Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

01zero PDF

Caricato da

Jinee SpookTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

01zero PDF

Caricato da

Jinee SpookCopyright:

Formati disponibili

Debt Instruments and Markets

Professor Carpenter

Coupon Bonds and Zeroes

Concepts and Buzzwords

Coupon bonds Zero-coupon bonds Bond replication No-arbitrage price relationships Zero rates Zeroes STRIPS Dedication Implied zeroes Semi-annual compounding

Reading

Veronesi, Chapters 1 and 2 Tuckman, Chapters 1 and 2

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Coupon Bonds

In practice, the most common form of debt instrument is a coupon bond. In the U.S and in many other countries, coupon bonds pay coupons every six months and par value at maturity. The quoted coupon rate is annualized. That is, if the quoted coupon rate is c, and bond maturity is time T, then for each $1 of par value, the bond cash flows are: c/2 c/2 c/2 1 + c/2 0.5 years 1 year 1.5 years T years

If the par value is N, then the bond cash flows are: Nc/2 Nc/2 Nc/2 N(1 + c/2) 0.5 years 1 year 1.5 years T years

U.S. Treasury Notes and Bonds

Institutionally speaking, U.S. Treasury notes and bonds form a basis for the bond markets. The Treasury auctions new 2-, 3-, 5-, 7-year notes monthly, and 10-year notes and 30-year bonds quarterly, as needed. See http://www.treas.gov/offices/domestic-finance/debtmanagement/auctions/auctions.pdf for a schedule. Non-competitive bidders just submit par amounts, maximum $5 million, and are filled first. Competitive bidders submit yields and par amounts, and are filled from lowest yield to the stop yield. The coupon on the bond, an even eighth of a percent, is set to make the bond price close to par value at the stop yield. All bidders pay this price. See, for example, http://fixedincome.fidelity.com/fi/FIFrameset? page=FISearchTreasury for a listing of outstanding Treasuries.

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Class Problem

The current long bond, the newly issued 30-year Treasury bond, is the 3 7/8s (3.875%) of August 15, 2040. What are the cash flows of $1,000,000 par this bond? (Dates and amounts.)

Bond Replication and No Arbitrage Pricing

It turns out that it is possible to construct, and thus price, all securities with fixed cash flows from coupon bonds. But the easiest way to see the replication and no-arbitrage price relationships is to view all securities as portfolios of zero-coupon bonds, securities with just a single cash flow at maturity. We can observe the prices of zeroes in the form of Treasury STRIPS, but more typically people infer them from a set of coupon bond prices, because those markets are more active and complete. Then we use the prices of these zero-coupon building blocks to price everything else.

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Zeroes

Conceptually, the most basic debt instrument is a zerocoupon bond--a security with a single cash flow equal to face value at maturity. Cash flow of $1 par of t-year zero: $1 Time t It is easy to see that any security with fixed cash flows can be constructed, and thus priced, as a portfolio of these zeroes.

Zero Prices

Let dt denote the price today of the t-year zero, the asset that pays off $1 in t years. I.e., dt is the price of a t-year zero as a fraction of par value. This is also sometimes called the t-year discount factor. Because of the time value of money, a dollar today is worth more than a dollar to be received in the future, so the price of a zero must always less than its face value: dt < 1 Similarly, because of the time value of money, longer zeroes must have lower prices.

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

A Coupon Bond as a Portfolio of Zeroes

Consider: $10,000 par of a one and a half year, 8.5% Treasury bond makes the following payments:

$425 0.5 years $425 1 year $10425 1.5 years

Note that this is the same as a portfolio of three different zeroes: $425 par of a 6-month zero $425 par of a 1-year zero $10425 par of a 1 1/2-year zero

No Arbitrage and The Law of One Price

Throughout the course we will assume: The Law of One Price Two assets which offer exactly the same cash flows must sell for the same price. Why? If not, then one could buy the cheaper asset and sell the more expensive, making a profit today with no cost in the future. This would be an arbitrage opportunity, which could not persist in equilibrium (in the absence of market frictions such as transaction costs and capital constraints).

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Valuing a Coupon Bond Using Zero Prices

Lets value $10,000 par of a 1.5-year 8.5% coupon bond based on the zero prices (discount factors) in the table below. These discount factors come from historical STRIPS prices (from an old WSJ). We will use these discount factors for most examples throughout the course.

Maturity 0.5 1.0 1.5 Discount Factor 0.9730 0.9476 0.9222 Bond Cash Flow $425 $425 $10425 Value $414 $403 $9614 Total $10430

On the same day, the WSJ priced a 1.5-year 8.5%-coupon bond at 104 10/32 (=104.3125).

An Arbitrage Opportunity

What if the 1.5-year 8.5% coupon bond were worth only 104% of par value? You could buy, say, $1 million par of the bond for $1,040,000 and sell the cash flows off individually as zeroes for total proceeds of $1,043,000, making $3000 of riskless profit. Similarly, if the bond were worth 105% of par, you could buy the portfolio of zeroes, reconstitute them, and sell the bond for riskless profit.

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Class Problems

In todays market, the discount factors are: d0.5=0.9991 , d1=0.9974 , and d1.5=0.9940. 1) What would be the price of an 8.5%-coupon, 1.5-year bond today? (Say for $100 par.)

2) What would be the price of $100 par of a 2%-coupon, 1-year bond today?

Securities with Fixed Cash Flows as Portfolios of Zeroes

More generally, if an asset pays cash flows K1, K2, , Kn, at times t1, t2, , tn, then it is the same as: K1 t1-year zeroes + K2 t2-year zeroes + + Kn tn-year zeroes Therefore no arbitrage requires that the assets value V is

V = K1 dt1 + K 2 dt 2 + .... + K n dt n

n

or V = K j dt j

j =1

Coupon Bonds and Zeroes 7

Debt Instruments and Markets

Professor Carpenter

Coupon Bond Prices in Terms of Zero Prices

For example, if a bond has coupon c and maturity T, then in terms of the zero prices dt, its price per $1 par must be

P (c, T ) = (c /2) ( d0.5 + d1 + d1.5 + ... + dT ) + dT

2T

or P (c, T ) = (c /2) ds / 2 + dT

s=1

Constructing Zeroes from Coupon Bonds

Often people would rather work with Treasury coupon bonds than with STRIPS, because the market is more active. They can imply zero prices from Treasury bond prices instead of STRIPs and use these to value more complex securities. In other words, not only can we construct bonds from zeroes, we can also go the other way. Example: Constructing a 1-year zero from 6-month and 1year coupon bonds. Coupon Bonds:

Maturity 0.5 1.0 Coupon Price in 32nds 4.250% 99-13 4.375% 98-31 Price in Decimal 99.40625 98.96875

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Constructing the One-Year Zero

Find portfolio of bonds 1 and 2 that replicates 1-year zero. Let N0.5 be the par amount of the 0.5-year bond and N1 be the par amount of the 1-year bond in the portfolio. At time 0.5, the portfolio will have a cash flow of N0.5 x (1+0.0425/2) + N1 x 0.04375/2 At time 1, the portfolio will have a cash flow of N0.5 x 0 + N1 x (1+0.04375/2) We need N0.5 and N1 to solve (1) N0.5 x (1+0.0425/2) + N1 x 0.04375/2 = 0 (2) N0.5 x 0 + N1 x (1+0.04375/2) => N1 = 97.86 and N0.5 = -2.10 =100

Implied Zero Price

So the replicating portfolio consists of long 97.86 par value of the 1-year bond short 2.10 par value of the 0.5-year bond. Class Problem: Given the prices of these bonds below,

Maturity 0.5 1.0 Coupon Price in 32nds 4.250% 99-13 4.375% 98-31 Price in Decimal 99.40625 98.96875

what is the no-arbitrage price of $100 par of the 1-year zero?

Coupon Bonds and Zeroes

Debt Instruments and Markets

Professor Carpenter

Inferring Zero Prices from Bond Prices: Short Cut

The last example showed how to construct a portfolio of bonds that synthesized (had the same cash flows as) a zero. We concluded that the zero price had to be the same as the price of the replicating portfolio (no arbitrage). If we don't need to know the replicating portfolio, we can solve for the implied zero prices more directly:

Price of bond 1 = (100 + 4.25 /2) d0.5 = 99.40625 Price of bond 2 = (4.375 /2) d0.5 + (100 + 4.375 /2) d1 = 98.96875 d0.5 = 0.973, d1 = 0.948

Class Problems

1) Suppose the price of the 4.25%-coupon, 0.5-year bond is 99.50. What is the implied price of a 0.5-year zero per $1 par?

2) Suppose the price of the 4.375%-coupon, 1-year bond is 99. What is the implied price of a 1-year zero per $1 par?

Coupon Bonds and Zeroes

10

Debt Instruments and Markets

Professor Carpenter

Replication Possibilities

Since we can construct zeroes from coupon bonds, we can construct any stream of cash flows from coupon bonds. Uses: Bond portfolio dedication--creating a bond portfolio that has a desired stream of cash flows funding a liability defeasing an existing bond issue Taking advantage of arbitrage opportunities

Market Frictions

In practice, prices of Treasury STRIPS and Treasury bonds don't fit the pricing relationship exactly transaction costs and search costs in stripping and reconstituting bid/ask spreads Note: The terms bid and ask are from the viewpoint of the dealer. The dealer buys at the bid and sells at the ask, so the bid price is always less than the ask. The customer sells at the bid and buys at the ask.

Coupon Bonds and Zeroes

11

Debt Instruments and Markets

Professor Carpenter

Interest Rates

People try to summarize information about bond prices and cash flows by quoting interest rates. Buying a zero is lending money--you pay money now and get money later Selling a zero is borrowing money--you get money now and pay later A bond transaction can be described as buying or selling at a given price, or lending or borrowing at a given rate. The convention in U.S. bond markets is to use semi-annually compounded interest rates.

Annual vs. Semi-Annual Compounding

At 10% per year, annually compounded, $100 grows to $110 after 1 year, and $121 after 2 years:

10% per year semi-annually compounded really means 5% every 6 months. At 10% per year, semi-annually compounded, $100 grows to $110.25 after 1 year, and $121.55 after 2 years:

Coupon Bonds and Zeroes

12

Debt Instruments and Markets

Professor Carpenter

Annual vs. Semi-Annual Compounding...

After T years, at annually compounded rate rA, P grows to Present value of F to be received in T years with annually compounded rate rA is

In terms of the semi-annually compounded rate r, the formulas become

The key: An (annualized) semi-annually compounded rate of r per year really means r/2 every six months.

Zero Rates

If you buy a t-year zero and hold it to maturity, you lend at rate rt where rt is defined by

Call rt the t-year zero rate or t-year discount rate.

Coupon Bonds and Zeroes

13

Debt Instruments and Markets

Professor Carpenter

Class Problems: Rate to Price

According to market convention, zero prices are quoted using rates. Sample STRIPS rates from our historic WSJ: 0.5-year rate: 5.54% 1-year rate: 5.45% 1) What is the 0.5-year zero price?

2) What is the 1-year zero price?

Class Problems: Price to Rate

1) The 1-year zero price implied from coupon bond prices was 0.947665. What was the implied zero rate?

2) In todays market, the 5-year zero price is 0.9075. What is the 5-year zero rate?

Coupon Bonds and Zeroes

14

Debt Instruments and Markets

Professor Carpenter

Value of a Stream of Cash Flows in Terms of Zero Rates

Recall that any asset with fixed cash flows can be viewed as a portfolio of zeroes. So its price must be the sum of its cash flows multiplied by the relevant zero prices:

Equivalently, the price is the sum of the present values of the cash flows, discounted at the zero rates for the cash flow dates:

Example

$10,000 par of a one and a half year, 8.5% Treasury bond makes the following payments: $425 0.5 years $425 1 year $10425 1.5 years

Using STRIPS rates from the WSJ to value these cash flows:

Coupon Bonds and Zeroes

15

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Illuminati DEMONS Against GodDocumento4 pagineIlluminati DEMONS Against GodmehorseblessedNessuna valutazione finora

- Clearing Negative SpiritsDocumento6 pagineClearing Negative SpiritsmehorseblessedNessuna valutazione finora

- Clearing Negative SpiritsDocumento6 pagineClearing Negative SpiritsmehorseblessedNessuna valutazione finora

- Interview With Princess Diana ConfidantDocumento2 pagineInterview With Princess Diana Confidantsml500100% (1)

- Brotherhood of Evil PT 3Documento4 pagineBrotherhood of Evil PT 3mehorseblessedNessuna valutazione finora

- Brotherhood of Evil PT 1Documento5 pagineBrotherhood of Evil PT 1mehorseblessedNessuna valutazione finora

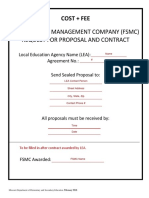

- Food Service Cost Fee PrototypeDocumento29 pagineFood Service Cost Fee PrototypemehorseblessedNessuna valutazione finora

- Luciferian Worship What The HellDocumento3 pagineLuciferian Worship What The HellmehorseblessedNessuna valutazione finora

- Equipment RFPDocumento2 pagineEquipment RFPmehorseblessedNessuna valutazione finora

- Hernia InguinalDocumento4 pagineHernia InguinalmehorseblessedNessuna valutazione finora

- Hernia Exercise Part 3Documento2 pagineHernia Exercise Part 3mehorseblessedNessuna valutazione finora

- 20 Steps To Remove Down ENERGY Part 1Documento5 pagine20 Steps To Remove Down ENERGY Part 1mehorseblessedNessuna valutazione finora

- Hernia Overview Non-Surgical TreatmentDocumento2 pagineHernia Overview Non-Surgical TreatmentmehorseblessedNessuna valutazione finora

- Simple Physical Medicine For HerniaDocumento2 pagineSimple Physical Medicine For HerniamehorseblessedNessuna valutazione finora

- Steps To Master TelepathyDocumento5 pagineSteps To Master Telepathymehorseblessed100% (1)

- The Top 10 Supplements To Boost EnergyDocumento4 pagineThe Top 10 Supplements To Boost EnergymehorseblessedNessuna valutazione finora

- Hernia Overview Non-Surgical TreatmentDocumento2 pagineHernia Overview Non-Surgical TreatmentmehorseblessedNessuna valutazione finora

- DR P Beter Topic 3Documento3 pagineDR P Beter Topic 3mehorseblessedNessuna valutazione finora

- Get Rid of Nail Fungus Naturally 2Documento5 pagineGet Rid of Nail Fungus Naturally 2mehorseblessedNessuna valutazione finora

- Quick Cure For HerniasDocumento1 paginaQuick Cure For HerniasmehorseblessedNessuna valutazione finora

- Get Rid of Nail Fungus Naturally 2Documento5 pagineGet Rid of Nail Fungus Naturally 2mehorseblessedNessuna valutazione finora

- DR P BETER Topic 2Documento6 pagineDR P BETER Topic 2mehorseblessedNessuna valutazione finora

- DR P Beter Audio Letter 80Documento8 pagineDR P Beter Audio Letter 80mehorseblessedNessuna valutazione finora

- Psalms 5th Power PrayerDocumento2 paginePsalms 5th Power PrayermehorseblessedNessuna valutazione finora

- Get Rid of Nail Fungus Naturally 1Documento5 pagineGet Rid of Nail Fungus Naturally 1mehorseblessedNessuna valutazione finora

- Building HUGE CalvesDocumento6 pagineBuilding HUGE CalvesmehorseblessedNessuna valutazione finora

- Alternative Web BrowserDocumento13 pagineAlternative Web BrowsermehorseblessedNessuna valutazione finora

- Racist Housing Policies Built FergusonDocumento2 pagineRacist Housing Policies Built FergusonmehorseblessedNessuna valutazione finora

- Central Intelligence Agency Business Part 2Documento12 pagineCentral Intelligence Agency Business Part 2mehorseblessedNessuna valutazione finora

- CIA Front Companies Part 1Documento2 pagineCIA Front Companies Part 1mehorseblessedNessuna valutazione finora