Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SEBI Crackdown On Unregistered Investment Advisory PMS SMS Service Providers

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SEBI Crackdown On Unregistered Investment Advisory PMS SMS Service Providers

Copyright:

Formati disponibili

PR No.

76/2013

SEBI Crackdown On Entities Engaged in Unregistered Investment Advisory And Portfolio Management Activities through Short Message Services (SMSs)

SEBI had noticed that certain entities were offering intraday tips and stock advisory services to investors through Short Message Services (SMSs) via mobile phones. SEBI , as part of its investigation, obtained details of the call data records of the telephone numbers used for sending such SMSs. Thereafter, SEBI conducted a surprise visit on the premises of one Mr. Imtiyaz Hanif Khanda and one Mr. Vali Mamad Habib Ghaniwala. It was prima-facie observed that the said persons through their proprietary concerns viz. M/s Right Trade,M/s Sai Traders, M/s Bull Trader and M/s Laxmi Traders were providing investment advice without being registered with SEBI. Further, M/s Right Trade had solicited business of portfolio management services from the general public without being registered as a portfolio manager with SEBI. The entities had also made misrepresentations by making unrealistic claims, false statements such as having office in various countries, FII based calls, jackpot calls, etc., and they also made representation in reckless and careless manner in their messages and website suggesting facts which are not true. By their acts and omissions they have prima-facie solicited, enticed and induced investors to deal in securities on the basis of their investment advices, stock trade tips, etc

In view of the above, The Whole Time Member, Shri Rajeev Kumar Agarwal passed an ad-interim ex-parte order dated August 20, 2013 debarring Mr. Imtiyaz Hanif Khanda and Mr. Vali Mamad Habib Ghaniwala from buying, selling or dealing in the securities market, either directly or indirectly, in any manner whatsoever till further orders. Further, the above entities including their proprietary concerns were directed to

(a) to cease and desist from acting as an investment advisors and portfolio managers and not to solicit or undertake such activities or any other unregistered activity in the securities market, directly or indirectly, in any manner whatsoever; (b) immediately withdraw and remove all advertisements, representations, literatures, brochures, materials, publications, documents, websites, etc. in relation to their investment advisory and portfolio management activities or any unregistered activity in the securities market.

The full text of the order is available on SEBI web-site www.sebi.gov.in.

page: 1 [ www.sebi.gov.in ]

Mumbai August 20, 2013

page: 2

[ www.sebi.gov.in ]

Potrebbero piacerti anche

- PR - SEBI Cautions Public To Deal With Only SEBI Registered Investment Advisers and Research AnalystsDocumento2 paginePR - SEBI Cautions Public To Deal With Only SEBI Registered Investment Advisers and Research AnalystsShyam SunderNessuna valutazione finora

- SEBI order against unregistered investment advisory firmDocumento22 pagineSEBI order against unregistered investment advisory firmPratim MajumderNessuna valutazione finora

- Noticees engaged in unregistered investment advisory servicesDocumento19 pagineNoticees engaged in unregistered investment advisory servicesPratim MajumderNessuna valutazione finora

- Merchant Banking Services and RegulationsDocumento30 pagineMerchant Banking Services and Regulationssai prabashNessuna valutazione finora

- Final Order in The Matter of Green Money Solution (Prop. Arvind Patidar)Documento13 pagineFinal Order in The Matter of Green Money Solution (Prop. Arvind Patidar)Pratim MajumderNessuna valutazione finora

- Final Order in The Matter of VRP Capital & Derivative Market Services (Prop. Mr. Vaibhav R Patil)Documento16 pagineFinal Order in The Matter of VRP Capital & Derivative Market Services (Prop. Mr. Vaibhav R Patil)Pratim MajumderNessuna valutazione finora

- Order in respect of Shri. Ravi Chouksey and Gravita Research Company under sections 11(1), 11B and 11D of the Securities and Exchange Board of India Act, 1992 read with the SEBI (Investment Advisers) Regulations, 2013Documento8 pagineOrder in respect of Shri. Ravi Chouksey and Gravita Research Company under sections 11(1), 11B and 11D of the Securities and Exchange Board of India Act, 1992 read with the SEBI (Investment Advisers) Regulations, 2013Shyam SunderNessuna valutazione finora

- SEBI regulates Indian capital markets to protect investorsDocumento5 pagineSEBI regulates Indian capital markets to protect investorsDhamankur GautamNessuna valutazione finora

- FSCA Press Release - FSCA Warns the Public Against Persons or Entities That May Be Unlawfully Providing Financial Products or Conducting Unauthorised Financial Services BusinessDocumento3 pagineFSCA Press Release - FSCA Warns the Public Against Persons or Entities That May Be Unlawfully Providing Financial Products or Conducting Unauthorised Financial Services BusinessRuanNessuna valutazione finora

- Order in The Matter of Unregistered Investment Advisory Activities.Documento11 pagineOrder in The Matter of Unregistered Investment Advisory Activities.Shyam SunderNessuna valutazione finora

- Unit 3Documento16 pagineUnit 3rishavNessuna valutazione finora

- Protection of The Interest of The InvestorDocumento15 pagineProtection of The Interest of The InvestorAnkitha ReddyNessuna valutazione finora

- Capital Market and Securities OutlineDocumento2 pagineCapital Market and Securities OutlineNUPUR KATIYARNessuna valutazione finora

- Arnav 245 (Sebi)Documento14 pagineArnav 245 (Sebi)ArnavNessuna valutazione finora

- Assignment On SebiDocumento8 pagineAssignment On SebiasthaparasarNessuna valutazione finora

- SEBI Functions and Role in Regulating Indian Securities MarketDocumento21 pagineSEBI Functions and Role in Regulating Indian Securities Marketkusum kalani100% (1)

- Merchant Banking: Manoj Verma MaimsDocumento18 pagineMerchant Banking: Manoj Verma Maimsrahul-singh-6592Nessuna valutazione finora

- Confirmatory Order in The Matter of Mr. Mansoor Rafiq Khanda and Mr. Feroz Rafiq KhandaDocumento6 pagineConfirmatory Order in The Matter of Mr. Mansoor Rafiq Khanda and Mr. Feroz Rafiq KhandaShyam SunderNessuna valutazione finora

- Amrit Pai Sushil Ingle Anand LihinarDocumento14 pagineAmrit Pai Sushil Ingle Anand Lihinaranand_lihinarNessuna valutazione finora

- SEBIDocumento29 pagineSEBISanjana Sen100% (1)

- SIT Recommendations - Black MoneyDocumento23 pagineSIT Recommendations - Black MoneyLive LawNessuna valutazione finora

- SEBI AssignmentDocumento9 pagineSEBI AssignmentDeepak KumarNessuna valutazione finora

- SEBI ActDocumento2 pagineSEBI ActPankaj2c100% (1)

- IFS 2 Insider TradingDocumento8 pagineIFS 2 Insider TradingShanu SinghNessuna valutazione finora

- Insider TradingDocumento6 pagineInsider TradingashhNessuna valutazione finora

- Security Analysis Project FinalDocumento37 pagineSecurity Analysis Project FinalDharodVarunNessuna valutazione finora

- INTERNAL AUDIT OF STOCK BROKERSDocumento75 pagineINTERNAL AUDIT OF STOCK BROKERSAnmol Kumar0% (1)

- SEBIDocumento19 pagineSEBIVarun GuptaNessuna valutazione finora

- Abf303 BQ2Documento4 pagineAbf303 BQ2Jay PatelNessuna valutazione finora

- Legal & Statutory Frameworks for Securities MarketsDocumento32 pagineLegal & Statutory Frameworks for Securities MarketsK DIVYANessuna valutazione finora

- The Companies Ordinance, 1984 Memorandum of Association OF XYZ Investment Bank LimitedDocumento11 pagineThe Companies Ordinance, 1984 Memorandum of Association OF XYZ Investment Bank LimitedHira AliNessuna valutazione finora

- Merchant BankingDocumento26 pagineMerchant BankingSanjay PareekNessuna valutazione finora

- Interim Order in The Matter of Mr. Anirudh SethiDocumento14 pagineInterim Order in The Matter of Mr. Anirudh SethiShyam SunderNessuna valutazione finora

- Merchant Banking: Financial Markets and Services - Kiran BinduDocumento20 pagineMerchant Banking: Financial Markets and Services - Kiran BinduRohit SharmaNessuna valutazione finora

- Resignation of Director - 3Documento4 pagineResignation of Director - 3EugeneNessuna valutazione finora

- Merchant Banking: Prepare By: Chandan GuptaDocumento20 pagineMerchant Banking: Prepare By: Chandan GuptaChandan GuptaNessuna valutazione finora

- 2 Year Semester 4: Subject:Industrial LawDocumento15 pagine2 Year Semester 4: Subject:Industrial LawReebeccaNessuna valutazione finora

- Corporate Law - 2122160 Sashwath JainDocumento7 pagineCorporate Law - 2122160 Sashwath Jainsashwath.s.jainNessuna valutazione finora

- Investment Banking ShobhitDocumento14 pagineInvestment Banking Shobhitmunnu tripathiNessuna valutazione finora

- Unit-5 Legal & Statutory Frame WorkDocumento32 pagineUnit-5 Legal & Statutory Frame WorkK DIVYANessuna valutazione finora

- DFCCIL Fraud Prevention Policy SummaryDocumento3 pagineDFCCIL Fraud Prevention Policy SummarymehtaNessuna valutazione finora

- Unit 3Documento22 pagineUnit 3gauravkumar954682Nessuna valutazione finora

- SEBI FinfluencersDocumento6 pagineSEBI FinfluencersAlpha TraderNessuna valutazione finora

- Banking OverviewDocumento46 pagineBanking OverviewnisseemkNessuna valutazione finora

- Financial Markets AND Financial Services: Chapter-31Documento7 pagineFinancial Markets AND Financial Services: Chapter-31Dipali DavdaNessuna valutazione finora

- SEBI RegulationDocumento10 pagineSEBI RegulationAryanNessuna valutazione finora

- Code of Ethics: Vi. Members Sometimes Coped With Pressures by Using Subtle and Ambiguous LanguageDocumento5 pagineCode of Ethics: Vi. Members Sometimes Coped With Pressures by Using Subtle and Ambiguous LanguageMohaiminul Islam ShuvraNessuna valutazione finora

- AMLA NotesDocumento5 pagineAMLA NotesRyDNessuna valutazione finora

- Merchant BankingDocumento17 pagineMerchant BankingShikha BhotikaNessuna valutazione finora

- SEBI's Role in Regulating India's Capital MarketsDocumento5 pagineSEBI's Role in Regulating India's Capital MarketsSaumya SnehalNessuna valutazione finora

- Merchant Banking and Financial ServiceDocumento61 pagineMerchant Banking and Financial Servicesemi_garryNessuna valutazione finora

- Investors Issuers Intermediaries Regulators: Four Important Participants of Securities MarketDocumento19 pagineInvestors Issuers Intermediaries Regulators: Four Important Participants of Securities Marketvijay_vmrNessuna valutazione finora

- Mission of SEBIDocumento7 pagineMission of SEBIananth100% (1)

- Presented by Rajiv Ranjan Section-B Roll. No. - 74Documento13 paginePresented by Rajiv Ranjan Section-B Roll. No. - 74rajivranjan70763% (8)

- Financial Services Assignment: 1. Explain The Role of Securities Exchange Board of India (SEBI) ?Documento5 pagineFinancial Services Assignment: 1. Explain The Role of Securities Exchange Board of India (SEBI) ?jincygeevarghese7132Nessuna valutazione finora

- Final RIRR As of 1 December - CLEAN - FinalDocumento65 pagineFinal RIRR As of 1 December - CLEAN - FinalDegz OsixNessuna valutazione finora

- Insider TradingDocumento10 pagineInsider TradingJatinder Singh KaliramanNessuna valutazione finora

- Memorandum of Understanding Cum AgreementDocumento6 pagineMemorandum of Understanding Cum AgreementRajesh ChauhanNessuna valutazione finora

- What Every Investor Needs to Know About Accounting FraudDa EverandWhat Every Investor Needs to Know About Accounting FraudNessuna valutazione finora

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaDa EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNessuna valutazione finora

- #IndiaStockExchange #BSE Update On 24th June 2015Documento2 pagine#IndiaStockExchange #BSE Update On 24th June 2015Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Wheat Production From 2010 To 2014Documento4 pagineIndia's Wheat Production From 2010 To 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- MSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Documento4 pagineMSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

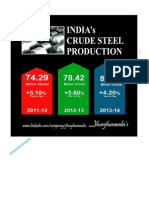

- India Crude Steel Production From 2011-2014Documento4 pagineIndia Crude Steel Production From 2011-2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Commercially Operating Nuclear Reactors in The World at The End of 2013Documento4 pagineCommercially Operating Nuclear Reactors in The World at The End of 2013Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Foreign Direct Investment in Equity Market in IndiaDocumento4 pagineForeign Direct Investment in Equity Market in IndiaJhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India Coir Trade From April To October 2014Documento4 pagineIndia Coir Trade From April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Rice Trade For 2014Documento5 pagineIndia's Rice Trade For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Per Capita Food Grain For 2014Documento3 pagineIndia's Per Capita Food Grain For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Documento3 pagineIndia's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Foreign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Documento3 pagineForeign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Diamond Reserves With Diamond Trade Update For 2014Documento6 pagineIndia's Diamond Reserves With Diamond Trade Update For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Foreign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Documento27 pagineForeign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Coal Reserves To Last 100 YearsDocumento3 pagineIndia's Coal Reserves To Last 100 YearsJhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Coal Production For Last 5 Years Upto October 2014Documento2 pagineIndia's Coal Production For Last 5 Years Upto October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Tourism Sector Performance For January and October 2014Documento15 pagineIndia's Tourism Sector Performance For January and October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Methane Hydrates Reserves 25th November 2014Documento3 pagineIndia's Methane Hydrates Reserves 25th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Crude Steel Production Estimate For 2014 To 2017Documento3 pagineIndia's Crude Steel Production Estimate For 2014 To 2017Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Fuel Price Change For Petrol, Diesel, and JetFuel in IndiaDocumento11 pagineFuel Price Change For Petrol, Diesel, and JetFuel in IndiaJhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Kharif and Rabi Crops Area Coverage For October and January 2014Documento10 pagineIndia's Kharif and Rabi Crops Area Coverage For October and January 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Mineral Production in Month of August 2014Documento3 pagineIndia's Mineral Production in Month of August 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Documento3 pagineIndia's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Import and Export Update For September and December 2014Documento16 pagineIndia's Import and Export Update For September and December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India's Index of Eight Core Industries From June To November 2014Documento57 pagineIndia's Index of Eight Core Industries From June To November 2014Jhunjhunwalas Digital Finance & Business Info Library100% (1)

- Global Central Banks Highlights For Monetary Policy Rates For October 2014Documento31 pagineGlobal Central Banks Highlights For Monetary Policy Rates For October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Global Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Documento11 pagineGlobal Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Indians Railways Revenue Earnings With Freight Traffic During April To October 2014Documento18 pagineIndians Railways Revenue Earnings With Freight Traffic During April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India 'S Total Kharif Crop Sowing Area As On July and August 2014Documento6 pagineIndia 'S Total Kharif Crop Sowing Area As On July and August 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- India Tax Collection From April To November 2014Documento11 pagineIndia Tax Collection From April To November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Documento5 pagineIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Paradox - Pcs200Documento32 pagineParadox - Pcs200Roberto SilvaNessuna valutazione finora

- Maybank 2 eDocumento6 pagineMaybank 2 eNurshafira Mohd NorNessuna valutazione finora

- SMS Alerts From TOPdeskDocumento3 pagineSMS Alerts From TOPdeskTOPdeskNessuna valutazione finora

- Airtel mobile bill detailsDocumento9 pagineAirtel mobile bill detailsAbhishek MeeNessuna valutazione finora

- SMS MomtDocumento3 pagineSMS Momtthanhbcvt_1989Nessuna valutazione finora

- Reference Book NameDocumento81 pagineReference Book Namensavi16eduNessuna valutazione finora

- GSM Based Smart Information System For Lost Atm Cards.Documento8 pagineGSM Based Smart Information System For Lost Atm Cards.Emin KültürelNessuna valutazione finora

- A Introduction To Nokia FBUSDocumento20 pagineA Introduction To Nokia FBUSGangal Norris100% (1)

- TSG PRD TS 11 V17 Cover - Device Field and Lab Test GuidelinesDocumento18 pagineTSG PRD TS 11 V17 Cover - Device Field and Lab Test GuidelinesAlberto Martín JiménezNessuna valutazione finora

- RIL and ModemDocumento2 pagineRIL and ModemRohit Pathania100% (1)

- New API Changelog and DocumentationDocumento23 pagineNew API Changelog and DocumentationSaeros22Nessuna valutazione finora

- F110 Service ManualDocumento204 pagineF110 Service ManualBradatan IonutNessuna valutazione finora

- Home Automation Disaster Management System Via SMS and GSMDocumento5 pagineHome Automation Disaster Management System Via SMS and GSMJournal of ComputingNessuna valutazione finora

- Affordable Matrimonial Website Script PricingDocumento9 pagineAffordable Matrimonial Website Script PricingAjayNessuna valutazione finora

- Mobile ComputingDocumento2 pagineMobile Computingurvesh_patel44100% (1)

- Bulk Sms PresentationDocumento16 pagineBulk Sms PresentationChristopher HerringNessuna valutazione finora

- Geovision 8.5 DVR NVR Software ManualDocumento664 pagineGeovision 8.5 DVR NVR Software ManualDiego KalikNessuna valutazione finora

- Agile Customer ExperiencesDocumento5 pagineAgile Customer ExperiencesIntense Technologies LimitedNessuna valutazione finora

- Prepaid Infocard June '14 OffersDocumento2 paginePrepaid Infocard June '14 OffersDhanush PvNessuna valutazione finora

- Uco Mbanking & ImpsDocumento2 pagineUco Mbanking & ImpssutanuprojectsNessuna valutazione finora

- Tank Water Level Monitoring System Using GSM Network: Related WorkDocumento7 pagineTank Water Level Monitoring System Using GSM Network: Related Workrajesh0024Nessuna valutazione finora

- 3g ss7 InterceptionDocumento21 pagine3g ss7 Interceptiongame___overNessuna valutazione finora

- GSM1308 SA-G+ Quad-Band GSM User Guide Rev1.02Documento37 pagineGSM1308 SA-G+ Quad-Band GSM User Guide Rev1.02Wilmer SalasNessuna valutazione finora

- Resume - Walead BadriDocumento5 pagineResume - Walead BadriWalead Khaled Al-badriNessuna valutazione finora

- RNC Dimensioning ProcedureDocumento14 pagineRNC Dimensioning ProcedureRezgar Mohammad100% (1)

- TK188A GSM/GPRS/GPS TrackerDocumento9 pagineTK188A GSM/GPRS/GPS TrackerFeJuniorNessuna valutazione finora

- Layer 3 - Umts PDFDocumento49 pagineLayer 3 - Umts PDFSukrit Chaudhary100% (6)

- SkoolSmart - BrochureDocumento3 pagineSkoolSmart - BrochureKarthikeyan SNessuna valutazione finora

- GSMDocumento12 pagineGSMAhmed Ibrahim JaradatNessuna valutazione finora

- Sample CV RFPDocumento11 pagineSample CV RFPDeepakNessuna valutazione finora