Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Eifrig

Caricato da

HNmaichoiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Eifrig

Caricato da

HNmaichoiCopyright:

Formati disponibili

Doc Eifrig: The No.

1 way to protect and grow your retirement nest egg

Tuesday, November 12, 2013 From Dr. David Eifrig, editor, Income Intelligence: One of the keys to successful income investing is proper asset allocation, how you balance your portfolio among stocks, bonds, cash, real estate, commodities, gold, and other investments. If you keep your entire net worth in stocks and the market pulls back, you'll suffer badly regardless of what stocks you own. Likewise, if you hold your net worth in gold and it falls $100 an ounce, your lack of asset allocation will hurt you. Concentrating your retirement nest egg into just a few stocks or a few asset classes is far too risky. One of the simplest ways to begin is to consider just four general asset classes you need to spread your wealth among to keep you financially balanced and healthy... Cash: 10%-45% Stocks: 25%-70% Fixed Income: 10%-50% Chaos Hedges: 1%-15% Note that each of those asset classes has a range of what percentage of your portfolio you should put in it, rather than a specific number. That's because everyone's situation is different. If you're in your 30s or 40s, your asset allocation should be different than if you're retired. That's because you have the ability to take more risks with your portfolio. So you need to determine how risky a portfolio you can stand, and what your time frame for investing is. Then you can set your percentages accordingly... and stick to them. As income investors, we'll be focusing on stocks and fixed-income assets. But we'll likely add some "chaos hedges," like gold or farmland, which will help to protect us in case of a market disaster

Steve Sjuggerud: This is the ONLY sure way to get rich investing

Tuesday, November 12, 2013 From Amber Lee Mason and Brian Hunt in the S&A Digest: It's a bull market, you know... The S&P 500 is trading near all-time highs. The tech-heavy Nasdaq is at a 13-year high... It's up over 30% in the last year. Another year like that and it'll reach its dot-com bubble peak. Our "new 52-week highs" list includes big names in energy, tech, health care, insurance, banking, beer... What are investors and traders to do in these circumstances? With so many sectors and indexes reaching new highs, some will think it's time to cash in their winnings and walk away from the table. Those people could be right. As we have told our DailyWealth Trader readers, we can't know the

future. But we think you're better off remembering the timeless advice of "Old Turkey"... It comes by way of Edwin Lefevre, in his classic 1923 book, Reminiscences of a Stock Operator, which detailed the life of legendary speculator Jesse Livermore. This book is in the top 10 reading list of every great trader. Old Turkey's story picks up at a hangout frequented by stock-market players, Fullerton's office... The customers used to go into Old Turkey and tell him what some friend of a friend had advised them to do in a certain stock. But whether the tip they had was to buy or sell, the old chap's answer was always the same. The customer would finish the tale of his perplexity and then ask: "What do you think I ought to do?" Old Turkey would cock his head to one side, contemplate his fellow customer with a fatherly smile, and finally he would say very impressively, "You know, it's a bull market!" Time and again I heard him say, "Well, this is a bull market, you know!" as though he were giving to you a priceless talisman wrapped up in a million-dollar accidentinsurance policy. And of course I did not get his meaning. I think it was a long step forward in my trading education when I realized at last that when Old Turkey kept on telling the other customers, "Well you know this is a bull market!" he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is... in sizing up the entire market and its trend. After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It was never my thinking that made the big money for me. It always was my sitting. Old Turkey was dead right in doing and saying what he did. He had not only the courage of his convictions, but the intelligent patience to sit tight. Our own Steve Sjuggerud has called learning how to sit tight and let positions "gain weight" to produce huge profits the "the toughest 'easy' lesson you must learn." Steve notes: If you want to get rich investing... if you want to make a fortune... you must learn this simple lesson. In principle, this lesson is so easy, you could teach a monkey to do it. But in practice, almost nobody is able to do it. And this is actually easy to do... It's not like trying to lose weight, where we know what to do, but it's hard to stick to it. But still, nobody is able do it. I have a hard time with it myself, darn it... and this is my career! I've gotten much better at it over the years, though. What is "it"? What is the lesson? The lesson is doing nothing... You see... the big gains are in the big trades. Your lifetime investing success is hiding in your big trades. If you sell early if you never

give a trade a chance to become a big trade you'll never get rich investing. Steve is uncommon in his ability to be right and sit tight. It's part of the reason his True Wealth subscribers are looking at seven 50%-plus winners in the portfolio... and three that are up triple digits. And he believes there's more to come. Here's an excerpt of his recent issue... We are now in about the sixth inning of this great bull market in stocks. (Real estate is still in the earlier innings.) But... I'm confident the biggest profits will happen in the final innings. With [Janet] Yellen [coming in] as the head of the Federal Reserve, I believe we have much bigger gains to come. I believe the big profits will come sooner as well, as investors come to fully realize what I've been saying. So instead of selling stocks or real estate today because they've gone up so much, you need to do the opposite... You need to buy more. While Steve is "sitting tight" during this bull market, he's aware that the Fed's cheap credit policy is causing stocks to rise... and he's not blind to the eventual risks... Yes, our government debts are soaring, and our politicians irreparably damaged our reputation overseas in the last month. And yes, the U.S. dollar is ultimately in serious trouble. This is why Steve is not only getting readers out of dollars and into stocks and real estate, he's also preparing them to protect themselves and profit from the coming crash. In his report, "My Timeline for the Next Market Collapse," he showed readers exactly how bad things will get... what to expect next... and which assets to buy right now

Doc Eifrig: How to take control of your retirement money NOW

Wednesday, November 06, 2013 Editor's note: Today's Crux is a special one... As we mentioned yesterday, our friend and colleague Doc Eifrig, editor of the incredibly popular Retirement Millionaire and Retirement Trader services, is launching a brand new service called Income Intelligence. Income Intelligence is designed specifically to help readers maximize every dollar of income possible from their investments. Today, in honor of Doc's new service, we're passing along some of his all-time best and most popular advice. We hope you enjoy it.

From Dr. David Eifrig in Retirement Millionaire: Don't trust your employer to do what is best for your retirement. Recently, Hostess Brands the bankrupt baked goods company admitted to using workers' pensions to pay for company operations. Not only was Hostess misusing retirement funds, the company missed over $20 million in pension payments. If you're over 40 years old, you may have a "pension," also known as a defined-benefits plan. It's a retirement account that your employer funds and controls. When you retire, your employer agrees to give you either a lump sum of money or monthly payments.

With a pension, you have zero control over what happens. You can't increase or decrease the amount that's being invested. Companies also hire managers who oversee where pension money is invested, and the fees they charge dilute returns. Plus, if you die right after you retire, your dependents might get nothing. But there is a solution... You can move money from your pension into a self-directed IRA. This gives you total control of your money. You get to grow your money tax-free, just like a pension... but there's no limit on how much you can make. A self-directed IRA is exactly what it sounds like... It puts you in charge of what you invest in. In addition to the conventional investments you can make in a typical IRA like stocks, bonds, and covered calls (something I regularly recommend to my Retirement Trader readers) a fully selfdirected IRA allows you to invest in many other assets, including real estate, private stocks, businesses, and even precious metals. You can invest in just about anything, as long as it's not employed for your personal benefit. This simply means you must avoid any conflicts of interest. You can't, for example, invest in companies you have a 50% interest in. But you can buy the house next door through your IRA and then rent it to a neighbor. You can also invest in a local small business (again, as long as it's not your own). I use my self-directed IRA to generate income by selling stock options. When I use this account for options trading, I don't have to follow any accounting or tax requirements. In fact, if you do all your trading inside a retirement account, you don't have to report any trades to the IRS. The goal is simply to maximize your total returns as quickly and as easily as you can... And get better returns than a pension could offer. There are two ways to move your pension to an IRA... One is to "roll over" the pension directly into an IRA. The broker or custodian you're opening an IRA with should have all the necessary forms for you to fill out. I have mine with Fidelity and TD Ameritrade. You can also take a lump-sum payment on your pension and then move the funds into an IRA. If you do this within days of taking the lump sum, you'll avoid being taxed on the money and the 10% early withdrawal penalty. (If you can just roll over the pension directly, you don't risk incurring taxes and penalties.) However you do it, don't wait. Why leave your pension the money you're counting on for retirement in someone else's hands?

Doc Eifrig: How to supercharge the dividends you get from normal income investments

Friday, November 08, 2013 From Dr. David Eifrig, editor, Income Intelligence: I've developed a method of timing income investments that allows you to collect higher dividend payments and larger capital gains. This bit of timing can add $86,000 in profits to your portfolio. I'll show you how today.

I'm not keeping any secrets, either. I'll lay out the whole technique in this short article. As you'll see, it makes sense... As the price of a dividend stock moves up, its yield moves down and vice versa. Obviously, all other things equal, you want to buy when the yield is high. That's going to give you bigger dividend payments. It's also going to give you larger capital gains. Take Honeywell (HON), for example. This manufacturing giant has paid dividends every year since 1887. Not many companies can say that. And over the last four years, the stock has been in a huge bull market...

You could have bought at any time during this run, and you'd be sitting on gains right now... But there's a simple way to maximize the gains you get from stocks like Honeywell. Take a look at the next chart. It shows Honeywell's dividend yield since mid-2010. You can see how it moved from 3%... down near 2%... back up to 3%... and back down to 2%.

That might not sound like much difference... But timing your purchases to when the dividend yield is relatively high (3% versus 2%) dramatically improves your results.

An investor who bought in early 2011 when the yield was low, near 2%, made 39% in capital gains on his Honeywell shares. An investor who bought in late 2011 when the yield was high, near 3%, made 93% in capital gains (plus, collected bigger dividend payments). Of course, most folks get scared when share prices are down... and yields are up... That can make timing your income investments a challenge. That's why I developed a timing indicator that pinpoints exactly when I should buy. Here's how it works, using the big benchmark S&P 500 stock index as an example... First, to judge the yield on stocks, you need something to compare it to. All alone, you don't know if a 2% yield is high or low. So I start by comparing the yield on 10-year corporate bonds with the dividend yield on the S&P 500. The difference between the two yields is the "spread." So if corporate bonds yield 4.5% and stocks yield 2.5%, the spread is 4.5% minus 2.5%, which equals 2%. If you watch the historical patterns of that spread, you can get a good idea of when stocks are expensive and when they are cheap. But I take it one step further... I compare the size of the spread right now to the average of the spread over the last year. This helps me pinpoint short-term selloffs, which often make great buying points. It also helps identify when stocks have gotten overvalued... and when it's time to consider an exit. When it comes to the S&P 500, the indicator isn't always perfect... But if you buy when the indicator is low (below -0.5), you'll usually get in when stocks are ready to move higher. And if you sell when the indicator is high (above 0.5), you'll often get out ahead of major selloffs.

Over the long term, the gains add up: If you'd simply bought stocks in 1995 and held on, you'd have 209% in capital gains. If you'd used this method, you'd have 295% in capital gains. On a $100,000 portfolio, that's an $86,000 difference. Huge. Right now, the indicator is flashing "sell." That doesn't mean I expect a massive selloff in stocks. But it does mean I'm making sure that every fund or stock I recommend is a great value in its own right. It means I'm running a similar "test" on every dividend sector I consider, like REITs, MLPs,

and more.

Doc Eifrig: The four prescription drugs you must have in a crisis... And how to get them in advance

Monday, November 11, 2013 From Dr. David Eifrig in The Doctor's Protocol Field Manual: In any crisis event, you could be on your own for days... even weeks. Hospitals could be impossible to get to. In fact, if we have a bioterrorism attack, plague, or viral outbreak, going to a hospital could be even more dangerous than staying home. Your town could be without running water for a month or more. No washing. No flushing toilets. No way to shower, clean dishes, or cleanse wounds. Every year, poor sanitation kills more than 2 million people around the globe. We don't see the effects of this very often in the United States, but in a real crisis, poor sanitation is deadly. As a medical doctor, I can tell you that one of the most important things you must have in your home is a good supply of antibiotics. Now how do you get antibiotics when you're not sick, and which ones should you keep on hand? Let me explain In short, there are four (4) prescription drugs I strongly recommend you have at home. One of these drugs is an often-overlooked antibiotic, called Doxycycline. Like all antibiotics, it treats bacterial infections. But the reason you want to have Doxycycline is because it also treats "atypical" bacteria such as Rickettsia, which causes Rocky Mountain spotted fever and typhus. I'm not sure how much you know about typhus, but it's extremely deadly (without treatment) and is sometimes referred to as "camp fever" or "hospital fever" because it affects large populations living near one another in poor sanitary conditions. Typhus epidemics have actually changed history. Typhus killed 3 million Russians during WWI and during one dark period in Britain, it killed 10% of the entire population. The point is, in a city or town with no electricity or running water, and generally poor sanitary conditions, typhus and similar epidemic diseases could definitely strike again. So Doxycycline is something you should definitely have around. And it's a lot cheaper and easier to get than most people think. A 10-day generic for Doxycycline shouldn't cost much more than $10 at any pharmacy. And in addition to Doxycycline, you definitely should also have three other drugs on hand: - Augmentin

- Ciprofloxin ("Cipro") - Bactrim (from the sulfa family). These drugs can be used to treat things like pneumonia, bronchitis, sinus infections, skin problems, and dozens of other deadly infections even exposure to the most common bioterrorism agent: anthrax. Make sure you are not allergic to any these antibiotics before taking them. Talk with your doctor now about how to get these drugs. He or she may have free trial packs (like the popular "Z-Pac") to share with you. Doctors will often prescribe Cipro and Bactrim DS (both as generics) for people planning overseas trips. You can get 60 pills (a one-month supply) of each at Wal-Mart for $20 or a 10-day supply for $10. Rite Aid sells generic Doxycycline for a similar price. Store these drugs in a sealed freezer bag with desiccant (anti-moisture) packets inside. Place them in the freezer. Once thawed, they will last for six to 12 months when kept at room temperature. Crux note: Get Doc's complete, expert advice on how to be prepared in a crisis from his new 96page Doctor's Protocol Field Manual. It's free with a risk-free subscription to Dr. Eifrig's Retirement Millionaire. And, right now, the offer's even better: Start your Retirement Millionaire subscription for 60% off the regular price and get a 100% money-back guarantee.

5 Things Super Successful People Do Before 8 AM

Rise and shine! Morning time just became your new best friend. Love it or hate it, utilizing the morning hours before work may be the key to a successful and healthy lifestyle. Thats right, early rising is a common trait found in many CEOs, government officials, and other influential people. Margaret Thatcher was up every day at 5 a.m.; Frank Lloyd Wright at 4 am and Robert Iger, the CEO of Disney wakes at 4:30am just to name a few. I know what youre thinking you do your best work at night. Not so fast. According to Inc. Magazine, morning people have been found to be more proactive and more productive. In addition, the health benefits for those with a life before work go on and on. Lets explore 5 of the things successful people do before 8 am. 1. Exercise. Ive said it once, Ill say it again. Most people that work out daily, work out in the morning. Whether its a morning yoga session or a trip to the gym, exercising before work gives you a boost of energy for the day and that deserved sense of accomplishment. Anyone can tackle a pile of paperwork after 200 ab reps! Morning workouts also eliminate the possibility of flaking out on your cardio after a long day at work. Even if you arent bright eyed and bushy tailed at the thought of a 5 am jog, try waking up 15 minutes early for a quick bedside set of pushups or stretching. Itll help wake up your body, and prep you for your day. 2. Map Out Your Day. Maximize your potential by mapping out your schedule for the day, as well as your goals and to dos. The morning is a good time for this as it is often one of the only quiet times a person gets throughout the day. The early hours foster easier reflection that helps when prioritizing your activities. They also allow for uninterrupted problem solving

when trying to fit everything into your timetable. While scheduling, dont forget about your mental health. Plan a 10 minute break after that stressful meeting for a quick walk around the block or a moment of meditation at your desk. Trying to eat healthy? Schedule a small window in the evening to pack a few nutritious snacks to bring to work the next day. 3. Eat a Healthy Breakfast. We all know that rush out the door with a cup of coffee and an empty stomach feeling. You sit down at your desk, and youre already wondering how early that taco truck sets up camp outside your office. No good. Take that extra time in the morning to fuel your body for the tasks ahead of it. It will help keep your mind on whats at hand and not your growling stomach. Not only is breakfast good for your physical health, it is also a good time to connect socially. Even five minutes of talking with your kids or spouse while eating a quick bowl of oatmeal can boost your spirits before heading out the door. 4. Visualization. These days we talk about our physical health ad nauseam, but sometimes our mental health gets overlooked. The morning is the perfect time to spend some quiet time inside your mind meditating or visualizing. Take a moment to visualize your day ahead of you, focusing on the successes you will have. Even just a minute of visualization and positive thinking can help improve your mood and outlook on your work load for the day. 5. Make Your Day Top Heavy. We all have that one item on our to do list that we dread. It looms over you all day (or week) until you finally suck it up and do it after much procrastination. Heres an easy tip to save yourself the stress do that least desirable task on your list first. Instead of anticipating the unpleasantness of it from first coffee through your lunch break, get it out of the way. The morning is the time when you are (generally) more well rested and your energy level is up. Therefore, you are more well equipped to handle more difficult projects. And look at it this way, your day will get progressively easier, not the other way around. By the time your work day is ending, youre winding down with easier to dos and heading into your free time more relaxed. Success!

Doug Casey in Cyprus: Crisis Investing in Action

Nick Giambruno, Senior Editor, International Man November 11, 2013 6:03am

Stocks in Cyprus Are Down 98%Time to Start Edging In?

Readers who have been with us for a while know that I've been hinting at the project Doug Casey and I have been working on in Cyprus for a while now. It's a project that dovetails perfectly with Doug's unique expertise. Now is the time to reveal what we have been up to. Nick Giambruno: Doug, you are one of the foremost authorities in the world on the topic of crisis investing. Tell us about your background on this topic and the potential for life-changing gains it offers for those who have the intestinal fortitude to speculate in crisis markets. Doug Casey: After my second book, Crisis Investing, came out in 1979, I started publishing a newsletter. I used the Chinese symbol for crisis as the logo. It is actually a combination of two symbols: the symbol for danger and the symbol for opportunity. The danger is what everybody sees; the opportunity is never quite so obvious as the danger, but it's always there.

Speculating in crisis markets is the ultimate way to be a contrarian, which means buying when nobody else wants to buy. It is true, as a general rule, that you want to "make the trend your friend." But there always comes an inflection point when trends change because a market becomes either greatly overvalued or greatly undervalued. And when any market is down by 90% or more, you've got to reflexively look at it, no matter how bad the news is, and see if it's a place where you want to put some speculative capital. Nick: Massive fortunes have been made throughout history with crisis investing. Was Baron Rothschild right when he said the time to buy is when blood is in the streets? Doug: That's a very famous aphorism, of course. It was supposedly occasioned by the Battle of Waterloo, when he was buying British securities while the issue was in doubt. He was able to pull off that coup because he made sure that he got the information as to whether Wellington beat Napoleon a day before anybody else did. He recognized that Europe was in a period of tremendous crisis; Napoleon, after all, was actually kind of a proto-Hitler. But a key point here is that a successful speculator capitalizes on politically caused distortions in the market. If we lived in a completely free-market worldone without government interventions like taxes, regulations, inflation, war, persecutions, and the likeit would be impossible to speculate, in the sense I'm using the word. But we don't live in a free-market world, so there are lots of good, speculative opportunities that, in effect, let you turn a lemon into lemonade. And a good speculative opportunity is both high potential and low risknot high potential and high risk. Most people don't understand that. Nick: That brings to mind the Russian oligarchs, who became oligarchs in the first place because they did some crisis investing, i.e., they bought when the blood was in the streets and picked up some of the crown jewels of the Russian economy for literally pennies on the dollar. Are similar opportunities a possibility today in other countries? Doug: It's interesting with the oligarchs because in the Soviet Union, everybody got certificates, which were traded for shares in businesses that were being privatized. The average person had no idea what they were or how to value them. The people who became oligarchs were able to buy them up for a couple of pennies on the dollar, taking advantage of the negative public hysteria following the collapse of the Soviet Union. So this is a recurring themebuying when the blood is in the streets. It's what speculation is all about: namely, taking advantage of politically caused distortions in the marketplace, or taking advantage of the aberrations of mass psychology. Nick: Exactlyand that was the main reason why you and I were recently in Cyprus. We were there to see if that recent crisis presented a contrarian opportunity. We all know what happened with the bank deposit confiscations and the capital controls, and most people would think you'd have to be crazy to put money into such an environment. Tell us how Cyprus fits into the theme of crisis investing.

Doug: What drew my attention to it was the fact that the Cyprus stock market is down 98% from its all-time high in October 2007. That's like a bell ringing at the bottom of the market. So I thought it was critical to go and get boots on the ground to see what the story really was. It's down about as much as any market index has been in history, which makes it a unique opportunity. In any case, it was worth seeing whether or not it's really only worth 2% of what it was at its peak. I'm not saying that we are absolutely at the bottom. I'm just saying that now is the time to pay close attention because when any market is down 90%, you're obligated to go and investigate. Whether you buy when it is down 98% or you wait for it to be down 99%which amounts to another 50% dropis perhaps like looking a gift horse in the mouth. Nick: Let's talk about the intrinsic value of Cyprus throughout history that comes from its geographybeing at the crossroads of Asia, the Middle East, Africa, and Europe. Does the collapse in the paper Ponzi scheme banking system diminish Cyprus's natural value, or do you think it creates some interesting speculative opportunities? Doug: Cyprus not only presents a tremendous speculative opportunity, but it is also quite instructive. The banking sector there got quite out of control; it's similar to what has happened to the banking sector in other countries, like Iceland and Ireland in the recent past. But it's also predictive of what's very likely going to happen to larger banking systems in the near future. Essentially, Cyprus became a favorite place for people of many nationalitiesparticularly, Russiansto put money that they wanted to diversify offshore. The banks became overwhelmed with large amounts of money that dwarfed their capital. When a bank takes money in, it's got to find something to do with that money, and when the local economy couldn't absorb much of it, they became quite reckless. Since most Cypriots are Greek-speakers, they naturally looked to Athens and wound up buying a lot of Greek government bonds, partly for patriotic reasons and partly because the yields were higher than elsewhere. Once the Greek government bonds went south, it wiped out the capital base of the Cypriot banks that had purchased them. The Cypriot government was not in a financial position to bail them out, so instead they had what is called a bail-in, where large depositors took a haircut. Nick: So, what kinds of speculative opportunities have been created from this crisis? Doug: In all chaotic situations, in all true crisis situations, the baby gets thrown out with the bathwater. Everybody has decided that they don't want to have anything to do with a stock market whose index is down 98%. But the fact of the matter is that there are sound, productive, and well-run businesses that are listed on the Cyprus Stock Exchange that got caught up in the maelstrom. There are businesses that will continue to produce earnings and pay dividends. As Damon Runyon famously said, "The race is not always to the swift, nor the battle to the strong, but that's the way to bet."

The country has some unique advantages going for it. Cyprus is a place where Warren Buffett would be looking if the market weren't so tiny. It's also quite illiquid now because most people who needed to sell have already done so, but almost everybody is still too afraid to buy. That said, I think it's time to start edging in. We also looked at opportunities the crisis has created in the real estate market. Nick: We should be clear that we are not necessarily talking about investing here. This is a long-term speculation. Can you elaborate on the differences? Doug: I think it is critical to use words accurately and precisely, so that we know exactly what we are talking about. "Investing" is about allocating capital so that it can be used productively and produce more capital. "Speculating" is different. As I said before, speculating is about capitalizing on politically caused distortions in the marketplace. One way this is pertinent to Cyprus is the fact that this is the first time the bail-in model was used and a government didn't step in to make depositors whole. That wiped out billions of euros and depressed the prices of financial assets. People often confuse speculators with traders, who try to scalp a couple of basis points over a short period of time. What we are doing with Cyprus is not a trade. This is a speculation, and a good speculation can take a considerable amount of time to work itself out. Nick: In order to take advantage of these opportunities and speculate on this market, one realistically needs to have a Cypriot brokerage account. It's a testament to the chilling effects of FATCA and other US regulations that the vast majority of financial institutions in Cyprus, which are extremely desperate for cash, won't even consider dealing with American citizens. And if Cypriot financial institutions won't deal with American clients, who will? Do you think the chilling effects of FATCA really amount to de facto capital controls for Americans? Doug: Yes. US citizens have had draconian reporting requirements on what they do with their money abroad for years. But the new FATCA law has taken it to a new level. Essentially, what it does is impose severe compliance burdens on foreign financial institutions that take an American client. It really makes the foreign banks, brokers, and other financial institutions unpaid employees of the US government. This is expensive, legally onerous, and actually ethically questionable as far as their relationship with their clients. So, for this reason, there are very few non-US financial institutions anywhere that are still willing to take US customers. It's increasingly hard, and in some cases impossible, for an American now to get money out of the country, simply because nobody is going to take it. I think as the global economic crisis that started in 2007 gets worseand there is every reason to believe it's going to get worse, since we're just in the eye of the storm at the momentthese regulations will become even more onerous, and are likely to spread from the US to other countries. So the takeaway from this is that your most important form of diversification in the world today is not diversification across investment classesalthough that's very important. It's

political diversification, so that all of your assets aren't under the control of one political entity, one government. Here's how you can get in The opportunity for contrarians in Cyprus is great, but it's hugely important to analyze and evaluate all of the options. Doug and Nick's recent trip gave them great insights into the real economic situation in Cyprus and the companies located there. After getting their boots on the ground, Doug and Nick found quite a few pigs with copious amounts of lipstick applied and a few shining gems, tooquality Cypriot stocks trading for tremendous crisis-driven bargains. You don't need to take a trip to Cyprus yourself to get the lay of the land. Doug and Nick have written a special report titled Crisis Investing in Cyprus detailing their trip and offering the top investment picks they found on the Cyprus Stock Exchange. In it, you'll find detailed information of the best way to access these amazing opportunities from your living room, the real story on the ground, and much more. The two of them also found a solution to the brokerage dilemmathey investigated every single brokerage on the island and found one willing to open accounts for American citizens remotely and without the need to visit the country. All the details and on-the-ground contacts are in their report, which shows you exactly how to access the opportunities on the Cyprus Stock Exchange from your computer. Crisis Investing in Cyprus is a crucial tool for taking the destructive actions of a desperate government and turning them on their head and to your advantage. For a limited time, you can get the report with a savings of 50% off the retail price of $199. That's just $99 for a huge speculative opportunity, penned by Doug Caseythe man who literally wrote the book on crisis investing. To get in on these opportunities, act now before the price discount is no longer offered

14 Things Successful People Do On Weekends

1. Make time for family and friends. This is especially important for those who dont spend much time with their loved ones during the week. 2. Exercise. Everyone needs to do it, and if you cant work out 4 to 5 days during the workweek, you need to be active on weekends to make up for some of that time, Vanderkam says. Its the perfect opportunity to clear your mind and create fresh ideas. I know an owner of a PR firm who takes walks in the park with his dog to spark ideas about how to pitch a new client, or what angle to take with the press for a story, Kurow says. Cohen suggests spin classes and outdoor cycling in the warmer months. Both are energizing and can be organized among people with shared interests. For example, it is not uncommon for hedge fund folks and Wall Street professionals to ride together on weekends. It is a great way to establish and cultivate relationships based on membership in this elite professional community.

3. Pursue a passion. Theres a creative director of a greeting card company who went back to school to pursue an MFA because of her love of art, Kurow says. Pursuing this passion turned into a love of poetry that she now writes on weekends. Successful people make time for what is important or fun, Egan adds. They make space for activities that add to their life balance. 4. Vacation. Getting away for the weekend provides a great respite from the grind of an intense week at work, Cohen says. 5. Disconnect. The most successful people avoid e-mail for a period of time, Vanderkam says. Im not saying the whole weekend, but even just a walk without the phone can feel liberating. I advocate taking a tech Sabbath. If you dont have a specific religious obligation of no-work time, taking Saturday night to mid-day Sunday off is a nice, ecumenical time that works for many people. 6. Volunteer. I know a commercial real estate broker who volunteers to help with cook-off events whose proceeds are donated to the Food Bank, Kurow says. The volunteer work provides a balance to the heavy analytical work she does all week and fulfills her need to be creative she designs the promotional material for the non-profit. Cohen says a lot of successful people participate in fundraising events. This is a great way to network and to meet others with similar interests, he says. The visibility also helps in branding a successful person as philanthropic. 7. Avoid chores. Every weekend has a few have-to-dos, but you want these to take the minimum amount of time possible, Vanderkam explains. Create a small window for chores and errands, and then banish them from your mind the rest of the time. 8. Plan. Planning makes people more effective, and doing it before the week starts means you can hit Monday ready to go, and means youll give clear directions to the people who work for you, so they will be ready to go, too, Vanderkam says. Trunk agrees. She says successful people plan their month and year because if you get stuck on short-term lists you dont get anything big accomplished. 9. Socialize. Humans are social creatures, and studies of peoples experienced happiness through the day finds that socializing ranks right up there, not too far down below sex, Vanderkam says. Go out with friends and family, or get involved in the local community. It has been demonstrated that successful people find great satisfaction in giving back, Cohen says. Board membership, for example, also offers access to other successful folks. 10. Gardening/crafts/games/sports/cooking/cultural activities. This is especially important for those cooped up in an office all week. For the pure joy, some folks find great satisfaction in creating beautiful gardens, Cohen says. Kurow knows an attorney who uses her weekends to garden and do mosaics and tile work to satisfy her creative side. Filling her life this way enables her to be refreshed on Monday and ready to tackle the litigation and trial prep work. Artwork for her is fulfilling in a way that feeds her soul and her need to connect with her spiritual side.

Bridge lessons and groups can also sharpen the mind and often create relationships among highly competitive smart professionals, Cohen says. I once saw a printout of a bridge clubs membership list; its members were a whos who of Wall Street. Theatre, opera and sporting events can also enrich ones spirit, he adds. 11. Network. Networking isnt an event for a successful person, its a lifestyle, Trunk says. Wherever they go and whatever they do, they manage to connect with new people. 12. Reflect. Egan says truly successful people make time on weekends to appreciate what they have and reflect on their happiness and accomplishments. As Rascoff said, weekends are a great chance to reflect and be more introspective about bigger issues. 13. Meditate. Classes and private instruction offer a bespoke approach to insight and peace of mind, Cohen says. How better to equip yourself for success in this very tough world? 14. Recharge. We live in a competitive world, Vanderkam says. Peak performance requires managing downtime, toowith the goal of really recharging your batteries. Thats how the most successful people get so much done. Successful people know that time is too precious to be totally leisurely about leisure, Vanderkam concludes. Youre not going to waste that time by failing to think about what youd like to do with it, and thus losing the weekend to TV, puttering, inefficient e-mail checking, and chores. If you dont have a busy workweek, your weekend doesnt matter so much. But if youre going from 8 a.m. to 8 p.m. every day, it certainly does.

Potrebbero piacerti anche

- The Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136Da EverandThe Pros and Cons of Closed-End Funds: How Do You Like Your Income?: Financial Freedom, #136Nessuna valutazione finora

- Jan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErDocumento8 pagineJan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErCSNessuna valutazione finora

- Bullet Proof InvestingDocumento25 pagineBullet Proof InvestingNiru0% (1)

- Manage: For Trading LongevityDocumento4 pagineManage: For Trading LongevityTraderLibrary67% (3)

- The Pursuit of Absolute Engagement EbookDocumento270 pagineThe Pursuit of Absolute Engagement EbookAmit Rajeshirke100% (1)

- Guide to Siddhartha Mukherjee’s The Emperor of All MaladiesDa EverandGuide to Siddhartha Mukherjee’s The Emperor of All MaladiesNessuna valutazione finora

- RadioActive RISKLESS Spread Trades PDFDocumento11 pagineRadioActive RISKLESS Spread Trades PDFRavikanth Chowdary Nandigam0% (1)

- The State of The Penny Stock Union: Tom Mccarthy Pre Promotion StocksDocumento46 pagineThe State of The Penny Stock Union: Tom Mccarthy Pre Promotion StocksTom McCarthyNessuna valutazione finora

- Investors Business Daily Stock Buying Check ListDocumento1 paginaInvestors Business Daily Stock Buying Check Listgalt67100% (1)

- Beginner's Guide To FuturesDocumento15 pagineBeginner's Guide To FuturesAnupam BhardwajNessuna valutazione finora

- 7twelve Israelson PDFDocumento58 pagine7twelve Israelson PDFJeffNessuna valutazione finora

- The Alpha Hunter: Profiting from Option LEAPSDa EverandThe Alpha Hunter: Profiting from Option LEAPSValutazione: 1 su 5 stelle1/5 (4)

- Bear Proof InvestingDocumento289 pagineBear Proof Investingbigjlk100% (1)

- Master Mechanics Part DeuxDocumento1 paginaMaster Mechanics Part DeuxCSNessuna valutazione finora

- The Master Trader: Birinyi's Secrets to Understanding the MarketDa EverandThe Master Trader: Birinyi's Secrets to Understanding the MarketNessuna valutazione finora

- Summary of Ed Slott's The New Retirement Savings Time BombDa EverandSummary of Ed Slott's The New Retirement Savings Time BombNessuna valutazione finora

- The Invincible Mogul Skier: A Highly-Detailed Technical Manual for the Advancement of Competitive Mogul SkiersDa EverandThe Invincible Mogul Skier: A Highly-Detailed Technical Manual for the Advancement of Competitive Mogul SkiersNessuna valutazione finora

- The Moses of Wall Street: Investing The Right Way For The Right ReasonsDa EverandThe Moses of Wall Street: Investing The Right Way For The Right ReasonsNessuna valutazione finora

- Gilmo Report Feb 2 2011Documento9 pagineGilmo Report Feb 2 2011Alessandro Ortiz FormoloNessuna valutazione finora

- The Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsDa EverandThe Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsNessuna valutazione finora

- Rational Investing: The Subtleties of Asset ManagementDa EverandRational Investing: The Subtleties of Asset ManagementNessuna valutazione finora

- Living Your Retirement Dreams and Growing Young in The Villages; Florida's Friendliest and Healthiest HometownDa EverandLiving Your Retirement Dreams and Growing Young in The Villages; Florida's Friendliest and Healthiest HometownNessuna valutazione finora

- Jeff Augen - Trading Options at Expiration-Strategies and Models For Winning The EndgameDocumento6 pagineJeff Augen - Trading Options at Expiration-Strategies and Models For Winning The EndgameBe SauNessuna valutazione finora

- High Impact Training For A Strong Body: Transcript and 10 Point ChecklistDocumento14 pagineHigh Impact Training For A Strong Body: Transcript and 10 Point ChecklistarthurNessuna valutazione finora

- RadioActive Trading IntroductionDocumento31 pagineRadioActive Trading IntroductionRavikanth Chowdary NandigamNessuna valutazione finora

- More Than Money: True Stories of People Who Learned Life's Ultimate LessonDa EverandMore Than Money: True Stories of People Who Learned Life's Ultimate LessonValutazione: 4 su 5 stelle4/5 (3)

- The Gold Storage Solution: Switzerland by Doug CaseyDocumento7 pagineThe Gold Storage Solution: Switzerland by Doug CaseyTom SenbergNessuna valutazione finora

- Global Value How To Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in The Stock Market (PDFDrive)Documento88 pagineGlobal Value How To Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in The Stock Market (PDFDrive)Mihaela Milea0% (1)

- How Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Da EverandHow Would Have a Low-Cost Index Fund Approach Worked During the Great Depression?Nessuna valutazione finora

- 7Twelve: A Diversified Investment Portfolio with a PlanDa Everand7Twelve: A Diversified Investment Portfolio with a PlanValutazione: 5 su 5 stelle5/5 (1)

- How To Trade The Secret Stock MarketDocumento37 pagineHow To Trade The Secret Stock MarketJoe DNessuna valutazione finora

- Lloyd Bud Winter: Sleep Deprivation StatisticsDocumento1 paginaLloyd Bud Winter: Sleep Deprivation Statisticsanna100% (1)

- 00f GML System Naaim Final Humphrey LloydDocumento34 pagine00f GML System Naaim Final Humphrey Lloydtempor1240Nessuna valutazione finora

- Manias, Panics and Crashes SynopsisDocumento2 pagineManias, Panics and Crashes SynopsisvideodekhaNessuna valutazione finora

- New Rules Of Retirement: What Your Financial Advisor Isn't Telling YouDa EverandNew Rules Of Retirement: What Your Financial Advisor Isn't Telling YouNessuna valutazione finora

- Time Series MomentumDocumento23 pagineTime Series MomentumpercysearchNessuna valutazione finora

- Thinkorswim Custom Study Installation and Usage GuideDocumento4 pagineThinkorswim Custom Study Installation and Usage GuideTSthinkscripter60% (5)

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Documento2 pagineWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- Amos Hostetter Mind MapsDocumento8 pagineAmos Hostetter Mind MapsquelthalasNessuna valutazione finora

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningDa EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNessuna valutazione finora

- Memoirs of Extraordinary Popular Delusions and the Madness of CrowdsDa EverandMemoirs of Extraordinary Popular Delusions and the Madness of CrowdsValutazione: 4 su 5 stelle4/5 (233)

- Screener Setup - GersteinDocumento86 pagineScreener Setup - Gersteinsreekesh unnikrishnanNessuna valutazione finora

- (David Dreman) Contrarian Investment Strategies - OrgDocumento34 pagine(David Dreman) Contrarian Investment Strategies - Orgarunpdn80% (5)

- A New Chapter in The Evolution of Yuval Noah Harari's Sapiens - Culture - The GuardianDocumento4 pagineA New Chapter in The Evolution of Yuval Noah Harari's Sapiens - Culture - The GuardianbrightstarNessuna valutazione finora

- Transforming Wall Street: A Conscious Path for a New FutureDa EverandTransforming Wall Street: A Conscious Path for a New FutureNessuna valutazione finora

- The Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendDa EverandThe Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendNessuna valutazione finora

- Agenda For 201905014 Meeting Between NJPT & CP1b (EM)Documento4 pagineAgenda For 201905014 Meeting Between NJPT & CP1b (EM)HNmaichoiNessuna valutazione finora

- OVI Cable TUV Certificate CheckDocumento1 paginaOVI Cable TUV Certificate CheckHNmaichoiNessuna valutazione finora

- VIBM - Fire Rated Test Laboratory AddressDocumento1 paginaVIBM - Fire Rated Test Laboratory AddressHNmaichoiNessuna valutazione finora

- M&E Last Week Document Submission StatusDocumento1 paginaM&E Last Week Document Submission StatusHNmaichoiNessuna valutazione finora

- M.E Check Wall Tile Elevation at B1F (21.mar.2019)Documento23 pagineM.E Check Wall Tile Elevation at B1F (21.mar.2019)HNmaichoiNessuna valutazione finora

- Diesel SpecificationDocumento4 pagineDiesel SpecificationHNmaichoiNessuna valutazione finora

- STOH-Delivery Panel For B1F B4F - Picture Report (10.apr.2019)Documento16 pagineSTOH-Delivery Panel For B1F B4F - Picture Report (10.apr.2019)HNmaichoiNessuna valutazione finora

- 3.1.details Lgs Screw Acw4kDocumento8 pagine3.1.details Lgs Screw Acw4kHNmaichoiNessuna valutazione finora

- Finishing Material-Product Testing-SVN - Rev1Documento15 pagineFinishing Material-Product Testing-SVN - Rev1HNmaichoiNessuna valutazione finora

- NJPT Association: Position of AnchorDocumento1 paginaNJPT Association: Position of AnchorHNmaichoiNessuna valutazione finora

- 20171214-b1f Wall ElevationDocumento118 pagine20171214-b1f Wall ElevationHNmaichoiNessuna valutazione finora

- Sheet 1Documento1 paginaSheet 1HNmaichoiNessuna valutazione finora

- Pump & Panel Location KD Mr. Vien AskDocumento2 paginePump & Panel Location KD Mr. Vien AskHNmaichoiNessuna valutazione finora

- Oph - b1fl - Drywall Partition (Third Submission)Documento58 pagineOph - b1fl - Drywall Partition (Third Submission)HNmaichoiNessuna valutazione finora

- 20171128-b1f Wall ElevationDocumento106 pagine20171128-b1f Wall ElevationHNmaichoiNessuna valutazione finora

- Application Work 20180411Documento2 pagineApplication Work 20180411HNmaichoiNessuna valutazione finora

- Application Work 20180412Documento2 pagineApplication Work 20180412HNmaichoiNessuna valutazione finora

- 3 Sign (En) NakagawaDocumento5 pagine3 Sign (En) NakagawaHNmaichoiNessuna valutazione finora

- 2018 Tet Holiday ScheduleDocumento1 pagina2018 Tet Holiday ScheduleHNmaichoiNessuna valutazione finora

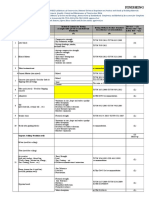

- MRT - M&E Standard List 6thapril 2018Documento7 pagineMRT - M&E Standard List 6thapril 2018HNmaichoiNessuna valutazione finora

- Fme 6 Decision Making Techniques PDFDocumento43 pagineFme 6 Decision Making Techniques PDFIsam KamalNessuna valutazione finora

- 2018.01.01 HCMC MRT Org (For QMS) - in A1 (Original)Documento1 pagina2018.01.01 HCMC MRT Org (For QMS) - in A1 (Original)HNmaichoiNessuna valutazione finora

- MRT - M&E Standard List 6thapril 2018Documento7 pagineMRT - M&E Standard List 6thapril 2018HNmaichoiNessuna valutazione finora

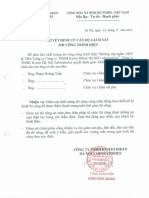

- KBHL Chung Chi Giam SatDocumento1 paginaKBHL Chung Chi Giam SatHNmaichoiNessuna valutazione finora

- Approved Calendar 2017Documento2 pagineApproved Calendar 2017HNmaichoiNessuna valutazione finora

- MR - Jafri SGPDocumento1 paginaMR - Jafri SGPHNmaichoiNessuna valutazione finora

- Calendar 2018Documento1 paginaCalendar 2018HNmaichoiNessuna valutazione finora

- Approved Calendar 2017 PDFDocumento2 pagineApproved Calendar 2017 PDFHNmaichoiNessuna valutazione finora

- IELTS Reading Answer SheetDocumento1 paginaIELTS Reading Answer Sheetskuppal50% (2)

- Toeic ResultDocumento1 paginaToeic ResultHNmaichoiNessuna valutazione finora

- (PMUY) Pradhan Mantri Ujjwala YojanaDocumento5 pagine(PMUY) Pradhan Mantri Ujjwala YojanaJitendra Suraaj TripathiNessuna valutazione finora

- Presentation David EatockDocumento22 paginePresentation David EatockpensiontalkNessuna valutazione finora

- Tax Saving Guide - 2022-23Documento28 pagineTax Saving Guide - 2022-23Padmapriya SrinivasanNessuna valutazione finora

- 2020 TaxReturnDocumento12 pagine2020 TaxReturnAdam Mason67% (3)

- Robinhood Trailing Stop LossDocumento3 pagineRobinhood Trailing Stop Lossj39jdj92oijtNessuna valutazione finora

- Intimation of Retirement/Death/Leaving Service: Sample FormDocumento9 pagineIntimation of Retirement/Death/Leaving Service: Sample FormDeliver rNessuna valutazione finora

- Trustee Handbook 4th EditionDocumento200 pagineTrustee Handbook 4th EditionBhakta PrakashNessuna valutazione finora

- IAS 19-Employee BenefitsDocumento46 pagineIAS 19-Employee Benefitsmdhuzzal100% (3)

- United States Court of Appeals, Eleventh CircuitDocumento8 pagineUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNessuna valutazione finora

- Microsoft Word - Choice of Superannuation Fund Form - HESTADocumento2 pagineMicrosoft Word - Choice of Superannuation Fund Form - HESTAYhr YhNessuna valutazione finora

- Handout 8.1 Annuity Due Sample ProblemsDocumento4 pagineHandout 8.1 Annuity Due Sample ProblemsEruel CruzNessuna valutazione finora

- GSIS V de LeonDocumento4 pagineGSIS V de LeonArtemisTzyNessuna valutazione finora

- Chapter 8 Time Value of Money - SolutionDocumento7 pagineChapter 8 Time Value of Money - SolutionanjaliNessuna valutazione finora

- 2017 BCSC 1226 (CanLII) - H.C.F. V D.T.F. - CanLIIDocumento3 pagine2017 BCSC 1226 (CanLII) - H.C.F. V D.T.F. - CanLIICharles BinghamNessuna valutazione finora

- Social Security DebateDocumento2 pagineSocial Security DebateKevin ArsenaultNessuna valutazione finora

- NuRS 115 ResearchDocumento15 pagineNuRS 115 ResearchD-Babygirl BlessedShorty DonnaNessuna valutazione finora

- Dharmadikari ReportDocumento43 pagineDharmadikari Reportricha_4ever20Nessuna valutazione finora

- Conte v. COADocumento11 pagineConte v. COAKirsten Rose Boque ConconNessuna valutazione finora

- A World Without WorkDocumento3 pagineA World Without WorkAidaAlizadeh100% (1)

- Income Tax Act ZimbabweDocumento177 pagineIncome Tax Act ZimbabweChristina TambalaNessuna valutazione finora

- IncomeTax Banggawan2019 Ch14Documento12 pagineIncomeTax Banggawan2019 Ch14Noreen Ledda0% (1)

- Unit - Problem Mejia Pablo1Documento2 pagineUnit - Problem Mejia Pablo1CM LanceNessuna valutazione finora

- 5 Financial Stages of LifeDocumento9 pagine5 Financial Stages of LifeEdward GanNessuna valutazione finora

- GE Waynesboro Plant News (1976)Documento204 pagineGE Waynesboro Plant News (1976)Ed PalmerNessuna valutazione finora

- Stupid ResearchDocumento5 pagineStupid ResearchAnton ArponNessuna valutazione finora

- Facts About Social SecurityDocumento14 pagineFacts About Social SecurityDavid BriggsNessuna valutazione finora

- Age Pension Income & Assets Form Completed. Mark LordDocumento18 pagineAge Pension Income & Assets Form Completed. Mark LordMark LordNessuna valutazione finora

- GSIS/SSS LawDocumento3 pagineGSIS/SSS LawCecille MangaserNessuna valutazione finora

- Employees Provident Fund and Miscellaneous Provisions Act 1952Documento20 pagineEmployees Provident Fund and Miscellaneous Provisions Act 1952Vidur Pandey100% (2)

- Formulas: F - Future Value P - Present/Principal ValueDocumento2 pagineFormulas: F - Future Value P - Present/Principal ValueJimuel Ace SarmientoNessuna valutazione finora