Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Telecommunications

Caricato da

Niks DujaniyaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Telecommunications

Caricato da

Niks DujaniyaCopyright:

Formati disponibili

Telecommunications Strategy

We help telecom companies and business units on critical strategic issues, ranging from which markets to target to which capabilities will yield a sustainable competitive advantage.

Global and regional telecom players face an increasing number of critical challenges, from traffic monetization to capital and labor productivity in mature markets to intensified competition in developing and emerging markets. We help a wide range of participants to understand these trends, including equipment and systems manufacturers, fixed- and mobile-service providers, and content and applications players. Our global practice serves incumbent companies in both mature and emerging markets, as well as new entrants in rapidly evolving markets in Asia and Africa. Given this broad perspective, McKinseys team can provide companies with uniquely informed strategic insight.

What we do

Our strategy work reflects the complex issues faced by telecom participants, and we bring demonstrable expertise in:

Corporate and portfolio strategy

More than 90 percent of telcos growth is determined by the dynamics of markets in which they compete. Accordingly, we help companies answer the most important strategic question where to play?by analyzing growth, profitability, and capital intensity of international and adjacent markets.

Business-unit strategy

Successful business unit strategies combine true sources of competitive advantage with privileged, granular insight to beat the market. We help operators identify pockets of opportunities and how to capture themincluding the level of commitment required in the boardroom as well as by the frontline managers.

Innovation strategy

Fewer than 10 percent of innovations become commercially successful, yet innovation is one of the greatest sources of competitive advantage, especially in telecom. We help companies develop the governance, processes, and skills needed to achieve continuous innovation at scale.

Regulatory strategy

Recent policy and regulatory regime changes illustrate how much of telecom companies value depends upon regulation. Whether it is meeting net neutrality standards, dissecting governments role in building new generation networks, or analyzing proposed taxes, McKinsey helps clients anticipate, understand and develop strategies to operate within regulatory environments.

Who we are

The 250 partners who lead McKinseys Telecom Practice bring broad strategy experience as well as specialized industry expertise in subsectors or organization functions and capabilities. Our strategy teams draw on McKinseys expertise and assets in areas such as corporat e finance, marketing and sales to provide operators with comprehensive support.

Recent examples of our work

Restructuring business portfolios to diagnose strengths and weaknesses and identify ways to maximize value creation Discovering ways to better leverage corporate or business-unit assets and capabilities for greater enterprise synergy and competitive impact Identifying the right mix of distinctive business, organizational, and technical capabilities needed to execute strategy effectively

Proprietary tools and insights

Our insights into winning strategies in telecom and, more generally, global business dynamic can be found in a variety of publications, including: Global Forces, research that incorporates original analysis and insight from more than 1,000 executives to identify five forces that will profoundly affect the global economy and their implications for global companies The Granularity of Growth, based upon proprietary research and written by three McKinsey strategists who dissect how to identify sources of growth in an era of hypercompetition and hyperglobalization NMIncite, a joint venture between Nielsen and McKinsey, analyzes consumer conversations in traditional and social media to gain real-time insights on products, topics, and brands. The analysis recently served as basis for a four-part series on mobile apps, including Transforming Branded Apps into Category Killers

Indian Telecom Industry

Last Updated: September 2013

Introduction India is the worlds second-largest telecommunications market, with 898 million subscribers as on March 2013. The sector's revenue grew by 13.4 per cent to reach US$ 64.1 billion in FY12. Telecom infrastructure in India is expected to increase at a compound annual growth rate (CAGR) of 20 per cent during 2008-15 to reach 571,000 towers in 2015. Internet traffic in India is expected to reach to 2.5 exabytes per month in 2017 from 393 petabytes per month in 2012, as per a Cisco study. In addition, the wireless connectivity in India is expected to grow at about 40 per cent traffic by 2017, up from 38 per cent in 2012. India has immense opportunities for telecom operators and is one of the best markets for telecom business. Right now, we feel the Indian market is ripe for M&A stories, highlighted Mr Dmitry Shukov, CEO, Sistema Shyam Teleservices (SSTL). Key Statistics India has recorded 55.48 crore mobile users as per Juxts study titled, India Mobile Landscape (IML) 2013. More than 29.8 crore, about 54 per cent, of these device owners are in rural areas as compared to 25.6 crore in cities and towns," added Mr Mrutyunjay, Co-founder, Juxt. The telecommunications industry attracted foreign direct investments (FDI) worth US$ 12,866 million during April 2000 to June 2013, an increase of 7 per cent to the total FDI inflows, according to data published by Department of Industrial Policy and Promotion (DIPP). Moreover, the cumulative revenue of telecom service providers was recorded at Rs 54,284 crore (US$ 8.32 billion) in the January-March 2013 quarter, as per Telecom Regulatory Authority of India (TRAI) data. Market Dynamics The Indian mobile phone market is highly competitive with more than 150 device manufacturers trying to attract the consumers with their schemes and offers. Most of these producers focus their efforts on the low-cost feature phone market, which constitutes over 91 per cent of overall mobile phone sales, offering a huge scope for growth. India added 1.49 million GSM subscribers in July 2013, taking the total GSM user base in India to 672.63 million. Moreover, in June 2013 the GSM telecom operators added 2.33 million new subscribers, to take the user base to 271.6 million at the end of the month, according to the data released by Cellular Operators Association of India (COAI) The GSM incumbentsBharti Airtel, Vodafone and Idea Cellularhave jointly crossed 70 per cent in revenue market share and had a 99.6 per cent share of the incremental revenues during the June 2013 quarter, as per the latest figures released by TRAI. The mobile value-added services (MVAS) market is expected to reach US$ 9.5 billion in 2015, from US$ 4.9 billion in 2012, as per a joint research report by Wipro Technologies and the Internet and Mobile Association of India (IAMAI). A total of 9.4 million smartphones were shipped into the country, registering a growth of 167.3 per cent on an annual basis. India also witnessed 73.5 million mobile handset shipments for the January-April 2013 period.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- OilGas DCF NAV ModelDocumento21 pagineOilGas DCF NAV ModelbankiesoleNessuna valutazione finora

- CFAS - Prelims Exam With AnsDocumento12 pagineCFAS - Prelims Exam With AnsAbarilles, Sherinah Mae P.Nessuna valutazione finora

- Procurement SOP SummaryDocumento12 pagineProcurement SOP SummaryFarhan100% (1)

- HeyDocumento35 pagineHeyMarth0100% (1)

- Options, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankDocumento6 pagineOptions, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankKevin Molly KamrathNessuna valutazione finora

- Question P8-1A: Cafu SADocumento29 pagineQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Project Report on IPO in IndiaDocumento7 pagineProject Report on IPO in IndianeetliNessuna valutazione finora

- Indian Consumer Durables MarketDocumento54 pagineIndian Consumer Durables MarketNiks Dujaniya75% (12)

- Homeware Products 15 PagesDocumento19 pagineHomeware Products 15 PagesNiks DujaniyaNessuna valutazione finora

- Prasanna Resume 2016NEWDocumento2 paginePrasanna Resume 2016NEWNiks DujaniyaNessuna valutazione finora

- Comprehensive Industry Document On Coffee Processing IndustryDocumento76 pagineComprehensive Industry Document On Coffee Processing IndustryepebeNessuna valutazione finora

- Hotel Management Power Point Presentation .Documento20 pagineHotel Management Power Point Presentation .Niks DujaniyaNessuna valutazione finora

- Corrected SynopsisDocumento7 pagineCorrected SynopsisNiks DujaniyaNessuna valutazione finora

- Book 1Documento5 pagineBook 1Niks DujaniyaNessuna valutazione finora

- Consumer CaseDocumento6 pagineConsumer CaseNiks DujaniyaNessuna valutazione finora

- RAKESH PAWAR'S BIO DATADocumento1 paginaRAKESH PAWAR'S BIO DATANiks DujaniyaNessuna valutazione finora

- Amul CompanyDocumento55 pagineAmul CompanyNiks Dujaniya100% (1)

- Research Meth.Documento31 pagineResearch Meth.Niks DujaniyaNessuna valutazione finora

- Resume: Name Swapnil Balaram Sakpal Father Name AddressDocumento1 paginaResume: Name Swapnil Balaram Sakpal Father Name AddressNiks DujaniyaNessuna valutazione finora

- Kritik Family Dhaba: Snacks (Veg)Documento6 pagineKritik Family Dhaba: Snacks (Veg)Niks DujaniyaNessuna valutazione finora

- Samsung Group: A Global Electronics GiantDocumento19 pagineSamsung Group: A Global Electronics GiantNiks Dujaniya100% (1)

- Sangeeth VargheseDocumento20 pagineSangeeth VargheseNiks DujaniyaNessuna valutazione finora

- Balance Sheet of Cadbury IndiaDocumento1 paginaBalance Sheet of Cadbury IndiaNiks Dujaniya100% (1)

- Personal Investment and Taxes PlanningDocumento28 paginePersonal Investment and Taxes PlanningNiks DujaniyaNessuna valutazione finora

- Budgetary Control of IndiaDocumento30 pagineBudgetary Control of IndiaNiks DujaniyaNessuna valutazione finora

- BCT Annual Report 2011 FinalDocumento29 pagineBCT Annual Report 2011 FinalNiks DujaniyaNessuna valutazione finora

- New Project Report CadburyDocumento66 pagineNew Project Report CadburypriyapangamNessuna valutazione finora

- Marketing in BankingDocumento59 pagineMarketing in BankingNiks Dujaniya100% (1)

- Tax PlanningDocumento8 pagineTax PlanningRaunak BhadaniNessuna valutazione finora

- Indian Money MarketDocumento33 pagineIndian Money MarketNiks DujaniyaNessuna valutazione finora

- Samsung Group: A Global Electronics GiantDocumento19 pagineSamsung Group: A Global Electronics GiantNiks Dujaniya100% (1)

- KMES College explores cultural value of mathematicsDocumento11 pagineKMES College explores cultural value of mathematicsNiks DujaniyaNessuna valutazione finora

- RAKESH PAWAR'S BIO DATADocumento1 paginaRAKESH PAWAR'S BIO DATANiks DujaniyaNessuna valutazione finora

- Personal Investment and Taxes PlanningDocumento28 paginePersonal Investment and Taxes PlanningNiks DujaniyaNessuna valutazione finora

- Corporate Tax PlanningDocumento21 pagineCorporate Tax Planninggauravbpit100% (3)

- The Role of Development Banks in The Twenty First CenturyDocumento30 pagineThe Role of Development Banks in The Twenty First CenturyNiks DujaniyaNessuna valutazione finora

- Labor CostsDocumento3 pagineLabor CostsNicolas MercadoNessuna valutazione finora

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Documento1 pagina007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamNessuna valutazione finora

- Two Methods To Find Out The Profit or Loss From Incomplete RecordsDocumento5 pagineTwo Methods To Find Out The Profit or Loss From Incomplete RecordsayyazmNessuna valutazione finora

- Topic 2 Complex GroupDocumento11 pagineTopic 2 Complex GroupSpencerNessuna valutazione finora

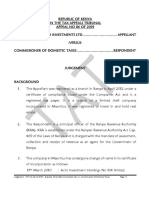

- Judgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesDocumento20 pagineJudgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesPhilip MwangiNessuna valutazione finora

- (Sffis: The 8tel. 735 9807 AccountancyDocumento18 pagine(Sffis: The 8tel. 735 9807 AccountancyCharry RamosNessuna valutazione finora

- Efficient solid waste management in TelanganaDocumento5 pagineEfficient solid waste management in TelanganaManvika UdiNessuna valutazione finora

- Week 7 Class Exercises (Answers)Documento4 pagineWeek 7 Class Exercises (Answers)Chinhoong OngNessuna valutazione finora

- Wonder Book Corp. vs. Philippine Bank of Communications (676 SCRA 489 (2012) )Documento3 pagineWonder Book Corp. vs. Philippine Bank of Communications (676 SCRA 489 (2012) )CHARMAINE MERICK HOPE BAYOGNessuna valutazione finora

- Sugar Factory CaseDocumento21 pagineSugar Factory CaseNarayan PrustyNessuna valutazione finora

- ON Dry Fish Business: Submitted byDocumento6 pagineON Dry Fish Business: Submitted byKartik DebnathNessuna valutazione finora

- Panukalang ProyektoDocumento10 paginePanukalang ProyektoIsidro Jungco Remegio Jr.Nessuna valutazione finora

- For The Families of Some Debtors, Death Offers No RespiteDocumento5 pagineFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsNessuna valutazione finora

- Meenachi RKDocumento7 pagineMeenachi RKmeenachiNessuna valutazione finora

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocumento3 pagineMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNessuna valutazione finora

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Documento2 pagineMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Lenaj EbronNessuna valutazione finora

- Annual Report of Honda AtlasDocumento1 paginaAnnual Report of Honda AtlaskEBAYNessuna valutazione finora

- PWC Emerging Logistics Trends 2030Documento64 paginePWC Emerging Logistics Trends 2030Jeffrey NsambaNessuna valutazione finora

- Buku Teks David L.Debertin-293-304Documento12 pagineBuku Teks David L.Debertin-293-304Fla FiscaNessuna valutazione finora

- Audit Cash Investments TitleDocumento7 pagineAudit Cash Investments TitleIulia BurtoiuNessuna valutazione finora

- Act1110 Quiz No. 1 Legal Structures QuestionnaireDocumento9 pagineAct1110 Quiz No. 1 Legal Structures QuestionnaireKhloe Nicole AquinoNessuna valutazione finora

- 8 13Documento5 pagine8 13Konrad Lorenz Madriaga UychocoNessuna valutazione finora

- MANAGEMENT Spice JetDocumento21 pagineMANAGEMENT Spice JetAman Kumar ThakurNessuna valutazione finora