Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Executive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006

Caricato da

idolbondocDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Executive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006

Caricato da

idolbondocCopyright:

Formati disponibili

EXECUTIVE SECRETARY vs. SOUTHWING HEAVY INDUSTRIES,INC., G.R. No.

164171 February 20, 2006 FACTS: The instant consolidated petitions seek to annul and set aside the Decisions of the Regional Trial Court of Olongapo City and Decision of the Court of Appeals which declared Article 2, Section 3.1 of Executive Order No. 156 (EO 156) unconstitutional. Said executive issuance prohibits the importation into the country, inclusive of the Special Economic and Freeport Zone or the Subic Bay Freeport (SBF or Freeport), of used motor vehicles, subject to a few exceptions. The undisputed facts show that on December 12, 2002, President Gloria Macapagal-Arroyo, through Executive Secretary Alberto G. Romulo, issued EO 156, entitled PROVIDING FOR A COMPREHENSIVE INDUSTRIAL POLICY AND DIRECTIONS FOR THE MOTOR VEHICLE DEVELOPMENT PROGRAM AND ITS IMPLEMENTING GUIDELINES. The challenged provision states: The issuance of EO 156 spawned three separate actions for declaratory relief before Branch 72 of the Regional Trial Court of Olongapo City, all seeking the declaration of the unconstitutionality of Article 2, Section 3.1 of said executive order. The cases were filed by herein respondent entities, who or whose members, are classified as Subic Bay Freeport Enterprises and engaged in the business of, among others, importing and/or trading used motor vehicles. G.R. No. 164171: On January 16, 2004, respondents Southwing Heavy Industries, Inc., (SOUTHWING) United Auctioneers, Inc. (UNITED AUCTIONEERS), and Microvan, Inc. (MICROVAN), instituted a declaratory relief case docketed as Civil Case No. 20-0-04, against the Executive Secretary, Secretary of Transportation and Communication, Commissioner of Customs, Assistant Secretary and Head of the Land Transportation Office, Subic Bay Metropolitan Authority (SBMA), Collector of Customs for the Port at Subic Bay Freeport Zone, and the Chief of the Land Transportation Office at Subic Bay Freeport Zone. SOUTHWING, UNITED AUCTIONEERS and MICROVAN prayed that judgment be rendered (1) declaring Article 2, Section 3.1 of EO 156 unconstitutional and illegal; (2) directing the Secretary of Finance, Commissioner of Customs, Collector of Customs and the Chairman of the SBMA to allow the importation of used motor vehicles; (2) ordering the Land Transportation Office and its subordinates inside the Subic Special Economic Zone to process the registration of the imported used motor vehicles; and (3) in general, to allow the unimpeded entry and importation of used motor vehicles subject only to the payment of the required customs duties. G.R. No. 164172: On January 20, 2004, respondent Subic Integrated Macro Ventures Corporation (MACRO VENTURES) filed with the same trial court, a similar action for declaratory relief docketed as Civil Case No. 22-0-04, with the same prayer and against the same parties as those in Civil Case No. 20-0-04. In this case, the trial court likewise rendered a summary judgment on May 24, 2004, holding that Article 2,

Section 3.1 of EO 156, is repugnant to the constitution. Elevated to this Court via a petition for review on certiorari, Civil Case No. 22-0-04 was docketed as G.R. No. 164172. G.R. No. 168741. On January 22, 2003, respondent Motor Vehicle Importers Association of Subic Bay Freeport, Inc. (ASSOCIATION), filed another action for declaratory relief with essentially the same prayer as those in Civil Case No. 22-0-04 and Civil Case No. 20-0-04, against the Executive Secretary, Secretary of Finance, Chief of the Land Transportation Office, Commissioner of Customs, Collector of Customs at SBMA and the Chairman of SBMA. This was docketed as Civil Case No. 30-0-2003, before the same trial court. ISSUE: Whether Article 2, Section 3.1 of Executive Order No. 156 (EO 156) unconstitutional. HELD: The Court finds that Article 2, Section 3.1 of EO 156 is void insofar as it is made applicable to the presently secured fenced-in former Subic Naval Base area as stated in Section 1.1 of EO 97-A. Pursuant to the separability clause of EO 156, Section 3.1 is declared valid insofar as it applies to the customs territory or the Philippine territory outside the presently secured fenced-in former Subic Naval Base area as stated in Section 1.1 of EO 97-A. Hence, used motor vehicles that come into the Philippine territory via the secured fenced-in former Subic Naval Base area may be stored, used or traded therein, or exported out of the Philippine territory, but they cannot be imported into the Philippine territory outside of the secured fenced-in former Subic Naval Base area.

Potrebbero piacerti anche

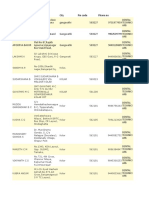

- X30531Documento48 pagineX30531Conrado Pinho Junior50% (2)

- Commissioner of Public Highway VDocumento2 pagineCommissioner of Public Highway VDc May O. LeepingNessuna valutazione finora

- JG Summit Holdings, Inc. vs. Court of Appeals, 345 SCRA 143, November 20, 2000Documento2 pagineJG Summit Holdings, Inc. vs. Court of Appeals, 345 SCRA 143, November 20, 2000idolbondocNessuna valutazione finora

- Manual On Cargo Clearance Process (E2m Customs Import Assessment System)Documento43 pagineManual On Cargo Clearance Process (E2m Customs Import Assessment System)Musa Batugan Jr.100% (1)

- 18 - G.R. No. 136351. July 28, 1999.Documento1 pagina18 - G.R. No. 136351. July 28, 1999.globeth berbanoNessuna valutazione finora

- La Chemise Lacoste, S.A. vs. Fernandez, 129 SCRA 373, May 21, 1984Documento2 pagineLa Chemise Lacoste, S.A. vs. Fernandez, 129 SCRA 373, May 21, 1984idolbondocNessuna valutazione finora

- Case Digest PILDocumento6 pagineCase Digest PILNyl John Caesar GenobiagonNessuna valutazione finora

- Phillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009Documento2 paginePhillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009idolbondoc100% (1)

- JG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003Documento2 pagineJG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003idolbondocNessuna valutazione finora

- 001 2. Social Justice Society vs. Atienza GR No 156052Documento2 pagine001 2. Social Justice Society vs. Atienza GR No 156052Raj AtmanNessuna valutazione finora

- SOP Customer ComplaintDocumento2 pagineSOP Customer ComplaintMohd Kamil77% (52)

- Garcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991Documento3 pagineGarcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991idolbondocNessuna valutazione finora

- Dualist VS MonistDocumento1 paginaDualist VS MonistGamy GlazyleNessuna valutazione finora

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994Documento2 pagineFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994idolbondocNessuna valutazione finora

- Case Digest For The Shiftless: People of The Philippines vs. Edwin Cabrera (G.r. No. 190175, November 12, 2014)Documento9 pagineCase Digest For The Shiftless: People of The Philippines vs. Edwin Cabrera (G.r. No. 190175, November 12, 2014)Josephine Redulla LogroñoNessuna valutazione finora

- Banat Case DigestDocumento2 pagineBanat Case DigestButter's ClosetNessuna valutazione finora

- Meb Ydt 16Documento21 pagineMeb Ydt 16Guney BeyNessuna valutazione finora

- Indophil Textile Mill Workers Union vs. Calica, 205 SCRA 697, February 03, 1992Documento2 pagineIndophil Textile Mill Workers Union vs. Calica, 205 SCRA 697, February 03, 1992idolbondocNessuna valutazione finora

- Miranda Versus Abaya and COMELECDocumento2 pagineMiranda Versus Abaya and COMELECDaphne RodriguezNessuna valutazione finora

- 721 SCRA 146 Imbong v. OchoaDocumento3 pagine721 SCRA 146 Imbong v. OchoaMylene Gana Maguen Manogan100% (1)

- Garcia vs. Board of Investments, 191 SCRA 288, November 09, 1990Documento2 pagineGarcia vs. Board of Investments, 191 SCRA 288, November 09, 1990idolbondocNessuna valutazione finora

- PEOPLE vs. ROGER RACAL at RAMBO, G.R. No. 224886, September 4, 2017 (Crim Law)Documento2 paginePEOPLE vs. ROGER RACAL at RAMBO, G.R. No. 224886, September 4, 2017 (Crim Law)Lalj Bernabecu100% (1)

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994Documento3 pagineFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994idolbondoc100% (1)

- John Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003Documento3 pagineJohn Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003idolbondocNessuna valutazione finora

- Communication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996Documento3 pagineCommunication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996idolbondocNessuna valutazione finora

- MR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002Documento3 pagineMR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002idolbondocNessuna valutazione finora

- Deed of Restrictions (DOR) UpdatedDocumento16 pagineDeed of Restrictions (DOR) Updatedmarj100% (1)

- Kulayan vs. TanDocumento18 pagineKulayan vs. TanKarla MTNessuna valutazione finora

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Documento3 pagineAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocNessuna valutazione finora

- Phil Bar Assn. v. ComelecDocumento22 paginePhil Bar Assn. v. ComelecQuiela Queen100% (1)

- PNB V CA (83 SCRA 237, 1978) NATURE: Certiorari To Review The Decision of The Court of Appeals Which Affirmed The Judgment of TheDocumento1 paginaPNB V CA (83 SCRA 237, 1978) NATURE: Certiorari To Review The Decision of The Court of Appeals Which Affirmed The Judgment of TheElla ArlertNessuna valutazione finora

- 2018 Bar - Legal EthicsDocumento11 pagine2018 Bar - Legal EthicsmarizenocNessuna valutazione finora

- Telecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998Documento2 pagineTelecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998idolbondoc100% (1)

- Ichong v. HernandezDocumento2 pagineIchong v. HernandezArvy VelasquezNessuna valutazione finora

- Pilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001Documento2 paginePilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001idolbondoc100% (1)

- Panasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010Documento2 paginePanasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010idolbondoc100% (1)

- Garcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989Documento2 pagineGarcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989idolbondocNessuna valutazione finora

- Political Law (Constitutional Law 2) Cases IDocumento260 paginePolitical Law (Constitutional Law 2) Cases IMaricar BautistaNessuna valutazione finora

- CRM AssignmentDocumento43 pagineCRM Assignmentharshdeep mehta100% (2)

- Sampayan Vs DazaDocumento2 pagineSampayan Vs DazaKhryz Callëja100% (1)

- Procedural Due Process - Asst. Executive SecretaryDocumento28 pagineProcedural Due Process - Asst. Executive SecretaryEzra Hilary CenizaNessuna valutazione finora

- Application For Admission To The Philippine Bar, Vicente Ching, B. M. 914, October 1, 1999Documento4 pagineApplication For Admission To The Philippine Bar, Vicente Ching, B. M. 914, October 1, 1999yanyan yuNessuna valutazione finora

- Philippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010Documento2 paginePhilippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010idolbondoc100% (1)

- Javellana Vs LuteroDocumento3 pagineJavellana Vs LuteroVirna SilaoNessuna valutazione finora

- Francisco Vs Fernando GR No. 166501Documento1 paginaFrancisco Vs Fernando GR No. 166501janeNessuna valutazione finora

- Civil Indemnity Is: People v. Degala, G.R. No. 129292, June 20, 2001Documento2 pagineCivil Indemnity Is: People v. Degala, G.R. No. 129292, June 20, 2001Maria Cherrylen Castor QuijadaNessuna valutazione finora

- Macondray - Co. v. Eustaquio, 64 Phil. 446 (1937) .Documento4 pagineMacondray - Co. v. Eustaquio, 64 Phil. 446 (1937) .Angela AquinoNessuna valutazione finora

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005Documento2 pagineCommissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005idolbondocNessuna valutazione finora

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Documento4 pagineCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNessuna valutazione finora

- 10 Maderada v. Mediodea DigestDocumento2 pagine10 Maderada v. Mediodea DigestbobNessuna valutazione finora

- 115028-2001-Shipside Inc. v. Court of Appeals PDFDocumento15 pagine115028-2001-Shipside Inc. v. Court of Appeals PDFJEANDEE FEI LEONORNessuna valutazione finora

- 010 Page 406 Baldado vs. Mejica Motion To DismissDocumento3 pagine010 Page 406 Baldado vs. Mejica Motion To DismissNafiesa ImlaniNessuna valutazione finora

- Rule 114 - Bail DigestDocumento18 pagineRule 114 - Bail DigestDemi PigNessuna valutazione finora

- Republic V MarcosDocumento11 pagineRepublic V MarcosPam RamosNessuna valutazione finora

- Petron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010Documento3 paginePetron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010idolbondocNessuna valutazione finora

- Pilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007Documento6 paginePilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007idolbondocNessuna valutazione finora

- Caunca Vs SalazarDocumento1 paginaCaunca Vs Salazarjetzon2022Nessuna valutazione finora

- Agustin v. Edu, G.R. No. L-49112Documento8 pagineAgustin v. Edu, G.R. No. L-49112Daryl CruzNessuna valutazione finora

- Persons and Family Relations Codal ProvisionsDocumento33 paginePersons and Family Relations Codal ProvisionsKIM REINA TOYONGANNessuna valutazione finora

- People VS Pacana 47 Phil 48Documento5 paginePeople VS Pacana 47 Phil 48AMTNessuna valutazione finora

- 3-Mamiscal Vs AbdullahDocumento26 pagine3-Mamiscal Vs AbdullahSugar Fructose GalactoseNessuna valutazione finora

- #57 People vs. Gregorio, 255 SCRA 380 (Different From Life Imprisonment)Documento2 pagine#57 People vs. Gregorio, 255 SCRA 380 (Different From Life Imprisonment)Jose Sunder Phil TabaderoNessuna valutazione finora

- Serana v. Sandiganbayan, G.R. No. 162059, January 22, 2008 PDFDocumento12 pagineSerana v. Sandiganbayan, G.R. No. 162059, January 22, 2008 PDFEmerson NunezNessuna valutazione finora

- Criminal Law Ii Midterms (Fiscal Petralba) CapuyanDocumento7 pagineCriminal Law Ii Midterms (Fiscal Petralba) CapuyanXyrus BucaoNessuna valutazione finora

- Case 37 Barba Vs Pedro 61 Scra 484Documento1 paginaCase 37 Barba Vs Pedro 61 Scra 484Rolando Mauring ReubalNessuna valutazione finora

- Rights of A Person Under Custodial InvestigationDocumento134 pagineRights of A Person Under Custodial InvestigationJessah Christee EgoniaNessuna valutazione finora

- STATCON Chapter 3 Digested CasesDocumento14 pagineSTATCON Chapter 3 Digested CasesSM BArNessuna valutazione finora

- People v. AgbotDocumento10 paginePeople v. AgbotKat ObreroNessuna valutazione finora

- Legal Ethics Cases For Canons 3 To 22Documento220 pagineLegal Ethics Cases For Canons 3 To 22Richard Allan LimNessuna valutazione finora

- A.M. No. 02-11-09-SCDocumento2 pagineA.M. No. 02-11-09-SCRenNessuna valutazione finora

- UntitledDocumento17 pagineUntitledanatheacadagatNessuna valutazione finora

- I. Omnibus Election Code (Sec 118)Documento43 pagineI. Omnibus Election Code (Sec 118)Jose Antonio BarrosoNessuna valutazione finora

- Case 5 GR No. 149927Documento2 pagineCase 5 GR No. 149927Wen JunhuiNessuna valutazione finora

- Case Digest of Assigned CasesDocumento56 pagineCase Digest of Assigned CasesGENEROSA GENOSANessuna valutazione finora

- People Vs ConcepcionDocumento6 paginePeople Vs ConcepcionSinetch EteyNessuna valutazione finora

- People V Peralto To People V Chua Ho SanDocumento18 paginePeople V Peralto To People V Chua Ho SanGladys Bustria OrlinoNessuna valutazione finora

- 15.pta vs. Pgde, Inc., March 19, 2012Documento5 pagine15.pta vs. Pgde, Inc., March 19, 2012Vince EnageNessuna valutazione finora

- Romualdez Vs SandiganbayanDocumento13 pagineRomualdez Vs SandiganbayanbogoldoyNessuna valutazione finora

- Esguerra NotesDocumento38 pagineEsguerra NotesjohnllenalcantaraNessuna valutazione finora

- CRIM Slides EditedDocumento6 pagineCRIM Slides EditedApril Kirstin ChuaNessuna valutazione finora

- In The Matter of The Petitions For Admission To The BarDocumento52 pagineIn The Matter of The Petitions For Admission To The BarGwenBañariaNessuna valutazione finora

- Comelec v. TagleDocumento1 paginaComelec v. TagleBenedict AlvarezNessuna valutazione finora

- 2 Lambino Vs ComelecDocumento2 pagine2 Lambino Vs ComelecApril Gem BalucanagNessuna valutazione finora

- PFR Case Valenzuela vs. Court of AppealDocumento2 paginePFR Case Valenzuela vs. Court of AppealNover Keithley Mente100% (1)

- G.R. No. 164171Documento31 pagineG.R. No. 164171Jericho CapitoNessuna valutazione finora

- Full-Text STATCONDocumento120 pagineFull-Text STATCONJIJAMNNessuna valutazione finora

- Tariff and CustomsDocumento64 pagineTariff and Customsdhyan09Nessuna valutazione finora

- EPA General PrinciplesDocumento190 pagineEPA General PrinciplesMichael Rangielo Brion GuzmanNessuna valutazione finora

- Vinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000Documento4 pagineVinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000idolbondocNessuna valutazione finora

- Toshiba Information Equipment (Phils.), Inc. vs. Commissioner of Internal Revenue, 614 SCRA 526, March 09, 2010Documento3 pagineToshiba Information Equipment (Phils.), Inc. vs. Commissioner of Internal Revenue, 614 SCRA 526, March 09, 2010idolbondocNessuna valutazione finora

- Schmid & Oberly, Inc. vs. RJL Martinez Fishing Corp., 166 SCRA 493, October 18, 1988Documento3 pagineSchmid & Oberly, Inc. vs. RJL Martinez Fishing Corp., 166 SCRA 493, October 18, 1988idolbondocNessuna valutazione finora

- National Economic Protectionism Association vs. Ongpin, 171 SCRA 657, April 10, 1989Documento2 pagineNational Economic Protectionism Association vs. Ongpin, 171 SCRA 657, April 10, 1989idolbondocNessuna valutazione finora

- Namuhe vs. Ombudsman, 298 SCRA 298, October 29, 1998Documento2 pagineNamuhe vs. Ombudsman, 298 SCRA 298, October 29, 1998idolbondocNessuna valutazione finora

- Garcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007Documento3 pagineGarcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007idolbondocNessuna valutazione finora

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996Documento3 pagineFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996idolbondocNessuna valutazione finora

- Lon L. Fuller The Problem of The Grudge InformerDocumento9 pagineLon L. Fuller The Problem of The Grudge InformerNikko SarateNessuna valutazione finora

- Statistik API Development - 080117 AHiADocumento6 pagineStatistik API Development - 080117 AHiAApdev OptionNessuna valutazione finora

- Gazette Issued Detailing Functions Under Namal's New MinistryDocumento5 pagineGazette Issued Detailing Functions Under Namal's New MinistryDarshana Sanjeewa0% (2)

- Lesson 2 - BasicDocumento7 pagineLesson 2 - BasicMichael MccormickNessuna valutazione finora

- IIM Kashipur Master of Business Administration (MBA) Microeconomics, Term I, Academic Year 2021-2022 Syllabus I. Instructor DetailDocumento20 pagineIIM Kashipur Master of Business Administration (MBA) Microeconomics, Term I, Academic Year 2021-2022 Syllabus I. Instructor DetailSai Teja MekalaNessuna valutazione finora

- Ruhr OelDocumento9 pagineRuhr OelJunghietu DorinNessuna valutazione finora

- Empower Catalog Ca6721en MsDocumento138 pagineEmpower Catalog Ca6721en MsSurya SamoerNessuna valutazione finora

- Plyler V Doe 1982Documento7 paginePlyler V Doe 1982api-412275167Nessuna valutazione finora

- StudioArabiyaTimes Magazine Spring 2022Documento58 pagineStudioArabiyaTimes Magazine Spring 2022Ali IshaanNessuna valutazione finora

- Revised WHD Quiz 2023 Flyer PDFDocumento5 pagineRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalNessuna valutazione finora

- Type Certificate Data Sheet: No. EASA.R.100Documento9 pagineType Certificate Data Sheet: No. EASA.R.100SauliusNessuna valutazione finora

- 2016 VTN Issue 026Documento24 pagine2016 VTN Issue 026Bounna PhoumalavongNessuna valutazione finora

- Eng 685 Paper 2Documento5 pagineEng 685 Paper 2api-531590952Nessuna valutazione finora

- 4 Marine Insurance 10-8-6Documento53 pagine4 Marine Insurance 10-8-6Eunice Saavedra100% (1)

- Dentapdf-Free1 1-524 1-200Documento200 pagineDentapdf-Free1 1-524 1-200Shivam SNessuna valutazione finora

- Nittscher vs. NittscherDocumento4 pagineNittscher vs. NittscherKeej DalonosNessuna valutazione finora

- Blind DefenseDocumento7 pagineBlind DefensehadrienNessuna valutazione finora

- Security System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Documento61 pagineSecurity System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Carlos Enrique Huertas FigueroaNessuna valutazione finora

- Philips AZ 100 B Service ManualDocumento8 paginePhilips AZ 100 B Service ManualВладислав ПаршутінNessuna valutazione finora

- Bhagwanti's Resume (1) - 2Documento1 paginaBhagwanti's Resume (1) - 2muski rajputNessuna valutazione finora

- سلفات بحري كومنز PDFDocumento8 pagineسلفات بحري كومنز PDFSami KahtaniNessuna valutazione finora

- Christmas Phrasal VerbsDocumento2 pagineChristmas Phrasal VerbsannaNessuna valutazione finora

- MCQ Chapter 1Documento9 pagineMCQ Chapter 1K57 TRAN THI MINH NGOCNessuna valutazione finora

- Quiz 5Documento5 pagineQuiz 5asaad5299Nessuna valutazione finora