Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Long Term Growth Fund Fact Sheet

Caricato da

maxamsterCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Long Term Growth Fund Fact Sheet

Caricato da

maxamsterCopyright:

Formati disponibili

Carlisle Management

Long Term Growth Fund Overview

Life Settlement Fund Fund

Long Term Growth Management fee Incentive fee

2009

ISIN

LU0412489550 2% 20% with 8% hurdle

Fund Highlights

An open-ended fund that seeks to deliver above average returns for investors through an innovative new asset class based in the area of traded life insurance policies. Offer investors a passively managed life settlement fund strategy. Focused exclusively in our core competency, life settlements. Offers returns with minimum correlation to traditional financial markets Fund policies are valued on a mark-to-market basis (fair value) based on current market Internal Rates of Return.

Fund Facts

Investment Manager Subcustodian Administrator Custodian Auditor Fund Domicile Class Inception Date Leverage Carlisle Management Company Wells Fargo Caceis Caceis KPMG Luxembourg July 1, 2009 0%

Fund Strategy

The Long Term Growth Funds strategy is to purchase carefully selected life insurance policies that are beyond the contestability period. The Fund seeks to build a large diversified portfolio across numerous sectors, including but not limited to carrier concentration, expected maturities, gender, age, medical impairment, geography and face value size. In order to properly implement a buy and hold strategy, the Fund seeks to isolate mortality risk and build a large sample size. Since policies are held through maturity, the managers employ extremely detailed actuarial and financial analysis to ensure that policies purchased are accounted for longevity risk as well as other variables of the statistical profile.

Investment Details

Minimum investment Subscription frequency Redemption frequency USD 250,000 Monthly Quarterly

Life Settlement Industry

A life settlement is the transfer of ownership and beneficiary rights of an unwanted or unneeded life insurance policy in exchange for a cash settlement. The seller no longer has the responsibility of paying future premiums. In exchange, investors profit based on the difference of the face value of the policy and acquisition and maintenance costs. The life settlement industry is one of the fastest growing sectors in financial markets today with 10 + consecutive years of positive growth.

Long Term Fund Pro-Forma

Past performance does not guarantee future results. Performance data quoted represents past performance, and current returns may be higher or lower. Share price and return will vary, and you may have a gain or loss when you sell your shares. To obtain a prospectus free of charge, call Carlisle Management Companys registered office in Luxembourg, info@carlislemanagementcompany.com or contact us by visiting our Web site at www.carlislemanagementcompany.com

Carlisle Management

Long Term Growth Fund Overview

Life Settlement Fund

2009 Fund Overview

Investment Manager

Carlisle Management Company S.C.A (CMC) is a Luxembourg based fund management firm that is focused on the United Stated secondary life insurance market. CMC operates The

Start with a broad universe of individual life insurance policies Filter out policies & partners that underpreform

Performance Report

Policies are purchased at above market IRR The expected mortality is experienced as planned. All proceeds are reinvested instantly and the balance of 80/20 investment/cash ratio is maintained.

Portfolio Process

The Long Term Growth Fund will calculate the NAV on a monthly basis utilizing four key inputs: The purchase price and purchase date of the policy The valuation date Historical premiums that have been paid The market discount rate

Extensive asset underwriting Select only the highest grade life settlement assets Fund purchases life settlement policies beyond the contestability period

Peninsula Funds, offering institutional investors with access to investment strategies based on life settlement products. CMC also specializes in alternative asset strategy consulting and portfolio development. Headquarters: Luxembourg Legal Entity: Socit en Commandite par Actions Investment Team Size: 6

Portfolio Management Team: Jose Garcia, CEO Tim Mol, COO Victor Heggelman, Financial Manager Javier Casares, VP

Returns will be generated by the buy and hold to maturity.

A funds investment objectives, risks, charges and expenses should be considered carefully before investing. This document contains information in summary form only and its accuracy or completeness cannot be guaranteed. No liability is accepted for any loss of whatsoever nature arising from the use of this information. Application for shares in this fund may only be made on the basis of a prospectus relating to the fund and this document may only be distributed to those eligible to receive that prospectus. The distribution of this document may be restricted in certain jurisdictions and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdictions. The prospectus contains this and other important information about the Funds.

To obtain a prospectus free of charge, call Carlisle Management Companys registered office in Luxembourg, at + 352.268.4.53.59, email info@carlislemanagementcompany.com which contains more information, including charges and other ongoing expenses. Or visit our website at www.cmclux.com. Investors should consider a funds objective, risks, and expenses carefully before investing. This and other information can be found in the funds prospectus. Read the prospectus carefully before investing.

Carlisle Management Company SCA | 9, Rue Sainte Zithe, 4th Floor | L-2763, Luxembourg City t. | +352.268.4.53.59

Potrebbero piacerti anche

- Post-Keynesian Theory Revisited: Money, Uncertainty and EmploymentDa EverandPost-Keynesian Theory Revisited: Money, Uncertainty and EmploymentNessuna valutazione finora

- Against the Dead Hand: The Uncertain Struggle for Global CapitalismDa EverandAgainst the Dead Hand: The Uncertain Struggle for Global CapitalismValutazione: 4 su 5 stelle4/5 (10)

- What Are Insurance Linked Securities (ILS), and Why Should They Be Considered?Documento17 pagineWhat Are Insurance Linked Securities (ILS), and Why Should They Be Considered?b_amer036793Nessuna valutazione finora

- The Inglorious Years: The Collapse of the Industrial Order and the Rise of Digital SocietyDa EverandThe Inglorious Years: The Collapse of the Industrial Order and the Rise of Digital SocietyNessuna valutazione finora

- Central Counterparties: Mandatory Central Clearing and Initial Margin Requirements for OTC DerivativesDa EverandCentral Counterparties: Mandatory Central Clearing and Initial Margin Requirements for OTC DerivativesValutazione: 4 su 5 stelle4/5 (1)

- The Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsDa EverandThe Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsValutazione: 5 su 5 stelle5/5 (1)

- Microfinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidDa EverandMicrofinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidNessuna valutazione finora

- Capital: The Process of Capitalist Production as a WholeDa EverandCapital: The Process of Capitalist Production as a WholeNessuna valutazione finora

- The New Economics of Sovereign Wealth FundsDa EverandThe New Economics of Sovereign Wealth FundsNessuna valutazione finora

- Ruling Capital: Emerging Markets and the Reregulation of Cross-Border FinanceDa EverandRuling Capital: Emerging Markets and the Reregulation of Cross-Border FinanceValutazione: 4 su 5 stelle4/5 (2)

- A Plan to Save the Planet: How to resolve climate change at the lowest cost.Da EverandA Plan to Save the Planet: How to resolve climate change at the lowest cost.Nessuna valutazione finora

- Behavioural Investing: A Practitioner's Guide to Applying Behavioural FinanceDa EverandBehavioural Investing: A Practitioner's Guide to Applying Behavioural FinanceValutazione: 4.5 su 5 stelle4.5/5 (6)

- Bloomberg - Performance Attribution ModelDocumento17 pagineBloomberg - Performance Attribution Modelde deNessuna valutazione finora

- Currency Board HandbookDocumento83 pagineCurrency Board HandbookwezhiraNessuna valutazione finora

- Detemining Treaty Residence Under Non-Dom and Other Special Attraction Regimes Sergio Mutis 10 08 2017Documento46 pagineDetemining Treaty Residence Under Non-Dom and Other Special Attraction Regimes Sergio Mutis 10 08 2017Sergio Iván Mutis PeraltaNessuna valutazione finora

- Cowen - The New Monetary EconomcsDocumento25 pagineCowen - The New Monetary EconomcsjpkoningNessuna valutazione finora

- Mishkin PPT Ch21Documento24 pagineMishkin PPT Ch21Atul KirarNessuna valutazione finora

- Voices On Infrastructure 2016Documento46 pagineVoices On Infrastructure 2016Anonymous RluKYotrNessuna valutazione finora

- Introduction To International Financial ManagementDocumento37 pagineIntroduction To International Financial ManagementhappyNessuna valutazione finora

- Ranald C. Michie - The London Stock Exchange - A History (2000)Documento697 pagineRanald C. Michie - The London Stock Exchange - A History (2000)miguelip01Nessuna valutazione finora

- 18 Ijarset Masjidhassan 1.... Caustic TreatmentDocumento9 pagine18 Ijarset Masjidhassan 1.... Caustic TreatmentFarah Talib Al-sudaniNessuna valutazione finora

- Mishkin PPT Ch20Documento23 pagineMishkin PPT Ch20Atul Kirar100% (1)

- Foreign Money and Vancouver Real EstateDocumento5 pagineForeign Money and Vancouver Real EstateIan YoungNessuna valutazione finora

- Explain The Essential Distinctions Among The StagesDocumento1 paginaExplain The Essential Distinctions Among The StagesMaureen LeonidaNessuna valutazione finora

- TFM Session Five FX ManagementDocumento64 pagineTFM Session Five FX ManagementmankeraNessuna valutazione finora

- Henri - Fayol's Centre For Administrative Studies PDFDocumento27 pagineHenri - Fayol's Centre For Administrative Studies PDFKristy LeNessuna valutazione finora

- Eis WR 2019 09 12Documento22 pagineEis WR 2019 09 12SiphoKhosaNessuna valutazione finora

- Online Gambling in Video Games: A Case Study On The Regulation of Loot BoxesDocumento62 pagineOnline Gambling in Video Games: A Case Study On The Regulation of Loot BoxesTiki TikiNessuna valutazione finora

- What The Great Fama-Shiller Debate Has Taught Us - Justin Fox - Harvard Business Review PDFDocumento2 pagineWhat The Great Fama-Shiller Debate Has Taught Us - Justin Fox - Harvard Business Review PDFppateNessuna valutazione finora

- Shadi Bartsch - Plato Goes To ChinaDocumento19 pagineShadi Bartsch - Plato Goes To ChinaJorsant Ed100% (1)

- S 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceDocumento174 pagineS 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceSiddhantSinghNessuna valutazione finora

- PB ROE ModelDocumento32 paginePB ROE Modeleulenet100% (1)

- Third Generation Islamic EconomicsDocumento25 pagineThird Generation Islamic EconomicsAsad ZamanNessuna valutazione finora

- Synopsis On ConformityDocumento15 pagineSynopsis On ConformityANessuna valutazione finora

- Investment Management PDFDocumento15 pagineInvestment Management PDFMelissa MillerNessuna valutazione finora

- Growth To Rebound in The Fourth Quarter, But Fade in 2020: Weekly ReportDocumento22 pagineGrowth To Rebound in The Fourth Quarter, But Fade in 2020: Weekly ReportSiphoKhosaNessuna valutazione finora

- Angus Madison World Economy 1000-2030Documento26 pagineAngus Madison World Economy 1000-2030Ml AgarwalNessuna valutazione finora

- Frontiers of Science ReportDocumento181 pagineFrontiers of Science ReportColumbia Daily SpectatorNessuna valutazione finora

- Irving Fisher and Intertemporal ChoiceDocumento5 pagineIrving Fisher and Intertemporal ChoiceAbdo Bunkari100% (1)

- Communication System by Simon Haykin 3rd Edition PDFDocumento2 pagineCommunication System by Simon Haykin 3rd Edition PDFKaren100% (1)

- Albourne Executive SummaryDocumento3 pagineAlbourne Executive SummarylifegaugeNessuna valutazione finora

- Canberra As A Planned CityDocumento12 pagineCanberra As A Planned Citybrumbies15100% (1)

- A Return To The Figure of The Free Nordic PeasantDocumento12 pagineA Return To The Figure of The Free Nordic Peasantcaiofelipe100% (1)

- Mutual Funds for Beginners Learning Mutual Funds BasicsDa EverandMutual Funds for Beginners Learning Mutual Funds BasicsNessuna valutazione finora

- Benefits of Investing in Mutual FundsDocumento4 pagineBenefits of Investing in Mutual Fundskumarpoonam2010Nessuna valutazione finora

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Da EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Nessuna valutazione finora

- Portfolio Management - Part 2: Portfolio Management, #2Da EverandPortfolio Management - Part 2: Portfolio Management, #2Valutazione: 5 su 5 stelle5/5 (9)

- B.M Collage of B.B.ADocumento12 pagineB.M Collage of B.B.AnilamgajiwalaNessuna valutazione finora

- Sunlife Balanced Fund KFDDocumento4 pagineSunlife Balanced Fund KFDPaolo Antonio EscalonaNessuna valutazione finora

- To Our Business Partners: (In Millions, Except Per Share Data)Documento10 pagineTo Our Business Partners: (In Millions, Except Per Share Data)maxamsterNessuna valutazione finora

- EEA Fact Sheet April 2010Documento2 pagineEEA Fact Sheet April 2010maxamsterNessuna valutazione finora

- To Our Business Partners: The 2012 HeadlinesDocumento10 pagineTo Our Business Partners: The 2012 HeadlinesmaxamsterNessuna valutazione finora

- EEA Fact Sheet Feb 2009Documento2 pagineEEA Fact Sheet Feb 2009maxamsterNessuna valutazione finora

- EEA Fact Sheet July 2009Documento2 pagineEEA Fact Sheet July 2009maxamsterNessuna valutazione finora

- Nikko AM Pulse 08-12 - FinalDocumento2 pagineNikko AM Pulse 08-12 - FinalmaxamsterNessuna valutazione finora

- Nikko AM Pulse 11-12Documento2 pagineNikko AM Pulse 11-12maxamsterNessuna valutazione finora

- eASE Analytics Global Fees - USDocumento1 paginaeASE Analytics Global Fees - USmaxamsterNessuna valutazione finora

- Finding Hope Amid Poverty: Micro FinancingDocumento30 pagineFinding Hope Amid Poverty: Micro FinancingParamjit Sharma100% (4)

- ALICIA OZIER - Oct 2019 PDFDocumento6 pagineALICIA OZIER - Oct 2019 PDFbombie bomboxNessuna valutazione finora

- A Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofDocumento10 pagineA Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofbabuluckyNessuna valutazione finora

- Problems With Solution Capital GainsDocumento12 pagineProblems With Solution Capital Gainsnaqi ali100% (1)

- Disconnect Notice: Total Past Due $364.55Documento4 pagineDisconnect Notice: Total Past Due $364.55Aut BeatNessuna valutazione finora

- Cost of Captial MCQDocumento5 pagineCost of Captial MCQAbhishek Sinha50% (4)

- Weekly Commentary BlackRockDocumento6 pagineWeekly Commentary BlackRockelvisgonzalesarceNessuna valutazione finora

- 03 - Literature Review PDFDocumento12 pagine03 - Literature Review PDFPreet kaurNessuna valutazione finora

- BIR Form 2307 - May2022Documento12 pagineBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- Structuring Local Currency Transactions Case Studies v2 1Documento15 pagineStructuring Local Currency Transactions Case Studies v2 1jai_tri007Nessuna valutazione finora

- Class Notes Redemption of Preference Share - PDFDocumento4 pagineClass Notes Redemption of Preference Share - PDFBhavya MehtaNessuna valutazione finora

- Statement Current yEAR KotakDocumento19 pagineStatement Current yEAR KotakRikshawala 420100% (1)

- Usefulness of Accounting Information To Investors and CreditorsDocumento19 pagineUsefulness of Accounting Information To Investors and Creditorsmuudey sheikhNessuna valutazione finora

- GST ChallanDocumento2 pagineGST ChallannavinNessuna valutazione finora

- Basta Ayun Na YunDocumento2 pagineBasta Ayun Na YunAngelo ReyesNessuna valutazione finora

- Marketing of Financial ServicesDocumento36 pagineMarketing of Financial ServicesSajad Azeez0% (3)

- Accounting Practice of Ethiopia - FinalDocumento33 pagineAccounting Practice of Ethiopia - FinalDgl100% (8)

- Finlatics Sector Project - 1Documento2 pagineFinlatics Sector Project - 1Aditya ChitaliyaNessuna valutazione finora

- Relief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationDocumento1 paginaRelief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationVassay KhaliliNessuna valutazione finora

- Mercantile Bar Review Material 1Documento209 pagineMercantile Bar Review Material 1shintaronikoNessuna valutazione finora

- Credit Risk AnalysisDocumento32 pagineCredit Risk AnalysisVishal Suthar100% (1)

- Topic 63 Country Risk Determinants, Measures and ImplicationsDocumento2 pagineTopic 63 Country Risk Determinants, Measures and ImplicationsSoumava PalNessuna valutazione finora

- Capital Reduction 2Documento6 pagineCapital Reduction 2SANJIB SHARMANessuna valutazione finora

- Chapter - Capital BudgetingDocumento33 pagineChapter - Capital BudgetingSakshi SharmaNessuna valutazione finora

- Microfinance Management: Chapter - 1Documento251 pagineMicrofinance Management: Chapter - 1sunit dasNessuna valutazione finora

- 2021 07 10 EOD File ChangeDocumento22 pagine2021 07 10 EOD File Changelalit bhandariNessuna valutazione finora

- Mathematics 8300/2F: Foundation Tier Paper 2 CalculatorDocumento31 pagineMathematics 8300/2F: Foundation Tier Paper 2 CalculatorT SolomonNessuna valutazione finora

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocumento38 pagineAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNessuna valutazione finora

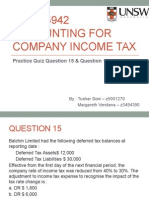

- ACCT5942 Week4 PresentationDocumento13 pagineACCT5942 Week4 PresentationDuongPhamNessuna valutazione finora