Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Starbucks - SectionA - Group13 - Case4 - Projected Statements

Caricato da

Sandeep ChowdhuryTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Starbucks - SectionA - Group13 - Case4 - Projected Statements

Caricato da

Sandeep ChowdhuryCopyright:

Formati disponibili

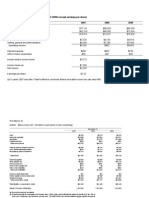

Projected Income statement for Starbucks - WITHOUT additional investment 2002 Revenue Co - Owned North American Co - Owned International

Total Company - Operated Retail Speciality Operations Net Revenues COGS Gross Profit Joint - Venture Income Expenses: Store Operating Expense Other Operating Expense Depreciation & Amortization Expense GAS Additional expense Operating Expense Operating Profit Net Income 1121.1 127.2 205.6 202.1 0 1656 1394.027 158.1663 255.6524 251.3004 40 pg-12 para 3 2099.146 2003 Data Source Assumption/Reasoning

*for Number of stores refer additional ca 2583.8 3199.003 pg-12, para 2 assuming revenue increases at the same 209.1 305.286 pg-12, para 2 assuming revenue increases at the same 2792.9 3504.289 496 585.28

assuming revenue increases at the same

3288.9 4089.569 1350 1678.652 1938.9 2410.917 35.8 44.75

assuming COGS to be a fixed percentage

assuming JV income growing at previous

assuming this expense to be a fixed perc assuming this expense tobe a fixed perce assuming this expense tobe a fixed perce assuming this expense tobe a fixed perce

318.7 356.5208 215.1 240.6264

fixed percentage ( 2002 )of Operating pro

*Data for 2002 from pg-13,Exhibit-1

n/Reasoning

er of stores refer additional calculation evenue increases at the same rate as previous year; rate for last year = 2583.3/2086.4 = 1.2381 evenue increases at the same rate as previous year; rate for last year = 209.1/143.2 = 1.46

evenue increases at the same rate as previous year; rate for last year = 496/419.4 = 1.18

OGS to be a fixed percentage (2002) of revenue(E13) for 2003

JV income growing at previous year's growth rate = 35.8/28.6=1.25

his expense to be a fixed percentage ( 2002 )of revenue(E13) of 2003 his expense tobe a fixed percentage ( 2002 )of revenue(E13) of 2003 his expense tobe a fixed percentage ( 2002 )of revenue(E13) of 2003 his expense tobe a fixed percentage ( 2002 )of revenue(E13) of 2003

ntage ( 2002 )of Operating profit of 2003; this implies a fixed tax rate

Projected Income statement for Starbucks - With additional $40million investment 2002 Revenue Co - Owned North American Co - Owned International Total Company - Operated Retail Speciality Operations Net Revenues COGS Gross Profit Joint - Venture Income Expenses: Store Operating Expense Other Operating Expense Depreciation & Amortization Expense GAS Additional expense Operating Expense Operating Profit Net Income 1121.1 127.2 205.6 202.1 0 1656 1826.779 207.2664 335.0155 329.3124 40 2738.374 2583.8 209.1 2792.9 496 4181.84 520 4701.84 657.267 2003

3288.9 5359.107 1350 2199.761 1938.9 3159.346 35.8 44.75

318.7 465.7222 215.1 314.3296

* Data for 2002 from pg-13,Exhibit-1

Summary Without additional investment Invest $40 mn Operating Income Net Income Operating Income Net Income Difference in NI 356.5208 240.6264 465.7222 314.3296 73.7 million $

(in favor of investment)

Data Source

Assumption/Reasoning

*for Number of stores refer additional calculation pg-12, para 2 assuming a best case estimate of weekly sales of $20,000 for all company operated stores in North America pg-12, para 2 assuming a best case estimate of weekly sales of $20,000 for all company operated stores in international ma

Assuming specialty operations income is directly proportional to no.of licensed stores; assuming ratio of sales

assuming COGS tobe a fixed percentage ( 2002 )of revenue of 2003

assuming JV income growing at previous year's growth rate = 35.8/28.6=1.25

assuming this expense tobe a fixed percentage ( 2002 )of revenue of 2003 assuming this expense tobe a fixed percentage ( 2002 )of revenue of 2003 assuming this expense tobe a fixed percentage ( 2002 )of revenue of 2003 assuming this expense tobe a fixed percentage ( 2002 )of revenue of 2003 pg-12 para 3

fixed percentage ( 2002 )of Operating profit of 2003

investment)

ted stores in North America ted stores in international markets

stores; assuming ratio of sales to licensed stores remains constant

Additional calculations Total no. of company -operated stores in North America in 2003 = 525+3496 = 4021 Total no. of licensed stores in North America in 2003 = 225+1078 = 1303 Total no. of International Company operated stores in 2003 = 1.301*384 = 500 where growth rate is previous years growth rate = 384/295=1.301 Similarly ,Total no. of International licensed stores in 2003 = 1.46*928 = 1358 avg sales per store for 2002 = net revenue /total no. of stores total no. of licensed stores = 1078 + 928 = 2006 Hence, avg sales per store for 2002 = 496/2006 = 0.247

Data Source page 7 ; para 5 and Exhibit 2 page 7 ; para 5 and Exhibit 2 pg-13, Exhibit 2 pg-13, Exhibit 2 pg-13, Exhibit 2

Assumption

Rate of increase in number of stores is same as last year

pg-13, Exhibit 2

4021

500

Potrebbero piacerti anche

- 8 Capital Structure Decision - Polaroid Corporation 1996Documento51 pagine8 Capital Structure Decision - Polaroid Corporation 1996Shelly Jain100% (2)

- Mercury AthleticDocumento13 pagineMercury Athleticarnabpramanik100% (1)

- Write Your Answer For Part A HereDocumento9 pagineWrite Your Answer For Part A HereMATHEW JACOBNessuna valutazione finora

- Millions of Dollars Except Per-Share DataDocumento14 pagineMillions of Dollars Except Per-Share DataVishal VermaNessuna valutazione finora

- Mini Case CH 3 SolutionsDocumento14 pagineMini Case CH 3 SolutionsTimeka CarterNessuna valutazione finora

- Name Atikesh Gupta: Write Your Answer For Part A HereDocumento7 pagineName Atikesh Gupta: Write Your Answer For Part A HereDeblina Mitra100% (2)

- Alliance Concrete ForecastingDocumento7 pagineAlliance Concrete ForecastingS r kNessuna valutazione finora

- Excel Spreadsheet For Mergers and Acquisitions ValuationDocumento6 pagineExcel Spreadsheet For Mergers and Acquisitions ValuationRenold DarmasyahNessuna valutazione finora

- ACME Prob - 04-01Documento6 pagineACME Prob - 04-01srutijnpNessuna valutazione finora

- 10408065Documento4 pagine10408065Joel Christian MascariñaNessuna valutazione finora

- +incest Schoolgirls PDFDocumento61 pagine+incest Schoolgirls PDFSandeep Chowdhury0% (1)

- Inventory SimulationDocumento60 pagineInventory SimulationMuhammad Ahsan MukhtarNessuna valutazione finora

- Microeconomics Practical Exercises: Topic 5 - 8 Section 1: Multiple Choice QuestionsDocumento10 pagineMicroeconomics Practical Exercises: Topic 5 - 8 Section 1: Multiple Choice QuestionsLinh Trinh NgNessuna valutazione finora

- Chapter 1 Marketing The Art and Science of Satisfying CustomersDocumento34 pagineChapter 1 Marketing The Art and Science of Satisfying CustomersWilliam ZhangNessuna valutazione finora

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocumento9 pagineNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNessuna valutazione finora

- Body ShopDocumento8 pagineBody ShopShopan J. Endrawan75% (4)

- Consolidated Profit & Loss Account For Continuing OperationsDocumento13 pagineConsolidated Profit & Loss Account For Continuing OperationsAlok JainNessuna valutazione finora

- Gitman 4e Ch. 2 SPR - SolDocumento8 pagineGitman 4e Ch. 2 SPR - SolDaniel Joseph SitoyNessuna valutazione finora

- Presented By:-: Ankur GuptaDocumento26 paginePresented By:-: Ankur GuptaRohit AgarwalNessuna valutazione finora

- KMBSolution 4Documento5 pagineKMBSolution 4Nurbek SeiitovNessuna valutazione finora

- Net Sales: January 28, 2012 January 29, 2011Documento9 pagineNet Sales: January 28, 2012 January 29, 2011장대헌Nessuna valutazione finora

- Enron Case Study - So What Is It WorthDocumento20 pagineEnron Case Study - So What Is It WorthJohn Aldridge ChewNessuna valutazione finora

- TRM 231.01 Financial Statements of Migros Assignment 1Documento6 pagineTRM 231.01 Financial Statements of Migros Assignment 1Neşe RomanNessuna valutazione finora

- 2003 2004 2005 2006 Answer Reason Decreasing CFO 2019 838 250 226 Trend Increase in Account ReceivableDocumento44 pagine2003 2004 2005 2006 Answer Reason Decreasing CFO 2019 838 250 226 Trend Increase in Account Receivablebabu senNessuna valutazione finora

- Long-Term Financial Planning: Plans: Strategic, Operating, and Financial Pro Forma Financial StatementsDocumento50 pagineLong-Term Financial Planning: Plans: Strategic, Operating, and Financial Pro Forma Financial StatementsSyed MohdNessuna valutazione finora

- PI Industries DolatCap 141111Documento6 paginePI Industries DolatCap 141111equityanalystinvestorNessuna valutazione finora

- Financial Statement AnalysisDocumento18 pagineFinancial Statement AnalysisSaema JessyNessuna valutazione finora

- Financial Planning and ForecastingDocumento17 pagineFinancial Planning and Forecastinglove_a123100% (1)

- V & H AnalysisDocumento19 pagineV & H AnalysisAslam SoniNessuna valutazione finora

- Growth Analysis 2Documento57 pagineGrowth Analysis 2Katty MothaNessuna valutazione finora

- CaseDocumento2 pagineCaseabhsaikatNessuna valutazione finora

- Analysis of Financial StatementsDocumento38 pagineAnalysis of Financial StatementsMATCHArtNessuna valutazione finora

- Interest Income, Non-BankDocumento206 pagineInterest Income, Non-BankArturo RiveroNessuna valutazione finora

- Anyway, EPS Is An Important Element of InvestmentDocumento5 pagineAnyway, EPS Is An Important Element of Investmentzhangshuang327Nessuna valutazione finora

- Att Ar 2012 ManagementDocumento35 pagineAtt Ar 2012 ManagementDevandro MahendraNessuna valutazione finora

- Flash Memory Inc Student Spreadsheet SupplementDocumento5 pagineFlash Memory Inc Student Spreadsheet Supplementjamn1979Nessuna valutazione finora

- Management - Ceo's Financial AssistantDocumento41 pagineManagement - Ceo's Financial AssistantasgbalajiNessuna valutazione finora

- Chapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)Documento10 pagineChapter 10 - SHAREHOLDER VALUE ADDED (ECONOMIC PROFIT)afwdemo Poppoltje1?Nessuna valutazione finora

- Sales Force Leadership: Sales Person Performance EvaluationDocumento31 pagineSales Force Leadership: Sales Person Performance EvaluationSabu VincentNessuna valutazione finora

- Roadshow Natixis Mar09Documento47 pagineRoadshow Natixis Mar09sl7789Nessuna valutazione finora

- Fin3320 Proj sp15 ChagutkalngDocumento8 pagineFin3320 Proj sp15 Chagutkalngapi-283250650Nessuna valutazione finora

- On Sale On Sale On SaleDocumento7 pagineOn Sale On Sale On SaleDaty HassanNessuna valutazione finora

- Condensed Consolidated Statements of IncomeDocumento7 pagineCondensed Consolidated Statements of IncomevenkeeeeeNessuna valutazione finora

- Target Corporation Reports Second Quarter Earnings 2023Documento12 pagineTarget Corporation Reports Second Quarter Earnings 2023Williams PerdomoNessuna valutazione finora

- CFA Lecture 4 Examples Suggested SolutionsDocumento22 pagineCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- ACF CaseDocumento22 pagineACF CaseHaris AliNessuna valutazione finora

- Pro Forma Models - StudentsDocumento9 paginePro Forma Models - Studentsshanker23scribd100% (1)

- Financial ReportDocumento151 pagineFinancial ReportleeeeNessuna valutazione finora

- Financial ReportDocumento151 pagineFinancial ReportleeeeNessuna valutazione finora

- Honda MotorDocumento46 pagineHonda MotorDaniela Denisse Anthawer LunaNessuna valutazione finora

- Case StudyDocumento2 pagineCase StudyRaisa TasnimNessuna valutazione finora

- Assignment 4Documento12 pagineAssignment 4giannimizrahi5Nessuna valutazione finora

- Citigroup Q4 2012 Financial SupplementDocumento47 pagineCitigroup Q4 2012 Financial SupplementalxcnqNessuna valutazione finora

- Colgate-Financial-Model-Solved-Wallstreetmojo ComDocumento34 pagineColgate-Financial-Model-Solved-Wallstreetmojo Comapi-300740104Nessuna valutazione finora

- Lecture 7 - Ratio AnalysisDocumento39 pagineLecture 7 - Ratio AnalysisMihai Stoica100% (1)

- Ceres Gardening Company Submission PriyanshuChaturvedi PDFDocumento6 pagineCeres Gardening Company Submission PriyanshuChaturvedi PDFPriyanshu ChaturvediNessuna valutazione finora

- BaiduDocumento29 pagineBaiduidradjatNessuna valutazione finora

- Target Corporation Reports Third Quarter EarningsDocumento12 pagineTarget Corporation Reports Third Quarter EarningsRafael BorgesNessuna valutazione finora

- Coca Cola Financial Statements 2008Documento75 pagineCoca Cola Financial Statements 2008James KentNessuna valutazione finora

- GRVY Compustat ReportDocumento15 pagineGRVY Compustat ReportOld School ValueNessuna valutazione finora

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryDa EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryDa EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Outboard Engines World Summary: Market Sector Values & Financials by CountryDa EverandOutboard Engines World Summary: Market Sector Values & Financials by CountryNessuna valutazione finora

- Collection Agency Revenues World Summary: Market Values & Financials by CountryDa EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- +in Sexual Pursuit PDFDocumento62 pagine+in Sexual Pursuit PDFSandeep ChowdhuryNessuna valutazione finora

- +incest Wife PDFDocumento55 pagine+incest Wife PDFSandeep Chowdhury50% (4)

- +incest Games PDFDocumento75 pagine+incest Games PDFSandeep Chowdhury100% (1)

- +hungry For Sister PDFDocumento79 pagine+hungry For Sister PDFSandeep Chowdhury100% (1)

- +into Sister, Into Incest PDFDocumento56 pagine+into Sister, Into Incest PDFSandeep ChowdhuryNessuna valutazione finora

- +hero's Mistress PDFDocumento51 pagine+hero's Mistress PDFDarko VrhovacNessuna valutazione finora

- +hot Naked Cousin PDFDocumento50 pagine+hot Naked Cousin PDFSandeep Chowdhury0% (1)

- +in Bondage Schoolgirl PDFDocumento53 pagine+in Bondage Schoolgirl PDFSandeep ChowdhuryNessuna valutazione finora

- +hot & Horny Weekend PDFDocumento68 pagine+hot & Horny Weekend PDFSandeep ChowdhuryNessuna valutazione finora

- +hot Bed Family PDFDocumento69 pagine+hot Bed Family PDFSandeep Chowdhury33% (3)

- It Risk Assesment TemplateDocumento22 pagineIt Risk Assesment TemplatekenptyNessuna valutazione finora

- +hot Pants Weather Girl PDFDocumento63 pagine+hot Pants Weather Girl PDFSandeep ChowdhuryNessuna valutazione finora

- +homespun FunDocumento76 pagine+homespun FunAna-Maria Ignat0% (1)

- RatingsDocumento3 pagineRatingsAnonymous SA40GK6Nessuna valutazione finora

- +horny Balling Mother PDFDocumento55 pagine+horny Balling Mother PDFSandeep Chowdhury100% (1)

- +horny Voyeur Schoolgirls PDFDocumento51 pagine+horny Voyeur Schoolgirls PDFSandeep ChowdhuryNessuna valutazione finora

- Synergy Valuation WorksheetDocumento4 pagineSynergy Valuation Worksheetabhishekbehal5012Nessuna valutazione finora

- Capital Budget TemplateDocumento1 paginaCapital Budget TemplaterajvakNessuna valutazione finora

- Microsoft Excel Sheet For Calculating (Money) Future & Present Value, Amortization Table, Present Value, Power of Compounding, EMI Calculation, MortgageDocumento7 pagineMicrosoft Excel Sheet For Calculating (Money) Future & Present Value, Amortization Table, Present Value, Power of Compounding, EMI Calculation, MortgageVikas Acharya100% (1)

- Proforma 7-00Documento24 pagineProforma 7-00nsadnanNessuna valutazione finora

- NPV IrrDocumento6 pagineNPV IrrSandeep ChowdhuryNessuna valutazione finora

- Valaution Model - A Model For Any Valuation.Documento6 pagineValaution Model - A Model For Any Valuation.kanabaramitNessuna valutazione finora

- Workbook1 2Documento73 pagineWorkbook1 2Sandeep ChowdhuryNessuna valutazione finora

- StatmntsDocumento6 pagineStatmntsRaunaq KulkarniNessuna valutazione finora

- InfltnDocumento3 pagineInfltnnsadnanNessuna valutazione finora

- History 5 00Documento14 pagineHistory 5 00nsadnanNessuna valutazione finora

- Implied Risk Premium Calculator: Sheet1Documento2 pagineImplied Risk Premium Calculator: Sheet1Sandeep ChowdhuryNessuna valutazione finora

- History PivotDocumento1 paginaHistory PivotnsadnanNessuna valutazione finora

- CAT QA 03 Percentage-3Documento34 pagineCAT QA 03 Percentage-3anuragNessuna valutazione finora

- Time Is More Important Than Money-1Documento7 pagineTime Is More Important Than Money-1Kholilul Rahman SiregarNessuna valutazione finora

- B.S Studies Pack BookDocumento225 pagineB.S Studies Pack Bookjungleman marandaNessuna valutazione finora

- Lecture Notes For Microeconomic Theory - ECON 630 (PDFDrive)Documento645 pagineLecture Notes For Microeconomic Theory - ECON 630 (PDFDrive)bernadette dellamasnocheNessuna valutazione finora

- Delta Neutral Hedging Strategy Premium Neutral Hedging StrategyDocumento4 pagineDelta Neutral Hedging Strategy Premium Neutral Hedging StrategyBen ShibeNessuna valutazione finora

- MACROECONOMICS Test (Finals)Documento76 pagineMACROECONOMICS Test (Finals)Merry Juannie U. PatosaNessuna valutazione finora

- Project SelectionDocumento58 pagineProject SelectionShoaib Aziz Meer100% (2)

- Explanatory Memorandum SSDocumento23 pagineExplanatory Memorandum SSkalluvarmaNessuna valutazione finora

- Hac 1001 NotesDocumento56 pagineHac 1001 NotesMarlin MerikanNessuna valutazione finora

- Credit & Borrowing - Cambridge PDFDocumento28 pagineCredit & Borrowing - Cambridge PDFdiana_kalinskaNessuna valutazione finora

- Profile of Care UtitlityDocumento15 pagineProfile of Care Utitlityamit22505Nessuna valutazione finora

- 12 Macro Economics Key Notes CH 02 National Income and Related AggregatesDocumento14 pagine12 Macro Economics Key Notes CH 02 National Income and Related AggregatesHackerzillaNessuna valutazione finora

- Security Analysis and Portfolio Management Pharmaceutical IndustryDocumento45 pagineSecurity Analysis and Portfolio Management Pharmaceutical IndustryparinchawdaNessuna valutazione finora

- Pa Aaaaa SssDocumento34 paginePa Aaaaa Ssspeter NHNessuna valutazione finora

- ShortingDocumento25 pagineShortingTony NguyenNessuna valutazione finora

- Marketing Across Cultures - EditedDocumento17 pagineMarketing Across Cultures - EditedMuhammad Sajid SaeedNessuna valutazione finora

- Comparative Analysis of SCAPMDocumento11 pagineComparative Analysis of SCAPMInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- MTWO Presentation Light GM V3.0Documento24 pagineMTWO Presentation Light GM V3.0GGNessuna valutazione finora

- Alpha InvestingDocumento4 pagineAlpha Investingapi-3700769Nessuna valutazione finora

- FM09-CH 09Documento12 pagineFM09-CH 09Mukul KadyanNessuna valutazione finora

- The Diamond 4CsDocumento14 pagineThe Diamond 4CsDipak MondalNessuna valutazione finora

- Country Risk and The Global CAPMDocumento12 pagineCountry Risk and The Global CAPMRosetta RennerNessuna valutazione finora

- Electric Power System Flexibility: Challenges and OpportunitiesDocumento44 pagineElectric Power System Flexibility: Challenges and Opportunitiesek9925Nessuna valutazione finora

- Acc 205 Ca1Documento11 pagineAcc 205 Ca1Nidhi SharmaNessuna valutazione finora

- Linking Operations With Finance CaseDocumento2 pagineLinking Operations With Finance CaseSharan SaarsarNessuna valutazione finora

- FIN338 Ch15 LPKDocumento90 pagineFIN338 Ch15 LPKjahanzebNessuna valutazione finora

- Course Information: Universiti Teknologi MaraDocumento8 pagineCourse Information: Universiti Teknologi MaraKhai VeChainNessuna valutazione finora

- Managing Member - Tim Eriksen Eriksen Capital Management, LLC 567 Wildrose Cir., Lynden, WA 98264Documento7 pagineManaging Member - Tim Eriksen Eriksen Capital Management, LLC 567 Wildrose Cir., Lynden, WA 98264Matt EbrahimiNessuna valutazione finora