Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Glenn Greenberg

Caricato da

annsusan21Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Glenn Greenberg

Caricato da

annsusan21Copyright:

Formati disponibili

Glenn Greenberg's Profile:

Glenn Greenberg and partner John Shapiro founded Chieftain Capital Management in 1984. By pursuing a disciplined investment strategy, Chieftain compounded its accounts at 22.5% (before management fees) during the period from 1984 through 2004 versus 12.9% for the S&P 500. Update: Chieftain Capital, founded by Glenn Greenberg and John Shapiro in 1984, has now divided into two separate entities. Mr. Shapiro and two Chieftain partners, Tom Stern and Joshua Slocum, plan to launch a new investment firm in 2010 that will keep the name Chieftain Capital Management. The existing Chieftain will be renamed Brave Warrior Advisors and will be run by Mr. Greenberg.

Investing Philosophy

Glenn Greenberg maintains a highly concentrated portfolio that he describes as a "defense against ignorance." He believes that the more companies you own, the less you will know about each, and the less you know about a business, the more likely you are to make mistakes due to fear and greed. He usually owns less than 10 stocks. Greenberg invests in companies with little competition, and places a great deal of emphasis on Return On Invested Capital. Greenberg was an English major in college and never contemplated going into investing. He ended up going to Columbia business school with no real career objective. He went to work for J.P. Morgan after b-school. A light bulb went off for Greenberg when he was asked to analyze a company that owned land with redwoods growing on it. He made some enquiries and discovered that the land was worth three times the price at which the company was trading. That shaped his thinking because he learned that there are situations out there where you dont need to be a genius to figure them out. He does feel that there are fewer such opportunities today because schools are turning out large numbers of value investors who are competing against each other. Greenberg worked for five years at J.P. Morgan but was dissatisfied because he did not think he was being trained to be a good money manager. He left and went to work for a small money management firm where he spent five years doing research. He then started his own firm, ten years after leaving school. He believes he profited from the ten years of experience and cautioned audience members about starting their own firm without adequate preparation. At the small firm where he worked, he was trained to internalize the numbers of a potential investment so he could really think about the business. His boss, who was the only one who could buy and sell stocks, would bring Greenberg into his office and grill him about a potential investment. Greenberg was expected to know the business and its numbers inside out. He does not believe in using pre-made spreadsheets. The investor has to become intimate with the financials. He started Chieftain in 1984 with $40 million, which was primarily family money. From the start, he chose to spend as little time on marketing as possible so he could focus on research. He also spent little time talking to clients which he views as non-productive. Those who need of a lot of hand holding are not a good fit for his firm. Since inception, he said he has beaten the market by an average of 8% annually. He recently started a new firm called Brave Warrior Capital. He said he re-focused on reading the

source material himself rather than relying on prepared data. He said that you should not use numbers prepared by others, but rather generate them yourself. This will also teach you what numbers you need to focus on. You need to boil it down to a small set of key drivers, because the performance of each business is typically driven by a set of key variables. He first wants to know if a prospective investment is a good business, i.e. could it survive a severe downturn. He then looks to see if it is cheap enough. He again stressed how it is critically important to read the 10-Ks. He was using Capital IQ but decided to drop it because he found too many errors. But more importantly by using it, he and his analysts were not becoming personally immersed in the numbers.

MAJOR INVESTMENTS

Glenn Greenberg Brave Warrior Capital Buys HPQ, FISV, BR, MA, ACGL, Sells DELL, XTEX, TDW, SGU, CMCSA, NICK, BAC

Posted by: gurufocus (IP Logged) Date: February 15, 2011 05:52PM

Glenn Greenberg of Brave Warrior Capital, Inc. reported his Q4 portfolio. As of 12/31/2010, Brave Warrior Capital, Inc. owns 11 stocks with a total value of $1.1 billion. These are the details of the buys and sells. Glenn Greenberg runs a very concentrated portfolio. He was a partner a hedge fund Chieftain Management. Then he split with his partner and started his own firm Brave Warrior Capital. Greenberg was an English major in college and never contemplated going into investing. He ended up going to Columbia business school with no real career objective. He went to work for J.P. Morgan after b-school. A light bulb went off for Greenberg when he was asked to analyze a company that owned land with redwoods growing on it. He made some enquiries and discovered that the land was worth three times the price at which the company was trading. That shaped his thinking because he learned that there are situations out there where you dont need to be a genius to figure them out. New Purchases: HPQ,

Added Positions: FISV, BR, MA, ACGL, Reduced Positions: GOOG, LMT, Sold Out: DELL, XTEX, TDW, SGU, CMCSA, NICK, BAC, AREX, For the details of Glenn Greenberg's stock buys and sells, go to http://www.gurufocus.com/StockBuy.php?GuruName=Glenn+Greenberg This is the sector weightings of his portfolio: Industrials Financials Technology 26.1% 24.5% 15.1%

Consumer Services 23.8%

Health Care

10.6%

These are the top 5 holdings of Glenn Greenberg 1. Fiserv Inc. (FISV) - 2,595,220 shares, 13.94% of the total portfolio. Shares added by 24.26% 2. Comcast Corp. Special (CMCSK) - 6,847,014 shares, 13.07% of the total portfolio. Shares reduced by 7.26% 3. Ryanair Holdings Plc (RYAAY) - 3,790,742 shares, 10.69% of the total portfolio. Shares reduced by 1.68% 4. LABORATORY CORP. OF AMER. (LH) - 1,310,563 shares, 10.57% of the total portfolio. Shares reduced by 5.93% 5. U.S. BANCORP (USB) - 3,876,191 shares, 9.59% of the total portfolio. Shares reduced by 12.34%

Potrebbero piacerti anche

- Glenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherDocumento5 pagineGlenn Greenberg at Columbia: How A Great Investor Thinks (Part 2) - Greg SpeicherYen GNessuna valutazione finora

- Sequoia Fund Investor Day 2014Documento24 pagineSequoia Fund Investor Day 2014CanadianValueNessuna valutazione finora

- BuybacksDocumento22 pagineBuybackssamson1190Nessuna valutazione finora

- Chou LettersDocumento90 pagineChou LettersLuke ConstableNessuna valutazione finora

- PremWatsaFairfaxNewsletter7 12-20-11Documento6 paginePremWatsaFairfaxNewsletter7 12-20-11able1Nessuna valutazione finora

- Schloss-10 11 06Documento3 pagineSchloss-10 11 06Logic Gate CapitalNessuna valutazione finora

- David Einhorn MSFT Speech-2006Documento5 pagineDavid Einhorn MSFT Speech-2006mikesfbayNessuna valutazione finora

- 5x5x5 InterviewDocumento7 pagine5x5x5 InterviewspachecofdzNessuna valutazione finora

- RV Capital June 2015 LetterDocumento8 pagineRV Capital June 2015 LetterCanadianValueNessuna valutazione finora

- The Future of Common Stocks Benjamin Graham PDFDocumento8 pagineThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNessuna valutazione finora

- Profit Guru Bill NygrenDocumento5 pagineProfit Guru Bill NygrenekramcalNessuna valutazione finora

- An Investment Only A Mother Could Love The Case For Natural Resource EquitiesDocumento12 pagineAn Investment Only A Mother Could Love The Case For Natural Resource EquitiessuperinvestorbulletiNessuna valutazione finora

- Distressed Debt Investing: Seth KlarmanDocumento4 pagineDistressed Debt Investing: Seth Klarmanjt322Nessuna valutazione finora

- Here Are A Few Relevant ExamplesDocumento6 pagineHere Are A Few Relevant ExamplesTeddy RusliNessuna valutazione finora

- Prem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Documento6 paginePrem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Damon MengNessuna valutazione finora

- Letter To Bruce BerkowitzDocumento1 paginaLetter To Bruce BerkowitzmattpaulsNessuna valutazione finora

- Letters of The Manager Since 1998Documento111 pagineLetters of The Manager Since 1998Lukas SavickasNessuna valutazione finora

- Graham value investing metrics explainedDocumento2 pagineGraham value investing metrics explainedfikgangNessuna valutazione finora

- Dempster Mills Manufacturing Case Study BPLsDocumento15 pagineDempster Mills Manufacturing Case Study BPLstycoonshan24Nessuna valutazione finora

- Aquamarine Fund Reports Strong Gains in JanuaryDocumento7 pagineAquamarine Fund Reports Strong Gains in JanuaryBrajesh MishraNessuna valutazione finora

- Distressed Debt InvestingDocumento5 pagineDistressed Debt Investingjt322Nessuna valutazione finora

- David Einhorn NYT-Easy Money - Hard TruthsDocumento2 pagineDavid Einhorn NYT-Easy Money - Hard TruthstekesburNessuna valutazione finora

- Bruce BerkowitzDocumento35 pagineBruce BerkowitznewbietraderNessuna valutazione finora

- Greenhaven Road Capital Q1 2017Documento12 pagineGreenhaven Road Capital Q1 2017superinvestorbulletiNessuna valutazione finora

- Investor Insight Brenton 2020Documento10 pagineInvestor Insight Brenton 2020BobNessuna valutazione finora

- Published July 20, 2005 News Index - News Arch: Alumni DirectoryDocumento4 paginePublished July 20, 2005 News Index - News Arch: Alumni DirectoryBrian LangisNessuna valutazione finora

- Market at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForDocumento10 pagineMarket at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForT Anil KumarNessuna valutazione finora

- Ruane, Cunniff Investor Day 2016Documento25 pagineRuane, Cunniff Investor Day 2016superinvestorbulletiNessuna valutazione finora

- Ruane, Cunniff & Goldfarb Investor Day 2009 - TranscriptDocumento24 pagineRuane, Cunniff & Goldfarb Investor Day 2009 - TranscriptThe Manual of IdeasNessuna valutazione finora

- Understanding the different levels of investing as a gameDocumento11 pagineUnderstanding the different levels of investing as a gamePradeep RaghunathanNessuna valutazione finora

- Vinall 2014 - ValuationDocumento19 pagineVinall 2014 - ValuationOmar MalikNessuna valutazione finora

- Washington PostBuffett Analysis1Documento2 pagineWashington PostBuffett Analysis1Calvin ChangNessuna valutazione finora

- RV Capital Mistakes of Omission May 2014Documento19 pagineRV Capital Mistakes of Omission May 2014manastir_2000Nessuna valutazione finora

- Graham & Doddsville Spring 2011 NewsletterDocumento27 pagineGraham & Doddsville Spring 2011 NewsletterOld School ValueNessuna valutazione finora

- Warren Buffett CNBC Transcript Feb-29-2016 PDFDocumento92 pagineWarren Buffett CNBC Transcript Feb-29-2016 PDFAndri ChandraNessuna valutazione finora

- Gmo Quarterly LetterDocumento16 pagineGmo Quarterly LetterAnonymous Ht0MIJ100% (2)

- 1976 Buffett Letter About Geico - FutureBlindDocumento4 pagine1976 Buffett Letter About Geico - FutureBlindPradeep RaghunathanNessuna valutazione finora

- BH 2015 AmDocumento14 pagineBH 2015 Amva.apg.90100% (2)

- Interview With Warren BuffettDocumento2 pagineInterview With Warren BuffettAdii BoaaNessuna valutazione finora

- Engaged Capital's Letter To Abercrombie & FitchDocumento9 pagineEngaged Capital's Letter To Abercrombie & FitchKim BhasinNessuna valutazione finora

- CNBC Transcript 2006 2019 02Documento1.575 pagineCNBC Transcript 2006 2019 02N BNessuna valutazione finora

- Value Investor Insight - March 31, 2014Documento11 pagineValue Investor Insight - March 31, 2014vishubabyNessuna valutazione finora

- Letter About Carl IcahnDocumento4 pagineLetter About Carl IcahnCNBC.com100% (1)

- Markel Breakfast 2011 NotesDocumento9 pagineMarkel Breakfast 2011 NotesbenclaremonNessuna valutazione finora

- Sequoia Ann 14Documento36 pagineSequoia Ann 14CanadianValueNessuna valutazione finora

- GMO Capital Q3 2013 Letter To InvestorsDocumento15 pagineGMO Capital Q3 2013 Letter To InvestorsWall Street WanderlustNessuna valutazione finora

- Value: InvestorDocumento4 pagineValue: InvestorAlex WongNessuna valutazione finora

- Creighton Value Investing PanelDocumento9 pagineCreighton Value Investing PanelbenclaremonNessuna valutazione finora

- Wesco Shareholder Letter 2007Documento7 pagineWesco Shareholder Letter 2007eblochNessuna valutazione finora

- The Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile MarketsDocumento13 pagineThe Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile Marketscrees25Nessuna valutazione finora

- Eric Khrom of Khrom Capital 2013 Q1 LetterDocumento4 pagineEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvalueNessuna valutazione finora

- Li Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent LectureDocumento14 pagineLi Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent Lecturepa_langstrom100% (1)

- Wisdom on Value Investing: How to Profit on Fallen AngelsDa EverandWisdom on Value Investing: How to Profit on Fallen AngelsValutazione: 4 su 5 stelle4/5 (6)

- Behind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersDa EverandBehind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersValutazione: 2 su 5 stelle2/5 (1)

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketDa EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNessuna valutazione finora

- Glenn Greenberg at ColumbiaDocumento2 pagineGlenn Greenberg at ColumbiaJUDS1234567Nessuna valutazione finora

- Summary of Joel Greenblatt's The Little Book That Still Beats the MarketDa EverandSummary of Joel Greenblatt's The Little Book That Still Beats the MarketNessuna valutazione finora

- Graham and Doddsville - Issue 9 - Spring 2010Documento33 pagineGraham and Doddsville - Issue 9 - Spring 2010g4nz0Nessuna valutazione finora

- Idea Cellular Limited: Investor PresentationDocumento20 pagineIdea Cellular Limited: Investor Presentationannsusan21Nessuna valutazione finora

- Idea Cellular Limited: Investor PresentationDocumento20 pagineIdea Cellular Limited: Investor Presentationannsusan21Nessuna valutazione finora

- Aditya Birla Group - The Global ScenarioDocumento2 pagineAditya Birla Group - The Global ScenarioGagan JaiswalNessuna valutazione finora

- Operations Strategy and Competitiveness-Ch02Documento38 pagineOperations Strategy and Competitiveness-Ch02Rob Christian100% (1)

- Equity Inv HW 2 BHDocumento3 pagineEquity Inv HW 2 BHBen HolthusNessuna valutazione finora

- Ethnic Conflicts and PeacekeepingDocumento2 pagineEthnic Conflicts and PeacekeepingAmna KhanNessuna valutazione finora

- HRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Documento33 pagineHRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Amira HosnyNessuna valutazione finora

- Trang Bidv TDocumento9 pagineTrang Bidv Tgam nguyenNessuna valutazione finora

- Maternity and Newborn MedicationsDocumento38 pagineMaternity and Newborn MedicationsJaypee Fabros EdraNessuna valutazione finora

- List of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity BanggoodDocumento6 pagineList of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity Banggoodyogesh parmarNessuna valutazione finora

- 00.arkana ValveDocumento40 pagine00.arkana ValveTrần ThànhNessuna valutazione finora

- Notes Socialism in Europe and RussianDocumento11 pagineNotes Socialism in Europe and RussianAyaan ImamNessuna valutazione finora

- Supply Chain AssignmentDocumento29 pagineSupply Chain AssignmentHisham JackNessuna valutazione finora

- Cost Allocation Methods & Activity-Based Costing ExplainedDocumento53 pagineCost Allocation Methods & Activity-Based Costing ExplainedNitish SharmaNessuna valutazione finora

- ISA standards, materials, and control room conceptsDocumento8 pagineISA standards, materials, and control room conceptsGiovanniNessuna valutazione finora

- Factors Affecting English Speaking Skills of StudentsDocumento18 pagineFactors Affecting English Speaking Skills of StudentsRona Jane MirandaNessuna valutazione finora

- Poetry Recitation Competition ReportDocumento7 paginePoetry Recitation Competition ReportmohammadNessuna valutazione finora

- Obtaining Workplace InformationDocumento4 pagineObtaining Workplace InformationJessica CarismaNessuna valutazione finora

- HERMAgreenGuide EN 01Documento4 pagineHERMAgreenGuide EN 01PaulNessuna valutazione finora

- ILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTDocumento54 pagineILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTCherry Lyn Belgira60% (5)

- McLeod Architecture or RevolutionDocumento17 pagineMcLeod Architecture or RevolutionBen Tucker100% (1)

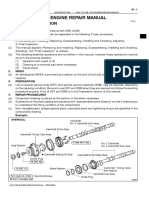

- How To Use This Engine Repair Manual: General InformationDocumento3 pagineHow To Use This Engine Repair Manual: General InformationHenry SilvaNessuna valutazione finora

- 05 Gregor and The Code of ClawDocumento621 pagine05 Gregor and The Code of ClawFaye Alonzo100% (7)

- The Neteru Gods Goddesses of The Grand EnneadDocumento16 pagineThe Neteru Gods Goddesses of The Grand EnneadKirk Teasley100% (1)

- CSR of Cadbury LTDDocumento10 pagineCSR of Cadbury LTDKinjal BhanushaliNessuna valutazione finora

- PIA Project Final PDFDocumento45 paginePIA Project Final PDFFahim UddinNessuna valutazione finora

- Phasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary EssayDocumento4 paginePhasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary Essayapi-428138727Nessuna valutazione finora

- MA CHAPTER 2 Zero Based BudgetingDocumento2 pagineMA CHAPTER 2 Zero Based BudgetingMohd Zubair KhanNessuna valutazione finora

- Popular Restaurant Types & London's Top EateriesDocumento6 paginePopular Restaurant Types & London's Top EateriesMisic MaximNessuna valutazione finora

- Codilla Vs MartinezDocumento3 pagineCodilla Vs MartinezMaria Recheille Banac KinazoNessuna valutazione finora

- Vegan Banana Bread Pancakes With Chocolate Chunks Recipe + VideoDocumento33 pagineVegan Banana Bread Pancakes With Chocolate Chunks Recipe + VideoGiuliana FloresNessuna valutazione finora

- MiQ Programmatic Media Intern RoleDocumento4 pagineMiQ Programmatic Media Intern Role124 SHAIL SINGHNessuna valutazione finora

- Environmental Science PDFDocumento118 pagineEnvironmental Science PDFJieyan OliverosNessuna valutazione finora

- Popular Painters & Other Visionaries. Museo Del BarrioDocumento18 paginePopular Painters & Other Visionaries. Museo Del BarrioRenato MenezesNessuna valutazione finora