Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indian Money Market

Caricato da

Niks DujaniyaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Indian Money Market

Caricato da

Niks DujaniyaCopyright:

Formati disponibili

INDIAN MONEY MARKET

INTRODUCTION

The seventh largest and second most populous country in the world, India has long been considered a country of unrealized potential. A new spirit of economic freedom is now stirring in the country, bringing sweeping changes in its wake. A series of ambitious economic reforms aimed at deregulating the country and stimulating foreign investment has moved India firmly into the front ranks of the rapidly growing Asia Pacific region and unleashed the latent strengths of a complex and rapidly changing nation. India's process of economic reform is firmly rooted in a political consensus that spans her diverse political parties. India's democracy is a known and stable factor, which has taken deep roots over nearly half a century. Importantly, India has no fundamental conflict between its political and economic systems. Its political institutions have fostered an open society with strong collective and individual rights and an environment supportive of free economic enterprise. India's time tested institutions offer foreign investors a transparent environment that guarantees the security of their long term investments.

3 3

INDIAN MONEY MARKET

These include a free and vibrant press, a judiciary which can and does overrule the government, a sophisticated legal and accounting system and a user friendly intellectual infrastructure. India's dynamic and highly competitive private sector has long been the backbone of its economic activity. It accounts for over 75% of its Gross Domestic Product and offers considerable scope for joint ventures and collaborations. Today, India is one of the most exciting emerging money markets in the world. Skilled managerial and technical manpower that match the best available in the world and a middle class whose size exceeds the population of the USA or the European Union, provide India with a distinct cutting edge in global competition. The average turnover of the money market in India is over Rs. 40,000 crores daily. This is more than 3 percents of the total money supply in the Indian economy and 6 percent of the total funds that commercial banks have let out to the system. This implies that 2 percent of the annual GDP of India gets traded in the money market in just one day. Even though the money market is many times larger than the capital market, it is not even fraction of the daily trading in developed markets.

3 3

INDIAN MONEY MARKET

1) Meaning of Money Market:

Money market refers to the market where money and highly liquid marketable securities are bought and sold having a maturity period of one or less than one year. It is not a place like the stock market but an activity conducted by telephone. The money market constitutes a very important segment of the Indian financial system. The highly liquid marketable securities are also called as money market instruments like treasury bills, government securities, commercial paper, certificates of deposit, call money, repurchase agreements etc. The major player in the money market are Reserve Bank of India (RBI), Discount and Finance House of India (DFHI), banks, financial institutions, mutual funds, government, big corporate houses. The basic aim of dealing in money market instruments is to fill the gap of short-term liquidity problems or to deploy the shortterm surplus to gain income on that.

3 3

INDIAN MONEY MARKET

2) Definition of Money Market:

According to the McGraw Hill Dictionary of Modern Economics, money market is the term designed to include the financial institutions which handle the purchase, sale, and transfers of short term credit instruments. The money market includes the entire machinery for the channelizing of short-term funds. Concerned primarily with small business needs for working capital, individuals borrowings, and government short term obligations, it differs from the long term or capital market which devotes its attention to dealings in bonds, corporate stock and mortgage credit. According to the Reserve Bank of India, money market is the centre for dealing, mainly of short term character, in money assets; it meets the short term requirements of borrowings and provides liquidity or cash to the lenders. It is the place where short term surplus investible funds at the disposal of financial and other institutions and individuals are bid by borrowers agents comprising institutions and individuals and also the government itself. According to the Geoffrey, money market is the collective name given to the various firms and institutions that deal in the various grades of the near money.

3) Objectives of Money Market:

A well developed money market serves the following objectives:

3 3

INDIAN MONEY MARKET

Providing an equilibrium mechanism for ironing out short-term surplus and deficits. Providing a focal point for central bank intervention for the influencing liquidity in the economy. Providing access to users of short-term money to meet their requirements at a reasonable price.

4) General Characteristics of Money Market:

The general characteristics of money market are outlined below: Short-term funds are borrowed and lent. No fixed place for conduct of operations, the transactions being conducted even over the phone and therefore, there is an essential need for the presence of well developed communications system. Dealings may be conducted with or without the help the brokers. The short-term financial assets that are dealt in are close substitutes for money, financial assets being converted into money with ease, speed, without loss and with minimum transaction cost. Funds are traded for a maximum period of one year.

3 3

INDIAN MONEY MARKET

Presence of a large number of submarkets such as inter-bank call money, bill rediscounting, and treasury bills, etc.

5) History of Indian Money Market:

Till 1935, when the RBI was set up the Indian money market remained highly disintegrated, unorganized, narrow, shallow and therefore, very backward. The planned economic development that commenced in the year 1951 market an important beginning in the annals of the Indian money market. The nationalization of banks in 1969, setting up of various committees such as the Sukhmoy Chakraborty Committee (1982), the Vaghul working group (1986), the setting up of discount and finance house of India ltd. (1988), the securities trading corporation of India (1994) and the commencement of liberalization and globalization process in 1991 gave a further fillip for the integrated and efficient development of India money market.

6) The Role of the Reserve Bank of India in the Money Market:

3 3

INDIAN MONEY MARKET

The Reserve Bank of India is the most important constituent of the money market. The market comes within the direct preview of the Reserve Bank of India regulations. The aims of the Reserve Banks operations in the money market are: To ensure that liquidity and short term interest rates are maintained at levels consistent with the monetary policy objectives of maintaining price stability. To ensure an adequate flow of credit to the productive sector of the economy and To bring about order in the foreign exchange market. The Reserve Bank of India influence liquidity and interest rates through a number of operating instruments - cash reserve requirement (CRR) of banks, conduct of open market operations (OMOs), repos, change in bank rates and at times, foreign exchange swap operations.

Treasury Bills

3 3

INDIAN MONEY MARKET

Treasury bills are short-term instruments issued by the Reserve Bank on behalf of the government to tide over short-term liquidity shortfalls. This instrument is used by the government to raise shortterm funds to bridge seasonal or temporary gaps between its receipt (revenue and capital) and expenditure. They form the most important segment of the money market not only in India but all over the world as well. In other words, T-Bills are short term (up to one year) borrowing instruments of the Government of India which enable investors to park their short term surplus funds while reducing their market risk T-bills are repaid at par on maturity. The difference between the amount paid by the tenderer at the time of purchase (which is less than the face value) and the amount received on maturity represents the interest amount on T-bills and is known as the discount. Tax deducted at source (TDS) is not applicable on T-bills.

Features of T-bills are:

They are negotiable securities.

3 3

INDIAN MONEY MARKET

They are highly liquid as they are of shorter tenure and there is a possibility of an interbank repos on them. There is absence of default risk. They have an assured yield, low transaction cost, and are eligible for inclusion in the securities for SLR purpose. They are not issued in scrip form. The purchases and sales are affected through the subsidiary general ledger (SGL) account. T-Bills are issued in the form of SGL entries in the books of Reserve Bank of India to hold the securities on behalf of the holder. The SGL holdings can be transferred by issuing a SGL transfer form Recently T-Bills are also being issued frequently under the Market Stabilization Scheme (MSS).

Advantages of investing in T-Bills:

No Tax Deducted at Source (TDS)

3 3

INDIAN MONEY MARKET

Zero default risk as these are the liabilities of GOI Liquid money Market Instrument Active secondary market thereby enabling holder to meet immediate fund requirement.

Amount:

Treasury bills are available for a minimum amount of Rs.25,000 and in multiples of Rs. 25,000. Treasury bills are issued at a discount and are redeemed at par. Treasury bills are also issued under the Market Stabilization Scheme (MSS). They are available in both Primary and Secondary market.

Auctions of Treasury Bills:

While 91-day T-bills are auctioned every week on Wednesdays, 182 days and 364-day T-bills are auctioned every alternate week on Wednesdays. The Reserve Bank of India issues a quarterly calendar of T-bill auctions which is shown below (table 1.1). It also announces the exact dates of auction, the amount to be auctioned and payment dates by issuing press releases prior to every auction.

Participants in the T-bills market:

The Reserve Bank of India, mutual funds, financial institutions, primary dealers, satellite dealers, provident funds, corporates, foreign

3 3

INDIAN MONEY MARKET

banks, and foreign institutional investors are all participants in the treasury bill market. The sale government can invest their surplus funds as non-competitive bidders in T-bills of all maturities.Treasury bills are pre-dominantly held by banks. In the recent years, there has been a growth in the number of non-competitive bids, resulting in significant holding of T- bills by provident funds, trusts and mutual funds. The table 1.2 presents holding pattern of outstanding T-bills. Investors RBI Banks State Government Others Total outstanding At the end of march (Rs.in Cr.) 2008 43,800 91,988 41,195 t-bills 1,76,98 3 2007 51,770 88,822 27,991 1,68,58 3 2006 49,187 60,184 8,146 1,17,51 7 2005 61,724 15,874 11,628 89,226

Source: RBI, Weekly Statistical Supplement, Various Issues.

Types of auctions of T-bills:

There are two types of auctions: Multiple-price auction Uniform-price auction

3 3

INDIAN MONEY MARKET

Multiple-price auction:

The Reserve Bank invites bids by price, that is, the bidders have to quote the price ( per Rs.100 face value) of the stock at which they desire to purchase. The bank then decides the cut-off price at which the issue would be exhausted. Bids above the cut-off price are allotted securities. In other words, each winning bidder pays the price it bid.

Uniform-price auction:

In this method, the Reserve Bank invites the bids in descending order and accepts those that fully absorb the issue amount. Each winning bidders pays the same (uniform) price decided by the Reserve Bank. The advantages of the uniform price auction are that they tend to minimize uncertainty and encourage broader participation.

Certificate of Deposits:

Certicate of deposit are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and development financial institutions.

3 3

INDIAN MONEY MARKET

The scheme of certificates of Deposits (CDs) was introduced by RBI as a step towards deregulation of interest rates on deposits. Under this scheme, any scheduled commercial banks, co-operative banks excluding land development banks, can issue certificate of deposits for a period of not less than three months and upto a period of not more than one year. The financial institutions specifically authorised by the RBI can issue certificate of deposits for a period not below one year and not above 3 years duration. Certificate of deposits, can be issued within the period prescribed for any maturity. Certificates of Deposit (CDs) is a negotiable money market instrument and issued in dematerialised form or as a Usance Promissory Note, for funds deposited at a bank or other eligible financial institution for a specified time period. Guidelines for issue of certificate of deposits are presently governed by various directives issued by the Reserve Bank of India.

Denomination For Certificate Of Deposits:

Minimum amount of a certificate of deposits should be Rs.1 lakh, i.e., the minimum deposit that could be accepted from a single subscriber should not be less than Rs. 1 lakh and in the multiples of Rs. 1 lakh thereafter. Certificate of deposits can be issued to individuals, corporations, companies, trusts, funds, associations,

3 3

INDIAN MONEY MARKET

etc.Non-Resident Indians (NRIs) may also subscribe to certificate of deposits, but only on non-repatriable basis which should be clearly stated on the Certificate. Such certificate of deposits cannot be endorsed to another NRI in the secondary market.

Maturity:

The maturity period of certificate of deposits issued by banks should be not less than 7 days and not more than one year. The FIs can issue certificate of deposits for a period not less than 1 year and not exceeding 3 years from the date of issue.

Discount on Issue of Certificate Of Deposits:

Certificate of deposits may be issued at a discount on face value. Banks/FIs are also allowed to issue certificate of deposits on floating rate basis provided the methodology of compiling the floating rate is objective, transparent and market -based. The issuing bank/FI is free to determine the discount/coupon rate.

Call Money Market:

Call and notice money market refers to the market for short -term funds ranging from overnight funds to funds for a maximum tenor of 14 days. Under Call money market, funds are transacted on overnight basis and under notice money market, funds are transacted

3 3

INDIAN MONEY MARKET

for the period of 2 days to 14 days. The call/notice money market is an important segment of the Indian Money Market. This is because, any change in demand and supply of short-term funds in the financial system is quickly reflected in call money rates. The RBI makes use of this market for conducting the open market operations effectively.Participants in call/notice money market currently include banks (excluding RRBs) and Primary dealers both as borrowers and lenders. Non Bank institutions are not permitted in the call/notice money market with effect from August 6, 2005. The regulator has prescribed limits on the banks and primary dealers operation in the call/notice money market. Call money market is for very short term funds, known as money on call. The rate at which funds are borrowed in this market is called `Call Money rate'. The size of the market for these funds in India is between Rs 60,000 million to Rs 70,000 million, of which public sector banks account for 80% of borrowings and foreign banks/private sector banks account for the balance 20%. Non-bank financial institutions like IDBI, LIC, and GIC etc participate only as lenders in this market. 80% of the requirement of call money funds is met by the non-bank participants and 20% from the banking system.In pursuance of the announcement made in the Annual Policy Statement of April 2006, an electronic screen-based negotiated quote-driven system for all dealings in call/notice and

3 3

INDIAN MONEY MARKET

term money market was operationalised with effect from September 18, 2006. This system has been developed by Clearing Corporation of India Ltd. on behalf of the Reserve Bank of India. The NDS -CALL system provides an electronic dealing platform with features like Direct one to one negotiation, real time quote and trade information, preferred counterparty setup, online exposure limit monitoring, online regulatory limit monitoring, dealing in call, notice and term money, dealing facilitated for T+0 settlement type for Call Money and dealing facilitated for T+0 and T+1 settlement type for Notice and Term Money. Information on previous dealt rates, ongoing bids/offers on re al time basis imparts greater transparency and facilitates better rate discovery in the call money market. The system has also helped to improve the ease of transactions, increased operational efficiency and resolve problems associated with asymmetry of information. However, participation on this platform is optional and currently both the electronic platform and the telephonic market are co-existing.

Volumes in the Call Money Market:

Call markets represent the most active segment of the money markets. Though the demand for funds in the call market is mainly governed by the banks' need for resources to meet their statutory reserve requirements, it also offers to some participants a regular

3 3

INDIAN MONEY MARKET

funding source for building up short -term assets. However, the demand for funds for reserve requirements dominates any other demand in the market.. Figure 4.1 displays the average daily volumes in the call markets. Figure : Average Daily Volumes in the Call Market (Rs. cr.) Committee Recommendation on Call Money Market: There are various committee suggested recommendation on Call Money Market are as follow:

The Sukhumoy Chakravarty Committee:

The call money market for India was first recommended by the Sukhumoy Chakravarty Committee, which was set up in 1982 to review the working of the monetary system. They felt that allowing

additional non-bank participants into the call market would not dilute

3 3

INDIAN MONEY MARKET

the strength of monetary regulation by the RBI, as resources from non-bank participants do not represent any additional resource for the system as a whole, and their participation in call money market would only imply a redistribution of existing resources from one participant to another. In view of this, the Chakravarty Committee recommended that additional non-bank participants may be allowed to participate in call money market.

The Vaghul Committee Report:

The Vaghul Committee (1990), while recommending the introduction of a number of money market instruments to broaden and deepen the money market, recommended that the call markets should be restricted to banks. The other participants could choose from the new money market instruments, for their short -term requirements. One of the reasons the committee ascribed to keeping the call markets as pure inter-bank markets was the distortions that would arise in an environment where deposit rates were regulated, while call rates were market determined.

The Narasimham Committee II Report:

The Narasimham Committee II (1998) also recommended that call money market in India, like in most other developed markets, should be strictly restricted to banks and primary dealers. Since non- bank participants are not subject to reserve requirements, the Committee

3 3

INDIAN MONEY MARKET

felt that such participants should use the other money market instruments, and move out of the call markets. Following the recommendations of the Reserve Banks Internal Working Group (1997) and the Narasimhan Committee (1998), steps were taken to reform the call money market by transforming it into a pure inter bank market in a phased manner. The non-banks exit was implemented in four stages beginning May 2001 whereby limits on lending by non-banks were progressively reduced along with the operationalisation of negotiated dealing system (NDS) and CCIL until their complete withdrawal in August 2005. In order to create avenues for deployment of funds by non-banks following their phased exit from the call money market, several new instruments were created such as market repos and CBLO.

Participants in the Call Money Market:

Participants in call money market include the following:

As lenders and borrowers: Banks and institutions such

as commercial banks, both Indian and foreign, State Bank of India, Cooperative Banks, Discount and Finance House of India ltd. (DFHL) and Securities Trading Corporation of India (STCI).

As lenders: Life Insurance Corporation of India (LIC), Unit

Trust of India (UTI), General Insurance Corporation (GIC), 3

3

INDIAN MONEY MARKET

Industrial Development Bank of India (IDBI), National Bank for Agriculture and Rural Development (NABARD), specified institutions already operating in bills rediscounting market, and entities/corporates/mutual funds. The participants in the call markets increased in the 1990s, with a gradual opening up of the call markets to non-bank entities. Initially DFHI was the only PD eligible to participate in the call market, with other PDs having to route their transactions through DFHI, and subsequently STCI. In 1996, PDs apart from DFHI and STCI were allowed to lend and borrow directly in the call markets. Presently there are 18 primary dealers participating in the call markets. Then from 1991 onwards, corporates were allowed to lend in the call markets, initially through the DFHI, and later through any of the PDs.

Reserve Repos:

A reverse repo is the mirror image of a repo. For, in a reverse repo, securities are acquired with a simultaneous commitment to resell. Hence whether a transaction is a repo or a reverse repo is determined only in terms of who initiated the first leg of the transaction. When the reverse repurchase transaction matures, the counter- party returns the security to the entity concerned and receives its cash along with a profit spread. One factor which

3 3

INDIAN MONEY MARKET

encourages an organization to enter into reverse repo is that it earns some extra income on its otherwise idle cash.

Importance of Repos:

Interest Rate: being collateralized loans, repos help reduce counter-party risk and therefore, fetch a low interest rate especially in a volatile market. Safety: repo is an almost risk-free instrument used to even-out liquidity changes in the system. Repos offer safe short-term outlet for temporary excess cash at close to market interest rates. Uses: As low-risk and flexible short-term instruments, repos are used to finance securities held in trading and investment account of security dealers, to establish short positions, to implement arbitrage activities besides meeting specific customer needs.

They offer low-cost investment opportunities with combination of yield and liquidity. In India, repo transactions are basically fund management/statutory liquidity reserve (SLR) management devices used by banks. Cash Management Tool: the repo arrangement essentially serves as a short-term cash management tool as the bank receives cash from the buyer in return for the securities. This

3 3

INDIAN MONEY MARKET

helps the banks to meet temporary cash requirements. This also makes the repos a pure money lending operation. On maturity of repos, the security is purchased back by the seller of the securities. Liquidity Control: The RBI uses repos as a tool of liquidity control for absorbing surplus liquidity from the banking system in a flexible way and there preventing interest rate arbitraging. All repo transactions are to be affected at Mumbai only and the deals are to be necessarily put through the subsidiary general ledger (SGL) account with the Reserve Bank of India.

Repo Rate:

Repo rate is nothing but the annualised interest rate for the funds transferred by the lender to the borrower. Generally, the rate at which it is possible to borrow through a repo is lower than the same offered on unsecured (or clean) inter-bank loan for the reason that it is a collateralized transaction and the credit worthiness of the issuer of the security is often higher than the seller. Other factors affecting the repo rate include the credit worthiness of the borrower, liquidity 3

3

INDIAN MONEY MARKET

of the collateral and comparable rates of other money market instruments. In a repo transaction, there are two legs of transactions viz. selling of the security and repurchasing of the same. In the first leg of the transaction which is for a nearer date, sale price is usually based on the prevailing market price for outright deals. In the second leg, which is for a future date, the price is structured based on the funds flow of interest and tax elements of funds exchanged. This is on account of two factors. First, as the ownership of securities passes on from seller to buyer for the repo period, legally the coupon interest accrued for the period has to be passed on to the buyer. Thus, at the sale leg, while the buyer of security is required to pay the accrued coupon interest for the broken period, at the repurchase leg, the initial seller is required to pay the accrued interest for the broken period to the initial buyer. Generally, norms are laid down for accounting of repos and valuation of collateral are concerned. While there are standard accounting norms, generally the securities used as collateral in repo transactions are valued at current market price plus accrued interest (on coupon bearing securities) calculated to the maturity date of the agreement less "margin" or "haircut". The haircut is to take care of market risk and it protects either the borrower or lender depending upon how the transaction is priced. The size of the haircut will

3 3

INDIAN MONEY MARKET

depend on the repo period, risky ness of the securities involved and the coupon rate of the underlying securities. Since fluctuations in market prices of securities would be a concern for both the lender as well as the borrower it is a common practice to reflect the changes in market price by resorting to marking to market..

Secondary Market Transaction in Repos:

Secondary market repo transactions are settled through the RBI SGL accounts, and weekly data is available from the RBI on volumes, rates and number of days. Though the NSE WDM also has the facility for reporting repo trades, there were no repo transactions recorded during 2005- 06, 2006-07 and 2007-08.

Repo Market in India: Some Recent Issues:

Repos being short term money market instruments are necessarily being used for smoothening volatility in money market rates by central banks through injection of short term liquidity into the market as well as absorbing excess liquidity fro m the system. Regulation of the repo market thus becomes a direct responsibility of RBI. Accordingly, RBI has been concerned with use of repo as an instrument by banks or non-bank entities and issues relating to type

3 3

INDIAN MONEY MARKET

of eligible instruments for undertaking repo, eligibility of participants to undertake such transactions etc. and it has been issuing instructions in this regard in consultation with the Central Government. After evidence of abuse in the repo market during the period leading to the securities scam of 1992, RBI had banned repos from the markets. It is only in the recent past that these restrictions have been removed, and after the acceptance of the report of the technical sub-groups recommendations, RBI has initiated efforts for creating an active market for repos. It was decided to adopt the international usage of the term Repo and Reverse Repo under LAF operations. Thus, when RBI absorbs liquidity it is termed as Reverse Repo and the RBI injecting liquidity is the repo operation. Since forward trading in securities was generally prohibited in India, repos were permitted under regulated conditions in terms of participants and instruments. Reforms in this market has encompassed both institutions and instruments. Both banks and nonbanks were allowed in the market. All government securities and PSU bonds were eligible for repos till April 1988. Between April 1988 and mid June 1992, only inter- bank repos were allowed in all government securities. Double ready forward transactions were part of the repos market throughout the period. Subsequent to the irregularities in securities transactions that surfaced in April 1992, repos were banned in all securities, except Treasury Bills, while double ready forward transactions were prohibited altogether.

3 3

INDIAN MONEY MARKET

Repos were permitted only among banks and PDs. In order to reactivate the repos market, the Reserve Bank gradually extended repos facility to all Central Government dated securities, Treasury Bills and State Government securities. It is mandatory to actually hold the securities in the portfolio before undertaking repo operations. In order to activate the repo market and promote transparency , the Reserve Bank introduced regulatory safeguards such as delivery versus payment system during 1995-96. The Reserve Bank allowed all non-bank entities maintaining subsidiary general ledger (SGL) account to participate in this money market segment. Furthermore, NBFCs, mutual funds, housing finance companies and insurance companies not holding SGL accounts were allowed by the Reserve Bank to undertake repo transactions from March 2003 through their gilt accounts maintained with custodians.

Money Market mutual fund (MMMFS):

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors and invests it in stocks, bonds, short- term money market instruments and other securities. Mutual funds have a fund manager who invests the money on behalf of the investors by buying / selling stocks, bonds etc.

3 3

INDIAN MONEY MARKET

Money market mutual funds (mmmfs) were introduced in April 1991 to provide an additional short-term avenue for investment and bring money market investment within the reach of individuals. These mutual funds would invest exclusively in money market instruments. Money market mutual funds bridge the gap between small investors and the money market. It mobilizes saving from small investors and invests them in short-term debt instruments or money market instruments. There are various investment avenues available to an investor such as real estate, bank deposits, post office deposits, shares, debentures, bonds etc. A mutual fund is one more type of Investment avenue available to investors.

There are many reasons why investors prefer mutual funds. An investors money is invested by the mutual fund in a variety of shares, bonds and other securities thus diversifying the investors portfolio across different companies and sectors. This diversification helps in reducing the overall risk of the portfolio. It is also less expensive to invest in a mutual fund since the minimum investment amount in mutual fund units is fairly low (Rs. 500 or so). With Rs.

3 3

INDIAN MONEY MARKET

500 an investor may be able to buy only a few stocks and not get the desired diversification. These are some of the reasons why mutual funds have gained in popularity over the years An Overview - Money Market Mutual Funds: Currently, the worldwide value of all mutual funds totals more than $US 26 trillion. The United States leads with the number of mutual fund schemes. There are more than 8000 mutual fund schemes in the U.S.A. Comparatively, India the last few years. has around 1000 mutual fund schemes, but this number has grown exponentially in

Recommendation on Indian Money Market by RBI:

Financial sector reforms and monetary policy measures the governor announced certain structural and other policy recommendation to strengthen and rationalise the functioning of money market.

1) Call/Notice Money Market:

RBI may migrate from OF (Owned Fund) to capital funds (sum of Tier I and Tier II capital) as the benchmark for fixing

3 3

INDIAN MONEY MARKET

prudential limits for call/notice money market for scheduled commercial banks. RBI may, however, continue with the present norm associated with co-operative banks (i.e., Aggregate Deposit), PDs (i.e., Net Owned Fund) and non-banks (i.e., 30 per cent of their average daily lending during 2000-01).

Call/notice money market transactions should be conducted on an electronic negotiated quote driven platform.

Banks and PDs with appropriate risk management systems in place and balance sheet structure may be allowed more flexibility to borrow in call/notice money market.

Upon accomplishing the call/notice money market into a pure inter-bank one, larger freedom in lending in call/notice market should be afforded to banks and PDs.

2) Repos/CBLO :

Consequent upon coming into effect of the FRBM Act 2003, there would be a need to broad-base the pool of securities to act as collateral for repo and CBLO markets. The possibility of conducting repo transactions on an electronic, anonymous order driven trading system may be explored.

3)

Term Money:

3 3

INDIAN MONEY MARKET

Reporting of term money transactions on NDS platform may be made compulsory to improve transparency. Term money market transactions on an electronic, negotiated quote driven platform should be introduced.

4) CD

Maturity period of CDs to be reduced to 7 days, in line with that under CP and fixed deposit.

5)Commercial Paper

Asset-backed CP should be introduced in the Indian market.

Development of a transparent benchmark Presence of a term money market

Development of policies that provide incentives for banks and financial institutions to manage risk and maximise profit Increasing secondary market activity in commercial paper and certificate of deposit. In case of commercial paper, underwriting should be allowed and revolving underwriting finance facility and Asset backed commercial paper should be introduced. In case of Certificate of deposits the tenure of those of the financial

3 3

INDIAN MONEY MARKET

institutions certificate of deposits should be rationalised. Moreover, floating rate certificate of deposits can be introduced. Rationalisation of the stamp duty structure. Multiple

prescription of stamp duty leads to in the administrative costs and administrative hassles. Change in the regulatory mindset of the Reserve Bank by shifting the focus of control from quantity of liquidity to price which can lead to an orderly development of money market. Good debt and cash management on the part of the government which will not only be complementary to the monetary policy but give greater freedom to the Reserve Bank in setting its operating procedures.

CONCLUSION

In recent years, the money market is undergoing structural changes in India. Many steps have been taken to transform the restricted and narrow market to an active and broad market. There have been a process of integration of the unorganised with the organised sector. The RBI has taken initiatives to expand the reach of commercial banks to rural areas. Setting up of the DFHI has led to widening of call money market. Recently, Schemes for the development of secondary market in commercial paper and for trading in CDs and PCs have been initiated by the RBI. All attempts 3

3

INDIAN MONEY MARKET

are being taken to promote the bill culture and development of Money Market Mutual Funds (MMMF). Various Credit rating agencies are been set up in the last decade. RBI set up the Securities Trading Corporation of India Ltd. (STCI) in 1994 to provide a secondary market in government securities. In view of these recent developments, the money market in India can no longer be called an underdeveloped one

BIBLIOGRAGHY:

BOOKS REFERENCE: DYNAMICS OF INDIAN FINANCIAL SYSTEM BY - PREETY SINGH INDIAN FINANCIAL SYSTEM BY BHARATI V. PATHAK

3 3

INDIAN MONEY MARKET

FINANCIAL SERVICE AND MARKET-BY DR.S.GURUSWAMY NSE DEBT MARKET (BASIC MODULE) WORK BOOK

WEBSITES:

www.rbi.org.in/weekly issues.co.in

statistical

supplement/various

www.investopedia.com. www.bseindia.com www.nseindia.com www.economics.indiatimes.com/

3 3

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- American Greetings Valuation CaseDocumento13 pagineAmerican Greetings Valuation Caseshershah hassan100% (1)

- Course of Financial AnalysisDocumento34 pagineCourse of Financial AnalysisSherlock HolmesNessuna valutazione finora

- Accounting For Business Combinations Second Grading ExaminationDocumento21 pagineAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Wa0022.Documento8 pagineWa0022.bellNessuna valutazione finora

- Indian Consumer Durables MarketDocumento54 pagineIndian Consumer Durables MarketNiks Dujaniya75% (12)

- Homeware Products 15 PagesDocumento19 pagineHomeware Products 15 PagesNiks DujaniyaNessuna valutazione finora

- Prasanna Resume 2016NEWDocumento2 paginePrasanna Resume 2016NEWNiks DujaniyaNessuna valutazione finora

- Comprehensive Industry Document On Coffee Processing IndustryDocumento76 pagineComprehensive Industry Document On Coffee Processing IndustryepebeNessuna valutazione finora

- Hotel Management Power Point Presentation .Documento20 pagineHotel Management Power Point Presentation .Niks DujaniyaNessuna valutazione finora

- Corrected SynopsisDocumento7 pagineCorrected SynopsisNiks DujaniyaNessuna valutazione finora

- Book 1Documento5 pagineBook 1Niks DujaniyaNessuna valutazione finora

- Consumer CaseDocumento6 pagineConsumer CaseNiks DujaniyaNessuna valutazione finora

- RAKESH PAWAR'S BIO DATADocumento1 paginaRAKESH PAWAR'S BIO DATANiks DujaniyaNessuna valutazione finora

- Amul CompanyDocumento55 pagineAmul CompanyNiks Dujaniya100% (1)

- Research Meth.Documento31 pagineResearch Meth.Niks DujaniyaNessuna valutazione finora

- Resume: Name Swapnil Balaram Sakpal Father Name AddressDocumento1 paginaResume: Name Swapnil Balaram Sakpal Father Name AddressNiks DujaniyaNessuna valutazione finora

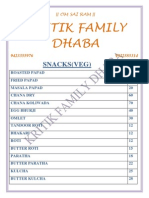

- Kritik Family Dhaba: Snacks (Veg)Documento6 pagineKritik Family Dhaba: Snacks (Veg)Niks DujaniyaNessuna valutazione finora

- Samsung Group: A Global Electronics GiantDocumento19 pagineSamsung Group: A Global Electronics GiantNiks Dujaniya100% (1)

- Sangeeth VargheseDocumento20 pagineSangeeth VargheseNiks DujaniyaNessuna valutazione finora

- Balance Sheet of Cadbury IndiaDocumento1 paginaBalance Sheet of Cadbury IndiaNiks Dujaniya100% (1)

- Tax PlanningDocumento8 pagineTax PlanningRaunak BhadaniNessuna valutazione finora

- Budgetary Control of IndiaDocumento30 pagineBudgetary Control of IndiaNiks DujaniyaNessuna valutazione finora

- Samsung Group: A Global Electronics GiantDocumento19 pagineSamsung Group: A Global Electronics GiantNiks Dujaniya100% (1)

- TelecommunicationsDocumento3 pagineTelecommunicationsNiks DujaniyaNessuna valutazione finora

- Marketing in BankingDocumento59 pagineMarketing in BankingNiks Dujaniya100% (1)

- RAKESH PAWAR'S BIO DATADocumento1 paginaRAKESH PAWAR'S BIO DATANiks DujaniyaNessuna valutazione finora

- Personal Investment and Taxes PlanningDocumento28 paginePersonal Investment and Taxes PlanningNiks DujaniyaNessuna valutazione finora

- New Project Report CadburyDocumento66 pagineNew Project Report CadburypriyapangamNessuna valutazione finora

- BCT Annual Report 2011 FinalDocumento29 pagineBCT Annual Report 2011 FinalNiks DujaniyaNessuna valutazione finora

- Personal Investment and Taxes PlanningDocumento28 paginePersonal Investment and Taxes PlanningNiks DujaniyaNessuna valutazione finora

- KMES College explores cultural value of mathematicsDocumento11 pagineKMES College explores cultural value of mathematicsNiks DujaniyaNessuna valutazione finora

- Corporate Tax PlanningDocumento21 pagineCorporate Tax Planninggauravbpit100% (3)

- The Role of Development Banks in The Twenty First CenturyDocumento30 pagineThe Role of Development Banks in The Twenty First CenturyNiks DujaniyaNessuna valutazione finora

- Surname 1Documento3 pagineSurname 1Paul NdegNessuna valutazione finora

- AFAR - Sir BradDocumento36 pagineAFAR - Sir BradOliveros JaymarkNessuna valutazione finora

- CH 6Documento6 pagineCH 6Natsu DragneelNessuna valutazione finora

- Security MarketDocumento30 pagineSecurity Marketashish_k_srivastavaNessuna valutazione finora

- RiskDocumento10 pagineRiskSanath FernandoNessuna valutazione finora

- Nido Education Prospectus (Lodged 20 Septmeber 2023)Documento238 pagineNido Education Prospectus (Lodged 20 Septmeber 2023)Johnny KaoNessuna valutazione finora

- Financial Accounting and Reporting 1: Umair Sheraz Utra, ACA Page - 1Documento4 pagineFinancial Accounting and Reporting 1: Umair Sheraz Utra, ACA Page - 1Ali OptimisticNessuna valutazione finora

- VCB - JP MorganDocumento23 pagineVCB - JP MorganNam Phuong DangNessuna valutazione finora

- Fin SolutionsDocumento9 pagineFin SolutionsTania Kalila HernandezNessuna valutazione finora

- Form Excel Siklus AkuntansiDocumento28 pagineForm Excel Siklus AkuntansiVioriza PuteriNessuna valutazione finora

- Depository Institutions Activities Risks Services RegulationDocumento3 pagineDepository Institutions Activities Risks Services Regulationsamuel kebedeNessuna valutazione finora

- Prancer Construction AnswerDocumento3 paginePrancer Construction AnswerAayush ThapaNessuna valutazione finora

- Theoretical Foundation of Technical AnalysisDocumento18 pagineTheoretical Foundation of Technical Analysispenumudi233Nessuna valutazione finora

- Principles of Property ValuationDocumento8 paginePrinciples of Property ValuationcivilsadiqNessuna valutazione finora

- Intermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1Documento35 pagineIntermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1anthony100% (40)

- Strategic Cost Management - Chapter 2 1Documento4 pagineStrategic Cost Management - Chapter 2 1luistrosamaralaineNessuna valutazione finora

- BCG Matrix ExplainedDocumento2 pagineBCG Matrix Explaineddip_g_007Nessuna valutazione finora

- Power of Attorney (Poa)Documento2 paginePower of Attorney (Poa)Xen Operation DPHNessuna valutazione finora

- Accounting Midterm ReviewDocumento3 pagineAccounting Midterm ReviewthexinfernoNessuna valutazione finora

- What Are Financial Markets?: Key TakeawaysDocumento2 pagineWhat Are Financial Markets?: Key Takeawayskate trishaNessuna valutazione finora

- Market: Oncept of Market and Major Markets in An EconomyDocumento2 pagineMarket: Oncept of Market and Major Markets in An EconomyIheti SamNessuna valutazione finora

- Illustrative Condensed Interim Financial StatemenstDocumento44 pagineIllustrative Condensed Interim Financial Statemenstalina6523305Nessuna valutazione finora

- The Syndication Process: Week 2Documento26 pagineThe Syndication Process: Week 2Sam DhuriNessuna valutazione finora

- Mergers and Acquisitions in Indian Banking SectorDocumento48 pagineMergers and Acquisitions in Indian Banking SectorJai GaneshNessuna valutazione finora

- Questions and Answers: On The Common Operation of The Market Abuse DirectiveDocumento9 pagineQuestions and Answers: On The Common Operation of The Market Abuse DirectiveblockakiNessuna valutazione finora

- Study online at quizlet.com/_wmil9Documento4 pagineStudy online at quizlet.com/_wmil9sam heisenbergNessuna valutazione finora