Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Management 1........

Caricato da

Bercea AdDryanaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Management 1........

Caricato da

Bercea AdDryanaCopyright:

Formati disponibili

2.3.

The elaboration of the treasury plans

The elaboration of the treasury plans require the association of a granted system with a predictions system. In order to establish the one year budget and the plans on shorter periods of time, a great number of information is needed, as these plans have as object the ensemble of predictions of cashing and payments. The predictions of cashing and payments are based either on already made operations (loans, sales), whose part is to integrate past information, either on foresights coming from other sections of programme of the activities of the company. Therefore, the treasury budget starts from the budget of the investment, provisioning, sale activity, having the role of converting the information of these sections into fluxes of casing and monthly payments. The elaboration of the treasury plants is bases on accounting information, as the safes and most precise source, but it is taken into consideration the fact that the information is belated in relation with the real time, the quickness of the information being indispensable to the treasurer. Also, in accounting it is taken into account the fact the expenses and the incomes are reflected in the real flux and not in the financial flux, ignoring the gap between the two. At the same time, at the basis of the elaboration of the treasury plants there are the statistic studies, useful for the determination of the flux predictions that may be repeated , especially, for the cashing coming from the sales. Knowing the figure of the predictions business of the sales budget, the cashing coming from the sales can be established, depending on the average cashing of the preceding interval in contrast with the sales from that month and in the following ones. Besides this information, for the one who operates the treasury, the knowledge of the sale structures (towards economic agents of the state, private customers or export) is extremely important, because, depending on this there are different possibilities of cashing. At the same time, in the elaboration of the treasury plants, the communicating system with the banks is of high importance, as well. It must be quick and it must facilitate the update of day-to-day predictions so as to make the corresponding decision. The bank offers sure information regarding the exact data of some transactions,with the necessary time for operating different instruments of discount, the lengths of the bank circuits, respectively.

On the basis of a reliable information system, there can be established the following types of treasury plans: the annual plan (the treasury budget); intermediate plans (3 to 6 months); daily predictions.

The treasury budget reflects the fluxes of cash with monthly and accumulated reflection of the deficit or of the surplus according to the relation: St =Vt + It + TPt Pt RIt In which: St = the cash stock of period t; Vt =the incomes of period t; It =the loans of period t;

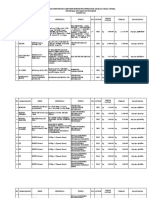

TPt =the investment titles in period t; Pt =the payments of period t RIt =the repayment of loans in period t; This equality has at base the way of treating the best composition of the monetary stock of the period, which is of the level of loans, investment titles, repayments of credits, so that the cost of the monetary stock be minimum. The treasury budget follows the establishment of the stock separately for the exploitation activity, the activity outside the expoitation and all the activities of each month of the year. It offers information regarding the months with problems of the necessities of the treasury or the ones resulting in surpluses, thus offering the possibility of an early choice of the most economic way of covering or of the best types of investment. Generally, the structure of the annual budget of treasury is presented according to the model in table 1.1. The model of the annual budget of treasury Tabel 1.1.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Parker HPD Product Bulletin (HY28-2673-01)Documento162 pagineParker HPD Product Bulletin (HY28-2673-01)helden50229881Nessuna valutazione finora

- Astm D 1196 PDFDocumento3 pagineAstm D 1196 PDFSetyawan Chill Gates0% (1)

- Parts Manual: Generator SetDocumento118 pagineParts Manual: Generator SetAhmed Kamal100% (2)

- India Biotech Handbook 2023Documento52 pagineIndia Biotech Handbook 2023yaduraj TambeNessuna valutazione finora

- Learning TheoryDocumento7 pagineLearning Theoryapi-568999633Nessuna valutazione finora

- Chunking Chunking Chunking: Stator Service IssuesDocumento1 paginaChunking Chunking Chunking: Stator Service IssuesGina Vanessa Quintero CruzNessuna valutazione finora

- 6 Uec ProgramDocumento21 pagine6 Uec Programsubramanyam62Nessuna valutazione finora

- VLT 6000 HVAC Introduction To HVAC: MG.60.C7.02 - VLT Is A Registered Danfoss TrademarkDocumento27 pagineVLT 6000 HVAC Introduction To HVAC: MG.60.C7.02 - VLT Is A Registered Danfoss TrademarkSamir SabicNessuna valutazione finora

- Course DescriptionDocumento54 pagineCourse DescriptionMesafint lisanuNessuna valutazione finora

- Beautiful SpotsDocumento2 pagineBeautiful SpotsLouise Yongco100% (1)

- Dash 3000/4000 Patient Monitor: Service ManualDocumento292 pagineDash 3000/4000 Patient Monitor: Service ManualYair CarreraNessuna valutazione finora

- Zigbee Technology:19-3-2010: Seminor Title DateDocumento21 pagineZigbee Technology:19-3-2010: Seminor Title Dateitdep_gpcet7225Nessuna valutazione finora

- Maharashtra State Board 9th STD History and Political Science Textbook EngDocumento106 pagineMaharashtra State Board 9th STD History and Political Science Textbook EngSomesh Kamad100% (2)

- Nikasil e AlusilDocumento5 pagineNikasil e AlusilIo AncoraioNessuna valutazione finora

- Remedy MidTier Guide 7-5Documento170 pagineRemedy MidTier Guide 7-5martin_wiedmeyerNessuna valutazione finora

- Case No. Class Action Complaint Jury Trial DemandedDocumento43 pagineCase No. Class Action Complaint Jury Trial DemandedPolygondotcom50% (2)

- The Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFDocumento9 pagineThe Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFYan XiongNessuna valutazione finora

- JBF Winter2010-CPFR IssueDocumento52 pagineJBF Winter2010-CPFR IssueakashkrsnaNessuna valutazione finora

- Design Practical Eden Swithenbank Graded PeDocumento7 pagineDesign Practical Eden Swithenbank Graded Peapi-429329398Nessuna valutazione finora

- Managemant PrincipleDocumento11 pagineManagemant PrincipleEthan ChorNessuna valutazione finora

- Jota - EtchDocumento3 pagineJota - EtchRidwan BaharumNessuna valutazione finora

- Rab Sikda Optima 2016Documento20 pagineRab Sikda Optima 2016Julius Chatry UniwalyNessuna valutazione finora

- List of Olympic MascotsDocumento10 pagineList of Olympic MascotsmukmukkumNessuna valutazione finora

- ASHRAE Elearning Course List - Order FormDocumento4 pagineASHRAE Elearning Course List - Order Formsaquib715Nessuna valutazione finora

- MPT EnglishDocumento5 pagineMPT Englishkhadijaamir435Nessuna valutazione finora

- Business Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiDocumento6 pagineBusiness Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiMuzammil DeshmukhNessuna valutazione finora

- Biscotti: Notes: The Sugar I Use in France, Is CalledDocumento2 pagineBiscotti: Notes: The Sugar I Use in France, Is CalledMonica CreangaNessuna valutazione finora

- Reference by John BatchelorDocumento1 paginaReference by John Batchelorapi-276994844Nessuna valutazione finora

- What Is A Fired Heater in A RefineryDocumento53 pagineWhat Is A Fired Heater in A RefineryCelestine OzokechiNessuna valutazione finora

- Community Resource MobilizationDocumento17 pagineCommunity Resource Mobilizationerikka june forosueloNessuna valutazione finora