Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1122

Caricato da

Pasqual Barretti JúniorCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1122

Caricato da

Pasqual Barretti JúniorCopyright:

Formati disponibili

1. Can Anita improve upon the current distribution operations ? Yes, she can.

Actually, transportation companies are chosen the routes for moving merchandise between distribution centres and warehouses; then they charge Orion Food $1,30 for each mile traveled. Anita does not know the routes that transportation companies are using. It means, the control of the distribution costs at this time are under control of the transportation companies. Anita must take control of the routes and specify the routes to the transportation companies. They can not continue choosing the routes because they have a vested interest and it could impact Orion costs. With more miles traveled, they can charge more money to Orion Foods. Having the routes map, distances and locations, she can make a routing analysis and take decisions about the routes used by transportation companies. Also, the contract allows her to specify the routes to the carriers. Because Orion Foods is paying for each mile traveled, it is vital for her to find the shortest routes and have the minimal cost for each route between distribution centres and warehouses. Using Logware and optimizing the current routes Orion Food can have a saving of $22.216 per year. Following table shows the result of the routing analysis, (1) Truckloads are calculated dividing Annual volume cwt by 300 cwt. 300 cwt is equivalent to 30.000 pounds and it is the actual shipment size. Actual transportation cost is $652.274 per year, but using the shortest routes the total cost is reduced to $630.058. This is $22.216 less than the actual cost. This cost reduction will increase Orion Foods profits. Also, Anita must specify to the transportation companies the routes that they must use for moving Orion Foods products. The

followings are the routes to be used by now on, Any change in routes should not be made before Orion Foods analyses options and found the best route. In this manner, Orion Foods can have the control of the distribution costs. 2. Is there any benefit to expanding the warehouse at Burns, OR ? According to Simchi-Levi et al (2008, p. 89), the turn over ratio is the ratio of the total annual outflow from the warehouse to the average inventory level. If the ratio is , then the average inventory level is total annual flow divided by . Using the turnover ratio concept, the capacity (inventory level) needed for each distribution centre is calculated as follows, Fresno = LA + Phoenix + SaltLake + SanFrancisco 132000 + 84000 + 56000 + 105000 377000 = = = 47.125cwt Turnover 8 8 Burns = Portland + Buttle + Seattle 57000 + 15000 + 79000 151.000 = = = 18.875cwt Turnover 8 8 Fresno distribution centre has no problems because its maximum capacity is 50.000 cwt and new projections demands 47.125 cwt. It means Fresno will use 94,25% of its capacity. Onthe other hand, Burns capacity needs to be expanded because its capacity is 15.000 cwt and new projections demand 18.875 cwt, so it means a shortage of 3.875 cwt. The minimal increment is 10.000 cwt, as a consequence, the Burns distribution centre must be expanded in 10.000 cwt and the cost of this expansion is $300.000. New capacity would be 25.000 cwt. This expansion will allow Burns distribution centre to receive new

volume according to marketing projections, but there will have a lot of space without use. Burn will expand 10.000 cwt, but it only needs 3.875 cwt, as a result, 6.125 cwt will be wasted or 61,25% of its space will be without use (inefficient utilization of resources). According to Simchi-Levi et al (2008, p. 57), forecasts not always are right and with longer forecasts horizon, the forecasts are worse. If projections will change for next 5 years and they will go up, Fresno distribution centre would be in problems because it would not have space and only could support 2.875 cwt more before reaching its maximum capacity. Burns only could go up until 25.000 cwt without problems. In the other hand, if projections will go down, Fresno would not have problems, but the expansion of Burns would be a waste of money because it would not be not used and Orion Food would have wasted $300.000. Expanding Burns could bring problems to Orion Foods because there is a risk of wasting money ($300.000) if the projections do not come true. Also, if projections come true with the numbers given by marketing department, Burn will have a 61,25% of their space without use. The only benefit with this expansion is to support the new volume. Orion Foods are not saving money or improving their costs with this expansion. 3. Is there any merit to consolidate the regional warehousing operation at Reno ? Consolidating operations in Reno would have administrative and operational benefits for Orion Foods. Some of the benefits are : Inventory would be reduced because one warehousing point would be eliminated. Overhead cost would be reduced. They would have more control over inventory and distribution operation because centralization leads to global optimization (Simchi-Levi, at all, 2008, p 232). Efficient utilization of resources (forklifts, warehousing racks, devices, conveyors belts, etc) because this new DC would have an aggregated volume. Table below shows the new routes to be used by transportation

companies and costs associated with them, The routes map is as follows : Also, there are benefits in cost terms. Using turnover ratio concept, the inventory level of Reno distribution centre can be calculated : Inventory = annual _ volume = 528.000 = 66.000cwt turnover 8 The standard cost for 100 pounds (1 cwt) of average product mix is $60. It means the inventory cost would be, Inventory _ cos t = 66.000 * 60 = $3.960.000 Carrying cost is 35% per year before taxes. Converting this cost from yearly to turnover period of time, 35% / 8 = 4,376% per turnover. Inventory _ Carrying _ cos t = $3.960.000 * 4,376% = $173.448 Current inventory cost would be $3.960.000 + $173.448 = $ 4.133.448 (without Renos consolidation) Consolidating in Reno would have the benefit of reducing inventory in 40%. The new inventory level would be, Inventory _ level = $3.960.000 * 60% = $2.376.000 or Inventory _ level = 66.000cwt * 60% = 39.600cwt * 60 = $2.376.00 New turnover would be : Inventory _ turnover = 528.000cwt = 13,3 39.600cwt And new inventory carrying cost would be : Inventory _ carrying _ cos t = $2.376.000 * 35% = $62,489 13,3

New Reno inventory cost would be $2.376.000 + $62.489 = $ 2.438.489, it means a cost reduction of $1.694.959 ($4.133.448 2.438.489) On the other hand, the distribution cost would increase with this new distribution centre from $896.519 per year to $1.198.838 per year. It means there would be a cost increase of $302.319 The total investment for Reno distribution centre is $2.000.000, the ROI would be, ROI = Total _ savings $1.694.959 $302.319 $1.392.640 = = = 69,63% Investment $2.000.000 $2.000.000 It means, the 69,63% of the investment would be paid back in a year, and the balance in 5,2 months of next year. The total investment would be paid back in 17,2 months. With this option, Orion Foods would have a distribution cost increase from $896.519 (with Fresno and Burns distribution centres) to $1.198.838. It is an increase of $302.319, a 33% more than previous option. In spite of increasing the distribution cost, the inventory and carrying cost reductions compensate this increase and finally give to Orion Foods a total saving of $1.392.640 per year after first 17,7 months. In summary, this option would let Orion Foods, Improve their cash flow and working capital ($1.351.60 in savings after paying back the investment). Reduce inventory level and carrying cost. Reduce operational and administrative cost Reduce the risk of obsolete inventory because the inventory level is reduced. This is a good thing keeping in mind they distribute perishable products (Fruit and Vegetables) Increase turnover from 8 to 13,3. It means the inventory remains in average less than one month in the distribution centre. Control and organize the distribution operation. This option has enough merits to be chosen instead option 2. With this option Orion Foods will have savings and they can improve

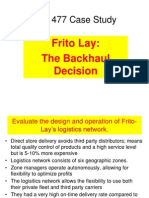

their cost and cash flow. This is a summary of the options studied in this case, BIBLIOGRAFY Ballou, R., 2004, Business Logistics / supply chain management : planning, organizing and controlling the th supply chain, 5 edn, Pearson Prentice Hall, New Jersey. SimchiLevu, D, Kaminsky, P, & Simchi-Levy, E, 2008, Designing and managing the supply chain: Concepts, rd strategies and case Studies, 3 edn, McGraw Hill, New York. Orion Foods, Inc. Distribution Center Chris Piazza, Peter Kirner, Mackenzie Morrison, Cory Schmidt, Tyler Cummings, Alex Wiener Fresno, CA & Burns, OR Reno, Nevada Fresno, CA distributes to LA, Phoenix, Salt Lake, and San Francisco Burns, OR distributes to Portland, Butte, and Seattle 2 regional distribution centers catering to 7 field warehouses Centralized location for distribution Initial investment of $2,000,000 40% inventory reduction throughout supply chain The Problem Currently no direction is given to contracted trucking company on which route to use Two options: Keep existing distribution centers in Fresno, CA and Burns, OR Open one centrally located distribution center in Reno, NV Burns warehouse is near capacity, so expansion would be required Reno, NV warehouse would be one-time cost of $2,000,000, but would reduce total inventory by 40% 3 Key Questions Can Anita improve upon the current distribution operations? Is there any benefit of expanding the warehouse at Burns, OR? Is there any merit to consolidating the regional warehousing operation in Reno, NV? Reduces total transport miles by 50,000 Reduces inventory by 40%

Reduces total number of shipments by 500 Transport cost savings of $70,000 Carrying costs savings of $400,000 Total savings after year 4: $210,000 Elimination of duplicate inventory Pre-selected transportation routes About Orion Foods, Inc Packer of wide variety of fruits and vegetables Sold throughout USA Anita Barley, newly appointed traffic manager First project is to "clean up distribution mess in the West" Cost to distribute product in West Coast is excessive Summary Recommendation Layout, Cont.

Potrebbero piacerti anche

- Throughput Accounting: A Guide to Constraint ManagementDa EverandThroughput Accounting: A Guide to Constraint ManagementNessuna valutazione finora

- Use MoreDocumento5 pagineUse Moreg14032Nessuna valutazione finora

- Ballou Logistics Solved Problems Chapter 14Documento25 pagineBallou Logistics Solved Problems Chapter 14RenTahL100% (1)

- National Cranberry Cooperative 1981Documento10 pagineNational Cranberry Cooperative 1981Nicole Dorado0% (1)

- HP CaseDocumento3 pagineHP CaseJuan Camilo ZarrukNessuna valutazione finora

- ManualDocumento41 pagineManualTuan Bình0% (2)

- Ballou07 ImDocumento18 pagineBallou07 ImLeonardo Daniel CarrascoNessuna valutazione finora

- Littlefield Assignment - Introduction PDFDocumento3 pagineLittlefield Assignment - Introduction PDFPavan MalagimaniNessuna valutazione finora

- Chopra Meindl SCM Ch1 PDFDocumento19 pagineChopra Meindl SCM Ch1 PDFKausarAtique100% (1)

- Case Write-Up: Grocery Gateway: Customer Delivery OperationsDocumento4 pagineCase Write-Up: Grocery Gateway: Customer Delivery OperationsCHARANJEET SINGHNessuna valutazione finora

- Unit 1: The Receiving of Goods and MaterialsDocumento33 pagineUnit 1: The Receiving of Goods and MaterialsMadhav Chowdary TumpatiNessuna valutazione finora

- This Study Resource Was: F (Q) Co Cu+CoDocumento8 pagineThis Study Resource Was: F (Q) Co Cu+Comarvin mayaNessuna valutazione finora

- Inventory ModelDocumento43 pagineInventory Modelndc6105058Nessuna valutazione finora

- Ballou Logistics Solved Problems Chapter 13Documento42 pagineBallou Logistics Solved Problems Chapter 13RenTahL60% (5)

- Group - Deepak Yadav 2020MBA124 Shreem Kohli 2020MBA161 Sanka Manoj Chandra 2020MBA Srinath S 2020MBADocumento6 pagineGroup - Deepak Yadav 2020MBA124 Shreem Kohli 2020MBA161 Sanka Manoj Chandra 2020MBA Srinath S 2020MBADeepak YadavNessuna valutazione finora

- Answers To Old Midterm QsDocumento11 pagineAnswers To Old Midterm QsdarshangoshNessuna valutazione finora

- Case Report (Boeing767)Documento1 paginaCase Report (Boeing767)ydb1627Nessuna valutazione finora

- OM - National Cranberry - TemplateDocumento3 pagineOM - National Cranberry - Templatebeta alpha gammaNessuna valutazione finora

- OM Case Write-UpDocumento2 pagineOM Case Write-UpTushar SinhaNessuna valutazione finora

- 05 - 07-07-2013 Case StudyDocumento5 pagine05 - 07-07-2013 Case StudyDavy SornNessuna valutazione finora

- Case Study DEP/GARD SolutionDocumento3 pagineCase Study DEP/GARD SolutionNadit BhootNessuna valutazione finora

- Chapter 13 - : Aggregate PlanningDocumento28 pagineChapter 13 - : Aggregate PlanningCHARU SURYAVANSHINessuna valutazione finora

- Home Work Chapter 1 To 12Documento50 pagineHome Work Chapter 1 To 12Haha JohnNgNessuna valutazione finora

- Littlefield Technologies ReportDocumento1 paginaLittlefield Technologies ReportHardik RupareliaNessuna valutazione finora

- Revenue Management at SkyJetDocumento8 pagineRevenue Management at SkyJetmilan Gandhi0% (1)

- Forecasting Littlefield LaboratoriesDocumento10 pagineForecasting Littlefield LaboratoriesLeland Coontz IV100% (1)

- SCM Assignment4Documento4 pagineSCM Assignment4mushtaque61Nessuna valutazione finora

- Usemore Soap CompanyDocumento8 pagineUsemore Soap Companyg14032Nessuna valutazione finora

- KLF Electronics QuestionDocumento5 pagineKLF Electronics QuestionSumit GuptaNessuna valutazione finora

- Bis CorporationDocumento2 pagineBis CorporationXinru ChenNessuna valutazione finora

- AD2 - Managing Risks in Supply Chains - Case Study - Questions and AnswersDocumento11 pagineAD2 - Managing Risks in Supply Chains - Case Study - Questions and Answersdanibgg823Nessuna valutazione finora

- Case3-Obermeyer Case StudyDocumento20 pagineCase3-Obermeyer Case StudyAbhilash PatniNessuna valutazione finora

- Designing The Distribution Network For Michaels HardwareDocumento6 pagineDesigning The Distribution Network For Michaels HardwareAhmed Bilal100% (1)

- HP Deskjet Case SummaryDocumento1 paginaHP Deskjet Case SummaryManish ParmarNessuna valutazione finora

- SOLUCIONARIO Cap 6,7 y 12Documento80 pagineSOLUCIONARIO Cap 6,7 y 12Yeni PauccarNessuna valutazione finora

- Philips Electronics Synchronizes Its Supply ChainDocumento30 paginePhilips Electronics Synchronizes Its Supply ChainAmit ChaudharyNessuna valutazione finora

- 19 KRM Om10 Ism ch16Documento36 pagine19 KRM Om10 Ism ch16OPMANG100% (1)

- Case Discussion Questions:: Calculations - SportsobermeyerDocumento3 pagineCase Discussion Questions:: Calculations - SportsobermeyerClaire ZhengNessuna valutazione finora

- Case 6-33 AMLDocumento10 pagineCase 6-33 AMLNana Slambuabuabu New PartNessuna valutazione finora

- Supply Planning and Purchasing Flow Chart v1Documento2 pagineSupply Planning and Purchasing Flow Chart v1harry4sap100% (1)

- 2 Case Studies For TransportationDocumento3 pagine2 Case Studies For TransportationNhư Nguyệt ĐặngNessuna valutazione finora

- AJAX OriginalDocumento7 pagineAJAX Originalreva_radhakrish1834Nessuna valutazione finora

- First Semester 2019 2104697 System Modeling and Analysis Homework 4 Due On November 23, 2019Documento2 pagineFirst Semester 2019 2104697 System Modeling and Analysis Homework 4 Due On November 23, 2019Jiraros SoponarunratNessuna valutazione finora

- Supply Chain ManagementDocumento20 pagineSupply Chain ManagementŞermin ŞahinNessuna valutazione finora

- Frito Lay PresDocumento8 pagineFrito Lay PresAmber LiuNessuna valutazione finora

- OPIM101 - Spring 2012 - Extra Study Problems With Solutions PDFDocumento17 pagineOPIM101 - Spring 2012 - Extra Study Problems With Solutions PDFjoe91bmw100% (1)

- Question 3. What Recommendations Would You Make To Rolfs in Order To Address The Both Near-And Longer-Term Issues? AnswerDocumento1 paginaQuestion 3. What Recommendations Would You Make To Rolfs in Order To Address The Both Near-And Longer-Term Issues? AnswerAchal GoelNessuna valutazione finora

- Beer GameDocumento2 pagineBeer Gameemuro001Nessuna valutazione finora

- Group - 02-Mi Adidas - Mass CustomizationDocumento16 pagineGroup - 02-Mi Adidas - Mass CustomizationAninda DuttaNessuna valutazione finora

- Analysis of PolysarDocumento84 pagineAnalysis of PolysarParthMairNessuna valutazione finora

- Operations ManagementDocumento6 pagineOperations ManagementRami smartNessuna valutazione finora

- Lehigh Steel Final DocumentDocumento6 pagineLehigh Steel Final DocumentSavita SoniNessuna valutazione finora

- Advanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting ProductsDocumento7 pagineAdvanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting ProductsArchit AroraNessuna valutazione finora

- Case-Study Giles Tabandite Tuerker WotkeDocumento16 pagineCase-Study Giles Tabandite Tuerker WotkeAlfred Poleng0% (1)

- Dream BeautyDocumento6 pagineDream BeautyANZ100% (5)

- Assignment 2 - Supply ChainDocumento5 pagineAssignment 2 - Supply ChainHeena SharmaNessuna valutazione finora

- New Zealand All Natural Ice Cream (NAN)Documento16 pagineNew Zealand All Natural Ice Cream (NAN)Ashish MohiteNessuna valutazione finora

- Chapter 05 1a EocDocumento9 pagineChapter 05 1a EocOmar CirunayNessuna valutazione finora

- Dollar Tree Case StudyDocumento11 pagineDollar Tree Case StudyVarun Sharda100% (2)

- Chartered University College: F5 Test 1 (Part A & Part B)Documento5 pagineChartered University College: F5 Test 1 (Part A & Part B)Rakib HossainNessuna valutazione finora

- Barilla SpADocumento2 pagineBarilla SpAyyyNessuna valutazione finora

- Final Financial Aspect PDFDocumento20 pagineFinal Financial Aspect PDFShedNessuna valutazione finora

- FsaDocumento3 pagineFsaCiptawan CenNessuna valutazione finora

- Permenlh 13-2010 Tentang Ukl-Upl Dan SPPLDocumento9 paginePermenlh 13-2010 Tentang Ukl-Upl Dan SPPLSyarif HidayatullahNessuna valutazione finora

- Inventories IAS2Documento9 pagineInventories IAS2SOhailNessuna valutazione finora

- Cost Allocation: Joint Products and ByproductsDocumento54 pagineCost Allocation: Joint Products and ByproductsLia AmeliaNessuna valutazione finora

- Financial Accounting Auditing - Paper IV PDFDocumento368 pagineFinancial Accounting Auditing - Paper IV PDFjashveer rekhiNessuna valutazione finora

- Just in Time InventoryDocumento29 pagineJust in Time InventoryGorky SinghNessuna valutazione finora

- Proposal Admass UniversityDocumento15 pagineProposal Admass UniversityHabteweld EdluNessuna valutazione finora

- Information Systems Used in Strategic Business Development in A RMG IndustryDocumento11 pagineInformation Systems Used in Strategic Business Development in A RMG IndustryGeetika GulyaniNessuna valutazione finora

- Movement Types For Customer Stock - Inventory Management - SAP LibraryDocumento3 pagineMovement Types For Customer Stock - Inventory Management - SAP Librarytrv.sapNessuna valutazione finora

- Principles of Financial AccountingDocumento7 paginePrinciples of Financial AccountingmfaizanzahidNessuna valutazione finora

- Supply Chain Management: Achieving Strategic Fit and ScopeDocumento220 pagineSupply Chain Management: Achieving Strategic Fit and ScopeAarav AnandNessuna valutazione finora

- New CMA Part 1 Section CDocumento124 pagineNew CMA Part 1 Section CSt Dalfour Cebu100% (1)

- ACC460Documento6 pagineACC460Samantha SchumacherNessuna valutazione finora

- NPTEL POMS Week 5 A05 - Final SolutionsDocumento3 pagineNPTEL POMS Week 5 A05 - Final SolutionsAnurag SharmaNessuna valutazione finora

- Acj Manufacturing - PresentationDocumento11 pagineAcj Manufacturing - PresentationJansen Benavidez100% (1)

- Reflection PAPER in REO WEBINARDocumento4 pagineReflection PAPER in REO WEBINARKyla Joy T. SanchezNessuna valutazione finora

- Practice Problems For The FinalDocumento20 paginePractice Problems For The FinalThanh Ngân0% (2)

- Qa Inventories Substantive TestingDocumento6 pagineQa Inventories Substantive TestingAsniah M. RatabanNessuna valutazione finora

- Product Cost by Sales Order: Scenario: PrerequisitesDocumento5 pagineProduct Cost by Sales Order: Scenario: PrerequisitesGK SKNessuna valutazione finora

- Required: If Green Machine Company Used The FIFO and The Weighted Average Methods ofDocumento6 pagineRequired: If Green Machine Company Used The FIFO and The Weighted Average Methods ofrook semayNessuna valutazione finora

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)Documento1 paginaAcc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)nicole bancoroNessuna valutazione finora

- JDE TablesDocumento3 pagineJDE TablesRaul Islas Tapia0% (1)

- Chapter 7 InventoriesDocumento4 pagineChapter 7 Inventoriesmaria isabellaNessuna valutazione finora

- Triple A SCMDocumento22 pagineTriple A SCMArun SinghNessuna valutazione finora

- FsaDocumento2 pagineFsaSNEAKER BANG BANG BANG BautistaNessuna valutazione finora

- Submitted By: Abhilash Rakesh Ranjan Gaurav Gupta Amar Keshari Paresh PatraDocumento10 pagineSubmitted By: Abhilash Rakesh Ranjan Gaurav Gupta Amar Keshari Paresh PatraAmar Keshari0% (1)

- Case Study: Read Below Case Study and Answer The Following Marks: 5Documento1 paginaCase Study: Read Below Case Study and Answer The Following Marks: 5shahzaman qureshiNessuna valutazione finora

- Chap 13 Inventory ManagementDocumento43 pagineChap 13 Inventory ManagementAcyslz50% (2)