Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Untitled

Caricato da

api-239405494Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Untitled

Caricato da

api-239405494Copyright:

Formati disponibili

Sector Review:

Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

Primary Credit Analysts: May Zhong, Melbourne (61) 3-9631-2164; may.zhong@standardandpoors.com Lawrence Lu, CFA, Hong Kong (852) 2533-3517; law.lu@standardandpoors.com Secondary Contacts: Sangyun Han, Hong Kong (852) 2533-3526; sangyun.han@standardandpoors.com Xavier Jean, Singapore (65) 6239-6346; xavier.jean@standardandpoors.com Gloria Lu, CFA, FRM, Hong Kong (852) 2533-3596; gloria.lu@standardandpoors.com Andrew M Wong, Singapore (65) 6239-6306; andrew.wong@standardandpoors.com

Table Of Contents

Slow Recovery In Credit Metrics For Metals And Minerals Companies Sector Outlook Key Risks And Trends Ask The Analyst Oil And Gas Fortunes Will Rise And Fall In Line With Economic Conditions Sector Outlook Key Risks And Trends Ask The Analyst Related Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT DECEMBER 4, 2013 1

1224110 | 301447691

Sector Review:

Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

(Editor's Note: This article is part of a series on the credit trends of Asia-Pacific's corporate sectors for 2014. The series responds to analytical queries received recently on a sector or a specific issuer in that sector.)

Slow Recovery In Credit Metrics For Metals And Minerals Companies

Analysts: May Zhong, Xavier Jean, Sangyun Han

Sector Outlook

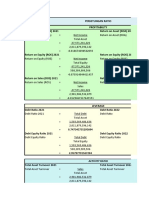

Standard & Poor's Ratings Services expects the negative credit outlook for the Asia-Pacific metals and mining sector to moderate in 2014 (see table 1). Our forecasts for the Asia-Pacific mining sector show that most companies' profitability and credit metrics should bottom out in 2013 (see charts 1, 2, and 3). Supporting this view are three key factors: 1) a ramp-up in volumes across the sector; 2) a leveling of operating margins in 2013 because of companies' initiatives to cut operating costs and improve productivity in response to low commodity prices; 3) deferral of growth capital expenditure to preserve cash.

Table 1

Asia-Pacific Metals and Minerals Sector

Business conditions Business outlook Financial trend Sector outlook Weak No change Slightly improving Negative

Nonetheless, we expect the improvement in credit metrics will be slow and modest. Commodity prices are unlikely to bounce back strongly in the next 12-18 months because of pockets of oversupply for certain minerals, such as coking and thermal coal and nickel, and metals such as steel and aluminum. The weak commodity prices would hamper a strong recovery in earnings and cash flows. In monitoring the sector's credit quality, we also focus on the liquidity levels of weaker companies, including their operating cost and working capital management, control over stripping costs, and refinancing activity.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 2

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

Chart 1

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 3

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

Chart 2

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 4

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

Chart 3

Key Risks And Trends

The major risk for the sector is slower demand growth for steel and raw materials from China. We expect China's demand growth for metals and minerals will be lower than its overall macroeconomic expansion, as the country gradually transitions to a consumption-led economic model. In India, in addition to moderate demand growth, internal factors such as a mining ban, delay in environmental clearances, and challenges with land acquisition are key risks for this country's metals and mining sector. Overcapacity will continue to plague the sector at least until the first half of 2014. Segments experiencing a severe glut are the aluminum, nickel, thermal coal, and coking coal industries. Meanwhile, merger and acquisition activities seem to be slowing on the back of a soft sector outlook.

Ask The Analyst

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 5

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

What's the profitability outlook for steel manufacturers in North Asia?

We don't expect steel prices and margins to recover strongly in 2014, although modest improvement and stabilization should occur during the period. Steelmakers in North Asia face persistently intense competition regionally and overcapacity, particularly in China. The mounting competition has spiked exports from China, Japan, and India. This trend might continue in 2014 because of slow demand recovery, significant overcapacity, robust production, and weaker local currencies. The only bright spot is lower raw material prices, in particular for coking coal. The price for coking coal has recently gone down to US$150/ton from almost US$300/ton in 2011.

What's the outlook for the iron ore sector?

We believe iron ore prices may continue to support miners' strong cash flows in the first half of 2014, with still robust demand from China and incremental increases in supply. However, we expect prices to trend downward in the medium term when new low-cost seaborne expansion from Australia and Brazil fully ramps up, and India resumes its iron ore exports. As such, Standard & Poor's price deck assumes an iron ore price (CIF China Fe62%) of US$110 per ton for calendar year 2014 and US$100 per ton for 2015, to calculate the expected credit metrics of rated companies. Given iron ore's significant contribution to earnings and cash flows to mining companies such as BHP Billiton Ltd., Rio Tinto PLC, and Fortescue Metals Group Ltd. (FMG), an unexpected significant decline in iron ore prices that coincides with heavy capital expenditure could worsen the credit quality of these companies. Mining majors such as Rio, BHP, and FMG have already cut costs substantially in light of the fall in prices. Moreover, productivity gains, cost cuts, and higher production volumes from their expansion projects should help to reduce their unit costs further. In our view, these initiatives should position major iron ore producers to weather a future downcycle after completion of their current round of expansion.

How are speculative-grade companies coping with lower commodity prices, particularly in terms of their liquidity levels and refinancing risk?

The subdued outlook for commodity prices could affect some companies' access to capital markets or reduce support from lenders. In fact, we took a number of negative rating actions in the past three months because of reducing liquidity levels and heightened refinancing risk for marginal miners. The ratings on Australia's Mirabela Nickel Ltd. were lowered to 'D' because of a missed interest payment recently. Meanwhile, Indonesian miner PT Bumi Resources Tbk.'s liquidity cushion has declined materially because cash flows have reduced as a result of lower prices and declining cash balances since early 2013. We believe the company still faces significant refinancing risk in 2014. Likewise, Mongolian Mining Corp. (MMC) was downgraded, to 'B-' in August 2013, because of the company's reduced liquidity cushion and refinancing risk. We expect MMC's liquidity sources will not cover its liquidity needs over the next 12 months, despite an improvement in operating cash flows and unless the company rolls over its promissory notes and refinances its bank loans. China's coal miner Hidili Industry International Development Ltd. is facing severe liquidity issues that will hamper its

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 6

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

ability to pay its high interest burden in the next 12 months. The negative outlook also reflects the company's limited options to repay its debt, and the possibility that it will be unable to roll over its short-term debt.

Oil And Gas Fortunes Will Rise And Fall In Line With Economic Conditions

Analysts: Lawrence Lu, Andrew Wong, Gloria Lu

Sector Outlook

The credit outlook for Asia-Pacific oil and gas companies will largely be stable for 2014. We think that refiners and marketers may face more challenges though, particularly in environments where price regulations exist. We don't project any startling developments for the sector in 2014, with most companies sticking to current business plans to keep their ratings stable at their respective levels (see table 2).

Table 2

Asia Pacific Oil And Gas Sector Outlook For 2014

Business conditions Business outlook Financial trends Sector outlook Satisfactory No change Same Stable

Key Risks And Trends

The sector's key risk is a slow global recovery or a recession that resulted in much lower demand, weaker prices, and reducing cash flows. Also posing risks are uncertain acquisition appetites and the financial discipline of oil companies, plus weaker profitability generally. Among the trends we've noticed are regional economic growth boosting energy demand, and an increase in the economic and political importance of the sector across the region. Elevated prices are supporting oil and gas companies' access to internal and external capital, while discretion in spending plans has been used amid an environment of weaker operating conditions all round.

Ask The Analyst

Has the investigation of CNPC's senior executives had an impact on CNPC's credit quality and, for that matter, China's oil and gas industry?

We believe that the investigation will have minimum impact on the daily operations of China National Petroleum Corp. (CNPC), because central government-owned enterprises like CNPC have tight supervision from the sole shareholder--the State Asset Supervision and Administration Commission. We expect CNPC to continue investing overseas, as China's reliance on import oil will continue to rise in line with its expanding economy--albeit likely at a slower pace than in the past. In our opinion, the growth momentum of China's

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 7

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

economy is unlikely to change in the next few years, and because scale is important for the oil companies to compete globally, the likelihood of the government breaking up such companies is remote in the near-to-medium term. That said, should the government open up the industry to allow more private capital participation, it would weaken the business risk profiles of China's three national oil companies, as it would undermine their current monopolistic positions in the domestic market.

What is Standard & Poor's view on the oil price and oil companies' spending plans?

While we routinely publish oil and natural gas price assumptions, we do not forecast oil and gas prices. We use the price assumptions for financial modeling to assess a company's credit quality and to compare credit quality among oil and gas companies. We have short-term (two-year) price deck assumptions that include a conservative discount for the hydrocarbon forward-price curves. The long-term price deck (three years and beyond) factors in supply and demand fundamentals and industry cost curves, among other factors. Typically, oil companies' spending plans are based on conservative price assumptions to evaluate the economics of a project through the cycle. Spending plans also consider future energy demand. We have seen oil and gas companies' spending plans spike by almost 80% since 2008. This increase is due to the size, complexity, and cost per barrel of oil of projects. We believe these spending plans will remain elevated, considering the growth in energy demand. However, these plans contain some discretion related to mergers and acquisitions, enabling companies to moderate expenditure should operating conditions deteriorate. That has been the case in the second half of 2013, with several companies (among them Petroliam Nasional Bhd. and PTT Public Co. Ltd.) announcing the deferral of expenditure in view of a weaker outlook for oil prices.

If the oil price declines sharply, the oil companies could face material impairment loss--how do you factor this in the rating analysis?

We view impairment losses as a balance-sheet impact only, and this does not directly affect our analysis. Instead, we look at the cash flow metrics and the impact of a sharp decline in oil prices on a company's cash flow coverage.

Related Research

Articles in the Asia-Pacific Credit Trends 2014 series: Transportation Infrastructure Faces Policy Uncertainty; Utilities Deal With High Energy Costs And Green Power, Dec. 4, 2013 Still Robust Domestic Growth and Steady Financial Profiles Underpin Our Mostly Stable Outlook On Indonesia's Corporate Sector, Oct. 30, 2013 Middle Classes Fuel Consumer Products; Retail To Keep Doing It Hard; Gaming On A Roll, Oct. 30, 2013 Real Estate Developers Wrestle With Regulatory Curbs; REITs Hunt For M&As, Oct. 29, 2013 Tech Firms Focusing On Asia And Smart Devices Will Outperform, Oct. 28, 2013 Telcos Look To The Cloud In Search Of Growth, Oct. 27, 2013

Standard & Poor's (Australia) Pty. Ltd. holds Australian financial services licence number 337565 under the Corporations Act 2001. Standard & Poor's credit ratings and related research are not intended for and must not be distributed to any person in Australia other than a wholesale

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 8

1224110 | 301447691

Sector Review: Asia-Pacific Credit Trends 2014: Mining Companies' Credit Metrics Will Mend Slowly; Oil And Gas Firms Foresee Higher Demand

client (as defined in Chapter 7 of the Corporations Act).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 9

1224110 | 301447691

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

DECEMBER 4, 2013 10

1224110 | 301447691

Potrebbero piacerti anche

- Safer Mortgage Loans Will Strengthen The Stability of Korea's Banking System at The Cost of ProfitabilityDocumento9 pagineSafer Mortgage Loans Will Strengthen The Stability of Korea's Banking System at The Cost of Profitabilityapi-239405494Nessuna valutazione finora

- Ratings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook StableDocumento7 pagineRatings On Thailand Affirmed at 'BBB+/A-2' and 'A-/A-2' Outlook Stableapi-239405494Nessuna valutazione finora

- China Property Watch: Tough Operating Conditions Could Further Polarize DevelopersDocumento21 pagineChina Property Watch: Tough Operating Conditions Could Further Polarize Developersapi-239405494Nessuna valutazione finora

- Ratings On The Republic of The Philippines Raised To 'BBB/A-2' Outlook StableDocumento8 pagineRatings On The Republic of The Philippines Raised To 'BBB/A-2' Outlook Stableapi-239405494Nessuna valutazione finora

- Dismissal of Thailand's Prime Minister Is Credit Negative, But Rating Not AffectedDocumento3 pagineDismissal of Thailand's Prime Minister Is Credit Negative, But Rating Not Affectedapi-239405494Nessuna valutazione finora

- Asia-Pacific Economic Outlook: Risks Abound, Led by China's Financial SectorDocumento11 pagineAsia-Pacific Economic Outlook: Risks Abound, Led by China's Financial Sectorapi-239405494Nessuna valutazione finora

- China's Department Stores Face An Uphill Battle As Competition Intensifies and Economic Growth SlowsDocumento10 pagineChina's Department Stores Face An Uphill Battle As Competition Intensifies and Economic Growth Slowsapi-239405494Nessuna valutazione finora

- Rated Indonesian Entities Will Remain Resilient To Persisting Policy Risks Under The Forthcoming AdministrationDocumento13 pagineRated Indonesian Entities Will Remain Resilient To Persisting Policy Risks Under The Forthcoming Administrationapi-239405494Nessuna valutazione finora

- Chinese Steelmaker's Default Highlights Troubles in Sector, Could Benefit Larger PlayersDocumento5 pagineChinese Steelmaker's Default Highlights Troubles in Sector, Could Benefit Larger Playersapi-239405494Nessuna valutazione finora

- Can Hong Kong's Power Companies Stay Insulated Against The Cold?Documento8 pagineCan Hong Kong's Power Companies Stay Insulated Against The Cold?api-239405494Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- ZNM STJV Qac ST XX 000037 (00) 1111Documento2 pagineZNM STJV Qac ST XX 000037 (00) 1111Roshan George PhilipNessuna valutazione finora

- Industry I Table of Key Performance IndicatorsDocumento24 pagineIndustry I Table of Key Performance IndicatorsSofiya BayraktarovaNessuna valutazione finora

- Capital Gains & LossesDocumento4 pagineCapital Gains & LossesYamateNessuna valutazione finora

- 哈佛商业评论 (Harvard Business Review)Documento7 pagine哈佛商业评论 (Harvard Business Review)h68f9trq100% (1)

- Proyeksi INAF - Kelompok 3Documento43 pagineProyeksi INAF - Kelompok 3Fairly 288Nessuna valutazione finora

- Strategic Management (MGMT 2301) : The Cost Leadership StrategyDocumento8 pagineStrategic Management (MGMT 2301) : The Cost Leadership StrategyDusmahomedNessuna valutazione finora

- SWAD 3D Printing Challenge GatewayDocumento2 pagineSWAD 3D Printing Challenge GatewayMuhammad AdilNessuna valutazione finora

- Spectra NDocumento5 pagineSpectra NRichelle Mea B. PeñaNessuna valutazione finora

- CorrectivePreventive Action Request (CPAR) RegistryDocumento7 pagineCorrectivePreventive Action Request (CPAR) RegistryManz ManingoNessuna valutazione finora

- Case Bloomsbury Capital NCDocumento39 pagineCase Bloomsbury Capital NCashmangano0% (1)

- Curriculum Vitae: Name: Ahmed Hallala Algerian Residence: Jijel - AlgeriaDocumento6 pagineCurriculum Vitae: Name: Ahmed Hallala Algerian Residence: Jijel - AlgeriaXulfi KhanNessuna valutazione finora

- Lesson 1business EthicsDocumento19 pagineLesson 1business EthicsNiña Gloria Acuin ZaspaNessuna valutazione finora

- VINAYAK KONDAL AI & Finance Report CBRDocumento7 pagineVINAYAK KONDAL AI & Finance Report CBRvinayakNessuna valutazione finora

- Final Project Business Plan 1. General GuidelinesDocumento13 pagineFinal Project Business Plan 1. General GuidelinesMehrozNessuna valutazione finora

- Sample Problems On Relevant CostsDocumento9 pagineSample Problems On Relevant CostsJames Ryan AlzonaNessuna valutazione finora

- Project Mangement FullDocumento20 pagineProject Mangement FullggyutuygjNessuna valutazione finora

- Final Report of Pakistan State OilDocumento18 pagineFinal Report of Pakistan State OilZia UllahNessuna valutazione finora

- Inventory Management System Research PaperDocumento8 pagineInventory Management System Research Paperkkxtkqund100% (1)

- Purchase Order TemplateDocumento8 paginePurchase Order TemplateromeeNessuna valutazione finora

- Excel Solutions To CasesDocumento32 pagineExcel Solutions To Cases박지훈Nessuna valutazione finora

- CH 1 Information-technology-For-management Test BankDocumento25 pagineCH 1 Information-technology-For-management Test Bankalfyomar79Nessuna valutazione finora

- Study On Effectiveness of RecruitmentDocumento46 pagineStudy On Effectiveness of RecruitmentManasa m100% (1)

- Top 99 Wholesale Sources PDFDocumento27 pagineTop 99 Wholesale Sources PDFAnonymous 8DYrvTUNessuna valutazione finora

- HOWA QA-HW-12 Supplier Quality Manual Rev.8 (English) - SignedDocumento25 pagineHOWA QA-HW-12 Supplier Quality Manual Rev.8 (English) - Signedl.hernandezNessuna valutazione finora

- MESTECH - Life Sciences SolutionsDocumento2 pagineMESTECH - Life Sciences SolutionsRashmiNessuna valutazione finora

- Case Study #4:: Defining Standard Projects at Global Green Books PublishingDocumento3 pagineCase Study #4:: Defining Standard Projects at Global Green Books PublishingHarsha ReddyNessuna valutazione finora

- RN Profile Foco 2022Documento16 pagineRN Profile Foco 2022MANINDER SINGHNessuna valutazione finora

- GDPR V ISO 27001 Mapping TableDocumento12 pagineGDPR V ISO 27001 Mapping Tablemr KNessuna valutazione finora

- ECON 1000 Exam Review Q41-61Documento5 pagineECON 1000 Exam Review Q41-61Slock TruNessuna valutazione finora

- The Sticking Point SolutionDocumento9 pagineThe Sticking Point SolutionTim JoyceNessuna valutazione finora