Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

G&A103 Travel and Entertainment

Caricato da

Hassan GardeziCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

G&A103 Travel and Entertainment

Caricato da

Hassan GardeziCopyright:

Formati disponibili

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

SOP # Revision: Effective Date: Title: Policy:

Prepared by: Approved by:

G&A103 TRAVEL AND ENTERTAINMENT All reservations required for business travel and entertainment will be made through the Travel Coordinator. Expenses are to be within established company guidelines and will be reimbursed with proper documentation. Employees are expected to spend the Companys money as carefully and judiciously as they would their own. The Company recognizes that employees who travel far from home to represent the company's business interests must forego their living accommodations and may forfeit personal time. Accordingly, the Company will make efforts to provide comfortable and secure accommodations for lodging, meals and travel for employees. However, these items are not intended to be perquisites and the Company reserves the right to deny reimbursement of expenses that are considered lavish or extravagant.

Purpose:

To provide guidelines for travel and entertainment expenses as they were actually spent, account for all advances promptly and accurately and to communicate the procedures for reimbursement. This procedure applies to all departments and individuals who travel or entertain for the company. Travel Coordinator is responsible for making arrangements needed for business travel. Accounting Department will receive and review the expense report documentation and process necessary employee reimbursement.

Scope:

Responsibilities:

Procedure: 1.0 1.1 TRAVEL ARRANGEMENTS All arrangements required for business travel are to be made through the Travel Coordinator. The coordinator can solicit better corporate discounts and rates for hotels, airlines, car rental agencies and travel agencies. Employees benefit because they do not have to spend their own time comparing rates and making their own arrangements. To arrange for travel, complete the G&A103 Ex1 TRAVEL ARRANGEMENTS FORM with all pertinent information and receive departmental approval. The form should then be forwarded to the Travel Coordinator. For maximum savings on airfares, this form should always be completed at least 15 days in advance unless an emergency trip is required. It is preferable that all employees travel during non-working hours to maximize efficiency. The Travel Coordinator will make arrangements for the trip as required and will return a travel itinerary and any tickets or reservation forms to the employee. Cash Advances - To help ensure accurate and timely expense report preparation and reduce the additional paperwork required to process and track Cash Advances, the

1.2

1.3

1.4

G&A103 Travel and Entertainment

page 1 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

Company generally discourages cash advances unless special circumstances apply. Employees are encouraged to use credit cards with a grace period to provide float time between incurring the expense and receiving reimbursement from the company. If an employee requires a cash advance, the amount should be completed on the travel arrangements form with a supporting explanation for the advance. The advance request will then be forwarded to accounting for processing. Travel advances should be no less than $100 and no more than $500 (for international travel). When a cash advance is received, the employee will reduce their expense reimbursement by the amount of the cash advance. In the case where the cash advance exceeds the expenses for the report submitted, the remaining cash must be turned into the accounting department with the expense report. Amounts owed the Company cannot be carried forward to future expense reports. Any advance outstanding will be deducted from the employee's paycheck. 1.5 2.0 2.1 Direct Billings - Direct billings to the Company from motels, restaurants, etc. are not permitted unless previously authorized. EXPENSE GUIDELINES Air Travel - The Travel Coordinator will make airline reservations based on the following criteria:

Expediency: Getting the employee to their destination in an expedient way. (Direct flights when possible or connecting flights if necessary for faster flight schedules). Cost: Employees will fly coach class unless extenuating circumstances apply. Air Carrier: An employee's preferred airline can be utilized as long as expediency and cost factors are equal. In most cases, airfare will be directly billed to the company's travel agency account. On occasion, employees may have no alternative but to book their own flight. If this is the case, employees must use regularly scheduled airlines and obtain the lowest (discount) fare available. This may mean that employees will fly at times that are not always the most convenient for them.

2.2

Lodging - The travel coordinator will make lodging arrangements based on value, convenience for the traveler and according to what is usual and customary company guide lines. Whenever multiple employees are traveling to the same location, employees will be required to share accommodations if possible (i.e. male/male or female/female). Lodging accommodations will then be made for double rooms accordingly. If an employee is accompanied by a non-employee such as family or a friend, and therefore requires separate accommodations, the employee will be responsible for payment of any excess lodging accommodations.

2.3

Meals - Employees will generally be responsible for obtaining their own meals while traveling. Meals do not include entertaining guests, which should be itemized as entertainment expenses.

G&A103 Travel and Entertainment

page 2 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

Meals and miscellaneous sundry items will be reimbursed according to the lesser of actual expenses or $45.00 per day. Occasionally, an employee may be traveling to a location with a higher than normal cost of living. For theses locations, including foreign travel, an employee can request an increase in the daily per diem rate, but should have it substantiated and authorized prior to departure. 2.4 Car Rentals - Advance arrangements should be made by the Travel Coordinator if a car is required at the destination. Vehicle selection will be based upon the most cost-effective class that satisfies requirements for the employee(s) and any demonstration equipment. Supplemental auto insurance coverage offered by car rental agencies is to be declined as Liability and Collision coverage is provided by the company's insurance policy. 2.5 Personal Vehicles - An employee required to use their own automobile for business will be reimbursed at the prevailing rate per tax guidelines for per-mile deductions. The employee must provide on the expense report, documentation including dates, miles traveled and purpose of each trip. The Company assumes no responsibility for personal automobiles used for business. Further, any parking or speeding violation is the sole responsibility of the employee. 2.6 Telephone - Business-related telephone charges on an itemized lodging receipt and/or telephone charge card should be itemized under telephone expense. If an employee is out-of-town on business for several days, the employee may make personal telephone calls home, as long as the charges and length of call are reasonable. 2.7 Entertainment - In order for entertainment to be a valid deductible entertainment expenses it must be an ordinary and necessary expense directly related or associated with the active conduct of business. For tax purposes, it is very important to properly document entertainment expenses and substantiate the following elements: 2.8 The date. The place (name and location). Description or type of entertainment. The business purpose and the nature of the business benefit expected to be gained by the Company. The business relationship to the Company of the persons entertained (name, occupation, title, etc.).

Miscellaneous Expenses - Any additional business expenses that are not categorized above should be listed under miscellaneous expenses and documented with all pertinent information to substantiate the expense. Non-Reimbursable Expenses - Some expenses are not considered valid business expenses by the company, yet may be incurred for the convenience of the traveling individual. Since these are not expenses for the business then they are not reimbursable. (The following can be used as a guide of expenses, which are not reimbursable) Examples include: Airline or travel insurance

2.9

G&A103 Travel and Entertainment

page 3 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

3.0 3.1

Airline or travel lounge clubs Shoe shine or Dry-cleaning (except for extended travel beyond 5 days) Movies or personal entertainment Books, magazines or newspapers Theft or loss of personal property Doctor bills, prescriptions, or other medical services Parking tickets, traffic tickets or Car towing if illegally parked Health club memberships Baby sitter or Pet care fees Barbers and Hairdressers

EXPENSE REPORT PREPARATION AND REIMBURSEMENT All business travel and entertainment expenditures incurred by employees of the Company are reimbursed through the use of the G&A103 Ex2 TRAVEL AND MISCELLANEOUS EXPENSE REPORT form and the G&A103 Ex3 ENTERTAINMENT AND BUSINESS GIFT EXPENSE REPORT form. Expense reports should be completed and turned in within two (2) weeks of return or incurrence of expenses. Expense report forms must be filled out and totaled completely. Use the appropriate headings and total on a daily basis. Required receipts for items charged must be attached to the report. Any questions regarding completion of the report should be directed to the employee's supervisor or the accounting department.

3.2

Upon completion, the expense report along with all attachments should be turned into the employee's supervisor for approval. After approval, the expense report is submitted to the accounting department for processing and reimbursement. In order to expedite reimbursement, the employee should ensure that the report is completed properly, required documentation is attached, proper authorization is obtained, and any unusual items properly explained and documented. Authorized expense reports will be reimbursed by a company check, normally within two or three weeks after receipt by the accounting department.

G&A103 Travel and Entertainment

page 4 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

Revision History: Revision 0 Date 10/13/20 13 Description of changes Initial Release Requested By

G&A103 Travel and Entertainment

page 5 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

[This page intentionally left blank]

G&A103 Travel and Entertainment

page 6 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

G&A103 Ex1 TRAVEL ARRANGEMENTS FORM

Name: Reason for Travel: Destination(s): Need to Arrive at Destination by: Date: Need to Return by: Date: Airline Preferred: Seating Preferred: (e.g. window/aisle) Car Needed: Hotel Needed:

Date:

Time: Time: am /

am / pm

pm

Yes Yes

No No

Number of Days Needed:

If Hotel is need, # of nights at which location (if employee will be going to several areas): Number of Nights at

Signature of Supervisor or Vice-President:

(Do not write below the line - for travel coordinator use only) Travel Agency: Contact: Departure: Date: Times: Departure: Airline: Flight#: Comments: Cost: Need to Ticket by: Penalties (if any): Arrival: Return: Date: Times: Departure: Airline: Flight #: Arrival: Phone:

G&A103 Travel and Entertainment

page 7 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

[This page intentionally left blank]

G&A103 Travel and Entertainment

page 8 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

G&A103 Ex2 TRAVEL AND MISCELLANEOUS EXPENSE REPORT

Name: Purpose of Trip: Dates and Details of Trip:

TRAVEL COSTS

Date No. of miles Mileage Reimburse . Parking Air Travel Ground (Car/Taxi)

LODGING

Hotel Telephone No.

MEALS

Amounts SUPPLIES (Describe Below) TOTALS

Totals

Gross Amount Less Advance

Signature: Approved by: Received by:

Date: Date: Date:

Gross Amount Less Advances Net Amount Due Employee Company (Attach Remittance)

G&A103 Travel and Entertainment

page 9 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

[This page intentionally left blank]

G&A103 Travel and Entertainment

page 10 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

G&A103 Ex3 ENTERTAINMENT AND BUSINESS GIFT EXPENSE REPORT

Name: Department: Date Place (Name & Location) Description or type of Entertainment or Gift Business Purpose / Discussion Individual / Company

(Name, title, etc.)

Amount

Totals

Signature: Approved by: Received by:

Date: Date: Date:

Gross Amount Less Advances Net Amount Due Employee Company (Attach Remittance)

G&A103 Travel and Entertainment

page 11 of 12

Accounting Policies, Procedures and Forms

paragonmultisolutions.com

[This page intentionally left blank]

G&A103 Travel and Entertainment

page 12 of 12

Potrebbero piacerti anche

- Sox Compliance ChecklistDocumento14 pagineSox Compliance ChecklistHassan GardeziNessuna valutazione finora

- Competency Chart 319Documento25 pagineCompetency Chart 319Hassan GardeziNessuna valutazione finora

- BEHAVIOURAL AND TECHNICAL COMPETENCY DICTIONARYDocumento42 pagineBEHAVIOURAL AND TECHNICAL COMPETENCY DICTIONARYjendralnyamuk100% (1)

- ACT000 Accounting Title PageDocumento1 paginaACT000 Accounting Title PageHassan GardeziNessuna valutazione finora

- DWC Rules and RegulationsDocumento78 pagineDWC Rules and RegulationsHassan GardeziNessuna valutazione finora

- Union Investments Objectives Sheet For The Year 2017 HRA OfficeDocumento1 paginaUnion Investments Objectives Sheet For The Year 2017 HRA OfficeHassan GardeziNessuna valutazione finora

- G&A102 Files and Records ManagementDocumento14 pagineG&A102 Files and Records ManagementHassan GardeziNessuna valutazione finora

- 100 IntroductionDocumento55 pagine100 IntroductionHassan GardeziNessuna valutazione finora

- G&A101 Chart of AccountsDocumento12 pagineG&A101 Chart of AccountsHassan Gardezi100% (1)

- 300 Accounting ManualDocumento53 pagine300 Accounting ManualHassan Gardezi100% (1)

- JAFZA RulesDocumento48 pagineJAFZA RulesShilpa AlaghNessuna valutazione finora

- Publicizing Iso9001 Iso14001 Certification 2010Documento11 paginePublicizing Iso9001 Iso14001 Certification 2010Rama Krishna Reddy DonthireddyNessuna valutazione finora

- GCC Food Industry Report June 2011Documento73 pagineGCC Food Industry Report June 2011myfishboneNessuna valutazione finora

- As ISO IEC 17024-2004 Conformity Assessment - General Requirements For Bodies Operating Certification of PersDocumento8 pagineAs ISO IEC 17024-2004 Conformity Assessment - General Requirements For Bodies Operating Certification of PersSAI Global - APAC100% (2)

- Org ChangeDocumento12 pagineOrg ChangeHassan GardeziNessuna valutazione finora

- How To Spend It: Obama Warns of Lengthy F Iscal CrisisDocumento56 pagineHow To Spend It: Obama Warns of Lengthy F Iscal CrisisHassan GardeziNessuna valutazione finora

- Change Management ProcessDocumento32 pagineChange Management ProcessHassan GardeziNessuna valutazione finora

- 611232.IAF-GD24-2009 Guidance On ISO 17024 Issue 2 Ver2 PubDocumento22 pagine611232.IAF-GD24-2009 Guidance On ISO 17024 Issue 2 Ver2 PubJhonny MuñozNessuna valutazione finora

- Annual Reports - 2010 - Berkshire HathawayDocumento110 pagineAnnual Reports - 2010 - Berkshire HathawayHassan GardeziNessuna valutazione finora

- Annual Reports - 2010 - Berkshire HathawayDocumento110 pagineAnnual Reports - 2010 - Berkshire HathawayHassan GardeziNessuna valutazione finora

- FT500 GlobalDocumento14 pagineFT500 GlobalHassan GardeziNessuna valutazione finora

- Brouchers - Software - 2012 - 01. CaseWare Segregation of DutiesDocumento6 pagineBrouchers - Software - 2012 - 01. CaseWare Segregation of DutiesHassan GardeziNessuna valutazione finora

- Diploma Supplement DetailsDocumento5 pagineDiploma Supplement DetailsHassan GardeziNessuna valutazione finora

- 10 Tips On Creating Training Evaluation FormsDocumento3 pagine10 Tips On Creating Training Evaluation FormsgayatrikuntalNessuna valutazione finora

- Articles - Other - 2012 - HR Training Through FilmsDocumento1 paginaArticles - Other - 2012 - HR Training Through FilmsHassan GardeziNessuna valutazione finora

- Global Salary Guide 2009Documento26 pagineGlobal Salary Guide 2009Hassan GardeziNessuna valutazione finora

- UAE Salary Guide 2013Documento19 pagineUAE Salary Guide 2013Hassan GardeziNessuna valutazione finora

- Annual Reports - 2010 - Berkshire HathawayDocumento110 pagineAnnual Reports - 2010 - Berkshire HathawayHassan GardeziNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 2 Core Principles of Fairness Accountability and TransparencyDocumento28 pagine2 Core Principles of Fairness Accountability and Transparencyrommel legaspi67% (3)

- Starting a Business: Organization Structure OptionsDocumento43 pagineStarting a Business: Organization Structure OptionsJing TampNessuna valutazione finora

- Objectives and Key ResultsDocumento20 pagineObjectives and Key ResultsDeepashree100% (1)

- Copsoq II Medium Size Questionnaire EnglishDocumento11 pagineCopsoq II Medium Size Questionnaire EnglishL_AverbookNessuna valutazione finora

- Case 2 LinkedIn and Modern Recruitment - 5!6!920210902130120Documento16 pagineCase 2 LinkedIn and Modern Recruitment - 5!6!920210902130120Ankita SinghNessuna valutazione finora

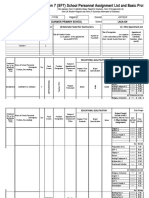

- School Form 7 (SF7) School Personnel Assignment List and Basic ProfileDocumento8 pagineSchool Form 7 (SF7) School Personnel Assignment List and Basic ProfileMarineth ArnaezNessuna valutazione finora

- KPK Professional Tax Act SummaryDocumento6 pagineKPK Professional Tax Act SummaryHumayunNessuna valutazione finora

- GCC Healthcare Sector Poised for Strong GrowthDocumento59 pagineGCC Healthcare Sector Poised for Strong GrowthToni Rose RotulaNessuna valutazione finora

- Strategic Management of WoolworthsDocumento13 pagineStrategic Management of WoolworthsAnonymous MAlCOtg1Z3Nessuna valutazione finora

- Appointment Letter Sample 1Documento4 pagineAppointment Letter Sample 1Yusnor YunusNessuna valutazione finora

- Guidelines for Selection of Service ProviderDocumento11 pagineGuidelines for Selection of Service ProviderKrishna Kumar RaiNessuna valutazione finora

- Job DescriptionDocumento4 pagineJob DescriptionSai DheerajNessuna valutazione finora

- How Mcdonalds Use Motivational TheoriesDocumento4 pagineHow Mcdonalds Use Motivational TheoriesPhuong AnhNessuna valutazione finora

- Director Business Development Sales in San Antonio TX Resume Dennis ReyesDocumento2 pagineDirector Business Development Sales in San Antonio TX Resume Dennis ReyesDennisReyesNessuna valutazione finora

- Accident Incident Reporting Treeaining Course - FSODocumento16 pagineAccident Incident Reporting Treeaining Course - FSOKarina Pérez SantosNessuna valutazione finora

- Dwnload Full Employment Law For Human Resource Practice 4th Edition Walsh Test Bank PDFDocumento7 pagineDwnload Full Employment Law For Human Resource Practice 4th Edition Walsh Test Bank PDFmaihemoynounkq3b100% (8)

- Cfas Quiz Pas 19Documento5 pagineCfas Quiz Pas 19Michaella NudoNessuna valutazione finora

- Serrano v. Gallant Maritime Services IncDocumento3 pagineSerrano v. Gallant Maritime Services IncVanessa Yvonne GurtizaNessuna valutazione finora

- Stress MGMTDocumento80 pagineStress MGMTsrn12Nessuna valutazione finora

- Economic Modelling: Rongsheng Tang, Gaowang WangDocumento20 pagineEconomic Modelling: Rongsheng Tang, Gaowang WangpalupiclaraNessuna valutazione finora

- National Occupational Classification (NOC) 2011: 7204 - Contractors and Supervisors, Carpentry TradesDocumento3 pagineNational Occupational Classification (NOC) 2011: 7204 - Contractors and Supervisors, Carpentry TradesSahil NarulaNessuna valutazione finora

- Consunji V GobresDocumento2 pagineConsunji V GobresChristine ValidoNessuna valutazione finora

- Brijesh Singh (p2) Project ReportDocumento106 pagineBrijesh Singh (p2) Project ReportBrijesh Singh100% (2)

- Norkis Trading V BuenavistaDocumento2 pagineNorkis Trading V BuenavistaPatrick To100% (1)

- GMAC Members DoubledDocumento1 paginaGMAC Members DoubledChou ChantraNessuna valutazione finora

- Illustrative Questions For Labour Law IIDocumento2 pagineIllustrative Questions For Labour Law IIRAJIKA THAPLIYALNessuna valutazione finora

- ESS 2 StandardDocumento7 pagineESS 2 StandardLineth DomingoNessuna valutazione finora

- Prepare and Deliver Training Sessions: D1.HRD - CL9.04 D1.HHR - CL8.04 Trainee ManualDocumento132 paginePrepare and Deliver Training Sessions: D1.HRD - CL9.04 D1.HHR - CL8.04 Trainee ManualDcs JohnNessuna valutazione finora

- Thesis Topics in Labour EconomicsDocumento7 pagineThesis Topics in Labour Economicsmichelleadamserie100% (3)

- HRH Group of Hotels - Training ReportDocumento88 pagineHRH Group of Hotels - Training Reportankita_ahuja04100% (2)