Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Ruling 5 (English)

Caricato da

samaanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Ruling 5 (English)

Caricato da

samaanCopyright:

Formati disponibili

AP

MALDIVES INLAND REVENUE AUTHORITY

Mal6. Rcpublic of Maldi\es

TAX RULING

Reference Number: 220-PR./TR/201 l/5

Datei To: Subject:

2l

December 2Ol I

All cST Registered persons

Change of Rate of Goods and Services Tax on I Januarv 2012

Time of supply when the rate of tax changes

l.

Section 17 of the Goods and Services Tax Acr shall apply lo determine the time of supply when the rate of tax changes in accordance with Scctions 15 or 16 of the Act,

or otherwise.

2.

Where the recipient of a good or service makes full or partial payment, tax shall be

accounted for on the full amount of the value of that good or service in accordance

with Scction l7(a) ofrhe Acr, excepl where Secrion l7(b) ofthe Acr applics, in which

case tax shall be accounted

for in accordance with that subsection. As per Section

has been agrccd

l7(b) of the Act, where payment for the supply of goods and services

to be made within a stipulated period under an inslallment agreement, payments made accordingly shall bc regardcd as separatc taxablc tmnsactions, and the time of supply

of goods and seftices in relation to iuy such transaction shall be deemed to be the date on which the installmcnt payment was rcceived, or the date on which the

installment paymcnt would otherwise fall due, whichever is earlier.

Cut-off date

3. If a registered

person supplies goods and services on a 24-hour basis, the rate of tax

applicablc to thc value of supplies made beforc 00:00 hours on I January 2012 shall

bc 3.57c (three point flvc pcr cent) and thc ratc of tax applicable to the value of

supplies made on or after 00:00 hours on I January 2012 shall be 60l. (six per cenl).

Maldi\e\ Inlad Re\enue Aurhont). T Auitdin-{. Amccns V!gu_ Matc. 10379. Mrtdi\A Tcl: (960) 132 2261. Fux: (960) :13 | 657?, E-nrait: info@rDn!.go!.mv, wcbsirc: wws..miru.rdt.m!

2-

4.

Persons not falling within paragraph 3

ofthis Ruling shull apply the rate of tax of67.

(six per cent) to lhe value of supplies made from the time of opening their business on

I January 2012.

Anti-avoidance rule

5. A rcgistered

person shall not conduct any transaction with the intent of avoiding or

evading tax, whether by ananging tbr the supply of a good or service to be made ar a particular time, or otherwise.

6.

A registered person shall be considered to be avoiding tax il

a tax invoice is issued or

any advance payment is received with respect ro the supply of a good or service that is

not consistent with lhe registered person s practice of issuing invoices and receiving

advance payments for such supplies in the absence ol a change in the rate

7.

oftax.

Registered persons shall submit the following particulars, where applicable, to

the M|RA by 29 January Z)12, using rhe tbrmat in Annoi I ro this Ruling:

(a) Details

of

advance payments receivcd and tax invoices issued between

September 201

and

3l

December 201 I, relating to goods or services that were or

would be physically supplied on or afrer I January 2012.

(b) Details

of

advancc payments received and tax invoices issued between

September 2010 and 3 | December 2010, relating to goods or services that were or

would be physically supplied on or after I January 201 L

Should you have any querics. please call us al

14 | 5

or email us al tcf@ mira.gov.mv.

azeed

mmissioner General of Taxation

Tc| (960)312

Maldives Iiland Rcvcnue Aurhoriry, T Building, Amccnee Magu. Mxtc 20t79, Maktiles

2261. F|lrr(9601331 65?7,

E-muil inlb@rmi.a.go!.ov. wchsite: www.nna.go!.lnv

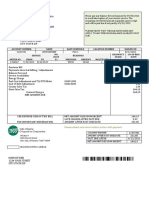

-3Annex 1: Details of Advance Pqlments Received and Tax Invoices Issued

TIN:

Taxpayer Name:

Details of Advance Pavments Received

Total Vtlue ofAdvancr Payments Received iD 2q!! for Goods and Srvices Supplied on or rfter I January 2gle *

Total Vrlue of Advonc! Payments Received ln 20!0 for Goods and Service! Supplld on or after I January 2011 *

fl

30 Septemher

MvR flusD

! MvR LUSD

November Decembcr

Details of Tax Invoices Issued

Totrl Value of Trx Invoices Issued Tottl Value of Tax Invoics Issued In 291! for Goods and Servics in 2010 for tus snd Sftic.es Supplid on or after I January Supplied on or allier I JaDuary

w.

mtt.

!

30 Scotember

MvR

LlusD

MvR f]usD

* Anaunt

erdtllitrc GST/T.GST

rll:

Maldilcs Inland Rcvcnuc Aurhoriry, T-Bu,tding. Amccne Magu. M.1. 20379. Matdivcs (96{)).1:r: 2261. F,x, (960) 131 657?. E-mail: inn,(dmia.so!.m\. wcb\irc: w*w.mira.!o\ mr

Potrebbero piacerti anche

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Udai Suthraya and Puththamansa Suthraya - Daham VilaDocumento18 pagineUdai Suthraya and Puththamansa Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Anapanasathi Suthraya and Maha Rahulowada Suthraya - Daham VilaDocumento21 pagineAnapanasathi Suthraya and Maha Rahulowada Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Exploring the Life and Works of F.N. de SilvaDocumento18 pagineExploring the Life and Works of F.N. de SilvaSamitha SandanuwanNessuna valutazione finora

- AnathapindikaAndSangnajaneeyaSuthraya - Daham VilaDocumento18 pagineAnathapindikaAndSangnajaneeyaSuthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Aditta Pariyaya and Kummopama Suthra - Daham VilaDocumento18 pagineAditta Pariyaya and Kummopama Suthra - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Upasena Suthraya and Awassutha Pariyaya Suthraya - Daham VilaDocumento17 pagineUpasena Suthraya and Awassutha Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Udai Suthraya and Puththamansa Suthraya - Daham VilaDocumento18 pagineUdai Suthraya and Puththamansa Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Sona Suthraya and Pariyaya Suthraya - Daham VilaDocumento20 pagineSona Suthraya and Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Sona Suthraya and Pariyaya Suthraya - Daham VilaDocumento20 pagineSona Suthraya and Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- 380.760: Corporate Finance: Payout PolicyDocumento17 pagine380.760: Corporate Finance: Payout PolicysamaanNessuna valutazione finora

- Wakkalee and Sakkayadittippahana Suthraya PDFDocumento22 pagineWakkalee and Sakkayadittippahana Suthraya PDFvasanthapradeepNessuna valutazione finora

- Waththupama Suthraya and Aggee Suthraya - Daham VilaDocumento16 pagineWaththupama Suthraya and Aggee Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- Waththupama Suthraya and Aggee Suthraya - Daham VilaDocumento16 pagineWaththupama Suthraya and Aggee Suthraya - Daham VilaDaham Vila BlogspotNessuna valutazione finora

- The Thuparama Temple at AnuradhapuraDocumento5 pagineThe Thuparama Temple at AnuradhapurasamaanNessuna valutazione finora

- Finance Lecture 9Documento15 pagineFinance Lecture 9samaanNessuna valutazione finora

- StelazineDocumento3 pagineStelazinesamaanNessuna valutazione finora

- 380.760: Corporate Finance: Payout PolicyDocumento17 pagine380.760: Corporate Finance: Payout PolicysamaanNessuna valutazione finora

- Lect 2Documento23 pagineLect 2ssregens82Nessuna valutazione finora

- Eval Food CostDocumento7 pagineEval Food CostsamaanNessuna valutazione finora

- 380.760: Corporate FinanceDocumento17 pagine380.760: Corporate Financessregens82Nessuna valutazione finora

- 380.760: Corporate Finance: Financing ProjectsDocumento19 pagine380.760: Corporate Finance: Financing Projectsssregens82Nessuna valutazione finora

- Ethics Hotel ManagerDocumento2 pagineEthics Hotel ManagersamaanNessuna valutazione finora

- Finance Lecture 3Documento21 pagineFinance Lecture 3samaanNessuna valutazione finora

- Lect 5Documento21 pagineLect 5ssregens82Nessuna valutazione finora

- Finance Lecture 3Documento21 pagineFinance Lecture 3samaanNessuna valutazione finora

- Lect 1Documento22 pagineLect 1ssregens82Nessuna valutazione finora

- Lect 4Documento23 pagineLect 4ssregens82Nessuna valutazione finora

- Class Note On Valuing Swaps: Corporate Finance Professor Gordon BodnarDocumento7 pagineClass Note On Valuing Swaps: Corporate Finance Professor Gordon Bodnarssregens82Nessuna valutazione finora

- Law On Foreign Investments in The Republic of MaldivesDocumento3 pagineLaw On Foreign Investments in The Republic of MaldivessamaanNessuna valutazione finora

- Lect 1Documento22 pagineLect 1ssregens82Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Master Services Agreement: Appen Butler Hill Pty, LTDDocumento14 pagineMaster Services Agreement: Appen Butler Hill Pty, LTDHappy manansalaNessuna valutazione finora

- Chapter 6 Monitoring and ControllingDocumento86 pagineChapter 6 Monitoring and ControllingJeff PanNessuna valutazione finora

- International Trade Theories: Course Pack - Unit II - IBEDocumento29 pagineInternational Trade Theories: Course Pack - Unit II - IBESagar BhardwajNessuna valutazione finora

- British CivilisationDocumento12 pagineBritish CivilisationMina AmounaNessuna valutazione finora

- Cottage Savings Assn V CirDocumento7 pagineCottage Savings Assn V CirKTNessuna valutazione finora

- How To Calculate Custom Duty: Compiled by DR Renu AggarwalDocumento6 pagineHow To Calculate Custom Duty: Compiled by DR Renu AggarwalJibran SakharkarNessuna valutazione finora

- 2019 Spring Ans (Q35 Ans Is C)Documento24 pagine2019 Spring Ans (Q35 Ans Is C)Zoe LamNessuna valutazione finora

- PD 1530, Eo 538Documento4 paginePD 1530, Eo 538givemeasign24Nessuna valutazione finora

- UntitledDocumento11 pagineUntitleddeepika devsaniNessuna valutazione finora

- 2019 07 23 09 00 40 881 - 452619484 - PDFDocumento6 pagine2019 07 23 09 00 40 881 - 452619484 - PDFSadhana TiwariNessuna valutazione finora

- The Savers-Spenders Theory of Fiscal Policy: by N. GDocumento10 pagineThe Savers-Spenders Theory of Fiscal Policy: by N. Gmaba424Nessuna valutazione finora

- DISPOSAL OF SUBSIDIARY SHARESDocumento9 pagineDISPOSAL OF SUBSIDIARY SHARESCourage KanyonganiseNessuna valutazione finora

- A-LEVEL European - History NOTES PDFDocumento642 pagineA-LEVEL European - History NOTES PDFmukholi100% (13)

- Salary, House Property and Other Income ITRDocumento6 pagineSalary, House Property and Other Income ITRHemant PatelNessuna valutazione finora

- Fa2 Final Final ReportDocumento15 pagineFa2 Final Final ReportMohammadNessuna valutazione finora

- Revised CPALE Syllabus - EditableDocumento19 pagineRevised CPALE Syllabus - EditableBromanineNessuna valutazione finora

- PNB vs. SantosDocumento2 paginePNB vs. SantosAyi Anigan100% (1)

- QuestionDocumento16 pagineQuestionda5ew99Nessuna valutazione finora

- Covering Letter-For Karanam Ind-PebDocumento13 pagineCovering Letter-For Karanam Ind-PebswapnilNessuna valutazione finora

- Dilg Joincircular 2016815 81d0d76d7eDocumento16 pagineDilg Joincircular 2016815 81d0d76d7eRaidenAiNessuna valutazione finora

- Zeian Cover RevisedDocumento13 pagineZeian Cover Revisedcherry valeNessuna valutazione finora

- Project Report (ABBOTT)Documento29 pagineProject Report (ABBOTT)MohsIn IQbalNessuna valutazione finora

- Accounting For Government and Non-Profit OrganizationsDocumento13 pagineAccounting For Government and Non-Profit OrganizationsPatricia ReyesNessuna valutazione finora

- C - L ElectricDocumento1 paginaC - L ElectricNoel FrömgenNessuna valutazione finora

- Print 1stDocumento1 paginaPrint 1stChristine Marie RamirezNessuna valutazione finora

- PaymentDocumento1 paginaPaymentPepe PeprNessuna valutazione finora

- Sec 443Documento11 pagineSec 443Mubeen NavazNessuna valutazione finora

- Gh-Morocco DtaDocumento2 pagineGh-Morocco DtabatuchemNessuna valutazione finora

- Gross Income 2b Received by or Accrued NotesDocumento27 pagineGross Income 2b Received by or Accrued Notestumonekongo02Nessuna valutazione finora