Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Khurrum Faisal Jamal - Comparative Study of Islamic Banking Between Malaysia and Pakistan 2

Caricato da

Mahmood KhanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Khurrum Faisal Jamal - Comparative Study of Islamic Banking Between Malaysia and Pakistan 2

Caricato da

Mahmood KhanCopyright:

Formati disponibili

COMPARATIVE STUDY OF ISLAMIC BANKING BETWEEN MALAYSIA AND PAKISTAN

A thesis submitted to the Faculty of Finance and Banking in partial fulfillment of the requirement for the degree Master of Science (Finance), Universiti Utara Malaysia

by Khurrum Faisal Jamal

Khurrum Faisal Jamal, 2006. All rights reserved

COMPARATIVE STUDY OF ISLAMIC BANKING BETWEEN MALAYSIA AND PAKISTAN

KHURRUM FAISAL JAMAL

UNIVERSITI UTARA MALAYSIA 2006

TABLE OF CONTENTS Page PERMISSION TO USE ABSTRAK ABSTRACT ACKNOWLEDGEMENT LIST OF TABLES i ii IIi iv V

CHAPTER ONE INTRODUCTION 1.1 Overview of Islamic Banking 1.2 Islamic Banking in Pakistan 1.3 Islamic Banking in Malaysia 1.4 Problem Statement 1.5 Objectives and Scope of Study 1.6 Limitation of the study 1 3 4 7 8 9

CHAPTER TWO LITERATURE REVIEW 2.1 Theory 2.1.1 Quranic Verses Related to Islamic Banking 2.1.2 Riba in Hadith 2.1.3 Finance Theories Related to Islamic Banking 2.1.3.1 Agency Problem 2.1.3.2 Moral Hazard & Adverse Selection 2.1.4 Ethical Banking Principle and Shariah Law 2.1.5 Issues and Problems 2.2 Related Studies 2.2.1 Empirical Evidence 10 10 13 17 17 20 21 23 26 38

CHAPTER THREE ISLAMIC FINANCIAL INSTRUMENTS PRACTICED IN MALAYSIA AND PAKISTAN

3.1 Murabaha

3.2 Ijara 3.3 Mudaraba 3.4 Musharaka 3.5 Bay Salam 3.6 Istisna 3.7 Bay Bithamal Ajjil 3.8 Bay al-inah 3.9 Bay al-Dayn

49

50 51 52 52 53 54 55 56

CHAPTER FOUR RESEARCH METHODOLOGY 4.1 Data Sources 4.2 Population 4.3 Sampling Unit 4.4 Sample Size 4.5 Research Design 4.6 Data Analysis 57 57 57 58 58 59

CHAPTER FIVE ANALYSIS OF RESULTS 5.1 Frequency Analysis Results 5.2 Cross Tabulation Results from Pakistan 5.3 Cross Tabulation Results from Malaysia 5.4 Correlation Result from Pakistan 5.5 Correlation Result from Malaysia 5.6 T-test Analysis 60 99 110 122 124 126

5.7 Financial Performance

133

CHAPTER SIX FINDINGS 6.1 Differences 6.2 Similarities 6.3 Summary of Financial Performance 137 140 142

CHAPTER SEVEN CONCLUSION AND RECOMMENDATION 7.1 Conclusion 7.2 Recommendations BIBLIOGRAPHY APPENDIX Questionnaire 143 147 150 156 157

PERMISSION TO USE

In presenting this thesis in partial fulfillment of the requirements for the post graduate degree from Universiti Utara Malaysia, I agree that the University Library may make it freely available for inspection. I further agree that permission for copying of this thesis in any manner, in whole or in part, for scholarly purposes may be granted by my supervisor(s) or, in their absence, by the Dean of the Faculty of Finance and Banking. It is understood that any copying or publication or use of this thesis or parts thereof for financial gain shall not be allowed without my written permission. It is also understood that due recognition shall be given to me and to Universiti Utara Malaysia for any scholarly use which may be made of any material from my thesis.

Requests for permission to copy or to make other use of materials in this thesis, in whole or in part, should be addressed to:-

Dean of Faculty of Finance and Banking Universiti Utara Malaysia 06010 UUM Sintok Kedah Darul Aman

ABSTRAK

Kajian ini mengupas beberapa isu dan juga 7 aspek ia-itu promosi, produk, keutamaan, pengetahuan, prestasi dan juga infrastruktur dalam membuat perbandingan perbankan Islam di Pakistan dan di Malaysia. Dua kaedah kajian telah di gunakan untuk menjawab objektif-objektif kajian. Pertamanya ialah kaedah kualitatif (soal-selidik) dan keduanya kaedah kuantitatif (analisa penyata kewangan). Penemuan kajian ini menunjukkan terdapat beberapa persamaan dan perbezaan dalam amalan system perbankan Islam di antara Pakistan dan Malaysia. Kekurangan kesedaran mengenai perbankan Islam di dapati sangant tinggi di Pakistan berbanding di Malaysia. Usaha promosi berkaitan perbankan Islam di Pakistan di dapati adalah di tahap yang rendah sedangkan pelanggan-pelanggan di Malaysia lebih mengetahui menegenai perbankan Islam kerana bank-bank lebih agresif mempromosikan perkhidmatan perbankan Islam mereka. Adalah di sarankan bahawa sokongan padu daripada kerajaan negara masing-masing masih di perlukan untuk terus memperkembangkan perbankan Islam. Hasil kajian juga mendapati bahawa faktor agama merupakan pendorong utama kepada perbankan Islam di Pakistan, sedangkan di Malaysia, perbankan Islam merupakan satu perbankan yang dapat menarik pelanggan Muslim dan juga yang bukan Muslim. Kajian ini juga memberi petanda yang perbankan Islam mempunyai potensi yang cerah di kedua-dua negara.

ii

ABSTRACT

This study deals with several objectives and 7 aspects namely promotion, product, preference, knowledge, performance, problem and infrastructure in making comparison on Islamic banking between Pakistan and Malaysia. Two techniques were used to answer the research objectives. Firstly, the qualitative method (questionnaire) and second the quantitative method (analysis of financial statements of the leading banks). The findings of thesis indicate that there are few differences and similarities exist between Malaysia and Pakistan in Islamic banking practices. The lack of awareness of Islamic banking is very high in Pakistan as compared to Malaysia. A few promotions were used by Islamic banks in Pakistan while in Malaysia customers are knowledgeable about Islamic banking because banks promote them aggressively. However there should be continuous and strong support by each government to stimulate Islamic banking system. The study finds that respondents in both countries agree that Islamic banking is a very important part of banking system primarily for religious factor in case of Pakistan and as for Malaysia it serves as an alternative banking system that appeals to both Muslims and non-Muslims. The study provides evidence that there is a vast potential of future growth in Islamic banking in both countries.

iii

ACKNOWLEDGEMENT

In the name of Allah, the most beneficent and merciful, who enables me to reach the Zenith of educational level of my life through His mercy. I am thankful to the Almighty Allah for His countless blessings. He is the one who give me that much perseverance to complete my Masters of Science (Finance) Degree.

I gratefully acknowledge to all the professors and teachers who offered valuable guidance and share their knowledge and experiences, with me during my studies at University Utara Malaysia.

I wish to express my deep thanks to my Thesis advisor Dr. Nor Hayati Ahmad for giving me her dynamic supervision, guidance and vast experience in shaping the proposal. Her influential ideas and vast experience in financial corporate sector as well as the way of encouraging and appreciation encouraged me to complete this report successfully and timely.

Thanks are due to all personnel of different banks in Pakistan and Malaysia who gave me their valuable time to help me gathering vital information to accomplish this task successfully. Finally, thanks to my family for their moral support in completing my studies.

Khurrum Faisal Jamal 86217

iv

LIST OF TABLES

Table 5.1 How do you rank the performance of Islamic Banking 60 in competition with Conventional Banking? Table 5.2 To what extent the present Islamic Banking System in Pakistan/Malaysia has Islamic spirit? Table 5.3 To what extent the products are designed according to customer's preference? 61

62

Table 5.4 To what extent the Islamic Banking Products are the 63 best substitute of Conventional Banking Products? Table 5.5 To what extent Islamic Banking Products are developed according to the shariah principle? Table 5.6 The role of present Supervisory Board in the development of Islamic Banking in Pakistan/ Malaysia at what level? 64

65

Table 5.7 Islamic Banks need to improve knowledge sharing 66 among them to make Islamic banking more attractive, how do you rank this? Table 5.8 Trained Staff can play vital role in the success of Islamic Banking System, how do you rank this statement? Table 5.9 To what extent Islamic banking in Pakistan/ Malaysia effected due to lack of research & development in this field? 68

69

Table 5.10 To what extent the Islamic Banking System tailored 70 the market performance? Table 5.11 To what extent the Forums/Conferences are important to create awareness about Islamic Banking? Table 5.12 How do you rank the advertising and promotional Campaign in Islamic Banking sector as a success factor? Table 5.13 To what extent currently Islamic Banks are using advertising and other promotional campaign to attract the customer in Pakistan/Malaysia? 71

72

73

Table 5.14 To what extent you consider Moral Hazard and Adverse Selection problem in Islamic Banking System? Table 5.15 Agency problem is a big issue faced by Islamic Banking System, how do you rank this problem? Table 5.16 Which is most popular Islamic Financial Product in Pakistan/Malaysia? Table 5.17 Which Financial Product is being commonly used in your bank for house financing? Table 5.18 Which Financial Product is being commonly used in your bank for creation of letter of credit? Table 5.19 What is the main challenge face by Islamic Banks in Pakistan/Malaysia? Table 5.20 What is the reason of giving preference to Islamic Banking In all over the World? Table 5.21 What are the reasons of not enough using Bay al-Inah and Bay al-Dayn products in Pakistan/ Malaysia? Table 5.22 How Education Sector can play its role to promote Islamic Banking? Table 5.23 How to make Islamic Banking more attractive for customer? Table 5.24 Mudarabah and Musharakah investment less popular compared to other form of investment (i.e. BBA, Ijarah and Murabaha) Table 5.25 BBA, Ijarah and Murabaha are more profitable and less risky than Musharakah and Mudarabah.

74

75

76

78

79

80

81

82

84

85

86

86

Table 5.26 Monitoring and supervising cost of the Mudarabah and Musharakah is very high for the bank.

87

vi

Table 5.27 Islamic Banking is just a mirror effect of Conventional 88 Banking, is it true? Table 5.28 Government support is a key factor to promote Islamic Banking in a country; do you agree with this statement? 88

Table 5.29 Are you satisfied from the contribution of government 89 and central bank in promoting Islamic Banking in Pakistan/Malaysia? Table 5.30 Have you ever attend any Conference on Islamic Banking? Table 5.31 Education sector contribution for Islamic Banking promotion is appreciateable, is it true? Table 5.32 Have you ever used Bay al-Inah and Bay al-Dayn in banking practice? Table 5.33 The customer prefers Islamic Banking because of interest free element. Table 5.34 Islamic Banking Products are innovative, is it true? Table 5.35 Do you think the Islamic Banking Products are easily available? Table 5.36 Gender Table 5.37 Designation Table 5.38 Age Table 5.39 Working Experience in banking sector Table 5.40 Qualification Table 5.41 Residential Area Table 5.42 Banks Table 5.43 Q16: Which is most popular Islamic Financial Product in Pakistan? *Q25: BBA, Ijarah and Murabaha are more profitable and less risky than Musharakah and Mudarabah. 90

90

91

92

93 93

94 95 95 96 97 97 98 99

Table 5.44 Q21: What are the reasons of not enough using 100 Bay al-Inah and Bay al-Dayn products in Pakistan?

vii

*Q32: Have you ever used Bay al-Inah and Bay al-Dayn in banking practice? Table 5.45 Q16: Which is most popular Islamic FInancial Product in Pakistan? *Q26: Monitoring and Supervising cost of the Mudarabah and Musharakah is very high for the bank. Table 5.46 Q20: What is the reason of giving preference to Islamic Banking in all over the World? * Q33: The customer prefers Islamic Banking because of interest free element Table 5.47 Q2: To what extent the present Islamic Banking System in Pakistan has Islamic spirit? * Q33: The customer prefers Islamic Banking because of interest free element. 101

102

103

Table 5.48 Q13: To what extent currently Islamic Banks are 104 using advertising and other promotional campaign to attract the customer in Pakistan? * Q19: What is the main challenge face by Islamic Banks in Pakistan? Table 5.49 Q5: To what extent Islamic Banking Products are developed according to the shariah priciple? *Q27: Islamic Banking is just a mirror effect of Conventional Banking, is it true? Table 5.50 Q6: The role of present Supervisory Board in the development of Islamic Banking in Pakistan at what level? * Q28: Government support is a key factor to promote Islamic Banking in a country; do you agree with this statement? Table 5.51 Q11: To what extent the Forums/Conferences are important to create awareness about Islamic Banking? * Q30: Have you ever attend any Conference on Islamic Banking? 105

106

108

Table 5.52 Q1: How do you rank the performance of Islamic 109 Banking in competition with Conventional Banking? *Q35: Do you think the Islamic Banking Products are easily available?

Table 5.53 Q16: Which is most popular Islamic FInancial Product in Malaysia? *Q25: BBA, Ijarah and Murabaha are more Profitable and less risky than Musharakah and Mudarabah.

110

viii

Table 5.54 Q21: What are the reasons of not enough using 111 Bay al-Inah and Bay al-Dayn products in Malaysia? *Q32: Have you ever used Bay al-Inah and Bay al-Dayn in banking practice? Table 5.55 Q16: Which is most popular Islamic Financial 112 Product in Malaysia? *Q26: Monitoring and supervising cost of the Mudarabah and Musharakah is very high for the bank. Table 5.56 Q20: What is the reason of giving preference to Islamic Banking in all over the World? * Q33: The customer prefers Islamic Banking because of interest free element. Table 5.57 Q2: To what extent the present Islamic Banking System in Malaysia has Islamic spirit? * Q33: The customer prefers Islamic Banking because of interest free element. 113

114

Table 5.58 Q19: What is the main challenge face by Islamic 116 Banks in Malaysia? * Q13: To what extent currently Islamic Banks are using advertising and other promotional campaign to attract the customer in Malaysia? Table 5.59 Q5: To what extent Islamic Banking Products are developed according to the shariah priciple?* Q27: Islamic Banking is just a mirror effect of Conventional Banking, is it true? Table 5.60 Q6: The role of present Supervisory Board in the development of Islamic Banking in Malaysia at what level? * Q28: Government support is a key factor to promote Islamic Banking in a country; do you agree with this statement? Table 5.61 Q11: To what extent the Forums/Conferences are important to create awareness about Islamic Banking? *Q30: Have you ever attend any Conference on Islamic Banking? 117

118

119

Table 5.62 Q1: How do you rank the performance of Islamic 120 Banking in competition with Conventional Banking? *Q35: Do you think the Islamic Banking Products are easily available? Table 5.63 Correlations Results from Pakistan Table 5.64 Correlations Results from Malaysia 122 124

ix

Table 5.65 Promotion Table 5.66 Product Table 5.67 Preference Table 5.68 Knowledge Table 5.69 Performance Table 5.70 Problem Table 5.71 Infrastructure Table 5.72 Liquidity Ratios Table 5.73 Risk and Solvency Ratio Table 5.74 Profitability Ratio

126 127 129 130 131 132 133 134 134 134

CHAPTER ONE

INTRODUCTION

1.1

Overview of Islamic Banking

Islamic banking is basically a system of financial intermediation, its primary objective is to avoid receipt and payment of interest. In other words we can say this is to conduct banking transaction with the ethos of the value system of Islam. Islam does not only prohibit dealing with interest but also with liquor, pork, gambling, pornography and any other thing which are considered haram according to shariah. The first modern experiment with Islamic banking was undertaken in Egypt, and it was without projecting an Islamic image. The pioneering effort, in Islamic banking was made by Ahmad El Najjar. He first established a savings bank based on profit-sharing in the Egyptian town of Mit Ghamr in l963. This experiment was successful and since then until l967 there were nine such banks in the country.

The Nasir Social Bank, established in Egypt in l97l, was declared an interestfree commercial bank. In the seventies, a number of Islamic banks came into existence in the Middle East, for example the Dubai Islamic Bank (l975), the Faisal Islamic Bank of Sudan (l977), the Faisal Islamic Bank of Egypt (l977), and the Bahrain Islamic Bank (l979), to mention a few. The Islamic Development Bank was established in l974 by the Organization of Islamic Countries (OIC). Over the last three decades Islamic banking did progress so rapidly and has

The contents of the thesis is for internal user only

BIBLIOGRAPHY

Abdul Halim Abdul Hamid & Norizaton Azmin Mohd Nordin. A study on Islamic banking education and Strategy for the new Millennium - Malaysian experience: International Journal of Islamic Financial Services Vol. 2 No.4

Abdullah M Noman. Imperatives of Financial Innovation for Islamic Banks: International Journal of Islamic Financial Services, Vol.4, No.3

Abdus Samad & M. Kabir Hassan. The performance of Malaysian Islamic bank During 1984-1997: an exploratory study: International Journal of Islamic Financial Services Vol. 1 No.3

Ahmad Kaleem & Mansor Md Isa. Causal relationship between Islamic and conventional Banking instruments in Malaysia: International Journal of Islamic Financial Services, Vol.4, No.4

Ahmad, N. and S. Haron, (2002). Perception of Malaysian Corporate Customers Towards Islamic Banking Products and Services, International Journal of Islamic Financial Services,.

Al-Arabi, Mohammad Abdullah, (l966). 'Contemporary banking transactions and Islam's views thereon', Islamic Review, London, May l966: l0-l6.

A.L.M. Abdul Gafoor. (2002-2004). Interest, Usury, Riba, and the Operational Costs of a Bank: Chapter 2 from Book.

Ariff, M. (1988). Islamic Banking: Asian Pacific Economic Literature, 2-2, PP 4864.

Chapra, M. Umer. (l982). Money and banking in an Islamic economy.

150

Choi, David and Valikangas, Liisa (2001). Six Sigma and TQM cannot create sustainable value unless coupled with a more innovative strategy. Strategy and Business, Issue 23, pp.15-16.

Concept and ideology: Issues and problems of Islamic banking.

Council of Islamic Ideology (CII), Pakistan. (l983). 'Elimination of interest from the economy', in Ziauddin, Ahmed et al.

Donsyah Yudistira. (2003).Efficiency in Islamic Banking: an Empirical Analysis of 18 Banks: Dr. Mabid Ali Al-Jarhi. Islamic finance: an Efficient & equitable Option. The Islamic Research and Training Institute.

Dennis Olson, Taisier A. Zoubi. Financial Characteristics of Banking Industry in the GCC Region: Islamic Vs. Conventional Banks.

Erol. C. and R. El-Bdour. (1989). Attituded, Behaviour and Patronage Factors of Bank Customers Towards Islamic Banks: International Journal of Bank Marketing, Volume 7, No. 6, pp. 31-37.

Gafoor A.L.M. (1996). Interest Free Commercial Banking: A S Noordeen, Kuala Lumpur.

Gerrard, P. and J. B. Cunningham. (1997) Islamic Banking: A Study in Singapore, International Journal of Bank Marketing, Volume 15, No. 6, pp. 20416. Gillian Rice, Ph.D. and Essam Mahmoud, Ph.D. (2001). Integrating Quality Management, Creativity and Innovation in Islamic Banks: Paper prepared for presentation at the American Finance House - Lariba 8th Annual International Conference, Pasadena, CA.

151

Gopalakrishnan, Shanthi. (2000). Unraveling the links between dimensions of innovation and organizational performance: The Journal of High Technology Management Research, 11, 137-153. Haron, S. Ahmad, N. and S. L. Planisek. (1994) Bank Patronage Factors of Muslim and Non-Muslim Customers: International Journal of Bank Marketing, Volume 12, No. 1, pp. 32-40.

Haroon and Noraffifah A. (2000). The Effects of Conventional Interest Rates and Rate of Profit on Funds Deposited with Islamic Banking System in Malaysia: International Journal of Islamic Financial services, 1, No.3,

Humayon a. Dar. Demand for Islamic Financial Services in the UK: Chasing a Mirage?

Iqbal, Zubair and Mirakhor, Abbas. (l987). Islamic Banking, International Monetary Fund: Occasional Paper 49, Washington D.C.

Irshad, S.A. (l964). Interest-Free Banking: Orient Press of Pakistan, Karachi

Kahf, Monzer. (1999).Islamic banks at the threshold of the third millennium. Special on Issue Islamic Banking: Thunderbird International Business Review, 41, 445-460.

Karim, R., Ali, A. (1989). Determinants of the financial strategy of Islamic banks: Journal of Business Finance and Accounting 16, 193-212.

Karsten, I. (1982). Islam and financial intermediation: IMF Staff Papers, (1):10842.

Khan, M. Fahim. (l983). 'Islamic banking as practised now in the world' in Ziauddin, Ahmad et al. (eds.).

152

M. Kabir Hassan, Abdel-Hameed M. Bashir. Determinants of Islamic Banking Profitability.

Man, Z (1988). Islamic Banking: The Malaysian Experiences, Islamic Banking in South East Asi:,Institute of South East Asian Studies, Singapore.

Miriam Sophia Netzer. (2004). Riba in Islamic Jurisprudence: the role of interest in discourse on law and State. Master of Arts in Law and Diplomacy Thesis

Metawa, S A and Almossawi, M. (1997). Banking Behavior of Islamic Bank Customers: Perspectives and Implications: International Journal of Bank Marketing, Vol. 16 No. 1, P. 32.

Mahmoud Amin El-Gamal. (2000). A Basic Guide to Contemporary Islamic Banking and Finance: Rice University.

Md. Abdul Awwal Sarker. Islamic business contracts, agency problem and the theory of the Islamic firm: International Journal of Islamic Financial Services Vol. 1 No.2

Mohamed Ariff. September 1988), Islamic Banking: University of Malaya, taken from Asian-Pacific Economic Literature, Vol. 2, No. 2 (pp. 46-62).

4 Islamic Financial Services. Pakistan: Financial Sector Assessment 2004. Muhammad Mazhar Iqbal. A Broader Definition of Riba.

Mohsin, M. (l982). 'Profile of riba-free banking', in M. Ariff (ed.), above. Naqvi, S.N.H., l98l. Ethics and Economics: An Islamic Synthesis: The Islamic Foundation, Leicester.

Naser, K. Jamal, A. and K. Al-Khatib. (1999) Islamic Banking: A Study of Customer Satisfaction and Preferences in Jordan: International Journal of Bank Marketing, Volume 17, No. 3, pp. 135-50.

153

Overview of Islamic Banking in Malaysia: Bank Negara Malaysia.

Qureshi, Anwar Iqbal. (l946). Islam and the Theory of Interest, Lahore.

Radiah A K. (1993). Performance and Market Implication of Islamic Banking (A Case Study of Bank Islam Malaysia Berhad): Unpublished PhD Thesis.

Range of Islamic Banking Products and Services in Malaysia Deposit: Bank Negara Malaysia (2006).

Rogers, E. (1983). Diffusion of Innovations: Third Edition. New York: Free Press.

Rosenblatt, J., Laroche, M., Hochstein, A., Mctavish, R., and Sheahan, M. (1988). Commercial banking in Canada: a study of the selection criteria and service expectations of treasury officers: International Journal of Bank Marketing, Vol. 6, No. 4, pp. 20-30.

Rosly, S. A., and Abu Bakar, M.A. (2003). Performance of Islamic and mainstream banks in Malaysia: International Journal of Social Economics 20, 1249-1265. Shabbir h. Kazmi. (2002). Islamization of Financial System in Pakistan: State Bank of Pakistan

Simon, H. (1991). Bounded rationality and organizational learning: Organization Science. 2, 125-134.

Sudin Haron. A Comparative Study of Islamic Banking Practices.

Sudin Haron & Norafifah Ahmad. Perceptions of Malaysian corporate customers Towards Islamic banking products & services: International Journal of Islamic Financial Services, Volume 3, Number 4

154

Towards Islamic Banks: International Journal of Banking Marketing, Vol 7- 6, PP 31-9

Turnbull, P.W. (1983). Corporate attitudes towards bank services: International Journal of Bank Marketing, Vol. 1, No. 1, pp. 53-68. Turnbull, P.W., and Gibbs, M.J. (1989). The selections of banks and banking services among corporate customers in South Africa: International Journal of Bank Marketing, Vol. 7, No. 5, pp. 36-39.

Tyler, K., and Stanley, E. (1999). UK bank-corporate relationships: large corporate expectations of Service: International Journal of Bank Marketing, Vol. 17, No. 4, pp. 158-172.

Uzair, Mohammad. ( l955). An Outline of `Interestless Banking: Raihan Publications, Karachi.

Von Krogh, G. (1998). Care in knowledge creation: California Management Review. 40, Spring, 133-153.

Yahia Abdul-Rahma. Islamic Instruments for Managing Liquidity: International Journal of Islamic Financial Services Vol. 1 No.1

155

Potrebbero piacerti anche

- Sustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersDa EverandSustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersNessuna valutazione finora

- Quality Assurance for Higher Education Institutions in MalawiDa EverandQuality Assurance for Higher Education Institutions in MalawiNessuna valutazione finora

- Exploring The Perceptions & Attitudes of Tertiary Students' Towards Islamic Banking in BangladeshDocumento53 pagineExploring The Perceptions & Attitudes of Tertiary Students' Towards Islamic Banking in BangladeshIbrahim HossainNessuna valutazione finora

- Shariah Risk Management Practices OF Islamic Banks in MalaysiaDocumento110 pagineShariah Risk Management Practices OF Islamic Banks in Malaysiausmaninuwa1040Nessuna valutazione finora

- Poverty and Microfinance in Pakistan...Documento182 paginePoverty and Microfinance in Pakistan...tazeenseema100% (1)

- Islamic Investment 2Documento65 pagineIslamic Investment 2fatinsyazwani_uumNessuna valutazione finora

- Internship Report: Main Branch Tatta Pani Aj&KDocumento54 pagineInternship Report: Main Branch Tatta Pani Aj&KHasnain ParvezNessuna valutazione finora

- Abdul Sattar 2018Documento48 pagineAbdul Sattar 2018ABDUL sattarNessuna valutazione finora

- Factors in Uencing Adoption of Islamic Banking: A Study From PakistanDocumento17 pagineFactors in Uencing Adoption of Islamic Banking: A Study From PakistanHariNessuna valutazione finora

- University of Mumbai Tilak College of Science and Commerce Vashi, Navi Mumbai-400705Documento6 pagineUniversity of Mumbai Tilak College of Science and Commerce Vashi, Navi Mumbai-400705Vishu SakpalNessuna valutazione finora

- Thesis On Determinants of Profitability of Islamic Banks in BangladeshDocumento35 pagineThesis On Determinants of Profitability of Islamic Banks in BangladeshRiday KhanNessuna valutazione finora

- Islamic Banking Experience of Pakistan: Comparison Between Islamic and Conventional BanksDocumento7 pagineIslamic Banking Experience of Pakistan: Comparison Between Islamic and Conventional BanksSaqib MehmoodNessuna valutazione finora

- Islamic Banking Experience of Pakistan: Comparison Between Islamic and Conventional BanksDocumento7 pagineIslamic Banking Experience of Pakistan: Comparison Between Islamic and Conventional BanksNadeemNessuna valutazione finora

- Islamic BankingDocumento63 pagineIslamic BankingMehak ZqNessuna valutazione finora

- Final Internship Report On NBLDocumento89 pagineFinal Internship Report On NBLMd. Rahat ChowdhuryNessuna valutazione finora

- Investment Policy of AIBLDocumento70 pagineInvestment Policy of AIBLSobuj BernardNessuna valutazione finora

- City University Research JournalDocumento24 pagineCity University Research JournalRabia AfzalNessuna valutazione finora

- MODULE P2112: Malaysia PolytechnicsDocumento11 pagineMODULE P2112: Malaysia PolytechnicsStephen WongNessuna valutazione finora

- Internship Report, Dubai Islamic BankDocumento61 pagineInternship Report, Dubai Islamic BankMuhammad DaniYal Rashid75% (4)

- Customers Preference Towards Islamic Banking - Religious Belief or Influence of Economic FactorsDocumento28 pagineCustomers Preference Towards Islamic Banking - Religious Belief or Influence of Economic FactorsIbrahim HossainNessuna valutazione finora

- Universiti Putra MalaysiaDocumento25 pagineUniversiti Putra MalaysiafandiezzatiNessuna valutazione finora

- Bank Alfalah: Muhammad Usama KhalidDocumento14 pagineBank Alfalah: Muhammad Usama KhalidusamaNessuna valutazione finora

- April June 2015 PDFDocumento108 pagineApril June 2015 PDFadepeNessuna valutazione finora

- MFG en Paper Non Productivity of Microfinance Loans in Pakistan Sep 2010Documento108 pagineMFG en Paper Non Productivity of Microfinance Loans in Pakistan Sep 2010Sufi KhanNessuna valutazione finora

- Financial Performance Analysis of Al Arafa Bank Ltd.Documento78 pagineFinancial Performance Analysis of Al Arafa Bank Ltd.Munsi Araf60% (5)

- The Level of Malay Awareness Towards Unit Trust InvestmentDocumento70 pagineThe Level of Malay Awareness Towards Unit Trust InvestmentRedzwan Jaafar0% (1)

- Dissertation Islamic FinanceDocumento129 pagineDissertation Islamic Financeleopantra100% (1)

- Internship Report On Islami Bank Bangladesh LTDDocumento68 pagineInternship Report On Islami Bank Bangladesh LTDrashed_8929685Nessuna valutazione finora

- Transformation - of - Bank - Islam - Malaysia - Be (2017)Documento12 pagineTransformation - of - Bank - Islam - Malaysia - Be (2017)Faidz FuadNessuna valutazione finora

- Report On Islamic Bank - FinalDocumento52 pagineReport On Islamic Bank - FinalAli Huzaifa0% (1)

- Panthapath Branch Dhaka. Panthapath Branch Dhaka. Panthapath Branch DhakaDocumento57 paginePanthapath Branch Dhaka. Panthapath Branch Dhaka. Panthapath Branch DhakaSolemanNessuna valutazione finora

- Transformationof Bank Islam Malaysia Berhad Leadingand Managing StrategicallyDocumento13 pagineTransformationof Bank Islam Malaysia Berhad Leadingand Managing StrategicallyUcheang KhengNessuna valutazione finora

- An Investigation of Customers Awareness Level and Customers Service Utilization Decision in Islamic BankingDocumento17 pagineAn Investigation of Customers Awareness Level and Customers Service Utilization Decision in Islamic BankingTutugo SwasonoNessuna valutazione finora

- AcknowledgementDocumento3 pagineAcknowledgementCh Arslan BashirNessuna valutazione finora

- Financial Analysis of SBI Bank PROJECT (MANSI)Documento110 pagineFinancial Analysis of SBI Bank PROJECT (MANSI)manan88% (8)

- 1Documento10 pagine1Nahidul Islam IUNessuna valutazione finora

- A Comparative Analysis of Bankers' Perception of Islamic Banking in BangladeshDocumento12 pagineA Comparative Analysis of Bankers' Perception of Islamic Banking in BangladeshA_D_I_BNessuna valutazione finora

- Islamic Microfinance Workshop-AzerbaijanDocumento7 pagineIslamic Microfinance Workshop-AzerbaijanAlHuda Centre of Islamic Banking & Economics (CIBE)Nessuna valutazione finora

- SirPoji Research Proposal Progress MGT646 - CompressedDocumento20 pagineSirPoji Research Proposal Progress MGT646 - CompressedMOHD ZULFAZLIE BIN MOHD JUHNessuna valutazione finora

- MBL Internship ReportDocumento34 pagineMBL Internship ReportAyman Ahmed Cheema0% (1)

- Islamic Economic FrameworkDocumento179 pagineIslamic Economic FrameworkdanishyasinNessuna valutazione finora

- Thesis Last VersionDocumento168 pagineThesis Last Versionbaehaqi17Nessuna valutazione finora

- A New Economic Framework Based On Islamic PrinciplesDocumento163 pagineA New Economic Framework Based On Islamic PrinciplesHeidi FreeNessuna valutazione finora

- Employees' Perceptions About Islamic Banking and Its Growth Potential in PakistanDocumento24 pagineEmployees' Perceptions About Islamic Banking and Its Growth Potential in PakistanshizaNessuna valutazione finora

- Internship Report of Sjibl-GbDocumento45 pagineInternship Report of Sjibl-GbsaminbdNessuna valutazione finora

- Challenges Facing Islamic BankingDocumento92 pagineChallenges Facing Islamic BankingMohamed Elgazwi88% (8)

- Micro Finance Thesis ReportDocumento67 pagineMicro Finance Thesis ReportSadiq Sagheer82% (11)

- Saimul Shihab KhanDocumento93 pagineSaimul Shihab Khanrohanfyaz00Nessuna valutazione finora

- Final Copy of Bank Alfalah ProjectDocumento58 pagineFinal Copy of Bank Alfalah ProjectAqeel GillNessuna valutazione finora

- Shariah Issues in IslamicDocumento14 pagineShariah Issues in IslamicEwan PeaceNessuna valutazione finora

- TAMIM at AIBLDocumento21 pagineTAMIM at AIBLsupershefatNessuna valutazione finora

- Internship Report On Social Islami Bank Limited 1Documento56 pagineInternship Report On Social Islami Bank Limited 1sakib100% (3)

- Md. Atiqur Rahman: Submitted by Submitted ToDocumento9 pagineMd. Atiqur Rahman: Submitted by Submitted Toatiq_iukNessuna valutazione finora

- Journal of Quality Assurance for Higher Education Institutions in Malawi: Book IiDa EverandJournal of Quality Assurance for Higher Education Institutions in Malawi: Book IiNessuna valutazione finora

- Algerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyDa EverandAlgerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyNessuna valutazione finora

- Strategic Leadership: Realizing Student Aspiration OutcomesDa EverandStrategic Leadership: Realizing Student Aspiration OutcomesNessuna valutazione finora

- How to Enhance Your Medical Academic Portfolio: A Guide for Doctors in TrainingDa EverandHow to Enhance Your Medical Academic Portfolio: A Guide for Doctors in TrainingNessuna valutazione finora

- Sri Lanka: Public Training Institutions in 2016: Tracer StudyDa EverandSri Lanka: Public Training Institutions in 2016: Tracer StudyNessuna valutazione finora

- Speech On 14th AugustDocumento2 pagineSpeech On 14th AugustMahmood KhanNessuna valutazione finora

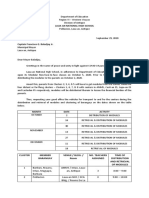

- # Bank/ DFI/ MFB Rating Agency Short Term Long Term Date of Rating RemarksDocumento1 pagina# Bank/ DFI/ MFB Rating Agency Short Term Long Term Date of Rating RemarksMahmood KhanNessuna valutazione finora

- Leverage Determinants in The Absence of Corporate Tax System: The Case of Non-Financial Publicly Traded Corporations in Saudi ArabiaDocumento29 pagineLeverage Determinants in The Absence of Corporate Tax System: The Case of Non-Financial Publicly Traded Corporations in Saudi ArabiaMahmood KhanNessuna valutazione finora

- Dissertation PDFDocumento89 pagineDissertation PDFMahmood KhanNessuna valutazione finora

- Shawn Charisma LectureDocumento20 pagineShawn Charisma LectureMahmood KhanNessuna valutazione finora

- Branch Manager: Las Vegas - Clark County Library DistrictDocumento5 pagineBranch Manager: Las Vegas - Clark County Library DistrictMahmood KhanNessuna valutazione finora

- Shawns Ethics LectureDocumento27 pagineShawns Ethics LectureMahmood KhanNessuna valutazione finora

- 1999 Annual Report of BAFDocumento16 pagine1999 Annual Report of BAFMahmood KhanNessuna valutazione finora

- Psychology 1508: VisionDocumento53 paginePsychology 1508: VisionMahmood KhanNessuna valutazione finora

- 1508 01 IntroDocumento14 pagine1508 01 IntroMahmood KhanNessuna valutazione finora

- Psychology 1508: Leadership CoachingDocumento21 paginePsychology 1508: Leadership CoachingMahmood KhanNessuna valutazione finora

- Horizontal AnalysisDocumento1 paginaHorizontal AnalysisMahmood KhanNessuna valutazione finora

- AAEC 4302 Advanced Statistical Methods in Agricultural ResearchDocumento11 pagineAAEC 4302 Advanced Statistical Methods in Agricultural ResearchMahmood KhanNessuna valutazione finora

- Bayeh AsnakewDocumento126 pagineBayeh AsnakewMahmood Khan100% (2)

- DLF New Town Gurgaon Soicety Handbook RulesDocumento38 pagineDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaNessuna valutazione finora

- Prince Baruri Offer Letter-1Documento3 paginePrince Baruri Offer Letter-1Sukharanjan RoyNessuna valutazione finora

- Depreciated Replacement CostDocumento7 pagineDepreciated Replacement CostOdetteDormanNessuna valutazione finora

- Savage Worlds - Space 1889 - London Bridge Has Fallen Down PDFDocumento29 pagineSavage Worlds - Space 1889 - London Bridge Has Fallen Down PDFPablo Franco100% (6)

- Restrictive Covenants - AfsaDocumento10 pagineRestrictive Covenants - AfsaFrank A. Cusumano, Jr.Nessuna valutazione finora

- Febi Dwirahmadi - PPT Disaster Management and COVID19Documento34 pagineFebi Dwirahmadi - PPT Disaster Management and COVID19Fenny RahmadianitaNessuna valutazione finora

- CompTIA Network+Documento3 pagineCompTIA Network+homsom100% (1)

- Module Letter 1Documento2 pagineModule Letter 1eeroleNessuna valutazione finora

- Weight Watchers Business Plan 2019Documento71 pagineWeight Watchers Business Plan 2019mhetfield100% (1)

- How Beauty Standards Came To BeDocumento3 pagineHow Beauty Standards Came To Beapi-537797933Nessuna valutazione finora

- Jurisdiction and Kinds of JurisdictionDocumento3 pagineJurisdiction and Kinds of JurisdictionANUKULNessuna valutazione finora

- RwservletDocumento2 pagineRwservletsallyNessuna valutazione finora

- Dwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFDocumento36 pagineDwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFbiolysis.roomthyzp2y100% (9)

- Relative Clauses: A. I Didn't Know You Only Had OnecousinDocumento3 pagineRelative Clauses: A. I Didn't Know You Only Had OnecousinShanti AyudianaNessuna valutazione finora

- Chapter 1 Introduction To Quranic Studies PDFDocumento19 pagineChapter 1 Introduction To Quranic Studies PDFtaha zafar100% (3)

- Gandhi An Exemplary LeaderDocumento3 pagineGandhi An Exemplary LeaderpatcynNessuna valutazione finora

- CHAPTER 1 - 3 Q Flashcards - QuizletDocumento17 pagineCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocumento13 pagineNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Sharmeen Obaid ChinoyDocumento5 pagineSharmeen Obaid ChinoyFarhan AliNessuna valutazione finora

- Comprehensive Problem Excel SpreadsheetDocumento23 pagineComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Jive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns AreDocumento2 pagineJive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns Aretic apNessuna valutazione finora

- C1 Level ExamDocumento2 pagineC1 Level ExamEZ English WorkshopNessuna valutazione finora

- Labor Law BarVenture 2024Documento4 pagineLabor Law BarVenture 2024Johnny Castillo SerapionNessuna valutazione finora

- Organization and ManagementDocumento65 pagineOrganization and ManagementIvan Kirby EncarnacionNessuna valutazione finora

- Daftar Kata Kerja Beraturan (Regular Verbs) : Kata Dasar Past Participle ArtinyaDocumento6 pagineDaftar Kata Kerja Beraturan (Regular Verbs) : Kata Dasar Past Participle ArtinyaEva Hirul MalaNessuna valutazione finora

- Testamentary Succession CasesDocumento69 pagineTestamentary Succession CasesGjenerrick Carlo MateoNessuna valutazione finora

- The Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Documento8 pagineThe Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Ivo CarneiroNessuna valutazione finora

- Elaine Makes Delicious Cupcakes That She Mails To Customers AcrossDocumento1 paginaElaine Makes Delicious Cupcakes That She Mails To Customers Acrosstrilocksp SinghNessuna valutazione finora

- Letter To Singaravelu by M N Roy 1925Documento1 paginaLetter To Singaravelu by M N Roy 1925Avinash BhaleNessuna valutazione finora