Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Imt 86

Caricato da

arun1974Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Imt 86

Caricato da

arun1974Copyright:

Formati disponibili

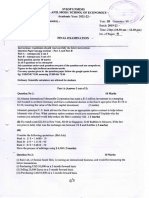

Subject Code: IMT-86

Subject Name : International

Financial Management

INSTRUCTION

a. b. c. d. A. B.

Write answers in your own words as far as possible and refrain from copying from the text books/handouts. Answers of Ist Set (Part-A), IInd Set (Part-B), IIIrd Set (Part C) and Set-IV (Case Study) must be sent together. Mail the answer sheets alongwith the copy of assignments for evaluation & return. Only hand written assignments shall be accepted. First Set of Assignments: Second Set of Assignments: 5 Questions, each question carries 1 marks. 5 Questions, each question carries 1 marks. 5 Questions, each question carries 1 marks. Confine your answers to 150 to 200 Words. Two Case Studies : 5 Marks. Each case study carries 2.5 marks.

C. Third Set of Assignments: D. Forth Set of Assignments:

ASSIGNMENTS

FIRST SET OF ASSIGNMENTS Assignment-I = 5 Marks

PART A

1. Thedeterminationofweightedaveragecostofcapitalrequiresthecalculationofspecificcosts ofdifferentsourcesoflongtermfunds.Comment 2. Whatdoyoumeanbyfinancialmarkets?Explainitstypesandfunctions. 3. Explainthemeaningofcrosslistingofshares.Whycompanydecidetocrosslistitsshares? 4. WhatdoyoumeanbyGoldStandard,explainitsadvantagesanddisadvantagesalso? 5. INR.47.10 47.25 per USD is a direct quote. Another direct quote is /179180. Specify: The countrywherethequoteismade. Thebid,askandspread. FortheAskprice: (i) Currencybeingboughtbythebank. (ii) Currencybeingboughtyou FortheBidprice: (iii) Currencybeingboughtbythebank (iv) Currencybeingboughtbyyou.

International Financial Management

Page1of3

IMT86

SECOND SET OF ASSIGNMENTS

Assignment-II = 5 Marks

PART B

1. WhenWorldBankcameintoexistence,howithasbeenconstituted?Explainitscharacteristics also. 2. Explainforeignexchangemarkets?Whoaretheplayersofthismarket? 3. Fromthefollowingimaginaryquotes $0.33020.3310perDM $0.11800.1190perFF DeriveBid/AskDMratesforoneunitofFF. Note:DMmeansDeutscheMarksandFFmeansFrenchFrancs. 4. Capitalbudgetingdecisionshavetobetakenkeepingtheperspectiveofboththesubsidiary andtheparentcompanyinmind,explainwiththehelpofreasonsforchangesincashinflows ofboththecompanies. 5. Whatiscountryriskandhowitcanbereduced?

THIRD SET OF ASSIGNMENTS Assignment-II = 5 Marks

PART C

1. Whatisdoubletaxationrelief?Whatarethemodesofgrantingdoubletaxationrelief? 2. ExplainthemeaningofIFRS.Whataretheirfeaturesandwhatarechallengesinimplementing IFRS? 3. Explainthemeaningofnetting.Explainitstypeswiththehelpofsuitableexample. 4. ExplaindomesticCAPMandInternationalCAPM.Whatarethemainareasofdifficultiesin extendingdomesticCAPMtotheinternationalCAPM? 5. Theriskfreeinterestrateis8%.Therateofreturnandtheriskintermsofstandarddeviationin Indiaandsomeforeigncountriesarerespectivelyasfollows: a. India11%and3.16 b. Australia10%and4.05 c. UK9%and1.80 d. USA14%and5.40 Findthecountry/countrieswhereanIndianinvestorshoulddiversifyitsinvestment.

FOURTH SET OF ASSIGNMENTS Assignment-IV = 2.5 Each Case Study

CASE STUDY - I

Deep Sea Fishing Co. Ltd. concluded an export order for 10 tones of packagedfish to USA on 20th January. The contract provided supply of contracted quantity in ten shipments, commencing from February itself. US importer had agreed on a price of $ 1825 per tone. The terms of payment were (i) 25% of entire contract value in advance on signing, and (ii) balance 75% as and when each shipment takesplace.Re/$ratesontheapplicabledatesduringthecontractperiodwereasunder:

International Financial Management

Page2of3

IMT86

20thJan 45.50 July 45.00 Feb 45.40 Aug 45.50 March 45.30 Sep 45.70 April 45.20 Oct 45.60 May 45.30 November 45.40 June 45.20

Required: (a) Whatwastheestimatedrupeeinflowatthetimeofsigningthecontract? (b) Whatistheinflowultimatelyregisteredbythecompany,oncompletionofthecontract? (c) Isthereadifference? (d) Nametheriskinvolved.

CASE STUDY-II

AnIndianinvestorinvestsinUSbondswithafacevalueof$10,000.Thebondshaveamarketpriceof$ 10,500 by the yearend and fetch $ 700 as interest during the year. $ appreciates by 3% during this period.Simultaneously,theinvestorinvestsinGermanbondswithafacevalueof30,000fetching3,000 as interest and the market price of the bonds going up to 30,500 during the year. depreciates by 2% duringthisperiod. Calculateportfolioreturn.

International Financial Management

Page3of3

IMT86

Potrebbero piacerti anche

- Exam AFE: Morning SessionDocumento14 pagineExam AFE: Morning SessionSalamaAlAmryNessuna valutazione finora

- Mba 109Documento2 pagineMba 109ramesh0% (1)

- Mba 109Documento2 pagineMba 109Komal Jariya0% (1)

- Mba 109Documento2 pagineMba 109Yash KotianNessuna valutazione finora

- Mba 109Documento2 pagineMba 109Karn RajeshNessuna valutazione finora

- Jaipur National University, Jaipur: School of Distance Education & Learning Internal Assignment No. 1Documento2 pagineJaipur National University, Jaipur: School of Distance Education & Learning Internal Assignment No. 1naren0% (2)

- JNU MBA Financial Management AssignmentsDocumento2 pagineJNU MBA Financial Management AssignmentsAbhishek GuptaNessuna valutazione finora

- Fin 103 CDocumento1 paginaFin 103 CPeaceful WarriorNessuna valutazione finora

- Soa Cfe Sample ExamDocumento16 pagineSoa Cfe Sample ExamJosh KhewNessuna valutazione finora

- Exam IA 27032012 - Example For BBDocumento6 pagineExam IA 27032012 - Example For BBJerry K FloaterNessuna valutazione finora

- Principles of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023Documento14 paginePrinciples of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023abrahabrima4Nessuna valutazione finora

- MCOM 1st Year English PDFDocumento8 pagineMCOM 1st Year English PDFakshaykr1189Nessuna valutazione finora

- Edu 2015 10 Cfesdm Exam PMDocumento13 pagineEdu 2015 10 Cfesdm Exam PMAyeshaAttiyaAliNessuna valutazione finora

- Testbank - Multinational Business Finance - Chapter 14Documento19 pagineTestbank - Multinational Business Finance - Chapter 14Uyen Nhi NguyenNessuna valutazione finora

- ACC 312 - Exam 1 - Form A - Fall 2012 PDFDocumento14 pagineACC 312 - Exam 1 - Form A - Fall 2012 PDFGeetika InstaNessuna valutazione finora

- CUTE5 - Set 2 ENGLISH Questions & Answers 140610Documento12 pagineCUTE5 - Set 2 ENGLISH Questions & Answers 140610Zack ZawaniNessuna valutazione finora

- Investments Levy and Post PDFDocumento82 pagineInvestments Levy and Post PDFDivyanshi SatsangiNessuna valutazione finora

- FM SD20 Examiner's ReportDocumento17 pagineFM SD20 Examiner's ReportleylaNessuna valutazione finora

- VIP Industries Marketing PlanDocumento18 pagineVIP Industries Marketing PlannandakishorejenaNessuna valutazione finora

- Two Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following InstructionsDocumento4 pagineTwo Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following Instructions47 sarada pattnayakNessuna valutazione finora

- m97 Speciman Coursework Assignment 2016Documento40 paginem97 Speciman Coursework Assignment 2016KELOILWE KEOTSHEPHILENessuna valutazione finora

- Mms Mbs Apr2012Documento32 pagineMms Mbs Apr2012Fernandes RudolfNessuna valutazione finora

- Globalisation and The Indian Economy Day 17 2024Documento2 pagineGlobalisation and The Indian Economy Day 17 2024justpeppezzNessuna valutazione finora

- Cambridge Pre U - 9772 Economics Example Candidate Responses BookletDocumento199 pagineCambridge Pre U - 9772 Economics Example Candidate Responses BookletFlorNessuna valutazione finora

- Imt 136Documento2 pagineImt 136Silvi KhuranaNessuna valutazione finora

- Examiners Reports March 2012Documento11 pagineExaminers Reports March 2012Abid Iqbal100% (4)

- XII Tourism Pre BoardDocumento4 pagineXII Tourism Pre Boardjanelleimelda5Nessuna valutazione finora

- Assignment 5 2020Documento5 pagineAssignment 5 2020林昀妤Nessuna valutazione finora

- 2syllabus2019 20final Copy 2019 03 07 130Documento192 pagine2syllabus2019 20final Copy 2019 03 07 130STUDY HUBNessuna valutazione finora

- Isbm University Semester Examination, April-20Documento2 pagineIsbm University Semester Examination, April-20Sidharth MIshraNessuna valutazione finora

- Assignments M Com PGDIBO English - 2012-13Documento8 pagineAssignments M Com PGDIBO English - 2012-13Minakshi KukrejaNessuna valutazione finora

- 2011 Za Exc CFDocumento13 pagine2011 Za Exc CFChloe ThamNessuna valutazione finora

- Resource 1 InstructionsDocumento4 pagineResource 1 InstructionsJoyceeNessuna valutazione finora

- Security Analysis and Portfolio ManagementDocumento2 pagineSecurity Analysis and Portfolio ManagementSidharth MIshraNessuna valutazione finora

- BCOC-137 Assignment 2021-22 (English)Documento4 pagineBCOC-137 Assignment 2021-22 (English)mohit vermaNessuna valutazione finora

- MBA (International Business)Documento52 pagineMBA (International Business)Nazhia KhanNessuna valutazione finora

- Edu 2017 Spring Qfi Core SyllabiDocumento11 pagineEdu 2017 Spring Qfi Core SyllabiJeffNessuna valutazione finora

- FR SD20 Examiner's ReportDocumento21 pagineFR SD20 Examiner's Reportngoba_cuongNessuna valutazione finora

- Test Bank For New Corporate Finance Online 1St Edition Eakins Mcnally 0132828944 9780132828949 Full Chapter PDFDocumento46 pagineTest Bank For New Corporate Finance Online 1St Edition Eakins Mcnally 0132828944 9780132828949 Full Chapter PDFrichard.may600100% (10)

- Final Paper 1Documento12 pagineFinal Paper 1ishujain007Nessuna valutazione finora

- Bba 5 Sem Dec 2019Documento17 pagineBba 5 Sem Dec 2019Tanmay SinghNessuna valutazione finora

- Chapter 10Documento13 pagineChapter 10Uyen Nhi NguyenNessuna valutazione finora

- VMOU Management Assignments 2013-14Documento24 pagineVMOU Management Assignments 2013-14ptgopoNessuna valutazione finora

- Test Bank For Finance Applications and Theory 5th Edition by Cornett DownloadDocumento54 pagineTest Bank For Finance Applications and Theory 5th Edition by Cornett Downloadtammiedavilaifomqycpes100% (24)

- B& I and SMA Question PapersDocumento4 pagineB& I and SMA Question Papersk.krishna raoNessuna valutazione finora

- FM402 2019Documento4 pagineFM402 2019skinnNessuna valutazione finora

- Northcentral University Assignment Cover Sheet: LearnerDocumento15 pagineNorthcentral University Assignment Cover Sheet: LearnerMorcy Jones100% (1)

- SMMD: Normal Distribution ProblemsDocumento2 pagineSMMD: Normal Distribution ProblemsSravya Sri0% (10)

- IMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Documento3 pagineIMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Ambrish (gYpr.in)Nessuna valutazione finora

- International Finance 2021-22Documento3 pagineInternational Finance 2021-22NAITIK SHAHNessuna valutazione finora

- Com Com PappDocumento43 pagineCom Com PappSajin BreakerNessuna valutazione finora

- Fundamentals of Multinational Finance 5Th Edition Moffett Test Bank Full Chapter PDFDocumento34 pagineFundamentals of Multinational Finance 5Th Edition Moffett Test Bank Full Chapter PDFdanielaidan4rf7100% (8)

- Financial Reporting: TestbankDocumento9 pagineFinancial Reporting: TestbankLaiba RazaNessuna valutazione finora

- FM SD21 Examiner's ReportDocumento19 pagineFM SD21 Examiner's ReportNiharika LuthraNessuna valutazione finora

- Investments, Levy and PostDocumento83 pagineInvestments, Levy and PostShakib Hossain Purno100% (1)

- FNCE3000 In-Class Assignment 1 Questions Chap 1madura TextDocumento4 pagineFNCE3000 In-Class Assignment 1 Questions Chap 1madura TextAshish KumarNessuna valutazione finora

- Chapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange ExposureDocumento19 pagineChapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange Exposurequeen hassaneenNessuna valutazione finora

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentDa EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentValutazione: 2.5 su 5 stelle2.5/5 (4)

- MRF Tyre Industry Ver 4Documento23 pagineMRF Tyre Industry Ver 4Sushant Sehra33% (3)

- Winning Strategies From Shiv Khera's Bestselling Book You Can WinDocumento11 pagineWinning Strategies From Shiv Khera's Bestselling Book You Can Winarun1974100% (1)

- Sarvpriya Mahajan Cghs LTD., New Delhi Subject:-Request For Issue DuplicateDocumento1 paginaSarvpriya Mahajan Cghs LTD., New Delhi Subject:-Request For Issue Duplicatearun1974Nessuna valutazione finora

- Container TrainDocumento24 pagineContainer Trainarun1974Nessuna valutazione finora

- Marketing Plan Himalaya'S Skin Care ProductsDocumento39 pagineMarketing Plan Himalaya'S Skin Care Productsarun197450% (4)

- Profile 2Documento3 pagineProfile 2arun1974Nessuna valutazione finora

- Company Profile @MRF TyresDocumento8 pagineCompany Profile @MRF TyresAnkur Dubey40% (5)

- Michaelkorssmplanplopan 140306182505 Phpapp02Documento57 pagineMichaelkorssmplanplopan 140306182505 Phpapp02Itee GuptaNessuna valutazione finora

- Program Evalutation and Review Technique For Building New Telecome Tower by EricssonDocumento2 pagineProgram Evalutation and Review Technique For Building New Telecome Tower by Ericssonarun1974Nessuna valutazione finora

- Understanding The Maturity Level of HR Practices in Indian OrganizationsDocumento2 pagineUnderstanding The Maturity Level of HR Practices in Indian Organizationsarun1974Nessuna valutazione finora

- Media KitDocumento20 pagineMedia Kitarun1974Nessuna valutazione finora

- The Traning and Development Procedures and Benefits at Amadeus DelhDocumento1 paginaThe Traning and Development Procedures and Benefits at Amadeus Delharun1974Nessuna valutazione finora

- Neem Presentation For IndiaDocumento21 pagineNeem Presentation For Indiaarun1974Nessuna valutazione finora

- Container TrainDocumento24 pagineContainer Trainarun1974Nessuna valutazione finora

- Future of Indian Software IndustryDocumento1 paginaFuture of Indian Software Industryarun1974Nessuna valutazione finora

- QuestionnaireDocumento16 pagineQuestionnairearun1974Nessuna valutazione finora

- Broadcast and Effective Online MediaDocumento1 paginaBroadcast and Effective Online Mediaarun1974Nessuna valutazione finora

- E&aDocumento61 pagineE&aarun1974Nessuna valutazione finora

- BenDocumento76 pagineBenarun1974Nessuna valutazione finora

- Oil SeedsDocumento17 pagineOil Seedsarun1974Nessuna valutazione finora

- AUSTRIA AT A GLANCEDocumento52 pagineAUSTRIA AT A GLANCEarun1974Nessuna valutazione finora

- Making Business Sense of E-OpportunityDocumento14 pagineMaking Business Sense of E-Opportunityarun1974Nessuna valutazione finora

- Spectr 1Documento17 pagineSpectr 1arun1974Nessuna valutazione finora

- BEERBUDocumento75 pagineBEERBUarun1974Nessuna valutazione finora

- Vikalp Dec2005 1Documento137 pagineVikalp Dec2005 1arun1974Nessuna valutazione finora

- Compu LearnDocumento14 pagineCompu Learnarun1974Nessuna valutazione finora

- CanadaDocumento156 pagineCanadaarun1974Nessuna valutazione finora

- Special Feature Economic Strengths of China: Mr. Huang Quanbeng, Consul General of The People's Republic of China, MumbaiDocumento40 pagineSpecial Feature Economic Strengths of China: Mr. Huang Quanbeng, Consul General of The People's Republic of China, Mumbaiarun1974Nessuna valutazione finora

- Oil SeedsDocumento17 pagineOil Seedsarun1974Nessuna valutazione finora

- Opportunity Analysis in CEMENT INDUSTRY in INDIA.Documento1 paginaOpportunity Analysis in CEMENT INDUSTRY in INDIA.arun1974Nessuna valutazione finora

- Fund Factsheets - IndividualDocumento57 pagineFund Factsheets - IndividualRam KumarNessuna valutazione finora

- Advanced Financial Management Exam QuestionsDocumento3 pagineAdvanced Financial Management Exam QuestionsRamakrishna NagarajaNessuna valutazione finora

- Pakistan's Economy & Financial MarketsDocumento11 paginePakistan's Economy & Financial MarketsXeeshan Bashir100% (1)

- Best Position Sizing in TradingDocumento27 pagineBest Position Sizing in TradingSiva No Fear33% (3)

- Trade Confirmation for INKP SharesDocumento1 paginaTrade Confirmation for INKP SharesMazterMaztermaztermazter MaztermaztermazterYandeNessuna valutazione finora

- Cash and Cash EquivalentsDocumento2 pagineCash and Cash EquivalentsMary Jullianne Caile SalcedoNessuna valutazione finora

- Basel-III Norms Impact Indian BankingDocumento3 pagineBasel-III Norms Impact Indian BankingNavneet MayankNessuna valutazione finora

- Leveraged Recapitalization and Exchange Offers: Prof. Ian GiddyDocumento28 pagineLeveraged Recapitalization and Exchange Offers: Prof. Ian GiddyMohit KhandelwalNessuna valutazione finora

- Dennis Odife Panel Report On The Review of The NCM by MoF Sept 1996 - AbridgedDocumento143 pagineDennis Odife Panel Report On The Review of The NCM by MoF Sept 1996 - AbridgedProshare100% (1)

- Mpa 111 Asg 1 CH 1 (Gp7 Mpa - NPT)Documento9 pagineMpa 111 Asg 1 CH 1 (Gp7 Mpa - NPT)MPA-NPT-5 AungZawWinNessuna valutazione finora

- DM21A24 - Hitakshi ThakkarDocumento8 pagineDM21A24 - Hitakshi ThakkarRAHUL DUTTANessuna valutazione finora

- What Is A Funded Debt?Documento3 pagineWhat Is A Funded Debt?Niño Rey LopezNessuna valutazione finora

- Trendline Trading: by Admiral Markets Trading CampDocumento10 pagineTrendline Trading: by Admiral Markets Trading CampKiran KrishnaNessuna valutazione finora

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocumento16 pagineYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNessuna valutazione finora

- Reverse Iron Condor Spread-1023Documento7 pagineReverse Iron Condor Spread-1023ramojiraNessuna valutazione finora

- Gen 009 - Sas 2Documento12 pagineGen 009 - Sas 2Reymark BaldoNessuna valutazione finora

- Capital Market in TanzaniaDocumento11 pagineCapital Market in TanzaniaJohnBenardNessuna valutazione finora

- Enterprise - Revision Notes: Exam Length: 1hourDocumento42 pagineEnterprise - Revision Notes: Exam Length: 1hourNguyễn Châu AnhNessuna valutazione finora

- Ba 623 Case AnalysisDocumento8 pagineBa 623 Case AnalysisSarah Jane OrillosaNessuna valutazione finora

- Round 1 Financial Stats and Stock DataDocumento15 pagineRound 1 Financial Stats and Stock DataDamanpreet Singh100% (1)

- Mid-Term Mini Case AnalysisDocumento14 pagineMid-Term Mini Case AnalysisA.Rahman SalahNessuna valutazione finora

- 3.3.2.2 Explain Stock Valuation Alolod DelicanoDocumento11 pagine3.3.2.2 Explain Stock Valuation Alolod DelicanoaiahNessuna valutazione finora

- Competitor Analysis - Day TradingDocumento109 pagineCompetitor Analysis - Day TradingShakeel AhmadNessuna valutazione finora

- Acc101 Ia Nguyen Thi Thanh Thuy Hs171230 Mkt1715Documento6 pagineAcc101 Ia Nguyen Thi Thanh Thuy Hs171230 Mkt1715Nguyen Thi Thanh ThuyNessuna valutazione finora

- Problems - Bonds - RevisedDocumento5 pagineProblems - Bonds - RevisedFake ManNessuna valutazione finora

- How To Calculate A Company's Stock PriceDocumento7 pagineHow To Calculate A Company's Stock PriceEdgar NababanNessuna valutazione finora

- Compound Interest: Compounded Mo Re Than Once A Yea RDocumento24 pagineCompound Interest: Compounded Mo Re Than Once A Yea RCristine CañeteNessuna valutazione finora

- Stocks and Their Valuation ExerciseDocumento42 pagineStocks and Their Valuation ExerciseLee Wong100% (2)

- Asset Rotation Strategy With PythonDocumento6 pagineAsset Rotation Strategy With PythonPeter SamualNessuna valutazione finora

- Cracking Mba Finance InterviewDocumento41 pagineCracking Mba Finance InterviewJITHIN PADINCHARE RAMATH KANDIYIL100% (1)