Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Noreen 1 e Exam 05

Caricato da

jklein2588Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Noreen 1 e Exam 05

Caricato da

jklein2588Copyright:

Formati disponibili

NOREEN MANAGERIAL ACCOUNTING FOR MANAGERS 1E Practice Exam Chapter 5

Print these pages. Answer each of the following questions, explaining your answers or showing your work, as appropriate, and then compare your solutions to those provided at the end of the practice exam. 1. The following is Shearer Corporation's contribution format income statement for last month: Sales Less variable expenses Contribution margin Less fixed expenses Net income $4,000,000 2,800,000 1,200,000 720,000 $ 480,000

A total of 80,000 units were produced and sold last month. The company has no beginning or ending inventories. Part (a) What is the companys breakeven in sales dollars?

Part (b) How many units would the company have to sell to attain target profits of $600,000?

Part (c) What is the companys margin of safety?

Part (d) What is the company's degree of operating leverage?

2. Morris Company sells a single product. The product has a selling price of $100 per unit and variable expenses of 80% of sales. If the company's fixed expenses total $150,000 per year, what is its break-even point? (Give answer in dollars and in units.)

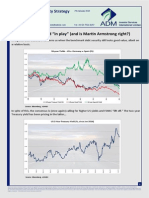

3. Garrett Company sells hand-crafted furniture. One item it sells is a small table that sells for $30 per unit. The variable costs related to the table, including product and shipping costs, are $18 per unit. Total fixed costs for the company are $60,000. Assume the tables are the only product the company sells this year and draw a CVP graph to represent the companys sales and expenses. From this graph, compute the approximate breakeven point in dollars and units.

NOREEN MANAGERIAL ACCOUNTING FOR MANAGERS 1E Practice Exam Chapter 5 Solutions

1. Part (a) Solution (Learning Objectives 1 and 5): Determine the contribution margin (CM) per unit as follows: Total contribution margin Number of units sold = CM per unit $1,200,000 80,000 units = $15 per unit So, breakeven in sales dollars are the fixed expenses ($720,000) divided by the 30% contribution margin percentage ($1,200,000 divided by $4,000,000, which equals 30%), or a breakeven of $2,400,000. Part (b) Solution (Learning Objective 6): Calculate the unit sales required to achieve the targeted profit as follows: (Fixed expenses + Targeted profit) CM per unit = Required units ($720,000 + $600,000) $15 per unit = $1,320,000 $15 = 88,000 units Part (c) Solution (Learning Objective 7): Note that breakeven sales are $2,400,000 (see part (a) above). Margin of safety = Total sales Breakeven sales Margin of safety = $4,000,000 - $2,400,000 = $1,600,000 Part (d) Solution (Learning Objective 8): Degree of operating leverage = Contribution margin Net income Degree of operating leverage = $1,200,000 $480,000 = 2.5 2. Solution (Learning Objectives 1 and 5): The contribution margin (CM) percentage may be calculated as: Sales percentage (100%) Variable expenses percentage equals CM percentage 100% 80% = 20% Then, the break-even point may be calculated as: Fixed costs divided by CM percentage equals break-even point (in sales dollars) $150,000 20% = $750,000. In units, divide contribution margin per unit ($20) into fixed costs ($150,000) for breakeven in units of 7,500. This also could be computed as breakeven in dollars ($750,000) divided by sales price of $100, which equals 7,500 units. 3. Solution (Learning Objective 1): On a CVP graph, the vertical axis is typically dollars, and the horizontal axis shows number of units. One line is drawn to represent fixed expenses (a flat line since fixed costs do not increase as volume increases.) Another line is drawn to represent the revenues (number of units times the selling price per unit) and another line is drawn to represent expenses (number of units times the variable expenses per unit, plus total fixed expenses). The amount of fixed expenses will be shown as the intercept on the vertical axis. Thus,

with a sales price of $30/unit, variable costs of $18/unit, and fixed costs of $60,000, the CVP graph would appear as follows:

$200,000 $175,000 $150,000 $125,000 $100,000 $ 75,000 $ 50,000 $ 25,000 $ 0 0 1,000 2,000 3,000 4,000 5,000 6,000 Fixed Expenses Total Revenues Total expenses Breakeven at 5000 units

Potrebbero piacerti anche

- GNB 13e Practice Exam Solutions - Chapter 2Documento5 pagineGNB 13e Practice Exam Solutions - Chapter 2TalukdarMohammadRajuNessuna valutazione finora

- Assignment No.2 206Documento5 pagineAssignment No.2 206Halimah SheikhNessuna valutazione finora

- FInal Exam KeyDocumento27 pagineFInal Exam KeyQasim AtharNessuna valutazione finora

- ExercisesDocumento19 pagineExercisesbajujuNessuna valutazione finora

- MGMT 027 Connect 04 HWDocumento7 pagineMGMT 027 Connect 04 HWSidra Khan100% (1)

- Bep QuestionDocumento5 pagineBep QuestionVinesh KumarNessuna valutazione finora

- Presented By: Ubaid Azam Wardag Babar Mustafa Muhammad UsmanDocumento13 paginePresented By: Ubaid Azam Wardag Babar Mustafa Muhammad UsmanShahid AshrafNessuna valutazione finora

- Add or Drop Product DecisionsDocumento6 pagineAdd or Drop Product DecisionsksnsatishNessuna valutazione finora

- Bca 423-Marginal Vs Absoption Costing.Documento8 pagineBca 423-Marginal Vs Absoption Costing.James GathaiyaNessuna valutazione finora

- Actg 1Documento12 pagineActg 1oconn1Nessuna valutazione finora

- The Finance Director of Stenigot Is Concerned About The LaxDocumento1 paginaThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNessuna valutazione finora

- Mba PracticalsDocumento7 pagineMba PracticalsRohit SinghNessuna valutazione finora

- Module 1 PDFDocumento13 pagineModule 1 PDFWaridi GroupNessuna valutazione finora

- 0568-Cost and Management AccountingDocumento7 pagine0568-Cost and Management AccountingWaqar AhmadNessuna valutazione finora

- KisikisiDocumento7 pagineKisikisijalunasaNessuna valutazione finora

- CP - Cma CaseDocumento5 pagineCP - Cma CaseYicong GuNessuna valutazione finora

- CMA Individual Assignment 1 & 2Documento3 pagineCMA Individual Assignment 1 & 2Abdu YaYa Abesha100% (2)

- Master Budget Assignment CH 9Documento4 pagineMaster Budget Assignment CH 9api-240741436Nessuna valutazione finora

- MARGINAL COSTING ExamplesDocumento10 pagineMARGINAL COSTING ExamplesLaljo VargheseNessuna valutazione finora

- All Intermediate ChapterDocumento278 pagineAll Intermediate ChapterNigus AyeleNessuna valutazione finora

- 2014 Bep Analysis ExercisesDocumento5 pagine2014 Bep Analysis ExercisesaimeeNessuna valutazione finora

- BEP N CVP AnalysisDocumento49 pagineBEP N CVP AnalysisJamaeca Ann MalsiNessuna valutazione finora

- Cost SheetDocumento6 pagineCost SheetAishwary Sakalle100% (1)

- Managerial Accounting: Tools For Business Decision-MakingDocumento56 pagineManagerial Accounting: Tools For Business Decision-MakingdavidNessuna valutazione finora

- Problems-Chapter 2Documento5 pagineProblems-Chapter 2An VyNessuna valutazione finora

- Topic 2 Support Department Cost AllocationDocumento27 pagineTopic 2 Support Department Cost Allocationluckystar251095Nessuna valutazione finora

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Documento2 pagine3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsDocumento9 pagineAf201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsChand DivneshNessuna valutazione finora

- Finals SolutionsDocumento9 pagineFinals Solutionsi_dreambig100% (3)

- GNB14 e CH 12 ExamDocumento6 pagineGNB14 e CH 12 Exama_elsaied0% (1)

- Chapter 07 TF MC With AnswersDocumento7 pagineChapter 07 TF MC With AnswersKlomoNessuna valutazione finora

- Breakeven QuestionDocumento14 pagineBreakeven QuestionALI HAMEED0% (1)

- Intermediate AccountingDocumento60 pagineIntermediate AccountingResky Andika YuswantoNessuna valutazione finora

- Question 1 Hatem MasriDocumento5 pagineQuestion 1 Hatem Masrisurvivalofthepoly0% (1)

- Assignment 3 (f5) 10341Documento8 pagineAssignment 3 (f5) 10341Minhaj AlbeezNessuna valutazione finora

- Chapter 7: Applying ExcelDocumento8 pagineChapter 7: Applying ExcelMan Tran Y NhiNessuna valutazione finora

- Tutorial 4 - Activity-Based CostingDocumento3 pagineTutorial 4 - Activity-Based Costingsouayeh wejdenNessuna valutazione finora

- W1 Assignment Chapter ProblemsDocumento2 pagineW1 Assignment Chapter ProblemsYvonne TotesoraNessuna valutazione finora

- Lesson 9 Problems of Transfer Pricing Practical ExerciseDocumento6 pagineLesson 9 Problems of Transfer Pricing Practical ExerciseMadhu kumarNessuna valutazione finora

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Documento50 pagineCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNessuna valutazione finora

- Exam281 20131Documento14 pagineExam281 20131AsiiSobhiNessuna valutazione finora

- Managerial Accounting Final ExamDocumento14 pagineManagerial Accounting Final ExamatifNessuna valutazione finora

- AsDocumento12 pagineAsShubham GautamNessuna valutazione finora

- Bài Tập 2-27 - Nhóm8LớpKN007Documento6 pagineBài Tập 2-27 - Nhóm8LớpKN007nguyenhongNessuna valutazione finora

- 68957Documento9 pagine68957Mehar WaliaNessuna valutazione finora

- Cost Assignment IDocumento5 pagineCost Assignment Ifitsum100% (1)

- STR 581 Capstone Final Exam Part Two Latest Question AnswersDocumento12 pagineSTR 581 Capstone Final Exam Part Two Latest Question AnswersaarenaddisonNessuna valutazione finora

- 23Documento83 pagine23الملثم الاحمرNessuna valutazione finora

- Brewer Chapter 2 Alt ProbDocumento6 pagineBrewer Chapter 2 Alt ProbAtif RehmanNessuna valutazione finora

- Egger's Roast Coffee Daniel Egger, Duke University Business Metrics For Data-Driven CompaniesDocumento2 pagineEgger's Roast Coffee Daniel Egger, Duke University Business Metrics For Data-Driven CompaniesraluchiiNessuna valutazione finora

- Mgt402 - 14midterm Solved PapersDocumento125 pagineMgt402 - 14midterm Solved Papersfari kh100% (1)

- Answer Key To Test #3 - ACCT-312 - Fall 2019Documento8 pagineAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNessuna valutazione finora

- F5 CKT Mock1Documento8 pagineF5 CKT Mock1OMID_JJNessuna valutazione finora

- Accounting For Foreign Currency TransactionsDocumento2 pagineAccounting For Foreign Currency Transactionskeith niduelanNessuna valutazione finora

- Brewer8e GEs PPT Chapter 8 UpdDocumento22 pagineBrewer8e GEs PPT Chapter 8 UpdNguyễn Ngọc Quỳnh TiênNessuna valutazione finora

- Garrison 14e Practice Exam - Chapter 5Documento4 pagineGarrison 14e Practice Exam - Chapter 5Đàm Quang Thanh TúNessuna valutazione finora

- Chapter 5 CVP Analysis-1Documento29 pagineChapter 5 CVP Analysis-1Ummay HabibaNessuna valutazione finora

- Managerial Accounting CH 5Documento89 pagineManagerial Accounting CH 5ErinPeterson71% (17)

- Cost Volume Profit Analysis: F. M. KapepisoDocumento19 pagineCost Volume Profit Analysis: F. M. KapepisosimsonNessuna valutazione finora

- Assignment On Management AccountingDocumento17 pagineAssignment On Management AccountingMarysun Tlengr100% (2)

- Narrative NantasketDocumento6 pagineNarrative Nantasketjklein2588Nessuna valutazione finora

- Team Practice Questions For Exam #3Documento2 pagineTeam Practice Questions For Exam #3jklein2588Nessuna valutazione finora

- Oregon ObjectionDocumento40 pagineOregon Objectionjklein2588Nessuna valutazione finora

- 2008 BBA Pre-Screen Case PDFDocumento3 pagine2008 BBA Pre-Screen Case PDFjklein25880% (1)

- VivianFashion FAC I Acquisitions Cycle TDocumento1 paginaVivianFashion FAC I Acquisitions Cycle Tjklein2588Nessuna valutazione finora

- ACC/490 Weekly Overview: Week One: Auditing and AssuranceDocumento2 pagineACC/490 Weekly Overview: Week One: Auditing and Assurancejklein2588Nessuna valutazione finora

- Personality Tests Are No Substitute For Interviews: Business WeekDocumento1 paginaPersonality Tests Are No Substitute For Interviews: Business Weekjklein2588Nessuna valutazione finora

- D. All of These Answers Are TrueDocumento2 pagineD. All of These Answers Are Truejklein2588Nessuna valutazione finora

- Membership Application: (Please Print)Documento2 pagineMembership Application: (Please Print)jklein2588Nessuna valutazione finora

- Key: Sample Exam 2 Vocab ProblemsDocumento1 paginaKey: Sample Exam 2 Vocab Problemsjklein2588Nessuna valutazione finora

- 2007 Preparing The Audit ReportDocumento1 pagina2007 Preparing The Audit Reportjklein2588Nessuna valutazione finora

- A Hunka Hunka Burnin BudsDocumento1 paginaA Hunka Hunka Burnin Budsjklein2588Nessuna valutazione finora

- Explanation of Key Terms Used in Analysis of Competitive ForcesDocumento1 paginaExplanation of Key Terms Used in Analysis of Competitive Forcesjklein2588Nessuna valutazione finora

- Accounting Changes+Sales & Right of ReturnDocumento4 pagineAccounting Changes+Sales & Right of Returnjklein2588Nessuna valutazione finora

- Name - Section # - Should DDT Be Used To Control Malaria?Documento1 paginaName - Section # - Should DDT Be Used To Control Malaria?jklein2588Nessuna valutazione finora

- Where Insects Fear To TreadDocumento2 pagineWhere Insects Fear To Treadjklein2588Nessuna valutazione finora

- Audit Sampling Case MemoDocumento12 pagineAudit Sampling Case Memojklein2588Nessuna valutazione finora

- 2008FValuation Presentation 1Documento29 pagine2008FValuation Presentation 1jklein2588Nessuna valutazione finora

- Compare Savings Accounts & ISAs NationwideDocumento1 paginaCompare Savings Accounts & ISAs NationwideVivienneNessuna valutazione finora

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocumento12 paginePatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNessuna valutazione finora

- Firma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableDocumento45 pagineFirma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableBento HartonoNessuna valutazione finora

- Nike CaseDocumento10 pagineNike CaseDanielle Saavedra0% (1)

- PDFDocumento1 paginaPDFKRUNAL ParmarNessuna valutazione finora

- Statement of Cash Flows Template Using The Direct Method North Carolina Community CollegesDocumento30 pagineStatement of Cash Flows Template Using The Direct Method North Carolina Community CollegesSumon MonNessuna valutazione finora

- 3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeDocumento6 pagine3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeMutahar HayatNessuna valutazione finora

- Mergers, EtcDocumento4 pagineMergers, EtcflorynmarianNessuna valutazione finora

- AgreementtoLease Commercial ShortForm 511 PDFDocumento3 pagineAgreementtoLease Commercial ShortForm 511 PDFtom75% (4)

- Advanced Global Trading - AGT Arena #1Documento38 pagineAdvanced Global Trading - AGT Arena #1advanceglobaltradingNessuna valutazione finora

- Topic2 Part1Documento16 pagineTopic2 Part1Abdul MoezNessuna valutazione finora

- Lehman Examiner's Report, Vol. 4Documento493 pagineLehman Examiner's Report, Vol. 4DealBookNessuna valutazione finora

- Deutsche Finan ExcelDocumento6 pagineDeutsche Finan ExcelAnonymous VVSLkDOAC1Nessuna valutazione finora

- Blackbook Project On Merchant BankingDocumento66 pagineBlackbook Project On Merchant BankingElton Andrade75% (12)

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDocumento4 pagineABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFAlfredo del Mundo Jr.80% (5)

- AOM 2023 001 Tuy ADocumento18 pagineAOM 2023 001 Tuy AKean Fernand BocaboNessuna valutazione finora

- 21 VBHN-BTC 512873Documento78 pagine21 VBHN-BTC 512873LET LEARN ABCNessuna valutazione finora

- Exter's Pyramid, by Paul MylchreestDocumento10 pagineExter's Pyramid, by Paul MylchreestTFMetalsNessuna valutazione finora

- Amalgmation, Absorbtion, External ReconstructionDocumento12 pagineAmalgmation, Absorbtion, External Reconstructionpijiyo78Nessuna valutazione finora

- CTC Calculation SheetDocumento1 paginaCTC Calculation SheetSathvika SaaraNessuna valutazione finora

- Negotiable Instrument Act 1881Documento29 pagineNegotiable Instrument Act 1881Anonymous WtjVcZCgNessuna valutazione finora

- Acc117 Group AssignmentDocumento15 pagineAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNessuna valutazione finora

- Indonesia Payment Systems Blueprint 2025 PDFDocumento72 pagineIndonesia Payment Systems Blueprint 2025 PDFErika ReviandaNessuna valutazione finora

- Cash Disbursement RegisterDocumento2 pagineCash Disbursement RegisterLucile Flores0% (1)

- Oracle ERP, EBS: M Mursaleen BhuiyanDocumento68 pagineOracle ERP, EBS: M Mursaleen BhuiyanMohammad Shaniaz IslamNessuna valutazione finora

- Chapter 07Documento3 pagineChapter 07Suzanna RamizovaNessuna valutazione finora

- Bata LK TW Iii 2022Documento98 pagineBata LK TW Iii 2022Dhimas KLSNessuna valutazione finora

- Estmt - 2020 08 21Documento8 pagineEstmt - 2020 08 21ventas.gopartNessuna valutazione finora

- Hire Purchase For Bcom and Nepal CADocumento14 pagineHire Purchase For Bcom and Nepal CANandani BurnwalNessuna valutazione finora

- FranchisorDocumento5 pagineFranchisorNaly YanoNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingDa EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingValutazione: 4.5 su 5 stelle4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 4.5 su 5 stelle4.5/5 (14)

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookDa EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNessuna valutazione finora

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDa EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsValutazione: 4 su 5 stelle4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetDa EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetValutazione: 4.5 su 5 stelle4.5/5 (14)