Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 7 Aa 1 Sol

Caricato da

Luffy D. IchigoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 7 Aa 1 Sol

Caricato da

Luffy D. IchigoCopyright:

Formati disponibili

CHAPTER 7

SUGGESTED ANSWERS

Exercise 7-1

1

.

Contract price

Cost incurred to date

Est. cost to complete

2006

2007

2008

P50,000,000

P 7,500,000

30,000,000

P50,000,000

P34,500,000

8,625,000

Total estimated cost

Total estimated gross profit

Percentage of completion

37,500,000

P12,500,000

20%

P43,125,000

P 6,875,000

80%

P50,000,000

P40,800,000

__________

P40,800,000

P 9,200,000

100%

2006 - Recognized revenue

Cost of revenue

Gross profit

To Date

P10,000,000

7,500,000

P 2,500,000

Recognized in prior year/s

-

To be recognized this year

P10,000,000

7,500,000

P 2,500,000

2007 - Recognized revenue

Cost of revenue

Gross profit

P40,000,000

34,500,000

P 5,500,000

P10,000,000

7,500,000

P 2,500,000

P30,000,000

27,000,000

P 3,000,000

2008 - Recognized revenue

Cost of revenue

Gross profit

P50,000,000

40,800,000

P 9,200,000

P40,000,000

34,500,000

P 5,500,000

P10,000,000

6,300,000

P 3,700,000

2006

2007

2008

2

.

a. Construction in progress

Cash, Materials, etc.

7,500,000

b. Accounts Receivable

8,000,000

Progress Billings on Const. Contracts

27,000,000

7,500,000

6,300,000

27,000,000

36,000,000

8,000,000

6,300,000

6,000,000

36,000,000

6,000,000

AA1 - Chapter 7 (2008 edition)

page

c. Cash

Accounts Receivable

5,500,000

d. Cost of LTCC

Construction in Progress

Revenue from LTCC

7,500,000

2,500,000

33,000,000

5,500,000

11,500,000

33,000,000

27,000,000

3,000,000

10,000,000

11,500,000

6,300,000

3,700,000

30,000,000

10,000,000

d. Progress Billings on

Construction Contracts

Construction In Progress

50,000,000

50,000,000

3

.

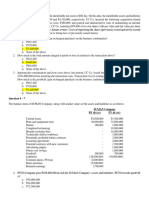

Statement of Financial Position

Current Assets:

Accounts Receivable

P5,500,000

Current Liabilities:

Progress Billings on Construction Contracts

Less Construction in Progress

P44,000,000

40,000,000

P4,000,000

Exercise 7-2

2006

a. Construction in Progress

Cash, Materials, etc.

32,000,000

b. Accounts Receivable

Progress Billing on Const. Contract

33,000,000

c. Cash

Accounts Receivable

31,000,000

2007

43,000,000

32,000,000

15,500,000

43,000,000

45,000,000

33,000,000

15,500,000

22,000,000

45,000,000

40,000,000

31,000,000

2008

22,000,000

29,000,000

40,000,000

29,000,000

AA1 - Chapter 7 (2008 edition)

Cost of LTCC

Construction in Progress

Revenue from LTCC

e. Progress Billing on Const. Contracts

Construction in Progress

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

page

23,000,000

2,000,000

45,250,000

4,750,000

25,000,000

2006

P100,000,000

P 32,000,000

60,000,000

P 92,000,000

P 8,000,000

25%

22,250,000

2,750,000

50,000,000

2007

P100,000,000

P 75,000,000

16,000,000

P 91,000,000

P 9,000,000

75%

2008

P100,000,000

P 90,500,000

___________

P 90,500,000

P 9,500,000

100%

2006 - Recognized revenue

Cost of revenue

Gross profit

To date

P25,000,000

23,000,000

P 2,000,000

Recognized in prior year/s

-

To be recognized this year

P25,000,000

23,000,000

P 2,000,000

2007 - Recognized revenue

Cost of revenue

Gross profit

P75,000,000

68,250,000

P 6,750,000

P25,000,000

23,000,000

P 2,000,000

P50,000,000

45,250,000

P 4,750,000

2008 - Recognized revenue

Cost of revenue

Gross profit

P100,000,000

90,500,000

P 9,500,000

P75,000,000

68,250,000

P 6,750,000

P25,000,000

22,250,000

P 2,750,000

Exercise 7-3

1

.

25,000,000

100,000,000

100,000,000

Contract price

Total estimated cost:

Cost incurred to date

Estimated cost to complete

P25,000,000

P 4,400,000

15,600,000

20,000,000

AA1 - Chapter 7 (2008 edition)

2

.

page

Total estimated gross profit

Percentage of completion ( P 400,000/20,000,000)

Gross profit to be recognized in 2008

P 5,000,000

22%

P 1,100,000

Accounts Receivable

(P25,000,000 x 30% x 10%)

P 750,000

Construction in Progress

Progress Billings on Construction Contracts

(P4,400,000 + P1,100,000)

(P25,000,000 x 30%)

P5,500,000

P7,500,000

Exercise 7-4

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

2006

P35,000,000

P17,500,000

10,500,000

P28,000,000

P 7,000,000

62.5%

2007

P35,000,000

P29,250,000

3,250,000

P32,500,000

P 2,500,000

90%

2008

P35,000,000

P31,000,000

P31,000,000

P 4,000,000

100%

2006 - Recognized revenue

Cost of revenue

Gross profit

To date

P21,875,000

17,500,000

P 4,375,000

Recognized in prior year/s

-

To be recognized this year

P21,875,000

17,500,000

P 4,375,000

2007 - Recognized revenue

Cost of revenue

Gross profit

P31,500,000

29,250,000

P 2,250,000

P21,875,000

17,500,000

P 4,375,000

P 9,625,000

11,750,000

P(2,125,000)

2008 - Recognized revenue

Cost of revenue

Gross profit

2. Journal entries

P35,000,000

31,000,000

P 4,000,000

P31,500,000

29,250,000

P 2,250,000

P 3,500,000

1,750,000

P 1,750,000

2006

a. Construction in Progress

17,500,000

2007

11,750,000

2008

1,750,000

AA1 - Chapter 7 (2008 edition)

page

Cash, Materials, etc.

17,500,000

b. Accounts Receivable

Progress Billing on

Const. Contracts

c. Cash

Accounts Receivable

16,000,000

d. Cost of LTCC

Construction in Progress

Construction in Progress

Rev. from LTCC

17,500,000

4,375,000

11,750,000

1,750,000

12,000,000

16,000,000

15,000,000

7,000,000

12,000,000

7,000,000

10,000,000

15,000,000

10,000,000

10,000,000

10,000,000

11,750,000

21,875,000

1,750,000

1,750,000

2,125,000

9,625,000

3,500,000

e. Progress Billing on Const. Contract

Construction in Progress

35,000,000

35,000,000

3.

2006 - Recognized revenue

Cost of revenue

Gross profit

To date

P17,500,000

17,500,000

==========

Recognized in prior year/s

============

To be recognized this year

P17,500,000

17,500,000

==========

2007 - Recognized revenue

Cost of revenue

Gross profit

P31,500,000

29,250,000

P 2,250,000

P17,500,000

17,500,000

----------------

P14,000,000

11,750,000

P 2,250,000

2008 - Recognized revenue

Cost of revenue

Gross profit

P35,000,000

31,000,000

P 4,000,000

P31,500,000

29,250,000

P 2,250,000

P3,500,000

1,750,000

P1,750,000

Exercise 7-5

Revenue recognized in 2008

(P26,000,000 x 40%)

P10,400,000

AA1 - Chapter 7 (2008 edition)

Gross profit/income recognized in 2008

Cost incurred in 2008

page

(P3,120,000 - P1,300,000)

1,820,000

P 8,580,000

Binondo Project

P12,000,000

12,400,000

P (400,000)

Pasig Project

P1,290,000

1,400,000

P( 110,000)

Exercise 7-6

Revenue (CP x % of work done in 2007)

Cost of revenue

Gross profit (loss)

Exercise 7-7

1. Contract revenue/price

Less Total profit

Total cost incurred

Less Cost incurred in 2006 and 2008

Cost incurred in 2007

P10,000,000

800,000

P 9,200,000

5,900,000

P 3,300,000

2. Gross profit to date, 12.31.07

Cost incurred to date, 12.31.07 (P1,800,000 + P3,300,000)

Revenue to date, 12.31.07

Percentage-of-completion (6,000,000/10,000,000)

P 900,000

5,100,000

P6,000,000

60%

3. Gross profit to date, 12.31.07

Percentage of completion

Total estimated gross profit

P 900,000

60%

P1,500,000

4. Contract price

Less Total estimated gross profit

Total estimated cost

Less Cost incurred to date

Estimated cost to complete

P10,000,000

1,500,000

P 8,500,000

5,100,000

P 3,400,000

Exercise 7-8

Cash

500,000

AA1 - Chapter 7 (2008 edition)

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

Exercise 7-9

1. Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

page

1,000,000

207,540

1,292,460

4,000,000

3,000,000

513,200

6,486,800

2. Cash

Notes Receivable

Discount on Notes Receivable

(3,000,000-(2.48685 x 1,000,000)

Revenue from Franchise Fees

4,000,000

3,000,000

3. Cash

Unearned Franchise Fees

4,000,000

513,200

6,486,800

4,000,000

4. Cash

4,000,000

Notes Receivable

3,000,000

Discount on Notes Receivable

Revenue from Franchise Fees

Unearned Franchise Fees (1,000,000 x 2.48685)

Exercise 7-10

2007

July 1 - Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fee

P800,000 x 3.1699 = P2,535,900

P3,200,000 - P2,535,900 = P664,100

513,200

4,000,000

2,486,800

1,200,000

3,200,000

644,100

3,735,900

AA1 - Chapter 7 (2008 edition)

page

Sept. 1 - Deferred Franchise Cost

Cash

100,000

100,000

Nov. 15 - Deferred Franchise Cost

Cash

Dec. 31 - Discount on Notes Receivable

Interest Revenue

P2,535,900 x 10% x 6/12 = P126,795

60,000

126,795

2008

Jan. 10 - Deferred Franchise Cost

Cash

100,000

60,000

126,795

100,000

15 - Unearned Franchise Fee

Franchise Fee Revenue

3,735,900

3,735,900

15 - Cost of Franchise Fee Revenue

Deferred Franchise Cost

260,000

260,000

July 1 - Cash

Notes Receivable

800,000

800,000

1 - Discount on Notes Receivable

Interest Revenue

126,795

126,795

Problem 7-1

2007

a. Construction in Progress

Cash, Materials, etc.

11,000,000

b. Accounts Receivable

Progress Billing on Const. Contract

10,800,000

c. Cash

10,000,000

2008

4,800,000

11,000,000

4,800,000

9,200,000

10,800,000

9,200,000

10,000,000

AA1 - Chapter 7 (2008 edition)

page

Accounts Receivable

10,000,000

d. Cost of LTCC

Construction in Progress

Revenue from LTCC

e. Progress Billing on Construction Contracts

Construction in Progress

11,000,000

2,750,000

13,750,000

20,000,000

Statement of Financial Position

Receivable: 2007

2008

P 800,000

-

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

Income (loss) Recognized

1,000,000

1,000,000

1,000,000

6,250,000

20,000,000

P2,750,000

1,450,000

Problem 7-3

Year

2006

2007

2008

10,000,000

4,800,000

1,450,000

Problem 7-2

Statement of Recognized Income and Expenses:

Income: 2007

2008

Inventory - CIP, net of billings

2007 (13,750,000 - 10,800,000)

2008

P2,950,000

Recl ending balance

380,000

940,000

2006

P15,000,000

P 4,000,000

8,000,000

P12,000,000

P 3,000,000

33 1/3%

CIP Invty. ending balance

5,000,000

12,000,000

2007

P15,000,000

P10,000,000

2,500,000

P12,500,000

P 2,500,000

80%

Cost in excess of billings

1,200,000

2,600,000

2008

P15,000,000

P12,000,000

---------------P12,000,000

P 3,000,000

100%

AA1 - Chapter 7 (2008 edition)

page

Gross profit to date

Less Gross profit recognized in prior year/s

Gross profit to be recognized this year

P 1,000,000

_____-______

P 1,000,000

P 2,000,000

1,000,000

P 1,000,000

PROJECT A

2007

2008

P29,000,000

P29,000,000

P16,800,000

P26,400,000

11,200,000

------------P28,000,000

P26,400,000

P 1,000,000

P 2,600,000

60%

100%

P 600,000

P 2,600,000

------600,000

PROJECT B

2007

2008

P34,000,000 P34,000,000

P14,400,000 P21,200,000

17,600,000

13,000,000

P32,000,000 P34,200,000

P 2,000,000 P( 200,000)

45%

P 900,000 P( 200,000)*

-----900,000

PROJECT C

2007

2008

P17,000,000

P17,000,000

P 3,200,000

P11,830,000

9,600,000

1,170,000

P12,800,000

P13,000,000

P 4,200,000

P 4,000,000

25%

91%

P 1,050,000

P 3,640,000

---1,050,000

P 900,000

P 1,050,000

10

P 3,000,000

2,000,000

P 1,000,000

Problem 7-4

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit (loss)

Percentage of completion

Gross profit (loss) to date

Less gross profit recognized in prior

year

Gross profit - current year

600,000

P 1,000,000

P(1,100,000)

* The entire loss should be recognized immediately

(1) Percentage of completion method

Gross profit

Operating expenses

Net income

2007

P2,550,000

1,200,000

P1,350,000

Problem 7-5

1. (a)

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

2006

P120,000,000

P 24,000,000

76,000,000

P100,000,000

P 20,000,000

2008

P3,890,000

1,200,000

P2,690,000

2007

P120,000,000

P60,500,000

49,500,000

P110,000,000

P 10,000,000

2008

P120,000,000

P90,000,000

10,000,000

P100,000,000

P 20,000,000

2009

P120,000,000

P105,000,000

-------P105,000,000

P 15,000,000

P 2,590,000

PROJECT D

2008

P2,000,000

P 5,600,000

10,400,000

P16,000,000

P 4,000,000

35%

P 1,400,000

----P 1,400,000

AA1 - Chapter 7 (2008 edition)

Percentage of completion

page

24%

55%

90%

Recognized in

2006-Revenue

Cost of revenue

Gross profit

To date

P28,800,000

24,000,000

P 4,800,000

prior year

----------------

2007-Revenue

Cost of revenue

Gross profit

To date

P66,000,000

60,500,000

P 5,500,000

Recognized in

prior year

P28,800,000

24,000,000

P 4,800,000

2008-Revenue

Cost of revenue

Gross profit

P108,000,000

90,000,000

P 18,000,000

P66,000,000

60,500,000

P 5,500,000

2009-Revenue

Cost of revenue

Gross profit

To date

P120,000,000

105,000,000

P 15,000,000

Recognized in

prior year

P108,000,000

90,000,000

P 18,000,000

2.

a

b.

Construction in Progress

Cash, Materials, etc.

Accounts Receivable

Progress Billings on Const. Contract

2006

24,000,000

26,000,000

P42,000,000

29,500,000

P12,500,000

To be

recognized

in current year

P 12,000,000

15,000,000

P( 3,000,000)

2008

29,500,000

36,500,000

31,000,000

26,000,000

100%

To be

recognized

in current year

P28,800,000

24,000,000

P 4,800,000

To be

recognized

in current year

P37,200,000

36,500,000

P 700,000

2007

36,500,000

24,000,000

11

2009

15,000,000

29,500,000

34,000,000

31,000,000

15,000,000

29,000,000

34,000,000

29,000,000

AA1 - Chapter 7 (2008 edition)

c.

d.

e.

page

Cash

Accounts Receivable

24,000,000

Cost of LTCC

Construction in Progress

Construction in Progress

Revenue from LTCC

24,000,000

4,800,000

27,000,000

24,000,000

30,000,000

27,000,000

36,500,000

700,000

28,800,000

30,000,000

30,000,000

29,500,000

12,500,000

37,200,000

3,000,000

12,000,000

42,000,000

120,000,000

120,000,000

Problem 7-6

2006

P14,000,000

P 5,000,000

7,500,000

P12,500,000

P 1,500,000

40%

P 600,000

-----P 600,000

2007

P14,000,000

P11,475,000

1,275,000

P12,750,000

P 1,250,000

90%

P 1,125,000

600,000

P 525,000

2008

P13,000.000

P12,295,000

------P12,295,000

P 705,000

100%

P 705,000

1,125,000

P (420,000)

Problem 7-7

1. Recognized revenue

Cost of revenue

Gross Profit (loss)

2. Contract-price

Cost incurred to date

Estimated cost to complete

Total estimated cost

30,000,000

15,000,000

Progress Billings on Const. Contracts

Construction in Progress

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

Gross profit to date

Less Gross profit recognized in prior year

Gross profit - current year

12

2006

P 1,100,000

1,000,000

P 100,000 (1)

2007

P1,300,000 (2)

1,250,000

P 50,000

2006

P3,500,000

1,000,000

P2,250,000

P3,250,000

2008

P1,100,000 (3)

1,150,000 (4)

P (50,000)

2007

P3,500,000

2,250,000

P 950,000

P3,200,000

Total

P3,500,000

3,400,000 (5)

P 100,000

AA1 - Chapter 7 (2008 edition)

page

Total estimated gross profit

250,000

Percentage of completion

30.77%

Gross profit to date

P 76,925

Less GP recognized in prior year/s

GP to be recognized this year

P 76,925

Problem 7-8

Franchise A:

The circumstances imply that the full accrual method could be used.

Franchise revenue

P3,578,000*

Franchise cost

1,400,000

Interest revenue (P2,178,000 x 4%)

Income from Franchise A

*Initial deposit

PV of four payments [4% for 4 periods

(P600,000 x 3.6299)]

13

300,000

70.3125%

P 210,938

76,925

P 134,013

P2,178,000

87,200

P2,265,200

P 1,400,000

2,178,000

P 3,578,000

Franchise B:

Because of the doubtful collection and only partial completion, the deposit method should be used. No revenue or income would be

recognized in 2008 from the franchise fee. However, because the first payment of P600,000 was made, interest revenue of P87,200 would

be recognized.

Franchise C:

Because of the doubtful collection but substantial completion, either the installment sales or cost recovery method could be used. If the

installment sales method is used, gross profit of P843,600* would be recognized in 2008 plus interest revenue of P87,200.

*Franchise revenue

Franchise cost

Franchise gross profit

Gross profit percentage: P1,578,000 P3,578,000

Collections in 2008:

Initial fee

P3,578,000

2,000,000

P1,578,000

44.1%

P1,400,000

AA1 - Chapter 7 (2008 edition)

page

14

First payment:

Interest

P 87,200

Principal

512,800

512,800

Total

P 600,000

P1,912,800

Gross profit recognized 2008: P1,912,800 x 44.1% = P843,600

If the cost recovery method is used, no revenue or income would be recognized, because the P2,000,000 collections are exactly offset by

the P2,000,000 costs.

Problem 7-9

2007

July 1

Cash

Notes Receivable

Unearned Franchise Fee

Aug. 15

Sept. 15

Dec. 31

2008

Jan. 1

15

31

7,000,000

8,000,000

15,000,000

Deferred Franchise Cost

Cash

800,000

Deferred Franchise Cost

Cash

500,000

Interest Receivable

Interest Revenue

400,000

800,000

500,000

400,000

Cash

Notes Receivable

Interest Receivable

2,400,000

Deferred Franchise Cost

Cash

1,000,000

Unearned Franchise Fee

Cost of Franchise Revenue

Franchise Fee Revenue

Deferred Franchise Cost

2,000,000

400,000

1,000,000

15,000,000

2,300,000

15,000,000

2,300,000

AA1 - Chapter 7 (2008 edition)

July

Dec.

31

page

Cash

Notes Receivable

Interest Revenue

P6,000,000 x 10% x 6/12

Interest Receivable

Interest Revenue

2,300,000

2,000,000

300,000

200,000

200,000

Problem 7-10

1. Downpayment made on 1/1/ 07

Present value of an ordinary annuity (P240,000 x 3.69590)

Total revenue recorded by Triple Eight

P 800,000.00

887,016.00

P1,687.016.00

e. Cost of acquisition

P 1,687,016

3. Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

f.

800,000.00

1,200,000.00

312,984.00

1,687,016.00

a.

P800,000 cash received from downpayment. (P887,016.00 is recorded as unearned revenue from franchise fees).

g. P800,000 cash received from downpayment

h. None. (P 800,000 is recorded as unearned revenue from Franchise fees).

MULTIPLE CHOICE

1.

2.

3.

4.

5.

C

B

D

A

C

6.

7.

8.

9.

10.

B

D

D

D

C

15

AA1 - Chapter 7 (2008 edition)

11

.

P20,000,000 x (3,000,000/15,000,000) =

12

.

Contract price

Less Total estimated cost:

Cost incurred to date

Est. cost to complete

Total estimated income

% of completion (3150/9450)

Income to be recognized in 2007

13

.

14

.

15

page

P4,000,000

P10,500,000

P3,150,000

6,300,000

9,450,000

P 1,050,000

33 1/3%

P 350,000

Contract price

P9,000,000

Total estimated cost

Total estimated income

Percentage-of-completion (27/81)

Income recognized last year

8,100,000

P 900,000

33 1/3%

P 300,000

Contract price

P15,000,000

Total estimated cost (P4,650,000 + P10,850,000)

Total estimated loss to be recognized in full

15,500,000

P 500,000

Contract price

Total estimated cost (P4M + P4M + P2M)

Total estimated gross profit

Percentage-of-completion (8M/10M)

P14,000,000

10,000,000

P 4,000,000

80%

16

AA1 - Chapter 7 (2008 edition)

page

Gross profit to date

Less Gross profit recognized in 2006

(P14M P8M = P6M x 4/8)

Gross profit to be recognized in 2007

P 3,200,000

P3,000,000

1,800,000

P1,200,000

33 1/3%

P 400,000

3,000,000

P 200,000

16

Contract price

Total estimated cost

Total estimated gross profit

Percentage-of-completion (600/1,800)

Gross profit to be recognized in 2007

17

.

Contract price

P12,000,000

Total cost incurred

Gross profit

Gross profit percentage (1,200/12,000)

10,800,000

P 1,200,000

10%

18

A

Contract price

Total estimated cost

Total est. gross profit

Percentage-of-completion

Gross profit to date

Less GP recognized in 2007

GP to be recognized In 2008

Total GP = P750,000 + P228,000

19.

20,000,000/24,000,000

20

Contract price

Total estimated cost

Total estimated gross profit

Percentage-of-completion

Cubao

P16,200,000

14,400,000

P 1,800,000

83 1/3%

P 1,500,000

750,000

P 750,000

Marikina

P25,200,000

23,100,000

P 2,100,000

100%

P 2,100,000

1,872,000

P 228,000

P 978,000

83.33%

P30,000,000

24,000,000

P 6,000,000

83.33%

17

AA1 - Chapter 7 (2008 edition)

GP to date

GP recognized in prior years

(P30M - P22M = P8M x 50%)

GP to be recognized in 2008

page

P 5,000,000

4,000,000

P 1,000,000

21.

Total amount billed

Less Balance of accounts receivable

Total collections

Amount deposited

Cash collected not yet deposited

22

23

P150,000 937,500/9,000,000

C

Mobilization fee (P1.2B x 1%)

Collections on billings (1.2B x 10% x 90%)

Total fee received by NNO

24

25

.

26

27

28

29

30

Downpayment

First installment payment

Addl fee (P1,000,000 x 3%)

Earned Franchise Fees

P 50,000

50,000

30,000

P130,000

31

P 100,000 x 1/5 = P 20,000 + 1% of P500,000 =

P 25,000

Contract price

Gross profit rate

Total estimated gross profit

Percentage-of-completion

Realized gross profit

P843,750

300,000

P543,750

500,000

P 43,750

P1,440,000

P 1.2M

10.8M

P12.0M

P100.00M

25%

P25.00M

50%

P12.50M

A

B

C

18

AA1 - Chapter 7 (2008 edition)

32

P 1,000,000 + 5% of P8,000,000 =

33

Downpayment

PV of installment payment

Additional fee ( P 9,000,000 x 5% )

Earned franchise fee

page

P1,400,000

P 100,000

199,650

450,000

P 749,650

19

Potrebbero piacerti anche

- Schaum's Outline of Principles of Accounting I, Fifth EditionDa EverandSchaum's Outline of Principles of Accounting I, Fifth EditionValutazione: 5 su 5 stelle5/5 (3)

- Chapter7 Adv PDFDocumento18 pagineChapter7 Adv PDFCharry May DelaCruz GalvanFaustinoNessuna valutazione finora

- Chapter 10Documento22 pagineChapter 10Dan ChuaNessuna valutazione finora

- LTCCDocumento5 pagineLTCCMondays AndNessuna valutazione finora

- Long Term Construction ContractsDocumento5 pagineLong Term Construction ContractsDJ ULRICHNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Construction ContractsDocumento5 pagineConstruction ContractsDJ ULRICHNessuna valutazione finora

- Accounting 3 4 Module 3aDocumento2 pagineAccounting 3 4 Module 3aMnriMinaNessuna valutazione finora

- Jawaban Soal Quiz No 2 Dan 3Documento4 pagineJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNessuna valutazione finora

- Practice Prepare FSDocumento8 paginePractice Prepare FSĐạt LêNessuna valutazione finora

- 10-column-worksheet-form (1)Documento1 pagina10-column-worksheet-form (1)catherinemariposa001Nessuna valutazione finora

- Capital Budgeting Answer KeyDocumento31 pagineCapital Budgeting Answer KeyEsel DimapilisNessuna valutazione finora

- Soal AKM 2015Documento24 pagineSoal AKM 2015Siti Armayani RayNessuna valutazione finora

- Auditing ProblemsDocumento29 pagineAuditing ProblemsPrincesNessuna valutazione finora

- Percentage-Of-Completion and Completed-Contract Methods.: SolutionDocumento7 paginePercentage-Of-Completion and Completed-Contract Methods.: SolutionTracy LeeNessuna valutazione finora

- CHUA - Exercise 3 - BudgetingDocumento1 paginaCHUA - Exercise 3 - BudgetingClaudeen Jade Antoinette ChuaNessuna valutazione finora

- Solusi Kuis Jelang UTS-AkbiDocumento7 pagineSolusi Kuis Jelang UTS-AkbiAnugerah BagusNessuna valutazione finora

- Fund Flow StatementDocumento41 pagineFund Flow StatementMahima SinghNessuna valutazione finora

- ACTIVITY 1 Capital BudgetingDocumento12 pagineACTIVITY 1 Capital BudgetingkmarisseeNessuna valutazione finora

- FAR Problem Quiz 1 SolDocumento3 pagineFAR Problem Quiz 1 SolEdnalyn CruzNessuna valutazione finora

- Mas ReviewerDocumento14 pagineMas ReviewerMichelle AvilesNessuna valutazione finora

- Construction Contract Income RecognitionDocumento13 pagineConstruction Contract Income RecognitionCiarwena PangcogaNessuna valutazione finora

- San Pedro College: Accounting & Financial ManagementDocumento4 pagineSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNessuna valutazione finora

- Chapter 09Documento12 pagineChapter 09Dan ChuaNessuna valutazione finora

- Udah Di Cek NihhDocumento5 pagineUdah Di Cek Nihhkartika.mhrn2104Nessuna valutazione finora

- Joint VentureDocumento24 pagineJoint VentureRoma Dela CruzNessuna valutazione finora

- Net Working Capital Current Assets - Current LiabilitiesDocumento11 pagineNet Working Capital Current Assets - Current LiabilitiesRahul YadavNessuna valutazione finora

- Fernandez Acctg 14N Finals ExamDocumento5 pagineFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONessuna valutazione finora

- FIRST PB FAR Solutions PDFDocumento6 pagineFIRST PB FAR Solutions PDFStephanie Joy NogollosNessuna valutazione finora

- CH 3 Problem SolutionsDocumento9 pagineCH 3 Problem SolutionsFrancisco PradoNessuna valutazione finora

- Advanced Accounting 3Documento1 paginaAdvanced Accounting 3Tax TrainingNessuna valutazione finora

- Past Paper Answers - 2017 (B) : Business Name:-NM Company LTDDocumento42 paginePast Paper Answers - 2017 (B) : Business Name:-NM Company LTDName of RoshanNessuna valutazione finora

- LTCCDocumento2 pagineLTCCMondays AndNessuna valutazione finora

- Statement of Cash FlowsDocumento6 pagineStatement of Cash FlowsLuiNessuna valutazione finora

- CHAPTER 4 (Accounts)Documento14 pagineCHAPTER 4 (Accounts)lcNessuna valutazione finora

- Quiz No 3Documento5 pagineQuiz No 3KristiNessuna valutazione finora

- This Study Resource Was: Guerrero / German Siy / de Jesus / Lim / FerrerDocumento5 pagineThis Study Resource Was: Guerrero / German Siy / de Jesus / Lim / FerrerKyla Dane P. PradoNessuna valutazione finora

- CashflowsDocumento6 pagineCashflowsJAN CHRISTOPHER CABADINGNessuna valutazione finora

- Intangibles Assignment - Valix 2017Documento3 pagineIntangibles Assignment - Valix 2017Shinny Jewel VingnoNessuna valutazione finora

- Afar PDFDocumento128 pagineAfar PDFMelyn Bustamante100% (1)

- AfarDocumento128 pagineAfarlloyd77% (57)

- Final Activity Income TaxationDocumento6 pagineFinal Activity Income TaxationPrincess MarianoNessuna valutazione finora

- Annexures For BlockchainDocumento6 pagineAnnexures For BlockchainDannyNessuna valutazione finora

- LA 2 Construction Contracts PDFDocumento3 pagineLA 2 Construction Contracts PDFliliNessuna valutazione finora

- Accounting Fundamentals Practice-ASH - IVADocumento12 pagineAccounting Fundamentals Practice-ASH - IVAalitohdezsalNessuna valutazione finora

- Fa July2023-Far210-StudentDocumento9 pagineFa July2023-Far210-Student2022613976Nessuna valutazione finora

- Soal A - Home Office Vs Branch (40%) : DimintaDocumento2 pagineSoal A - Home Office Vs Branch (40%) : DimintaAlvin Prabu WNessuna valutazione finora

- Steps to consolidate financial statementsDocumento5 pagineSteps to consolidate financial statementsIlham FaridNessuna valutazione finora

- L18.12 UTS 1718 v3Documento11 pagineL18.12 UTS 1718 v3AnggiNessuna valutazione finora

- Accounting Fundamentals PracticeDocumento9 pagineAccounting Fundamentals PracticealitohdezsalNessuna valutazione finora

- AA-4101-Midterm-with-answersDocumento9 pagineAA-4101-Midterm-with-answersAlyssa AnnNessuna valutazione finora

- Model Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleDocumento11 pagineModel Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleMilind VatsiNessuna valutazione finora

- Accounts Paper Answer 24.06.2020Documento17 pagineAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNessuna valutazione finora

- Group 4 Problem 4Documento9 pagineGroup 4 Problem 4Johanna Nina UyNessuna valutazione finora

- Costco2-Quiz End-TermDocumento4 pagineCostco2-Quiz End-TermmhikeedelantarNessuna valutazione finora

- FM Question BookletDocumento66 pagineFM Question Bookletdeepu deepuNessuna valutazione finora

- Children Live in PovertyDocumento3 pagineChildren Live in PovertyStephanie SundiangNessuna valutazione finora

- Story TellingDocumento1 paginaStory TellingStephanie SundiangNessuna valutazione finora

- Top 5 Market Player in PhilippinesDocumento2 pagineTop 5 Market Player in PhilippinesStephanie SundiangNessuna valutazione finora

- Pearl Harbor Is A Classic Tale of Romance Set During A War That Complicates EverythingDocumento4 paginePearl Harbor Is A Classic Tale of Romance Set During A War That Complicates EverythingStephanie Sundiang100% (1)

- Science AND Health::Kyla Joy B. SundiangDocumento7 pagineScience AND Health::Kyla Joy B. SundiangStephanie SundiangNessuna valutazione finora

- Teen PregnancyDocumento5 pagineTeen PregnancyStephanie SundiangNessuna valutazione finora

- AlgorithmDocumento1 paginaAlgorithmStephanie SundiangNessuna valutazione finora

- Once Upon A TimeDocumento1 paginaOnce Upon A TimeStephanie SundiangNessuna valutazione finora

- Egg RecipesDocumento12 pagineEgg RecipesStephanie SundiangNessuna valutazione finora

- Cebu Ay Kilala para Sa Danggit NitoDocumento3 pagineCebu Ay Kilala para Sa Danggit NitoStephanie SundiangNessuna valutazione finora

- When I Was Your ManDocumento18 pagineWhen I Was Your ManStephanie SundiangNessuna valutazione finora

- Essential kitchen toolsDocumento6 pagineEssential kitchen toolsStephanie SundiangNessuna valutazione finora

- Vegetative ReproductionDocumento1 paginaVegetative ReproductionStephanie SundiangNessuna valutazione finora

- Macarthur Hwy, Angeles, Pampanga CasinoDocumento3 pagineMacarthur Hwy, Angeles, Pampanga CasinoStephanie SundiangNessuna valutazione finora

- Search SleuthDocumento2 pagineSearch SleuthStephanie SundiangNessuna valutazione finora

- How The Gumamela Flower Is Attached To The StemDocumento2 pagineHow The Gumamela Flower Is Attached To The StemStephanie SundiangNessuna valutazione finora

- Teen PregnancyDocumento5 pagineTeen PregnancyStephanie SundiangNessuna valutazione finora

- Burnt Toast!: (Chemical Reaction)Documento2 pagineBurnt Toast!: (Chemical Reaction)Stephanie SundiangNessuna valutazione finora

- The History and Development of the Computer MouseDocumento6 pagineThe History and Development of the Computer MouseStephanie SundiangNessuna valutazione finora

- Pakistan Is Home To Several Beautiful and Attractive PlacesDocumento5 paginePakistan Is Home To Several Beautiful and Attractive PlacesStephanie SundiangNessuna valutazione finora

- PusoDocumento4 paginePusoStephanie SundiangNessuna valutazione finora

- Burnt Toast!: (Chemical Reaction)Documento2 pagineBurnt Toast!: (Chemical Reaction)Stephanie SundiangNessuna valutazione finora

- Essential kitchen toolsDocumento6 pagineEssential kitchen toolsStephanie SundiangNessuna valutazione finora

- Teen PregnancyDocumento5 pagineTeen PregnancyStephanie SundiangNessuna valutazione finora

- Pakistan Is Home To Several Beautiful and Attractive PlacesDocumento5 paginePakistan Is Home To Several Beautiful and Attractive PlacesStephanie SundiangNessuna valutazione finora

- Hazel BDocumento3 pagineHazel BStephanie SundiangNessuna valutazione finora

- Lady 4Documento1 paginaLady 4Stephanie SundiangNessuna valutazione finora

- My Learning in MusicDocumento1 paginaMy Learning in MusicStephanie SundiangNessuna valutazione finora

- ScienceDocumento7 pagineScienceStephanie SundiangNessuna valutazione finora

- Lecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020Documento4 pagineLecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020May Grethel Joy PeranteNessuna valutazione finora

- DocxDocumento12 pagineDocxDianneNessuna valutazione finora

- Far 360Documento24 pagineFar 360Kirana SofeaNessuna valutazione finora

- Southworth Company SelfDocumento3 pagineSouthworth Company SelfJoan RecasensNessuna valutazione finora

- Shares and Dividends Class X Maths CISCEDocumento23 pagineShares and Dividends Class X Maths CISCENatasha SinghNessuna valutazione finora

- Start-Up E-Commerce Financial ModelDocumento8 pagineStart-Up E-Commerce Financial ModelManish SharmaNessuna valutazione finora

- POA 2008 ZA + ZB CommentariesDocumento28 paginePOA 2008 ZA + ZB CommentariesEmily TanNessuna valutazione finora

- MOD 1 - Introduction On Cost AccountingDocumento10 pagineMOD 1 - Introduction On Cost Accountingzach thomasNessuna valutazione finora

- Midterm ReviewerDocumento2 pagineMidterm ReviewerAdan EveNessuna valutazione finora

- Introduction To Managerial Accounting ACC 200Documento22 pagineIntroduction To Managerial Accounting ACC 200Rahmati RahmatullahNessuna valutazione finora

- Audit Assertions - Guide of The Different Assertions in AuditingDocumento5 pagineAudit Assertions - Guide of The Different Assertions in Auditingtunlinoo.067433Nessuna valutazione finora

- Vertical Analysis of Balance SheetDocumento4 pagineVertical Analysis of Balance SheetMinionsNessuna valutazione finora

- NPV Analysis of MBAT Plant Subsidy AlternativesDocumento4 pagineNPV Analysis of MBAT Plant Subsidy AlternativesAprva100% (1)

- Calculate Payback Period, NPV-Chapter 2Documento13 pagineCalculate Payback Period, NPV-Chapter 2Khuetu NguyenhoangNessuna valutazione finora

- Problems Revenues FR Contracts With CustomersDocumento17 pagineProblems Revenues FR Contracts With CustomersJane DizonNessuna valutazione finora

- MCQs on Non-Profit Accounting FundamentalsDocumento6 pagineMCQs on Non-Profit Accounting Fundamentalsbobby AggarwalNessuna valutazione finora

- Financial Analysis of Dewan Mushtaq GroupDocumento26 pagineFinancial Analysis of Dewan Mushtaq Groupسید نیر سجاد البخاري100% (2)

- Revised Syllabus (FPOE-2018-19) : Specialized Training ProgramDocumento37 pagineRevised Syllabus (FPOE-2018-19) : Specialized Training ProgramPAAA IDCNessuna valutazione finora

- 8 Adjusted Trial BalanceDocumento3 pagine8 Adjusted Trial Balanceapi-299265916100% (1)

- Technician Pilot Papers PDFDocumento133 pagineTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Case - Ragan Engines Group 9Documento9 pagineCase - Ragan Engines Group 9Ujjwal BatraNessuna valutazione finora

- Acctg1205 - Chapter 4 PROBLEMSDocumento6 pagineAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronNessuna valutazione finora

- FINANCIAL MANAGEMENT full module (1) (1)Documento72 pagineFINANCIAL MANAGEMENT full module (1) (1)negamedhane58Nessuna valutazione finora

- Module 5 Loans ReceivablesDocumento52 pagineModule 5 Loans ReceivablesMarjorie PalmaNessuna valutazione finora

- Solution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194Documento36 pagineSolution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194stephanievargasogimkdbxwn100% (20)

- Chapter 15&16 Problems and AnswersDocumento22 pagineChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- Q.1. (E) Comparison ChartDocumento19 pagineQ.1. (E) Comparison Chartshiv mehraNessuna valutazione finora

- Kuliah I AkpDocumento51 pagineKuliah I AkpMuhammad Tamul FikriNessuna valutazione finora

- ACCCOB2 Financial Accounting Discussion PDFDocumento5 pagineACCCOB2 Financial Accounting Discussion PDFJose GuerreroNessuna valutazione finora

- Far DrillDocumento5 pagineFar DrillJung Hwan SoNessuna valutazione finora