Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

690 Assignment 4 Twin Def

Caricato da

Animat_MeDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

690 Assignment 4 Twin Def

Caricato da

Animat_MeCopyright:

Formati disponibili

Econ 690 Assignment # 4: The Twin Deficits

Senior Seminar Dr. King

This assignment covers Macro/International Finance. You will download data from the

Federal Reserve Bank of St. Louis and use it to analyze “the twin deficits”—that is, the

relationship between the US federal budget deficit and US trade deficit. You should

complete the assignment on your own. In this assignment you will test the hypothesis

that government budget deficits cause current account deficits.

1. Read Notes. I posted notes on the Balance of Payments accounts which relates

the accounting/theoretical relationship between budget deficits/surpluses and

trade deficits/surpluses. Please read these notes carefully and make sure you

understand the relationship. Please also read the following (one page) article:

http://research.stlouisfed.org/publications/iet/20010501/cover.pdf

2. Please examine the FREDII database at http://research.stlouisfed.org/fred2/ to see

what is available. Next, decide what data you will need to collect, for example:

GDP, Consumption, public and private savings, the current account, etc. You may

need to calculate some of these from the definitions given (e.g., private savings).

You will also need to make some choices (e.g., monthly, quarterly or annual data

—quarterly is probably best). Please justify all your assumptions and remember

there is more than one correct methodology (though I suggest you use real as

opposed to nominal data).

You can download a series from FRED into excel. For example, if you want

interest rate data:

• Click on interest rates.

• Click Treasury Index Note

• Click on download data

• Click on the file with file extension *.xls

Now you have your excel series.

3. Plot a time series graph of the government budget deficit and trade deficit to show

the relationship between the two.

a) Is there always a twin deficit (i.e., a positive correlation between the two)?

b) Calculate the statistical relationship between the two series for various time

periods. You might want to use decades, or more logically administrations

(Reagan, Clinton, Republican, Democratic, etc.) For example, you could use

the “correl” command and create a table similar to the one in the

International Economic Trends newsletter linked above. If you are more

adventurous you can do a lot more in Excel (and receive a higher grade!)

c) Calculate the relationship between the CA balance and other aggregate data

(e.g., public and private savings).

d) Plot the data and create a table with the correlation coefficients.

4. What conclusions can you draw from your analysis? Is there a correlation

between the two deficits? Does it hold for certain time periods and not others?

Do you have any explanations for your results? Please note that there is no

definitive explanation for the relationship (or lack of one) between the two

deficits, so there is no right and wrong answer.

5. Write up your results and submit them to me at pgking@sfsu.edu. Please tell me

who did what.

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Directorate For Financial, Fiscal and Enterprise AffairsDocumento43 pagineDirectorate For Financial, Fiscal and Enterprise AffairsAnimat_MeNessuna valutazione finora

- Assignment Success Workshops, MSC 08/09 Essay Writing Workshop 1: Analysing The QuestionDocumento2 pagineAssignment Success Workshops, MSC 08/09 Essay Writing Workshop 1: Analysing The QuestionAnimat_MeNessuna valutazione finora

- Met A Searching Conference ReportDocumento9 pagineMet A Searching Conference ReportAnimat_MeNessuna valutazione finora

- Prospectus Nus Diploma Course in Tissue BankingDocumento6 pagineProspectus Nus Diploma Course in Tissue BankingAnimat_Me100% (1)

- Major FinanceDocumento14 pagineMajor FinanceAnimat_Me100% (2)

- Master of Computer Application (Mca)Documento23 pagineMaster of Computer Application (Mca)Animat_Me100% (2)

- ECON 563 - Commercial BankingDocumento9 pagineECON 563 - Commercial BankingAnimat_Me0% (1)

- Doing Business in Indonesia: A Short-Form Business ProfileDocumento7 pagineDoing Business in Indonesia: A Short-Form Business ProfileAnimat_MeNessuna valutazione finora

- Mariner's Bank Personal Internet Banking Access AgreementDocumento8 pagineMariner's Bank Personal Internet Banking Access AgreementAnimat_MeNessuna valutazione finora

- Faculty of Business Computing and Information Management: Making An Ap (E) L Application A Student GuideDocumento13 pagineFaculty of Business Computing and Information Management: Making An Ap (E) L Application A Student GuideAnimat_Me100% (2)

- Chapter 7 - Illinois Common Law Assignments For The Benefit of CreditorsDocumento6 pagineChapter 7 - Illinois Common Law Assignments For The Benefit of CreditorsAnimat_MeNessuna valutazione finora

- The Intention of Customers Use Internet Banking: An Examination ofDocumento13 pagineThe Intention of Customers Use Internet Banking: An Examination ofAnimat_Me100% (2)

- 26 Amul MarketingDocumento6 pagine26 Amul MarketingAnimat_Me75% (4)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- MG Pete Chiarelli Director of Operations, Readiness and Mobilization NEIT-532Documento42 pagineMG Pete Chiarelli Director of Operations, Readiness and Mobilization NEIT-5329/11 Document ArchiveNessuna valutazione finora

- 4-Parens Patriae - Alfred AdaskDocumento8 pagine4-Parens Patriae - Alfred AdaskOneNationNessuna valutazione finora

- Balfour DeclarationDocumento7 pagineBalfour DeclarationaroosaNessuna valutazione finora

- Feudalism and Manorial IsmDocumento28 pagineFeudalism and Manorial Ismjhfletcher100% (1)

- Asyah 2Documento17 pagineAsyah 2khairul wahidiNessuna valutazione finora

- Important Current Affairs 2019 2020Documento63 pagineImportant Current Affairs 2019 2020studentmgmNessuna valutazione finora

- Breen, 2004, The Marketplace of Revolution, How Consumer Politics Shaped American IndependenceDocumento401 pagineBreen, 2004, The Marketplace of Revolution, How Consumer Politics Shaped American IndependenceFelipe RochaNessuna valutazione finora

- Province of Batangas v. RomuloDocumento4 pagineProvince of Batangas v. RomuloNoreenesse Santos100% (1)

- Poli DigestDocumento373 paginePoli Digestjennifer falconNessuna valutazione finora

- Combatants For Peace StatementDocumento3 pagineCombatants For Peace StatementThe WireNessuna valutazione finora

- Ali vs. Atty. Bubong (A.C. No. 4018. March 8, 2005) : FactsDocumento12 pagineAli vs. Atty. Bubong (A.C. No. 4018. March 8, 2005) : FactsAnonymous 5k7iGyNessuna valutazione finora

- Communication in Multicultural SettingDocumento16 pagineCommunication in Multicultural SettingRaquel NacarioNessuna valutazione finora

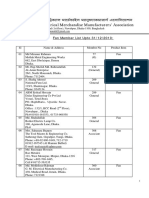

- Fan MemberDocumento6 pagineFan MemberMigration SolutionNessuna valutazione finora

- Establishment of Military JusticeDocumento1 paginaEstablishment of Military JusticeEsLebeDeutschlandNessuna valutazione finora

- Ingles 10 Doris - JudithDocumento10 pagineIngles 10 Doris - JudithLuz Mercedes Rugeles GelvezNessuna valutazione finora

- IR Lecture 21 Maternity Benefit ActDocumento13 pagineIR Lecture 21 Maternity Benefit ActradhikaNessuna valutazione finora

- Full Cases PDFDocumento792 pagineFull Cases PDFMainam GangstaNessuna valutazione finora

- Preclaro Vs Sandiganbayan CDDocumento1 paginaPreclaro Vs Sandiganbayan CDKenneth Ray AgustinNessuna valutazione finora

- Chapter - V Conclusions and SuggestionsDocumento15 pagineChapter - V Conclusions and SuggestionsVinay Kumar KumarNessuna valutazione finora

- Part 2 General EducationDocumento3 paginePart 2 General EducationPhotography Rios 2022Nessuna valutazione finora

- CPWD Maintenance Manual 2012Documento136 pagineCPWD Maintenance Manual 2012sujeetroyNessuna valutazione finora

- Namma Kalvi 12th History Minimum Learning Material em 217048Documento37 pagineNamma Kalvi 12th History Minimum Learning Material em 217048Arul kumarNessuna valutazione finora

- Tamirat LayneDocumento9 pagineTamirat LayneMeleseNessuna valutazione finora

- Bribery Ethical Profession 1Documento13 pagineBribery Ethical Profession 1BelBelle TanNessuna valutazione finora

- 3 Biometric Overseas Travelling Form - V1Documento1 pagina3 Biometric Overseas Travelling Form - V1razarafiq033Nessuna valutazione finora

- The Weimar Constitution.Documento9 pagineThe Weimar Constitution.Maitaishe GoraNessuna valutazione finora

- Nationalism in India Syllabus. 2Documento3 pagineNationalism in India Syllabus. 2Sakshi SinghNessuna valutazione finora

- Negros Oriental Electric Corp Vs Sec of LaborDocumento3 pagineNegros Oriental Electric Corp Vs Sec of LaborheymardsNessuna valutazione finora

- Legislative Powers of The PresidentDocumento3 pagineLegislative Powers of The PresidentSubham AgarwalNessuna valutazione finora

- Southern Hemisphere vs. Anti-Terrorism Council, October 5, 2010Documento57 pagineSouthern Hemisphere vs. Anti-Terrorism Council, October 5, 2010CJ Ivanne DichosoNessuna valutazione finora