Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Assignment MB0041 MBA 1 Fall 2013

Caricato da

nitinsoodCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Assignment MB0041 MBA 1 Fall 2013

Caricato da

nitinsoodCopyright:

Formati disponibili

DRIVE PROGRAM SEMESTER SUBJECT CODE & NAME BK ID CREDIT MARKS

ASSIGNMENT FALL 2013 MBADS / MBAHCSN3 / MBAN2 / PGDBAN2 / MBAFLEX I MB0041 & FINANCIAL AND MANAGEMENT ACCOUNTING B1624 4 60

Marks Total Marks Criteria Q.No Inventory in a business is valued at the end of an accounting period, at either cost or market price, 1 whichever is lower. This is accepted convention or a practice in accounting. Give a small introduction on accounting conventions and elucidate all the eight accounting conventions. A Introduction of accounting convention Explanation of all the 8 types of conventions 2 2 8 10

Write down a table with the accounts involved / the nature of account/its affects/ debit or credit. Please have the transactions given below and prepare the table as per the instructions given above for each transaction. a. 1.1.2011 Sunitha started his business with cash Rs. 5,00,000 b. 2.1.2011 Borrowed from Malathi Rs. 5,00,000 c. 2.1.2011 Purchased furniture Rs. 1,00,000 d. 4.1.2011 Purchased furniture from Meenal on credit Rs. 1,50,000 e. 5.1.2011 Purchased goods for cash Rs. 50,000 f. 6.1.2011 Purchased goods from Ram on credit Rs. 2,50,000 g. 8.1.2011 Sold goods for cash Rs. 1,25,000 h. 8.1.2011 Sold goods to Shyam on credit Rs. 55,000 i. 9.1.2011 Received cash from Shyam Rs. 25,000 j. 10.1.2011 Paid cash to Ram Rs. 90,000 Filling in all the details in the table for all the transactions. Each transaction carries one mark(1*10=10)

10

10

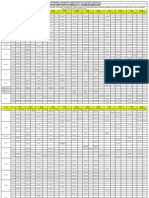

From the given trial balance, draft an Adjusted Trial Balance. Trial Balance as on 31.03.2013 Debit balances Furniture and Fittings Buildings Sales Returns Bad Debts Sundry Debtors Purchases Advertising Cash Taxes and Insurance General Expenses Salaries TOTAL Rs. Credit balances 15000 Bank Over Draft 500000 Capital Account 1000 Purchase Returns 2000 Sundry Creditors 25000 Commission 90000 Sales 20000 10000 5000 7000 20000 695000 TOTAL 695000 Rs. 16000 400000 4000 35000 5000 235000

Adjustments: 1. Charge depreciation at 10% on Buildings and Furniture and fittings. 2. Write off further bad debts 1000 3. Taxes and Insurance prepaid 2000 4. Outstanding salaries 5000 5. Commission received in advance1000 A Preparation of all the ledger a/cs Preparation of adjusted trial balance as on 31.3.2013 5 5 10

The reports prepared in financial accounting are also used in the management accounting. But there are few major differences between financial accounting and management accounting. Explain the differences between financial accounting and management accounting in various dimensions. Writing down all the differences between the 10 10 financial and management accounting Draw the Balance Sheet for the following information provided by Sandeep Ltd.. a. Current Ratio : 2.50 b. Liquidity Ratio : 1.50 c. Net Working Capital : Rs.300000 d. Stock Turnover Ratio : 6 times e. Ratio of Gross Profit to Sales : 20%

f. g. h. i. A 6

Fixed Asset Turnover Ratio Average Debt collection period Fixed Assets to Net Worth Reserve and Surplus to Capital :

: 2 times : 2 months : 0.80 0.50 10 10

Preparation of Balance sheet (Includes all the ratios)

Write the main differences between cash flow analysis and fund flow analysis. Following is the balance sheet for the period ending 31st March 2011 and 2012. If the current years net loss is Rs.38,000, Calculate the cash flow from operating activities. 31st MARCH 2011 2012 15,000 18,000 30,000 8,000 1,200 18,000 20,000 15,000 13,000 10,000 22,000 800 600 300 500 4 6 10

Short-term loan to employees Creditors Provision for doubtful debts Bills payable Stock in trade Bills receivable Prepaid expenses Outstanding expenses Differences between cash flow and fund flow analysis Preparation of statement showing cash flow from operating activities

*A-Answer Note Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme.

Potrebbero piacerti anche

- TIME TABLE - Winter 15-April16 ExamDocumento15 pagineTIME TABLE - Winter 15-April16 ExamNitinSoodNessuna valutazione finora

- MB0045Documento13 pagineMB0045nitinsoodNessuna valutazione finora

- Sample 2Documento26 pagineSample 2nitinsoodNessuna valutazione finora

- 1Documento19 pagine1nitinsoodNessuna valutazione finora

- TIME TABLE - Spring 15 (July 2015 Exam) - V1Documento16 pagineTIME TABLE - Spring 15 (July 2015 Exam) - V1nitinsoodNessuna valutazione finora

- Scholarship - Additional InfoDocumento1 paginaScholarship - Additional InfonitinsoodNessuna valutazione finora

- Re-Evaluation Form (Form - 3 R) PDFDocumento1 paginaRe-Evaluation Form (Form - 3 R) PDFnitinsoodNessuna valutazione finora

- MB0044Documento6 pagineMB0044MeenakshiGautamNessuna valutazione finora

- Gyandeep Scholarship Terms With Declaration PDFDocumento4 pagineGyandeep Scholarship Terms With Declaration PDFReeshma NairNessuna valutazione finora

- Available Before ExaminationsDocumento15 pagineAvailable Before ExaminationsKartik RoksNessuna valutazione finora

- Re-Evaluation Form (Form - 3 R) PDFDocumento1 paginaRe-Evaluation Form (Form - 3 R) PDFnitinsoodNessuna valutazione finora

- Instructions Form 16 Re-AdmissionDocumento5 pagineInstructions Form 16 Re-AdmissionnitinsoodNessuna valutazione finora

- SU SDE Datesheet Aug 2014Documento20 pagineSU SDE Datesheet Aug 2014nitinsoodNessuna valutazione finora

- Maruti Suzuki Project AnalysisDocumento2 pagineMaruti Suzuki Project AnalysisnitinsoodNessuna valutazione finora

- SMU - 3rd Sem MBA - Synopsis and ProjectGuidelinesDocumento37 pagineSMU - 3rd Sem MBA - Synopsis and ProjectGuidelinesnitinsood0% (1)

- SyllabusDocumento32 pagineSyllabusnitinsoodNessuna valutazione finora

- Appointment PGT - IP - .pdf30 - 16 - 2014 - 03 - 05 - 43Documento36 pagineAppointment PGT - IP - .pdf30 - 16 - 2014 - 03 - 05 - 43nitinsood100% (2)

- Rajesh Kumar CVDocumento1 paginaRajesh Kumar CVnitinsoodNessuna valutazione finora

- SMU TIME TABLE - Spring14 (July 2014 Exam) - V1Documento16 pagineSMU TIME TABLE - Spring14 (July 2014 Exam) - V1nitinsoodNessuna valutazione finora

- Assignment MB0039Documento10 pagineAssignment MB0039nitinsoodNessuna valutazione finora

- The Study On Indian Financial System Post Liberalization: A Project Report Under The Guidance of MR - Satish KumarDocumento106 pagineThe Study On Indian Financial System Post Liberalization: A Project Report Under The Guidance of MR - Satish Kumarnitinsood0% (1)

- AssignmentDocumento7 pagineAssignmentnitinsoodNessuna valutazione finora

- Reliance Life Insurance ReportDocumento70 pagineReliance Life Insurance ReportnitinsoodNessuna valutazione finora

- MB0052Documento2 pagineMB0052Runa RashidNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 90+ Indian Cities List with Location and Address DetailsDocumento9 pagine90+ Indian Cities List with Location and Address DetailsnitinsoodNessuna valutazione finora

- Hospital Management SystemDocumento46 pagineHospital Management SystemnitinsoodNessuna valutazione finora

- AilmentDocumento2 pagineAilmentnitinsoodNessuna valutazione finora

- 90+ Indian Cities List with Location and Address DetailsDocumento9 pagine90+ Indian Cities List with Location and Address DetailsnitinsoodNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Topic:-Green Bonds in India-Performance, Scope and Future Scenario in The CountryDocumento5 pagineTopic:-Green Bonds in India-Performance, Scope and Future Scenario in The Countryrishav tiwaryNessuna valutazione finora

- INTERNAL RECONSTRUCTION OF COMPANIESDocumento4 pagineINTERNAL RECONSTRUCTION OF COMPANIESZiya ShaikhNessuna valutazione finora

- Forex Literature ReviewDocumento6 pagineForex Literature Reviewafmzhpeloejtzj100% (1)

- Updated AP ListDocumento12 pagineUpdated AP ListSusan KunkleNessuna valutazione finora

- 1AY19MBA68 Kavyashree Final Reprot.1pdfDocumento96 pagine1AY19MBA68 Kavyashree Final Reprot.1pdfkavyashree mesthaNessuna valutazione finora

- Ceres Gardening Company cash flow analysisDocumento3 pagineCeres Gardening Company cash flow analysisrtrakashgera 220% (1)

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Documento12 pagineChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNessuna valutazione finora

- Ketan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School KolkataDocumento13 pagineKetan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School Kolkatamohitbothra50% (4)

- Letter of Interest TemplatesDocumento9 pagineLetter of Interest TemplatesMelissa BritoNessuna valutazione finora

- Preqin Quarterly Private Debt Update Q2 2015Documento8 paginePreqin Quarterly Private Debt Update Q2 2015ed_nycNessuna valutazione finora

- Quiz 1Documento6 pagineQuiz 1jojojepNessuna valutazione finora

- Significance of Payback Analysis in Decision-MakingDocumento9 pagineSignificance of Payback Analysis in Decision-MakingdutrafaissalNessuna valutazione finora

- Invoice / Statement of Account: Invois / Penyata AkaunDocumento4 pagineInvoice / Statement of Account: Invois / Penyata AkauntinaNessuna valutazione finora

- Money and BankingDocumento8 pagineMoney and BankingMuskan RahimNessuna valutazione finora

- Bollinger Band (Part 2)Documento5 pagineBollinger Band (Part 2)Miguel Luz RosaNessuna valutazione finora

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocumento4 pagineInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNessuna valutazione finora

- Board Question Paper EconomicsDocumento18 pagineBoard Question Paper Economics9137373282abcdNessuna valutazione finora

- Select City Walk (Tarun)Documento15 pagineSelect City Walk (Tarun)Tarun BatraNessuna valutazione finora

- Geothermal Exploration Best Practices: A Guide To Resource Data Collection, Analysis, and Presentation For Geothermal ProjectsDocumento74 pagineGeothermal Exploration Best Practices: A Guide To Resource Data Collection, Analysis, and Presentation For Geothermal ProjectsIFC Sustainability100% (1)

- Chapter 15: Maintaining Integrity, Objectivity and IndependenceDocumento11 pagineChapter 15: Maintaining Integrity, Objectivity and IndependenceMh AfNessuna valutazione finora

- 57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCDocumento85 pagine57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCAravamudhan Srinivasan100% (4)

- Tax Advisor Confirmation LetterDocumento1 paginaTax Advisor Confirmation LetterAung Zaw Htwe100% (1)

- The British Money MarketDocumento2 pagineThe British Money MarketAshis karmakarNessuna valutazione finora

- Investing Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderDocumento1 paginaInvesting Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderCosimo Dell'OrtoNessuna valutazione finora

- Stoic Lesson On FinanceDocumento8 pagineStoic Lesson On Financefrank menshaNessuna valutazione finora

- Share Capital + Reserves Total +Documento2 pagineShare Capital + Reserves Total +Pitresh KaushikNessuna valutazione finora

- Taxation Course OutlineDocumento6 pagineTaxation Course OutlineMawanda Ssekibuule SuudiNessuna valutazione finora

- Key Fact StatementDocumento4 pagineKey Fact Statementsanjeev guptaNessuna valutazione finora