Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Marklog: A B2B Marketing and Logistics Simulation

Caricato da

Raul Diaz MirandaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Marklog: A B2B Marketing and Logistics Simulation

Caricato da

Raul Diaz MirandaCopyright:

Formati disponibili

MARKLOG

The cochinilla red bug

A B2B MARKETING AND LOGISTICS SIMULATION

Edited and produced by Michelsen Consulting Ltd 2010

INTRODUCTION Since the beginnings of recorded history, fables, parables, and simulations have been used by teachers to instruct in a wide variety of subjects. In biblical times, the parable was in common use to teach religion, philosophy, and other subjects. The fable has been used, sometimes satirically, to illustrate history and to teach political science. Simulations of various kinds have been used to teach children the joy of play, to teach youngsters the importance of a good physique, and to demonstrate to adults how various strategies can be developed. While the use of simulations as teaching devices antedate the computer by several thousand years, the computer has had a pronounced impact upon simulations as a teaching device. The computer simply makes it possible to play simulations that were previously too complex and that simulate the business world. Some of the early computer simulations (in the field of business) were concerned with pricing, with marketing, and with advertising. Other simulations were concerned with product mix and with various aspects of manufacturing. Some simulations such as Tenpomatic, Simserv or Brandestrat, reproduce the total environment of a business. This simulation is concerned with business logistics and the transactions between organizations, an area called B2B Marketing. When the first version of this simulation was developed as the Stanford Business Logistics Simulation, it was the first computer simulation to be developed in the setting of business logistics. Since that time the simulation has been modified several times. These modifications in themselves reflect the growing sophistication of executives who are concerned with logistics and B2B marketing and the increased capacity of the computer to serve as a tool. The Stanford Business Logistics Simulation has been used in the Transportation Management Program since it was first devised. It has also been used in connection with the Business Logistics course in the Graduate School of Business at Stanford. Each time it has been used, various participants have suggested ways in which the simulation could be made even more useful. The present version of the simulation, Marklog, incorporates many of those suggestions. In this simulation the manager is concerned with the profit position of his company as a whole. He is not concerned simply with freight costs, or with warehouse charges, or with the maintenance of an adequate inventory. Rather, he must attempt to keep within reasonable bounds all of the costs with which he is charged (and which he can control to a large extent) while at the

same time making certain that his customers are reasonably happy. While he has relatively few decisions to make, and they appear to be relatively simple, the impact of these decisions is important. While many things are different than they were a century or two ago, some human characteristics remain basically unchanged. Most human beings would rather learn new concepts through the vehicle of a simulation than through some more tedious method. We think that some of the concepts of Business logistics and B2B Marketing be developed through the medium of a simulation. And that is the principal reason why this simulation was developed. We hope you will enjoy playing the simulation and that you, too, will learn while you play.

Participants' Instructions The Marklog simulation has been developed to illustrate the various aspects of the physical distribution function in a large international manufacturing company and its impact in the market. The participants assume the role of Directors of Business and Trade Marketing for a manufacturer established in the West coast of South America that ships a product to the East coast . He is faced with making a variety of decisions that are directly concerned with logistics and marketing. This makes it necessary for the participant to consider the impact of possible strategies on the enterprise as a whole and not on the logistics function alone. Beginning in the 90s a new industry was developed at the foothills of the long chain of mountains that lines de coast of the Pacific Ocean from Mexico to Chile. The industry centres in the recollection, selection, process and packaging of organic natural products, also known as ecological products. Two applications were developed, one focused on food processing and the other on the the textile industry. The founder of the company chose to concentrate in the latter as he had had international experience marketing european textile machinery. After meticulous research and several trial tests the new company dedicated itself to purchase select, process and export Carmin, a very red textile dye made from the insect dactylopius coccus, commonly known throughout Latin America as cochinilla. The female of this insect is about the size of 8 milimeters with a conic head, short antenae, philoform face and covered with a fine white hair. She lives inside the leaves of the tuna cactus (opuntia ficus indica) and other cacti abundant in the dry foothills of the Andes and Mexico. After she has reached a mature age, insects are collected by hand and dried to produce a very red water soluble dye called Carmin in Spanish, producing a colour similar to the red wore by Cardinals and Kings. Carmin was well known by pre columbian meso american and south american cultures but the milling of insects was performed following a slow and time consuming process. The simulation is designed to give the participants an opportunity to plan their distribution strategies carefully (perhaps experimenting with a novel strategy), and to help them to see problems from the viewpoint of the enterprise as a whole. Participants are organized into teams or companies that operate in a highly competitive atmosphere. Each team's decisions has an effect upon the success of that team and upon the growth and prosperity of the industry as a whole. The description of the simulation and the operating instructions in the following pages

should be read carefully before resgistering decisions on the webpages decision forms. This material may also prove useful as a reference before subsequent decisions are made.

GENERAL INDUSTRY DESCRIPTION The major market for dyes in Latin America is in Sao Paulo, Brasil. With 120 million inhabitants, Brasil and the very industrial city of Sao Paulo are the largest textile market of Latin America. Being completely tropical, it does not have the dry mountain ranges typical of the Pacific Coast where cacti grow that are the preferred residence for Cochinilla, Dactylopus Coccus. The brasilian market has a large number of textile manufacturers who purchase their daily requirements form a host of wholesalers. Occasionally manufacturers will place a large "special order" with the Sao Paulo warehouse. They usually place such orders some time in advance of their requirements. They pick up these orders from the warehouses during the week required. During the early stages of the establishment of the Carmin Dye industry in Latin America , the Dye Industry Association made a thorough study of the chemical dye industry, with which the organic dye industry would compete. That study indicated that at the selling price of $1.00 per kilo, at the Sao Paulo warehouse, carmin dye oil could compete with the chemical dye anilin. For many textile products, the two products were interchangeable, and either one of them could be used. The Dye Industry Association discovered that the sales trend of chemical dye historically bore a close relationship to the Brasilian Economic Growth Index. The Association also discovered that the weekly sales of chemical dye fluctuated to about the same degree as did the production of textiles. The Brasilian Department of Commerce will start to publish a Dye Production Index next year. The total production of textiles in which both dyes participated last year is shown in Exhibit 1 below

YOUR COMPANY Your company's production facilities are located at a port in the West coast of South America. The facilities are efficient, and no production difficulties are expected. Production costs of $0.60 per kilo will remain constant

throughout the simulation. Your firm has been testing the market for the past two months. Complete shipping records were kept for the past four weeks (weeks 49-52). The results of the market test convinced top management that the Sao Paulo market should be quite profitable. The company's data processing department will tell you periodically what orders have been received, the amount of inventory in your Sao Paulo warehouse, and what shipments are scheduled to arrive at the Sao Paulo warehouse during the next four weeks. The historical data given you is data for the previous fiscal year which ended with week 52. The new fiscal year is about to begin. You will first be concerned with weeks 1-4.

Exhibit 1 Weekly Brazilian Production of Textiles in Which dyes was an Ingredient Last Year .

MANAGEMENT REPORTING SYSTEM At the beginning of each month you will be provided with three Management Reports for the previous four weeks. While the controller has indicated that the new computer system may at some future time make it possible to issue weekly reports, he is able to provide only monthly reports at the present time. These reports are described in detail in a later section of these instructions.

YOUR JOB An important part of your job involves maintaining adequate (but not excessive) inventories in Sao Paulo. This involves careful planning so that the needs of the wholesalers and the occasional manufacturers' order will be satisfied. Since this is a new industry with little historical data upon which to base decisions, your job will be particularly challenging. While there will be forecasts of the dye production index and the economic growth index, you will have to develop your own forecasts for sales of your product. Several things are known about the market to guide these forecasts. The occasional manufacturers' order will represent between 10% and 20% of the weekly demand. The weekly demand will fluctuate with the seasonal trend. It is also true that service is vitally important. All customers expect the product to be in good condition, and they want to have merchandise immediately available in a Sao Paulo warehouse. When you provide good service, your share of the market, and the total market for organic dyes, should tend to increase. On the other hand, if you give poor service, your customers will tend to substitute organic dyes for chemical dyes and the total market for Carmin will tend to decrease. Each company producing Carmin dyes shares in the total market for the product. The market share of each firm will depend on the quality of service provided to its customers, a key componente of B2B marketing. In this industry there is no "brand loyalty," since for all practical purposes the dye produced by one firm cannot be distinguished from that produced by any other. This means that whenever a firm provides exceptionally good service, the total market for Carmin dyes will increase, and its share of the market will also increase. The large textile manufacturers place their orders every two to six weeks. This usually allows for advance notification, but occasionally that is not possible. They take delivery from the Sao Paulo warehouse. If your warehouse does not have sufficient stock on hand to fill all orders, the manufacturer's orders are filled first, then the wholesalers orders are filled until the

stock is depleted. If the warehouse cannot fill an order in full, it will fill the order partially, and the customer will automatically buy the balance from one of your competitors. It is not possible for you to "back order" and fill orders at a later date. Any "stockout" condition hurts the reputation of your company for service. Your company's reputation for service will affect the demand for your company individually and for the organic dye industry as a whole.

YOUR OBJECTIVES Since you are in charge of the complete B2B marketing and logistics function of your firm, you are concerned with all the costs associated. Therefore, you should consider the present demand for your product and the forecast of future demand. Since your reputation for service affects the demand for your product, you should try to provide the best possible service for every customer at the lowest possible total cost.

TRANSPORTATION MODES The six modes of transportation available to you are: air freight, truck, rail, freight forwarder a company whose duties include the booking of space on a ship or airplane and providing all the necessary documentation and arranging customs clearance, pooling their shipments to achieve lower freight rates, shippers' cooperative (a group of shippers who combine their shipments to achieve lower freight charges) , and steamship. There are four truck lines and two air lines available to you. One air line provides both passenger and cargo service, while the other is an all-freight carrier. There may be differences in the quality of the service provided by the several carriers. Some will do more damage than others to the product while in transit. Excessive damage hurts your service reputation. Each mode of transportation has different characteristics. Some modes are faster than others. Loss and damage characteristics vary. Costs for packing and packaging differ. Shipments by water, for instance, must be packed in expensive heavy containers often sharing space with other products. Shipments by air freight require expensive crates and boxes. Each mode of transportation advertises a "normal" or "scheduled" delivery time. For instance, shipments by rail "normally" arrive within the second week after dispatch. But occasionally, because of crowded rail yards, inclement weather, or other conditions, rail shipments may be delayed as much as two additional weeks and thus not arrive until the fourth week after dispatch. Shipments made by other modes may be delayed for similar reasons. Occasionally other things may happen. Through a paperwork "snafu" or snarl, the order may be misdirected and lost. A shipment may be destroyed in an accident or fall into the sea, quite a common occurrence in the rough seas of the Straight of Magellan as there is a two meter difference between the level of the Atlantic and the Pacific Oceans. If a shipment is lost or destroyed, you will be notified, and the carrier will promptly reimburse your manufacturing cost, interest cost, packing costs, and prepaid freight charges. Once a shipment is lost, it will never arrive in Sao Paulo. If it is found it will be returned to the production department for a complete quality control inspection. While no mode of transportation guarantees that shipments will arrive at any particular time, all of them advertise "normal" or "scheduled" arrival times. Air freight shipments normally arrive the same week as shipped. Shipments by truck normally arrive at the beginning of the second week; rail and freight forwarder shipments normally arrive at the beginning of the third

week; shipments by shippers' cooperative normally arrive at the beginning of the fourth week; ship cargos normally arrive at the beginning of the fifth week. Shipments normally arrive "on schedule." But sometimes they are delayed, and on occasion they arrive early. Delay of one shipment does not affect other shipments by that mode or by any other mode. Exhibit 2 indicates the normal arrival times and the range of possible arrival times (in weeks) for each mode. The traffic for the various modes are shown. in Exhibit 3. All rates include pick up charges at the factory and delivery charges to the Sao Paulo warehouse. If your shipment is somewhat less than the minimum quantity necessary to qualify for the incentive rate but larger than the "break point," you will automatically be charged the lower rate. For example, if you ship 950 kilos by air, you would be charged for 1000 kilos at the incentive rate of 184 or $180.00 and not for 950 at 204 or $190.00. AEROFLETES LATINOS, the all-cargo airline, also offers a "blocked space" contract. Under this arrangement the shipper contracts for a fixed amount of space every week. The contract rate varies with the amount of space that the shipper contracts to use each week (see Exhibit 4) .

Exhibit 2 Scheduled (or Normal) Arrival Times and Range of Actual Arrival Times (in weeks) for each mode of Transportation

Mode Air freight Truck Rail Forwarder Shippers Coop Ship

Week Dispatched 1 1 1 1 1 1

Week in Which Arrival is Scheduled 1 2 3 3 4 5

Weeks in Which Shipment May Actually Arrive 1, 2 1, 2, 3 2, 3, 4, 5 2, 3, 4, 5 3, 4, 5, 6 3, 4, 5, 6, 7

Exhibit 3 Freight Rates by Various Modes for Carmin Dye (All rates are in cents per kilo) Air Basic Rate Incentive Rate Incentive Minimum (kilos) Break Points (kilos) Minimum Shipment (kilos) Packing Costs .5 1 1.5 1.5 1.5 2 900 10 21,818 25,000 100 100 34,286 100 22,857 75,000 100 500 20 18 1000 Truck 11 8 Rail 8 5 Forwarder Co-op 7 6 40,000 7 4 Ship 2 1.5

30,000 40,000

40,000 100,000

Exhibit 4 Amount of Rate per blocked kilo space 10,000 $ .15 20,000 .14 30,000 .13 40,000 .12 50,000 .11 60,000 .10 70,000 .09 80,000 and up .08 Weekly Fixed Charge $ 1,500 2,800 3,900 4,800 5,500 6,000 6,300 6,400

"Blocked space" contracts are available only in multiples of 10,000 kilos, and only one contract may be signed in any one week. All "blocked space" contracts run for a period of one year (52 weeks), and the shipper will be charged for any "blocked space" for which he has contracted and does not use. Shipments requiring more space than that contracted for will be shipped at the block space rate. For example, if you contract for weekly blocked space for 30,000 kilos, you will be charged $3,900 per week for "blocked space" whether you ship 30,000 kilos or not. Shipments in excess of 30,000 kilos would be charged at $.13 per kilo. Thus, if you ship only 25,000 kilos by "blocked space" air freight you would be charged $3,900 under your "blocked space" contract.If you ship 35,000 you would be charged the fixed weekly cost of $3,900 for the first 30,000 kilosplus $650 for the additional 5,000 kilos or a total of $4,550.

WAREHOUSING The capacity of your Sao Paulo warehouse is 80,000 kilos. Whenever the company warehouse is full, any excess goods that arrive in Sao Paulo are stored in various public warehouses. This involves extra handling charges and higher warehousing costs. Since extra handling is involved, and top-quality warehouse space in public warehouses may not always be available, your product may be exposed to some deterioration or damage if it is necessary to use public warehouse space. This adds to your costs. Warehousing costs in all company warehouses are $.05 per kilo per week. The total cost of warehousing in public warehouses (including all handling costs, space costs, deterioration and breakage costs) is $.10 per kilo per week. If you have any goods stored in public warehouses, those goods will be used first to fill orders during any given week. Additional permanent warehouse space (in units of 40,000 kilos) is available next door to your company warehouse through a long term, non cancelable lease. Weekly lease rental payments ($800 per week per 40,000 lbs capacity) must be paid whether all of the space is used or not. Only one contract may be signed in any one week. This space is in all respects comparable to warehouse space presently utilized by the company. The cost of storing dye powder in this space is also five cents per kilo per week -- the same charge that is assessed for using regular company warehouse space.

WORKING CAPITAL COST Working capital is required to finance inventories and goods in transit.

Working capital needed for all day-to-day operations may be provided by bank loans, the stockholders, banks, or other sources. The company computes its cost of working capital required for inventory and goods in transit at .4% per week. This cost reflects not just the direct cost of borrowing funds but what management feels the funds could earn if invested in other company projects.

SUMMARY OF WAREHOUSE COSTS AND CAPACITIES Your firm's Sao Paulo warehouse capacity: 80,000 kilos. Leased warehouse available: 40,000 kilos units. Cost of leased warehouse space: $800 per week per each unit of 40,000 kilo capacity. Cost of warehousing in company warehouse or leased warehouse space: $.05 per kilo per week. Cost of warehousing in public warehouses: $.10 per kilo per week. Working capital cost: 0.4% per week.

HOW TO MAKE DECISIONS Under the rules of the simulation, decisions are made for four weeks at a time. That means that your first decisions will be concerned with weeks 1-4 of the new fiscal year. The data will be registered at your website using the ID and password sent to you as team member. Steps to follow: 1. Enter the website using your team ID and password. 2. The decision form shown on page 19 shows the decisions made by the previous managemente team for the weeks 49 through 52. 3. Now complete your shipping schedule on the form shown on the screen. Notice that columns are not labelled. Week number is assumed by sequence. Enter the quantity you wish dispatched in the column for the week you wish it dispatched. Since the Management Reports do not include any Bill of Lading number, you must code individual shipments. Instead of dispatching 10,000 kilos in week 1 by rail, you should dispatch 10,001 kilos to indicate that this shipment was dispatched in week 1. Instead of shipping 10,000 kilos by rail in week 2, register 10,002 kilos so that you will know that the arriving shipment was dispatched in week 2. The results for the past four week period shows that 15,049 kilos arrived by shippers' coop: that means that it was dispatched in week 49. 4. If you wish to contract for one 10,000 kilo unit of "blocked air space" in any week, enter a "1" in the blocked space box on the decision sheet for that

week. You will then contract for 10,000 kilos of blocked space for the life of the simulation . The non-cancellable "blocked space" contract is effective immediately. You may contract for an additional unit of blocked space in any subsequent week by again entering a "1" in the blocked space box for that week. During the past fiscal year, your predecessor contracted for one 10,000 kilo unit (the maximum allowable in any one week) of "blocked space" in week 50. He was thus committed to paying $1,500 a week for this space whether or not all of it was used. In week 51 he contracted for an additional unit of 10,000 kilos of air freight. He was, thus, committed to a total of 20,000 kilos of air freight space each week at a total cost of $2,800 per week. These contracts expired at the end of week 52, at the close of the fiscal year just ended. These transactions illustrate the use of "blocked space" air freight. As the new fiscal year begins, you are not under contract for any "blocked space" air freight but are free to use "blocked space" or not, as you wish. 5. If you wish to lease additional permanent warehouse space at any time, enter a "1" in the leased space box for that week. The lease is thus effective immediately. You may lease as many additional units (40,000 kilo capacity) as you wish, but you may not lease more than one additional unit in any week of the simulation.

When you lease one unit of permanent warehouse space, you are committed to the weekly lease cost of $800 per week, whether the space is fully used or not. However, once permanent leased warehouse space is available to you, the cost of using the space is 5 cents per kilo per week -- the same cost as using your own company warehouse. This is just one-half the cost of using public warehouse space that is not on permanent lease. During the last fiscal year, your predecessor leased one 40,000 kilo unit of permanent warehouse space in week 51. He was charged a fixed weekly lease cost of $800. However, that lease expired at the end of the fiscal year, and you are not presently committed to any leased warehouse space. 6. The simulation instructor will announce the times that decision data must be entered at the website. It is important that the decision data be turned in on time. The instructor will also announce when you can download results from the website.

PRESENT STATUS Your first decision will cover shipments to be made in weeks 1 through 4.

The remaining inventory at the end of week 52 is your beginning inventory for week 1 of the new fiscal year and equals 40,399 kilos. Three shipments are also scheduled to arrive during this period. Two arrivals are scheduled during week 1: 5,049 kilos by VAPORES MAGALLANES and 15,052 kilos by CONFICARGAS. A shipment of 15,052 kilos is scheduled to arrive by FREIGHT FORWARDER during week 2. These are scheduled arrival times; there is no guarantee that the various shipments will necessarily arrive when they are scheduled to arrive. MANAGEMENT REPORTS The three pages of the initial Management Report can be downloaded from the website (See results on the Menu). A copy of the results for weeks 49 through 52 is provided at the end of this manual. The first page shows the current status of shipments by all modes. For example, during the past four weeks, 10,049 kilos were dispatched by Aeroinca in week 49. Air freight shipments are scheduled to arrive in the week of dispatch. Therefore, 10,049 kilos were scheduled to arrive in week 49. The shipment did arrive in week 49. 15,049 kilos was dispatched in week 49 by COOP. The shipment was scheduled to arrive in week 52 and did arrive in the week scheduled. If a shipment is lost or destroyed, notification will be given at the bottom of this page. Notice of loss by an air line or a truck line is given in the week of dispatch. Notice of loss by rail or forwarder is given in the week following dispatch. Notice of loss by ship or Coop is given two weeks after dispatch. For example, notice of loss of 25,000 kilos by a truck line would be given to you during the week of loss as follows: "TOTAL RECENT FREIGHT LOSS BY (Name of Carrier) = 25,000." However, notice of loss by any mode other than air or truck is delayed for one to two weeks. Therefore, notice of loss may not appear until the decision period following the period of dispatch. Page 2 of the Management Report shows the amount of current inventory and provides a profit and loss statement for each week of the period. On the inventory statement, the amount "Total Demand" equals the sum of wholesalers' demand plus manufacturers' special orders. For internal purposes your company uses an "accrual" accounting system. While the company pays freight charges, warehouse charges, and other costs promptly, these costs and other logistics costs are not assessed against the logistics department until the goods are actually sold. This is standard accounting procedure. Since the actual freight charges for shipments coming by the slower modes are different from the actual freight

charges for shipments coming by faster modes, the company's accounting department averages all freight charges that have been accrued against all of the goods in the Sao Paulo warehouses at any one time and assesses these average costs against your department when goods are actually sold. This means that while your department may incur shipping costs when it makes a shipment from the West Coast of Latin America, it will not be charged internally for freight costs until goods are sold. Since costs for "blocked space" air freight and rental charges for leased permanent warehouse space are fixed, these charges are shown separately each week, as the charges are incurred. Any other special or extraordinary charges are also detailed. The Dye Industry Association may occasionally make special market studies for a fee. These fees would be shown on this report. Weekly profit appears as the last line of this statement. Occasionally there are items of general interest which appear at the bottom of page 2 of the report. Page 3 of the Management Report presents statistical and economic information. It gives weekly industry data on sales, inventories, and average profit margins. It also gives pertinent information on the chemical dye industry. The information provided on your own team is cumulative. The Economic Growth Index indicates the economic trends of the economy in general, while the Textile Production Index indicates the actual output of the textile industry and its cyclical fluctuations. Your company has a research staff which uses this data to forecast the probable directions of the Economic Growth Index and the Textile Production Index. They issue forecasts of the Textile Production Index for the next four weeks. Their forecasts of the Economic Growth Index is for as far as twelve weeks in advance. The three page Management Report will be available for downloading shortly after processing for each reporting period (presently four weeks). The Report fort weeks 49 to 52 is to be found in the last pages of this Manual.

Decision Sheet for weeks 49-52

DECISION DATA FOR WEEK: 49 50 51 52

Marklog HISTORY AND PERFORMANCE OF YOUR COMPANY: RESULTS FOR WEEKS 49 THROUGH 52

MARKLOG * MARKETING AND LOGISTICS WEEK NUM. AIRINCA DISPATCHED LLEGADA PROGR REAL ARRIVAL LATIN AIRFREIGHTS DISPATCHED SCHED. ARRIVAL ZAS TRUCKS DISPATCHED SCHED. ARRIVAL REAL ARRIVAL SUPERTRUCKS DISPATCHED SCHED. ARRIVAL REAL ARRIVAL RELIABLE TRUCKS 15049 0 0 0 15049 15049 0 0 0 0 0 0 0 20048 20048 0 0 0 20051 0 0 20051 0 20051 0 0 0 10050 10050 10050 20051 20052 20051 20052 20051 20052 week 52) (10,050 kilos were scheduled to arriev in week 50) (20,052 kilos arrived in 49 50 51 52 CO . 1 2 3 4 (10,049 kilos were dispatched in week 49) (Firm number will appear here)

10049 10049 10049

0 0 0

0 0 0

0 0 0

DISPATCHED SCHED. ARRIVAL REAL ARRIVAL TRANSCARGA DISPATCHED SCHED. ARRIVAL REAL ARRIVAL AMAZONIC RAIL DISPATCHED SCHED. ARRIVAL REAL ARRIVAL FREIGHT FORWARDER DISPATCHED SCHED. ARRIVAL REAL ARRIVAL SHIPPERS COOP DISPATCHED SCHED. ARRIVAL REAL ARRIVAL MAGELLAN LINE DISPATCHED SCHED. ARRIVAL REAL ARRIVAL

0 0 0

0 0 0

0 0 0

15052 0 0

15052

15049 0 0

0 15049 15049

0 0 0

0 0 0

15049 0 0

0 0 0

0 15049 15049

0 0 0

0 30047 30047 0 0

0 0 0

15052 0 0 15052 0

15049 0 0

0 10047 10047

0 0 0 15049 0 0 15049

5049 0 0

0 15046 15046

0 0 0

0 0 5049 0

( ** If there is a missing or destroyed shipment a message will appear here **)

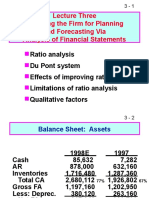

INVENTORY: POSITION WEEK NUMBER BEGINNING INVENTORY TOTAL KILOS RECEIVED TOTAL KILOS AVAILABLE TOTAL DEMAND WHOLESALERS MANUFACTURERS CLOSING INVENTORY COST OF INVENTORY $ STOCKOUTS 49 39813 60144 99957 55366 55366 0 44591 31947 0 50 44591 65421 109832 52900 52900 0 56932 39093 0 51 56932 35100 92302 55938 51511 4427 36094 23489 0 52 36094 55152 91246 50847 50847 0 40399 27230 0

NEXT MANUFACTURERS ORDEN IN WEEK SEM 3 FOR 5040 KILOS

PROFIT AND LOSS STATEMENT WEEK NUMBER 49 50 52900 31740 5086 2230 0 51 55938 33563 3706 2797 0 52 50847 30508 2151 These costs are set by the 1854 Accounting Department and are 0 charged to the Logistic

SALES REVENUE 55366 COST OF GOODS SOLD MANUFACTURING COST 33220 FREIGHT COST 4767 REGULAR INVENTORY COST 2128 EXCESS INVENTORY COST 0 Department

PACKING COST INTEREST COST FIXED COST BLOCKED AIR SPACE COST LEASED WAREHOUSE COST OTHER COSTS/REVENUES TOTAL COST PROFIT

776 189 0 0 0 41097 14287

622 302 1500 0 0 41480 11420

688 607 2800 800 0 44961 10977

479 when a sale is made. 339 2800 800 0 38932 11915

STATISTICAL AND ECONOMIC DATA

WEEK NUMBER FIRM NUMBER TOTAL SALES TO DATE TOTAL COSTS TO DATE TOTAL PROFIT TO DATE AVERAGE PROFIT/SALES TOTAL INDUSTRY WEEKLY SALES CLOSING INVENTORIES WEEKLY PROFIT/SALES ECONOMIC DATA IECONOMIC GROWTH INDEX TEXTIL PRODUCTION INDEX CHEMICAL DYE SHIPMENTS

49

50

51

52

55366 41079 14287 0.25845

108266 82559 25707 0.237445

164204 127520 36684 0.223405

215051 166452 48599 0.225990

AVAILABLE FROM THE FIRST WEEK

105 105 105 106 AVAILABLE FROM THE FIRST WEEK 7443658 7056286 6701215 6310882

ECONOMIC GROWTH INDEX FORECAST WEEK ONE = 100 PERIOD WEEK 4 WEEK 12 LOW 100 101 NORMAL 101 103 103 104 HIGH

TEXTIL PRODUCTION FORECAST WEEK ONE = 100 PERIOD WEEK WEEK WEEK WEEK 1 2 3 4 LOW 100 92 86 81 NORMAL 100 96 89 85 100 99 93 89 HIGH

TO OPERATE MARKLOG USE THE MENU

MENU DRIVEN CLICK-BASED ACTIVITIES

Tells when decisions were registered and sent by each team

MENU DRIVEN CLICK-BASED ACTIVITIES

Read the Manual Make a decision, register the data, send it Compare your results with those of other participating teams

Answer questions correctly Inspect and analyze results obtained in Excell format Stores past results and decision data

Tells when decisions were registered and sent by each team

DECISION FORM FILLED CORRECTLY FOR THE FIRST 4 WEEKS

HELPS DEFINING THE DECISION ITEM

A CLICK ON THE QUESTION MARK WILL OPEN A DESCRIPTION OF THE DECISION ITEM AND THE PAGE NUMBER IN THE MANUAL WHERE IT IS DISPLAYED

ACCUMULATED WEEKLY PROFITS ARE DISPLAYED AND GRAPHED

DECISION FORM FILLED CORRECTLY FOR THE FIRST 4 WEEKS

HELPS DEFINING THE DECISION ITEM

Potrebbero piacerti anche

- By: Elisabeth Marin Davila Evidencia 10: Selection Criteria in Distribution Channels Ceramicol CompanyDocumento5 pagineBy: Elisabeth Marin Davila Evidencia 10: Selection Criteria in Distribution Channels Ceramicol CompanyAnonymous TjeFqv5NsNessuna valutazione finora

- Marklog en StudentDocumento23 pagineMarklog en StudentgitzNessuna valutazione finora

- 12 Evidencia 10 Selection Criteria in Distribution Channels Ceramicol CompanyDocumento4 pagine12 Evidencia 10 Selection Criteria in Distribution Channels Ceramicol CompanyjenniferNessuna valutazione finora

- Design to Grow: How Coca-Cola Learned to Combine Scale and Agility (and How You Can Too)Da EverandDesign to Grow: How Coca-Cola Learned to Combine Scale and Agility (and How You Can Too)Valutazione: 4.5 su 5 stelle4.5/5 (3)

- Ts NotesDocumento90 pagineTs NotesalibrownNessuna valutazione finora

- Primark 1Documento12 paginePrimark 1Fadhil WigunaNessuna valutazione finora

- Report 1Documento14 pagineReport 1Maham ZainabNessuna valutazione finora

- WalMart Retailing ReportDocumento20 pagineWalMart Retailing ReportMalik Muhammad JamalNessuna valutazione finora

- Sales Promotion of CocacolaDocumento49 pagineSales Promotion of CocacolaUrsheen KaurNessuna valutazione finora

- Chapter 11: Relationship Marketing Chapter 12: Competitive StrategyDocumento6 pagineChapter 11: Relationship Marketing Chapter 12: Competitive StrategyKhensley Gira ColegaNessuna valutazione finora

- Predicting Package Performance: September 1999 NumberDocumento6 paginePredicting Package Performance: September 1999 NumberPatrick AdamsNessuna valutazione finora

- International MarketingDocumento3 pagineInternational MarketingVarga CasianaNessuna valutazione finora

- Business Plan PawDocumento12 pagineBusiness Plan PawInocando GabrielNessuna valutazione finora

- Chapter 12Documento14 pagineChapter 12mohamed elnagdyNessuna valutazione finora

- Test Bank CH 3Documento5 pagineTest Bank CH 3Taleen TabakhnaNessuna valutazione finora

- Coca ColaDocumento83 pagineCoca ColaNishant Namdeo50% (2)

- Venezuelan Diaper MarketDocumento7 pagineVenezuelan Diaper MarketFamilia Santander VelazquezNessuna valutazione finora

- Marketing Plan Pull&BearDocumento50 pagineMarketing Plan Pull&Beartatiana_carr9081100% (17)

- BISSU FinalDocumento51 pagineBISSU FinalScribdTranslationsNessuna valutazione finora

- Taking Back Retail: Transforming Traditional Retailers Into Digital RetailersDa EverandTaking Back Retail: Transforming Traditional Retailers Into Digital RetailersNessuna valutazione finora

- Subject Segment Topic: Do Industries Also Have A Life Cycle?Documento5 pagineSubject Segment Topic: Do Industries Also Have A Life Cycle?Burhan Al MessiNessuna valutazione finora

- Research Paper On Abercrombie and FitchDocumento4 pagineResearch Paper On Abercrombie and Fitchgz7veyrh100% (1)

- Seizing the White Space (Review and Analysis of Johnson's Book)Da EverandSeizing the White Space (Review and Analysis of Johnson's Book)Nessuna valutazione finora

- Changeship - Workbook: Building and scaling next generation businesses in the digital polypol: Purpose driven - Customer dedicated - Sustainability enabledDa EverandChangeship - Workbook: Building and scaling next generation businesses in the digital polypol: Purpose driven - Customer dedicated - Sustainability enabledNessuna valutazione finora

- ThesisDocumento27 pagineThesisJessabelle Espina80% (5)

- Draft of TRIUMPH2000 Business PlanDocumento10 pagineDraft of TRIUMPH2000 Business Planandy necioNessuna valutazione finora

- Thesis On Retail IndustryDocumento6 pagineThesis On Retail Industrydwtt67ef100% (1)

- Quiz 5 - Carlos YaqueDocumento2 pagineQuiz 5 - Carlos YaqueCarlos YaqueNessuna valutazione finora

- Marks and Spencer ThesisDocumento8 pagineMarks and Spencer Thesisjuliegonzalezpaterson100% (2)

- Shark - v221118Documento5 pagineShark - v221118VictorNessuna valutazione finora

- Learning Objectives: After Studying This Chapter, You Should Be Able ToDocumento25 pagineLearning Objectives: After Studying This Chapter, You Should Be Able ToDenitto GiantoroNessuna valutazione finora

- Coventry University Dissertation Front CoverDocumento6 pagineCoventry University Dissertation Front CoverBuySchoolPapersCanada100% (1)

- Research Paper RetailingDocumento7 pagineResearch Paper Retailingxwrcmecnd100% (1)

- AA 11 Ev 2 Describing and Comparing ProductsDocumento9 pagineAA 11 Ev 2 Describing and Comparing ProductsGrupo senaNessuna valutazione finora

- Coca ColaDocumento83 pagineCoca ColaSanjana SinghNessuna valutazione finora

- Dissertation Topics On Retail IndustryDocumento8 pagineDissertation Topics On Retail IndustryPayToWriteAPaperUK100% (1)

- Gap IncDocumento21 pagineGap IncJayvee Erika Reyes BaulNessuna valutazione finora

- Chacha CokeDocumento85 pagineChacha CokeKapil SharmaNessuna valutazione finora

- CASE STUDY AVO-WPS OfficeDocumento6 pagineCASE STUDY AVO-WPS Officeoluwaniyiisaac12Nessuna valutazione finora

- Colgate Marketing Plan PDFDocumento23 pagineColgate Marketing Plan PDFSabee Khan50% (2)

- Coca ColaDocumento83 pagineCoca ColaAbeer ArifNessuna valutazione finora

- Project Report On Coca ColaDocumento86 pagineProject Report On Coca ColanishaNessuna valutazione finora

- Segmentation Targeting and Positioning in ServicesDocumento42 pagineSegmentation Targeting and Positioning in ServicesAmbuj SinhaNessuna valutazione finora

- Customer Based Brand EquityDocumento11 pagineCustomer Based Brand Equitybidrohi75Nessuna valutazione finora

- 0130323713Documento42 pagine0130323713Rakib AhmedNessuna valutazione finora

- ManiDocumento6 pagineManiManikandan PandiNessuna valutazione finora

- Li & Fung Global Supply ChainDocumento19 pagineLi & Fung Global Supply ChainTarun UraiyaNessuna valutazione finora

- Challenges Encountered by Abaca Product Manufacturers in San Andres, CatanduanesDocumento44 pagineChallenges Encountered by Abaca Product Manufacturers in San Andres, CatanduanesPatricia Mae ObiasNessuna valutazione finora

- Blue Ocean StrategyDocumento6 pagineBlue Ocean Strategypriyank1256100% (1)

- Wal-Mart Stores, Inc., Global Retailer case study, the GUIDE editionDa EverandWal-Mart Stores, Inc., Global Retailer case study, the GUIDE editionNessuna valutazione finora

- Research Paper On Share MarketDocumento5 pagineResearch Paper On Share Marketfefatudekek3100% (1)

- EssayDocumento14 pagineEssaypersephoniseNessuna valutazione finora

- Module 1Documento4 pagineModule 1Trương Thoại LiễuNessuna valutazione finora

- Part II: Discussion QuestionsDocumento8 paginePart II: Discussion Questionssamuel39Nessuna valutazione finora

- Cost Accounting and ManagementDocumento7 pagineCost Accounting and ManagementCris Tarrazona CasipleNessuna valutazione finora

- NIT Hamirpur: Inventory Management Inventory ManagementDocumento58 pagineNIT Hamirpur: Inventory Management Inventory Managementabhinav.v9Nessuna valutazione finora

- Greenwich Sales Report August 2012Documento2 pagineGreenwich Sales Report August 2012HigginsGroupRENessuna valutazione finora

- JUST IN TIME AND BACKFLUSH COSTING With Illustrative ProblemDocumento7 pagineJUST IN TIME AND BACKFLUSH COSTING With Illustrative Problemenzo0% (1)

- Musa Moshref and Shaniqua Hollins Have Operated A Successful FirmDocumento2 pagineMusa Moshref and Shaniqua Hollins Have Operated A Successful FirmMuhammad ShahidNessuna valutazione finora

- Product Availability Inventory SCM Chopra3 PPT Ch12.CompleteDocumento31 pagineProduct Availability Inventory SCM Chopra3 PPT Ch12.CompleteSteve CruzNessuna valutazione finora

- Parcor Quiz Manufacturing Operations ProblemDocumento1 paginaParcor Quiz Manufacturing Operations ProblemArman DizonNessuna valutazione finora

- Paper 4 Material Management Question BankDocumento3 paginePaper 4 Material Management Question BankDr. Rakshit Solanki100% (2)

- Comprehensive Operating Budget Budgeted Balance Sheet SlopesDocumento2 pagineComprehensive Operating Budget Budgeted Balance Sheet Slopestrilocksp SinghNessuna valutazione finora

- Flexible Spline Milling ENGDocumento4 pagineFlexible Spline Milling ENGpatr01Nessuna valutazione finora

- True FalseDocumento2 pagineTrue Falsewaiting4y100% (1)

- Analysis of Financial Statements (D'Leon)Documento48 pagineAnalysis of Financial Statements (D'Leon)John SamonteNessuna valutazione finora

- 03COM - The Quote To Order ProcessDocumento30 pagine03COM - The Quote To Order Processthomas_akapNessuna valutazione finora

- Smart Accounting Chap 8Documento8 pagineSmart Accounting Chap 8Pereyanka RajeswaranNessuna valutazione finora

- EEIM in EngineeringDocumento4 pagineEEIM in EngineeringKhan BasharatNessuna valutazione finora

- Project Report FirstDocumento7 pagineProject Report Firstfzr84Nessuna valutazione finora

- Problemas 2 para EVA01P3Documento4 pagineProblemas 2 para EVA01P3henry huilcamaiguaNessuna valutazione finora

- Business ID: Project:, Sap Ecc 6.0 ImplementationDocumento6 pagineBusiness ID: Project:, Sap Ecc 6.0 ImplementationArvind DavanamNessuna valutazione finora

- Basics of MerchandisingDocumento18 pagineBasics of MerchandisingBrian RobbinsNessuna valutazione finora

- Process Cost System: University of Santo Tomas Ust - Alfredo M. Velayo College of Accountancy SECOND TERM AY 2019-2020Documento17 pagineProcess Cost System: University of Santo Tomas Ust - Alfredo M. Velayo College of Accountancy SECOND TERM AY 2019-2020allNessuna valutazione finora

- OSCA M2 OwaisDocumento7 pagineOSCA M2 OwaisOwais ShaikhNessuna valutazione finora

- CostcoDocumento7 pagineCostcoAbeer arifNessuna valutazione finora

- Inventory C3Documento22 pagineInventory C3quynhtrang01.lscNessuna valutazione finora

- College of Management: Capiz State UniversityDocumento13 pagineCollege of Management: Capiz State UniversityLenlyn SalvadorNessuna valutazione finora

- 6tb Sched 1Documento43 pagine6tb Sched 1Darwin Competente LagranNessuna valutazione finora

- Sap Controlling - Product Costing Part-1 - Sap BlogsDocumento61 pagineSap Controlling - Product Costing Part-1 - Sap BlogsPritpal Singh SNessuna valutazione finora

- ERPNEXTDocumento3 pagineERPNEXTDet RobirNessuna valutazione finora

- BP AFS Function ListDocumento10 pagineBP AFS Function Listsubandiwahyudi08Nessuna valutazione finora

- Sap MMDocumento12 pagineSap MMMajid KhachniNessuna valutazione finora