Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Parte 2 Segundo Parcial

Caricato da

Jose Luis Rasilla GonzalezCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Parte 2 Segundo Parcial

Caricato da

Jose Luis Rasilla GonzalezCopyright:

Formati disponibili

Chapter 13

Inputs are in Blue

Answers are in Red

NOTE: Some functions used in these spreadsheets may require that

the "Analysis ToolPak" or "Solver Add-In" be installed in Excel.

To install these, click on the Office button

then "Excel Options," "Add-Ins" and select

"Go." Check "Analysis ToolPak" and

"Solver Add-In," then click "OK."

2012, The McGraw-Hill Companies

Quiz 1

Micro Spinoffs, Inc., issued 20-year debt a year ago at par value with a coupon

rate of 8%, paid annually. Today, the debt is selling at $1,050. If the firms tax bracket is 35%,

what is its after-tax cost of debt?

Time 20 years

Coupon rate 8%

Sales cost of debt 1,050.00 $

Tax bracket 35%

Solution:

Using a financial calculator:

Interest rate on debt = 7.50%

After-tax cost of debt = 4.88%

2012, The McGraw-Hill Companies

Quiz 2

Micro Spinoffs has preferred stock outstanding. The stock pays a dividend

of $4 per share, and the stock sells for $40. What is the cost of preferred stock?

Dividend 4.00 $

Stock price 40.00 $

Solution:

Cost of preferred stock = 10%

2012, The McGraw-Hill Companies

Quiz 3

Micro Spinoffs, Inc., issued 20-year debt a year ago at par value with a coupon rate

of 8%, paid annually. Today, the debt is selling at $1,050. The firms tax bracket is 35%. Micro

Spinoffs also has preferred stock outstanding. The stock pays a dividend of $4 per share,

and the stock sells for $40. Suppose Micro Spinoffs cost of equity is 12%.

What is its WACC if equity is 50%, preferred stock is 20%, and debt is 30% of total capital?

Time 20.00 years

Coupon rate 8%

Sales cost of debt 1,050.00 $

Tax bracket 35%

Dividend 4.00 $

Stock price 40.00 $

Cost of equity 12%

Equity 50%

Preferred stock 20%

Debt 30%

Solution:

After-tax cost of debt = 4.88%

Cost of preferred stock = 10.00%

Cost of equity = 12.00%

WACC = 9.46%

(

+

(

+

(

=

equity preferred debt

WACC r

V

E

r

V

P

T r

V

D

C

) 1 (

2012, The McGraw-Hill Companies

Quiz 4

Reliable Electric is a regulated public utility, and it is expected to provide steady growth

of dividends of 5% per year for the indefinite future. Its last dividend was $5 per share;

the stock sold for $60 per share just after the dividend was paid.

What is the companys cost of equity?

Growth of dividends 5%

Last dividend 5.00

Stock price 60.00

Solution:

Cost of Equity = 13.75%

2012, The McGraw-Hill Companies

Quiz 5

Reactive Industries has the following capital structure. Its corporate tax rate is 35%.

What is its WACC?

Debt $20 million 6%

Preferred stock 10 million 8%

Common stock 50 million 12%

Tax rate 35%

Solution:

Firm value = $80.00 million

Weights

Debt: = 25.00%

Preferred: = 12.50%

Common: = 62.50%

WACC = 9.475%

Security Market Value Required Rate of Return

(

+

(

+

(

=

equity preferred debt

) 1 ( WACC r

V

E

r

V

P

T r

V

D

C

2012, The McGraw-Hill Companies

Quiz 6

Geothermals WACC is 11.4%. Executive Fruits WACC is 12.3%. Now

Executive Fruit is considering an investment in geothermal power production.

Should it discount project cash flows at 12.3%? Why or why not?

Geothermals WACC 11.40%

Executive Fruits WACC 12.30%

Solution:

The proper discount rate to discount the project cash flows is 11.40% .

Executive Fruit should use the WACC of Geothermal, not its own WACC, when

evaluating an investment in geothermal power production. The risk of the project

determines the discount rate, and in this case Geothermals WACC is more

reflective of the risk of the project in question.

2012, The McGraw-Hill Companies

Quiz 7

Icarus Airlines is proposing to go public, and you have been given the task of estimating

the value of its equity. Management plans to maintain debt at 30% of the companys present

value, and you believe that at this capital structure the companys debtholders will demand

a return of 6% and stockholders will require 11%. The company is forecasting that next

years operating cash flow (depreciation plus profit after tax at 40%) will be $68 million and

that investment expenditures will be $30 million. Thereafter, operating cash flows and

investment expenditures are forecast to grow by 4% a year.

a. What is the total value of Icarus?

b. What is the value of the companys equity?

Debt ratio 30%

Debt cost 6%

Equity cost 11%

Tax rate 40%

Operating cash flow 68.00 $ million

Investment expenditures 30.00 $ million

Growth rate 4%

Solution:

a.

WACC = 8.78%

Total value of Icarus = 795.00 $ million

b. Value of Equity = 556.50 $ million

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 8

The common stock of Buildwell Conservation & Construction, Inc., has a beta of .90.

The Treasury bill rate is 4%, and the market risk premium is estimated at 8%. BCCIs capital

structure is 30% debt, paying a 5% interest rate, and 70% equity. What is BCCIs cost of equity

capital? Its WACC? Buildwell pays tax at 40%.

Beta 0.90

Treasury bill rate 4%

Market risk premium 8%

Debt 30%

Interest rate 5%

Equity 70%

Tax rate 40%

Solution:

Cost of equity capital = 11.20%

WACC = 8.74%

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 9

The common stock of Buildwell Conservation & Construction, Inc., has a beta of .90.

The Treasury bill rate is 4%, and the market risk premium is estimated at 8%. BCCIs capital

structure is 30% debt, paying a 5% interest rate, and 70% equity. Buildwell pays tax at 40%.

BCCI is evaluating a project with an internal rate of return of 12%. Should it accept the project?

If the project will generate a cash flow of $100,000 a year for 8 years, what is the most BCCI

should be willing to pay to initiate the project?

Beta 0.90

Treasury bill rate 4%

Market risk premium 8%

Debt 30%

Interest rate 5%

Equity 70%

Tax 40%

Internal rate 12%

Cash flow 100,000.00

Time 8.00 years

Solution:

Cost of equity capital = 11.20%

WACC = 8.74%

Present value cash flows = $558,870.94

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 10

The common stock of Buildwell Conservation & Construction, Inc., has a beta of .90.

The Treasury bill rate is 4%, and the market risk premium is estimated at 8%. BCCIs capital

structure is 30% debt, paying a 5% interest rate, and 70% equity. What is BCCIs cost of equity

capital? Its WACC? Buildwell pays tax at 40%.

You need to estimate the value of Buildwell Conservation. You have the following

forecasts (in millions of dollars) of Buildwells profits and of its future investments

in new plant and working capital:

1 2 3 4

Earnings before interest, taxes, depreciation,

and amortization (EBITDA) 80 100 115 120

Depreciation 20 30 35 40

Pretax profit 60 70 80 80

Investment 12 15 18 20

From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged

at year-4 levels. Estimate the companys total value and the separate values of its debt and

equity.

Beta 0.90

Treasury bill rate 4%

Market risk premium 8%

Debt 30%

Interest Rate 5%

Equity 70%

Tax 40%

Solution:

1 2 3 4

3. EBITDA 80 100 115 120

4. Depreciation 20 30 35 40

5. Profit before tax = 3 4 60 70 80 80

6. Tax at 40% 24 28 32 32

7. Profit after tax = 5 6 36 42 48 48

8. Operating cash flow = 4 + 7 56 72 83 88

9. Investment 12 15 18 20

10. Free cash flow = 8 9 44 57 65 68

WACC 8.74%

Horizon value at year 4 is: 778.03 $ million

The companys total value is: 744.33 $ million

Value of the firms debt 223.30 $ million

Value of the firms equity 521.03 $ million

Year

Year

2012, The McGraw-Hill Companies

Practice Problem 11

Find the WACC of William Tell Computers. The total book value of the firms equity is $10 million;

book value per share is $20. The stock sells for a price of $30 per share, and the cost of equity

is 15%. The firms bonds have a face value of $5 million and sell at a price of 110% of face value.

The yield to maturity on the bonds is 9%, and the firms tax rate is 40%.

Book value firms equity 10.00 $ million

Book value per share 20.00 $

Stock sells for a price of 30.00 $

Cost of equity 15%

Bonds total face value 5.00 $ million

Selling price of bond 110%

Yield to maturity of bonds 9%

Firms tax rate 40%

Bonds face value 1,000.00 $

Solution:

Security Market Value

Debt $5.50 million

Equity 15.00 million

Total $20.50

WACC = 12.42%

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 12

Nodebt, Inc., is a firm with all-equity financing. Its equity beta is .80. The Treasury bill rate

is 4%, and the market risk premium is expected to be 10%. What is Nodebts asset beta?

What is Nodebts weighted-average cost of capital? The firm is exempt from paying taxes.

Beta 0.80

Treasury bill rate 4%

Market risk premium 10%

Solution:

Since the firm is all-equity financed, asset beta = equity beta = 0.80

The WACC is the same as the cost of equity, which can be calculated using the CAPM:

r

equity

= 12%

) r - (r r r

f m f equity

| + =

2012, The McGraw-Hill Companies

Practice Problem 14

Bunkhouse Electronics is a recently incorporated firm that makes electronic entertainment systems.

Its earnings and dividends have been growing at a rate of 30%, and the current dividend yield is 2%.

Its beta is 1.2, the market risk premium is 8%, and the risk-free rate is 4%.

Growth Rate 30%

Current dividend yield 2%

Beta 1.20

Market risk premium 8%

Risk-free rate 4%

a. Calculate two estimates of the firms cost of equity.

b. Which estimate seems more reasonable to you? Why?

Solution:

a. Using the recent growth rate of 30% and the dividend yield of 2%, one estimate would be: 32%

Another estimate, based on the CAPM, would be:

r

equity

= 13.6%

b. The estimate of 32% seems far less reasonable. It is based on a historic growth rate

that is impossible to sustain. The DIV

1

/P

0

+ g rule requires that the growth rate of dividends

per share must be viewed as highly stable over the foreseeable future. In other words, it

requires the use of the sustainable growth rate.

) r - (r r r

f m f equity

| + =

2012, The McGraw-Hill Companies

Practice Problem 15

Olympic Sports has two issues of debt outstanding. One is a 9% coupon bond with a face value

of $20 million, a maturity of 10 years, and a yield to maturity of 10%. The coupons are paid

annually. The other bond issue has a maturity of 15 years, with coupons also paid annually, and

a coupon rate of 10%. The face value of the issue is $25 million, and the issue sells for 94% of

par value. The firms tax rate is 35%.

Bond 1:

Coupon Rate 9%

Total face Value 20 million

Maturity 10.00 years

Yield to maturity 10%

Bond 2:

Coupon Rate 10%

Total face Value 25 million

Maturity 15.00 years

Issue sells for 94%

Tax rate 35%

Face Value 1,000.00

a. What is the before-tax cost of debt for Olympic?

b. What is Olympics after-tax cost of debt?

Solution:

a. The 9% coupon bond has a yield to maturity of 10% and sells for 93.86% of face value,

as shown below:

Present Value $938.55 or 93.86%

Therefore, the market value of the issue is $18.77 million.

The 10% coupon bond sells for 94% of par value and has a yield to maturity of: 10.83%

The market value of the issue is $23.50 million.

Weighted-average before-tax cost of debt = 10.46%

b. After-tax cost of debt = 6.80%

2012, The McGraw-Hill Companies

Practice Problem 16

Examine the following book-value balance sheet for University Products, Inc. What is the capital

structure of the firm on the basis of market values? The preferred stock currently sells for $15 per share

and the common stock for $20 per share. There are 1 million common shares outstanding.

Liabilities and Net Worth

Cash and short-term securities 1.00 $ Bonds, coupon = 8%, paid annually

(maturity = 10 years, current yield

to maturity = 9%) 10.00 $

Accounts receivable 3.00 Preferred stock (par value $20 per

share) 2.00

Inventories 7.00 Common stock (par value $.10) 0.10

Plant and equipment 21.00 Additional paid-in stockholders

equity 9.90

Retained earnings 10.00

Total 32.00 $ Total 32.00 $

Preferred stock current price 15.00 $

Common stock current price 20.00 $

Bond Coupon 8%

Bond par value 1,000.00 $

Maturity 10.00 years

Current yield to maturity 9%

Preferred stock par value 20.00 $

Common stock par value 0.10 $

Common shares outstanding 1.00 million

Solution:

Capital structure :

Security

Market Value

(in millions) Percent

Bonds 9.36 $ 30.3%

Preferred Stock 1.50 4.9%

Common Stock 20.00 64.8%

Total 30.86 $ 100.0%

BOOK VALUE BALANCE SHEET

(all values in millions)

Assets

2012, The McGraw-Hill Companies

Practice Problem 17

Examine the following book-value balance sheet for University Products, Inc. The preferred stock

currently sells for $15 per share and the common stock for $20 per share.

There are 1 million common shares outstanding.

If the preferred stock pays a dividend of $2 per share, the beta of the common stock is .8,

the market risk premium is 10%, the risk-free rate is 6%, and the firms tax rate is 40%, what

is Universitys weighted-average cost of capital?

Liabilities and Net Worth

Cash and short-term securities 1.00 $ Bonds, coupon = 8%, paid annually

(maturity = 10 years, current yield

to maturity = 9%) 10.00 $

Accounts receivable 3.00 Preferred stock (par value $20 per

share) 2.00

Inventories 7.00 Common stock (par value $.10) 0.10

Plant and equipment 21.00 Additional paid-in stockholders

equity 9.90

Retained earnings 10.00

Total 32.00 $ Total 32.00 $

Preferred stock current price 15.00 $

Common stock current price 20.00 $

Bond Coupon 8%

Bond par value 1,000.00 $

Maturity 10.00 years

Current yield to maturity 9%

Preferred stock par value 20.00 $

Common stock par value 0.10 $

Common shares outstanding 1.00 million

Preferred stock dividend 2.00 $

Common stock beta 0.80

Market risk premium 10%

Risk-free rate 6%

Tax Rate 40%

Solution:

Capital structure :

Security

Market Value

(in millions)

% de

deuda

bancaria

Costo

obligacion

Bonds 9.36 $ 30.3% Deuda 9%

Preferred Stock 1.50 4.9% 13.30%

Common Stock 20.00 64.8% 14.50%

Total 30.86 $ 100.0%

Para el WACC siempre utilizaremos el valor del mercado

BOOK VALUE BALANCE SHEET

(all values in millions)

Assets

(

+

(

+

(

=

equity preferred debt

) 1 ( WACC r

V

E

r

V

P

T r

V

D

C

2012, The McGraw-Hill Companies

WACC = 11.36%

Checar ya que el resultado boto un 11.68%

(

+

(

+

(

=

equity preferred debt

) 1 ( WACC r

V

E

r

V

P

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 18

Following is the book-value balance sheet for University Products, Inc. The preferred stock currently

sells for $15 per share and the common stock for $20 per share. There are 1 million common

shares outstanding. Preferred stock pays a dividend of $2 per share, the beta of the common stock is

.8, the market risk premium is 10%, the risk-free rate is 6%, and the firms tax rate is 40%.

University Products is evaluating a new venture into home computer systems. The internal rate of

return on the new venture is estimated at 13.4%. WACCs of firms in the personal computer industry

tend to average around 14%. Should the new project be pursued? Will University Products make the

correct decision if it discounts cash flows on the proposed venture at the firms WACC?

Cash and short-term securities 1.00 $ Bonds, coupon = 8%, paid annually

(maturity = 10 years, current yield

to maturity = 9%) 10.00 $

Accounts receivable 3.00 Preferred stock (par value $20 per

share) 2.00

Inventories 7.00 Common stock (par value $.10) 0.10

Plant and equipment 21.00 Additional paid-in stockholders

equity 9.90

Retained earnings 10.00

Total 32.00 $ Total 32.00 $

Preferred stock current price 15.00 $

Common stock current price 20.00 $

Bond Coupon 8%

Bond par value 1,000.00 $

Maturity 10.00 years

Current yield to maturity 9%

Preferred stock par value 20.00 $

Common stock par value 0.10 $

Common shares outstanding 1.00 million

Preferred stock dividend 2.00 $

Common stock beta 0.80

Market risk premium 10%

Risk-free rate 6%

Tax Rate 40%

IRR on new venture 13.4%

WACC (industry average) 14%

BOOK VALUE BALANCE SHEET

Assets Liabilities and Net Worth

(all values in millions)

2012, The McGraw-Hill Companies

Solution:

Capital structure :

Security

Market Value

(in millions) Percent

Bonds 9.36 $ 30.3%

Preferred Stock 1.50 4.9%

Common Stock 20.00 64.8%

Total 30.86 $ 100.0%

WACC = 11.36%

The IRR on the computer project is less than the WACC of firms in the computer

industry. Therefore, the project should be rejected. However, the WACC of the firm

(based on its existing mix of projects) is only 11.36% . If the firm uses this figure

as the hurdle rate, it will incorrectly go ahead with the venture in home computers.

(

+

(

+

(

=

equity preferred debt

) 1 ( WACC r

V

E

r

V

P

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 19

The total market value of Okefenokee Real Estate Company is $6 million, and the total value of its

debt is $4 million. The treasurer estimates that the beta of the stock currently is 1.2 and that the

expected risk premium on the market is 10%. The Treasury bill rate is 4%.

a. What is the required rate of return on Okefenokee stock?

b. What is the beta of the companys existing portfolio of assets? The debt is perceived to be

virtually risk-free.

c. Estimate the weighted-average cost of capital assuming a tax rate of 40%.

d. Estimate the discount rate for an expansion of the companys present business.

e. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The

beta of optical manufacturers with no debt outstanding is 1.4. What is the required rate of

return on Okefenokees new venture? (You should assume that the risky project will not

enable the firm to issue any additional debt.)

Total market value 6.00 $ million

Total value of debt 4.00 $ million

Beta 1.20

Expected risk premium 10%

Treasury bill rate 4%

Tax Rate 40%

Beta (e) 1.40

Solution:

a.

Required rate of return = 16%

b. Weighted-average beta = 0.72

c.

WACC = 10.56%

d. If the company plans to expand its present business, then the WACC is a

reasonable estimate of the discount rate since the risk of the proposed project

is similar to the risk of the existing projects. Use a discount rate of 10.56%

e. The WACC of optical projects should be based on the risk of those projects.

Using a beta of 1.4, the discount rate for the new venture is: 18.00%

) r - (r r r

f m f equity

| + =

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 20

With a tax rate of 35%, Big Oil had a WAAC of 10.5%. Suppose Big Oil is excused from

paying taxes. How would its WACC change? Now suppose Big Oil makes a large stock

issue and uses the proceeds to pay off all its debt. How would the cost of equity change?

Common stock beta 0.85

Risk-free interest rate 6%

Debt Value 385.70

Common stock 1,200.00

Debt interest rates 9%

Cost of equity 12%

Solution:

New WACC = 11.27%

If Big Oil issues new equity and uses the proceeds to pay off all of its debt, the cost

of equity will decrease. There is no longer any leverage, so the equity becomes safer

and therefore commands a lower risk premium. In fact, with all-equity financing, the

cost of equity would be the same as the firms WACC, which is 11.27%. This is less

than the previous value of 12.0%. (We use the WACC derived in the absence of

interest tax shields since, for the all-equity firm, there is no interest tax shield.)

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Practice Problem 21

With a tax rate of 35%, Big Oil had a WAAC of 10.5%. Suppose Big Oil is excused from

paying taxes.

TABLE 13.3

Security Type

Debt D = 385.7 D/V 0.243 r

debt

9%

Common stock E = 1,200.00 E/V 0.757 r

equity

12%

Total V = 1,585.70

Suppose Big Oil starts from the financing mix in Table 13.3, and then borrows an additional

$200 million from the bank. It then pays out a special $200 million dividend, leaving its assets

and operations unchanged. What happens to Big Oils WACC, still assuming it pays no

taxes? What happens to the cost of equity?

Common stock beta 0.85

Risk-free interest rate 6%

Debt Value 385.70

Common stock 1,200.00

Debt interest rates 9%

Cost of equity 12%

Borrowed 200.00 million

Special Dividend 200.00 million

Solution:

The net effect of Big Oils transaction is to leave the firm with $200 million more

debt (because of the borrowing) and $200 million less equity (because of the

dividend payout). Total assets and business risk are unaffected. The WACC will

remain unchanged because business risk is unchanged. However, the cost of

equity will increase. With the now-higher leverage, the business risk is spread

over a smaller equity base, so each share is now riskier.

New WACC = 11.27%

We solve to find that r

equity

= 12.60%

Required Rate of Return Capital Structure

(

+

(

=

equity debt

) 1 ( WACC r

V

E

T r

V

D

C

2012, The McGraw-Hill Companies

Potrebbero piacerti anche

- Homework Chapter 18 and 19Documento7 pagineHomework Chapter 18 and 19doejohn150Nessuna valutazione finora

- TVM Activity 4 SolutionsDocumento2 pagineTVM Activity 4 SolutionsAstrid BuenacosaNessuna valutazione finora

- Chap 5Documento52 pagineChap 5jacks ocNessuna valutazione finora

- FINMATHS Assignment2Documento15 pagineFINMATHS Assignment2Wei Wen100% (1)

- FRM Notes PDFDocumento149 pagineFRM Notes PDFmohamedNessuna valutazione finora

- Analyze Capital Structure Using EBIT-EPS AnalysisDocumento3 pagineAnalyze Capital Structure Using EBIT-EPS AnalysisJann KerkyNessuna valutazione finora

- Cost of Capital Lecture Slides in PDF FormatDocumento18 pagineCost of Capital Lecture Slides in PDF FormatLucy UnNessuna valutazione finora

- Ratio Analysis: Profitability RatiosDocumento10 pagineRatio Analysis: Profitability RatiosREHANRAJNessuna valutazione finora

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocumento4 pagineBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Chapter 7 Notes Question Amp SolutionsDocumento7 pagineChapter 7 Notes Question Amp SolutionsPankhuri SinghalNessuna valutazione finora

- Finance Chapter 18Documento35 pagineFinance Chapter 18courtdubs100% (1)

- Cost of CapitalDocumento30 pagineCost of CapitalNirmal ShresthaNessuna valutazione finora

- CH 6 Cost Volume Profit Revised Mar 18Documento84 pagineCH 6 Cost Volume Profit Revised Mar 18beccafabbriNessuna valutazione finora

- Cash Flows IIDocumento16 pagineCash Flows IIChristian EstebanNessuna valutazione finora

- Several Discussion Meetings Have Provided The Following Information About OneDocumento1 paginaSeveral Discussion Meetings Have Provided The Following Information About OneMuhammad Shahid100% (1)

- Fundamental of FinanceDocumento195 pagineFundamental of FinanceMillad MusaniNessuna valutazione finora

- Questions Chapter 16 FinanceDocumento23 pagineQuestions Chapter 16 FinanceJJNessuna valutazione finora

- Unit 7Documento46 pagineUnit 7samuel kebedeNessuna valutazione finora

- FM - 30 MCQDocumento8 pagineFM - 30 MCQsiva sankarNessuna valutazione finora

- Corporate Finance Exam GuideDocumento8 pagineCorporate Finance Exam Guideneilpatrel31Nessuna valutazione finora

- Chapter 4Documento24 pagineChapter 4FăÍż SăįYąðNessuna valutazione finora

- Chapter Three CVP AnalysisDocumento65 pagineChapter Three CVP AnalysisBettyNessuna valutazione finora

- Sa Sept10 Ias16Documento7 pagineSa Sept10 Ias16Muiz QureshiNessuna valutazione finora

- IAS-33 Earning Per ShareDocumento10 pagineIAS-33 Earning Per ShareButt Arham100% (1)

- Mortgage Markets Practice Problems SolutionsDocumento8 pagineMortgage Markets Practice Problems Solutionsjam linganNessuna valutazione finora

- Problem 20-4Documento5 pagineProblem 20-4Rohail Khan NiaziNessuna valutazione finora

- Finance Chapter 17Documento30 pagineFinance Chapter 17courtdubs75% (4)

- Paper - 2: Strategic Financial Management Questions Security ValuationDocumento21 paginePaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNessuna valutazione finora

- B LawDocumento240 pagineB LawShaheer MalikNessuna valutazione finora

- Accounting 1 FinalDocumento2 pagineAccounting 1 FinalchiknaaaNessuna valutazione finora

- ACCT-312:: Exercises For Home Study (From Chapter 6)Documento5 pagineACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasNessuna valutazione finora

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocumento7 pagineChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNessuna valutazione finora

- Problems On MergerDocumento7 pagineProblems On MergerSUNILABHI_APNessuna valutazione finora

- Internship Report Final PDFDocumento88 pagineInternship Report Final PDFSumaiya islamNessuna valutazione finora

- Stone Industries: Accounting Case StudyDocumento7 pagineStone Industries: Accounting Case StudyAshok Sharma100% (1)

- Principles of Capital Budgeting Cash FlowsDocumento97 paginePrinciples of Capital Budgeting Cash FlowsHassaan Shaikh100% (1)

- B&a - MCQDocumento11 pagineB&a - MCQAniket PuriNessuna valutazione finora

- Model PAPER-Analysis of Financial Statement - MBA-BBADocumento5 pagineModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

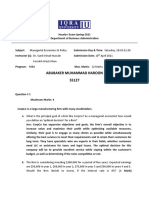

- Abubaker Muhammad Haroon 55127Documento4 pagineAbubaker Muhammad Haroon 55127Abubaker NathaniNessuna valutazione finora

- Calculating finance lease accounting entriesDocumento7 pagineCalculating finance lease accounting entriessajedulNessuna valutazione finora

- 4 - Estimating The Hurdle RateDocumento61 pagine4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocumento17 pagineACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNessuna valutazione finora

- TB Chapter20Documento25 pagineTB Chapter20Viola HuynhNessuna valutazione finora

- Chapter 7 Asset Investment Decisions and Capital RationingDocumento31 pagineChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNessuna valutazione finora

- Ross 9e FCF SMLDocumento425 pagineRoss 9e FCF SMLAlmayayaNessuna valutazione finora

- Capital Budgeting MethodsDocumento3 pagineCapital Budgeting MethodsRobert RamirezNessuna valutazione finora

- Name Mahrish Akhtar ID: 022-20-121366: POF Assignment 2 - (Stock Valuation)Documento3 pagineName Mahrish Akhtar ID: 022-20-121366: POF Assignment 2 - (Stock Valuation)shoaib akhtarNessuna valutazione finora

- Analyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDocumento2 pagineAnalyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDanang0% (2)

- Receivable Management KanchanDocumento12 pagineReceivable Management KanchanSanchita NaikNessuna valutazione finora

- Role of Financial Management in OrganizationDocumento8 pagineRole of Financial Management in OrganizationTasbeha SalehjeeNessuna valutazione finora

- Payback SOlved ExamplesDocumento3 paginePayback SOlved ExamplesIqtadar AliNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- Jun18l1cfi-C01 QaDocumento3 pagineJun18l1cfi-C01 QaJuan Pablo Flores QuirozNessuna valutazione finora

- Jun18l1cfi-C01 Qa PDFDocumento3 pagineJun18l1cfi-C01 Qa PDFJuan Pablo Flores QuirozNessuna valutazione finora

- Meseleler 100Documento9 pagineMeseleler 100Elgun ElgunNessuna valutazione finora

- Chapter 7 - Risk and The Cost of CapitalDocumento4 pagineChapter 7 - Risk and The Cost of Capital720i0180Nessuna valutazione finora

- Actividad 8 en ClaseDocumento2 pagineActividad 8 en Claseluz_ma_6Nessuna valutazione finora

- Cost of CapitalDocumento16 pagineCost of CapitalReiner NuludNessuna valutazione finora

- PAS 20 Accounting for Government GrantsDocumento20 paginePAS 20 Accounting for Government GrantsJustine VeralloNessuna valutazione finora

- Financial Report 2022Documento147 pagineFinancial Report 2022sujithNessuna valutazione finora

- Questions FinanceDocumento3 pagineQuestions Financeanish narayanNessuna valutazione finora

- Ashok Leyland Valuation - ReportDocumento17 pagineAshok Leyland Valuation - Reportbharath_ndNessuna valutazione finora

- Entrep 12 GASDocumento2 pagineEntrep 12 GASCamille ManlongatNessuna valutazione finora

- Percentage Taxes: Line of Business/ Activity Tax Base Tax RateDocumento2 paginePercentage Taxes: Line of Business/ Activity Tax Base Tax RateMae MaupoNessuna valutazione finora

- Financial Measures: (Amazon, 2021)Documento6 pagineFinancial Measures: (Amazon, 2021)najeeb shajudheenNessuna valutazione finora

- PAS 1 & 2 Financial Statement StandardsDocumento2 paginePAS 1 & 2 Financial Statement StandardsAnime LoverNessuna valutazione finora

- Investor Protection and Corporate Governance-Dissertation For Seminar Paper IDocumento54 pagineInvestor Protection and Corporate Governance-Dissertation For Seminar Paper Ijjgnlu100% (4)

- Kellton Tech Solutions Ltd financial analysis and key metrics from 2012-2021Documento9 pagineKellton Tech Solutions Ltd financial analysis and key metrics from 2012-2021jatan keniaNessuna valutazione finora

- Audit of Cash PDFDocumento3 pagineAudit of Cash PDFVincent SampianoNessuna valutazione finora

- Unisa Bcompt Fac3703 Past Exams and SolDocumento117 pagineUnisa Bcompt Fac3703 Past Exams and SolDanny MahomaneNessuna valutazione finora

- 001 - CHAPTER 00 - Introduction To Class PDFDocumento12 pagine001 - CHAPTER 00 - Introduction To Class PDFIFRS LabNessuna valutazione finora

- Facebook IPO Performance and ValuationDocumento4 pagineFacebook IPO Performance and ValuationHanako Taniguchi PoncianoNessuna valutazione finora

- Learn Financial Modelling & Get NSE CertifiedDocumento25 pagineLearn Financial Modelling & Get NSE CertifiedSukumarNessuna valutazione finora

- Currency Swaps: 180 Days Per PeriodDocumento6 pagineCurrency Swaps: 180 Days Per PeriodAngelica MaeNessuna valutazione finora

- 93-A China Banking Corporation v. Court of AppealsDocumento2 pagine93-A China Banking Corporation v. Court of AppealsAdi CruzNessuna valutazione finora

- Ruis 2014 ArDocumento103 pagineRuis 2014 ArMuhammad Nurielhuda RachmanNessuna valutazione finora

- Option Chain (Equity Derivatives)Documento2 pagineOption Chain (Equity Derivatives)sudhakarrrrrrNessuna valutazione finora

- Audit of Cash and Cash Equivalents Internal ControlsDocumento7 pagineAudit of Cash and Cash Equivalents Internal ControlsmoNessuna valutazione finora

- Accounting For A Service CompanyDocumento9 pagineAccounting For A Service CompanyAnnie RapanutNessuna valutazione finora

- Straight Line MethodDocumento3 pagineStraight Line MethodKhaez Almariego CaindoyNessuna valutazione finora

- Who Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionDocumento46 pagineWho Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionVincent S Vincent0% (1)

- Revenue RecognitionDocumento8 pagineRevenue RecognitionSedrick ChiongNessuna valutazione finora

- Corporate Governance Q BankDocumento6 pagineCorporate Governance Q BankMahek InamdarNessuna valutazione finora

- Annual Report - Jindal Poly Film - FY 2016Documento133 pagineAnnual Report - Jindal Poly Film - FY 2016krrkumarNessuna valutazione finora

- Term Loan/Project Appraisal A Presentation: by A K Mishra IifbDocumento69 pagineTerm Loan/Project Appraisal A Presentation: by A K Mishra Iifbmithilesh tabhaneNessuna valutazione finora

- Physical Fitness Gym Business PlanDocumento28 paginePhysical Fitness Gym Business Planabasyn_university83% (6)

- Govt College Teaching Plans for Financial, Management SubjectsDocumento4 pagineGovt College Teaching Plans for Financial, Management SubjectsGFGC BCANessuna valutazione finora

- Bindura Nickel Corporation Limited PDFDocumento1 paginaBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNessuna valutazione finora