartDocumento19 pagineBlue DartB.v. SwethaNessuna valutazione finora

- Rajesh Konathala,: Curriculum VitaeDocumento3 pagineRajesh Konathala,: Curriculum VitaeRAJESHNessuna valutazione finora

- Stock Market Indicators: S&P 500 Buybacks & Dividends: Yardeni Research, IncDocumento11 pagineStock Market Indicators: S&P 500 Buybacks & Dividends: Yardeni Research, IncchristiansmilawNessuna valutazione finora

- Ch01 TB RankinDocumento9 pagineCh01 TB RankinAnton VitaliNessuna valutazione finora

- De: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolDocumento6 pagineDe: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolJONNessuna valutazione finora

- Concluding Case 6-2: Jersak Holdings LTDDocumento2 pagineConcluding Case 6-2: Jersak Holdings LTDÛbř ÖňNessuna valutazione finora

- Homework Problems-Futures (Fin. 338) - Updated (With Answers)Documento3 pagineHomework Problems-Futures (Fin. 338) - Updated (With Answers)Duc ThaiNessuna valutazione finora

- Alternative Calculation For Budgeted Factory Overhead CostsDocumento7 pagineAlternative Calculation For Budgeted Factory Overhead CostsChoi MinriNessuna valutazione finora

- Chimni - Third World Approaches To International LawDocumento25 pagineChimni - Third World Approaches To International LawTayná CarneiroNessuna valutazione finora

- 060220190337333zwlnfa8igts45ho0q Estatement 012019 910 PDFDocumento5 pagine060220190337333zwlnfa8igts45ho0q Estatement 012019 910 PDFAnanya NadendlaNessuna valutazione finora