Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RPG Enterprises-Phase 1 Questions

Caricato da

Kush234Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RPG Enterprises-Phase 1 Questions

Caricato da

Kush234Copyright:

Formati disponibili

RPG Group: Widening Horizon

Phase I

RPG Enterprises, established in 1979, is one of Indias fastest growing business groups with a turnover touching over Rs. 17,000 crs. RPG is a global & diversified Indian business group which consists of over fifteen companies managing diverse business interests in the areas of Automotive Tyres, Infrastructure, IT, Pharmaceuticals, Plantations and Power Ancillaries. Corporate General Manager Mr. Yasaswy Kothari, while sipping his coffee had a closer look at the financial reports of CEAT, KEC and Zensar for the year 2013. Sitting alone in the cabin he started brainstorming on the current stepping stones and building blocks of these companies. CEAT, one of the most recognised brands in India has over 50 yrs of presence in the tyre industry. With exports to over 130 countries & over Rs 1000 crs in FY 13, it is one of the leading tyre exporters from India. Currently, No. 1 player in Srilanka and has expanded its footprint in Bangladesh which is part of the N11 countries as identified by GS economist Jim ONeill. With revenue doubling in the last 5 years, consistent volume growth backed by improved margins augurs well for the company in future. KEC International Limited is one of the largest multinational Power Transmission Engineering, Procurement & Construction (EPC) companies in the world. KEC is growing presence in Power Systems, Cables, Telecom, Railways and Water. KEC has gone from strength to strength successfully exporting its EPC services to over 50 countries and widening its client base across the world. Spread across 6 continents it is currently executing projects in over 30 countries. Sales growth of over 20% in the last 5 years with an order book of over Rs 10,000 crs will help the firm achieve greater heights in future. Zensar is among the top 13 software services providers from India and is spread across 20 locations globally servicing over 290 active customers. The Company has developed tools and methodologies, which enables its clients with innovative business solutions and a rapid 'go-to-market' capability. The Company supports Fortune 500 clients with software business solutions that help them compete in the digital economy. 22% CAGR for Revenue and PAT in the last 5 years will only grow from here in the near future. These three companies contribute more than Rs. 14,000 crores to the top line of the group. But drilling deeper what concerns Yasaswy is the market capitalization and bottom line figures. A closer look reflects tremendous opportunities for improvement in these two areas.

Mr. Yasaswy is keen on hiring consultants who can improve the current financial figures of these group companies and is capable of proposing innovative and practical ideas on improving the market capitalization and bottom line of these three companies.

Can you be the consultant to RPG? Deliverable 1:

Analyse the current financial status of these three companies of RPG vis--vis the peers in India and globally. Analyse the comparative PE multiple and market capitalization of these 3 companies with other listed peers. As per your view what should be the fair value for each of the 3 companies?

Refer to the following links for financial data of: CEAT http://www.ceat.in/newsite/aboutus/investors.asp KEC - http://kecrpg.com/corporate-presentation ZENSAR - http://www.zensar.com/investors

Potrebbero piacerti anche

- Company Analysis Note TACLDocumento8 pagineCompany Analysis Note TACLmadhu vijaiNessuna valutazione finora

- FM ProjectDocumento13 pagineFM Projectabhi choudhuryNessuna valutazione finora

- Industry Analysis of Ceat Lt1Documento9 pagineIndustry Analysis of Ceat Lt1santosh panditNessuna valutazione finora

- TCS: Leading Indian IT Services CompanyDocumento10 pagineTCS: Leading Indian IT Services CompanyvaidwaraNessuna valutazione finora

- 15 Stocks Oct15th2018Documento4 pagine15 Stocks Oct15th2018ShanmugamNessuna valutazione finora

- Investor Presentation Q2FY17 (Company Update)Documento30 pagineInvestor Presentation Q2FY17 (Company Update)Shyam SunderNessuna valutazione finora

- Dalal Street English Magazine Preview Issue 15Documento14 pagineDalal Street English Magazine Preview Issue 15deba11sarangiNessuna valutazione finora

- Case Study #5 On Putex Corporation: Corporate Planning ProcessDocumento7 pagineCase Study #5 On Putex Corporation: Corporate Planning ProcessshreyasNessuna valutazione finora

- Vce Final ReportDocumento32 pagineVce Final ReportTushar GuptaNessuna valutazione finora

- Literature Review of Two Wheeler IndustryDocumento6 pagineLiterature Review of Two Wheeler Industrydafobrrif100% (1)

- 2 SM Tariq Zafar 36 Research Article BMAEBM September 2012Documento10 pagine2 SM Tariq Zafar 36 Research Article BMAEBM September 2012muktisolia17Nessuna valutazione finora

- ZensarTech Multibagger StockDocumento9 pagineZensarTech Multibagger StockArunesh SinghNessuna valutazione finora

- CEAT Annual Report 2014 15Documento196 pagineCEAT Annual Report 2014 15Raven FormourneNessuna valutazione finora

- Sapm Assignment 2123634Documento2 pagineSapm Assignment 2123634siddharth gargNessuna valutazione finora

- Policy Bazar: Valuation PerspectiveDocumento5 paginePolicy Bazar: Valuation PerspectiveSHIVANGI SINGH 21221043Nessuna valutazione finora

- Tata Motors Ratio AnalysisDocumento12 pagineTata Motors Ratio AnalysisVasu AgarwalNessuna valutazione finora

- Hero Motocorp Annual Report 2012-13Documento155 pagineHero Motocorp Annual Report 2012-13Apurv GuptaNessuna valutazione finora

- FM CIA3Documento30 pagineFM CIA3dhrivsitlani29Nessuna valutazione finora

- Investor Presentation May 2016 (Company Update)Documento29 pagineInvestor Presentation May 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Asia18 HighlightsDocumento13 pagineAsia18 Highlightsarif420_999Nessuna valutazione finora

- IIP Report SynopsisDocumento7 pagineIIP Report SynopsisSwati PayalNessuna valutazione finora

- India Equity Analytics Today: Buy Stock of KPIT TechDocumento24 pagineIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNessuna valutazione finora

- Ifmr GSB - It Industry ReportDocumento9 pagineIfmr GSB - It Industry ReportAntraNessuna valutazione finora

- Jamna AutoDocumento41 pagineJamna Autorupesh4286Nessuna valutazione finora

- Baan Born AgainDocumento3 pagineBaan Born AgainDDCAANessuna valutazione finora

- Tata Motors Profitability AnalysisDocumento72 pagineTata Motors Profitability AnalysisBhanu PrakashNessuna valutazione finora

- CSR 10 India Index 2012: How The Top Private Sector Companies Fair?Documento5 pagineCSR 10 India Index 2012: How The Top Private Sector Companies Fair?Nobhonil PanditNessuna valutazione finora

- Tata Motors: By-Pankaj NayakDocumento18 pagineTata Motors: By-Pankaj NayakAnjali SharmaNessuna valutazione finora

- Redington IndiaDocumento73 pagineRedington Indialokesh38Nessuna valutazione finora

- Indian Investing Conclave NotesDocumento21 pagineIndian Investing Conclave NotesNavin ChandarNessuna valutazione finora

- Mahindra and Mahindra FinanceDocumento43 pagineMahindra and Mahindra FinanceWwe MomentsNessuna valutazione finora

- Ashok Leyland Product Development and CompetitionDocumento24 pagineAshok Leyland Product Development and CompetitionSaranya VillaNessuna valutazione finora

- CIA-1 (Financial Management) ReportDocumento14 pagineCIA-1 (Financial Management) Reportabhishek anandNessuna valutazione finora

- Top 10 IT Companies in India 2020Documento7 pagineTop 10 IT Companies in India 2020MALATHI MNessuna valutazione finora

- Top Recommendation - 140911Documento51 pagineTop Recommendation - 140911chaltrikNessuna valutazione finora

- Wealth Creation 2008 - 13Documento52 pagineWealth Creation 2008 - 13Pratik JoshteNessuna valutazione finora

- Project Report on Metro Tyres LimitedDocumento37 pagineProject Report on Metro Tyres LimitedAnmolDhillonNessuna valutazione finora

- Market Wizard Newsletter Issue 20Documento25 pagineMarket Wizard Newsletter Issue 20riyaNessuna valutazione finora

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Da EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Nessuna valutazione finora

- The Hunt Report V 8Documento46 pagineThe Hunt Report V 8riya5021617Nessuna valutazione finora

- Hero ScribdDocumento16 pagineHero ScribdApoorv KalraNessuna valutazione finora

- The Right Time ToInvestDocumento10 pagineThe Right Time ToInvestPrabu RagupathyNessuna valutazione finora

- (Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3Documento17 pagine(Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3equityanalystinvestor100% (1)

- Cebbco Annual Report 2013Documento118 pagineCebbco Annual Report 2013didwaniasNessuna valutazione finora

- Human Resource Planning Project On Aditya Birla GroupDocumento17 pagineHuman Resource Planning Project On Aditya Birla GroupAditya MohapatraNessuna valutazione finora

- Project ReportDocumento63 pagineProject ReportBharath MahendrakarNessuna valutazione finora

- CEAT Annual Report 2010 11Documento136 pagineCEAT Annual Report 2010 11SudheirKumarYadavNessuna valutazione finora

- Igarashi MotorsDocumento4 pagineIgarashi MotorsDynamic LevelsNessuna valutazione finora

- Analysis of Indian IT CompaniesDocumento4 pagineAnalysis of Indian IT CompaniesSwapnil DeorukhkarNessuna valutazione finora

- Financial Statement Analysis: IT Sector CompaniesDocumento49 pagineFinancial Statement Analysis: IT Sector CompaniesnityaNessuna valutazione finora

- Comparative Financial Performance of Maruti and Tata MotorsDocumento19 pagineComparative Financial Performance of Maruti and Tata Motorsemmanual cheeranNessuna valutazione finora

- Company Details of LANCODocumento24 pagineCompany Details of LANCOGp MishraNessuna valutazione finora

- Tata MotorsDocumento14 pagineTata MotorsADITYA GURJARNessuna valutazione finora

- Chairman Speech 2007 HerohondaDocumento4 pagineChairman Speech 2007 HerohondaMitesh ChhabraNessuna valutazione finora

- Krishi Rasayan Exports PVT LTDDocumento5 pagineKrishi Rasayan Exports PVT LTDIndia Business ReportsNessuna valutazione finora

- Credit Analysis and Research: Investment RationaleDocumento6 pagineCredit Analysis and Research: Investment RationaleSunil KumarNessuna valutazione finora

- Data On BpoDocumento13 pagineData On BpoSadhi KumarNessuna valutazione finora

- MS-11 Strategic Management AssignmentDocumento9 pagineMS-11 Strategic Management AssignmentHarpal PanesarNessuna valutazione finora

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentDa EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentNessuna valutazione finora

- Moving up the Value Chain: The Road Ahead for Indian It ExportersDa EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNessuna valutazione finora

- CIL - Leave Encashment Rule ExecutiveDocumento5 pagineCIL - Leave Encashment Rule ExecutiveKush234Nessuna valutazione finora

- Rinso Brazil Launches Mid-Priced Soap with Superior CleaningDocumento1 paginaRinso Brazil Launches Mid-Priced Soap with Superior CleaningKush234Nessuna valutazione finora

- AHEL Leave PolicyDocumento11 pagineAHEL Leave PolicyKush234Nessuna valutazione finora

- BEML HR Handbook GuideDocumento88 pagineBEML HR Handbook Guidesatheeshacoorg100% (5)

- How To Learn JapaneseDocumento31 pagineHow To Learn JapanesebmonaandaNessuna valutazione finora

- E10 - Target Latin America, Middle East and Europe MarketsDocumento9 pagineE10 - Target Latin America, Middle East and Europe MarketsKush234Nessuna valutazione finora

- CHP 2 - Technology - Data AnalyticsDocumento19 pagineCHP 2 - Technology - Data AnalyticsShahpal KhanNessuna valutazione finora

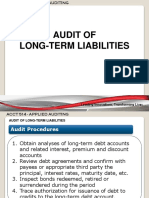

- Audit of Long-Term LiabilitiesDocumento43 pagineAudit of Long-Term LiabilitiesEva Dagus0% (1)

- A literature review of maintenance performance measurementDocumento32 pagineA literature review of maintenance performance measurementm sai ravi tejaNessuna valutazione finora

- Ms. Swati - PPT - HRM - HR Analytics - PGDM - 2019 - Week 2 Session 1 - 30th March 2020Documento54 pagineMs. Swati - PPT - HRM - HR Analytics - PGDM - 2019 - Week 2 Session 1 - 30th March 2020AnanyaNessuna valutazione finora

- Financial Markets and Services NotesDocumento94 pagineFinancial Markets and Services NotesShravan Richie100% (7)

- WEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFDocumento29 pagineWEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFMoca ΔNessuna valutazione finora

- L6 Interpreting FlowchartDocumento28 pagineL6 Interpreting FlowchartRykkiHigajVEVONessuna valutazione finora

- Attachment 2 - Sample Master Service AgreementDocumento11 pagineAttachment 2 - Sample Master Service AgreementAnubha MathurNessuna valutazione finora

- BA 235 - Part 1a - 1bDocumento33 pagineBA 235 - Part 1a - 1bRon OrtegaNessuna valutazione finora

- ISO27k Controls (2005 2013 NIST)Documento29 pagineISO27k Controls (2005 2013 NIST)Hemant Sudhir WavhalNessuna valutazione finora

- CRM Project PlanDocumento12 pagineCRM Project Planwww.GrowthPanel.com100% (5)

- Chapter 3 - Problem SetDocumento14 pagineChapter 3 - Problem SetNetflix 0001Nessuna valutazione finora

- Nazila Azizi CV FinalDocumento7 pagineNazila Azizi CV FinalulearnasaidshahtestNessuna valutazione finora

- Data Warehouse AssessmentDocumento2 pagineData Warehouse AssessmentAnonymous cuHV7lTNessuna valutazione finora

- Annual Dealer Conference InvitationDocumento40 pagineAnnual Dealer Conference Invitationkaveesha sathsaraniNessuna valutazione finora

- Sap SD Exclusive Study Materials - Sap SD Interview Questions and AnswersDocumento17 pagineSap SD Exclusive Study Materials - Sap SD Interview Questions and AnswersSrinivasa Kirankumar100% (1)

- Financial Evaluation of Debenhams PLCDocumento16 pagineFinancial Evaluation of Debenhams PLCMuhammad Sajid SaeedNessuna valutazione finora

- Fi HR Integration PDFDocumento2 pagineFi HR Integration PDFBrentNessuna valutazione finora

- Accounting for Managers Final Exam RatiosDocumento7 pagineAccounting for Managers Final Exam RatiosGramoday FruitsNessuna valutazione finora

- 180DC KMC CaseStudyResponse RiyaManchandaDocumento5 pagine180DC KMC CaseStudyResponse RiyaManchandaRiya ManchandaNessuna valutazione finora

- Ohsas 18001Documento2 pagineOhsas 18001InnoviaNessuna valutazione finora

- Chapter 1: The Problem and Its BackgroundDocumento3 pagineChapter 1: The Problem and Its BackgroundPatricia Anne May PerezNessuna valutazione finora

- Financial Analysis M&PDocumento34 pagineFinancial Analysis M&Panastasia_kalliNessuna valutazione finora

- Intern Report - ajoy.ASH 1510049MDocumento35 pagineIntern Report - ajoy.ASH 1510049MAjoyNessuna valutazione finora

- Maxs-Burgers-The-Dollar-Value-of-EthicsDocumento20 pagineMaxs-Burgers-The-Dollar-Value-of-Ethicscuong462003Nessuna valutazione finora

- Module 4 Topic 1 UTSDocumento36 pagineModule 4 Topic 1 UTSAbd El Mounim BzizNessuna valutazione finora

- Private Organization Pension Amendment ProclamationDocumento8 paginePrivate Organization Pension Amendment ProclamationMulu DestaNessuna valutazione finora

- C. Body of The ProposalDocumento12 pagineC. Body of The ProposalBiniam NegaNessuna valutazione finora

- Trading Checklist 1Documento12 pagineTrading Checklist 1rangghjNessuna valutazione finora