Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case Study Foreign Investment Analysis - A Tangled Affair

Caricato da

Angel PinaHardinTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Case Study Foreign Investment Analysis - A Tangled Affair

Caricato da

Angel PinaHardinCopyright:

Formati disponibili

Running Head: FOREIGN INVESTMENT ANALYSIS

Foreign Investment Analysis: A Tangled Affair Angel PinaHardin ACCU 615 September 15, 2013 Brandman University

Running Head: FOREIGN INVESTMENT ANALYSIS Foreign Investment Analysis: A Tangled Affair Introduction Knowing when and how to diversify a corporations operations can lead to major profit

or great loss. The Chief Financial Officer of Marisa Corporation must decide how to diversify its operations. One option Marisa Corporation is reviewing is the procurement of MBI International, a US-based multi-national corporation with operations in many countries. Before acquiring MBI International consideration must be given to the positive and negative affects of such an acquisition, how MBI International translates its accounts and the effect the exchange rate will have on these translations. Pros and Cons Marisa Corporation is a major electronics manufacturer headquartered in Connecticut. The Corporation is looking to expand globally; one possibility is to purchase a multinational company that is well established. A potential candidate is MBI International. MBI is a company that operates in a significant number of countries. Marisa Corporation needs to look at the positive and negative aspects of purchasing MBI International. Some positive outcomes for purchasing MBI International include establishing international presence and diversifying Marisa Corporations. Some negative outcomes of purchasing a multinational company include the company of interest may not disclose movement and fluctuation of currency in the countries it operates in. When looking at the positives and negatives effects of acquiring a multinational company that already has major international presence, it is encouraged and recommended review the financial reports from the previous years of operation to obtain a better understanding of how a company manages its finances. Having an international presence established, MBI

Running Head: FOREIGN INVESTMENT ANALYSIS International is able to offer a saving to Marisa Corporation because major advertising will not be necessary compared to if Marisa Corporation wanted to expand independently. According to Choi and Meek (2011), Marisa Corporation estimates that approximately 60% of MBI

Internationals earnings are from abroad (pg. 384). With the merger of Marisa Corporation and MBI Internationals, Marisa Corporation would expand globally. Entrepreneur Magazine (n.d.) states that buying an already established business is less risky and that taking over the operations is moderately easier as the business is already generating cash flow and profit. Although the purchase of an international company is convenient for Marisa Corporation there could be negatives side effects as well. Entrepreneur Magazine (n.d.) says if not careful, there is the possibility of being stuck with obsolete inventory, uncooperative employees or outdated distribution methods. According to Choi and Meek (2011), since MBI International

does not disclose data explaining the movement of the major currencies, Marisa Corporation should use caution before making an acquisition. Marisa Corporation should require MBI International to explain how the major currency are moved on their financial reports. With the rise of global acquisitions, it is important to understand the differences between US GAAP and IFRS. If Marisa Corporation decides to purchase MBI International, their accounting and financial teams will need to learn about IFRS. When generating annual reports, most companies have a private auditing company that validates the report. This is important to investors and stockholders to they have a better understanding on how their investment is being utilized. Investing in a company with global locations can create a burden on financial managers of Marisa Corporation. There be a requirement for additional training to ensure all in the corporation have an understanding if IFRS. Understanding [the] differences [between US GAAP and IFRS] and their impact on key deal metrics, as well as both short and long-term

Running Head: FOREIGN INVESTMENT ANALYSIS

financial reporting requirements, will lead to a more informed decision-making process and help minimize late surprises that could significantly impact, or even derail, a potential purchase or sale transaction in terms of either value or completion (PricewaterhouseCoopers, LLP, 2012). A major problem with a global acquisition is the fluctuation of the currency rate around the world. Choi & Meek (2011) state, fluctuating exchange values are particularly evident in Eastern Europe, Latin America, and certain parts of Asia (pg. 172). Additionally, this fluctuation can increase the number of translations create rates that can be used in the translation process and create foreign exchange gains and losses (Choi & Meek, 2011). Translations of accounts Some questions that Marisa Corporation should ask MBI International is how they translate financial reports from all of the countries within which they operate. Because all accounts translate differently, Choi & Meek (2011) state, translating accounts from a stable to an unstable currency is not the same as translating accounts from an unstable currency to a stable one (pg. 183). One issue already taken into consideration is the fluctuation of currency, which puts the 10% of MBI Internationals non-US revenue at a translation loss because of operating in high inflationary countries. Marisa Corporation should look at the different translation approaches that best suits the perspective, parent or local company, and their stockholders and investors. Three methods discussed by Choi and Meek (2011) are (1) the historical method, (2) the current method, and (3) no translation at all (pg. 184). Conclusion Marisa Corporation is a major electronics manufacturer that is looking to expand internationally; Marisa Corporations headquarters are located in Connecticut. Marisa

Running Head: FOREIGN INVESTMENT ANALYSIS Corporation has many options in expanding internationally. A possible option is to purchase a company already established internationally. A perspective company identified as MBI International would produce a faster return on their investment than having to establish a new company. Regardless if purchasing a company overseas or locally, there are positive and negative effects to acquiring of any company. These must also be taken into consideration when purchasing a company. However, once the decision is made to purchase a multinational company, the purchaser should state in which format they would like the translation of financial

funds prior to assuming custody of the new company. Knowing and understanding translation of currency when filing annual reports will offer some insight for managers and investors to know if their investment is paying off.

Running Head: FOREIGN INVESTMENT ANALYSIS References Choi, F. D., & Meek, G. K. (2011). International accounting (7th ed.). Upper Saddle River: Pearson Education Inc. PricewaterhouseCoopers, LLP. (2012, October). IFRS and US GAAP: Similarities and differences. Retrieved from PWC: http://www.pwc.com/en_US/us/issues/ifrsreporting/publications/assets/ifrs-and-us-gaap-similarities-and-differences-2012.pdf Unknown. (n.d.). How to buy a business. Retrieved from Entrepreneur Magazine: http://www.entrepreneur.com/article/79638

Potrebbero piacerti anche

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaDocumento25 pagineUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviNessuna valutazione finora

- Five Steps To Valuing A Business: 1. Collect The Relevant InformationDocumento7 pagineFive Steps To Valuing A Business: 1. Collect The Relevant InformationArthavruddhiAVNessuna valutazione finora

- Lecture 16: Overview of Private Equity: FNCE 751Documento50 pagineLecture 16: Overview of Private Equity: FNCE 751jkkkkkkkkkretretretrNessuna valutazione finora

- SBDC Valuation Analysis ProgramDocumento8 pagineSBDC Valuation Analysis ProgramshanNessuna valutazione finora

- On Buy Back of ShareDocumento30 pagineOn Buy Back of Shareranjay260Nessuna valutazione finora

- Edelweiss Alpha Fund - November 2016Documento17 pagineEdelweiss Alpha Fund - November 2016chimp64Nessuna valutazione finora

- Fundamentals of FinancemangementDocumento103 pagineFundamentals of FinancemangementjajoriavkNessuna valutazione finora

- Term LoanDocumento39 pagineTerm Loanashok_gupta077Nessuna valutazione finora

- Case Study Alliston AssignmentDocumento6 pagineCase Study Alliston AssignmentParamvir SinghNessuna valutazione finora

- WLAS - CSS 12 - w3Documento11 pagineWLAS - CSS 12 - w3Rusty Ugay LumbresNessuna valutazione finora

- Electronic Check ProcessingDocumento1 paginaElectronic Check Processingaaes2Nessuna valutazione finora

- VC FundsDocumento42 pagineVC FundsJogendra BeheraNessuna valutazione finora

- A Note On Valuation in Entrepreneurial SettingsDocumento4 pagineA Note On Valuation in Entrepreneurial SettingsUsmanNessuna valutazione finora

- Project FinanceDocumento12 pagineProject FinancePiyush HirparaNessuna valutazione finora

- Exit Via Ipo in China: An Examination of The Exit EnvironmentDocumento23 pagineExit Via Ipo in China: An Examination of The Exit EnvironmentShirlene TsuiNessuna valutazione finora

- Reverse Discounted Cash FlowDocumento11 pagineReverse Discounted Cash FlowSiddharthaNessuna valutazione finora

- Corporate RestructuringDocumento18 pagineCorporate Restructuring160286sanjeevjha50% (6)

- Armor MagazineDocumento56 pagineArmor Magazine"Rufus"100% (2)

- GKC Projects Limited: Enterprise Valuation ReportDocumento31 pagineGKC Projects Limited: Enterprise Valuation Reportcrmc999Nessuna valutazione finora

- UBS Outlook 2024Documento120 pagineUBS Outlook 2024Vivek TiwariNessuna valutazione finora

- M&a 3Documento25 pagineM&a 3Xavier Francis S. LutaloNessuna valutazione finora

- Unit 5 - Simulation of HVDC SystemDocumento24 pagineUnit 5 - Simulation of HVDC Systemkarthik60% (10)

- IPO / Listing Planning: Affan Sajjad - ACADocumento35 pagineIPO / Listing Planning: Affan Sajjad - ACAKhalid MahmoodNessuna valutazione finora

- ProjectDocumento24 pagineProjectAayat R. AL KhlafNessuna valutazione finora

- Valuation-Dividend Discount ModelDocumento23 pagineValuation-Dividend Discount Modelswaroop shettyNessuna valutazione finora

- Fundamentals of Foreign InvestmentsDocumento4 pagineFundamentals of Foreign InvestmentsVIPUL ThakurNessuna valutazione finora

- Debt ValuationDocumento39 pagineDebt Valuationdianne878Nessuna valutazione finora

- PDF - Investment Policy Statement ReviewDocumento12 paginePDF - Investment Policy Statement Reviewmungufeni amosNessuna valutazione finora

- Equity Research Report On Mundra Port SEZDocumento73 pagineEquity Research Report On Mundra Port SEZRitesh100% (11)

- Case StudyDocumento3 pagineCase StudyAnqi Liu50% (2)

- M&A PitchDocumento13 pagineM&A PitchMatt EilbacherNessuna valutazione finora

- Mergers Acquisitions Valuation With ExcelDocumento4 pagineMergers Acquisitions Valuation With ExcelTazeen Islam0% (1)

- Nutrition and Diet Therapy ExaminationDocumento8 pagineNutrition and Diet Therapy ExaminationIrwan M. Iskober100% (3)

- A Study On Leveraged Buyout's in IndiaDocumento83 pagineA Study On Leveraged Buyout's in IndiaVinod Ambolkar100% (1)

- Ipo ProcessDocumento9 pagineIpo Processrahulkoli25Nessuna valutazione finora

- Quantile Regression (Final) PDFDocumento22 pagineQuantile Regression (Final) PDFbooianca100% (1)

- Waterfront Development Goals and ObjectivesDocumento2 pagineWaterfront Development Goals and ObjectivesShruthi Thakkar100% (1)

- Analysis Report On Macquarie GroupDocumento55 pagineAnalysis Report On Macquarie GroupBruce BartonNessuna valutazione finora

- Research Challenge Acb Report National Economics UniversityDocumento21 pagineResearch Challenge Acb Report National Economics UniversityNguyễnVũHoàngTấnNessuna valutazione finora

- Mergers and AcquisitionDocumento38 pagineMergers and AcquisitionRajesh WariseNessuna valutazione finora

- Corporate Finance: Risk Analysis ReportDocumento3 pagineCorporate Finance: Risk Analysis ReportJasdeep Singh KalraNessuna valutazione finora

- Cub Energy Reverse TakeoverDocumento331 pagineCub Energy Reverse TakeoverAlex VedenNessuna valutazione finora

- Nestle Report AnalysisDocumento3 pagineNestle Report AnalysisAkshatAgarwalNessuna valutazione finora

- Mid MonthDocumento4 pagineMid Monthcipollini50% (2)

- Theoretical Framework of Foreign Direct InvestmentDocumento18 pagineTheoretical Framework of Foreign Direct Investmentmahantesh123100% (8)

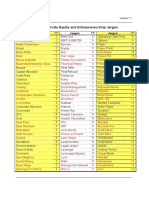

- Private Equity JargonDocumento14 paginePrivate Equity JargonWilling ZvirevoNessuna valutazione finora

- Helion Ventures PartnersDocumento4 pagineHelion Ventures Partnersaimanfatima100% (1)

- Creative Analysis of Financial ReportDocumento31 pagineCreative Analysis of Financial ReportHitesh PatelNessuna valutazione finora

- Equity Valuation:: Applications and ProcessesDocumento21 pagineEquity Valuation:: Applications and ProcessesMohid SaleemNessuna valutazione finora

- Strategic Management and Strategic Competitiveness: R. Dennis MiddlemistDocumento53 pagineStrategic Management and Strategic Competitiveness: R. Dennis MiddlemistShruti AgrawalNessuna valutazione finora

- Lbo Model Short FormDocumento4 pagineLbo Model Short FormAkash PrasadNessuna valutazione finora

- Term Paper Investment AnalysisDocumento29 pagineTerm Paper Investment AnalysissdfdsfNessuna valutazione finora

- Eco ProjectDocumento29 pagineEco ProjectAditya SharmaNessuna valutazione finora

- Term Sheet: NBAD GCC Opportunities Fund (AJAJ)Documento12 pagineTerm Sheet: NBAD GCC Opportunities Fund (AJAJ)gaceorNessuna valutazione finora

- Investment Analysis in BanksDocumento63 pagineInvestment Analysis in Bankschandu_jjvrpNessuna valutazione finora

- Lbo ModelDocumento4 pagineLbo Modelharshalp1212Nessuna valutazione finora

- Investment Banking - Session 1Documento28 pagineInvestment Banking - Session 1Grishma Rupera100% (1)

- RATIOS AnalysisDocumento61 pagineRATIOS AnalysisSamuel Dwumfour100% (1)

- Excel Assignment 1 Stock PortfolioDocumento16 pagineExcel Assignment 1 Stock PortfolioSonya TkachmanNessuna valutazione finora

- RC Equity Research Report Essentials CFA InstituteDocumento3 pagineRC Equity Research Report Essentials CFA InstitutetheakjNessuna valutazione finora

- IGNOU MBA MS - 04 Solved Assignment 2011Documento12 pagineIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNessuna valutazione finora

- Workshop VC FoFsDocumento6 pagineWorkshop VC FoFsProtalinaNessuna valutazione finora

- The Hertz Corporation Chapter 11 FilingDocumento27 pagineThe Hertz Corporation Chapter 11 FilingTradeHawkNessuna valutazione finora

- The Finance Professional 2020-ACCADocumento20 pagineThe Finance Professional 2020-ACCAAyodeji Yosef OlumoNessuna valutazione finora

- Social Impact Bond CaseDocumento21 pagineSocial Impact Bond CaseTest123Nessuna valutazione finora

- Asg 1 Role of Finance ManagerDocumento2 pagineAsg 1 Role of Finance ManagerRokov N ZhasaNessuna valutazione finora

- Share CapitalDocumento21 pagineShare CapitalMehal Ur RahmanNessuna valutazione finora

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketDocumento13 pagineBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaNessuna valutazione finora

- Dcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Documento6 pagineDcat2014 - Simulated Set B - Section 3 - Reading Comprehension - Final v.4.7.2014Joice BobosNessuna valutazione finora

- Hoaxes Involving Military IncidentsDocumento5 pagineHoaxes Involving Military IncidentsjtcarlNessuna valutazione finora

- Pplied Hysics-Ii: Vayu Education of IndiaDocumento16 paginePplied Hysics-Ii: Vayu Education of Indiagharib mahmoudNessuna valutazione finora

- Sample Marketing Plan HondaDocumento14 pagineSample Marketing Plan HondaSaqib AliNessuna valutazione finora

- Position Paper Guns Dont Kill People Final DraftDocumento6 paginePosition Paper Guns Dont Kill People Final Draftapi-273319954Nessuna valutazione finora

- Art 3-6BDocumento146 pagineArt 3-6BCJNessuna valutazione finora

- Paleontology 1Documento6 paginePaleontology 1Avinash UpadhyayNessuna valutazione finora

- Of Bones and Buddhas Contemplation of TH PDFDocumento215 pagineOf Bones and Buddhas Contemplation of TH PDFCNessuna valutazione finora

- Aleister Crowley Astrological Chart - A Service For Members of Our GroupDocumento22 pagineAleister Crowley Astrological Chart - A Service For Members of Our GroupMysticalgod Uidet100% (3)

- B2 First Unit 11 Test: Section 1: Vocabulary Section 2: GrammarDocumento1 paginaB2 First Unit 11 Test: Section 1: Vocabulary Section 2: GrammarNatalia KhaletskaNessuna valutazione finora

- ART 6 LEARNING PACKET Week2-3Documento10 pagineART 6 LEARNING PACKET Week2-3Eljohn CabantacNessuna valutazione finora

- Ais Activiy Chapter 5 PDFDocumento4 pagineAis Activiy Chapter 5 PDFAB CloydNessuna valutazione finora

- Blue Mountain Coffee Case (ADBUDG)Documento16 pagineBlue Mountain Coffee Case (ADBUDG)Nuria Sánchez Celemín100% (1)

- Full TextDocumento143 pagineFull TextRANDYNessuna valutazione finora

- Edgardo Macabulos - FS1-Activity-1Documento8 pagineEdgardo Macabulos - FS1-Activity-1Macabulos Edgardo SableNessuna valutazione finora

- ECON266 Worksheet 8Documento4 pagineECON266 Worksheet 8Oi OuNessuna valutazione finora

- AMU BALLB (Hons.) 2018 SyllabusDocumento13 pagineAMU BALLB (Hons.) 2018 SyllabusA y u s hNessuna valutazione finora

- Classics and The Atlantic Triangle - Caribbean Readings of Greece and Rome Via AfricaDocumento12 pagineClassics and The Atlantic Triangle - Caribbean Readings of Greece and Rome Via AfricaAleja KballeroNessuna valutazione finora

- Pitch PDFDocumento12 paginePitch PDFJessa Mae AnonuevoNessuna valutazione finora

- 10 Problems of Philosophy EssayDocumento3 pagine10 Problems of Philosophy EssayRandy MarshNessuna valutazione finora