Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LTA Policy

Caricato da

iamonlyoneCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LTA Policy

Caricato da

iamonlyoneCopyright:

Formati disponibili

HUMAN RESOURCE POLICY GUIDELINES LEAVE TRAVEL ASSISTANCE POLICY

OBJECTIVE To provide as a measure of welfare, travel assistance to the employees of the Company and members of their families for visiting their Home Town/any place in India.

SCOPE

This policy is applicable to all the permanent employees working with Asia MotorWorks Ltd, India.

GENERAL GUIDELINES

The Company will provide Leave Travel Assistance (LTA) to its employee every year which is a part of the CTC.

As per Income Tax Act 1961, LTA for two journeys in a block of four years are exempted from income tax. The current block period is 2006 09 (1st January 2006 to 31st December 2009). LTA is exempted from Income Tax in respect of employee,

spouse, dependant children and dependant parents. EXPLANATION An employee thus can avail LTA twice in a block of 4 years once for traveling to his home town only and once for the journey to any place in India including his home town. The concession to visit any place in India is adjustable against the concession to visit home town to which an employee is eligible at the time of undertaking the journey to visit any place in India.

In case, an employee does not utilize the LTA before the end of financial year as on 31st March, the same shall be carried forward for utilization in the subsequent year.

Policy No. HRC/0009

Date : 02.05.09

The exemption under Income Tax on expenditure under LTA head is available to the following extent:

I.

Air / Rail or any other mode of transport from Head Quarters to a specified place and back.

II.

Where journey is performed by Air, economy class fare by National Carrier by shortest route or amount spent which ever is less.

III.

Where journey is performed by Rail, amount of first class air- conditions fare by shortest route or amount spent which ever is less.

IV.

Where place of destination of journey is not connected by rail or air, the first class or deluxe class fare on Public transport system shall be allowed.

V.

The quantum of exemption is limited to the actual expenditure incurred on the journey.

VI.

Where the journey is performed by a circuitous route, the exemption is limited to what is admissible by the shortest route. Likewise, where the journey is performed in a circular form touching different places, the exemption will be limited to what is admissible for the journey from the place of origin to the farthest point reached, by the shortest route.

VII.

Where journey between places connected by rail or a part thereof is performed by road by public transport or chartered bus, reimbursement will be on the basis of the railway fare by the entitled class by the shortest route or on the basis of actual expenses, whichever is less. Where such journey is performed by private car (registered in the employees own name), the cost of propulsion being borne by the employee himself, reimbursement will be equivalent to what would have been admissible had the journey been performed by rail by the entitled class by the shortest route.

VIII.

The exemption is strictly limited to expenses on air fare, rail fare, and bus fare only. No other expenses, like scooter charges at ends, portage expenses during the journey and lodging / boarding expenses will qualify for exemption.

Policy No. HRC/0009

Date : 02.05.09

IX.

Exemption on travel concession will not be eligible to more than two surviving children of an individual born.

ELIGIBILITY FOR CLAIMING THE LTA

To become eligible for reimbursement of LTA, the employee should avail of minimum five days of Privilege Leave during the period journey/s are undertaken. The reimbursement will be made on actual based on submission of copy of journey tickets and boarding passes for the air journeys and original tickets for train or other journeys. If the employee surrenders train ticket/s at exit point at railway station, then he is required to submit photocopy of the ticket along with a declaration to the effect that the original ticket has been surrendered to the Railway Authority.

In case of Advance LTA the entire amount as per the eligibility will be paid along with the salary. Advance LTA claim should be settled with one month time of the travel. If the same is not settled with a month then the same will be taxed in the next month Salary.

Advance LTA can be released one month before the travel date.

In cases where the LTA claimed by the employees is less then the eligibility then, the same shall be refunded to the concerned employee after deducting income tax at the end of the financial year in which the LTA is claimed.

To apply for LTA / advance LTA, please fill up the prescribed form which is available on the Intranet.

SUBMISSION OF CLAIMS The claims for LTA to any place in India shall be submitted within one month of the completion of the return journey and shall be supported by appropriate proof of the journeys having been performed (e.g. Air ticket, Boarding passes, railway ticket numbers, bus/taxi numbers, cash receipts etc). Where advance was sanctioned, the balance should be refunded while submitting the final bill, failing which it will be recovered from the salary of the employee.

Policy No. HRC/0009

Date : 02.05.09

OTHER

To avail IT benefits, employees should produce proof of Travel as per the Income Tax Act.

Employee can club the LTA if they have not availed the LTA in the previous year. Recovery of LTA will be done on a pro rata basis for those employees who resign from the services of the company and have claimed LTA in that financial year.

As far as taxability of LTA is concerned, Income Tax Act will be referred and will be applicable to all the employees.

The company reserves to itself the right to modify, amend or cancel any of these rules without notice.

********************************

Policy No. HRC/0009

Date : 02.05.09

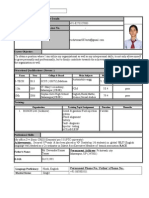

APPLICATION FORM FOR LEAVE TRAVEL ASSISTANCE

To, HR DEPARTMENT I am proceeding. on PL for __________________ days from _________________Kindly sanction Leave Travel Assistance to me for the year____________________.

Applicant's Signature :__________________ Name :______________________________ Date :___________ Employee Code:________________

(For HR. Dept.) Leave Balance as on 1st January LT.A. eligibility P.L. Sanctioned Whether LTA drawn during proceeding year Days worked during proceeding year : __________________Days : Prorata / Full : From :_____________ To ________________ : Yes / No : _____________ Days

Sanctioned Rs._____________(Rupees _____________________________________________)

_________________________ Sanctioned by

_____________________________ Approved by

Policy No. HRC/0009

Date : 02.05.09

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Christine Gledhill - Home Is Where The Heart Is - Melodrama 1987Documento373 pagineChristine Gledhill - Home Is Where The Heart Is - Melodrama 1987Diana CiucuNessuna valutazione finora

- Attendance PolicyDocumento4 pagineAttendance Policyiamonlyone100% (1)

- Labrel Sugbuanon Rural Bank Vs Laguesma Case DigestDocumento1 paginaLabrel Sugbuanon Rural Bank Vs Laguesma Case DigestRoland de la CruzNessuna valutazione finora

- International Economic LawDocumento17 pagineInternational Economic LawToluwalope Sammie-Junior Banjo100% (1)

- Fascism Is More Than Reaction - Roger GriffinDocumento8 pagineFascism Is More Than Reaction - Roger GriffinCastro Ricardo100% (1)

- JULIAN HENRIQUES (Ed) - 'Stuart Hall - Conversations, Projects, and Legacies' PDFDocumento329 pagineJULIAN HENRIQUES (Ed) - 'Stuart Hall - Conversations, Projects, and Legacies' PDFJuan Andrés Suárez100% (1)

- Mcdonalds Marketing StartegyDocumento24 pagineMcdonalds Marketing Startegydileshtare94% (16)

- Recruitment & Selection Hero MotorsDocumento86 pagineRecruitment & Selection Hero MotorsShrangesh Nigam69% (16)

- Consumer BeahviourDocumento73 pagineConsumer BeahviourPrasad PagdhareNessuna valutazione finora

- Ra 7192Documento4 pagineRa 7192WeGovern InstituteNessuna valutazione finora

- PLATODocumento33 paginePLATOAsim NowrizNessuna valutazione finora

- FAQs On Leave & Attendance - R0 - 2012Documento2 pagineFAQs On Leave & Attendance - R0 - 2012iamonlyoneNessuna valutazione finora

- Saarc ProjectDocumento25 pagineSaarc ProjectiamonlyoneNessuna valutazione finora

- Marketing Strategies of Tata NanoDocumento49 pagineMarketing Strategies of Tata NanoiamonlyoneNessuna valutazione finora

- Rec and SelectionDocumento20 pagineRec and SelectioniamonlyoneNessuna valutazione finora

- Auto ResumeDocumento2 pagineAuto ResumeiamonlyoneNessuna valutazione finora

- Determinants of Customer Churn Behavior On Telecom Mobile: Ms. Rajewari, P.SDocumento15 pagineDeterminants of Customer Churn Behavior On Telecom Mobile: Ms. Rajewari, P.SPrasad PagdhareNessuna valutazione finora

- Tata NanoDocumento42 pagineTata NanoiamonlyoneNessuna valutazione finora

- Future of RecruterDocumento3 pagineFuture of RecruteriamonlyoneNessuna valutazione finora

- S M YahamaDocumento36 pagineS M YahamaiamonlyoneNessuna valutazione finora

- Mcdonalds Marketing StartegyDocumento25 pagineMcdonalds Marketing Startegys_sarieddineNessuna valutazione finora

- PANKAJRSORATHIADocumento2 paginePANKAJRSORATHIAiamonlyoneNessuna valutazione finora

- Big Bazzaar ProjectDocumento5 pagineBig Bazzaar ProjectiamonlyoneNessuna valutazione finora

- Ravi ResumeDocumento2 pagineRavi ResumeiamonlyoneNessuna valutazione finora

- Customer LoyaltyDocumento39 pagineCustomer LoyaltyGundupagi ManjunathNessuna valutazione finora

- Big Bazzaar ProjectDocumento5 pagineBig Bazzaar ProjectiamonlyoneNessuna valutazione finora

- Customer Loyality Towards Brand ProjectDocumento20 pagineCustomer Loyality Towards Brand ProjectiamonlyoneNessuna valutazione finora

- 129-F540.pdSuzuki Motor Corporation (スズキ株式会社 Suzuki Kabushiki-Kaisha?)[5] is a Japanese multinational corporation headquartered in Minami-ku, Hamamatsu, Japan,[6] which specializes in manufacturing automobiles, four-wheel drive vehicles, motorcycles, all-terrain vehicles (ATVs), outboard marine engines, wheelchairs and a variety of other small internal combustion engines. In 2011, Suzuki was the tenth biggest automaker by production worldwide.[7] Suzuki employs over 45,000 and has 35 main production facilities in 23 countries and 133 distributors in 192 countries.[citation needed] According to statistics from the Japan Automobile Manufacturers Association (JAMA), Suzuki is Japan's second-largest manufacturer of small cars and trucks.fDocumento5 pagine129-F540.pdSuzuki Motor Corporation (スズキ株式会社 Suzuki Kabushiki-Kaisha?)[5] is a Japanese multinational corporation headquartered in Minami-ku, Hamamatsu, Japan,[6] which specializes in manufacturing automobiles, four-wheel drive vehicles, motorcycles, all-terrain vehicles (ATVs), outboard marine engines, wheelchairs and a variety of other small internal combustion engines. In 2011, Suzuki was the tenth biggest automaker by production worldwide.[7] Suzuki employs over 45,000 and has 35 main production facilities in 23 countries and 133 distributors in 192 countries.[citation needed] According to statistics from the Japan Automobile Manufacturers Association (JAMA), Suzuki is Japan's second-largest manufacturer of small cars and trucks.fBishwaranjan RoyNessuna valutazione finora

- ZIJMRDocumento17 pagineZIJMRArpan GautamNessuna valutazione finora

- Countable and Uncountable Nouns Elizabeth RosasDocumento2 pagineCountable and Uncountable Nouns Elizabeth RosasMichael Clifford NiroNessuna valutazione finora

- School Form 2 (SF 2) JULYDocumento8 pagineSchool Form 2 (SF 2) JULYTinTinNessuna valutazione finora

- REVIEW of Reza Zia-Ebrahimi's "The Emergence of Iranian Nationalism: Race and The Politics of Dislocation"Documento5 pagineREVIEW of Reza Zia-Ebrahimi's "The Emergence of Iranian Nationalism: Race and The Politics of Dislocation"Wahid AzalNessuna valutazione finora

- Team Based Compensation: Made By: Prashansa Madan Pragya SabharwalDocumento18 pagineTeam Based Compensation: Made By: Prashansa Madan Pragya SabharwalVijay AnandNessuna valutazione finora

- Reflection Paper Human Right and GenderDocumento8 pagineReflection Paper Human Right and GenderStephen Celoso EscartinNessuna valutazione finora

- Constitution of IndiaMarathiDocumento304 pagineConstitution of IndiaMarathiGirish OakNessuna valutazione finora

- MUNRO The Munro Review of Child Protection Final Report A Child-Centred SystemDocumento178 pagineMUNRO The Munro Review of Child Protection Final Report A Child-Centred SystemFrancisco EstradaNessuna valutazione finora

- Sir Roger Vernon ScrutonDocumento26 pagineSir Roger Vernon ScrutonZviad MiminoshviliNessuna valutazione finora

- Grade 9 Preparation Term 4Documento3 pagineGrade 9 Preparation Term 4Erlan DaniyarNessuna valutazione finora

- Greater Political Power Alone Will Not Improve Women's PlightDocumento4 pagineGreater Political Power Alone Will Not Improve Women's PlightJaiganesh ArumugamNessuna valutazione finora

- Angela DavisDocumento12 pagineAngela DavisRyan Wilbur Jenkins RandolphNessuna valutazione finora

- Geneva AccordsDocumento13 pagineGeneva AccordsGirly placeNessuna valutazione finora

- History Research PaperDocumento7 pagineHistory Research Paperapi-241248438100% (1)

- Witch Hunting A Gendercide Tool To Subordinate Women: Priyanka BharadwajDocumento4 pagineWitch Hunting A Gendercide Tool To Subordinate Women: Priyanka BharadwajSharon TiggaNessuna valutazione finora

- Role of Cultural Awareness in A Multicultural Business EnvironmentDocumento7 pagineRole of Cultural Awareness in A Multicultural Business Environmentabbas.noureldaemNessuna valutazione finora

- Traditional Industry in The Economy of Colonial IndiaDocumento263 pagineTraditional Industry in The Economy of Colonial Indiaikswaku100% (1)

- 167aDocumento36 pagine167aVasu Gupta67% (3)

- FSVP 2 - Fsma-Foreign-Supplier-Verification-Program-Outline, 2016Documento6 pagineFSVP 2 - Fsma-Foreign-Supplier-Verification-Program-Outline, 2016Diego GordoNessuna valutazione finora

- CBCP Monitor Vol. 17 No. 19Documento20 pagineCBCP Monitor Vol. 17 No. 19Areopagus Communications, Inc.Nessuna valutazione finora

- The Doll's House AnalysisDocumento3 pagineThe Doll's House AnalysisMuhammad Abuzar Khan0% (1)

- Unit 3 - Characteristics of Society and CultureDocumento18 pagineUnit 3 - Characteristics of Society and CultureKaylah WintNessuna valutazione finora

- Islamic Economics in The Light of Quran o SunnahDocumento26 pagineIslamic Economics in The Light of Quran o SunnahAli JumaniNessuna valutazione finora

- Japanese Period (The 1943 Constitution)Documento3 pagineJapanese Period (The 1943 Constitution)Kiko CorpuzNessuna valutazione finora

![129-F540.pdSuzuki Motor Corporation (スズキ株式会社 Suzuki Kabushiki-Kaisha?)[5] is a Japanese multinational corporation headquartered in Minami-ku, Hamamatsu, Japan,[6] which specializes in manufacturing automobiles, four-wheel drive vehicles, motorcycles, all-terrain vehicles (ATVs), outboard marine engines, wheelchairs and a variety of other small internal combustion engines. In 2011, Suzuki was the tenth biggest automaker by production worldwide.[7] Suzuki employs over 45,000 and has 35 main production facilities in 23 countries and 133 distributors in 192 countries.[citation needed] According to statistics from the Japan Automobile Manufacturers Association (JAMA), Suzuki is Japan's second-largest manufacturer of small cars and trucks.f](https://imgv2-1-f.scribdassets.com/img/document/172776332/149x198/c7fe695b5b/1380731232?v=1)