Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Deduct at Source

Caricato da

ankit1070Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Deduct at Source

Caricato da

ankit1070Copyright:

Formati disponibili

TAX DEDUCT AT SOURCE

TDS or best known as Tax Deducted at Source of collecting income tax from assesses in India. This is governed under Indian Income Tax Act, 1961, by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue managed by Indian Revenue Service (IRS), Ministry of Finance, Govt. of India. In simple terms, TDS is amount of tax getting deducted from the person (employee/deductee's) salary/income by the person (employer/deductor) paying salary/payments. National Securities Depository Ltd. (NSDL) after having modernized the settlement system in the Indian Capital Market by pioneering scripless settlement is now in the process of establishing a nationwide Tax Information Network (TIN) on behalf of the Income Tax Department (ITD). This is designed to make the tax administration more effective, furnishing of returns convenient, reduce compliance cost and bring greater transparency.

A. SCHEME OF TAX DEDUCTION AT SOURCE

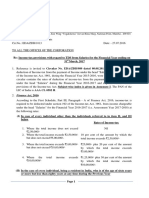

Under Section 152, the scheme of tax deduct at source, persons responsible for making payment of income, covered by the scheme, are responsible to deduct tax at source and deposit the same to the Governments treasury within the stipulated time. The recipient of income though he gets only the net amount (after deduction of tax at source) is liable to tax on the gross amount and the amount deducted at source is adjusted against his final tax liability.

B. RATES FOR TAX DEDUCTION AT SOURCE

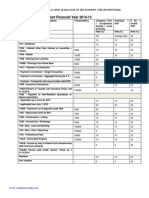

Tax is deductible at source at the rates given in table. If PAN of the deductee is not intimated to the deductor, tax will be deducted at source either at the rate given in table or at the rate of 20 percent, whichever is higher. Further, under section 94A(5), if payment or credit is made or given to a deductee who is located in a notified jurisdictional area, tax is deductible at the rate given in the table or at the rate 30 percent, whichever is higher. TDS rates for the financial year 2013-2014 are as followsWhen recipient is resident Nature of payment TDS (SC:Nil,EC:Nil,SHEC: Nil)

Sec. 192 Payment of Salary (normal tax rates are applicable SC: 10% (If net income exceeds Rs. 1crore), EC: 2% and SHEC: 3% -

Sec. 193 Interest on Securities a. interest on (a) debentures/ securities for money issued by or behalf of any local authority/statutory corporation, (b) listed debentures of a company, (c) any security of the Central or State Government b. any other interest on securities (including interest on non-listed debentures) 10 10

Sec. 194 Dividend a. deemed dividend under section 2(22)(e) b. any other dividend 10 Nil 10 30 30

Sec. 194A- Interest other than interest on securities Sec.194B- Winnings from lottery or crossword puzzle or card game or other game of any sort Sec. 194BB- Winning from horse races Sec.194C- Payment or credit to a resident contractor/sub contractor a. payment/credit to an individual or a Hindu undivided family b. payment/credit to any person other than an individual or a Hindu undivided family

1 2 10 20

Sec.194D- Insurance Commission Sec.194EE- Payment in respect of deposits under National Savings Scheme, 1987 Sec.194F- Payment on account of repurchase of units of MF or UTI Sec.194G- Commission on sale of lottery tickets Sec.194H- Commission or brokerage

20 20 10

Sec.194I- Renta. rent of plant and machinery b. rent of land or building or furniture or fitting

2 10

Sec.194IA- Payment/credit of consideration to a resident transferor for transfer of any immovable property (other than rural agriculture land)

(applicable from June1,2013) Sec.194J- Professional fees, technical fees, royalty or remuneration to a director Sec.194LAPayment of compensation on

10 10

acquisition of certain immovable property

Potrebbero piacerti anche

- What Is Tax Deducted at SourceDocumento6 pagineWhat Is Tax Deducted at SourcejdonNessuna valutazione finora

- Some Issues On Practice of TDS Law Seminar by NIRCDocumento29 pagineSome Issues On Practice of TDS Law Seminar by NIRCShashank Deva SunnyNessuna valutazione finora

- Presentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaDocumento15 paginePresentation On TDS Provision: by Nilesh Deharkar & AMAN BhattacharyaAman BhattacharyaNessuna valutazione finora

- Some Issues On Practice of TDS Law Seminar by NIRCDocumento29 pagineSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNessuna valutazione finora

- Seminar On TDSDocumento29 pagineSeminar On TDSCA Virendra ChhajerNessuna valutazione finora

- Intro of TdsDocumento6 pagineIntro of Tdsshivani singhNessuna valutazione finora

- Some Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCDocumento29 pagineSome Issues On Practice of TDS Law Some Issues On Practice of TDS Law Seminar by NIRC Seminar by NIRCJinoy P MathewNessuna valutazione finora

- Requirements U/S 195: By: Ca Sanjay K. AgarwalDocumento71 pagineRequirements U/S 195: By: Ca Sanjay K. AgarwalHemanthKumarNessuna valutazione finora

- NTPC Tax CircularDocumento20 pagineNTPC Tax CircularKundan RathodNessuna valutazione finora

- Tax Deducted at SourceDocumento29 pagineTax Deducted at SourceAmbar Pratik MishraNessuna valutazione finora

- Tax Deducted at Source IMPORTANT POINTSDocumento2 pagineTax Deducted at Source IMPORTANT POINTSnABSAMNNessuna valutazione finora

- Tds Law and Practice: Under Income Tax Act, 1961Documento84 pagineTds Law and Practice: Under Income Tax Act, 1961Vaibhav ChauhanNessuna valutazione finora

- TDS ElaboratedDocumento80 pagineTDS ElaboratedAncyNessuna valutazione finora

- 30851ipcc May Nov14 It Vol1 CP 9.unlockedDocumento43 pagine30851ipcc May Nov14 It Vol1 CP 9.unlockedavesatanas13Nessuna valutazione finora

- TDS Rate Financial Year 13-14Documento10 pagineTDS Rate Financial Year 13-14Heena AgreNessuna valutazione finora

- Lecture Notes - Study Module 9 - TDSDocumento32 pagineLecture Notes - Study Module 9 - TDSdata.mvgNessuna valutazione finora

- Tax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)Documento20 pagineTax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)shefalijais6491Nessuna valutazione finora

- Ty Tax Project (Final)Documento14 pagineTy Tax Project (Final)raj_s_harmaNessuna valutazione finora

- Tax Deduction at SourceDocumento5 pagineTax Deduction at SourceSarayu BhardwajNessuna valutazione finora

- For Tds On Non SalaryDocumento39 pagineFor Tds On Non SalaryicahimanshumehtaNessuna valutazione finora

- TDS, TCS & Advance Payment of TaxDocumento54 pagineTDS, TCS & Advance Payment of TaxFalak GoyalNessuna valutazione finora

- Module-1: Basic Concepts and DefinitionsDocumento35 pagineModule-1: Basic Concepts and Definitions2VX20BA091Nessuna valutazione finora

- TDS Rate Chart PDFDocumento2 pagineTDS Rate Chart PDFjdhamdeep07Nessuna valutazione finora

- TDS & TCSDocumento3 pagineTDS & TCSRajashree DasNessuna valutazione finora

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocumento49 pagineNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNessuna valutazione finora

- 19771ipcc It Vol1 Cp9Documento40 pagine19771ipcc It Vol1 Cp9Joseph SalidoNessuna valutazione finora

- Income Tax 2017 Edazdb1013Documento50 pagineIncome Tax 2017 Edazdb1013Pradeep PatilNessuna valutazione finora

- CH 6Documento95 pagineCH 6mulu melakNessuna valutazione finora

- 195 BCA PresentationDocumento36 pagine195 BCA PresentationCA Sagar WaghNessuna valutazione finora

- Tax Treatment of InvestmentsDocumento7 pagineTax Treatment of InvestmentsbnmallickNessuna valutazione finora

- Deduction, Collection & Recovery of TaxesDocumento143 pagineDeduction, Collection & Recovery of TaxesjyotiNessuna valutazione finora

- TDS - TCSDocumento55 pagineTDS - TCSBeing HumaneNessuna valutazione finora

- All About Tax Deducted at Source (TDS) - Taxguru - inDocumento11 pagineAll About Tax Deducted at Source (TDS) - Taxguru - inwaqtkeebaatein12Nessuna valutazione finora

- Tax Deducted at Source UnitDocumento13 pagineTax Deducted at Source Unitsatyanarayan dashNessuna valutazione finora

- The Rigours of TDS - An OverviewDocumento31 pagineThe Rigours of TDS - An OverviewShaleenPatniNessuna valutazione finora

- Income Tax Regulation No 78 2002Documento20 pagineIncome Tax Regulation No 78 2002buffoxxx100% (1)

- Income Tax Circular No. 17/2014 Dated 10.12.14Documento70 pagineIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNessuna valutazione finora

- Tds Rate Chart Fy 2014-15 Ay 2015-16Documento26 pagineTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86Nessuna valutazione finora

- Tds Amendements Via Finance Bill 2020Documento12 pagineTds Amendements Via Finance Bill 2020ABHISHEKNessuna valutazione finora

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDocumento3 pagineTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNessuna valutazione finora

- Tax Deduction at SourceDocumento4 pagineTax Deduction at SourcevishalsidankarNessuna valutazione finora

- TDS RatesDocumento9 pagineTDS RatesCharu JagetiaNessuna valutazione finora

- Instructions For Filling Out FORM ITR-2Documento8 pagineInstructions For Filling Out FORM ITR-2Ganesh KumarNessuna valutazione finora

- 31188sm DTL Finalnew-May-Nov14 Cp28Documento66 pagine31188sm DTL Finalnew-May-Nov14 Cp28gvcNessuna valutazione finora

- IT Rates For Tax Deduction at SourceDocumento12 pagineIT Rates For Tax Deduction at SourceArun EmmiNessuna valutazione finora

- TDS On Salaries - Income Tax Department, INDIADocumento112 pagineTDS On Salaries - Income Tax Department, INDIAArnav MendirattaNessuna valutazione finora

- With Holding Tax RatesDocumento3 pagineWith Holding Tax Ratesvenkat6299Nessuna valutazione finora

- Tds Rate ChartDocumento15 pagineTds Rate ChartJain MjNessuna valutazione finora

- TDS 3Documento16 pagineTDS 3payal AgrawalNessuna valutazione finora

- TDS Notes in Hindi PDFDocumento8 pagineTDS Notes in Hindi PDFRohit VermaNessuna valutazione finora

- TDS Rent - 194I - 194C PDFDocumento54 pagineTDS Rent - 194I - 194C PDFkashyap_ajNessuna valutazione finora

- Advance Learning On TDS Under Section 194-I and 194-C: MeaningDocumento52 pagineAdvance Learning On TDS Under Section 194-I and 194-C: MeaningTejTejuNessuna valutazione finora

- Income Tax Rules, 2002 PDFDocumento244 pagineIncome Tax Rules, 2002 PDFAli Minhas100% (1)

- Chapter 12 Tds & TcsDocumento28 pagineChapter 12 Tds & TcsRajNessuna valutazione finora

- All About TDS Part 2Documento9 pagineAll About TDS Part 2Animesh Kumar TilakNessuna valutazione finora

- Finance Act 1991Documento6 pagineFinance Act 1991Govardhan VaranasiNessuna valutazione finora

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDa Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNessuna valutazione finora

- 1040 Exam Prep: Module I: The Form 1040 FormulaDa Everand1040 Exam Prep: Module I: The Form 1040 FormulaValutazione: 1 su 5 stelle1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeDa Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeValutazione: 1 su 5 stelle1/5 (1)

- Branding ExcerciseDocumento1 paginaBranding Excerciseankit10700% (1)

- Finance Dissertation SynopsisDocumento4 pagineFinance Dissertation Synopsissatyasri1989Nessuna valutazione finora

- Question On Fund Flow StatementDocumento2 pagineQuestion On Fund Flow Statementankit1070Nessuna valutazione finora

- Rtgs Form PDFDocumento1 paginaRtgs Form PDFankit1070Nessuna valutazione finora

- Tax Deduct at SourceDocumento4 pagineTax Deduct at Sourceankit1070Nessuna valutazione finora

- Exchange RatesDocumento81 pagineExchange Ratesankit1070Nessuna valutazione finora

- Lloyd Annual Report 2010-2011Documento108 pagineLloyd Annual Report 2010-2011ankit1070Nessuna valutazione finora

- Weekly GST Communique A2Z Taxcorp LLP 18-03-2024Documento60 pagineWeekly GST Communique A2Z Taxcorp LLP 18-03-2024xetay24207Nessuna valutazione finora

- Foreign Trade Policy FTP 2023 Concepts Notes Questions With MCQsDocumento27 pagineForeign Trade Policy FTP 2023 Concepts Notes Questions With MCQscadkmarwah0% (1)

- 1022 2021Documento15 pagine1022 2021nfk roeNessuna valutazione finora

- NEW 2023 DT Bullet (Prov) by CA Saumil Manglani - CS ExecutiveDocumento275 pagineNEW 2023 DT Bullet (Prov) by CA Saumil Manglani - CS ExecutiveMukund RaiNessuna valutazione finora

- Taxation NotesDocumento54 pagineTaxation Notesmuskansethi2001Nessuna valutazione finora

- Delegation of Financial Powers Rules, 1978Documento31 pagineDelegation of Financial Powers Rules, 1978sairam dulipudiNessuna valutazione finora

- Issuance of Look Out Circulars (LOC) For Indirect Tax DefaultsDocumento2 pagineIssuance of Look Out Circulars (LOC) For Indirect Tax DefaultsLuv Sanjay ShahNessuna valutazione finora

- The Inspiring Story of Suharsha BhagatDocumento20 pagineThe Inspiring Story of Suharsha BhagatSwadhin NandaNessuna valutazione finora

- CBIC Civil List As On 01.01.2022Documento568 pagineCBIC Civil List As On 01.01.2022रुद्र प्रताप सिंह ८२Nessuna valutazione finora

- CBIC Civil List As On 01.01.2023Documento391 pagineCBIC Civil List As On 01.01.2023रुद्र प्रताप सिंह ८२Nessuna valutazione finora

- Concept of Salary Under Income Tax ActDocumento29 pagineConcept of Salary Under Income Tax ActMaaz Alam100% (1)

- Judgment1 CAT D Quahed Chargesheet Xerox Doc RegdDocumento15 pagineJudgment1 CAT D Quahed Chargesheet Xerox Doc Regdanwa1Nessuna valutazione finora

- Black Money in IndiaDocumento24 pagineBlack Money in IndiasweetfeverNessuna valutazione finora

- Final Vacancies For CGLE2022 26042023 1Documento3 pagineFinal Vacancies For CGLE2022 26042023 1BM JEETNessuna valutazione finora

- Kbs Sidhu PunjabDocumento3 pagineKbs Sidhu Punjabkbssidhu90Nessuna valutazione finora

- 01 Mica-January-2017-EnglishDocumento116 pagine01 Mica-January-2017-EnglishVinod Kumar ReddyNessuna valutazione finora

- Pillar 2 CompleteDocumento278 paginePillar 2 CompleteAnshul SinghNessuna valutazione finora

- Ias 1Documento2 pagineIas 1kasireddyvinodhaNessuna valutazione finora

- FTP 2023Documento28 pagineFTP 2023venkatrao_100Nessuna valutazione finora

- Civil List DocumentDocumento284 pagineCivil List DocumentmalanarunaNessuna valutazione finora

- Top Indian Bureaucracy News Whispers in The CorridorsDocumento1 paginaTop Indian Bureaucracy News Whispers in The CorridorsCBS CHANDIGARHNessuna valutazione finora

- Ias / PCS: Awareness ProgrammeDocumento50 pagineIas / PCS: Awareness ProgrammeShahid Ali A100% (1)

- Draw A Chart Showin Tax Structure in IndiaDocumento106 pagineDraw A Chart Showin Tax Structure in IndiagamingNessuna valutazione finora

- IDT Notes June - OrganizedDocumento200 pagineIDT Notes June - Organizedmightybanana121Nessuna valutazione finora

- First Report TARCDocumento594 pagineFirst Report TARCnewguyat77Nessuna valutazione finora

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFDocumento17 pagineUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFAbhishekNessuna valutazione finora

- Sampark Feb 2023Documento523 pagineSampark Feb 2023RAHUL LAMBANessuna valutazione finora

- DT Bullet (Summary) Sample Dec 20 Exams CA CS CMA Exec InterDocumento84 pagineDT Bullet (Summary) Sample Dec 20 Exams CA CS CMA Exec InterRohit GargNessuna valutazione finora

- Reinventing The Agmut and Danics Cadre - A Civil Service For Indian Union Territories.Documento34 pagineReinventing The Agmut and Danics Cadre - A Civil Service For Indian Union Territories.rpmeena_12Nessuna valutazione finora

- CCS Conduct Rule 22 Consumption of Intoxicating Drinks ExemptionsDocumento6 pagineCCS Conduct Rule 22 Consumption of Intoxicating Drinks ExemptionsAmit KulkarniNessuna valutazione finora