Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GFH

Caricato da

Chennai TuitionsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GFH

Caricato da

Chennai TuitionsCopyright:

Formati disponibili

Q: Can I open an account jointly? Ans :Yes. You may open an account jointly, with up to three applicants.

Q1: Who can submit information online for opening a Savings Bank account? Ans :Any resident Indian desirous of opening a Savings Bank Account with any branch of State Bank of India. Q3: Will KYC documents be required for all account holders? Ans :Yes. KYC documents in respect of all joint account holders will be required.

Q4: Can the KYC documents be different for the joint account holders? Ans :Yes, provided each submits a set of KYC documents as stipulated by the Bank.

Q5: Can a minor submit information online for opening a Savings Bank account? Ans :A minor may submit information online for opening a Savings Bank account provided he/she is more than 10 years old and can sign uniformly.

Q6: Can an account be opened in the names of more than three persons? Ans :Yes, but in such cases you cannot submit the information online. Please approach the branch for opening such accounts.

Q7: Is there a time limit within which I must approach a branch after submitting the information online? Ans :Yes, you must approach a branch within 30 days of submitting the information online. If the account is not opened within 30 days, your customer information will be deleted from our records.

Q8: I will have to submit my personal information online. Is it safe? Ans :Yes. The page you will submitting your information is VeriSign secured and the information will be encrypted before transmission.

Q9: Can I submit the documents to the branch by email? Ans :No. Each person who wishes to be an account holder will have to visit the branch personally, show his KYC documents, and sign the AOF in the presence of an authorized official of the Bank.

Q10: Can I submit the documents to any branch of SBI? Ans :Yes. To locate a branch, use our Branch Locator. Once you have submitted the Account Opening Form to one branch, you will not be able to submit the same form to another branch.

Q11: I have forgotten the TARN. Can I retrieve it? Ans :When the TARN is generated, it is also sent to you by SMS. If that SMS is not available with you, you will need to enter the information again and generate a new TARN.

Step 1: Fill the Customer Information Section

This section will have to be filled for each person wishing to open the account. You must fill Part A first. Once you fill Part A and save the form, a Temporary Customer Reference Number (TCRN) will be generated which may please be noted. You will need it later to edit the form, if you desire, and to link the customer in the Account Opening Form.

Note:

Subsequent parts in this step can be filled only after you have successfully filled Part A.

Step 2: Fill the Account Information Section Part A: Type of Account and Services Required. Part B: Nomination Form (optional but recommended).

This section will have to be filled for each account that you wish to open. You must fill Part A first. Once you fill Part A and save the form, a Temporary Account Reference Number (TARN) will be generated which may please be noted. You will need it later to edit or print the form.

Subsequent parts in this step can be filled only after you have successfully filled Part A.

After successful filling up of data in the account opening form, an SMS notification will be sent to 1st applicant's mobile number along with the TARN. Step 3: Read the Savings Bank Rules

Please read these rules carefully before signing the account opening form. By applying to the Bank for opening the account, you would be confirming that you have read the rules and that you agree to abide by these. A print of the same can also be taken by you after generation of TARN.

Potrebbero piacerti anche

- BNNDocumento2 pagineBNNChennai TuitionsNessuna valutazione finora

- Fill Customer and Account Info Online for SBI Savings BankDocumento2 pagineFill Customer and Account Info Online for SBI Savings BankChennai TuitionsNessuna valutazione finora

- GATE Score Considered by PSUs Like BHEL, NTPC, IOCL for RecruitmentDocumento1 paginaGATE Score Considered by PSUs Like BHEL, NTPC, IOCL for RecruitmentChennai TuitionsNessuna valutazione finora

- Advert - A 01 2012Documento2 pagineAdvert - A 01 2012vizordNessuna valutazione finora

- Gear Calculations Rev3Documento5 pagineGear Calculations Rev3ghostghost123Nessuna valutazione finora

- Fill Customer and Account Info Online for SBI Savings BankDocumento2 pagineFill Customer and Account Info Online for SBI Savings BankChennai TuitionsNessuna valutazione finora

- 7658 PDFDocumento1 pagina7658 PDFChennai TuitionsNessuna valutazione finora

- The Junk Seller 6: Find Out: How Much For A Cup of Tea?Documento9 pagineThe Junk Seller 6: Find Out: How Much For A Cup of Tea?joydeep_d3232Nessuna valutazione finora

- 7658 PDFDocumento1 pagina7658 PDFChennai TuitionsNessuna valutazione finora

- Carts & Wheels: You Must Have Seen Many Such Round Things Around You. List Some More in Your NotebookDocumento13 pagineCarts & Wheels: You Must Have Seen Many Such Round Things Around You. List Some More in Your NotebookChennai TuitionsNessuna valutazione finora

- எலுமிச்சைDocumento3 pagineஎலுமிச்சைChennai TuitionsNessuna valutazione finora

- GATE Score Considered by PSUs Like BHEL, NTPC, IOCL for RecruitmentDocumento1 paginaGATE Score Considered by PSUs Like BHEL, NTPC, IOCL for RecruitmentChennai TuitionsNessuna valutazione finora

- Guide to Indian Engineering Service Group ADocumento4 pagineGuide to Indian Engineering Service Group AChennai TuitionsNessuna valutazione finora

- Names of Examination / Service and Code NumbersDocumento3 pagineNames of Examination / Service and Code NumbersChennai TuitionsNessuna valutazione finora

- TNPSC Group 2Documento22 pagineTNPSC Group 2Ram Krishnan0% (1)

- M3plan SathyabamaDocumento1 paginaM3plan SathyabamaChennai TuitionsNessuna valutazione finora

- Tamilnadu Police Strength: S.No Name of The Post Sanctioned Actual VacancyDocumento1 paginaTamilnadu Police Strength: S.No Name of The Post Sanctioned Actual VacancyChennai TuitionsNessuna valutazione finora

- OrganisationDocumento1 paginaOrganisationChennai TuitionsNessuna valutazione finora

- m5 Upto Nov 2012Documento31 paginem5 Upto Nov 2012Chennai TuitionsNessuna valutazione finora

- Why GATE?: GATE Exam Is Important Because of Below Mentioned FactorsDocumento7 pagineWhy GATE?: GATE Exam Is Important Because of Below Mentioned FactorsChennai TuitionsNessuna valutazione finora

- IOCL NewDocumento6 pagineIOCL Newjaipee1234Nessuna valutazione finora

- Tancet Mba Cut OffDocumento1 paginaTancet Mba Cut OffChennai TuitionsNessuna valutazione finora

- Me Test 03 A Batch FM 120813 Final ResultDocumento8 pagineMe Test 03 A Batch FM 120813 Final ResultChennai TuitionsNessuna valutazione finora

- SMTX 1010 Engineering Mathematics Iv: (Common To All Branches Except Bio Informatics)Documento1 paginaSMTX 1010 Engineering Mathematics Iv: (Common To All Branches Except Bio Informatics)Chennai TuitionsNessuna valutazione finora

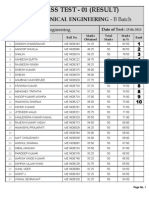

- Class Test - 01 (Result) : Mechanical Engineering - B BatchDocumento10 pagineClass Test - 01 (Result) : Mechanical Engineering - B BatchChennai TuitionsNessuna valutazione finora

- ENGINEERING MATHEMATICS IIDocumento1 paginaENGINEERING MATHEMATICS IIChennai TuitionsNessuna valutazione finora

- Me Test 01 A Batch Tom FinalDocumento11 pagineMe Test 01 A Batch Tom FinalChennai TuitionsNessuna valutazione finora

- SMTX1001 Engineering Mathematics I Gate AcademyDocumento1 paginaSMTX1001 Engineering Mathematics I Gate AcademyChennai TuitionsNessuna valutazione finora

- Advt. Octocttactt-Online DSP 1Documento4 pagineAdvt. Octocttactt-Online DSP 1Chennai TuitionsNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Best Practices Max ComputeDocumento228 pagineBest Practices Max ComputeDeka Dwi AbriantoNessuna valutazione finora

- Manual de GoniometríaDocumento4 pagineManual de GoniometríaEd RománNessuna valutazione finora

- ITH24 ReactJS Modelpaper MoodleDocumento2 pagineITH24 ReactJS Modelpaper MoodleThrinadhNessuna valutazione finora

- Login - Ufone Technical Department - Login Creation - Access - Form - HammadDocumento1 paginaLogin - Ufone Technical Department - Login Creation - Access - Form - HammadhammadNessuna valutazione finora

- How To Copy A ProjectDocumento7 pagineHow To Copy A ProjectManoj TyagiNessuna valutazione finora

- How to manage software and hardware assetsDocumento8 pagineHow to manage software and hardware assetsHirdesh VishawakrmaNessuna valutazione finora

- Fundamentals of Planning & P6Documento19 pagineFundamentals of Planning & P6Mada MinicopyNessuna valutazione finora

- Objective TestsDocumento2 pagineObjective TestsobepspNessuna valutazione finora

- CSE4006: Software Engineering: Lab 3: Project ManagementDocumento15 pagineCSE4006: Software Engineering: Lab 3: Project ManagementVince KaoNessuna valutazione finora

- Website Login SystemDocumento3 pagineWebsite Login SystemCarl JohnsonNessuna valutazione finora

- PICASA Software DocumentationDocumento12 paginePICASA Software DocumentationFurrukh MahmoodNessuna valutazione finora

- Aqua Connect ComplaintDocumento45 pagineAqua Connect ComplaintMike WuertheleNessuna valutazione finora

- VC 6000Documento8 pagineVC 6000simbamikeNessuna valutazione finora

- 2 Fault Types ModelingDocumento9 pagine2 Fault Types ModelingkvinothscetNessuna valutazione finora

- Sign in message disables Teredo - solve by updating driver or disabling IPv6Documento4 pagineSign in message disables Teredo - solve by updating driver or disabling IPv6MyScribd_ieltsNessuna valutazione finora

- Hazen-Williams Equation - Calculating Head Loss in Water PipesDocumento8 pagineHazen-Williams Equation - Calculating Head Loss in Water PipesJonnah Faye MojaresNessuna valutazione finora

- PreDCR Do and DontDocumento31 paginePreDCR Do and Dontvenkata satyaNessuna valutazione finora

- Object-Oriented Programming Fundamentals in CDocumento9 pagineObject-Oriented Programming Fundamentals in CNikita PatilNessuna valutazione finora

- Assembly 2Documento40 pagineAssembly 2sivagamipalaniNessuna valutazione finora

- Microsoft Digital Literacy: First Course: Instructor's ManualDocumento25 pagineMicrosoft Digital Literacy: First Course: Instructor's ManualShrey ChandrakerNessuna valutazione finora

- LA415003 Infotainment Diag PDFDocumento5 pagineLA415003 Infotainment Diag PDFGino PierNessuna valutazione finora

- Adams Bash ForthDocumento7 pagineAdams Bash ForthChAdnanUlQamarNessuna valutazione finora

- Mobile Computing Previous Papers by JNTUKDocumento4 pagineMobile Computing Previous Papers by JNTUKKumara Raja JettiNessuna valutazione finora

- Leslie Cabarga - Logo, Font and Lettering Bible (2004, David & Charles)Documento244 pagineLeslie Cabarga - Logo, Font and Lettering Bible (2004, David & Charles)Júlio Moura100% (2)

- Weather Forecasting ProjectDocumento17 pagineWeather Forecasting ProjectAbhinav TiwariNessuna valutazione finora

- Week 7 Assignment Solution Jan 2023Documento4 pagineWeek 7 Assignment Solution Jan 2023polunati naga kenishaNessuna valutazione finora

- Privacy IdeaDocumento353 paginePrivacy IdeaHạt Đậu NhỏNessuna valutazione finora

- Demantra 71 Implementation GuideDocumento1.120 pagineDemantra 71 Implementation GuideRadhakanta MishraNessuna valutazione finora

- A.) B.) C.) D.)Documento4 pagineA.) B.) C.) D.)Anonymous xMYE0TiNBcNessuna valutazione finora

- Info Tech Word AssignmentDocumento9 pagineInfo Tech Word Assignmentnyasha gundaniNessuna valutazione finora