Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Economics of Trade Restrictions 1

Caricato da

gathoplayerDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Economics of Trade Restrictions 1

Caricato da

gathoplayerCopyright:

Formati disponibili

Lac Hong University

Th Lan i

Economics of Trade Restrictions

Excerpt from Gaining from International Trade, International Business

Despite the potential benefits from free trade, almost all nations have erected trade barriers. Tariff, quotas, and exchange-rate controls are the most commonly used trade restricting devices.

A tariff is nothing more than a tax on imports from foreign countries. The tariff benefits domestic producers and the government at the expense of consumers. Since they do not pay the tariff, domestic producers will expand their output in respond to the higher (protected) market price. In effect, the tariff acts as a subsidy to domestic producers.

An import quota, like a tariff, is designed to restrict foreign goods and protect domestic industries. A quota places a ceiling on the amount of a product that can be imported during a given period (typically a year). As in the case of tariffs, the primary purpose of quotas is to protect domestic industries from foreign competition.

In many ways, quotas are more harmful than tariffs. With a quota, foreign producers are prohibited from selling additional units regardless of how much lower their costs are relative to those of domestic producers. In contrast to a tariff, a quota brings in no revenue for the government. While a tariff transfer revenue from U.S. consumers to the Treasury, quotas transfer these revenues to foreign producers, who are granted licenses (quotas) to sell various amounts in the U.S. market. Clearly, this right to sell at a

English in Foreign Trade

Lac Hong University

Th Lan i

premium price (since domestic price exceeds the world market price) is extremely valuable. Thus, foreign producers will compete for the permits. They will hire lobbyists, make political contributions, and engage in other rent-seeking activities in an effort to secure the right to sell at a premium price in the U.S. market. AS a result, removal of a quota is often even more difficult to achieve than a tariff reduction.

Some countries fix the exchange-rate value of their currency above the market rate and impose restrictions on exchange-rate transactions. At the official exchange-rate, the countrys export goods will be extremely expensive to foreigners. As a result, foreigners will purchase goods elsewhere, and the countrys exports will be small. In turn, the low level of exports will make it difficult for domestic residents to obtain the foreign currency required for the purchase of imports. Such exchange-rate controls both reduce the volume of trade and lead to black-market currency exchanges. In deed, a large blackmarket premium indicates that the countrys exchange-rate policy is substantially limiting the ability of its citizens to trade with foreigners. While exchange-rate controls have declined in popularity, they are still an important trade barrier in many less-developed countries.

Why do nations adopt trade restrictions? There are three major arguments for protecting certain domestic industries from foreign competitors: national-defense, infant-industry, and anti-dumping arguments.

English in Foreign Trade

Lac Hong University

Th Lan i

According to the national-defense argument, certain industriesaircraft, petroleum, and weapons, for exampleare vital to national-defense and therefore should be protected from foreign competitors so that a domestic supply of necessary materials would be available in case of an international conflict.

Advocates of the infant-industry argument hold that new domestic industries should be protected from older, established foreign competitors. As the new industry matures, it will be bale to stand on its own feet and compete effectively with foreign producers, at which time protection can be removed.

Dumping involves the sale of goods by a foreign firm at a price below cost or below the price charged in the firms home-base market. Dumping is illegal and if a domestic industry is harmed, current law provides relief in the form of anti-dumping duties (tariffs imposed against violators).

English in Foreign Trade

Potrebbero piacerti anche

- Actuarial ToolkitDocumento20 pagineActuarial ToolkitgathoplayerNessuna valutazione finora

- Market Research 1Documento4 pagineMarket Research 1gathoplayerNessuna valutazione finora

- TOEFL SuccessDocumento41 pagineTOEFL SuccessgathoplayerNessuna valutazione finora

- HDgiaidethi KTLDocumento25 pagineHDgiaidethi KTLgathoplayerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Analyzing Costs and Profits in Perfect CompetitionDocumento5 pagineAnalyzing Costs and Profits in Perfect CompetitionFrany IlardeNessuna valutazione finora

- Managerial Economics Course OutlineDocumento35 pagineManagerial Economics Course OutlinerheaNessuna valutazione finora

- FAR 4320 Book Value Per Share Earnings Per Share PDFDocumento3 pagineFAR 4320 Book Value Per Share Earnings Per Share PDFAnjolina BautistaNessuna valutazione finora

- Maths Stats - Question - EM 13.11.2022Documento16 pagineMaths Stats - Question - EM 13.11.2022Shubham RahNessuna valutazione finora

- Costco Case Study and Strategic Analysis PDFDocumento11 pagineCostco Case Study and Strategic Analysis PDFMaryam KhushbakhatNessuna valutazione finora

- Requirement: Provide All The Entries in 20x4 and 20X5.: Intermediate Accounting 3Documento3 pagineRequirement: Provide All The Entries in 20x4 and 20X5.: Intermediate Accounting 3happy2408230% (1)

- Bata Company Term PaperDocumento20 pagineBata Company Term Paperahmadksath100% (1)

- Profit CenterDocumento3 pagineProfit CenterMAHENDRA SHIVAJI DHENAKNessuna valutazione finora

- 15-IFRS 15 - SummaryDocumento6 pagine15-IFRS 15 - SummaryhusseinNessuna valutazione finora

- Project Report: "Transfer Pricing"Documento34 pagineProject Report: "Transfer Pricing"Dev RaiNessuna valutazione finora

- Profile On Sheep and Goat FarmDocumento14 pagineProfile On Sheep and Goat FarmFikirie MogesNessuna valutazione finora

- Final PPT - Airline 4aprilDocumento15 pagineFinal PPT - Airline 4aprilSadanand RamugadeNessuna valutazione finora

- Bearish PatternsDocumento41 pagineBearish PatternsKama Sae100% (1)

- Clique Pens Case AnalysisDocumento8 pagineClique Pens Case AnalysisShweta Verma100% (1)

- BS Assignment 02 21273184Documento25 pagineBS Assignment 02 21273184Suren Theannilawu75% (4)

- Wood and Company ANY Security Printing Initation Report 20171215Documento36 pagineWood and Company ANY Security Printing Initation Report 20171215Anonymous UPBYhtNessuna valutazione finora

- Litigation Complaint 122107Documento13 pagineLitigation Complaint 122107AndrewCatNessuna valutazione finora

- Marketing Sales Operations in Chicago IL Resume Curt PetersonDocumento3 pagineMarketing Sales Operations in Chicago IL Resume Curt PetersoncurtpetersonNessuna valutazione finora

- Inventory Count BY HM RANADocumento47 pagineInventory Count BY HM RANAIcap FrtwoNessuna valutazione finora

- A Global Guide To M&A - India: by Vivek Gupta and Rohit BerryDocumento14 pagineA Global Guide To M&A - India: by Vivek Gupta and Rohit BerryvinaymathewNessuna valutazione finora

- 100 Hardest ProblemsDocumento7 pagine100 Hardest ProblemsJaloliddin IsmatillayevNessuna valutazione finora

- Teachers UnderpaidDocumento7 pagineTeachers UnderpaiddespaNessuna valutazione finora

- Safal Niveshak Mastermind BrochureDocumento3 pagineSafal Niveshak Mastermind BrochureR. SinghNessuna valutazione finora

- C.K. Tang: The Fight Towards Privatisation: Case OverviewDocumento11 pagineC.K. Tang: The Fight Towards Privatisation: Case OverviewZoo HuangNessuna valutazione finora

- Engineering Economics and Management B.E. 3 /4 Semester: Gujarat Technological UniversityDocumento2 pagineEngineering Economics and Management B.E. 3 /4 Semester: Gujarat Technological UniversityShital Solanki MakwanaNessuna valutazione finora

- Vighnharta List For Costing Nov-23 - 230919 - 201728Documento516 pagineVighnharta List For Costing Nov-23 - 230919 - 201728sixipa1033Nessuna valutazione finora

- Bay State Wind 400 Megawatt Public BidDocumento323 pagineBay State Wind 400 Megawatt Public BidAndy TomolonisNessuna valutazione finora

- Cgse StatsDocumento20 pagineCgse StatsChandu SagiliNessuna valutazione finora

- Economy PerformanceDocumento16 pagineEconomy PerformanceMuhammad UmarNessuna valutazione finora

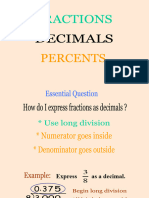

- Fraction, Decimal and PercentDocumento49 pagineFraction, Decimal and PercentTashaun NizodNessuna valutazione finora