Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Service Tax and Vat Problems By-Bharath

Caricato da

rajdeeppawarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Service Tax and Vat Problems By-Bharath

Caricato da

rajdeeppawarCopyright:

Formati disponibili

Service Tax and Vat Problems By-Bharath

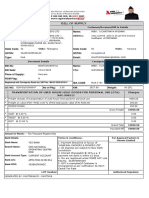

Problem No.1 A partnership firm, gives the following particulars relating to the services provided to various clients by them for the halfyear ended on 30-9-2008: 1. Total bills raised for Rs. 8,75,000 out of which bill for Rs. 75,000 was raised on an approved International Organization and payments of bills for Rs. 1,00,000 were not, received till 30-9-2008. 2. Amount of Rs. 50,000 was received as an advance from XYZ Ltd. on 25-9-2008 to whom the services were to be provided in October, 2008. You are required to work out the: a. taxable value of services b. Amount of service tax payable Sol: Particulars Total Bills Raised Less: Bill raised for an approved international organization(not liable to service tax) Amount not yet received Total Add- Amount received in advance Taxable value of services provided Service tax payable @ 12.36% on Rs. 750000 Rs. 875000. 75000 100000 700000 50000 750000 92700.

Problem No.2: MSD Ltd. has agreed to render services to Mr. Guru. The following are the Chronological events: Contract for services entered into on 3 182008 Rs. Advance received in September 2008 towards all 60000 services Total value of services billed in February2009 210000 Above includes nontaxable services of 70000 Balance amount is received in March 2009 When does the liable to pay service tax arise and for what amount? Contract contains clear details of services consideration and service tax are charged separately, as mutually agreed.

Solution: As taxable service includes the services to be provided, the liability to pay service tax arises both at the time of receipt of advance in September, 2008 and at the time of receipt of balance consideration in March 2009. However, the liability to pay service tax arises only upon the receipt of the value of taxable services and not when the bill is raised.

Advance portion Advance received towards all Services in September 2008 Amount billed for taxable services (210000- 70000) proportionate advance received towards taxable services(60000 x 140000/210000) Service tax @ 12% (since service tax is charged separately) on Rs. 40000 Add: Education cess @ 2% Add: SHEC @ 1% Rs. 60000 140000 40000 4800 96 48

Service Tax and Vat Problems By-Bharath

Total service tax liability 4944

The due date for payment of service tax in the above case will be 5-10-2008

Balance portion Total amount billed Less: Amount for nontaxableService Less: Amount already received on which service tax has been paid Balance amount Service tax @ 12% on Rs. 100000 Add: Education cess @ 2% Add: SHEC @ 1% Total Service tax liability Rs. 210000 70000 140000 40000 12000 240 120 12360.

VAT

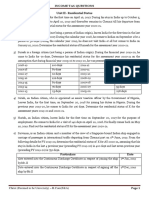

Problem No.1: Compute the invoice value to be charged and amount of tax payable under VAT by a dealer who had purchased goods for Rs. 1,20,000 and after adding for expenses of Rs.10,000 and of profit Rs. 15,000 had sold out the same. The rate of VAT on purchases and sales is 12.5%. Sol: Purchase price of goods Add: Expenses Add: Profit margin Amount to be billed Add: VAT @ 12.5% Total invoice value Invoice value to be charged 120000 10000 15000 145000 18125 163125

VAT to be paid

VAT charged in the invoice Less: VAT credit on input 12.5% of Rs. 120000 Balance VAT payable 18125 15000 3125

Problem No.2: Manufacturer A sold product X to B of Delhi @ Rs. 1000 per unit. He has charged CST @ 4% on the said product and paid Rs. 60 as freight. B of Delhi sold goods to C of Delhi @ Rs. 1250 per unit and charged VAT @ 12.5%. C of Delhi sold goods to D, a consumer @ Rs. 1500 per unit and charged VAT @ 12.5% B Liability of VAT Rs. Cost of product X purchased from Mumbai Rs. 1100 1000 + 40 (CST) + Rs. 60(Credit of CST shall not be allowed under VAT) Sale price 1250

Service Tax and Vat Problems By-Bharath

VAT payable@ 12.5% on 1200 C Liability of VAT Purchase price exclusive of VAT VAT credit to be taken on purchase from B Sale price VAT payable @ 12.5% on 1500 VAT credit allowed Net VAT payable . 156.25 Rs. 1250 156.25 1500 187.50 156.25 31.25

Potrebbero piacerti anche

- BOSTS192004731Documento2 pagineBOSTS192004731Chaitu Rishan100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Flowchart Real Property TaxDocumento1 paginaFlowchart Real Property TaxPrincess Mae SamborioNessuna valutazione finora

- N13 IPCC Tax Guideline Answers WebDocumento12 pagineN13 IPCC Tax Guideline Answers WebGeorge MooneyNessuna valutazione finora

- (With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusDocumento25 pagine(With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusTushar BhattacharyyaNessuna valutazione finora

- Ipc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamDocumento8 pagineIpc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamAnuj Harshwardhan SharmaNessuna valutazione finora

- Servicetaxandvat 130420194223 Phpapp01Documento65 pagineServicetaxandvat 130420194223 Phpapp01Ram ShiralkarNessuna valutazione finora

- Part DDocumento20 paginePart DAra Bianca InofreNessuna valutazione finora

- Examples On Taxable Services A To L (Chapter 59)Documento6 pagineExamples On Taxable Services A To L (Chapter 59)kapilchandanNessuna valutazione finora

- Sample Assessment Questions: Formative Activity: / Summative AssessmentDocumento15 pagineSample Assessment Questions: Formative Activity: / Summative AssessmentEli_Hux50% (2)

- Chapter 12: Tax Deduction at Source and Introduced To Tax Collection at SourceDocumento5 pagineChapter 12: Tax Deduction at Source and Introduced To Tax Collection at SourceNaimish AbhangiNessuna valutazione finora

- Chapter 9 - Service TaxDocumento5 pagineChapter 9 - Service TaxNURKHAIRUNNISANessuna valutazione finora

- Taxation 2013 NovDocumento25 pagineTaxation 2013 NovAshok 'Maelk' RajpurohitNessuna valutazione finora

- IPCC Taxation Guideline Answer Nov 2015 ExamDocumento16 pagineIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNessuna valutazione finora

- Service TaxDocumento3 pagineService Taxapi-3822396Nessuna valutazione finora

- Re: Service Tax-Change in CENVAT Credit Rules 2004Documento7 pagineRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalNessuna valutazione finora

- M 14 Final Financial Reporting Guideline AnswersDocumento16 pagineM 14 Final Financial Reporting Guideline Answersmj192Nessuna valutazione finora

- 1 Budget Impact 2012-13Documento5 pagine1 Budget Impact 2012-13Rajkamal TiwariNessuna valutazione finora

- PROJECT of Service TaxDocumento34 paginePROJECT of Service TaxPRIYANKA GOPALE100% (2)

- VAT MathDocumento3 pagineVAT Mathtisha10rahman50% (4)

- Enabling Service Tax in TallyDocumento4 pagineEnabling Service Tax in TallySanctaTiffanyNessuna valutazione finora

- Balance Sheet:: Profit and Loss AccountDocumento6 pagineBalance Sheet:: Profit and Loss AccountAhmed JavaidNessuna valutazione finora

- Liability of Service TaxDocumento7 pagineLiability of Service TaxkasiriverNessuna valutazione finora

- Indian Service TaxDocumento13 pagineIndian Service Taxanon_993677Nessuna valutazione finora

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDocumento16 pagineGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakNessuna valutazione finora

- Reverse Charge in Service TaxDocumento14 pagineReverse Charge in Service TaxvishalsolsheNessuna valutazione finora

- 2015 VAT in Cambodia Sesion II 22aug 2015Documento27 pagine2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNessuna valutazione finora

- Cenvat - Overview: V S DateyDocumento33 pagineCenvat - Overview: V S Dateygsanjay84Nessuna valutazione finora

- 2 Service TaxDocumento10 pagine2 Service TaxArchana ThirunagariNessuna valutazione finora

- Indirec TaxDocumento8 pagineIndirec TaxSubashNessuna valutazione finora

- Suggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Documento13 pagineSuggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Parasuram IyerNessuna valutazione finora

- Service TaxDocumento7 pagineService TaxmurusaNessuna valutazione finora

- Part Two Value Added Tax VATDocumento54 paginePart Two Value Added Tax VATSawsan HatemNessuna valutazione finora

- FA - Excercises & Answers PDFDocumento17 pagineFA - Excercises & Answers PDFRasanjaliGunasekeraNessuna valutazione finora

- Service Tax in One PageDocumento1 paginaService Tax in One PageMonica MercadoNessuna valutazione finora

- VatDocumento9 pagineVatmayurgharatNessuna valutazione finora

- Practice QuestionsDocumento4 paginePractice QuestionsMff DeadsparkNessuna valutazione finora

- Cascading Effect: Indirect Tax Structure Before GSTDocumento5 pagineCascading Effect: Indirect Tax Structure Before GSTNavendu ShuklaNessuna valutazione finora

- VAT AnnotatedDocumento46 pagineVAT AnnotatedDr SafaNessuna valutazione finora

- Additions To TaxDocumento22 pagineAdditions To Taxstannis69420Nessuna valutazione finora

- POA - D. Adjusting EntriesDocumento40 paginePOA - D. Adjusting EntriesMariñas, Romalyn D.Nessuna valutazione finora

- Corporate Income TaxDocumento14 pagineCorporate Income Tax36. Lê Minh Phương 12A3Nessuna valutazione finora

- 4 - Input Tax Credit (ITC)Documento25 pagine4 - Input Tax Credit (ITC)ShrutiNessuna valutazione finora

- 7th Sem BINEET SIR PROJECTDocumento12 pagine7th Sem BINEET SIR PROJECTAnamika VatsaNessuna valutazione finora

- Commercial and Industrial ActivitiesDocumento15 pagineCommercial and Industrial ActivitiesMR BeastNessuna valutazione finora

- Branch AccountingDocumento8 pagineBranch AccountingMasoom FarishtahNessuna valutazione finora

- Tax Note No. 6 (Tax On Commercial - Part1)Documento10 pagineTax Note No. 6 (Tax On Commercial - Part1)Eman AbasiryNessuna valutazione finora

- Final Tax Sem 4PAYMENT, REGISTRATION AND RETURNS OF SERVICE TAXDocumento32 pagineFinal Tax Sem 4PAYMENT, REGISTRATION AND RETURNS OF SERVICE TAXkarthika kounderNessuna valutazione finora

- Advanced Tax (Math)Documento1 paginaAdvanced Tax (Math)Engr. Md. Ishtiak HossainNessuna valutazione finora

- Liabilities Are Decreased When: The Owner Pays The Existing Debt of Her Business From His Personal MoneyDocumento12 pagineLiabilities Are Decreased When: The Owner Pays The Existing Debt of Her Business From His Personal Moneyalexis chimNessuna valutazione finora

- Vat Vs GST FinalDocumento35 pagineVat Vs GST FinalJatin GoyalNessuna valutazione finora

- File Final YearDocumento18 pagineFile Final YearSaurabh SinghNessuna valutazione finora

- 8VATDocumento70 pagine8VATNoelNessuna valutazione finora

- Assessment 1 - Written or Oral QuestionsDocumento7 pagineAssessment 1 - Written or Oral Questionswilson garzonNessuna valutazione finora

- Value Added Tax Returns Form 002Documento5 pagineValue Added Tax Returns Form 002JUDY OSUSUNessuna valutazione finora

- Module 04 Income Tax Compliance RevisedDocumento25 pagineModule 04 Income Tax Compliance RevisedSly BlueNessuna valutazione finora

- Vat Advisor ExamDocumento79 pagineVat Advisor ExamMoin UddinNessuna valutazione finora

- Vat 1Documento77 pagineVat 1Shajid HassanNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNessuna valutazione finora

- SCS 2006 02Documento40 pagineSCS 2006 02rajdeeppawarNessuna valutazione finora

- SCS 2007 04Documento40 pagineSCS 2007 04rajdeeppawarNessuna valutazione finora

- SCS 2011 01Documento43 pagineSCS 2011 01rajdeeppawar100% (1)

- SCS 2007 02Documento29 pagineSCS 2007 02rajdeeppawarNessuna valutazione finora

- SCS 2007 03Documento36 pagineSCS 2007 03Suppy PNessuna valutazione finora

- SCS 2007 11Documento46 pagineSCS 2007 11rajdeeppawarNessuna valutazione finora

- SCS 2006 02Documento40 pagineSCS 2006 02rajdeeppawarNessuna valutazione finora

- Trade Unions Act 1926Documento15 pagineTrade Unions Act 1926JenniferMujNessuna valutazione finora

- Statutory Due Date For F y 15 16Documento1 paginaStatutory Due Date For F y 15 16rajdeeppawarNessuna valutazione finora

- Paper 6Documento3 paginePaper 6Suppy PNessuna valutazione finora

- Paper 8Documento3 paginePaper 8rajdeeppawarNessuna valutazione finora

- Paper 5Documento4 paginePaper 5rajdeeppawarNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento4 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Exam Form Issue CircularDocumento1 paginaExam Form Issue CircularrajdeeppawarNessuna valutazione finora

- Paper 7Documento4 paginePaper 7Suppy PNessuna valutazione finora

- Paper 2Documento12 paginePaper 2rajdeeppawarNessuna valutazione finora

- Diff Bet USGAAP IGAAP IFRSDocumento7 pagineDiff Bet USGAAP IGAAP IFRSrajdeeppawarNessuna valutazione finora

- Roll No : Part - ADocumento5 pagineRoll No : Part - ArajdeeppawarNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento3 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Exam Centre Node CentreDocumento17 pagineExam Centre Node CentrerajdeeppawarNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento3 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Roll No : Part - ADocumento5 pagineRoll No : Part - ArajdeeppawarNessuna valutazione finora

- GrammerDocumento10 pagineGrammerrajdeeppawarNessuna valutazione finora

- Cost Accounting Standards at A GlanceDocumento10 pagineCost Accounting Standards at A GlancerajdeeppawarNessuna valutazione finora

- Story On DT Case Law Nov.13: Amit JainDocumento3 pagineStory On DT Case Law Nov.13: Amit JainrajdeeppawarNessuna valutazione finora

- Dtaa UsaDocumento35 pagineDtaa UsarajdeeppawarNessuna valutazione finora

- Changes in Remittance Procedures For Payments To NonDocumento5 pagineChanges in Remittance Procedures For Payments To NonrajdeeppawarNessuna valutazione finora

- Tds 195Documento46 pagineTds 195rajdeeppawarNessuna valutazione finora

- Cost Accounting Standards at A GlanceDocumento10 pagineCost Accounting Standards at A GlancerajdeeppawarNessuna valutazione finora

- MIRO Credit MemoDocumento5 pagineMIRO Credit Memochapx032Nessuna valutazione finora

- Correcting Erroneous Information Returns, Form #04.001Documento144 pagineCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)

- II A - Income Tax QuestionsDocumento1 paginaII A - Income Tax QuestionsRohith krishnan ktNessuna valutazione finora

- Home Hardening Tax Exemption TIP - 22A01-07Documento2 pagineHome Hardening Tax Exemption TIP - 22A01-07ABC Action NewsNessuna valutazione finora

- Presentation of TaxationDocumento10 paginePresentation of TaxationMaaz SiddiquiNessuna valutazione finora

- FRM W8DM HRDocumento2 pagineFRM W8DM HRmiscribeNessuna valutazione finora

- Google Bill - MarchDocumento1 paginaGoogle Bill - MarchBartosz KondekNessuna valutazione finora

- Employee TRN# Last Name First Name AddressDocumento6 pagineEmployee TRN# Last Name First Name AddressKhimo DacostaNessuna valutazione finora

- Tax Invoice: Akbar & CompanyDocumento1 paginaTax Invoice: Akbar & CompanyTTIPLNessuna valutazione finora

- Sale 45 22-11-2023Documento1 paginaSale 45 22-11-2023Surya NavikNessuna valutazione finora

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,896Documento1 paginaBilling Summary Customer Details: Total Amount Due (PKR) : 2,896Rooh UllahNessuna valutazione finora

- Chapter 7: What is GST: Definition of GST GST की परिभाषाDocumento8 pagineChapter 7: What is GST: Definition of GST GST की परिभाषाSandeep SinghNessuna valutazione finora

- Fin - Accounts Objective2Documento3 pagineFin - Accounts Objective2Swarup MukherjeeNessuna valutazione finora

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocumento8 pagineIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNessuna valutazione finora

- Inv 2075060833 20230402 145029Documento2 pagineInv 2075060833 20230402 145029Sunny PandeyNessuna valutazione finora

- Gains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Documento11 pagineGains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Mylene SantiagoNessuna valutazione finora

- Arun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017Documento2 pagineArun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017AshokNessuna valutazione finora

- DRW 2021 Cash001cajj018598 V1Documento8 pagineDRW 2021 Cash001cajj018598 V1Russell Chyle100% (1)

- Payroll TemplateDocumento1 paginaPayroll Templatejenny PrietoNessuna valutazione finora

- Aguilera Law Office: Office of The Municipal TreasurerDocumento2 pagineAguilera Law Office: Office of The Municipal TreasurerAlthea Jorgine HernandezNessuna valutazione finora

- Form No. 36 Form of Appeal To The Appellate Tribunal: Applicable)Documento3 pagineForm No. 36 Form of Appeal To The Appellate Tribunal: Applicable)saurav royNessuna valutazione finora

- Payslip CALCJB635 Apr 2023Documento1 paginaPayslip CALCJB635 Apr 2023alphonse INessuna valutazione finora

- CIR V CA and GCLDocumento2 pagineCIR V CA and GCLWilliam SantosNessuna valutazione finora

- Vikram Rathi - Taxing SituationsDocumento2 pagineVikram Rathi - Taxing SituationsVikram RathiNessuna valutazione finora

- One-Time Transaction (Onett) Process Flowchart: StartDocumento1 paginaOne-Time Transaction (Onett) Process Flowchart: StartJenely Joy Areola-TelanNessuna valutazione finora

- 04 2014 ST Vijay SalesDocumento8 pagine04 2014 ST Vijay SalesSivaRamanNessuna valutazione finora

- Mobile Invoice1 PDFDocumento1 paginaMobile Invoice1 PDFjayrajsinh daymaNessuna valutazione finora

- Export Invoice: Item Description: Qty: UOM: Curr Unit PriceDocumento4 pagineExport Invoice: Item Description: Qty: UOM: Curr Unit PriceAdam GreenNessuna valutazione finora

- Paystub 2-24Documento1 paginaPaystub 2-24katy.haugland2Nessuna valutazione finora