Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Money, Interest, and Inflation: Answers To Checkpoints

Caricato da

b96309Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Money, Interest, and Inflation: Answers To Checkpoints

Caricato da

b96309Copyright:

Formati disponibili

Chapter

ANSWERS TO CHECKPOINTS

Money, Interest, and Inflation

CHECKPOINT 12.1 Money and the Interest Rate

1. The figure shows the demand for money curve. The quantity of money supplied is $3.9 trillion. What is the nominal interest rate? The nominal interest rate is 6 percent a year because that is the nominal interest rate at which the quantity of money demanded equals the quantity of money supplied. 2. The figure shows the demand for money curve. If real GDP decreases, how will the interest rate change? Explain what happens in the market for bonds as the money market returns to equilibrium. If real GDP decreases, the nominal interest rate falls. When real GDP decreases, the demand for money curve shifts leftward. At the original nominal interest rate, people want to hold less money than they are actually holding. So they spend the money by buying other financial assets such as bonds. The demand for financial assets increases, the prices of these assets rise, and the nominal interest rate falls. The nominal interest rate keeps falling until the quantity of money that people want to hold increases to equal the quantity of money supplied.

208

Part 4 . THE MONEY ECONOMY

3. The figure shows the demand for money curve. If the Fed increases the quantity of money from $3.9 trillion to $4.0 trillion, what is the change in the nominal interest rate? What happens to the price of bonds? If the Fed increases the quantity of money to $4.0 trillion, the nominal interest rate falls to 4 percent a year. At the original interest rate, people would like to hold less money then they are actually holding. So they try to get rid of money by buying other financial assets such as bonds. The demand for financial assets increases, the prices of these assets rise, and the nominal interest rate falls. The nominal interest rate keeps falling until the quantity of money that people want to hold increases to equal the quantity of money supplied. 4. Suppose that banks launch an aggressive marketing campaign to get everyone to use credit cards for every conceivable transaction. They offer prizes to new cardholders and slash the interest rate on outstanding credit card balances. How would the demand for money and the nominal interest rate change? The demand for money decreases as people use their credit cards more often and use money less often for transactions. Because the demand for money decreases, the nominal interest rate falls.

CHECKPOINT 12.2 Money, the Price Level, and Inflation

1. In 2002, the United Kingdom was at full employment. Nominal GDP was 850 billion, the real interest rate was 5 percent per year, the inflation rate was 6 percent a year, and the price level was 120. Calculate the nominal interest rate. If the real interest rate remains unchanged when the inflation rate in the long run decreases to 3 percent a year, explain how the nominal interest rate changes. The nominal interest rate equals the real interest rate plus the inflation rate. So the nominal interest rate equals the real interest rate, 5 percent a year, plus the inflation rate, 6 percent a year, which is 11 percent a year. When the inflation rate decreases by 3 percentage points, the nominal interest rate falls by 3 percentage points, in this case from 11 percent a year to 8 percent a year. 2. In 2003, the United Kingdom was at full employment. Nominal GDP was 900 billion, the nominal interest rate was 8 percent per year, the price level was 130, and the velocity of circulation was constant at 2. What was the quantity of money in the United Kingdom? The equation of exchange is M V = P Y. Rearranging this equation to solve for M gives M = (P Y) V. P Y equals nominal GDP, which is given in the problem as 900 billion.

Chapter 12 . Money, Interest, and Inflation

209

Velocity was given as 2. So the quantity of money, M, is (900 billion) 2, which is 450 billion. 3. In exercise 2, if the velocity of circulation remains at 2, money grows at 8 percent a year, and real GDP grows at 5 percent a year in the long run, what is the inflation rate in the long run? In growth rates, the equation of exchange is (Money growth) + (Velocity growth) = (Inflation) + (Real GDP growth). Rearranging this equation gives Inflation = (Money growth) + (Velocity growth) (Real GDP growth). The velocity of circulation is constant (at 2) so its growth equals 0 percent. Real GDP grows at 5 percent a year and money grows at 8 percent a year, so inflation equals (8 percent a year) + (0 percent a year) (5 percent a year), which is 3 percent a year.

CHECKPOINT 12.3 The Cost of Inflation

Sally has a credit card balance of $4,000. The credit card company charges a nominal interest rate of 18 percent a year on unpaid balances. The inflation rate is 3 percent a year. 1. Calculate the real interest rate that Sally pays the credit card company. The real interest rate is the nominal interest rate minus the inflation rate, which is 18 percent a year minus 3 percent a year = 15 percent. 2. If the inflation rate falls to 2 percent a year and the nominal interest rate remains the same, calculate the real interest rate that Sally pays. The real interest rate rises to 16 percent a year (18 percent a year minus 2 percent a year).

210

Part 4 . THE MONEY ECONOMY

ANSWERS TO CHAPTER CHECKPOINT

Problems

1. Draw a graph to illustrate the demand for money curve. On the graph show the effect of an increase in real GDP and the effect of an increase in the number of families that have a credit card. A demand for money curve is illustrated as MD0 in Figure 12.2. An increase in real GDP increases the demand for money and the demand for money curve shifts rightward. Figure 12.2 illustrates this change as the shift from MD0 to MD1. An increase in the number of families with credit cards decreases the demand for money. The demand for money curve shifts leftward, from MD0 to MD2 in Figure 12.2 2. The Fed decreases the quantity of money. Explain the effects of this action in the short run and the long run on the quantity of money demanded and the nominal interest rate. In the short run, the decrease in the quantity of money raises the nominal interest rate, so the quantity of money demanded decreases. In the long run, the nominal interest rate returns to its initial level, but the price level falls, which decreases the demand for money. 3. The Fed conducts an open market purchase of securities. [Hint: Check back with Chapter 11 if you need a reminder about the effects of an open market operation.] Explain the effects of this action in the short run and the long run on the real interest rate and the price level. If the Fed conducts an open market purchase of securities, the quantity of money increases in both the short run and long run. In the short run, the increase in the quantity of money lowers the nominal interest rate and the real interest rate. There is no immediate effect on the price level. In the long run, the nominal interest rate and the real interest rate both return to their initial levels. The price level rises in the long run.

Chapter 12 . Money, Interest, and Inflation

211

In 2000, the United States was at full employment. The quantity of money was growing at 8.3 percent a year, the nominal interest rate was 9.5 percent a year, real GDP grew at 5 percent a year, and the inflation rate was 3.1 percent a year. Use this information to answer Problems 4 and 5. 4. Calculate the real interest rate. The real interest rate equals the nominal interest rate minus the inflation rate, so it is equal to 9.5 percent a year minus 3.1 percent a year, which is 6.4 percent a year. 5. Was the velocity of circulation constant? [Hint: Use the quantity theory of money.] If velocity of circulation was not constant, how did it change and why might it have changed? Velocity was not constant. Its growth rate equals inflation (3.1 percent a year) plus real GDP growth (5.0 percent a year) minus money growth (8.3 percent a year), which is 0.2 percent a year; that is, its growth rate was negative. The growth rate was negative because the quantity of money was growing at a faster rate than the growth rate of GDP. 6. Suppose the government passes a new law that sets a limit on the interest rate that credit card companies can charge on overdue balances. As a result, the nominal interest rate charged by credit card companies falls from 15 percent a year to 7 percent a year. If the average income tax rate is 30 percent, explain how the real aftertax interest rate on overdue credit card balances changes. The fall in the nominal interest rate lowers the real after-tax interest rate on credit cards. The after-tax real interest rate equals the after-tax nominal interest rate minus the inflation rate. Before the governments new law, the after-tax nominal interest rate was 10.5 percent. With the new law, it is 4.9 percent. So with no change in the inflation rate, the government has decreased the after-tax real interest rate by 5.6 percentage points. 7. If the quantity of money is $3 trillion, real GDP is $10 trillion, the price level is 0.9, the real interest rate is 2 percent a year, and the nominal interest rate is 7 percent a year, calculate the velocity of circulation, the value of M V, and nominal GDP? The velocity of circulation, V is equal to (P Y) M, where P is the price level, Y is real GDP and M is the quantity of money. Using this formula gives V = (0.9 $10 trillion) $3 trillion, which equals 3. M V is equal to $3 trillion 3, or $9 trillion.

212

Part 4 . THE MONEY ECONOMY

Nominal GDP is P Y, where P is the price level and Y is real GDP. So, nominal GDP equals 0.9 $10 trillion, which is $9 trillion. Nominal GDP also equals M V. 8. If the velocity of circulation is growing at 1 percent a year, the real interest rate is 2 percent a year, the nominal interest rate is 7 percent a year, and the growth rate of real GDP is 3 percent a year, calculate the inflation rate, the growth rate of money, and the growth rate of nominal GDP. The inflation rate is the difference between the nominal interest rate and the real interest rate. So the inflation rate is 7 percent a year 2 percent a year, which is 5 percent a year. Money growth + Velocity growth = Inflation + Real GDP growth. Rearranging this formula gives Money growth = Inflation + Real GDP Velocity. Inflation is 5 percent, real GDP growth is 3 percent, and velocity growth is 1 percent, so money growth equals 5 percent + 3 percent 1 percent, which is 7 percent a year. The growth rate of nominal GDP is the sum of the inflation rate plus the growth rate of real GDP. So the growth rate of nominal GDP is 5 percent a year + 3 percent a year, which is 8 percent a year. How Bad Is Inflation in Zimbabwe? at a supermarket toilet paper costs $417. No, not per roll. A roll costs $145,750in American currency, about 69 cents. The price of toilet paper, like everything else here, soars almost daily. All are casualties of the hyperinflation that is roaring toward 1,000 percent a year. Zimbabwes prices are ... doubling about once every three or four months. ... At the same time, Mr. Mugabes government has printed trillions of new Zimbabwean dollars to keep ministries functioning and at least $21 trillion [to repay an IMF] debt. Michael Wines, The New York Times, May 2, 2006 9. Compare inflation in Zimbabwe today with that in Germany in 1923. Why did Germany print money in 1923 and create hyperinflation? Why is Zimbabwe printing money today? Both Germany and Zimbabwe are suffering from hyperinflations, the result of extremely rapid growth in the quantity of money. Both Germany and Zimbabwe inflated the quantity of money in their economies in an effort to raise funds for the government. Zimbabwe, for instance, printed trillions of new Zimbabwean dollars to pay an IMF debt. Germany likewise printed trillions of German marks to help pay reparations were imposed on Germany after World War I.

Chapter 12 . Money, Interest, and Inflation

213

Exercises

1. Explain how the spread of ATMs has influenced the demand for money. The spread of ATMs has increased the demand for money. As a result, the demand for money curve shifts rightward. 2. The Fed increases the quantity of money. Explain the effects of this action in the short run and the long run on the quantity of money demanded, the real interest rate, and the price level. In the short run, the increase in the quantity of money lowers the nominal interest rate, so the quantity of money demanded increases. In the short run, the fall in the nominal interest rate corresponds to a fall in the real interest rate. In the short run, the price level does not change or, if it changes at all, it rises but by not very much. In the long run, the nominal interest and the real interest rate both return to their initial levels, but the price level rises, which increases the demand for money. 3. The Fed conducts an open market sale of securities. Explain the effects of this action in the short run and the long run on the nominal interest rate, the real interest rate, and real GDP. The sale of securities decreases the quantity of money. In the short run, the nominal interest rate rises. In the short run, the rise in the nominal interest rate corresponds to a rise in the real interest rate. Real GDP decreases. In the long run, the nominal interest rate, the real interest rate, and real GDP all return to their initial levels. 4. Draw a graph of the money market to illustrate equilibrium in the short run. If the growth rate of the quantity of money increases, explain what happens to the real interest rate and the nominal interest rate in the short run. Figure 12.3 shows the money market in the short run. In the short run, the increase in the growth rate of the quantity of money lowers the nominal interest rate. In Figure 12.3, the increase in the growth rate of the quantity of money increases the quantity of money from $0.98 trillion to $1.02 trillion and lowers the nominal interest rate from 5 percent to 3 percent. Because the inflation rate does not change in the short run, the real interest rate also falls.

214

Part 4 . THE MONEY ECONOMY

5. Draw a graph of the money market to illustrate equilibrium in the long run. If the growth rate of the quantity of money increases, explain what happens to the real interest rate and the nominal interest rate in the long run. Figure 12.4 shows the money market in the long run. In the long run, the inflation rate rises so that the price level rises, which increases the demand for money. in Figure 12.4, the demand for money curve shifts rightward from MD0 to MD1. Since more time has passed, the quantity of money is assumed to have increased to $1.04 trillion. The increase in the inflation rate increases the nominal interest rate. In the figure, the new equilibrium nominal interest rate is 6 percent. The real interest rate, however, returns to its initial value. 6. Explain why the short-run effects of an increase in the growth rate of money on the real and nominal interest rate are different from the long-run effects. The short-run effects differ from the long-run effects because in the short run the inflation rate does not change (or, at least, does not change by very much). As time passes after the increase in the growth rate of money, the inflation rate begins to rise. Eventually the inflation rate rises by the same amount as the increase in the growth rate of the quantity of money. The long-run increase in the inflation rate increases the nominal interest rate. However the real interest rate is determined in the market for loanable funds and so in the long run it returns back to its original level. 7. What is the quantity theory of money? The quantity theory of money is the proposition that when real GDP equals potential GDP, an increase in the quantity of money brings an equal percentage increase in the price level. 8. Define the velocity of circulation and explain how it is measured. The velocity of circulation is the average number of times in a year that the each dollar of money gets used to buy final goods and services. The formula used to measure the velocity of circulation is V = (P Y) M, where P is the price level, Y is real GDP, and M is the quantity of money.

Chapter 12 . Money, Interest, and Inflation

215

9. If the velocity of circulation is constant, real GDP is growing at 3 percent a year, the real interest rate is 2 percent a year, and the nominal interest rate is 7 percent a year, calculate the inflation rate, the growth rate of money, and the growth rate of nominal GDP. The inflation rate is the difference between the nominal interest rate and the real interest rate. So the inflation rate is 7 percent a year 2 percent a year, which is 5 percent a year. Because the velocity of circulation is constant, its growth rate is zero. Then, Money growth + Velocity growth = Inflation + Real GDP growth. Rearranging, Money growth = Inflation + Real GDP growth Velocity, which is 5 percent a year + 3 percent a year 0 percent a year = 8 percent a year. The growth rate of nominal GDP is the sum of the inflation rate plus the growth rate of real GDP. So the growth rate of nominal GDP is 5 percent a year + 3 percent a year, which is 8 percent a year. 10.If the economy is at full employment and the Fed increases the growth rate of the quantity of money, explain what happens to the inflation rate in the long run if velocity of circulation is constant and real GDP grows 3 percent a year. In the long run, the inflation rate increases by the same amount as the increase in the growth rate of the quantity of money. 11.List the costs of inflation and provide an example of each type of cost. There are four costs of inflation: Tax Costs. Inflation is a tax because inflation transfers resources from households and businesses to government. This tax has a cost similar to any other tax: People consume fewer goods and services because some of their income is taxed. Inflation also interacts with the tax code because there is an income tax levied on nominal interest. So, the higher the inflation rate, the lower is the after-tax interest rate received by lenders. With a low after-tax real interest rate, the incentive to save is weakened, so the supply of saving and hence investment decreases. This cost is reflected in lower economic growth and a resulting lower standard of living. Shoe-Leather Costs. Shoe-leather costs refer to the costs that arise from an increase in the velocity of circulation of money and the increase in the amount of running around that people do to try to avoid incurring losses from the falling value of money. For instance, in hyperinflations, people are paid twice a day and so must rush out twice a day to spend their money on goods and services. Confusion Costs. Inflation creates difficulty in measuring costs and benefits when the price level is unstable. This cost can lead firms to make incorrect decisions about what goods and services are in demand and lead to inefficient production of goods and services.

216

Part 4 . THE MONEY ECONOMY

Uncertainty Costs. The increased uncertainty of inflation makes long-term planning difficult and gives people a shorterterm focus. Investment falls and so the economic growth rate falls.

Zimbabwe Inflation to Hit 1.5m% Zimbabwes inflation will rocket to 1.5m% before the end of the year, forecasting massive disruption and instability. I can barely cope with inflation in the thousands, but millions? We will die, said Iddah Mandaza, a Harare factory worker. Mr. Mandaza said some workers are now saving on transport costs by going to their jobs on Monday and sleeping at the workplace until Friday. They all share their meals. Many Zimbabweans are resorting to barter. I traded some soap for two buckets of maize meal [Zimbabwes staple food]. It was far much better than trying to buy it in the shops. At the other end of the technological scale, enterprising Zimbabweans abroad have set up internet trading schemes, ... in which Zimbabweans overseas pay for goods with foreign currency and then vouchers for fuel, food and medicines are sent to recipients in Zimbabwe via email or on their cell phones. Andrew Meldrum, Guardian Unlimited, June 21, 2007 Use this information to answer Exercises 12 and 13. 12.What are some of the costs that inflation is imposing on Zimbabweans? It is clear that the inflation is imposing massive costs on many Zimbabweans. From the article, it seems as if the monetary system is breaking down, with people resorting to barter. Barter is extremely costly and inefficient, which inflicts further costs on the people because barter creates tremendous confusion costs. In addition, some workers no longer go home in the evening because their pay wont easily cover transportation and other necessities. The fact that some Zimbabweans are using Internet trading methods to avoid losses reflects the shoe-leather cost and probably also the uncertainty cost of inflation. In the absence of such tremendous inflation, these Zimbabweans could use their expertise to create other goods and services that people could consume and improve their well being. Additionally, they likely would planning for a much longer time horizon than striving to avoid this weeks (or this days) massive inflation. 13.Describe how Zimbabweans are coping with disruption and scarcity. Some Zimbabweans are sleeping at their workplace rather than spend income on transportation. Others are bartering rather than trying to use money. Still others are using foreign currency, via the Internet or cell phones to buy goods and services.

Chapter 12 . Money, Interest, and Inflation

217

Critical Thinking and Web Activities

1. Explain what the costs of inflation were for Brazilians when inflation in 1994 hit 40 percent a month in Brazil. When inflation hit 40 percent a month in Brazil, the costs of the inflation for Brazilians were many. First, inflation is a tax. The government used the inflation tax to buy goods and services, which crowded out private spending. Second, there was no doubt a huge increase in the shoe-leather costs of inflation, which arise from an increase in the velocity of circulation of money because of the increase in the amount of running around that people do to avoid incurring losses from the falling value of money. In addition, the increased uncertainty made long-term planning difficult, if not impossible and gave people a shorterterm focus. Investment fell and so the growth rate slowed. 2. Explain why businesses paid workers twice a day during the hyperinflation in Germany after World War I and why workers spent their incomes as soon as they were paid. Businesses paid their workers twice a day to retain their work force. Businesses knew that workers would see a large decline in the purchasing power of money throughout the course of the day. If a firm delayed paying its workers, the workers would suffer a tremendous loss in purchasing power and so they might well quit to look for another, more accommodating business. Workers spent their wages virtually as fast as they received them to avoid the loss in value. 3. With the spread of credit cards, debit cards, and e-cash, people will want to hold less and less money. Eventually, no one will want to hold any money and the Federal Reserve will have no role. Critically evaluate this view. The statement overstates the case because for the foreseeable future, people will want to hold money. Even with credit cards, debit cards, and e-cash, moneyM1 or M2remains useful for making ordinary, day-to-day purchases. In addition, credit card bills still need to be paid with money and debit cards still need to access money in an account. So, money wont immediately disappear. And, even if people no longer held currency or checking accounts, they would still need money in the form of ecash or other electronic means and the Federal Reserve can regulate the quantity of e-cash in the same way it regulates M1 and M2 today. 4. The Federal Reserve could easily eliminate inflation by making the quantity of money grow at a rate equal to the growth rate of real GDP minus the growth rate of the velocity of circulation. Do you think the Fed should pursue this objective? Explain why or why not. Your students answers will differ according to their views. Students who disagree might suggest that it is not easy to make

218

Part 4 . THE MONEY ECONOMY

the quantity of money grow at a rate equal to real GDP growth minus the growth rate of velocity. After all, if it is so easy, why isnt it done? Other students might point out that if the Feds sole purpose is to make the inflation rate equal zero, then the Fed will not be able to influence economic activity by changing the quantity of money. These students likely will see little harm in low inflation rates. Students who agree with the statement should point out the costs of inflation and state that society would be better off if these costs were avoided. 5. The Federal Reserve could hold the interest rate constant by making the quantity of money adjust to match the quantity of money demanded at the chosen interest rate. Do you think the Fed should pursue this objective? Explain why or why not. Your students answers will differ according to their views. However, If the Fed chooses to peg the nominal interest rate, the inflation rate equals the difference between the (pegged) nominal interest rate and the real interest rate. As long as the Fed does not change its pegged interest rate, any change in the real interest rate leads to a change in the inflation rate. If the real interest rate changes frequently, then the inflation rate changes frequently, which leads to uncertainty. In addition, if the Fed pegged the nominal interest rate at a level above the real interest rate, inflation would be positive, or if the Fed pegged the nominal interest rate at a level below the real interest rate, inflation would be negative. The Fed achieves zero inflation, which is presumably a desirable target, only if it pegged the nominal interest rate equal to the real interest rate. 6. Do you think the Federal Reserve could simultaneously pursue a fixed interest rate and a money growth rate equal to the growth rate of real GDP minus the growth rate of the velocity of circulation? Explain why or why not. It is almost certainly the case that the Fed cannot simultaneously pursue a fixed interest rate and also set the money growth rate equal to the growth rate of real GDP minus the growth rate of the velocity of circulation. If the Fed set the money growth rate equal to the growth rate of real GDP minus the growth rate of the velocity of circulation, the inflation rate would equal zero. The nominal interest rate equals the real interest rate plus the inflation rate. If the Fed follows the policy of setting the inflation rate to zero, then the nominal interest rate equals the real interest rate. Only if the Fed happened to pick this value for the interest rate are the policies compatible. And even then, any change in the demand for money would lead to a change in the interest, which the Fed would need to offset by changing the growth rate of the quantity of money in order to keep the interest rate fixed.

Chapter 12 . Money, Interest, and Inflation

219

7. Visit the Web sites of the Federal Reserve and the Bureau of Economic Analysis and obtain the latest data on the quantity of M1, the quantity of M2, real GDP, and the price level. a. Calculate the inflation rate, the growth rate of the two money aggregates, and the growth rate of real GDP. Use the information you calculated to determine whether the velocity of circulation was constant. If it was not constant, how did it change? If it changed, why might it have changed? The answers your students calculate for the various growth rates depend on when you assign this question. One major reason velocity changes is because the nominal interest rate changes. If the nominal interest rate rises, the opportunity cost of holding money increases and so velocity rises. Conversely, if the nominal interest rate falls, the opportunity cost of holding money decreases and so velocity slows. b. Given the information that you obtained, do you think the Fed is trying to slow inflation, speed up inflation, or neither? If neither, what do you think the Fed is trying to do? As with the other question, your students answers will depend when you assign the question. Regardless of what they answer, one way to determine the Feds intent is to look at the growth rate of the quantity of money. If it has slowed, its a safe bet that the Fed is fearing inflation. If it has risen, most likely the Fed is trying to speed up the economy and inflation will result. 8. Visit the Web site of the European Central Bank. Obtain data on money supply growth rates and inflation rates for the euro area. a. Is the money supply in the euro area growing faster or slower than that in the United States? The answers your students obtain depend on when you assign this question. b. Would you expect inflation in the euro area to be higher, lower, or about the same as that in the United States? Explain why. Although the precise answers your students obtain depend on when you assign this question, nonetheless the answer to this part of the question ought to hinge upon a comparison of the money growth rates. If the quantity of money is growing more rapidly in the Euro area, inflation probably will be higher in the Euro area; if it growing more slowly in the Euro area, then inflation probably will be lower in the Euro area; and,. If it is growing at the same rate in the Euro area, then inflation will probably be the Euro area.

220

Part 4 . THE MONEY ECONOMY

9. Visit the International Monetary Funds World Economic Outlook database Web site. Obtain data on money growth rates and inflation rates for Advanced Economies and the Developing Economies. Use a spreadsheet program (Excel or Lotus 1-2-3) to make a scatter diagram of the data placing money growth on the x-axis and inflation on the yaxis. Do these data support or contradict the quantity theory of money? Although the precise graph will depend on when the question is assigned, nonetheless it will be the case that there will be a cluster of low inflation/low money growth rate nations near the origin and a more spread out cluster of high inflation/high money growth rate nations in the upper right of the figure. Whether the data precisely support the quantity theory depends on the data your students use, but the data should generally support the quantity theory insofar as the high money growth rate nations will all have significantly higher inflation rates than the low money growth rate nations. You might ask your students to draw a line between these two groups of nations and calculate its slope. The slope should be close to 1.0, which is the prediction of the quantity theory. (That is, the quantity theory asserts that if velocity does not change, an x percentage point increase in the growth rate of the quantity of money will lead to an x percentage point increase in the inflation rate.)

Chapter 12 . Money, Interest, and Inflation

221

ADDITIONAL EXERCISES FOR ASSIGNMENT Questions

CHECKPOINT 12.1 Money and the Interest Rate 1. Suppose that the nominal interest rate is such that there is an excess demand for money. Explain the adjustment process that takes place as the money market moves to equilibrium. CHECKPOINT 12.2 Money, the Price Level, and Inflation 2. In 2000, the United Kingdom was close to full employment. Nominal GDP was 800 billion, the real interest rate was 4 percent a year, the inflation rate was 6 percent a year, and the price level was 120. 2a. Calculate the nominal interest rate. 2b. If the real interest rate remains unchanged when the inflation rate in the long run decreases to 3 percent a year, explain how the nominal interest rate changes. 3. In 2000, the United Kingdom was at full employment. Nominal GDP was 800 billion, the nominal interest rate was 7 percent a year, the price level was 120, and the velocity of circulation was 2. What was the quantity of money in the United Kingdom? 4. Imagine a scenario in which an international counterfeiting ring prints enough U.S. dollars to increase the nations quantity of money by 10 percent. Then the news media breaks the story wide open and makes the details known to the public. Assuming that the government is not able to rid the economy of this counterfeit money and it is for all intents and purposes untraceable, discuss what happens in the long run if the counterfeiting is a one-time episode or if the counterfeiting is ongoing so that each year the quantity of money grows by an additional 10 percent. 5. Suppose the economy is at full employment and that velocity does not change when the quantity of money changes. What will be the impact on real GDP and the price level if the Fed increases the quantity of money by 5 percent? CHECKPOINT 12.3 The Cost of Inflation 6. Sally has a credit card balance of $3,000. The credit card charges a nominal interest rate of 15 percent a year on unpaid balances. The inflation rate is 3 percent a year. 6a. Calculate the real interest rate that Sally pays the credit card company. 6b. If the inflation rate falls to 2 percent a year and the credit card company keeps the nominal interest rate at 15 percent a year, calculate the real interest rate that Sally pays.

222

Part 4 . THE MONEY ECONOMY

Answers

CHECKPOINT 12.1 Money and the Interest Rate 1. With an excess demand for money, the interest rate is below its equilibrium level. People are holding less money than they would like to hold. So they try to get more money by selling other financial assets. The demand for financial assets decreases, the prices of these assets fall, and the interest rate rises. The interest rate keeps rising until the quantity of money that people want to hold decreases to equal the quantity of money supplied. CHECKPOINT 12.2 Money, the Price Level, and Inflation 2a. The nominal interest rate equals the real interest rate plus the inflation rate. So the nominal interest rate equals 4 percent a year plus the inflation rate of 6 percent a year, which is 10 percent a year. 2b. The nominal interest rate falls from 10 percent a year to 7 percent a year. 3. The equation of exchange is M V = P Y. Rearranging this equation to solve for M gives M = (P Y) V. P Y equals nominal GDP, which is 800 billion. Velocity is 2. So the quantity of money, M, is equal to (800 billion) 2, which is 400 billion. 4. The counterfeiting would be the equivalent of increasing the quantity of money. If the counterfeiting is a one-time event, the ultimate impact is a 10 percent rise in the price level, and no change in the inflation rate or nominal interest rates. If the counterfeiting is ongoing, so that each year the quantity of money grows by 10 percent, in the long run the inflation rate and nominal interest rate rise by 10 percentage points. 5. The equation of exchange states that the quantity of money multiplied by the velocity of circulation equals real GDP multiplied by the price level. If the economy is at full employment and velocity does not change when the quantity of money changes, the increase in the quantity of money only has an impact on the price level. The 5 percent increase in the quantity of money raises the price level by 5 percent and real GDP does not change. CHECKPOINT 12.3 Money and the Interest Rate 6a. The real interest rate equals the nominal interest rate minus the inflation rate. So Sally pays a real interest rate of 15 percent a year minus 3 percent a year, which is 12 percent.

6b. The real interest rate rises to 15 percent a year minus 2 percent a year, which is 13 percent a year.

Potrebbero piacerti anche

- Chapter 25Documento7 pagineChapter 25Tasnim SghairNessuna valutazione finora

- Practice For Chapter 5 SolutionsDocumento6 paginePractice For Chapter 5 SolutionsAndrew WhitfieldNessuna valutazione finora

- Inflation: Its Causes, Effects, and Social Costs: Questions For ReviewDocumento5 pagineInflation: Its Causes, Effects, and Social Costs: Questions For ReviewAbdul wahabNessuna valutazione finora

- Short Essay Questions - With AnsDocumento4 pagineShort Essay Questions - With Ansmoon loverNessuna valutazione finora

- Money and Inflation: Questions For ReviewDocumento6 pagineMoney and Inflation: Questions For ReviewErjon SkordhaNessuna valutazione finora

- Economy Test Answer Previous QuestionDocumento18 pagineEconomy Test Answer Previous Questionsantiago.paredes.molinaNessuna valutazione finora

- Session 11 - Money Demand - Equil Interest RateDocumento7 pagineSession 11 - Money Demand - Equil Interest Rates0falaNessuna valutazione finora

- 9 - ch27 Money, Interest, Real GDP, and The Price LevelDocumento48 pagine9 - ch27 Money, Interest, Real GDP, and The Price Levelcool_mechNessuna valutazione finora

- Chapter 20 Problems and SolutionsDocumento5 pagineChapter 20 Problems and Solutionsfahmeed786Nessuna valutazione finora

- Philips CurveDocumento7 paginePhilips CurveMohammad Zeeshan BalochNessuna valutazione finora

- 4.2 InflationDocumento4 pagine4.2 InflationArju LubnaNessuna valutazione finora

- Money Growth and Inflation: The Classical Theory of InflationDocumento5 pagineMoney Growth and Inflation: The Classical Theory of InflationIzzahNessuna valutazione finora

- Money Market Equilibrium ExplainedDocumento24 pagineMoney Market Equilibrium ExplainedArrianeNessuna valutazione finora

- Macroeconomics 9Th Edition Mankiw Solutions Manual Full Chapter PDFDocumento28 pagineMacroeconomics 9Th Edition Mankiw Solutions Manual Full Chapter PDFjane.hardage449100% (11)

- Macroeconomics 9th Edition Mankiw Solutions Manual 1Documento36 pagineMacroeconomics 9th Edition Mankiw Solutions Manual 1tinacunninghamadtcegyrxz100% (27)

- The Financial Sector of The Economy: Money and BankingDocumento12 pagineThe Financial Sector of The Economy: Money and BankingNefta BaptisteNessuna valutazione finora

- Name Class Assignment DateDocumento6 pagineName Class Assignment Datehyna_khanNessuna valutazione finora

- Macroeconomics Quiz Answers ExplainedDocumento6 pagineMacroeconomics Quiz Answers ExplainedEmmanuel MbonaNessuna valutazione finora

- Assignment 1Documento6 pagineAssignment 1Ken PhanNessuna valutazione finora

- Assignment On Marco EconomicsDocumento9 pagineAssignment On Marco EconomicsMosharraf HussainNessuna valutazione finora

- Mini Exam 3Documento17 pagineMini Exam 3course101Nessuna valutazione finora

- C Compare Net Export Effect and Crowding Out Effect With The Help of GDP?Documento5 pagineC Compare Net Export Effect and Crowding Out Effect With The Help of GDP?M Waqar ZahidNessuna valutazione finora

- Money Growth and Inflation LessonDocumento27 pagineMoney Growth and Inflation Lessonlarasetiari123Nessuna valutazione finora

- Monetary and Fiscal PolicyDocumento5 pagineMonetary and Fiscal PolicyJanhavi MinochaNessuna valutazione finora

- Quiz+5 SolutionDocumento4 pagineQuiz+5 SolutionM Saqib ShahzadNessuna valutazione finora

- Online Test 1 Memo Unit 1 and 2 2022Documento2 pagineOnline Test 1 Memo Unit 1 and 2 2022ndonithando2207Nessuna valutazione finora

- Interest Rates and The Loanable Funds FrameworkDocumento4 pagineInterest Rates and The Loanable Funds FrameworkIvy RosalesNessuna valutazione finora

- Monetary PolicyDocumento10 pagineMonetary PolicykafiNessuna valutazione finora

- Macroeconomics CH 7Documento32 pagineMacroeconomics CH 7karim kobeissiNessuna valutazione finora

- Major Economic Indicators of Successful & Declining EconomiesDocumento9 pagineMajor Economic Indicators of Successful & Declining EconomiesAli Zafar0% (1)

- Resumen de Exposicion 7Documento6 pagineResumen de Exposicion 7Rafael GaliciaNessuna valutazione finora

- What Distinguishes Money From Other Assets in The Economy?: Week 3 QuestionsDocumento6 pagineWhat Distinguishes Money From Other Assets in The Economy?: Week 3 QuestionsWaqar AmjadNessuna valutazione finora

- Chap30 Tut8Documento3 pagineChap30 Tut8Nghiêm Trường GiangNessuna valutazione finora

- Lecturer-Led Tutorial Chapter 5 (2023)Documento9 pagineLecturer-Led Tutorial Chapter 5 (2023)Ncebakazi DawedeNessuna valutazione finora

- EC101 Revision Questions - Graphical Analysis - SolutionsDocumento10 pagineEC101 Revision Questions - Graphical Analysis - SolutionsZaffia AliNessuna valutazione finora

- ECN 111 Ch 13 Money, Interest Rates & InflationDocumento3 pagineECN 111 Ch 13 Money, Interest Rates & InflationmustafaNessuna valutazione finora

- Interest RatesDocumento18 pagineInterest Ratesapi-555390406Nessuna valutazione finora

- Tutorial 9 AnswersDocumento4 pagineTutorial 9 AnswersFahad Afzal Cheema50% (2)

- Money and Inflation - Mankiw CH: 4Documento5 pagineMoney and Inflation - Mankiw CH: 4Shiza NaseemNessuna valutazione finora

- Literature Review On Money Supply and InflationDocumento5 pagineLiterature Review On Money Supply and Inflationea8dpyt0100% (1)

- It Starts With InflationDocumento3 pagineIt Starts With InflationVelayNessuna valutazione finora

- Ch. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocumento11 pagineCh. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandBing TinsleyNessuna valutazione finora

- Principles of MacroeconomicsDocumento52 paginePrinciples of Macroeconomicsmoaz21100% (1)

- Inflation, Unemployment and The Fed: Real GDPDocumento5 pagineInflation, Unemployment and The Fed: Real GDPKaterina McCrimmonNessuna valutazione finora

- Seigniorage:: Interest Rate. If I Denotes The Nominal Interest Rate, R The Real Interest Rate, and P The Rate ofDocumento2 pagineSeigniorage:: Interest Rate. If I Denotes The Nominal Interest Rate, R The Real Interest Rate, and P The Rate ofSadi MohaiminulNessuna valutazione finora

- Technical Questions 1 and 3 On P. 414. in Our Textbook Pg. No. 444Documento4 pagineTechnical Questions 1 and 3 On P. 414. in Our Textbook Pg. No. 444Ehab ShabanNessuna valutazione finora

- InflationDocumento2 pagineInflationandm.enactusftuNessuna valutazione finora

- (Macro) Bank Soal Uas - TutorkuDocumento40 pagine(Macro) Bank Soal Uas - TutorkuDella BianchiNessuna valutazione finora

- Economic Report of The President, Show Recent Variations in Rates For High-Quality orDocumento6 pagineEconomic Report of The President, Show Recent Variations in Rates For High-Quality orAida FitrianaNessuna valutazione finora

- Money Demand, Interest Rates and InflationDocumento21 pagineMoney Demand, Interest Rates and InflationSadaqatullah NoonariNessuna valutazione finora

- HandoutsDocumento3 pagineHandoutsdratzky3658Nessuna valutazione finora

- Jamal Abdul Nasir Discusses Monetary Policy and Open EconomiesDocumento3 pagineJamal Abdul Nasir Discusses Monetary Policy and Open EconomiesMalielMaleo YTchannelNessuna valutazione finora

- 2008.04.28 - John Mauldin - The Velocity of MoneyDocumento7 pagine2008.04.28 - John Mauldin - The Velocity of MoneyTREND_7425Nessuna valutazione finora

- Monetary Policy PDFDocumento7 pagineMonetary Policy PDFDaniel SozonovNessuna valutazione finora

- How to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongDa EverandHow to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongNessuna valutazione finora

- Impact of Inflation On Purchasing PowerDocumento34 pagineImpact of Inflation On Purchasing Powermuhammadtahir012Nessuna valutazione finora

- IB ECONOMICS: Central Banks and Monetary PolicyDocumento46 pagineIB ECONOMICS: Central Banks and Monetary PolicyTanvi Shukla (Yr. 21-23)Nessuna valutazione finora

- Ec103 Week 09 and 10 s14Documento44 pagineEc103 Week 09 and 10 s14юрий локтионовNessuna valutazione finora

- CHAPTER 14 PowerPoint Presentation 1-1Documento22 pagineCHAPTER 14 PowerPoint Presentation 1-1Cyrine EliasNessuna valutazione finora

- UntitledDocumento164 pagineUntitledDrRaghavendra GulgiNessuna valutazione finora

- Finland As A Knowledge Economy - Carl J Dahlman - Jorma RouttiDocumento136 pagineFinland As A Knowledge Economy - Carl J Dahlman - Jorma Routtim_kv1363Nessuna valutazione finora

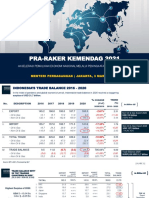

- Pra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDocumento38 paginePra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDedy Lampe PRayaNessuna valutazione finora

- The Effect of Financial Innovation and Bank Competition On Firm Value - A Comparative Study of Malaysian and Nigerian BanksDocumento9 pagineThe Effect of Financial Innovation and Bank Competition On Firm Value - A Comparative Study of Malaysian and Nigerian BanksMayowa AriyibiNessuna valutazione finora

- Impact of Exchange Rate On The Performance of Small and Medium Enterprises in NigeriaDocumento7 pagineImpact of Exchange Rate On The Performance of Small and Medium Enterprises in NigeriaEditor IJTSRD100% (1)

- Tutorial 3 Suggested SolutionsDocumento5 pagineTutorial 3 Suggested Solutionsrais husseinNessuna valutazione finora

- Madagascar Country Analysis - Poor Economy Hampered by InstabilityDocumento9 pagineMadagascar Country Analysis - Poor Economy Hampered by InstabilitySimon WoolhouseNessuna valutazione finora

- Rwanda Employment JobsDocumento107 pagineRwanda Employment JobsAbdifatah Ali MohamedNessuna valutazione finora

- National IncomeDocumento1 paginaNational IncomeAnmol SinghNessuna valutazione finora

- Trends in Public & Private Sector in India.: BY: Ashutosh Gupta Krishan KumarDocumento29 pagineTrends in Public & Private Sector in India.: BY: Ashutosh Gupta Krishan KumarAkashdeep GhummanNessuna valutazione finora

- CH 4 Economics Systems and Market MethodsDocumento12 pagineCH 4 Economics Systems and Market MethodsSadi Mohammad HridoyNessuna valutazione finora

- Sustainability 12 03411 PDFDocumento11 pagineSustainability 12 03411 PDFLallyn BaylesNessuna valutazione finora

- 3.1 The Level of Overall Economic ActivityDocumento12 pagine3.1 The Level of Overall Economic ActivityRaffaella PeñaNessuna valutazione finora

- The Age of Perplexity - BBVA OpenMindDocumento373 pagineThe Age of Perplexity - BBVA OpenMindPakDefenderDefenderNessuna valutazione finora

- Financial Planning Tools and ConceptDocumento22 pagineFinancial Planning Tools and ConceptRonamay ParNessuna valutazione finora

- Research On Bangladesh Readymade GarmentsDocumento128 pagineResearch On Bangladesh Readymade GarmentsSk.Ashiquer Rahman100% (5)

- 16 Anwar Amar IqbalDocumento38 pagine16 Anwar Amar IqbalVaibhav KaushikNessuna valutazione finora

- Qizz 1,2,4Documento60 pagineQizz 1,2,4Đào Duy TúNessuna valutazione finora

- Malaysia Investment Performance Report 2020 Highlights ResilienceDocumento142 pagineMalaysia Investment Performance Report 2020 Highlights ResilienceMuhammad Redzwan Bin IsmailNessuna valutazione finora

- ECO 461.26 - OutlineDocumento6 pagineECO 461.26 - OutlinewiliamkrintonNessuna valutazione finora

- Investment Opportunity in Manufacturing Industry PDFDocumento34 pagineInvestment Opportunity in Manufacturing Industry PDFGashaw AlelignNessuna valutazione finora

- Risks 11 00076 v2Documento25 pagineRisks 11 00076 v2Rudana SausanNessuna valutazione finora

- Corbo-V Lüders, R. Spiller P. The Institutional Foundations of Economic Reforms...Documento44 pagineCorbo-V Lüders, R. Spiller P. The Institutional Foundations of Economic Reforms...Anonymous cWCcgiNessuna valutazione finora

- Economic Survey Eng2019-20Documento172 pagineEconomic Survey Eng2019-20Kamal JaswalNessuna valutazione finora

- Mekdes DawitDocumento76 pagineMekdes DawitBereket RegassaNessuna valutazione finora

- The Economic Landscape - Country Review - VenezuelaDocumento9 pagineThe Economic Landscape - Country Review - VenezuelaPamela MahinayNessuna valutazione finora

- CLASS 10 CH-1 ECO DEVELOPMENT Question AnswersDocumento8 pagineCLASS 10 CH-1 ECO DEVELOPMENT Question AnswersDoonites DelhiNessuna valutazione finora

- Microsoft Word - Sabeco - MarketingplanDocumento40 pagineMicrosoft Word - Sabeco - MarketingplanMai Hai Au0% (1)

- Economics Edexcel Theme2 Workbook Answers 1Documento40 pagineEconomics Edexcel Theme2 Workbook Answers 1Thais LAURENTNessuna valutazione finora

- Untitled5 PDFDocumento32 pagineUntitled5 PDFMariam AlbannaNessuna valutazione finora