Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

UNIKZN Negotiable Instruments Exam Questions

Caricato da

qanaqDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

UNIKZN Negotiable Instruments Exam Questions

Caricato da

qanaqCopyright:

Formati disponibili

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: SUBJECT, COURSE AND CODE: DURATION: 2 HOURS + 15 minutes reading time External Examiner

Internal Examiner : : Professor JT Pretorius Mr A Ramdhin NOVEMBER 2009 NEGOTIABLE INSTRUMENTS (LAWS4NG) TOTAL MARKS: 75

STUDENTS ARE REQUESTED, IN THEIR OWN INTERESTS, TO WRITE LEGIBLY

STUDENT NUMBER:

____________________

___________________________________________________________________________________________ INSTRUCTIONS: 1. 2. 3. 4. This paper consists of TEN (10) pages. Please ensure that you have all of the pages. Please note that Section A and Section B are compulsory. There is, however, a choice between Section C and Section D. Please note the marks allocated for each question and apportion your time accordingly. Please note that this question paper must be handed in together with your answer booklet. Under no circumstances will your answers be marked if this question paper is not submitted therewith. Please note that the multiple choice questions must be answered in your answer booklet and not on this question paper.

5.

SECTION A (10 MARKS)

Please select the most appropriate answer from the options provided.

1.1 Which of the following statements is/are correct? i According to the case of Standard Bank of SA Ltd v Minister of Bantu Education 1966 (1) SA 229 (N) a savings account may give rise to a bank-customer relationship for the purposes of the Bills of Exchange Act. A current account without an overdraft facility does not constitute a credit facility for the purposes of the National Credit Act. A fixed deposit receipt/ fixed deposit certificate is a negotiable instrument. (A) (B) (C) (D) (E) Statement i only Statement ii only Statements ii and iii Statements i, ii and iii None of the above options

ii

Iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 2

1.2

Which of the following statements is/are correct? i According to the case of Nedbank v Pestana 2009 (2) SA 189 (SCA), a bank may not unilaterally reverse a credit transfer under any circumstances. In the case of Diners Club SA (Pty) Ltd v Singh and another 2004 (3) SA 630 (D), the court upheld a clause in a contract between the credit card issuer and the cardholder which placed the risk of loss or unauthorised use squarely on the cardholder. Where there is an agreement between the debtor and creditor to accept payment by stop order, the stop order creates a vinculum juris between the creditor and the bank. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

1.3

Peter draws a cheque in favour of Cash or Order and issues the cheque to Zuraida. Zuraida specially indorses the cheque in favour of Kwami and hands the cheque to him. The cheque is stolen from Kwami by Junaid. Which of the following statements is/are incorrect? i Junaid would not qualify as the holder of the instrument but will nevertheless have title to sue should the cheque be dishonoured. In the event of the cheque being dishonoured, Zuraida cannot be sued in terms of the cambial obligation as she is a transferor by delivery. In the event of the cheque being dishonoured, and Junaid deciding to sue Peter in terms of the cambial obligation, Peter cannot raise the defence of no delivery as Junaid may qualify as a holder in due course. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 3

1.4

A draws a cheque in favour of B or order and issues the cheque to B. B then indorses the cheque in favour of C and hands the cheque to C. C then indorses the cheque in favour of D and hands it to D who in turn indorses the cheque in favour of E and hands it to E. E then indorses the cheque in favour of F and delivers it to him. Which of the following statements is/are correct? i It is not possible for F to negotiate the cheque to D as the Bills of Exchange Act prohibits the negotiation of a cheque back to a prior indorser. It is possible for F to negotiate the cheque back to D, and in the event of the cheque being dishonoured, D will be able to sue any one of A, B, C, E or F for the full amount of the debt. If the cheque was crossed and marked not negotiable then it would not have been possible for B (i.e. the named payee) to have negotiated the cheque further. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

1.5

A owes money to B for goods which B sold and delivered to him pursuant to a contract of sale. A issues a cheque in favour of B in payment of the debt. Which of the following statements is/are incorrect? i If the cheque is dishonoured then B may elect to sue A either in terms of the cambial obligation or in terms of the contract of sale save in circumstances where the parties have agreed that the taking of the cheque will amount to a novation of the underlying debt. Although it is possible for B to sue A in terms of the contract of sale (in the event of the cheque being dishonoured) he will be precluded from doing so if he has in the interim negotiated the cheque to C. If the cheque is dishonoured, B would be precluded from suing A on the cheque in circumstances where he has retained possession of the cheque but has ceded his rights in terms of the contract of sale to C. (A) (B) (C) (D) (E) Statement ii only Statement iii only Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 4

1.6

X draws a cheque in favour of P or order for the amount of R 1 000, 00 and issues the cheque to P. P specially indorses the cheque in favour of Q and hands the cheque to Q. Q then hands the cheque to Z. The cheque in question is dishonoured as a result of the drawer having countermanded payment. Which of the following statements is/are incorrect? i Z will not qualify as the holder and will therefore be precluded from suing on the instrument. Even if Z qualified as the holder of the instrument, he will not be able to sue X without first giving him notice of dishonour. If Q, upon receiving the cheque from P, had indorsed the cheque Pay Z, R 500, 00 and delivered the cheque to Z, then Z would qualify as the holder in these circumstances. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

1.7

Darren draws a cheque in favour of Stephanie or order for the sum of R 1 000. Stephanie, who is a minor, increases the amount to R 10 000 and negotiates the instrument to Rowen (who does not realise that Stephanie is a minor). Which of the following statements is/are incorrect? i If the instrument is dishonoured, Rowens attempts to sue Darren on the instrument can be thwarted by the defence of lack of capacity. If the instrument is dishonoured, Darren can avoid any liability to Rowen on the basis of a material alteration even if Rowen qualifies as a holder in due course. If Rowen indorses and delivers the cheque to Peter and the instrument is subsequently dishonoured, Rowen if sued by Peter, can raise the defence of material alteration. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 5

1.8

Which of the following statements is/are correct? i Provided that the requirements stipulated in the section are met, s 58 of the Bills of Exchange Act provides protection to a drawee bank which pays out on an order cheque in which the drawers signature is forged. Every holder in due course is a holder and every holder is a holder in due course. A banks which pays cash over the counter on an unindorsed or irregularly indorsed cheque will not be entitled to the protection provided by s 83 of the Bills of Exchange Act (as amended). (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii iii

1.9

Which of the following statements is/are incorrect? i A not transferable cheque does not fall within the ambit of the protection provided by s 83 of the Bills of Exchange Act. According to the Bills of Exchange Act, a natural person may sign by making a mark instead of writing out his/her full name and surname A drawee bank which acts negligently may still be entitled to the protection provided by s 58 of the Bills of Exchange Act if it otherwise complies with the provisions of the section. (A) (B) (C) (D) (E) Statement i only Statements i and ii Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 6 1.10 Which of the following statements is/are incorrect? i A bank which negligently supplies an incorrect or inaccurate bankers reference to a third party can incur delictual liability to the third party on the basis of negligent misstatement or negligent misrepresentation. According to the decision of ABSA Bank Ltd v Fouche 2003 (1) SA 176 (SCA), a bank is under a duty to disclose any shortcomings in its security system to a customer who rents a safety-deposit box from the bank even where this was not material to the customers decision to enter into the contract for the hire of the safety-deposit box. The case of Commissioner, South African Revenue Service and another v ABSA Bank Ltd and another 2003 (2) SA 96 (W) constitutes authority for the proposition that a bank cannot incur delictual liability to a third party for negligently opening a bank account in circumstances where it does not act in the capacity as collecting bank. (A) (B) (C) (D) (E) Statement iii only Statement ii only Statements ii and iii Statements i, ii and iii None of the above options

ii

iii

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 7 SECTION B (45 MARKS)

PLEASE NOTE THAT THIS SECTION IS COMPULSORY AND THAT ALL QUESTIONS IN THIS SECTION MUST BE ANSWERED

QUESTION 1

(25)

R draws a cheque on ABSA Bank dated 30 November 2009 in favour of X or order for the amount of R 1800, 00 and issues the cheque to X. X specially indorses the cheque in favour of Y and delivers the cheque to him. Y appends his signature to the back of the cheque (without writing any further words thereon) and hands the cheque to Z who hands the cheque to P. P inserts the words Pay S above Ys signature on the back of the cheque and hands the cheque to S who hands the cheque to Q. In light of the above facts, answer the following questions: 1.1 Explain whether Q is the holder of the instrument and explain what rights he has in respect of the instrument. (5 marks) Assume that the instrument is subsequently dishonoured and that Q is entitled to sue on the instrument. Explain whether Q would be entitled to sue the following parties: 1.2.1. 1.2.2. 1.3 P Z (2 marks) (3 marks)

1.2

You are approached by R (i.e. the drawer of the cheque). Advise your client fully on the legal position in each of the following separate instances: 1.3.1 R informs you that he countermanded payment and Q now wants to sue him on the dishonoured cheque bearing the amount of R 18 000, 00. (5 marks) R informs you that he countermanded payment but ABSA Bank overlooked the countermand and paid Q the amount of R 18 000, 00 on 28 November 2009. ABSA Bank subsequently debited his account in the amount of R 18 000, 00. (10 marks)

1.3.2

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 8

QUESTION 2 (8)

2.1 2.2 2.3 Explain the difference between a credit transfer and a debit transfer. Explain what you understand by the term EFTPOS Explain the effect of the following marking on the face of a particular cheque: (4 marks) (2 marks) (2 marks)

QUESTION 3 (12)

Explain the legal position in each of the following separate instances: 3.1 Mr Dirk Swart is a practising attorney who runs his practice in Pietermaritzburg. He holds his trust current account and trust savings account at CSI Bank. Unfortunately, Mr Swart is presently under investigation by the Kwazulu-Natal Law Society and CSI Bank subsequently receives a letter from the Council of the Law Society requesting a certificate of balance in respect of the accounts held at the bank by Mr Swart. Explain whether the bank is allowed to provide the Law Society with the requisite information in light of the duty of confidentiality which it owes to its customer. (4 marks) Mr Tom Jones has a current account at CSI Bank which presently reflects a credit balance of R 10 000, 00. Tom also has an overdraft facility with the bank which was granted under the cover of a deed of suretyship. The aforesaid suretyship has subsequently been withdrawn. Tom draws a cheque in favour of the Msunduzi Municipality in the amount of R 10 800, 00. Explain whether CSI Bank is obliged to honour the cheque in these circumstances. (5 marks) Mr Hardluck is a client of CSI Bank. On Friday, 13 September 2009, Mr Hardluck attempted to withdraw money from an ATM machine at CSI Bank. Unfortunately, his card got stuck in the machine and, after seeking the assistance of various personnel in the bank, he was finally able to retrieve his card (although he did not make the desired withdrawal). At the end of the month, Mr Hardluck receives a bank statement which indicates that his account was debited in the amount of R 4 000, 00 on 13 September 2009. An aggrieved Mr Hardluck subsequently reports the matter to the Ombudsman for Banking Services. The Ombudsman makes a recommendation to the effect that CSI Bank should reimburse Mr Hardluck for any loss which he has suffered as the bank was not entitled to debit his account in these circumstances. Explain whether CSI Bank is legally bound by the recommendation made by the Ombudsman (you can assume for the purposes of this question that CSI bank is subject to the jurisdiction of the Ombudsman for Banking Services). (3 marks)

3.2

3.3

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 9 PLEASE ANSWER EITHER SECTION C OR SECTION D ________________________________________________________________________________ SECTION C (20 marks)

QUESTION 1

(10)

The bank becomes the owner of all moneys deposited in its customers current and can use such money immediately for its own purposes, to the exclusion of the rights of any third parties

Critically discuss the above statement in light of the case of Joint Stock Co Varvarinskoye v ABSA Bank Ltd and Others 2008 (4) SA 287 (SCA) AND

QUESTION 2

(10)

Explain whether X can qualify as a holder in due course in each of the following separate instances. For the purposes of this question you need only mention the element/elements which might be in issue. 2.1 X is in possession of a cheque drawn in favour of Y or order. The cheque was drawn by Z in favour of Y and subsequently negotiated to X by Y. Although the cheque in question was intended to be post-dated, Zs computer system which generated the cheque was unable to do this. As a result thereof, the date which appeared on the cheque was the date on which the cheque was generated. However, prior to issuing the cheque to Y, Z altered the date to reflect the intended date for payment and signed the alteration in question. X acquired the cheque in good faith and for value. (5 marks) X is the payee of a post-dated cheque. The cheque is issued to him by Y pursuant to a valid contract of sale of sale between the parties. (3 marks) X is in possession of a cheque drawn in favour of Y or order. The cheque was drawn by Z in favour of Y in payment of a debt stemming from the sale of pirated DVDs, and was subsequently negotiated to X by Y. X knows that Y sells pirated DVDs among other goods and is aware of the circumstances under which the cheque was issued. (2 marks)

2.2

2.3

UNIVERSITY OF KWAZULU-NATAL, PIETERMARITZBURG EXAMINATIONS: NOVEMBER 2009 SUBJECT: NEGOTIABLE INSTRUMENTS PAGE 10 SECTION D (20 marks)

QUESTION 1

(10)

Write a note in you critically discuss South Africas Code of Banking Practice. Your answer should cover the following: Is there a need for a Code of Banking Practice? Are the provisions of the Code of Banking Practice legally enforceable? Can a provision of the Code of Banking Practice be construed as forming a tacit term in the relationship between the bank and its customer? What role does the Ombudsman for banking services play in enforcing the Code of Banking Practice?

AND

QUESTION 2

(4)

Peter Poonsamy receives an order cheque from one of his debtors. The cheque is made payable to Pieter Moonsamy. Explain whether he will qualify as the holder of the cheque. Assume that Peter wishes to negotiate the cheque to Jack Daniels in payment of a debt which he owes. What must Peter do in order to validly negotiate the cheque to Jack?

AND

QUESTION 3

(6)

You are approached for legal advice by X. He advises you that on 10 June 2005, he drew a cheque on behalf of Y in favour of Z or order. The cheque was drawn pursuant to a contract of sale between Y and Z. Although Ys name appears with Xs signature on the face of the cheque, there are no words inscribed on the cheque indicating that X was signing in a representative capacity. The cheque was subsequently dishonoured but Z only serves the summons on X on 10 August 2009. X requires advice on whether Z is precluded from suing on the cheque in light of the fact that the underlying debt has prescribed. Furthermore, X requires advice on whether he can incur personal liability as he did not qualify as his signature when he signed the cheque. It is common cause that X was duly authorised to sign the cheque on behalf of Y.

Potrebbero piacerti anche

- Negotiable Instruments 2010Documento12 pagineNegotiable Instruments 2010qanaqNessuna valutazione finora

- CDCS Specimen Paper C - QPDocumento30 pagineCDCS Specimen Paper C - QPNavin ChoudharyNessuna valutazione finora

- Century Egg Dedicated to Carl VincentDocumento31 pagineCentury Egg Dedicated to Carl VincentMary Rose Ramos100% (1)

- Nego Suggested Answers 2008Documento11 pagineNego Suggested Answers 2008farsuyNessuna valutazione finora

- Mid-Terms Negotiable Instrument Questionnaire February 2 2016 Ver 1.2Documento12 pagineMid-Terms Negotiable Instrument Questionnaire February 2 2016 Ver 1.2Eppie SeverinoNessuna valutazione finora

- LIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Documento30 pagineLIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Abhay PandereNessuna valutazione finora

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocumento4 pagineACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNessuna valutazione finora

- Delivery of Instrument Key to LiabilityDocumento3 pagineDelivery of Instrument Key to LiabilityAquino, JPNessuna valutazione finora

- Quizzer 2 Pdic SBD Ub Week 14 Set BDocumento7 pagineQuizzer 2 Pdic SBD Ub Week 14 Set Bmariesteinsher0Nessuna valutazione finora

- 151218142343Documento60 pagine151218142343asdf100% (1)

- PT Bank Maybank Syariah Indonesia v Mindo-Trade Sdn Bhd Summary JudgmentDocumento16 paginePT Bank Maybank Syariah Indonesia v Mindo-Trade Sdn Bhd Summary JudgmentTsai Shiang YeapNessuna valutazione finora

- Law Neg o PDFDocumento14 pagineLaw Neg o PDFKendrew SujideNessuna valutazione finora

- Mock 06 001Documento36 pagineMock 06 001masud khan0% (1)

- Bespile SDN BHD (In Liquidation) V Asianshine SDN BHD & OrsDocumento18 pagineBespile SDN BHD (In Liquidation) V Asianshine SDN BHD & OrsSaidatulnajwaNessuna valutazione finora

- CDCS Specimen Paper A - 2017-18Documento35 pagineCDCS Specimen Paper A - 2017-18LêTrungHiếuNessuna valutazione finora

- Sample ExamDocumento2 pagineSample ExamattymauNessuna valutazione finora

- AR Astern Niversity: Atty. Aldren D. Abrigo, CPADocumento3 pagineAR Astern Niversity: Atty. Aldren D. Abrigo, CPARamainne RonquilloNessuna valutazione finora

- (C 01) DBP vs. Sima Wei, 219 SCRA 736, March 9, 1993Documento8 pagine(C 01) DBP vs. Sima Wei, 219 SCRA 736, March 9, 1993JJNessuna valutazione finora

- Nego Final Exam QuestionsDocumento2 pagineNego Final Exam QuestionsResci Angelli Rizada-Nolasco50% (2)

- 12-Development Bank of Rizal v. Sima Wei 219 SCRA 736 (1993)Documento3 pagine12-Development Bank of Rizal v. Sima Wei 219 SCRA 736 (1993)Ronald Alasa-as AtigNessuna valutazione finora

- Adobe Scan 31-Mar-2024Documento24 pagineAdobe Scan 31-Mar-2024Mishra DPNessuna valutazione finora

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocumento13 pagineSuggested Answers To Bar Exam Questions 2008 On Mercantile LawMary LouiseNessuna valutazione finora

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocumento9 pagineSuggested Answers To Bar Exam Questions 2008 On Mercantile LawsevenfivefiveNessuna valutazione finora

- 1991-1996 BAR Mercantile QuestionsDocumento63 pagine1991-1996 BAR Mercantile QuestionsasdgafsdgadfgNessuna valutazione finora

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocumento4 pagineACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNessuna valutazione finora

- 59Documento4 pagine59KAYE JAVELLANANessuna valutazione finora

- Law 20013 Finals ReviewerDocumento9 pagineLaw 20013 Finals ReviewerHans ManaliliNessuna valutazione finora

- Escober, Alon & Associates For Petitioner. Martin D. Pantaleon For Private RespondentsDocumento17 pagineEscober, Alon & Associates For Petitioner. Martin D. Pantaleon For Private RespondentsCarla Eclarin BojosNessuna valutazione finora

- RIVERA, Lyka A. (Assign 4 - Law)Documento4 pagineRIVERA, Lyka A. (Assign 4 - Law)Lysss EpssssNessuna valutazione finora

- COMMREV Nego DigestsDocumento36 pagineCOMMREV Nego DigestsAnge Buenaventura Salazar100% (3)

- 129179-1992-Bank of The Philippine Islands v. Court Of20210424-12-F7qjuzDocumento26 pagine129179-1992-Bank of The Philippine Islands v. Court Of20210424-12-F7qjuzLydia Marie Inocencio-MirabelNessuna valutazione finora

- Development Bank of Rizal v. Sima WeiDocumento6 pagineDevelopment Bank of Rizal v. Sima WeiKaren Patricio LusticaNessuna valutazione finora

- NEGOTIABLE INSTRUMENTS LAWDocumento4 pagineNEGOTIABLE INSTRUMENTS LAWLing EscalanteNessuna valutazione finora

- (A) Pancho Asked The Payor Bank To Recredit His Account. Should The Bank Comply? Explain Fully. (3%)Documento5 pagine(A) Pancho Asked The Payor Bank To Recredit His Account. Should The Bank Comply? Explain Fully. (3%)zhoy26Nessuna valutazione finora

- HCA322D - 2008 BonusclaimDocumento141 pagineHCA322D - 2008 BonusclaimpschilNessuna valutazione finora

- Development Bank of Rizal v. Sima Wei and or Lee Kian HuatDocumento2 pagineDevelopment Bank of Rizal v. Sima Wei and or Lee Kian HuatbearzhugNessuna valutazione finora

- Equity Bank Tanzania LTD Vs Johnelly TZ Company Limited (Civil Appeal 37 of 2020) 2021 TZHC 6076 (22 July 2021)Documento13 pagineEquity Bank Tanzania LTD Vs Johnelly TZ Company Limited (Civil Appeal 37 of 2020) 2021 TZHC 6076 (22 July 2021)kelvinmalwa50Nessuna valutazione finora

- Resa Anti Bouncing Checks LawDocumento2 pagineResa Anti Bouncing Checks LawArielle D.Nessuna valutazione finora

- BPI v. CADocumento23 pagineBPI v. CApistekayawaNessuna valutazione finora

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawDocumento28 pagineSuggested Answers To Bar Exam Questions 2008 On Mercantile LawRJay JacabanNessuna valutazione finora

- UntitledDocumento3 pagineUntitledJunaid DadayanNessuna valutazione finora

- 2015 Bar Exam Suggested Answers in Mercantile LawDocumento14 pagine2015 Bar Exam Suggested Answers in Mercantile Lawargao100% (1)

- Understanding Contracts of Indemnity and Bank GuaranteesDocumento4 pagineUnderstanding Contracts of Indemnity and Bank GuaranteesPriyanshi VashishtaNessuna valutazione finora

- Nego 2022Documento16 pagineNego 2022crescente pagadduNessuna valutazione finora

- JJ CasesDocumento30 pagineJJ CasesRhose Azcelle MagaoayNessuna valutazione finora

- Nego MCQDocumento13 pagineNego MCQwainie_deroNessuna valutazione finora

- NEGOTIABLE INSTRUMENTS: FUNCTIONS, TYPES, AND PARTIESDocumento3 pagineNEGOTIABLE INSTRUMENTS: FUNCTIONS, TYPES, AND PARTIESWilson Freo Jr.Nessuna valutazione finora

- Mercantile Law ReviewerDocumento13 pagineMercantile Law ReviewerMarjorie Ramirez100% (1)

- Death Claim Settlement Policy SummaryDocumento11 pagineDeath Claim Settlement Policy SummaryPIYUSH YADAVNessuna valutazione finora

- STATE INVESTMENT HOUSE, INC. Vs CADocumento5 pagineSTATE INVESTMENT HOUSE, INC. Vs CAClaudia Rina LapazNessuna valutazione finora

- NegoDocumento8 pagineNegoJica GulaNessuna valutazione finora

- Dev Bank of Rizal VS Sima WeiDocumento4 pagineDev Bank of Rizal VS Sima WeiKristanne Louise YuNessuna valutazione finora

- Development Bank of Rizal Vs Sima Wei PDFDocumento3 pagineDevelopment Bank of Rizal Vs Sima Wei PDFkaren mae bollerNessuna valutazione finora

- Section 1. Interrogatories To Parties Service Thereof. - Upon Ex Parte Motion, Any Party Desiring To ElicitDocumento3 pagineSection 1. Interrogatories To Parties Service Thereof. - Upon Ex Parte Motion, Any Party Desiring To ElicitAmerigo VespucciNessuna valutazione finora

- 2015 Bar Exam Suggested Answers in Mercantile Law by The UP Law ComplexDocumento14 pagine2015 Bar Exam Suggested Answers in Mercantile Law by The UP Law ComplexLenar GamoraNessuna valutazione finora

- DBP Vs Sima WeiDocumento5 pagineDBP Vs Sima WeiKrister VallenteNessuna valutazione finora

- 2008 Bar Questions and AnswersDocumento15 pagine2008 Bar Questions and AnswersimoymitoNessuna valutazione finora

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionDa EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNessuna valutazione finora

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Da EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Nessuna valutazione finora

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsDa EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsValutazione: 5 su 5 stelle5/5 (1)

- Geography P1 Memo Eng Nov 2008 FinalDocumento17 pagineGeography P1 Memo Eng Nov 2008 FinalPatrick Van WykNessuna valutazione finora

- Geography P2 Memo Eng Nov 2008 FinalDocumento9 pagineGeography P2 Memo Eng Nov 2008 FinalqanaqNessuna valutazione finora

- Geography P1 Nov 2008 EngDocumento25 pagineGeography P1 Nov 2008 EngqanaqNessuna valutazione finora

- Hospitality Studies Memo Nov 2008 Eng MemoDocumento14 pagineHospitality Studies Memo Nov 2008 Eng MemoqanaqNessuna valutazione finora

- History P1 Eng. Nov. 2008Documento10 pagineHistory P1 Eng. Nov. 2008qanaq100% (1)

- History P1 Nov 2010 Memo EngDocumento30 pagineHistory P1 Nov 2010 Memo EngqanaqNessuna valutazione finora

- History p2 Nov 2008 Memo EngDocumento30 pagineHistory p2 Nov 2008 Memo Engqanaq0% (1)

- History P2 Eng Nov 2008Documento10 pagineHistory P2 Eng Nov 2008qanaqNessuna valutazione finora

- Life Sciences P2 Nov 2008 Eng Memo FinalDocumento13 pagineLife Sciences P2 Nov 2008 Eng Memo FinalqanaqNessuna valutazione finora

- Life Sciences P2 Nov 2008 Eng Memo FinalDocumento13 pagineLife Sciences P2 Nov 2008 Eng Memo FinalqanaqNessuna valutazione finora

- IT P2 Eng Memo Nov 2008Documento15 pagineIT P2 Eng Memo Nov 2008qanaqNessuna valutazione finora

- Life Sciences P2 Nov 2008 Eng Memo FinalDocumento13 pagineLife Sciences P2 Nov 2008 Eng Memo FinalqanaqNessuna valutazione finora

- Information Technology P1 Eng. Nov. 2008Documento32 pagineInformation Technology P1 Eng. Nov. 2008qanaqNessuna valutazione finora

- National Senior Certificate: Grade 12Documento21 pagineNational Senior Certificate: Grade 12qanaqNessuna valutazione finora

- Life Science P1 Nov 2008 Eng Memo FinalDocumento13 pagineLife Science P1 Nov 2008 Eng Memo Finalbellydanceafrica9540Nessuna valutazione finora

- Life Science P1 Nov 2008 EngDocumento18 pagineLife Science P1 Nov 2008 EngqanaqNessuna valutazione finora

- Mechanical Technology Nov 2008 EngDocumento25 pagineMechanical Technology Nov 2008 EngqanaqNessuna valutazione finora

- Music P1 Nov 2008 EngDocumento26 pagineMusic P1 Nov 2008 EngqanaqNessuna valutazione finora

- National Senior Certificate: Grade 12Documento13 pagineNational Senior Certificate: Grade 12qanaqNessuna valutazione finora

- 20140109151014542Documento7 pagine20140109151014542qanaqNessuna valutazione finora

- Physical Sciences P2 Memo Eng & Afr Nov 2008Documento18 paginePhysical Sciences P2 Memo Eng & Afr Nov 2008qanaq50% (2)

- Maths Literacy P2 Nov 2008 Memo EngDocumento22 pagineMaths Literacy P2 Nov 2008 Memo Engqanaq25% (4)

- Maths Literacy P1 Nov 2008 Memo AfrDocumento17 pagineMaths Literacy P1 Nov 2008 Memo AfrqanaqNessuna valutazione finora

- Life Sciences P2 Nov 2008 EngDocumento16 pagineLife Sciences P2 Nov 2008 EngqanaqNessuna valutazione finora

- Terms and Conditions: Prepaid RentalsDocumento1 paginaTerms and Conditions: Prepaid RentalsqanaqNessuna valutazione finora

- Mechanical Technology Nov 2008 Eng MemoDocumento19 pagineMechanical Technology Nov 2008 Eng MemoqanaqNessuna valutazione finora

- Music P2 Nov 2008 Eng MemoDocumento12 pagineMusic P2 Nov 2008 Eng MemoqanaqNessuna valutazione finora

- Music P1 Nov 2008 Eng MemoDocumento29 pagineMusic P1 Nov 2008 Eng MemoqanaqNessuna valutazione finora

- Maths Literacy P1 Nov 2008 Memo EngDocumento17 pagineMaths Literacy P1 Nov 2008 Memo Engqanaq100% (2)

- Mechanical Technology Nov 2008 Eng MemoDocumento19 pagineMechanical Technology Nov 2008 Eng MemoqanaqNessuna valutazione finora

- 3 Duets From J.S. Bach's English SuitesDocumento8 pagine3 Duets From J.S. Bach's English SuitesSilvia MacejovaNessuna valutazione finora

- People V ViernesDocumento14 paginePeople V Viernesjack fackageNessuna valutazione finora

- Kramer - Dynamic of Destruction Culture and Mass Killing in The First World War (2007) PDFDocumento447 pagineKramer - Dynamic of Destruction Culture and Mass Killing in The First World War (2007) PDFJeffNessuna valutazione finora

- FC Steaua BucurestiDocumento17 pagineFC Steaua BucurestiMartina MartyNessuna valutazione finora

- Policy Guidelines On The Proper Use of Computer and NetworkDocumento9 paginePolicy Guidelines On The Proper Use of Computer and NetworkJeanette Gonzales Aliman0% (1)

- War Crimes: AFP PNPDocumento19 pagineWar Crimes: AFP PNPsensei.adoradorNessuna valutazione finora

- Gabionsa v. CADocumento11 pagineGabionsa v. CADennis VelasquezNessuna valutazione finora

- Vda. de Bautista V Marcos DigestDocumento1 paginaVda. de Bautista V Marcos DigestBenedict EstrellaNessuna valutazione finora

- Emma Rothschild The Quest For World Order What Is 1995Documento47 pagineEmma Rothschild The Quest For World Order What Is 1995Marin100% (1)

- Articles Price CollusionDocumento7 pagineArticles Price CollusionNidhi ShahNessuna valutazione finora

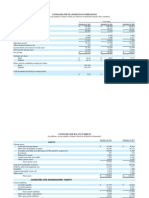

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Documento5 pagineConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNessuna valutazione finora

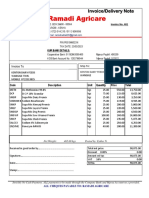

- Ramadi Agricare: Invoice/Delivery NoteDocumento2 pagineRamadi Agricare: Invoice/Delivery NoteRamadi cyberNessuna valutazione finora

- Copyright SamplingDocumento256 pagineCopyright SamplingsukanmikNessuna valutazione finora

- PSAK 51-RevDocumento5 paginePSAK 51-Revapi-3708783Nessuna valutazione finora

- Gashem Shookat Baksh v. Court of Appeals GR No. 97336. February 19, 1993Documento3 pagineGashem Shookat Baksh v. Court of Appeals GR No. 97336. February 19, 1993Debroah Faith PajarilloNessuna valutazione finora

- Kalinchowk Darshan Limited PDFDocumento52 pagineKalinchowk Darshan Limited PDFMandip DcNessuna valutazione finora

- Daphne Hermetic Oil Fv50s Eu1Documento3 pagineDaphne Hermetic Oil Fv50s Eu1torqueuNessuna valutazione finora

- Property Regimes Self-TestDocumento16 pagineProperty Regimes Self-TestMardeePinedaBorcena33% (18)

- Digitalization of Work in The Mirror of Labour Law Principles in HungaryDocumento11 pagineDigitalization of Work in The Mirror of Labour Law Principles in HungaryGlobal Research and Development ServicesNessuna valutazione finora

- TESDA Circular No. 038-2019Documento12 pagineTESDA Circular No. 038-2019Leonicia MarquinezNessuna valutazione finora

- Solution for Chapter 23 causality and transformationsDocumento8 pagineSolution for Chapter 23 causality and transformationsSveti JeronimNessuna valutazione finora

- Ias 40 - Presentation PDFDocumento21 pagineIas 40 - Presentation PDFAnonymous ns1HpZKAfNessuna valutazione finora

- Ched-Dbm Joint Memorandum Circular No. 2017-1Documento13 pagineChed-Dbm Joint Memorandum Circular No. 2017-1John Ceasar PascoNessuna valutazione finora

- FMBO 205 IInd Sem QBDocumento18 pagineFMBO 205 IInd Sem QBanishaNessuna valutazione finora

- Developing Good Work EthicDocumento3 pagineDeveloping Good Work Ethiclance100% (1)

- Calculate The Standard Free Energy For The Following Reaction by Using Given DataDocumento5 pagineCalculate The Standard Free Energy For The Following Reaction by Using Given DatamuraliMuNessuna valutazione finora

- What Is Forensic AccountingDocumento2 pagineWhat Is Forensic AccountingJonhmark AniñonNessuna valutazione finora

- FA1 NotesDocumento270 pagineFA1 Notesdaneq80% (10)

- Cantesco SolventDocumento5 pagineCantesco Solventmasv792512Nessuna valutazione finora

- Questions On Alphabet Series PDFDocumento4 pagineQuestions On Alphabet Series PDFGajendra JoshiNessuna valutazione finora