Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LESSON 14 - Growth of Firms and Economies of Scale

Caricato da

Chirag HablaniCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LESSON 14 - Growth of Firms and Economies of Scale

Caricato da

Chirag HablaniCopyright:

Formati disponibili

LESSON 14- Growth of Firms and Economies of Scale

Main Lecture:1. Introduction There are two methods by which firms can grow. The first is by internal growth where firm increases its own size by producing more under its existing structure of management and control. The second and more common method today, is by amalgamation (or integration). This occurs when one or more firms join together to form a larger enterprise. 2.Amalgamation:Firms can amalgamate or integrate in one of these two ways. (i) Take-over A take over or aquisition occurs when one company buys all, or at least 50%, of the shares in the ownership of another company. In this way, the firm loses being taken over by another company often loses its own identity and becomes part of the other company. Alternatively an entirely new company may be formed for the sole purpose of buying up shares in the ownership of a number of other companies. This is known as holding company. The companies acquired in this way may keep their own names and management but their overall policies are decided by the holding company. (ii) Merger A merger occurs when two or more firms agree to join to form a new enterprise. This is usually done by shareholders of the two or more companies exchanging their shares for new shares in the new company.

3. Types of integration (i) Horizontal integration This occurs when firms engaged in the production of the same type of good or service combine. Most amalgamations are of this type, for example h joining of British Petroleum with Amoco in the oil and gas industry. This type of integration may come with a lot of advantages. For example, the employment of more specialized machines and labour, the spreading of administration costs and bulk buying. (ii) Vertical Integration This occurs when firms engaged in different stages of production combine. This would be the case if an oil refinery combined with a chain of petrol stations. This is called forward integration. In this way, the oil refinery is assured places to sell its petrol. Firms can also undertake backward integration, for example, a bread manufacturer combining with a wheat producers' association. In this way the firm can ensure a supply of materials. (iii) Lateral integration This happens when firms in the same stage of production, for example, primary or secondary production, but producing different products combine. This is often termed a conglomerate merger to form conglomerates which are firms which produce a wide range of products. This may be to reduce the risk of a fall in demand for one of their products or seek out the profit making potential of selling other products in other markets. For example, Unilever is a firm famous for its detergents but with interests in food, chemicals, paper, plastics, animal feeds, transport and tropical plantations.

4. Economies of Scale The question which now arises is that why do firms want to grow? Well the answer is pretty simple: they want to enjoy the benefits of being a large organization and these benefits are commonly known as the economies of scale. Here's a look at few:-

(i) Financial economies A large firm has several financial advantages because it is large, well known and becomes more credit-worthy borrower than a smaller firm. This means: (a) A large firm can borrow money from a number of different sources, to buy new machines, etc. Large firms may also be able to raise money from the general public by selling them shares through the Stock Exchange. (b) Large firms have more assets than a small firm therefore it is highly unlikely that they cannot repay a loan. Because such happening is so unlikely, financial institutions are very willing to lend money to these firms. (c) Because large firms represent such low risk borrowers, financial institutions may not charge them so much for giving them a loan.

(ii) Marketing economies The way large firms buy materials, transport and sell their products can also bring them advantages. (a) A large firm is able to buy in bulk large quantities of the materials they need and may also be able to store them. Because of this, suppliers will often sell things in bulk at discount prices. (b) The large firm is able to afford to employ specialist buyers who have the knowledge and the skills necessary to buy the best quality materials at the best possible prices. (c) Although large firms spend huge amounts of money on advertising their products to create a want for them, their advertising costs are spread over a large output.

3. Technical economies (a) Large firms can afford to employ specialist workers and machineries. They can divide up the production process into specialized tasks so that production becomes faster as each worker becomes an expert in their particular job

(b) Large firms can also afford to research and develop new faster methods of production and new products. (c) The larger the firm the more transport it needs to carry materials and products to and fro. As a firm grows in size it can afford to use large types of transport, like large trucks, or, in the case of oil companies, supertankers.

4. Risk bearing economies Running a firm is a risky business and clearly the bigger the firm the more things can go wrong. Therefore larger firms can overcome this risk in a number of ways. (a) A large firm needs to buy materials in bulk and if they cannot obtain these for some reason, then their whole operation would grind to a halt. Large firms will try to reduce the risk of this happening by using many different suppliers, buying some of the materials they need from each. (b) In order to reduce the risk of a fall in consumer demand damaging the firm, large enterprise often produce a whole variety of goods or services, so that if demand for one falls they still have others they can make and sell. This is known as diversification. You can clearly see that only large firms can evade risk in this manner. Small firms are likely to suffer. Thus the above points are also considered as economies of scale.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Evolution of StupasDocumento21 pagineEvolution of StupasChirag HablaniNessuna valutazione finora

- HPH PDFDocumento10 pagineHPH PDFChirag HablaniNessuna valutazione finora

- Le CorbusierDocumento10 pagineLe CorbusierChirag HablaniNessuna valutazione finora

- Articles: Books: EntrepreneurshipDocumento5 pagineArticles: Books: EntrepreneurshipChirag HablaniNessuna valutazione finora

- Thermal Boredom in ARchitectureDocumento2 pagineThermal Boredom in ARchitectureChirag HablaniNessuna valutazione finora

- Climate Responsive Architecture Creating Greater Design Awareness Among Architects PDFDocumento11 pagineClimate Responsive Architecture Creating Greater Design Awareness Among Architects PDFChirag Hablani100% (1)

- Liak Teng LitDocumento54 pagineLiak Teng LitChirag HablaniNessuna valutazione finora

- Experiment Voltaic CellsDocumento7 pagineExperiment Voltaic CellsChirag HablaniNessuna valutazione finora

- Architecture Books To ReadDocumento3 pagineArchitecture Books To ReadChirag HablaniNessuna valutazione finora

- Articles: BackgroundDocumento11 pagineArticles: BackgroundChirag HablaniNessuna valutazione finora

- Assign Sheet TrigDocumento3 pagineAssign Sheet TrigChirag Hablani100% (1)

- Logarithms Practice Questions: Attempt These Questions Without A CalculatorDocumento1 paginaLogarithms Practice Questions: Attempt These Questions Without A CalculatorazrindothmanNessuna valutazione finora

- Math IaDocumento14 pagineMath IaChirag Hablani100% (3)

- Physics HL (Part 1)Documento21 paginePhysics HL (Part 1)Chirag HablaniNessuna valutazione finora

- Physics HL (Part 2)Documento19 paginePhysics HL (Part 2)Chirag HablaniNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- A Comprehensive Guide To The American Silver EagleDocumento12 pagineA Comprehensive Guide To The American Silver EagleJonas Vets100% (1)

- Slovenly Betsy by Hoffmann, Heinrich, 1809-1894Documento56 pagineSlovenly Betsy by Hoffmann, Heinrich, 1809-1894Gutenberg.org100% (1)

- Investment Management Module 1Documento21 pagineInvestment Management Module 1rijochacko87Nessuna valutazione finora

- Pin Code Summary 20200318Documento234 paginePin Code Summary 20200318acrajeshNessuna valutazione finora

- Microeconomics For Today 9E 9Th Edition Irvin B Tucker Full ChapterDocumento67 pagineMicroeconomics For Today 9E 9Th Edition Irvin B Tucker Full Chapterjacqueline.newman665100% (5)

- 1) Authoritarian States: A) Conservative AuthoritarianismDocumento4 pagine1) Authoritarian States: A) Conservative AuthoritarianismSpencer DangNessuna valutazione finora

- No Annual FeesDocumento2 pagineNo Annual FeeschrstlllaoNessuna valutazione finora

- Exim PolicyDocumento21 pagineExim PolicyRitu RanjanNessuna valutazione finora

- Airtech Systems (India) Pvt. LTD.: Salary Slip For The Month of October 2018Documento1 paginaAirtech Systems (India) Pvt. LTD.: Salary Slip For The Month of October 2018Mohsin ShaikhNessuna valutazione finora

- Assignment AccDocumento17 pagineAssignment AccNajma FatiniNessuna valutazione finora

- Thesis 2 Sugar IntroductionDocumento4 pagineThesis 2 Sugar IntroductionKyroNessuna valutazione finora

- Hasil Laporan Wawancara Dengan Orang AsingDocumento3 pagineHasil Laporan Wawancara Dengan Orang AsingZEN AMALIANessuna valutazione finora

- Bird FeederDocumento4 pagineBird FeederJayme LealNessuna valutazione finora

- ChecklistDocumento6 pagineChecklistMay Grethel Joy PeranteNessuna valutazione finora

- Unit 5 Rgqs and Vocab f18Documento2 pagineUnit 5 Rgqs and Vocab f18api-327777794Nessuna valutazione finora

- Group 2 Valley TechnologyDocumento5 pagineGroup 2 Valley TechnologyKhanMuhammadNessuna valutazione finora

- Technical Analysis FTSE-100Documento3 pagineTechnical Analysis FTSE-100S Waris HussainNessuna valutazione finora

- Agriculture of SloveniaDocumento3 pagineAgriculture of SloveniaGospodin RajkovićNessuna valutazione finora

- VFFS: Duterte's Health Saga: A Timeline Part 2 (Sources)Documento3 pagineVFFS: Duterte's Health Saga: A Timeline Part 2 (Sources)VERA FilesNessuna valutazione finora

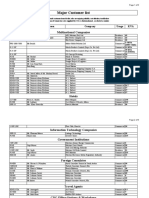

- Major Customer List: Multinational CompaniesDocumento6 pagineMajor Customer List: Multinational CompaniesDominic Alfred PascalNessuna valutazione finora

- SM - FINAL WORD - AirtelDocumento30 pagineSM - FINAL WORD - AirtelVasant Chaudhary100% (1)

- Formal and Informal Seed Supply System in PakistanDocumento143 pagineFormal and Informal Seed Supply System in PakistanMuhammad Boota Sarwar100% (2)

- Office of The Sangguniang BarangayDocumento2 pagineOffice of The Sangguniang BarangayAnaliza LabsangNessuna valutazione finora

- TRAIN Law Implementing Rules and Regulations - Facing PH TaxesDocumento10 pagineTRAIN Law Implementing Rules and Regulations - Facing PH Taxesreneth davidNessuna valutazione finora

- P2 Q1Documento5 pagineP2 Q1Chris100% (1)

- Memorandum of AgreementDocumento2 pagineMemorandum of AgreementBenflor J. Biong84% (25)

- p91 PDFDocumento1 paginap91 PDFpenelopegerhardNessuna valutazione finora

- Handbook of Research On Social Entrepreneurship - 2010Documento350 pagineHandbook of Research On Social Entrepreneurship - 2010lolipop4650% (2)

- How To Get A Job in International DevelopmentDocumento46 pagineHow To Get A Job in International DevelopmentPratheep PurushothNessuna valutazione finora

- Bocq Advisory - Financial Modeling TrainingDocumento7 pagineBocq Advisory - Financial Modeling TrainingThomas DldesNessuna valutazione finora