Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Banking Law Negotiable Instruments Act

Caricato da

rizofpicicCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Banking Law Negotiable Instruments Act

Caricato da

rizofpicicCopyright:

Formati disponibili

26

PAPER-5

( 2 Semester, 1 Year of the 3-Year LLB course) Introduction Evolution of Banking Institutions Services of Banks Functions of Commercial Banks Social Control of Banks Nationalisation of Banks Institutional Frame work of Banking The Reserve Bank of India and its Role Functions of the Reserve Bank of India RB and its promotional Role R.B. and Commercial Banks. The Banking Reuglation Act, 1949

BANKING LAW INCLUDING NEGOTIABLE INSTRUMENTS ACT nd st

1. Preliminary 2. Business of Banking Companies 3. Provisions of the Nationalizing Act Application of B.R. Act 1949 to the Nationalized banks Regulations for Nationalized Banks, Management of Nationalized Banks effects of Nationalisation Achievement of Nationalised Banks 4. Controls over Management 5. Acquisition of the undertaking of Banking Companies in certain cases 6. Suspension of Business and winding up of Banking companies 7. Special Provisions for speedy disposal of winding up proceedings 8. Provisions relating to certain operations of Banking Companies 9. Miscellaneous Provisions 10. Banking organizations Private individuals partnership firms Hindu Joint family system Banking companies or corporations. 11. Banker and customer : Definition of Banker customer the General relation between Banker and Customer Special features of the relationship Statutory obligation on Banks in India Bankers general lien Banker obligation Unremunerative Accounts Law and limitation and Deposits. 12. Bankers / Borrowers : Forms of Borrowing Discounting Bills Participation certificates, Bank deposits fixed or time deposits saving deposits Attachment of Deposit by income Tax authorities opening of new account Special types of Customers ; Married Women Joint Accounts Insolvency of Joint Account Holder, Drawing of cheque Survivorship Nomination Power to overdraw Husband and wife Joint Stock Companies Precautions to be taken in opening Accounts Opening Accounts opening of partnership Accounts. 13. Banking Operations ; Negotiable instruments and their characteristics Payment of cheques Protection to the Paying Banker Crossing of Cheque Payment of Customers Cheques Collecting Banker and Customer Account. 14. Guarantees : Definitions Indemnity and Guarantee Distinction obligations of the Banker Rights of Banker against surely Termination of Guarantee Letters of Credit and Bank Guarantee.

27 15. Advances Secured by Collateral Securities Modes of Securing Advances - Bankers Lien Pledge Mortgage of Movables Hypothecation Advances against goods and documents of title of goods. 16. Mortgages Leading Cases 1. State of Maharashtra Vs M.N.Kaul AIR 1967 SC 1934 2. Kerala Electrical and Allied Engineering Co Ltd Vs Canara Bank and other AIR 1980 Kar 151 3. Nagpur Nagarik Sahakari Bank Ltd Vs Union of India 1981 AP 153 4. Texmace Ltd Vs State Bank of India (1979) 83 CN 807 5. Maharashtra State Electricity Board Vs Official Liquidator, Ernakular AIR 1983 SC 1947 6. United Bank of India, Vs Nederlandsche, Standard Bank (1963) 33 Compo Cas 1 7. Roshal Lal Anand Vs Mercantile Bank Ltd (1975) 5 Compos Cas 519 8. Ellerman and bucknall steamship Co Ltd Vs Sha Misrimal Bherajee AIR 1966 SC 1992 9. Morvi Mercantile Bank Ltd Vs Union of India (1965) 35 Compo Cas 629 10. Union Bank of India Vs Swastika Motors AIR 1983 Del 240 11. Syndicate Bank Vs The Arfician Co P Ltd 1977 Ker 103 12. The Canara Industrial and Banking Syndicate Ltd Vs Ramachandra Ganapathy Prabhu AIR 1968 Ms 133 13. Canara Bank Vs Canara Sales Corporation Ltd (1974) 44 Compo Cas 6 14. New Central Hall Vs The United Commercial Bank LTd AIR 1959 Mad 153 15. Canara Bank Ltd Vs I.V.Rajagopal (1975) 1 MLJ 420 16. Bapulal Premcahnd Vs North Bank Ltd AIR 1946 Bom 482 17. Maturi Sanyasalingam Vs the Exchange bank of India and Africa Ltd (1947) 17 Com Cas 233 18. Bharat Bank Vs Kishin Chand Clellaram 1954 (1 MLJ 560) 19. Bansilal Abirchand Vs Sadasiv Bhopathi (1942) 12 Compo Cas 116 20. Gopal Singh Hirasingh Vs Punjab National Bank and others AIR 1976 Delhi 115 21. Bank of Bihar Vs State of Bihar (1971) 41 Compos Cas 591 22. Tanjore Permanent Bank Ltd Vs Pangachari AIR 1959 Mad 119 Case Law Banker and Customer 23. Bank of Commercial Ltd Vs Kunj Behari Kar AIR 1945 24. SBI Vs Shyama Devi AIR 1978 SC 1263 25. Underwood Vs Banclays Bank 1924 1 KB 775 26. Canara Bank Ltd I.V. Raja Gopal Books Recommended S.Tannan Banking Law and Practice in India M.S.Parthasarathy : Banking Law Leading Indian Ceases Negotiable Instruments :

28 Negoitable and Assignability Bill of Exchange, Cheque and Promissory Notes Indoresement _ Different types of Indosement- Effect of Indorsement conversionof blank indorsement into full indorsement. Negotionation or dishounoured and over due instruments present for acceptance presentment for payment when presentment for payment unnecessary parties to bill of exchange holder and holder in due course special rights in due course Classification Negotiable. Instruments Liabilities of Parties Discharge from Liability, material alternation Protection of Bankers paying bank and collecting Banks. Dischonour, noting and Protest Cheques special features Distinction with bill of exchange and promissory note Crossing of cheque Kinds of crossing legal effect of crossing special rules of evidence Presumptions promissory notes right and liabilities of parties. Comparison with bill of Exchange and cheque.

Potrebbero piacerti anche

- How To Use DoulCi To Unlock Iphone For Free (Guide)Documento26 pagineHow To Use DoulCi To Unlock Iphone For Free (Guide)rizofpicic100% (2)

- The Declaration of Independence: A Play for Many ReadersDa EverandThe Declaration of Independence: A Play for Many ReadersNessuna valutazione finora

- Duties of Banker Towards His CoustomerDocumento24 pagineDuties of Banker Towards His CoustomerAakashsharma0% (2)

- 2 ND Moot Final Respondent Memo 2019 XTH SemDocumento20 pagine2 ND Moot Final Respondent Memo 2019 XTH SemManoj SnNessuna valutazione finora

- University Institute's Course on Equity, Trusts & Relief ActsDocumento13 pagineUniversity Institute's Course on Equity, Trusts & Relief ActsHarneet Kaur50% (2)

- Effect of Recent Amendments in Negotiable Instruments Act On The Pending Cases As Well As Appeals.Documento27 pagineEffect of Recent Amendments in Negotiable Instruments Act On The Pending Cases As Well As Appeals.kshemaNessuna valutazione finora

- Equity PrototypeDocumento17 pagineEquity PrototypeMugambo MirzyaNessuna valutazione finora

- What Is The Difference Between Commercial Banking and Merchant BankingDocumento8 pagineWhat Is The Difference Between Commercial Banking and Merchant BankingScarlett Lewis100% (2)

- Law of Damages in IndiaDocumento52 pagineLaw of Damages in IndiaAishwarya PandeyNessuna valutazione finora

- Darfting and Pleading SlidesDocumento29 pagineDarfting and Pleading Slidesbik11111Nessuna valutazione finora

- Economics of Money Banking and Financial Markets 9th Edition Mishkin Test BankDocumento27 pagineEconomics of Money Banking and Financial Markets 9th Edition Mishkin Test BankĐỗ Ngọc Huyền Trang100% (1)

- Excel ShortcutsDocumento10 pagineExcel ShortcutsrizofpicicNessuna valutazione finora

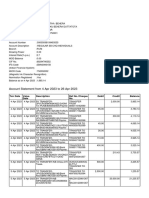

- Account statement from 4 Apr 2023 to 26 Apr 2023Documento7 pagineAccount statement from 4 Apr 2023 to 26 Apr 2023BIKRAM KUMAR BEHERANessuna valutazione finora

- Promissory NoteDocumento3 paginePromissory NoteABNessuna valutazione finora

- Writ of Quo WarrantoDocumento11 pagineWrit of Quo WarrantoArushi KumarNessuna valutazione finora

- CAT Paper FA2Documento16 pagineCAT Paper FA2Asra Javed100% (1)

- Banking Law BookDocumento179 pagineBanking Law Bookbhupendra barhatNessuna valutazione finora

- Tutorial 9 - Bills of ExchangeDocumento5 pagineTutorial 9 - Bills of Exchangemajmmallikarachchi.mallikarachchiNessuna valutazione finora

- Trade Finance: GuideDocumento36 pagineTrade Finance: Guidesujitranair100% (1)

- Promisory Note: Unit - 2 BY Prof. Thaseen Sultana GFGC Frazer Town, BangaloreDocumento12 paginePromisory Note: Unit - 2 BY Prof. Thaseen Sultana GFGC Frazer Town, BangaloreThaseen SultanaNessuna valutazione finora

- Dishonour of Cheque Banking LawDocumento12 pagineDishonour of Cheque Banking LawAnurag PatelNessuna valutazione finora

- RURAL Banking in India ProjectDocumento107 pagineRURAL Banking in India Projectdevendra68% (28)

- Rajasthan High Court Judgment DT August 10, 2015, Declared The Jain Practice of SantharaDocumento46 pagineRajasthan High Court Judgment DT August 10, 2015, Declared The Jain Practice of SantharaLatest Laws TeamNessuna valutazione finora

- Procedure in Relation To Children in Need of Care and Protection Under JJ ActDocumento14 pagineProcedure in Relation To Children in Need of Care and Protection Under JJ ActSoumiki GhoshNessuna valutazione finora

- Arun Mishra and S. Abdul Nazeer, JJDocumento15 pagineArun Mishra and S. Abdul Nazeer, JJShreya SinghNessuna valutazione finora

- BANKER-CUSTOMER RELATIONSHIPDocumento30 pagineBANKER-CUSTOMER RELATIONSHIPUtkarsh LodhiNessuna valutazione finora

- Debts Recovery Tribunals ExplainedDocumento2 pagineDebts Recovery Tribunals Explainedsimoncm999Nessuna valutazione finora

- Rectification or Cancellation of InstrumentsDocumento13 pagineRectification or Cancellation of InstrumentsVarun OberoiNessuna valutazione finora

- Assignment ON NEGOTIABLE INSTRUMENTS ACTDocumento12 pagineAssignment ON NEGOTIABLE INSTRUMENTS ACTFarha RahmanNessuna valutazione finora

- PMI Practice Standard For SchedulingDocumento29 paginePMI Practice Standard For SchedulingAjay Kumar75% (4)

- Unit 2 Sherman Antitrust Act of 1890Documento15 pagineUnit 2 Sherman Antitrust Act of 1890Prachi Tripathi100% (1)

- Mishkin 6ce TB Ch08Documento29 pagineMishkin 6ce TB Ch08JaeDukAndrewSeoNessuna valutazione finora

- VILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Documento6 pagineVILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Stephen VillanteNessuna valutazione finora

- Fintech 400 PDFDocumento410 pagineFintech 400 PDFHarshil MehtaNessuna valutazione finora

- Understanding Banker's LienDocumento13 pagineUnderstanding Banker's Liengeegostral chhabraNessuna valutazione finora

- Deficiency of Service in Banks (India)Documento10 pagineDeficiency of Service in Banks (India)Parveen Kumar0% (1)

- Law of Banking Updated-2Documento14 pagineLaw of Banking Updated-2Ashraf AliNessuna valutazione finora

- Sl. No. Name and Designation of The Officer Page NoDocumento77 pagineSl. No. Name and Designation of The Officer Page NoPranav PagareNessuna valutazione finora

- Grounds of Eviction. Land LawsDocumento8 pagineGrounds of Eviction. Land Lawsaruba ansariNessuna valutazione finora

- Essential Elements of Drafting A Gift DeedDocumento9 pagineEssential Elements of Drafting A Gift DeedAniruddha Kaul100% (1)

- Moses v. MacferlanDocumento1 paginaMoses v. MacferlanBhumikaNessuna valutazione finora

- Recovery of Debts Due To Banks and FinancialDocumento15 pagineRecovery of Debts Due To Banks and FinancialantcbeNessuna valutazione finora

- Class Moot Medical NegligenceDocumento19 pagineClass Moot Medical NegligenceasthaNessuna valutazione finora

- Conflict of Law Project FinalDocumento31 pagineConflict of Law Project FinalSHUBHAM PANDEYNessuna valutazione finora

- The Doctrine of Promissory PDFDocumento25 pagineThe Doctrine of Promissory PDFAmita SinwarNessuna valutazione finora

- Indemnity Bond ExplainedDocumento4 pagineIndemnity Bond ExplainedAksa Rasool100% (1)

- Agency in Law of ContractDocumento11 pagineAgency in Law of ContractYash Vardhan SinghNessuna valutazione finora

- IRDA Act ExplainedDocumento5 pagineIRDA Act ExplainedSuraj ChandraNessuna valutazione finora

- Consitution - Meaning, Need, TypesDocumento20 pagineConsitution - Meaning, Need, TypesJoseph MondomaNessuna valutazione finora

- Damages and Penalty Under Sec 73 & 74 of ICADocumento10 pagineDamages and Penalty Under Sec 73 & 74 of ICAGyan Prakash0% (1)

- Cheque Brief Introduction and RequisitesDocumento3 pagineCheque Brief Introduction and Requisitespurinaresh850% (1)

- Constitutional Law IRACDocumento7 pagineConstitutional Law IRACChinmay GuptaNessuna valutazione finora

- BailmentDocumento7 pagineBailmentdynamo vjNessuna valutazione finora

- Unjust Enrichment and Contract LawDocumento21 pagineUnjust Enrichment and Contract LawShraddhaNessuna valutazione finora

- "Debenture Trustee" - Position, Powers and Duties - It Is The LawDocumento13 pagine"Debenture Trustee" - Position, Powers and Duties - It Is The LawRohitSharmaNessuna valutazione finora

- Defamation Is Injury To The Reputation of A PersonDocumento23 pagineDefamation Is Injury To The Reputation of A PersonAkwasi BoatengNessuna valutazione finora

- Fidelity Bank PLC vs. Okwuowulu & Anor (2012) LPELR-8497 (CA)Documento3 pagineFidelity Bank PLC vs. Okwuowulu & Anor (2012) LPELR-8497 (CA)GraceNessuna valutazione finora

- Doctrine of Ultra ViresDocumento8 pagineDoctrine of Ultra ViresAkash Verma100% (1)

- Parag RIGHTS AND LIABLITIES OF BENEFICIARIES UNDER TRUSTDocumento18 pagineParag RIGHTS AND LIABLITIES OF BENEFICIARIES UNDER TRUSTVishal Saxena100% (1)

- Chapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"Documento12 pagineChapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"vaishnav bridNessuna valutazione finora

- Teaching Plan - Socio-Economic OffencesDocumento16 pagineTeaching Plan - Socio-Economic OffencesramNessuna valutazione finora

- Business and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3Documento41 pagineBusiness and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3UtsavNessuna valutazione finora

- Once a Mortgage, Always a Mortgage: Understanding the Doctrine of Equity of RedemptionDocumento4 pagineOnce a Mortgage, Always a Mortgage: Understanding the Doctrine of Equity of RedemptionRupeshPandyaNessuna valutazione finora

- World Legal SystemDocumento15 pagineWorld Legal SystemPranjali GuptaNessuna valutazione finora

- Government Recruits CHOs and MLHPsDocumento10 pagineGovernment Recruits CHOs and MLHPsswapnitha tummaNessuna valutazione finora

- (BCO200027) Understanding Lien and Its TypesDocumento18 pagine(BCO200027) Understanding Lien and Its TypesMukilan AloneNessuna valutazione finora

- Bennett National Moot Court Competition MemorialDocumento41 pagineBennett National Moot Court Competition MemorialAditi PradhanNessuna valutazione finora

- Banking Law Negotiable Instruments Act PDFDocumento3 pagineBanking Law Negotiable Instruments Act PDFJohnNessuna valutazione finora

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Documento490 pagineUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SNessuna valutazione finora

- Banking Systems in India: S.P.Mohanty Assistant General Manager Reserve Bank of India BhubaneswarDocumento22 pagineBanking Systems in India: S.P.Mohanty Assistant General Manager Reserve Bank of India BhubaneswarSanjay ParidaNessuna valutazione finora

- MS2010 Excel 2010 Core External ODDocumento3 pagineMS2010 Excel 2010 Core External ODrizofpicicNessuna valutazione finora

- Quantitative MethodsDocumento8 pagineQuantitative MethodsPatrick MondlaneNessuna valutazione finora

- Mohammad Nadeem Iqbal FINALDocumento1 paginaMohammad Nadeem Iqbal FINALrizofpicicNessuna valutazione finora

- LicenseDocumento6 pagineLicensemerrysun22Nessuna valutazione finora

- Urriculum Vitae: Muhammad Amin ShabbirDocumento1 paginaUrriculum Vitae: Muhammad Amin ShabbirrizofpicicNessuna valutazione finora

- Muhammad Ibrahim: Itae UrriculumDocumento3 pagineMuhammad Ibrahim: Itae UrriculumrizofpicicNessuna valutazione finora

- Muhammad Ateeq Sadeeq Address Email Phone ObjectiveDocumento2 pagineMuhammad Ateeq Sadeeq Address Email Phone ObjectiverizofpicicNessuna valutazione finora

- Ed ExcelDocumento60 pagineEd ExcelrizofpicicNessuna valutazione finora

- Muhammad Aleem Javed: ObjectiveDocumento1 paginaMuhammad Aleem Javed: ObjectiverizofpicicNessuna valutazione finora

- Awais Arif CV WD ExpDocumento1 paginaAwais Arif CV WD ExprizofpicicNessuna valutazione finora

- ReadmeDocumento1 paginaReadmerizofpicicNessuna valutazione finora

- Hafiz Muhammad Nazeer Khan: Computer OperatorDocumento2 pagineHafiz Muhammad Nazeer Khan: Computer OperatorrizofpicicNessuna valutazione finora

- Hafiz Zohair Fayyaz: ObjectiveDocumento2 pagineHafiz Zohair Fayyaz: ObjectiverizofpicicNessuna valutazione finora

- Hafiz Zohair Fayyaz: ObjectiveDocumento2 pagineHafiz Zohair Fayyaz: ObjectiverizofpicicNessuna valutazione finora

- Hasan Akhtar: QualificationsDocumento3 pagineHasan Akhtar: QualificationsrizofpicicNessuna valutazione finora

- Arslan C.VDocumento3 pagineArslan C.VrizofpicicNessuna valutazione finora

- Hasan Akhtar: QualificationsDocumento3 pagineHasan Akhtar: QualificationsrizofpicicNessuna valutazione finora

- 98-349 MTA SSG WindowOS SSG Without CropDocumento65 pagine98-349 MTA SSG WindowOS SSG Without CropAlexandra VilceanuNessuna valutazione finora

- HepatitisC Guide 2014Documento207 pagineHepatitisC Guide 2014Myo Thet HanNessuna valutazione finora

- Save Ur Money Get Ups in Watts No in Va, Watt Is Bigger Then Va Mean 1000w Ups 1600va - Lahore - ElectronicsDocumento6 pagineSave Ur Money Get Ups in Watts No in Va, Watt Is Bigger Then Va Mean 1000w Ups 1600va - Lahore - ElectronicsrizofpicicNessuna valutazione finora

- Conversion UnitsDocumento1 paginaConversion UnitsEdrian DiazNessuna valutazione finora

- ReadmeDocumento1 paginaReadmerizofpicicNessuna valutazione finora

- SQL Manual UpgradeDocumento3 pagineSQL Manual UpgraderizofpicicNessuna valutazione finora

- 162 3 1000782165 e IDocumento3 pagine162 3 1000782165 e IrizofpicicNessuna valutazione finora

- Edit Hosts File in Windows 7Documento4 pagineEdit Hosts File in Windows 7rizofpicicNessuna valutazione finora

- Conversion UnitsDocumento1 paginaConversion UnitsEdrian DiazNessuna valutazione finora

- Save Ur Money Get Ups in Watts No in Va, Watt Is Bigger Then Va Mean 1000w Ups 1600va - Lahore - ElectronicsDocumento6 pagineSave Ur Money Get Ups in Watts No in Va, Watt Is Bigger Then Va Mean 1000w Ups 1600va - Lahore - ElectronicsrizofpicicNessuna valutazione finora

- DRDADocumento8 pagineDRDAworld_best284562100% (1)

- Accounting RevisionDocumento8 pagineAccounting RevisionAnish KanthetiNessuna valutazione finora

- Analysis of Frauds in Indian Banking SectorDocumento4 pagineAnalysis of Frauds in Indian Banking SectorEditor IJTSRD100% (1)

- Cases Brief - ShivamDocumento6 pagineCases Brief - ShivamShivam ChoudharyNessuna valutazione finora

- Ayala CorporationDocumento9 pagineAyala CorporationJo AntisodaNessuna valutazione finora

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Documento17 pagineR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNessuna valutazione finora

- Adat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THDocumento4 pagineAdat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THJayasankar MallisseriNessuna valutazione finora

- Digipay GuruDocumento13 pagineDigipay GuruPeterhill100% (1)

- Cash Management System of Commercial Bank of EthiopiaDocumento44 pagineCash Management System of Commercial Bank of EthiopiaEfrem Wondale88% (8)

- Dissertation On Financial Crisis 2008Documento115 pagineDissertation On Financial Crisis 2008Brian John SpencerNessuna valutazione finora

- Working Capital ManagementDocumento59 pagineWorking Capital ManagementjuanferchoNessuna valutazione finora

- Chapter 14Documento12 pagineChapter 14Aditi SenNessuna valutazione finora

- Project Report of Bank of KathmanduDocumento30 pagineProject Report of Bank of Kathmandushyamranger85% (27)

- Deed of UndertakingDocumento5 pagineDeed of UndertakingPeter Roderick M. OlpocNessuna valutazione finora

- FI Group AssignmentDocumento20 pagineFI Group AssignmentLilyNessuna valutazione finora

- DH3050 Tenancy Assistance Application 03.21Documento16 pagineDH3050 Tenancy Assistance Application 03.21Sarah VirziNessuna valutazione finora

- Oxford Internship GuideDocumento18 pagineOxford Internship GuideVijeta KumariNessuna valutazione finora

- Module - 3 PDFDocumento7 pagineModule - 3 PDFKeyur PopatNessuna valutazione finora

- SUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREDocumento18 pagineSUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREEy-ey ChioNessuna valutazione finora

- Protecting Bank CustomersDocumento19 pagineProtecting Bank CustomersMUHAMMAD REVITO ADRIANSYAHNessuna valutazione finora

- CAPITAL-MARKET-BBA-3RD-SEM - FinalDocumento84 pagineCAPITAL-MARKET-BBA-3RD-SEM - FinalSunny MittalNessuna valutazione finora

- Great DepressionDocumento32 pagineGreat DepressionBerenice MondilloNessuna valutazione finora