Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2012 The Future of Asian Banking

Caricato da

nurul000Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2012 The Future of Asian Banking

Caricato da

nurul000Copyright:

Formati disponibili

Sunday, March 18, 2012 Business

The future of Asian banking

Vehicles are seen in the congested traffic of Bangkok. Thailand's economy, affected y floods in !ecem er, is no" on the mend. #hoto$ %&#%ndre" Sheng

This "eek "as my first 'isit to Bangkok since the floods in !ecem er. The city seems to ha'e reco'ered and the economy is on the mend. %fter an estimated 0.1 (ercent gro"th in real )!# in 2011, the *nternational *nstitute of &inance +**&, is forecasting a ro ust (ercent gro"th reco'ery in 2012, hel(ed y a multi.year fiscal stimulus that "ould ring the fiscal deficit to an estimated /./ (ercent of )!# for the fiscal year 2011.2012. The (ackage of fiscal stimulus included a 00 (ercent hike in minimum "ages from %(ril and an aggressi'e cut in cor(orate income ta1 rate from current 20 (ercent to 22 (ercent and a further cut to 20 (ercent for 2012. This "ould (ut Thai cor(orate ta1 rate closer to those of its neigh ours. The com ination of increase in minimum "age rates and generous (rice su((ort (rogramme for rice mean that the go'ernment is serious a out tackling income ga(s and (ushing consum(tion. The (ur(ose of the Bangkok tri( "as to de ate the future of %sian anking usiness models. The central 3uestion is ho" to recycle %sian sa'ings "ithin %sia. Because of its demogra(hics and (rudence in consum(tion, 4ast %sia has al"ays run a net current account sur(lus, "ith its accumulation in sa'ings (laced largely in the ad'anced markets. 5hy can't some of these sa'ings e used to fund much needed infrastructure "ithin the region6 *n 2002, !ooley, &olkerts.7andau and )ar er named the current cross.#acific arrangement Bretton 5oods **, "here %sia funded the 8S current account deficit y rein'esting its sa'ings ack in the ad'anced markets. This arrangement can also e called the )rand Bargain. Basically %sia s"a((ed dollars for 9o s for the youth entering the la our force and the e1(loitation of its natural resources. The )rand Bargain is ending as %sians realise that their holdings of dollars may e e1(osed to future de(reciation and that %sian la our force and natural resources should not e chea( fore'er. The )rand Bargain had im(lications for the ad'anced country anking usiness models. % deficit country "ill 'ery soon find that its anking system must ha'e loans:de(osit ratios running higher than 100 (ercent, ecause the e1cess consum(tion has to e funded y credit. *n %sia, the a'erage loans:de(osit ratio is lo"er than 100 (ercent, ecause sa'ings are larger than de t. The %merican anking system had to shift from retail anking into a "holesale anking system, relying on securitisation of its assets +mortgages and loans, and selling them into the glo al market to fund its loan ook. ;uite a lot of %%%.rated securities ended u( in 4uro(ean (ortfolios, ecause the (rudent %sians stuck mostly to Treasuries. Thus, "hen the su (rime crisis eru(ted in 200-, the 4uro(ean anks "ere one of the igger 'ictims.

There are good reasons "hy 8S and 4uro(ean anks e'ol'ed into le'eraged "holesale anks tur ocharged y deri'ati'e markets. <inety (ercent of =T> deri'ati'e trading in the 8S are dominated y fi'e large anks. 4uro(e as a region accounts for -0 (ercent of total glo al interest rate deri'ati'e trading. The %tlantic anks "ent into (ro(rietary trading and financing engineering ecause y the 1?80s, under com(etition from the @a(anese anks, net interest margin usiness + asically the margin et"een lending rate and de(osit rates, ecame less and less (rofita le. This shift out of traditional retail anking usiness "as also due to the free market ideology to reduce market friction to Aero y lo"ering transaction costs +such as transaction ta1es and commissions,. *n the old days "hen rokers made money from fat commissions, they "ere "illing to (ro'ide research for their customers. 5hen margins ecame near Aero "ith com(uterised trading, securities firms engaged more and more into (ro(rietary trading and le'eraged trading in order to make money. )ood 3uality research ecame scarce. Banks made more money from B(ushingC deri'ati'e (roducts to their retail in'estors, ecause they could earn more fees u(.front and from granting credit to their customer from le'eraged trading. The com ination of (ro(rietary trading and le'eraged deri'ati'e financial engineering mor(hed anking usiness a"ay from eing a trusted agent of the real sector into a com(etitor or (rinci(al that may trade sometimes in conflict against the interest of its customers. The financial sector ecame a (rinci(al in its o"n right, "ith total assets larger than the real sector and therefore Too Big to &ail. This change in culture "as e1em(lified y the remarka le =(.4d y )reg Smith, a former e1ecuti'e director in )oldman Sachs, (u lished in the *nternational Derald Tri une on March1/, 2012, "hich * read on the (lane ack to Dong Eong. De asically highlighted the de ate "hether one should e making money for the ank or making money for the client. Because %sia as a "hole did not run into deficit, the anking system has not strayed from its retail anking roots. %fter the (ainful lessons of the 1??-.?8 %sian financial crisis, %sian regulators ha'e een much more cautious in allo"ing %sian anks to go the deri'ati'e route. The game is changing dramatically ecause %sian interest margins are also eginning to e s3ueeAed as com(etition intensifies. Some %sian anks are already eing ra((ed on the knuckles for not (aying enough attention to client suita ility in selling ina((ro(riate "ealth management (roducts to customers. So the de ate on "hether %sian anks should make more money from ca(ital market usiness is 'ery much on the ta le. This raises a fundamental 3uestion "hich the current glo al regulatory reforms ha'e not addressed. * ha'e gone on record to say that if green engineers are (aid less than financial engineers, "ill "e e1(ect a green economy to emerge efore asset u les6 Similarly, if anks are to ser'e their real sector customers etter, "hat (olicies are re3uired to induce them to make more money from real customer ser'ice than le'eraged (ro(rietary trading6

This means that regulators need to (ursue less "hat anks should not do, ut "hat usiness models are a((ro(riate for the anks to ser'e the real sector etter6 This o 'iously re3uires the regulators and the industry to ha'e a etter con'ersation than the current lines of engagement.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Exchange Ratio - Problems N SolutionsDocumento26 pagineExchange Ratio - Problems N SolutionsBrowse Purpose82% (17)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- IDX Annually Statistic 2019Documento202 pagineIDX Annually Statistic 2019Ghina Salsabila100% (7)

- Driving Digital Innovation For A Sustainable Inclusive GrowthDocumento209 pagineDriving Digital Innovation For A Sustainable Inclusive Growthnurul000100% (1)

- Gross Cheque CalculationDocumento1 paginaGross Cheque Calculationnurul000Nessuna valutazione finora

- Stamp RequisitionDocumento20 pagineStamp Requisitionnurul000Nessuna valutazione finora

- Feb 232022 BR PDL 07Documento1 paginaFeb 232022 BR PDL 07amirentezamNessuna valutazione finora

- Application - Form of BkmeaDocumento3 pagineApplication - Form of Bkmeanurul000Nessuna valutazione finora

- Sep182018dfim03Documento4 pagineSep182018dfim03nurul000Nessuna valutazione finora

- Name Change - Feb032019dfiml01Documento1 paginaName Change - Feb032019dfiml01nurul000Nessuna valutazione finora

- Fixing Rate of Interest On Credit Card - Sep242020brpdl47Documento1 paginaFixing Rate of Interest On Credit Card - Sep242020brpdl47nurul000Nessuna valutazione finora

- E Vswks Cöwewa I BXWZ Wefvm: Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocumento11 pagineE Vswks Cöwewa I BXWZ Wefvm: Evsjv 'K E VSK Cöavb KVH©VJQ XVKVkhan knitwareNessuna valutazione finora

- Cheque Clearing FeeDocumento1 paginaCheque Clearing Feenurul000Nessuna valutazione finora

- Tolet or Lease of Floor Space - Aug052019dfiml13Documento1 paginaTolet or Lease of Floor Space - Aug052019dfiml13nurul000Nessuna valutazione finora

- Accounting Job FunctionDocumento1 paginaAccounting Job Functionnurul000Nessuna valutazione finora

- Appointment of External Auditors in Financial Institutions - Apr302015dfim04eDocumento3 pagineAppointment of External Auditors in Financial Institutions - Apr302015dfim04enurul000Nessuna valutazione finora

- Write Off - Apr082015fid03Documento1 paginaWrite Off - Apr082015fid03nurul000Nessuna valutazione finora

- Avoidance of High Expenses For Luxurious Vehicles and Decoration - Nov182015dfim12eDocumento1 paginaAvoidance of High Expenses For Luxurious Vehicles and Decoration - Nov182015dfim12enurul000Nessuna valutazione finora

- A Xkvibvgv 'WJJ: 'WJJ Möwnzvi BVG I WVKVBV T BVG T GVT Avt Iv VK Dwki QweDocumento6 pagineA Xkvibvgv 'WJJ: 'WJJ Möwnzvi BVG I WVKVBV T BVG T GVT Avt Iv VK Dwki Qwenurul000Nessuna valutazione finora

- Application For Leave of AbsenceDocumento1 paginaApplication For Leave of Absencenurul000Nessuna valutazione finora

- K Xcyi Mve Iwrwó Awdm: GVQVT BVWQGV - Vgxi BVG T GVT LVKVDocumento8 pagineK Xcyi Mve Iwrwó Awdm: GVQVT BVWQGV - Vgxi BVG T GVT LVKVMohammad Kawsar HowladerNessuna valutazione finora

- Payment Settlements R 2009Documento8 paginePayment Settlements R 2009nurul000Nessuna valutazione finora

- Basel IIIDocumento4 pagineBasel IIInurul000Nessuna valutazione finora

- Basel IIIDocumento4 pagineBasel IIInurul000Nessuna valutazione finora

- Table-A: CAF (For Asset-Side Products) : Description of Loan/Lease FacilityDocumento4 pagineTable-A: CAF (For Asset-Side Products) : Description of Loan/Lease Facilitynurul000Nessuna valutazione finora

- Bank Asia ATM LocationsDocumento4 pagineBank Asia ATM Locationsnurul000Nessuna valutazione finora

- Central BankDocumento57 pagineCentral Banknurul000Nessuna valutazione finora

- ALM Maturity Profile 1Documento8 pagineALM Maturity Profile 1nurul000Nessuna valutazione finora

- ALM Maturity Profile 1Documento8 pagineALM Maturity Profile 1nurul000Nessuna valutazione finora

- The Bankers' Book Evidence Act, 1891Documento4 pagineThe Bankers' Book Evidence Act, 1891nurul000Nessuna valutazione finora

- An Overview of ITPFDocumento3 pagineAn Overview of ITPFnurul000Nessuna valutazione finora

- Forfaiting: Dr. Prashanta K. BanerjeeDocumento4 pagineForfaiting: Dr. Prashanta K. Banerjeenurul000Nessuna valutazione finora

- Know Your Marketability Know Your Marketability Know Your Marketability Know Your MarketabilityDocumento22 pagineKnow Your Marketability Know Your Marketability Know Your Marketability Know Your Marketabilitynurul000Nessuna valutazione finora

- Annual Report Project On Muthoot Finance LTDDocumento39 pagineAnnual Report Project On Muthoot Finance LTDAnu ArjaNessuna valutazione finora

- Investment - 2019 Edition - Chapter 21Documento1 paginaInvestment - 2019 Edition - Chapter 21Lastine AdaNessuna valutazione finora

- Market Timing Performance of The Open enDocumento10 pagineMarket Timing Performance of The Open enAli NadafNessuna valutazione finora

- Homework On Inventories Problem 1 (Borrowing Cost ConceptsDocumento3 pagineHomework On Inventories Problem 1 (Borrowing Cost ConceptsJazehl Joy ValdezNessuna valutazione finora

- Cost of Goods Sold and Inventory MethodsDocumento31 pagineCost of Goods Sold and Inventory MethodsTNessuna valutazione finora

- The 25 KPIs Every Manager Needs To Know091220141Documento2 pagineThe 25 KPIs Every Manager Needs To Know091220141jheison16Nessuna valutazione finora

- CH 19Documento26 pagineCH 19Samphors SengNessuna valutazione finora

- Stress Testing For Bangladesh Private Commercial BanksDocumento11 pagineStress Testing For Bangladesh Private Commercial Banksrubayee100% (1)

- Ziraat Bank 2014 US Resolution PlanDocumento9 pagineZiraat Bank 2014 US Resolution Planahmet aslanNessuna valutazione finora

- PPL Cup DifficultDocumento8 paginePPL Cup DifficultRukia Kuchiki100% (1)

- The Biggest Fund Investors in Private EquityDocumento7 pagineThe Biggest Fund Investors in Private EquityDavid KeresztesNessuna valutazione finora

- SubtitleDocumento2 pagineSubtitleBlack LotusNessuna valutazione finora

- Intermediate Accounting 17th Edition Kieso Test BankDocumento56 pagineIntermediate Accounting 17th Edition Kieso Test Bankesperanzatrinhybziv100% (26)

- Financial Statement Analysis: Principles of Managerial AccountingDocumento101 pagineFinancial Statement Analysis: Principles of Managerial AccountingLucy UnNessuna valutazione finora

- Graham Paul BarmanDocumento122 pagineGraham Paul BarmanMonique HoNessuna valutazione finora

- Week 3 Current Entry, Exit and Mixed Value AccountingDocumento36 pagineWeek 3 Current Entry, Exit and Mixed Value Accountingwawa1303Nessuna valutazione finora

- Answer Paper 4Documento18 pagineAnswer Paper 4SomeoneNessuna valutazione finora

- Analisis Kinerja Keuangan Pada PT Ciputra Development TBK Dan Sinarmas Land TBK Pada Periode 2012 - 2017Documento9 pagineAnalisis Kinerja Keuangan Pada PT Ciputra Development TBK Dan Sinarmas Land TBK Pada Periode 2012 - 2017dontokeNessuna valutazione finora

- Ramo 1-2000Documento526 pagineRamo 1-2000Mary graceNessuna valutazione finora

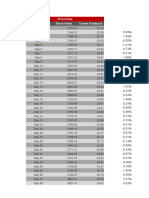

- Price Data Date Stock Index Turner FastbuckDocumento14 paginePrice Data Date Stock Index Turner FastbuckRampraveen ChamarthiNessuna valutazione finora

- Ibm FinancialsDocumento132 pagineIbm Financialsphgiang1506Nessuna valutazione finora

- Acct 2001 Chapter 1 Student LectureDocumento38 pagineAcct 2001 Chapter 1 Student LectureJosephNessuna valutazione finora

- Evaluate Cost-Cutting Automation ProposalDocumento5 pagineEvaluate Cost-Cutting Automation ProposalĐặng Thuỳ HươngNessuna valutazione finora

- ACC 318 Module Four Assignment TemplateDocumento2 pagineACC 318 Module Four Assignment Templateefren9397Nessuna valutazione finora

- Lo 1Documento3 pagineLo 1Uzma SiddiquiNessuna valutazione finora

- Chapter 18: Risk Management and DerivativesDocumento14 pagineChapter 18: Risk Management and Derivativesarwa_mukadam03Nessuna valutazione finora

- PMBA PB6020 July2020 Cases Questions 23june2020Documento24 paginePMBA PB6020 July2020 Cases Questions 23june2020Deepa GNessuna valutazione finora

- Himatsingka Seida LTD.: Ratio Analysis SheetDocumento1 paginaHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNessuna valutazione finora