Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Icici Bank: Key Financial Ratios

Caricato da

Sriharsha KrishnaprakashDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Icici Bank: Key Financial Ratios

Caricato da

Sriharsha KrishnaprakashCopyright:

Formati disponibili

ICICI Bank | Key Financial Ratios > Banks - Private Sector > Key Financi...

1 of 2

http://www.moneycontrol.com/stocks/company_info/print_financials.php...

This data can be easily copy pasted into a Microsoft Excel sheet

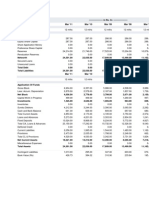

ICICI Bank

Previous Years

Key Financial Ratios

Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

Face Value

10.00

10.00

10.00

10.00

10.00

Dividend Per Share

20.00

16.50

14.00

12.00

11.00

Operating Profit Per Share (Rs)

46.32

76.15

64.08

49.80

48.58

347.40

346.19

281.04

293.74

343.59

Free Reserves Per Share (Rs)

--

376.49

358.12

356.94

351.04

Bonus in Equity Capital

--

--

--

--

--

--

4.44

4.01

5.66

3.66

Adjusted Cash Margin(%)

18.20

17.45

17.52

13.64

11.45

Net Profit Margin

17.19

16.14

15.91

12.17

9.74

Return on Long Term Fund(%)

51.77

52.09

42.97

44.72

56.72

Return on Net Worth(%)

12.48

10.70

9.35

7.79

7.58

Adjusted Return on Net Worth(%)

12.48

10.70

9.27

7.53

7.55

Return on Assets Excluding Revaluations

578.21

524.01

478.31

463.01

444.94

Return on Assets Including Revaluations

578.21

524.01

478.31

463.01

444.94

Interest Income / Total Funds

7.93

9.07

8.41

8.82

9.82

Net Interest Income / Total Funds

2.74

3.89

4.01

4.08

3.99

Non Interest Income / Total Funds

1.65

0.03

--

0.08

0.08

Interest Expended / Total Funds

5.19

5.18

4.41

4.74

5.83

Operating Expense / Total Funds

1.69

1.89

2.09

2.59

2.60

Profit Before Provisions / Total Funds

2.61

1.91

1.77

1.41

1.30

Net Profit / Total Funds

1.65

1.47

1.34

1.08

0.96

Loans Turnover

0.34

0.18

0.17

0.17

0.18

Total Income / Capital Employed(%)

9.58

9.10

8.41

8.90

9.90

Interest Expended / Capital Employed(%)

5.19

5.18

4.41

4.74

5.83

Total Assets Turnover Ratios

0.08

0.09

0.08

0.09

0.10

Asset Turnover Ratio

0.08

0.09

0.09

0.10

0.11

Interest Expended / Interest Earned

65.40

68.00

65.29

68.44

73.09

Other Income / Total Income

17.24

0.37

0.02

0.92

0.86

Operating Expense / Total Income

17.60

20.77

24.81

29.05

26.22

--

0.73

0.94

0.72

1.74

18.74

18.52

19.54

19.41

15.53

--

65.30

64.96

58.57

69.86

Investment Valuation Ratios

Net Operating Profit Per Share (Rs)

Profitability Ratios

Interest Spread

Management Efficiency Ratios

Profit And Loss Account Ratios

Selling Distribution Cost Composition

Balance Sheet Ratios

Capital Adequacy Ratio

Advances / Loans Funds(%)

7/16/2013 12:17 PM

ICICI Bank | Key Financial Ratios > Banks - Private Sector > Key Financi...

2 of 2

http://www.moneycontrol.com/stocks/company_info/print_financials.php...

Debt Coverage Ratios

Credit Deposit Ratio

43.54

92.23

87.81

90.04

91.44

Investment Deposit Ratio

60.38

61.16

59.77

53.28

46.35

Cash Deposit Ratio

7.21

8.60

11.32

10.72

10.14

Total Debt to Owners Fund

4.39

4.23

4.10

3.91

4.42

Financial Charges Coverage Ratio

0.52

0.39

0.44

0.33

0.25

Financial Charges Coverage Ratio Post

Tax

1.34

1.31

1.34

1.26

1.20

0.98

0.13

0.11

0.14

0.13

10.53

16.71

15.86

14.70

5.94

Dividend Payout Ratio Net Profit

31.22

32.82

35.23

37.31

36.60

Dividend Payout Ratio Cash Profit

29.48

30.36

31.76

32.33

31.00

Earning Retention Ratio

68.78

67.19

64.49

61.40

63.23

Cash Earning Retention Ratio

70.52

69.65

68.01

66.70

68.87

AdjustedCash Flow Times

33.19

36.54

39.77

44.79

49.41

Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

72.17

56.09

44.73

36.10

33.76

578.21

524.01

478.31

463.01

444.94

Leverage Ratios

Current Ratio

Quick Ratio

Cash Flow Indicator Ratios

Earnings Per Share

Book Value

Source : Dion Global Solutions Limited

7/16/2013 12:17 PM

Potrebbero piacerti anche

- Small Money Big Impact: Fighting Poverty with MicrofinanceDa EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNessuna valutazione finora

- ICICI Bank RatiosDocumento2 pagineICICI Bank RatiosSriharsha KrishnaprakashNessuna valutazione finora

- Microsoft Dynamics AX 2012 R3 Financial ManagementDa EverandMicrosoft Dynamics AX 2012 R3 Financial ManagementValutazione: 5 su 5 stelle5/5 (2)

- Balance SheetDocumento1 paginaBalance SheetKian EganNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Money ControlDocumento1 paginaMoney ControlRishu ThakurNessuna valutazione finora

- Bank RatiosDocumento5 pagineBank RatiosSubba RaoNessuna valutazione finora

- Money ControlDocumento1 paginaMoney ControlsindhukotaruNessuna valutazione finora

- State Bank of India: PrintDocumento2 pagineState Bank of India: PrintakshayNessuna valutazione finora

- Money Control 3Documento2 pagineMoney Control 3Deepraj PathakNessuna valutazione finora

- Money ControlDocumento2 pagineMoney ControlHIGUYS_CHILLEDNessuna valutazione finora

- Moneycontrol cf3Documento1 paginaMoneycontrol cf3Avalanche SainiNessuna valutazione finora

- HDFCDocumento1 paginaHDFCAjith KumarNessuna valutazione finora

- Mahindra & Mahindra Financial Services: Previous YearsDocumento4 pagineMahindra & Mahindra Financial Services: Previous YearsJacob KvNessuna valutazione finora

- Eveready Industries India: Dion Global Solutions LimitedDocumento1 paginaEveready Industries India: Dion Global Solutions LimitedDeepraj PathakNessuna valutazione finora

- Tata Motors RatiosDocumento2 pagineTata Motors RatiosRahul GargNessuna valutazione finora

- Moneycontrol BOIDocumento1 paginaMoneycontrol BOIswap2390Nessuna valutazione finora

- Adani Ports and Special Economic Zone - Consolidated Balance Sheet - Infrastructure - General - Consolidated Balance Sheet of Adani Ports and Special Economic Zone - BSE - 532921, NSE - ADANIPORTS PDFDocumento2 pagineAdani Ports and Special Economic Zone - Consolidated Balance Sheet - Infrastructure - General - Consolidated Balance Sheet of Adani Ports and Special Economic Zone - BSE - 532921, NSE - ADANIPORTS PDFShashank YadavNessuna valutazione finora

- Dabur India: Key Financial RatiosDocumento5 pagineDabur India: Key Financial RatiosHiren ShahNessuna valutazione finora

- South Indian Bank: PrintDocumento1 paginaSouth Indian Bank: Printrohitplus123Nessuna valutazione finora

- Maruti Suzuki India: PrintDocumento2 pagineMaruti Suzuki India: PrintAbhinav Prakash100% (1)

- Tata Consultancy Services - Balance Sheet Computers - Software Balance Sheet of Tata Consultancy Services - BSE - 532540, NSE - TCSDocumento2 pagineTata Consultancy Services - Balance Sheet Computers - Software Balance Sheet of Tata Consultancy Services - BSE - 532540, NSE - TCSSuraj GeorgeNessuna valutazione finora

- Amity School of Business Amity University, Noida, Uttar PradeshDocumento11 pagineAmity School of Business Amity University, Noida, Uttar PradeshGautam TandonNessuna valutazione finora

- 2 FaaaltuDocumento1 pagina2 FaaaltuMehul DhameliyaNessuna valutazione finora

- Assignment of Fundamentals of Financial ManagementDocumento10 pagineAssignment of Fundamentals of Financial ManagementShashwat ShuklaNessuna valutazione finora

- Fundcard: SBI Banking & Financial Services Fund - Regular PlanDocumento4 pagineFundcard: SBI Banking & Financial Services Fund - Regular PlanNikit ShahNessuna valutazione finora

- Financial Analysis: A Study of J & K Bank Limited: AbhinavDocumento6 pagineFinancial Analysis: A Study of J & K Bank Limited: AbhinavSanjay SaqlainNessuna valutazione finora

- Data 2010Documento9 pagineData 2010krittika03Nessuna valutazione finora

- Money RolDocumento2 pagineMoney RolAman BansalNessuna valutazione finora

- Performance Benchmarking Report 12 NewDocumento46 paginePerformance Benchmarking Report 12 NewVishal KoulNessuna valutazione finora

- 09p165 Mbfi Swot AnalysisDocumento9 pagine09p165 Mbfi Swot AnalysisrudranilsterNessuna valutazione finora

- Tata Steel: PrintDocumento2 pagineTata Steel: PrintKanika SinghNessuna valutazione finora

- Print: Previous YearsDocumento2 paginePrint: Previous YearsMayur PatelNessuna valutazione finora

- Indian Banking: Emerging Issues and Enhancing Competitive EfficiencyDocumento19 pagineIndian Banking: Emerging Issues and Enhancing Competitive EfficiencykishorejalaparthiNessuna valutazione finora

- Basic StatisticsDocumento2 pagineBasic StatisticsBeing Sumit SharmaNessuna valutazione finora

- All Bank of RajasthanDocumento7 pagineAll Bank of RajasthanAnonymous 6TyOtlNessuna valutazione finora

- UntitledDocumento1 paginaUntitledSaraswathy ArunachalamNessuna valutazione finora

- EMSCFIN-FARDocumento37 pagineEMSCFIN-FARPuwanachandran KaniegahNessuna valutazione finora

- Stock Analysis of Computer Software Companies of IndiaDocumento17 pagineStock Analysis of Computer Software Companies of IndiabhargavigowdaNessuna valutazione finora

- Valuation SheetDocumento23 pagineValuation SheetDanish KhanNessuna valutazione finora

- Bs Syndicate BankDocumento1 paginaBs Syndicate BankMangesh ChandeNessuna valutazione finora

- Kotak Mahindra Bank: Previous YearsDocumento2 pagineKotak Mahindra Bank: Previous YearsSandip PatelNessuna valutazione finora

- Askri Final 1Documento10 pagineAskri Final 1fahadsiddiqNessuna valutazione finora

- ValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19Documento4 pagineValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19asddsffdsfNessuna valutazione finora

- Revenue StatementDocumento2 pagineRevenue StatementShiva ShettyNessuna valutazione finora

- M B MDocumento22 pagineM B MAparna SinghNessuna valutazione finora

- Icici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceDocumento7 pagineIcici Bank, HDFC Bank &: Evaluation & Comparison of PerformanceNabarun MajumderNessuna valutazione finora

- Fundcard: HDFC Sensex ETFDocumento4 pagineFundcard: HDFC Sensex ETFChittaNessuna valutazione finora

- Kotak Mahindra BankDocumento3 pagineKotak Mahindra BankShubham SahNessuna valutazione finora

- Mahindra and Mahindra: PrintDocumento2 pagineMahindra and Mahindra: PrintSombwit KabasiNessuna valutazione finora

- Careeer Point Word - Doc FINALDocumento13 pagineCareeer Point Word - Doc FINALKaran JainNessuna valutazione finora

- Balance Sheet of InfosysDocumento5 pagineBalance Sheet of InfosysLincy SubinNessuna valutazione finora

- ValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02Documento4 pagineValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02JoydeepSuklabaidyaNessuna valutazione finora

- ValueResearchFundcard SBIBanking&FinancialServicesFund DirectPlan 2019jun16Documento4 pagineValueResearchFundcard SBIBanking&FinancialServicesFund DirectPlan 2019jun16Phani VemuriNessuna valutazione finora

- Question BankDocumento8 pagineQuestion BankEvangelineNessuna valutazione finora

- Tata Consultancy Services: PrintDocumento2 pagineTata Consultancy Services: PrintParasVashishtNessuna valutazione finora

- 4june2014 India DailyDocumento40 pagine4june2014 India DailyhitpunNessuna valutazione finora

- My Bank Has Better NPA Than Your BankDocumento7 pagineMy Bank Has Better NPA Than Your Bankhk_scribdNessuna valutazione finora

- Kotak Mahindra Bank: Previous YearsDocumento24 pagineKotak Mahindra Bank: Previous YearsSandip PatelNessuna valutazione finora

- Monthly Corporate Action Tracker: June 6, 2016Documento11 pagineMonthly Corporate Action Tracker: June 6, 2016arun_algoNessuna valutazione finora

- Equilibrium Forward Curves For CommoditiesDocumento42 pagineEquilibrium Forward Curves For CommoditiesSriharsha KrishnaprakashNessuna valutazione finora

- Sovereign Credit AnalyisDocumento7 pagineSovereign Credit AnalyisSriharsha KrishnaprakashNessuna valutazione finora

- Relation BT Forw Price & Fut Price - Journal of Financial Economics PDFDocumento26 pagineRelation BT Forw Price & Fut Price - Journal of Financial Economics PDFSriharsha KrishnaprakashNessuna valutazione finora

- Burghardt Hoskins The Convexity Bias in Eurodollar FutureDocumento16 pagineBurghardt Hoskins The Convexity Bias in Eurodollar FutureMohamad KarakiNessuna valutazione finora

- Health PackagesDocumento2 pagineHealth PackagesSriharsha KrishnaprakashNessuna valutazione finora

- Sovereign Credit AnalyisDocumento7 pagineSovereign Credit AnalyisSriharsha KrishnaprakashNessuna valutazione finora

- Deciphering The Liquidity and Credit CrunchDocumento25 pagineDeciphering The Liquidity and Credit CrunchSriharsha KrishnaprakashNessuna valutazione finora

- Indian Banking IndustryDocumento19 pagineIndian Banking IndustryCarlos BaileyNessuna valutazione finora

- Obama's Speech ParliamentDocumento9 pagineObama's Speech ParliamentNikhil TrivediNessuna valutazione finora

- Risk Management Failures - What Are They and When Do They Happen PDFDocumento20 pagineRisk Management Failures - What Are They and When Do They Happen PDFSriharsha KrishnaprakashNessuna valutazione finora

- Morningstar Equity and Credit Research CoverageDocumento25 pagineMorningstar Equity and Credit Research CoverageSriharsha KrishnaprakashNessuna valutazione finora

- Financial RatiosDocumento15 pagineFinancial RatiosValentinorossiNessuna valutazione finora

- Excel FormulaeDocumento208 pagineExcel FormulaePrasoon SinghNessuna valutazione finora

- Financial RatiosDocumento15 pagineFinancial RatiosValentinorossiNessuna valutazione finora

- Union Budget FY13Documento8 pagineUnion Budget FY13Sriharsha KrishnaprakashNessuna valutazione finora

- Trikala Rigvediya Sandhya VandanamDocumento74 pagineTrikala Rigvediya Sandhya Vandanamrrachuri100% (2)

- Obama's Speech ParliamentDocumento9 pagineObama's Speech ParliamentNikhil TrivediNessuna valutazione finora

- 1 - Top Interview QuestionsDocumento6 pagine1 - Top Interview QuestionsMahesh SudrikNessuna valutazione finora

- Assignment Ratio AnalysisDocumento11 pagineAssignment Ratio Analysiscrossbonez93100% (1)

- Engineers' Pay and Financial Performance: Technical FeatureDocumento5 pagineEngineers' Pay and Financial Performance: Technical FeatureVinod NairNessuna valutazione finora

- Retail Book Chap06Documento21 pagineRetail Book Chap06Harman Gill100% (1)

- Atlas Incorporated - Marketing Management ReportDocumento38 pagineAtlas Incorporated - Marketing Management Reportagreen89Nessuna valutazione finora

- Tea UnderstandingDocumento3 pagineTea UnderstandingSadiya SaharNessuna valutazione finora

- Test Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Documento7 pagineTest Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Christian Villahermosa ToleroNessuna valutazione finora

- Biomass Conversion and Liquefaction Process v1 0Documento22 pagineBiomass Conversion and Liquefaction Process v1 0AlexanderNessuna valutazione finora

- AQA As Business Unit 2 Course CompanionDocumento130 pagineAQA As Business Unit 2 Course CompanionCiaraHyndsNessuna valutazione finora

- CO5117 TuteSols Topic08 2011Documento2 pagineCO5117 TuteSols Topic08 2011Shibin JayaprasadNessuna valutazione finora

- Key Performance Indicators Sample ChapterDocumento48 pagineKey Performance Indicators Sample ChapterMihaela Dobre100% (1)

- Analysis & Interpretation of Data RatioDocumento28 pagineAnalysis & Interpretation of Data RatiomallathiNessuna valutazione finora

- SM Supersonic Stereo ExhibitsDocumento9 pagineSM Supersonic Stereo ExhibitsAshish MittalNessuna valutazione finora

- Ramji Bai VasavaDocumento9 pagineRamji Bai Vasavaajatc6048100% (1)

- Icici Bank: Key Financial RatiosDocumento2 pagineIcici Bank: Key Financial RatiosSriharsha KrishnaprakashNessuna valutazione finora

- Gross ProfitDocumento3 pagineGross ProfitRafeh2Nessuna valutazione finora

- Quiz Financial Management 1keyDocumento14 pagineQuiz Financial Management 1keyAdiansyach Patonangi100% (1)

- UKMM1043 Basic Economic, Accounting and Management May 2012 QuestionDocumento2 pagineUKMM1043 Basic Economic, Accounting and Management May 2012 QuestionJoson ChaiNessuna valutazione finora

- Tutorial 1-Financial AnalysisDocumento3 pagineTutorial 1-Financial AnalysisOh Yi ZeNessuna valutazione finora

- Common Size and Comparative Statements Format of Statement of Profit and LossDocumento18 pagineCommon Size and Comparative Statements Format of Statement of Profit and LosssatyaNessuna valutazione finora

- Unit 18: Calculating Food Costs, Selling Prices and Making A ProfitDocumento4 pagineUnit 18: Calculating Food Costs, Selling Prices and Making A Profitkarupukamal100% (2)

- Ratio Analysis and Comparative Study at Bhushan Steel1Documento45 pagineRatio Analysis and Comparative Study at Bhushan Steel1pujanswetalNessuna valutazione finora

- Tata Motors RatiosDocumento2 pagineTata Motors RatiosRahul GargNessuna valutazione finora

- A Study On Financial Performance Analysis of HDFC Limited: WWW - Aensi.inDocumento11 pagineA Study On Financial Performance Analysis of HDFC Limited: WWW - Aensi.inPiyush DhanukaNessuna valutazione finora

- Profit and Loss Projection 1yr 0Documento1 paginaProfit and Loss Projection 1yr 0Suraj RathiNessuna valutazione finora

- Case 4 Apple ValleyDocumento43 pagineCase 4 Apple ValleyPrincess Likely100% (2)

- Profitability Analysis - Cost AccountingDocumento15 pagineProfitability Analysis - Cost AccountingMA CadizNessuna valutazione finora

- Cloud Mustang Executive SummaryDocumento7 pagineCloud Mustang Executive SummarygowrishhhhNessuna valutazione finora

- Forrest GumpDocumento4 pagineForrest Gumpcarmenng19900% (1)

- Tata Motors Ratio Analysis 1235110826059887 1Documento14 pagineTata Motors Ratio Analysis 1235110826059887 1Hari OmNessuna valutazione finora

- Money ControlDocumento2 pagineMoney ControlHIGUYS_CHILLEDNessuna valutazione finora

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDa EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsValutazione: 5 su 5 stelle5/5 (1)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDa EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistValutazione: 4 su 5 stelle4/5 (32)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Mind over Money: The Psychology of Money and How to Use It BetterDa EverandMind over Money: The Psychology of Money and How to Use It BetterValutazione: 4 su 5 stelle4/5 (24)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- How to Measure Anything: Finding the Value of Intangibles in BusinessDa EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessValutazione: 3.5 su 5 stelle3.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)