Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Goldfield Perumí.2013

Caricato da

MVAZ233Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Goldfield Perumí.2013

Caricato da

MVAZ233Copyright:

Formati disponibili

The Mining Economy: How to grow grow, not shrink shrink, the pie

NICK HOLLAND Chief Executive Officer

September 2013

Resource Nationalism is entirely rational

Definition: Countries efforts to extract maximum value and developmental impact for their people from their finite natural resources

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

.particularly as stated under fiscal pressure

$30T

80% 60 40

20

10

20 0

2003 2004 2005 2006 2007 2008 2009 2010 2011

Central Government Debt ($T) Central Government Debt as % of GDP

Includes the 41 countries who have continuous central government debt data from 2003 to 2011 Source: World Bank

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

But Resource Nationalism is viewed badly Resource nationalism

a key threat to mining

Bl kR k, Oct BlackRock O t 2011

Miners encounter the hard rock of resource nationalism

The Telegraph (UK), Nov 2011

Resource nationalism plagues the oil market market

Wall Street Journal, Mar 2012

Resource nationalism: the usual suspects or a wider problem?

RigZone, May 2012

Resource nationalism is miners number one fear and major threat to global security

Mining.com, December 2012

Resource Nationalism #1 on mining risk list

Ernst & Young, Aug 2011

Canadas veto of Petronas deal raises spectre of resource nationalism

Daily Telegraph (UK), Oct 2012

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

What is the disconnect?

Too many fingers in the wrong pie Mining profits Not growing the right pie The Mining Economy to create jobs, fuel development and attract investment capital

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

Too many fingers in the wrong pie

At first glance, it might appear theres a bigger slice to take.

Note: Data based on PwC Mine 2012 analysis of income statements from the top 40 companies but scaled up to represent the whole mining sector Source: IHS Global Insight; Mine: PwC Mine 2013

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

Mining industry is going through tough times

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline

Note: Cost per tonne is the weighted average of 8 major gold producers by total ore mined; average grade is the weighted average of 8 major gold producers by total ore mined; Major Gold producers: AngloGold Ashanti, Barrick, Harmony, Kinross, Goldcorp, Gold Fields, Newmont and Newcrest. Source: Gold Fields company data; annual reports, Condemned to Excellence report(IAMGOLD Corporation, Dec 2012)

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

Margins in the gold sector are under pressure

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline

Gold industry example: margins in rapid decline

Margins M i under d greater t pressure as gold price has since fallen as low as $1300/oz

Gold price 80 60

US$/oz $1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 2006 2007

Margin 100%

Avg cash costs

40

Avg capex

% margin (RHS) 2008 2009 2010 2011 2012 Q1

20 0 2012 Q2

Source: Streetwise reports website

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

as they are for the Top 40 global miners

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline Similarly the top 40 mining companies are experiencing serious financial troubles

%

35 30 25 20 15 10 5 0

Gearing ratio Return on capital employed Net profit Return on Equity

Top 40 Mining Giants - financial distress

2007

2008

2009

2010

2011

2012

Source: PWC Review of global mining trends 2012

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

Industry is not self-funding at present

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline Operating cash flows not sufficient to cover investments

Note: Data based on PwC Mine 2012 analysis of top 40 companies Source: IHS Global Insight; Mine: PwC Mine 2013 ;Note: Gearing ratio = Net borrowings / Equity

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

10

Investors are deserting the sector

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline Operating cash flows not sufficient to cover investments Equity model is at breaking point

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

11

Industry is halting new investments

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline Operating cash flows not sufficient to cover investments Equity model is at breaking point Mining investments under threat A harsh environment with new projects increasingly being delayed and cancelled

Sources: Factiva, Literature search

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

12

and cutting back on existing operations

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is I In reality, lit margins i and d returns t from mining are in decline Operating cash flows not sufficient to cover investment Equity model is at breaking point Mining investments under threat Existing mines under pressure from price decreases and cost increases; greater taxes will aggravate the problem

150 jobs go as Tanami closes mine

The West Australia\n April 24, 2013

South African miner Amplats closes shafts and cuts jobs

BBC Jan, J 2013

Xstrata's Sinclair mine in WA to close, follows closure of nearby Cosmos

Dow Jones - May 2, 2013

Brunswick Mine closes Bathurst-area operation: Unemployment hit 20.2% 20 2%

CBC News - May 1, 2013

Sibanye Gold to Cut 1,110 Jobs to R t Return B Beatrix ti W West t to t P Profit fit

Bloomberg May 29, 2013

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

13

This is why mining earnings is the wrong pie

At first glance, it might appear theres a bigger slice to take Our industry has made this pie look more attractive than it is In reality, reality margins and returns from mining are in decline Operating cash flows not sufficient to fund investment Equity model is at breaking point Mining investment is under threat The revenue pie shows just how little there is still to take

Note: Data based on PwC Mine 2012 analysis of income statements from top 40 companies but scaled up to represent the whole mining sector Source: IHS Global Insight; Mine: PwC Mine 2013

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

14

This is the lose - lose pie

The more everyone takes, the greater the risk the pie shrinks: Rising costs of mining combined with a greater fi fiscal lt take k jeopardise further investment The result: loss of jobs and longterm government revenues

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

15

No development without growth

GDP growth is essential for governments targeting effective development and economic transformation.

Increased political stability/ certainty

Increased investor confidence

+

Capacity to deliver t d li

+

Increased investment

Development + Economic Transformation

Increased growth

Countries must both g grow AND develop p. Growth OR development is untenable

Source: Brenthurst Initiative, 2003

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

16

Growing the right pie: Mining GDP

GDP growth is essential for governments targeting effective transformation Mining GDP is the right pie, especially for resource-rich g countries developing In 2010 the economies of 40 countries were driven to a significant extent by mining: Metals and Minerals accounted for >25% of exports

BRICS 2010

Direct mining share of GDP 2% ($200B)

7 other resource rich countries 2010

Source: ICMM: Minings contribution to sustainable development October 2012; Note: Top 7 countries selected from top 20 countries other than BRICS by 2010 production value and where production values is greater than 5% of GDP. These include Australia, Chile, Peru, Ukraine, Ghana, Zambia, Papua New Guinea (South Africa included in BRICS)

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

17

The Mining Economy has large multiplier effects

GDP growth is essential for governments targeting effective transformation GDP is the right pie, especially for resource-rich developing countries Mining punches above its weight with its GDP multiplier effect

1

GDP contribution of mining (indexed)

3 0.9 2.6

1.0

Mining has boosted RSA GDP by y R468 0.3 billion or 18.7% of 0.4 total GDP

~2.5x for South Africa ~3.2x for Ghana ~1.7x in Peru

Direct 1st round Indirect Induced Total direct mining Impact impact impact and indirect effect of mining

Source: Facts about mining ins South Africa (South Africa Chamber of Mines, November 2012), The Socio-Economic Impact of Newmont Ghana Gold Limited (Newmont Ghana Gold Limited, June 2011), The economic contribution of large scale gold mining in Peru (World Gold Council, May 2012). South Africa: IDC and Quantec study

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

18

Job and livelihood multiplier effect is significant

GDP growth is essential for governments targeting effective transformation GDP is the right pie, especially for resource-rich developing countries Mining punches above its weight with its GDP multiplier effect One direct mining job supports one indirect job and one impacted job in SA, one job supports on average around nine dependents

Number of jobs and livelihoods supported by each mining worker 30 4 14 20

~27x for S. Africa ~28x for Ghana

27

10

~18-19x in Peru

1 0

Mine worker Direct Secondary Informal Total sector direct and impact and tertiary indirect sectors impact

Note: Peru study based on five mines and Ghana study based on analysis of one mine Source: The Rise of Resource Nationalism report (South African Institute of Mining and Metallurgy, February 2012), The Socio-Economic Impact of Newmont Ghana Gold Limited (Newmont Ghana Gold Limited, June 2011), The economic contribution of large scale gold mining in Peru (World Gold Council, May 2012); IDC and Quantec study

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

19

Benefits go beyond jobs

GDP growth is essential for governments targeting effective transformation GDP is the right pie, especially for resource rich countries Mining punches above its weight with its GDP multiplier effect g in mining g creates j jobs, , Investing investment and uplifts communities Multiplier benefits go beyond jobs

Capital inflows Skills / education Catalyst for other industries

Technology transfer

Infrastructure

Community development

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

20

Growing mining activity has a dramatic impact

Mining impact on GDP

GDP growth is essential for governments targeting effective transformation GDP is the right pie, especially for resource-rich developing countries Mining punches above its weight with its GDP multiplier effect Investing in mining creates jobs and uplifts communities A 1% increase in mining in just 12 countries creates ~$8-9B of value in Year 1

BRICS and 7 resource rich countries

Direct impact of mining =3% 5% ($340B)

2.6x

Full multiplier effect of mining 7% % = 12% ($850B)

Impact of a 1% increase in mining activity ti it in i BRICS and d 7 other th resource rich countries after:

One Year

$8-9B

Source: ICMM: Minings contribution to sustainable development October 2012; Indirect effect estimated at 2.5X Note: Top 7 countries selected from top 20 countries other than BRICS by 2010 Production value and where Production values is greater than 5% of GDP. These include Australia, Chile, Peru, Ukraine, Ghana, Zambia, Papua New Guinea; First figure is weighted average; Second figure is numerical average

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

21

Mining impact on GDP

GDP is the right pie, especially for resource-rich developing countries GDP growth is essential for governments targeting effective transformation Mining punches above its weight with its GDP multiplier effect Investing in mining creates jobs a uplifts communities A 1% increase in mining in just 12 countries creates ~$8-9B of value in Year 1 compounded over several years it is even more significant i ifi t

BRICS and 7 resource rich countries

Direct impact of mining 3% = 5% ($340B)

2.6x

Full multiplier effect of mining 7% % = 12% ($850B)

Impact of a 1% increase in mining activity ti it in i BRICS and d 7 other th resource rich countries after:

One Year

Five Years

Ten Years

$8-9B

$45B

Source: ICMM: Minings contribution to sustainable development October 2012; Indirect effect estimated at 2.5X Note: Top 7 countries selected from top 20 countries other than BRICS by 2010 Production value and where Production values is greater than 5% of GDP. These include Australia, Chile, Peru, Ukraine, Ghana, Zambia, Papua New Guinea; First figure is weighted average; Second figure is numerical average

>$90B

22

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

Growing GDP through mining is the win - win pie

Growth leads to more investment The result: increased employment, development and national GDP growth How do we get there? It has been done before

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

23

Peru acted to continue growth

The Humala government recently enacted similar policies to continue growth: Proactively engaged with industry and communities in a full review of all the options E Ended d d up with ith a pragmatic ti focus on rent taxes Seeks to ring-fence benefits for regions and projects linked to mining to help address sensitive local community issues

GDP at PPP (indexed to 100)

800

Direct mining was 9% of GDP in 2010

CAGR (80-12)

600

Peru

1990:Fujimores govt govt. liberalisation

6%

400

2011: Humala elected

200

1980s: Period of hyperinflation

0

0 0 5 5 5 0 20 0 19 8 19 8 19 9 19 9 20 0 20 1 0

Source: World Bank data, March 2013

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

24

Botswana partnered to grow the pie

Strong long term partnership to ensure mutual success 40-year y partnership p p to drive benefits for both Botswana and Debswana Limited government involvement in production Government invested in social transformation including infrastructure and education

1,000

GDP at PPP (Indexed to 100)

2,000

CAGR (80-12)

Direct mining was >33% of GDP in 2010

1,500

Botswana

10%

500

SADC Index

6%

0

19 80 19 85 19 90 19 95 20 00 20 05 20 10

Note: SADC region GDP per capita has been calculated as total regional GDP / population. Countries included in the index are Angola, Botswana, Dem. Republic of Congo, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Swaziland, Tanzania, Zambia, Zimbabwe. Data excludes Zimbabwe before 2000 and it also excludes Namibia before 1990 Source: IMF data, March 2013

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

25

Starting point: Ore bodies

Long term collaborative partnerships (Miners, Governments, Labour, Communities Dev. Communities, Dev Agencies) Agencies) leading to more investment The result: increased employment, development and GDP growth

______________________________________

Rising Ri i costs t of f mining. i i combined with a greater fiscal take jeopardise further investment The result: loss of jobs, a shrinking pie

How do we grow the win - win pie?

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

26

Starting point: Ore bodies

1. They cant be moved, changed or replaced

2. Development is expensive and inherently risky with long lead times

3 Development has a major impact on 3. communities and the environment

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

27

What can you do with them?

You either have ore bodies or you dont

If you have them and theyre economically viable, environmentally sound and socially acceptable, acceptable develop them

Determine full socioeconomic viability by taking the potential economic multiplier impact into account

However, this is not possible in the absence of investors

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

28

But how do investors feel about the sector today

Equity investors have become frustrated as miners have spent their money y with little to show for it Cash, not growth, is king: Miners are cancelling new projects and closing existing mines: returns just do not warrant the risk Thi This leaves l ore bodies b di undeveloped d l d that th t are economically i ll and d socially i ll viable (when the GDP multiplier is taken into account) Moreover, the full potential benefit from mining on communities and the environment i t is i not t always l being b i addressed dd d or delivered d li d

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

29

How to align national interests with investors?

The role of mining companies 1. Acknowledge the role mining companies have played historically in exploiting resources and people 2 Recognise that both a mining licence and a social 2. social licence licence are required to operate 3. Develop practices that crack the code on long-term sustainable community development beyond life of mine 4. Engage with government on how to fund infrastructure development, fuel growth in other sectors and improve social outcomes

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

30

Making progress but more needs to be done

Moving from philanthropy to systematic creation of shared value, recognising the impact of the GDP multiplier effect

Ring-fenced benefits to drive value in host communities and beyond

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

31

Example: Development of local suppliers at Cerro Corona

2013-2014 Establish the foundation

To adjust GFLC's information system to be able to identify local suppliers in our system and in large contractors' systems To identify competitiveness gaps of local suppliers To prepare a training and technical assistance i t plan l for f local l l suppliers li in i order to improve competitiveness To select an external operator to execute a training and technical assistance plan for local suppliers

2015-2016 Pro-active and innovative

To guarantee competitiveness gaps are closed for 75% of local suppliers To ensure 50% of local suppliers have at least 3 important clients To ensure over 50% of local suppliers' employees are from the di t i t of H district Hualgayoc lg o To replace suppliers from Lima for competitive suppliers from Hualgayoc and Cajamarca

2017-2018 Long-term sustainability

To ensure 75% of GFLC's local suppliers are competitive and p their sales and profits. p improve To promote a cluster of mine suppliers in Cajamarca to contribute to the development of mining in the Region and create local jobs.

Total purchases from local suppliers 2012: US$31m (14% of total) Estimated Cost: US$500,000 over next two years

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

32

How to align national interests with investors

The role of governments 1. Seek collaborative partnerships with miners who are better able to operate and develop ore bodies and who are good social partners 2 P 2. Put t in i place l stable, t bl competitive titi tax t systems t that allow equity investors to earn competitive riskweighted returns, with governments benefitting increasingly from the upside 3 Ensure full impact of mining is taken into 3. account when assessing economic viability and social acceptability (requires a good understanding of the multiplier benefit as well as the full costs of mining) 4. Create a climate conducive to responsible investment: provide policy certainty (and then stick to the rules); develop infrastructure and the broader economy; partner to manage input costs; help miners to procure locally 5. Adopt a use it or lose it approach (within an overall win:win context) to ensure all socially acceptable/ economically viable ore bodies can be developed p

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

33

Not easy to do, but the upside is vast

Challenge Partnership p

Mitigation Working g and collaborative p partnerships p between miners, governments, labour and communities Balance long-term growth strategies with short-term fi fiscal li imperatives ti Total transparency in reporting individual asset performance Long-term commitments from governments not to change the rules of the game Simple rules of the game that align interests and can be applied to all assets

Balance

Transparency

Certainty

Simplicity

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

34

Conclusion: Winning nations will choose the high road

Engage to develop collaborative long term partnerships increase investment Drive GDP growth: every 1% increase is worth ~$8-9B in just one year in just 12 developing countries ________________________________ Fight for a share of declining profits but radically reduce investment in the long term Result: loss of jobs, a shrinking pie` pie

Governments who recognise investors need fair risk-weighted returns Miners who recognise the need to deliver full potential socio-economic returns Labour / Communities who temper demands to what can be delivered/ sustained

Resource Nationalism: How to grow, not shrink the pie | Nick Holland | September 2013

35

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Book TurmericDocumento14 pagineBook Turmericarvind3041990100% (2)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- You Are The Reason PDFDocumento1 paginaYou Are The Reason PDFLachlan CourtNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Contract of Lease (711) - AguilarDocumento7 pagineContract of Lease (711) - AguilarCoy Resurreccion Camarse100% (2)

- PsychometricsDocumento4 paginePsychometricsCor Villanueva33% (3)

- (IME) (Starfinder) (Acc) Wildstorm IndustriesDocumento51 pagine(IME) (Starfinder) (Acc) Wildstorm IndustriesFilipe Galiza79% (14)

- ANSI-ISA-S5.4-1991 - Instrument Loop DiagramsDocumento22 pagineANSI-ISA-S5.4-1991 - Instrument Loop DiagramsCarlos Poveda100% (2)

- Proposal For Real Estate Asset Management and Brokerage ServicesDocumento2 pagineProposal For Real Estate Asset Management and Brokerage ServicesTed McKinnonNessuna valutazione finora

- Bodhisattva and Sunyata - in The Early and Developed Buddhist Traditions - Gioi HuongDocumento512 pagineBodhisattva and Sunyata - in The Early and Developed Buddhist Traditions - Gioi Huong101176100% (1)

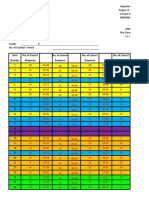

- SHS StatProb Q4 W1-8 68pgsDocumento68 pagineSHS StatProb Q4 W1-8 68pgsKimberly LoterteNessuna valutazione finora

- Trabajo Fisica IDocumento5 pagineTrabajo Fisica IMVAZ233Nessuna valutazione finora

- Ing4y5 2015 U1 Sesion 03 Ficha de TrabajoDocumento2 pagineIng4y5 2015 U1 Sesion 03 Ficha de TrabajoMVAZ2330% (1)

- Collection MineralsDocumento14 pagineCollection MineralsMVAZ233Nessuna valutazione finora

- 9852 1872 01b Driving E2, L1, L2 and MDocumento2 pagine9852 1872 01b Driving E2, L1, L2 and MMVAZ233Nessuna valutazione finora

- Simplified Electronic Design of The Function : ARMTH Start & Stop SystemDocumento6 pagineSimplified Electronic Design of The Function : ARMTH Start & Stop SystembadrNessuna valutazione finora

- Phylogenetic Tree: GlossaryDocumento7 paginePhylogenetic Tree: GlossarySab ka bada FanNessuna valutazione finora

- FCAPSDocumento5 pagineFCAPSPablo ParreñoNessuna valutazione finora

- Final Test General English TM 2021Documento2 pagineFinal Test General English TM 2021Nenden FernandesNessuna valutazione finora

- Item AnalysisDocumento7 pagineItem AnalysisJeff LestinoNessuna valutazione finora

- 5Documento3 pagine5Carlo ParasNessuna valutazione finora

- DH 0507Documento12 pagineDH 0507The Delphos HeraldNessuna valutazione finora

- Placement TestDocumento6 paginePlacement TestNovia YunitazamiNessuna valutazione finora

- Specification - Pump StationDocumento59 pagineSpecification - Pump StationchialunNessuna valutazione finora

- AMUL'S Every Function Involves Huge Human ResourcesDocumento3 pagineAMUL'S Every Function Involves Huge Human ResourcesRitu RajNessuna valutazione finora

- English 10-Dll-Week 3Documento5 pagineEnglish 10-Dll-Week 3Alyssa Grace Dela TorreNessuna valutazione finora

- Community Service Learning IdeasDocumento4 pagineCommunity Service Learning IdeasMuneeb ZafarNessuna valutazione finora

- Topic 6Documento6 pagineTopic 6Conchito Galan Jr IINessuna valutazione finora

- Literatures of The World: Readings For Week 4 in LIT 121Documento11 pagineLiteratures of The World: Readings For Week 4 in LIT 121April AcompaniadoNessuna valutazione finora

- Chemistry InvestigatoryDocumento16 pagineChemistry InvestigatoryVedant LadheNessuna valutazione finora

- ANI Network - Quick Bill Pay PDFDocumento2 pagineANI Network - Quick Bill Pay PDFSandeep DwivediNessuna valutazione finora

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocumento6 pagineAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNessuna valutazione finora

- Damodaram Sanjivayya National Law University VisakhapatnamDocumento6 pagineDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyNessuna valutazione finora

- A - Persuasive TextDocumento15 pagineA - Persuasive TextMA. MERCELITA LABUYONessuna valutazione finora

- MEAL DPro Guide - EnglishDocumento145 pagineMEAL DPro Guide - EnglishkatlehoNessuna valutazione finora

- Pharmaniaga Paracetamol Tablet: What Is in This LeafletDocumento2 paginePharmaniaga Paracetamol Tablet: What Is in This LeafletWei HangNessuna valutazione finora