Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Statement Analysis 2011 - 2012

Caricato da

Shams STitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Statement Analysis 2011 - 2012

Caricato da

Shams SCopyright:

Formati disponibili

Financial Statement Analysis

2011 2012

INTRODUCTION Financial management is planning organizing,

Directing and controlling various financial activities of the organization. In order to perform all the managerial function effective and efficiency, sufficient, part and present information about the form and its operation should be equipped along with this changes overtime. And this financial information can be derived from the basic financial statement. A statement portion of information required in financial decision-making is found in financial statements, particularly, the income statements and the balance sheet financial statements and the balance sheet financial statement, particularly, the income statements and the balance sheet financial statements also help in forecasting the financial effects of planning. Analysis of financial statements refers to the process of the critical examination of the financial information contained in the financial statements the process dissection, establishing relationship and interpretation there of to understand the working and financial position of a firm is termed as the analysis of financial weaknesses and strength of the firm.

Dept of Management, SKTRMEC

Sujala Pipes Pvt. Ltd

2011 2012

Importance of the Study: Management is getting things, done with the use of men, material, machinery methods and money in an effective and efficient manner, the functional area, which deals with money is termed as financial management and this department of finance is treated as the key area in the organization is treated as the key area in the organization because it includes crucial decision regarding the flow and utilization of funds. The optimum decision of financial activities is with the help of a relative analysis of the financial statement relative analysis of the financial statement prepared for the time to time by the company namely income statements and the balance sheet. The theoretical knowledge will in doubt will bestow the aspirant to improve attitude skills and knowledge but the practical explosive will add a special harous to excel in to the world with high zeal and enthusiasm. For the purpose, this special study on the analysis of financial statement will entrance my knowledge in the case of the financial decision making.

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

SCOPE OF THE STUDY: The critical scope of the study was confirmed with study of available financial statements of Sujala Pipes Pvt Ltd. The present study is intended to covers a period of four years from 2007-2011 for comparative balance sheet analysis. The Study is limited to the financial aspects of the organization and that to with their aspects which are required for the calculation and analysis of the financial statement of Sujala Pipes Pvt Ltd. Objectives of the Study: To study the profile of Sujala Pipes Pvt Ltd. To prepare and analyze the comparative statement i.e. income statement and balance sheet of the company. In order to know the relative change in the financial activities. To interpret the result of the interpretation it self will facilities smooth decisions making To study the financial statements of Hyderabad division of Vijay Electrical Ltd. for the past 5 Years. To make necessary conclusions and suggestion.

Dept. of Management, SKTRMCE. 3

Sujala Pipes Pvt. Ltd

2011 2012

RESEARCH METHODOLOGY: The analysis is worked out by using various sources of data, which is gathered in two ways. Primary Data 2. Secondary Data Primary Data : The Primary data is collected through the interaction with officers & executives of the company in financial & accounts department. Secondary Data: The secondary data is collected from printed books, like text books, magazines, company website, newspaper, annual reports of Sujala Pipes Pvt Ltd. Company and Financial Management books. They are: 1.

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

LIMITATIONS OF THE STUDY: The study also suffers from the following limitations: 1. The study is conducted for the purpose of fulfillment of the condition stipulated by the University for Completion of course, so the study may not fulfillment all the requirements of a detailed investigation. 2. The study was conducted with the data available and the analysis was made according the details of the study are for the past for years only 2007-2008, 20082009, 2009-2010 and 2010-2011. 3. This is the study conducted with in a short period. Therefore, the time factor is also a Limitation.

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

COMPARATIVE STATEMENTS The comparative financial statements are

statements of the financial position at different period of time. The elements of financial position are shown in a comparative form so as to give an idea of financial position at two or more periods. Any statement prepared in a comparative form will be covered prepared in a comparative form for financial statements (Balance sheet and income statement) are prepared in comparative form of financial analysis purposes. Not only the comparison of figures of two periods but also the relationship between balance sheet and income statement enables an in-depth study of financial position and operative results. Comparative Balance Sheets: - The comparative

balance sheet analysis is the study of the trend of the same items, group of items and computed items in two an more balance sheets of the same business enterprise an different dates. The changes in periodic balance sheet items reflect the conduct of a business. Interpretation of Comparative Balance Sheet: While interpretation comparative balance sheet the interpretation is expected to study the following aspects. 1) Current financial position and liquidity position. 2) Long-term financial position.

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

3) Profitability of the concern. 1) For studying current financial position or short term financial position of a concern one should see the working capital in both

the years. The excess of current assets over current liabilities will give the figures of working capital. The increase in working 2) capital will mean improvement in the current financial position of the business. An increase in

current assets accompanied by the increase in current liabilities of the same amount will not show any improvement in the short-term financial position. 3) The long term financial position of the concern can be analyzed by studying the changes in fixed assets, long term liabilities and capital the proper financial policy of the concern will be finance fixed assets by the issue of either long term securities such as debentures, bonds, loans from financial institution on issue of fresh share capital. term loans and capital. 4) The next aspect to be studied in a comparative balance sheet question is the profitability balance sheet question is the profitability of the concern. An increase in fixed assets should be compared to the increase in long-

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

The study of increase or decrease in retained earning, various resources and surplus etc. enable the interpretation to see whether profitability has improved or not. 5) After studying various assets and liabilities an opinion should be formed about the financial position of the concern are cannot say if short term financial position is good then long term financial position is good then long term financial position will also be good or vice-versa. Will the

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

INDUSTRY PROFILE

PVC pipes poly Vinyl chloride pipes have become synonymous, with modern living. It is undoubtedly a product which has deeply penetrated in to common mans life. No wonder the industry has achieved remarkable progress in terms of supply of raw materials, And manufacturing and diversification of processing capabilities.

of processing machinery and ancillary equipments sophistication.

This versatile material with superior qualities such as light weight, easy processing, corrosion resistance, energy conservative, nontaxis etc. may substitute to a large estimate of many conventional and costly industrial materials like wood, glass, metal and leather etc. In the future the manifold applications of plastics in the field of automobiles, electronics, electrical, packaging and agriculture give its immense utility in PVC plastics.

At present as percent of total requirement of raw material and almost all types of plastic machines required for the industry are not adequately available. The present investment in all the three segments of industry namely, production of raw materials, expansion and diversification of raw materials, expansion and diversification of processing capacities, manufacturing of processing machinery. Equipment is 1250 crores and it provided employment at more than 8 lakh people.

Dept. of Management, SKTRMCE.

Sujala Pipes Pvt. Ltd

2011 2012

Plastics have been subjected to levies not only at the central level but also at the state and local governments. These levels have effected the price of the plastic products adversely. The percapita consumption of plastics is very low at 0.5 kg. as against the world average of 11 kgs. The per-capita consumption is 68 kgs in FRANCE, 33 kgs in U.K. and even in Asian countries like SOUTH KOREA it is 8.5 kgs. On account of their inherent advantage in properties and versatile in adoption and use, plastics have come to play a vital role in a variety of applications the world over. In our country plastics are used in marking essential consumer goods which are of daily use for common man. Such as baskets carry bags, bottles, pipes, pens, chairs etc,. and electronics. The government of India recognized the importance of plastics in agriculture appointed on March 7th

,

They also have applications in Agriculture,

building constructions, water management resources, engineering

1981 a national

committee on the use of plastics in agriculture under chairmanship of Dr. G.V.K.Rao. the committee has forecast a treatment as fright of drip irrigation through a net work of plastic tubes and pipes. In its origin large scale adoption of irrigation would lead to support in demand for P.V.C.Pipes LDPE tubes and play proper by lane emitters. The committee mane a number of recommendations for promoting the use of plastics. The implementation of the recommendations would so a long way is increasing the consumption of plastics, which at present is very low.

Dept. of Management, SKTRMCE.

10

Sujala Pipes Pvt. Ltd

2011 2012

The committee has highlighted the importance of use of PVC resin is the manufacture of rigid pipes, flexible pipes and sheets which are being used for agricultural operations to carry water from place to place and living of panels and reservoirs to reduce sweepers and most important in drip irrigation sequenc A break through had already taken place in the field of channel lining with poly urethane in the state of Gujarath, Madhya Pradesh, Punjab and Haryana. The irrigation departments in these states have taken concrete steps to incorporate canal living with LDPE (Low density) pipes on priority basis. Another variety of plastics, that requires artificial manufacturing relates to true engineering plastics which is used as an alternative to (or)replacement of metals in load needing applications. Modified P.P.O. Nylon, Polycetal, Poly carbonates, polyester (PBT/PET) phendic are same of the plastic materials following under the category of engineering plastics. Engineering plastics are being increasingly used for various applications in automatic, electronic, telecommunications and other industries. The plastics are classified into two classes. (1) Thermo Plastics (2) Thermostats

Dept. of Management, SKTRMCE.

11

Sujala Pipes Pvt. Ltd

2011 2012

The thermo plastics become sufficiently soft as the applications of heat. The thermostats are the initial application of heat and pressure subjected to fire, but upon further application of heat and pressure they are cured to heat and pressure. They are cured to hard moulded piece which cannot be resofted by reheating.

LDPE : Low Density Poly Ethylene :

Production of LDPE was started in the year in 1995. at present there are 3 units manufacturing LDPE with a total capacity of 1.15 lakh tones. Products targeted of LDPE by the end of 1999 is placed at 1.86 lakh tones.

HDPE : High Density Poly Ethylene :

Production of HDPE in India commended in 1968, at present there is a unit (Play Defins Industries Ltd.,) in India, producing HDPE by the end of 1989-90 was producing 1.25 Lakh tones.

PVC : Poly Vinyl Chloride : Production of PVC started in 1961, against first production of PVC in the world, 1927. at present there are 6 units manufactures PVC resins. The total installed capacity comes to 1.7 lakh tones. The production target of PVC by the end of 1989-90 is placed of 2.33 lakh tonees.

Dept. of Management, SKTRMCE.

12

Sujala Pipes Pvt. Ltd

2011 2012

Polystyrene : Polystyrene was first manufactured in India in May 1987. the production target of polystyrene by the end of 1989-90 is set out to 29,000 tonnes.

Poly propylene : The first production of poly propylene in India commenced in 1978. A production target of 36,000 tonnes is achieved by the end of 1993-94.

ABS (Acrylonitril Bujtadient Sysrenl) : The production of ABS in India started in 1978. the present total installed capacity is 5000 tonnes.

Problems :

Raw material is always been a problem to be recorded with the plastic industry. The situation was slightly improved recently and is expected to charge considerably by commissioning the major petrol chemical project in the pipe line by the year 1990. The Mahasastra Gas Cracker complex, Haldia Petrol Chemicals and Reliance petro chemicals together with the expansion of existing giants will go a long way to mitigate this long, study problems. By the terminal year of the plan, the installed capacity targeted in almost 8 lakh tones.

Dept. of Management, SKTRMCE.

13

Sujala Pipes Pvt. Ltd

2011 2012

The steep rise in the raw materials as a result of imposition of duties and taxes poses another problem to the plastic industry. On account of this domestic price of finished goods are higher than the rest of world. Apart from this, the administered pieces for basic raw materials have not been implemented with a balanced view to accommodation the interests of both consumers and manufactures. The feed stocks for petro chemical industries are napritna, alcohol and calcium chloride. 85% of the polymers are made from naptha feedstock. Hence the pricing naptha by the government has a cascading effect. Export of the Plastic Goods : Plastics have been excellent potentialities. Our country

equipped with all kinds of processing machines and skilled labour and undoubtedly, an extra effort to boost export finished plastic goods will yield rich dividend. Today, India exports plastics product to as many as 80 countries all over the world. The exports, which were stagnant at around Rs . 60-70 crore per annum doubled to 129 crore in early 1990s in 1991-92 plastic industry has taken up a challenge of achieves export target of 250 crores. Major export markets for plastic products and usage are Australia, Bangladesh, Canada, Egypt, France, Holland, Italy, Hong, Sri Lanka, Sweeden, Tawan, U.K., U.S.A. and Russia.

Dept. of Management, SKTRMCE.

14

Sujala Pipes Pvt. Ltd

2011 2012

With a view to boosting the exports, the plastics and linoleums, export promotion council has requested the government to reduce import duty on plastic raw materials supply of raw materials at international prices, fix duty free backs on weighed average basis and charge freight rate on plastic products on weight base interested of volume basis.

Prospects : The production of various plastics raw materials the country is expected to double by the end of the seventh five year plan. When the PCSs capacity expansion programme is completed as well as the new plants by other manufacturers like PIL, century Enka, Reliance are set up during the period, the consumption of commodity plastic including LDPE, HDPE, PP, PS and PVC is expected to touch the one million tones mark by 1989-90. there is immense scope for the use of plastics in agriculture, electronics, automobile, telecommunication an irrigation and thus, the plastic industry is on the threshold of an explosive growth.

Dept. of Management, SKTRMCE.

15

Sujala Pipes Pvt. Ltd

2011 2012

Role of Plastics in the National Economy : Plastics are get perceived as just simple colourful house hold products in the minds of common man. A dominant part of plastics of present and future improved their utilization in the following areas.

(1) Agriculture, Forestry and Water management (2) Automobiles and Transportation (3) Electronics and Telecommunications, Building (4) Construction and Furniture especially wood substitutes (5) Food processing and packaging (6) Power and Gas distribution

Dept. of Management, SKTRMCE.

16

Sujala Pipes Pvt. Ltd

2011 2012

COMPANY PROFILE

Sujala pipes (pvt. ) ltd. Nandyal was incorporated in the year 1998, it is located in the industrial estate ,Nandyal . the company has Rani Plastic Pipe Industry as its sister concern in the manufacture of PVC pipes. This company is promoted by the managing director mr . S.P.Y.reddy ,B.e.(match)who has decades of experience in the manufacturing industry . The company has 3 main PVC pipes brands. They are

Nandi,Sujala and Rani. But the flagship brand is Nandi Pipes. The name Nandi derives from the historical aspects of this town, Nabdyal. The Brand name Nandi Pipes as taken from the piligrimage place called Mahanandi which is 15 KM from Nandyal. The company has diversified in to various fields in the in the recent past. Apart from manufacture of PVC pipes, which is the main flagship, they are also in the manufacture of mineral water under the brand name Nandi Mineral Water. Diary products Nandi Diary which supplies regularly milk to the people of Nandyal and Villages in and around Nandyal. The company rightly thinks there is an inseparable relation between education and business. Managing Director, Mr. S,P.Y. Reddy I encouraging women to educate by establishing womens college in Nandyal. Sujala pipes also gone for expansion programme. They have taken over monarch pipes good source of employment to the people who are at both workmen level as well as administrative level.

Dept. of Management, SKTRMCE.

17

Sujala Pipes Pvt. Ltd

2011 2012

Sujala pipes which was once upon a time a sole manufacture of plastic goods now branched in to many companies. Their turnover touched a remarkable figure nearly Rs.30 crores in the year 1999-2000. As The main objective in stating this industry was to cater to the needs of facilitate water flow in this area which lacks rainfall and to use the water resources productively. This helps the farmers in lifting the ground water to the surface as well free flow of the water as an and when necessary. Initially the industry was producing polythene pipes (BlackPipes), and PVC (Poly Vinyl Chloride) pipes were introduced under the same brand name later in1984-85.the growth of PVC industry in Rayalaseema area of A.P. has seen rapid growth in the early 90sThe company also produces PVC fittings. In short it can be concluded that the company enjoys 95% of South Indian market have in the PVC pipes industries. One of the credible things that the company does is free offer of transportation to the door steps of the customers when he purchases 100 or more pipes. The company also provides free breakfast, free lunch and free dinner to their employees at factorys canteen. The management of the company known as Nandi group was bestowed with another company in to their cap known as Indian thermo plastics Ltd, Hyderabad. The company also has manufacturing unit at Beedar, Karnataka.

Dept. of Management, SKTRMCE.

18

Sujala Pipes Pvt. Ltd

2011 2012

The company also has manufacturing unit at Beedar, Karnataka. The company which has its head quarters at Nandyal also started Nandi Super Market, which offers concessions to their employees. The company also provides free medical facilities to the employees. Sujala Pipes also involved in social activities by providing free water supply to the needy people. Company organizes free medical camps to the poor people. It also gives loans to unemployed youth in fulfilling their career objectives. As the company caters to the needs of farmer and its main product is agricultural related product, they enjoy maximum benefits given by the government. They are no unions in the organization an there is good relation and working climate exists in the organization between management and employees. It basically work on 2 shifts. Residences are also provided by the company to its workforce and employees at concessionrent.Very recently the company had approached the Karur Vysya Bank, Nandyal for working capital loan of 150 lakhs in order to meet the changing requirements of industrial scenario. Financially the company sounds very good. It gives a credit of 21 days to its customers. It has a wide distribution network both in A.P. as well as neighbouring states in the South India. Industrial accidents are also nil in the company. The company markets products through telephone orders. It has a wide net work of distributors all over south India. As and when the order is received, it immediately sent to the production department as

Dept. of Management, SKTRMCE.

19

Sujala Pipes Pvt. Ltd

2011 2012

well as stores. Basing on the orders reqirment and availability at the stores the products are manufactured and sent. ORGANISATION STRUCTURE OF SUJALA PIPES (PVT.)LTD.

Dept. of Management, SKTRMCE.

20

Sujala Pipes Pvt. Ltd

2011 2012

Production process PVC pipes :

The material used in PVC pipes manufacture are : (1) PVC (Poly Vinyl Chloride) (2) Tri Basic Lead Sulphate (TBCS) (3) Die Basic Lead Sulphate (DBLS) (4) Calcium Steric (5) Lead Steric (6) Calcium carbonate (CaC03) (7) Titanic Dioxide (8) Steric Acid (9) Wax The above material are mixed in fixed proportion in a big container and they get processed in to a solidified product. Immediately pipes of various diameters are manufactured by using various moulds. Once the pipes are manufactured, they will be shifted to warehouses. As and when the requirement comes, they will be dispatched to the destinated places.

Dept. of Management, SKTRMCE.

21

Sujala Pipes Pvt. Ltd

2011 2012

OVERALL VIEW FINANCIAL MANAGEMENT: Before going to know more about financial statement analysis we have to know some basic knowledge regarding financial management financial analysis, planning and control are one of the important tasks in financial management. Financial management is that managerial activity which is concerned with the planning and controlling of the firms. Financial resources. It was branch of economics, till 1980 and thus as a separate discipline it is of a recent origin. The subject of financial management is a immense interest to both academicians, and practicing managers it is of a great interest to academician because the subject is still developing and there are still certain area where contra varies exist for which no unanimous solution have been reached yet. Practicising manager are interested in this subject because among the most curlicues decision of firm are there of which the relate theory to of finance, financial, and and an an understanding

understanding of the theory of financial mgt. Provides them with concepted and analytical assigner to make there decision skill fully.

Dept. of Management, SKTRMCE.

22

Sujala Pipes Pvt. Ltd

2011 2012

Financial

management

is

concerned

there

managerial decision, which results in the acquisition and financing of long-term and short-term assets of a firm. It therefore deals with situation, which call for selection of specific assets and specific liabilities as also with the problems of size and growth of an enterprise. An analysis of their decisions is boned upon exported inflows and outflows of funds and their effects on the stated management objectives. There are two well know objectives: They are: 1. Profit Maximization. 2. Wealth Maximization. However, wealth maximization is a superior objectives them that of profit maximization and keeps in pale with modern times profit maximization might have been an appropriate objective before the company form of organization man fully developed but in modern timer the corporate form of organization has to discharge it responsibilities to the shareholder, employees and the society as whole and this context profit maximization cannot be a valid objective moreover it suffers from various other draw books viz, it is vague it ignores the timing of retain and it also ignores the risk factors.

Dept. of Management, SKTRMCE.

23

Sujala Pipes Pvt. Ltd

2011 2012

Hence wealth maximization is a better objective of financial management wealth maximization means maximizing the net present value of wealth of a course of action this concept is consistent with the objectives if maximization of owner economic welfare by maximizing the market value of the company share it also satisfies the interest the management and society as a whole. The important tasks of financial management may be summarized as follows:

Dept. of Management, SKTRMCE.

24

Sujala Pipes Pvt. Ltd

2011 2012

(A) Financial Analysis, Planning and Control 1. Analysis of financial condition & performance. 2. Profit Planning. 3. Financial forecasting and 4. Finance control. (B) Inventing: 1. Management of consent asset (Cash, Marketable Securities, Receivables and Inventories) 2. Capital budgeting (Identification, Selection & Implementation of long-term projects. 3. Management of mergers, reorganization (C) Financing: 1. Identification of sources of finance and

determination of financing mix. 2. Cultivating sources of funds and raiding funds and 3. Disposition of profit between dividends and retained earnings. The following list depicts the various functions area of financial management: Determine finance needs. Determining sources of funds.

Dept. of Management, SKTRMCE.

25

Sujala Pipes Pvt. Ltd

2011 2012

Financial analysis. Optimum capital structure. Cost volume profits analysis Profit planning and control. Fixed asset manager. Project planning and Evaluation. Capital budgeting. Working capital management. Dividend policies. Acquisition and mergers. Corporate taxation. Financial management involves taxing tour important decision viz. 1. The financing decision. 2. The investment decision. 3. The dividend decision. 4. The current asset management. Decision-making requires critical analysis and careful interpretation of the published financial statement. In general, the common tools used by the management to facilitate analysis are ratio analysis, comparative analysis, common size analysis, cash flow analysis and funds flow analysis.

Dept. of Management, SKTRMCE.

26

Sujala Pipes Pvt. Ltd

2011 2012

But rather establisher a sound and systematic basis for its rational application.

Dept. of Management, SKTRMCE.

27

Sujala Pipes Pvt. Ltd

2011 2012

Significance: The significance of financial statement lies not in their preparation but in their analysis and interpretation of financial statement involves a study of relationship their meaning and significance the financial analysis must understand determine the the plan extend and of policies analysis, of management data regularize

available as per requirement establish relationship among financial figures and makes interpretation in a simple and unbiased way. Financial Statement: A financial statement is a compilation of data, which is logically & consistently organized according to accruing principles. Its purpose is to convey an understanding of some financial aspects of a business firm, if a position.

FINANCIAL STATEMENT ANALYSIS: Nature: Financial statement analysis consists of the analytical tools and techniques to the data in financial statement in order to derive from they measurement and relationship that are significant and useful for decisionmaking.

Dept. of Management, SKTRMCE.

28

Sujala Pipes Pvt. Ltd

2011 2012

The process of financial analysis can be described in various ways depending or the objectives to be obtained financial analysis can be used as a preliminary screening tool in the selection of stocks in secondary markets. It can be used as a forecasting tool of future financial condition and results it may be used as a process of evolution and diagnosis of managerial operating as other problems areas above all financial analysis reduces reliance an institution, and thus narrows the areas of uncertainty that is present in all decision making process financial analysis does not taxes the need for judgment but at a moment in a time, as in the case of a balance sheet as may reveal a series of a activities over major mean through which firms present their financial situation to stock holders, creditors, and the general public. The majority of firms include extensive financial statement in their annual reports, which receive wide distribution. Financial statement as normally understand, refer to a set of reports and schedule which can accountant prepare at the end of a period of a time for a business enterprise, According to smith, as financial statement are the end products of financial accounting, prepared by the accountant, that purpose to reveal the financial position of the enterprise the result of its recent activities and an analysis of what has been done with the earnings.

Dept. of Management, SKTRMCE.

29

Sujala Pipes Pvt. Ltd

2011 2012

There are six basic financial statements of special importance. They are: 1. The income statement (Profit & Loss a/c). 2. The position statement (Balance Sheet). 3. Fund Flow Statement. 4. Cash Flow Statement. 5. The Statement of Retained Earning. 6. Scheduler. 1. Income Statement: The income statement also called the profit & loss a/c is the according report which summarize the revenues, expenses, and the differences between them for an accounting period the construction of income statement is in accordance with the concepts of accruals accounting period, matching, maternity and realization. There is format. 2. The Position Statement: The position statement or the balance sheet shown the financial statement of a business at a given point of time. All the assets owned by the business and all the liabilities and claim it owner to out. Sider and owner are listed the balance sheet must always be in balance i.e., the total liabilities, the balance sheet of a point stock company must be prepared as per part of schedule of a company act separate statutory formats exists for the preparation of the formats exists for the preparation of the balance sheets of banking and insurance companies.

Dept. of Management, SKTRMCE.

30

Sujala Pipes Pvt. Ltd

2011 2012

3. The funds flow statements: The terms Fund normally mean working capital. The funds flow statement several the sources from which funds are reveals the sources from which funds are received and the user to which there have been put. It is a valuable tool to analyze the changes in the financial conditions of the business between two periods and helps the management in policy formulation and performance appraisal. 4. The cash flow statement: The cash flow statement is a statement of changes in the financial position of a firm as cash bases It is very much similar to the funds flow statement except that the cash flow statement lays emphasis on cash changes only.

Dept. of Management, SKTRMCE.

31

Sujala Pipes Pvt. Ltd

2011 2012

5. The statement of rational earnings: The statement of retained earnings also known as the profit and loss appropriation account, is a continuation of the income statement it reveals the profit freely available after deduction of all expenses, including tax and low it has been appropriated. The balance after all appropriated is shown in the liabilities side of the balance sheets. Thus, the statement of retained earning is the link between the income statement and the balance sheet. 6. Schedule: Schedules are statements, which describes the summarized information present ion in the income statement and the balance sheet in greater detail. Schedules are part of the financial statement and enable a better understanding of the financial position of business. TYPE OF ANALYSIS: The process of financial analysis may be classified based on the nature of information used and as the basis of methodology of operation. 1) On the basis of nature of information used: -

Dept. of Management, SKTRMCE.

32

Sujala Pipes Pvt. Ltd

2011 2012

a) External Analysis: - The information used is that which is freely available to any body published financial statement are an example of such information. There is no access to internal records of an organization with increasing emphasis on disclosers in recent timer the quality of external analysis is likely to improve in the future. b) Internal Analysis: The source of

information is internal analysis is the internal for use of mgt. For other internal needs of the organizations. 2. On the basis of methodology of operation: a) Horizontal analysis: - It involves analysis and review of financial statements; pertaining to a number of years. An attempt is made to identify the periodical trend of various items in the financial statement percentage Increases/Decreases is calculated for all such item. Alternatively base years are indexed to that of base period. It is also known as dynamic analysis a) Trends Analyses. b) Vertical Analyses: - Vertical analysis involves anglicizing a single set of financial statement, by expressing various items of the statement,

Dept. of Management, SKTRMCE.

33

Sujala Pipes Pvt. Ltd

2011 2012

as

percentage

of

particulars

item.

Quantitative relationship is established among great various items at a particular data. It is also known as Static analysis (or) structural analysis. Methods of Financial Statement Analysis: 1) Comparative statement analysis. 2) Communalize statement analysis. 3) Trend analysis. 4) Fund flow analysis. 5) Cash flow analysis. 6) Ratio analysis. 1) Comparative statement analysis: - Comparative financial statement refers to comparison of financial pertaining to two different periods by putting them side by side and finding out the changes with the respect to each item of the statement and overall changes in absolute d relative changes. Points to be noted: a) The financial data, which is to be compared, should be properly designed. comparisons. b) The accounting policies followed during the years of comparisons should be uniform if there is any A particular account head must have the same connotation for all the period of

Dept. of Management, SKTRMCE.

34

Sujala Pipes Pvt. Ltd

2011 2012

change in any policy. The signs should be adjusted to ensure uniformly. c) It is preferable to present financial information in vertical statement form. d) Comparative financial statement must reveal changes in both Absolute and Relative measure. 2) Common Size Statement Analysis: A common size statement facilitates comparison of financial statements of not only a single firm over a time period but also comparison of financial statements of different companies of financial statements of different companies for any given time. Under this method, all the times of the statement are presented as percentages or rations of a particulars item. Therefore, Even if the Different scale of absolute figures relates to a vastly.

operations, a common base for comparison is created. In case of common size income statement, all items are presented as a percentage of net saler. A common size balance sheet shows each item as a percentage of total asset or total liabilities. A common size statement helps in determining the relative efficiency and sounders of a firm and helps in under standing its financial strategy. 3) Trend analysis: -

Dept. of Management, SKTRMCE.

35

Sujala Pipes Pvt. Ltd

2011 2012

Trend

analysis

involves

computations

of

index

number of the movements of the various financial items in the financial statements for a no.of periods. It helps in understandings the nature and rate of movements in various financial factors however; conclusion should not be drawn on the basis of a single trend. Trends of related items should be carefully studied. Due weighted should be given to extraneous factors such as govt. policy, economic policy, economic conditions etc, as they can affect the trend significantly. Points to be noted: 1. The accounting policies for the entire period should be uniform. 2. Trend values must be read along with absolute values. 3. Non-Financial factors should be considered while interpreting the trend. 4. Fund flow analysis: A funds flow statements is a statement which explain the various sources from which funds were raised and the user to which these funds were put. (The reader may notice that this definition of funds flow statement comes disconcertingly close to the definition of a balance sheet. Since liabilities and assets are themselves sources and user of funds respectively even a balance sheet itself

Dept. of Management, SKTRMCE.

36

Sujala Pipes Pvt. Ltd

2011 2012

may be considered a form of funds flow statement one would notice that in fact the balance sheet of most companies are increasingly being expressed in the Sources of funds and Application of funds formats. The major differences, however, between a true fund flow statement and a balance sheet lies in the fact that the former capturer the movements in funds. While the latter merely presents a static picture of the sources and user of funds an account of this property a funds flow statement would enable one to see how the business financed so on. its fixed assets, built up the inventory, discharged its liabilities, paid its dividends and taxes and Similarly it would enable one to see how the business managed to meet the above capital or revenue expenditure was it by raising additional capital or loans from public? Was it by stretching the trade creditors or by incurring some other liabilities? 4. Cash flow analysis: Cash flow analysis involves the preparation of a cash flow statement from one period to another. The term cash includes cash and bank balance. This statement is very much similar to the statement of funds flow statement focuses attention cash instead of working capital.

Dept. of Management, SKTRMCE.

37

Sujala Pipes Pvt. Ltd

2011 2012

Ratio Analysis: Ratios are well known and widely used tools of financial analysis. A ratio gives the mathematical relationship between one variable and another. Though the computation of a ratio involves only a simple arithmetic operation, its interpretation is a difficult exercise. The analysis of a ratio can disclose relationship as well as basis of comparison that reveal conditions of the ratio. The usefulness of ratios is ultimately dependent on their intelligent and skill interpretation. Problem Analysis: Analysis of financial statement using above tools can be very helpful in understanding a companys financial performance and condition. Yet there are certain problems, which come in the way of such analysis. 1) Development industries. company of Bench Marks: Many Encounted in Financial Statement

companies have operations spread across a no. Of As there may not be any other having a presence in the same

industries, that too in the same proportion, development of a benchmark becomes a problem. Even when the company is not a diversified one, figures for the various firms is needed in addition

Dept. of Management, SKTRMCE.

38

Sujala Pipes Pvt. Ltd

2011 2012

to 2)

the

industry

average -

in

over may

draw

meaningful conclusion. Window-Diversing: Firms windowdressers the financial statements in orders to show a rosy picture. In such a case, the whole exercise of analysis the statements become useless. In order to draw some meaningful results of the analysis, the average figures over a period of time should be looked into. 3) Price Level Changes: - Financial statements do not take into account changes in the price levels. Analysis of such statements may not give a clear picture of the state of affair. 4) Different in Accounting Policies: - Different companies may follow different accounting policies in respect of depreciation stock valuation etc comparison between the ratios of two firms. Different policies may not give the true result.

COMPARATIVE STATEMENTS The comparative financial statements are

statements of the financial position at different period of time. The elements of financial position are shown in a comparative form so as to give an idea of financial position at two or more periods. Any statement prepared

Dept. of Management, SKTRMCE.

39

Sujala Pipes Pvt. Ltd

2011 2012

in a comparative form will be covered prepared in a comparative form for financial statements (Balance sheet and income statement) are prepared in comparative form of financial analysis purposes. Not only the comparison of figures of two periods but also the relationship between balance sheet and income statement enables an in-depth study of financial position and operative results. Comparative Balance Sheets: - The comparative

balance sheet analysis is the study of the trend of the same items, group of items and computed items in two an more balance sheets of the same business enterprise an different dates. The changes in periodic balance sheet items reflect the conduct of a business. Interpretation of Comparative Balance Sheet: While interpretation comparative balance sheet the interpretation is expected to study the following aspects. 4) Current financial position and liquidity position. 5) Long-term financial position. 6) Profitability of the concern. 6) For studying current financial position or short term financial position of a concern one should see the working capital in both

Dept. of Management, SKTRMCE.

40

Sujala Pipes Pvt. Ltd

2011 2012

the years. The excess of current assets over current liabilities will give the figures of working capital. The increase in working 7) Capital will mean improvement in the current financial position of the business. An increase in current assets accompanied by the increase in current liabilities of the same amount will not show any improvement in the short-term financial position. 8) The long term financial position of the concern can be analyzed by studying the changes in fixed assets, long term liabilities and capital the proper financial policy of the concern will be finance fixed assets by the issue of either long term securities such as debentures, bonds, loans from financial instritation on issue of fresh share capital. An increase in fixed assets should be compared to the increase in longterm loans and capital. 9) The next aspect to be studied in a comparative balance sheet question is the profitability balance sheet question is the profitability of the concern. The study of increase or decrease in retained earning, various resources and surplus etc. enable 10) the interpretation to see whether profitability has improved or not. After studying various assets and liabilities an opinion should be formed about the financial position Will the

Dept. of Management, SKTRMCE.

41

Sujala Pipes Pvt. Ltd

2011 2012

of the concern are cannot say if short term financial position is good then long term financial position is good then long term financial position will also be good or vice-versa. A concluding word about the overall financial position must be given at the end.

Comparative business.

Income

Statement:

The

income

statement gives the results of the operations of a The comparative income statement gives an idea of the progress of a business over a period of 2004 to 2008 time. The changes in absolute data in the money values and percentage can be determined to analyze the profitability of the business. Interpretation: The analysis and interpretation of income statement will involve the following steps. 1) A change in sales is meaningful only if it is compared with a change on cost of goods sold. 2) A change in operating expenses might be due to change it in scale of operations or in account of change in degree of managerial efficiency. 3) A change in net profit is good indicator of overall profitability of the organization.

Dept. of Management, SKTRMCE.

42

Sujala Pipes Pvt. Ltd

2011 2012

4) An opinion should be formed about profitability of the concern and it should be given at the end. should be mentioned whether the profitability is good or not. It overall

Dept. of Management, SKTRMCE.

43

Sujala Pipes Pvt. Ltd

2011 2012

Comparative Income Statement for the year 200304 20042005

(Rupees in Lakhs)

and

Particulars Sales (l) Less: Cost of Goods Sold (ll) Gross Profit (A) = l-ll Less: Operating Expenses (B) Operating Profit (A-B) = C Add: Non-Operating Income (D) (C+D) = E Less: Non-operating Expenses

2007-08 10234.8 7 3066.34 7168.13 5198.13 1970.40 414.66 2385.06 527.43

200809 11546.3 3399.17 8147.13 7070.59 1076.54 399078

Change 1131.43 332.83 978.6 1872.46 (893.86) -14.88

% 11.05% 10.85% 35.65% 36.02% 45.3% 3.58

1476.32 496064

-908.74 -30.79

38.10 5.83

PBT Less Tax Net Profit

1124.46 1124.46

979.68 979.68

-144.78 -144.78

12.87 12.87

NOTE; COGS =material + work in progress.

Dept. of Management, SKTRMCE.

44

Sujala Pipes Pvt. Ltd

2011 2012

Dept. of Management, SKTRMCE.

45

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) Sales are increased by 11.05% from 2007 to 2008. It points towards increased acceptability of the

companys products and customer satisfaction. 2) An increase in expenditure is 36.02%. It shows the change in scale of operations are more and an account efficiency. 3) Net profit after tax is decreased by 12.87%. It is bad indicator of over all profitability of the organization. 4) Currently the firm is in improving business, the profitability situation also bad, so the overall of change in degree of managerial

profitability of the organization is not satisfactory.

Dept. of Management, SKTRMCE.

46

Sujala Pipes Pvt. Ltd

2011 2012

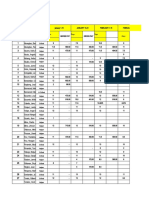

Comparative Balance Sheet for the Year Ended 3103-07 and 31-03-08

(Rupees in Lakhs)

Particulars CURRENT ASSSETS Inventory Sundry debtors Cash & Bank balances Other C.A Loans & Advances Total (A): Fixed Asset Gross Block Less: Dep Net block Miscellaneous Expenses Profit & Loss A/C Cap. W.I.P M & E Transit Investment (B) Total Assets (A+B) Liabilities C. Liabilities Secured Loans Unsecured Loans D Capital & Server & Surplus S.Capital Reserver & Surplus Total Liabilities(C+D+E)

31-03-07 1368.2 905.4 78.2 46.8 587.1 2985.7 2133.1 1608 525.1 1214.9 961.7 0.4 10.6 2712.7 5698.4

31-03-08 1342.2 850.8 64.125 52.2 755.6 3027.1 2127.9 1648.8 479.1 1983.2 1668.2 0.7 10.2 4141.4 7168.5

Change 26 54.6 14.1 5.4 168.5 41.4 5.2 40.8 46 768.3 706.5 0.3 0.4 1428.7 1470.1

% 1.9 6% 18% 11.5% 28.7% 1.38% 0.2% 2.5% 8.76% 63.24% 73.46% 75% 3.7% 52.67% 25.79

2345.6 649 2595.6 3244.6 107 1.2 108.2 5698.4

2205 643 4212.3 4855.3 107 1.2 108.2 7168.5

140.6 6 1616.7 1610.7 1470.1

6% 0.9% 6.2% 49.6% 25.79

Long Term Funds

Dept. of Management, SKTRMCE.

47

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) There has been a rise of 1.38% in the current assets of the company. This inspite of a fall in cash and

bank balances and sales of short-term investments. An account of decrease in debtors. might have changed if credits policy. 2) The fixed assets if the company compare with the long-term funds of the company. The long term The company

funds being used to fund the current assets of the company 3) The profitability of the company appears to be impressive, as judged by constant in Reserver and Surplus. 4) The over all financial position of the company appears to be satisfactory.

Dept. of Management, SKTRMCE.

48

Sujala Pipes Pvt. Ltd

2011 2012

Dept. of Management, SKTRMCE.

49

Sujala Pipes Pvt. Ltd

2011 2012

COMPARATIVE INCOME STATEMENT FOR THE YEAR 2007-08 AND 2008-09

Lakhs)

(Rupees

in

Sales

Particulars (l)

2007-08 11546.3 3399.17 8147.13 7070.59 1076.54 399.78 1476.32 496.64 979.68

2008-09 15540.29 4085.94 11454.35 10628.95 825.3 312.58 1137.98 419.56 718.42 718.42

Absolute 3993.99 688.81 3307.22 3358.36 (251.24) -87.2 -338.34 -77.08 -261.26 -261.26

Change 34.59% 20.26% 40.59% 50.32% 23.33% 21.81 22.91 15.52 26.66 26.66

Less: Cost of Goods Sold (ll) Gross Profit (A) = l-ll Less: Operating Expenses (B) Operating Profit (A-B) = C Add: Non-Operating Income (D) (C+D) = E Less: Operating Expenses PBT Less Tax Net Profit

979.68

Dept. of Management, SKTRMCE.

50

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) Sales are increased by 34.59% from 2008 to 2009. It points towards increased acceptability of the

companies products and customers satisfaction. 2) An increase in expenditure is 50.32%. It shows the changes in scale of operations are more and an account efficiency. 3) Net profit after tax is decreased by 26.66% it is bad indicator of over all profitability of the organization. 4) Currently the firm is in improving business the profitability satisfactory. situation of the organization is of change in degree of managerial

Dept. of Management, SKTRMCE.

51

Sujala Pipes Pvt. Ltd

2011 2012

Comparative Balance Sheet for the Year Ended 31-03-08 and

31-03-09

(Rupees in Lakhs)

Particulars ASSETS CURRENT ASSSETS Inventory Sundry debtors Cash & Bank balances Other C.A Loans & Advances (A): Fixed Asset Gross Block Less: Dep Net block Miscellaneous Expenses Profit & Loss A/C Cap. W.I.P M& E Transit Investment (B) Liabilities (A+B)TA C. Liabilities Secured Loans Unsecured Loans D Capital & Server & Surplus S.Capital Reserver & Surplus (E) Total Liabilities(C+D+E) Long Term Funds

31-03-08

31-03-09

Change

1342.2 850.8 64.1 52.2 755.6 3027.1 2127.9 1648.8 479.1 1983.2 1668.2 0.7 10.2 4141.4 7168.5 2205 643 4212.3 4855.3 107 1.2 108.2 7168.5

1101.9 754.8 92.6 45.6 634.2 2628.7 2121.3 1678.5 442.8 2165.3 2688.7 2.4 7.8 0.1 5307.1 7935.8 2752.4 631 4445 5076.4 107 107 79.35.8

240.3 96 28 6.6 121.4 398.4 6.6 29.7 36.3 182.1 1020.5 1.7 2.4 1165.7 767.3 547.4 12 232.7 221.1 1.2 1.2 767.3

17.9 11.2% 43.7% 12.64% 16.07% 13.16% 0.3% 1.8% 7.57% 9.18% 6.12% 242% 23.51% 28.14% 10.7% 24.8% 1.8% 5.5% 4.5% 1% 1.1% 10.7%

Dept. of Management, SKTRMCE.

52

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) There has been a decrease of 13.16% in the Current Assets of the Company. This is inspite of a increase in cash and bank balances and sales of short term investments. An account of decrease in debtors.

The company might have changed it credit policy. 2) The fixed asset of the company compares with the long term funds of the company. The long term

funds being used to fund the current assets of the company. 3) The profitability of the company appears to be impressive, as judged by 2009-nil in Reserves & Surplus. 4) The overall financial position of the company

appears to be satisfactory.

Dept. of Management, SKTRMCE.

53

Sujala Pipes Pvt. Ltd

2011 2012

Comparative Income Statement for the Year 2007-08 and 2008-09

(Rupees in Lakhs)

Particulars Sales (l)

2007-08 15540.29 4085.94

2008-09 16729.8 5931.05

Absolute 1189.5 688.81 655.60 246.54 408.96 291.97 117.09 16.81

Change 57.65% 16.8% 5.7% 2.3% 49.5% 93.4% 10.28% 4%

Less: Cost of Goods Sold (ll) Gross Profit (A) = l-ll Less: Operating Expenses (B) Operating Profit (A-B) =C Add: Non-Operating Income (D) (C+D) = E Less: Non- Operating Expenses PBT Less: - Tax

11454.35 10798.75 10628.95 10382.41 825.3 312.58 1137.98 419.56 718.42 416.34 604.55 1020.89 436.37 584.52 -

133.926 18.63% -

Net Profit

718.42

584.52

133.9

18.63%

Dept. of Management, SKTRMCE.

54

Sujala Pipes Pvt. Ltd

2011 2012

Dept. of Management, SKTRMCE.

55

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) Sales are increased by 7.65% from 2008 to 2009. It points towards increased acceptability of the

companys products and customer satisfaction. 2) An decrease in expenditure is 2.3%. It shows the

changes in scale of operation are more and an account of change in degree of managerial

efficiency. 3) Net profit after tax is decreased by 18.63%. bad indicator of over all profitability of It is the

organization. 4) Currently the firm is in improving business, the profitability situation also bad. So the overall

profitability of the organization is not satisfactory.

Dept. of Management, SKTRMCE.

56

Sujala Pipes Pvt. Ltd

2011 2012

Comparative Balance Sheet for the Year Ended 31-03-08 and 31-03-09

(Rupees in Lakhs)

Particulars ASSETS CURRENT ASSSETS Inventory Sundry debtors Cash & Bank balances Other C.A Loans & Advances (A): Fixed Asset Gross Block Less: Dep Net block Miscellaneous Expenses Profit & Loss A/C Cap. W.I.P Transit Investment (B) Liabilities C. Liabilities Secured Loans Unsecured Loans D Capital & Server & Surplus S.Capital Reserver & Surplus (E) Total Liabilities (C+D+E) Long Term Funds (A+B)Total Ast

31-03-08

31-03-09

Change

1101.9 754.8 92.1 45.6 634.2 2628.7 2121.3 1648.5 442.8 2165.3 2688.7 2.4 7.8 0.7 5307.1 7935.8 2752.4 631 4445 5076.4 107 107 7935.8

1019.7 668.0 153.7 33.1 549.4 2425.8 2117.2 1728.5 388.7 1883.3 3879.5 0.4 11.4 0.1 6163.4 8587.2 2723.8 621.4 5135.1 5135.1 107 107 8587.2

82.2 86.8 61.6 12.5 84.8 202.9 4.1 50 54.1 282 1190.8 2 3.6 856.3 651.4 28.6 9.6 690.1 680.5 651.4

7.4% 11.50% 66.8% 27.4% 13.37% 7.7% 0.19% 2.97% 12.2% 13.03% 44.28% 83.33% 46.15% 16.13% 8.20%% 1.03% 1.52% 15.52% 13% 8.2%

Dept. of Management, SKTRMCE.

57

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: -

1) There has been a decrease of 7.7% in the current assets of the company. This is inspite of an

increase in cash and balances and scales of shortterm investments. The rise in mainly an account of decrease in debtors. The company might have

changed its credit policy.

2) Fixed asset of the company compare with the long term funds of the company. The long term funds being used to fund the current assets of the company.

3) The overall financial position of the company appears to be satisfactory.

Dept. of Management, SKTRMCE.

58

Sujala Pipes Pvt. Ltd

2011 2012

COMPARATIVE INCOME STATEMENT FOR THE YEAR 2008-09 AND 2009-10

(Rupees in Lakhs)

Particulars Sales (l) Less: Cost of Goods Sold (ll) Gross Profit (A) = l ll Less: Operating Expenses (B) Operating Profit (A B) = C Add: NonOperating Income (D) (C+D) = E Less: Operating Expenses PBT Less: Tax Net Profit

2008-09 16729.8 5931.05 10798.75 10382.41 416.34 604.55

2009-10 Absolute Change 17735.23 1005.43 6% 8505.14 9228.09 9234.42 -6.33 701.55 2576.09 1570.66 1147.99 -410.01 97 16.04% 43.43% 14.54% 11.05% 98.87%

1020.89 436.37 584.52 584.52

695.22 236.37 458.85 458.85

325.67 200 125.67 125.67

31.90% 45.83% 21.49% 21.49

Dept. of Management, SKTRMCE.

59

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) Sales are increased by 6% from 2009 to 2010. It points towards increased acceptability of the

companys products and customer satisfaction. 2) An increase in expenditure is 11.05% it shows the changes in scale of operation are more and an account of change in degree of managerial

efficiency. 3) A net profit after tax is decreased by 21.49. It is bad indicator of overall profitability of the

organization. 4) Currently the firm is in improving business, the profitability situation also good. So the overall

profitability of the organization is satisfactory.

Dept. of Management, SKTRMCE.

60

Sujala Pipes Pvt. Ltd

2011 2012

Comparative Balance Sheet for the year Ended 31-03-09 to 31-03-10

Particulars ASSETS CURRENT ASSSETS Inventory Sundry debtors Cash & Bank balances Other C.A Loans & Advances (A): Fixed Asset Gross Block Less: Dep Net block Miscellaneous Expenses Profit & Loss A/C Cap. W.I.P M&E Transit Investment (B) ) Liabilities (A+B) C. Liabilities Secured Loans Unsecured Loans D Capital & Server & Surplus S.Capital Reserver & Surplus (E) Total Liabilities (C+D+E) 107 107 8587.2 107 107 8646.4 59.2 0.69% Long Term Funds 621.4 5135.1 5756.1 610.5 5966.0 6576.5 10.9 830.9 820 1.75% 16.18% 14.24% 1019.7 668.0 153.7 33.1 549.4 2425.8 2117.2 1728.5 388.7 1883.3 3879.5 0.4 11.4 0.1 6163.4 8587.2 2723.8 995.2 629.4 228.2 28.6 444.4 2325.8 2086.9 1759.8 326.9 1758.3 4222 0.7 12.6 0.1 6320.6 8646.4 1962.9 24.5 38.6 74.5 4.5 105 100 31 31.11 61.8 125 342.5 0.3 1.2 157.2 59.2 760.9 2.4% 5.7% 48.5% 13.59% 19.11% 4% 1.47% 1.799% 15.9% 6.63% 8.82% 75% 10.5% 2.55% 0.69% 27.9% 31-03-09 31-03-10

(Rupees in Lakhs)

Change

(A+B)=Total Assets

Dept. of Management, SKTRMCE.

61

Sujala Pipes Pvt. Ltd

2011 2012

Interpretation: 1) There has been a fall of 4% in the current Assets of the company. This is in spite of in cash and bank The rise in The

balances and short-term investments.

mainly on account of decrease in debtors. company might have changed its credit policy.

2) The fixed assets of the company compare with the long term funds of the company. The long term

funds being used to fund. The current assets of the company.

3) The

overall

financial

position

of

the

company

appears to be satisfactory.

Dept. of Management, SKTRMCE.

62

Sujala Pipes Pvt. Ltd

2011 2012

FINDINGS: Fixed assets are decreased drastically in the last five year. The long-term financial position of the organization is depends on the firm fixed assets capacity. In the year 2004 to 2008 the firm fixed assets decreased from525.1million to 326.9million. the increased fixed assets will give good future production possibilities. The firm long-term source of funds also increased in the same level of fixed assets. So the firm is maintaining good business policy. For long term run of the business the firm should maintain this policy effectively. Sources: Fixed assets: 2007-525.1m, 2008-479.1m, 2009442.1m, 2010-388.7m, 2011-326.9m, Long-Term funds: 2008-643m, 610.5m, Unsecured loans: 2007-2595.6m, 2008-4212.3m, 2009-4445m, 2010-5135.1m, 2011-5966m, Secured loans: 2007-649m, 2010-621.4m, 20112009-631m,

Dept. of Management, SKTRMCE.

63

Sujala Pipes Pvt. Ltd

2011 2012

The firm current financial position or short term financial position is depends on the working capital of the organization. The excess current liabilities over current assets will give figures of the working capital. The firm working capital is decreased in 2007 and 2008 comparatively the previous year 2007 and 2008 the working capital is decreased. Liquid assets are maintained considerably. The firm should think about the effective working capital policy.

Sundry

debtors:-

2007-905.4m,

2008-850.8m,

2009-754.8m, 2010-668m, 2011-629.4m, Cash & bank balance: 2007-78.2m, 2008-64.1m, 2009-92.1m, 2010-153.7m, 2011-228.2m, There is a constant in reserves &surplus of the organization its shows the firm profitability position is good. Its shows firm is having considerable capital funds. Reserves & surplus: 2007-1.2m, 2008-1.2m, The income from operation are decreased every year the expenditure are also decreased same proportion. The firm has to think about expenditure.

Dept. of Management, SKTRMCE.

64

Sujala Pipes Pvt. Ltd

2011 2012

The net profit of the organization are also constantly fluctuating i.e. (profit after tax) 1124.46m in 2007, 979.68m in 2008, 718.42m in 2009, 584.52m in 2010, 458.85m in 2011,the firm has to think about profitability. The firm should try to improve operational effectives and should reduce the unnecessary expenditure so that the firm future proceeding is in good position.

Dept. of Management, SKTRMCE.

65

Sujala Pipes Pvt. Ltd

2011 2012

RECOMMENDATIONS: There should be effective coordination between the different department like production, sales, purchase, finance, marketing etc.. this will enhance the efficiency of the organization. There should be a proper budgeting control system. To reduce the cash crunch it is necessary for HMT There centers. There should be well-organized manpower planning, especially with regard to production. Education about the importance of budgeting should be communicated to all concerned authorities, involved directly or indirectly to work according, for the growth of the company. to revamp be the existing credit and budgeting policies. should proper communication between various department and responsibility

Dept. of Management, SKTRMCE.

66

Sujala Pipes Pvt. Ltd

2011 2012

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST MARCH, 2011

(Rupees in Lakhs)

Schedule

Year Ended 2011

Year Ended 2010

EARNINGS: -

Sales

8.1

17,735.23 8.2 701.55 (2345.55) 16091.23 -

16,729.80

Transfer to Plant Miscellaneous income

604.55

W.I.P

8.3

(1459.32) 15875.03 Less: - OUT GOING

Material Personnel Depreciation Other Expenses Int, on loan

9.1 9.2 9.3

6159.59 6986.20 6056.32 3178.10

236.3 22,616.58

4471.80 5659.35 8050.26 2332.15

436.37 20,949.83

Profit/(Loss) before tax 3615.48 Provision for Income tax Profit/(Loss) after tax

5074.80 5074.80 3615.48

Dept. of Management, SKTRMCE.

67

Sujala Pipes Pvt. Ltd

2011 2012

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 ST MARCH, 2010

(Rupees in Lakhs)

Schedule 2009 EARNINGS: Sales Transfer to Plant Miscellaneous income W.I.P Less: - OUT GOING Material Personnel Depreciation Other Expenses Int, on loan

Year Ended2010

Year Ended

8.1 8.2 8.3

16,729.80 604.55 (1459.32) 15875.03

15,540.29 312.58 (1265.32) 15852.87 2820.62 5975.15 7325.00 3,303.95 419.56 19,844.28 3991.41 -

9.1 9.2 9.3

4471.80 5659.35 8050.26 2332.15 436.37 20,949.83 3615.48 -

Profit/(Loss) before tax Provision for Income tax

Profit/(Loss) after tax

3615.48

3991.41

Dept. of Management, SKTRMCE.

68

Sujala Pipes Pvt. Ltd

2011 2012

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 ST MARCH, 2009

(Rupees in Lakhs)

Schedule Ended

Year Ended 2009

Year

2008

EARNINGS: Sales Transfer to Plant Miscellaneous income W.I.P Less: - OUT GOING Material Personnel Depreciation Other Expenses Int, on loan

8.1 8.2 8.3

15,540.29 312.58 (1265.32) 15852.87

11,546.3 399.78 (925.15) 11946.08 2474.02 6225.75 5864.05 1206.54 496.64 16,267 4320.92 4320.92

9.1 9.2 9.3

2820.62 5975.15 7325.00 3,303.95 419.56 19,844.28 3991.41 3991.41

Profit/(Loss) before tax Provision for Income tax Profit/(Loss) after tax

Dept. of Management, SKTRMCE.

69

Sujala Pipes Pvt. Ltd

2011 2012

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 ST MARCH, 2008

(Rupees in Lakhs)

Schedule Ended

Year Ended 2008

Year

2007

EARNINGS: Sales Transfer to Plant Miscellaneous income W.I.P 10649.53 Less: - OUT GOING Material Personnel Depreciation Other Expenses Int, on loan 14,396.91 Profit/(Loss) before tax Provision for Income tax Profit/(Loss) after tax

8.1 8.2 8.3

11,540.29 399.78 (925.15) 11946.08

10,234.87 414.66 (745.24)

9.1 9.2 9.3

2474.02 6225.75 5864.05 1206.54 496.64 16,267

2321.10 6350.25 3859.25 1338.88 527.43

4320.92 4320.92

3747.38 3747.38

Dept. of Management, SKTRMCE.

70

Sujala Pipes Pvt. Ltd

2011 2012

BALANCE SHEET AS AT 31ST MARCH, 2011

(Rupees in Million)

Schedule SOURCES OF FUNDS SHAREHOLDER'S FUNDS Capital Reserves & Surplus LOAN FUNDS Secured Loans Unsecured Loans APPLICATION OF FUNDS FIXED ASSETS Gross Block Less: Depreciation Net Block Capital Work-in-Progress Machinery & Equipment in transit & under inspection/erection INVESTMENT CURRENT ASSETS, LOANS AND ADVANCES Inventories Sundry Debtors Cash and Bank Balances Other Current Assets Loans and Advances Less: CURRENT LIABILITIES AND PROVISIONS Current Liabilities Net Current Assets MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) PROFIT & LOSS A/C

As at Year 2011

As at Year 2010

107

107

610.5 5966

6576.5 6683.5

621.4 5135.1

5756.5 5863.5

2086.2 1759.6 326.9 0.7 12.6 0.1

2117.2 1728.5 388.7 0.4 11.4 0.1

5.1 5.2 5.3 5.4 5.5

995.2 629.4 228.2 28.6 444.4 2325.8

1019.7 668 153.7 33.1 549.4 2423.58

6.1

1962.9 -362.9 1758.3 7.1 7.2

2723.8 299 1883.3

4222 6683.5

3879.5 5863.5

Dept. of Management, SKTRMCE.

71

Sujala Pipes Pvt. Ltd

2011 2012

BALANCE SHEET AS AT 31ST MARCH, 2010

(Rupees in Million)

Schedule SOURCES OF FUNDS SHAREHOLDER'S FUNDS Capital Reserves & Surplus LOAN FUNDS Secured Loans Unsecured Loans APPLICATION OF FUNDS FIXED ASSETS Gross Block Less: Depreciation Net Block Capital Work-in-Progress Machinery & Equipment in transit & under inspection/erection INVESTMENT CURRENT ASSETS, LOANS AND ADVANCES Inventories Sundry Debtors Cash and Bank Balances Other Current Assets Loans and Advances Less: CURRENT LIABILITIES AND PROVISIONS Current Liabilities Net Current Assets MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) PROFIT & LOSS A/C

As at Year 2010

As at Year 2009

1.1 1.2 2.1 2.2 3 2117.2 1728.5 621.4 5135.1

107

5756.5 5863.5

630.9 4445.4

5076.3 5183.3

2121.3 1678.5 388.7 2.4 7.8

442.8

0.4 11.4

11.8 0.1

10.2 0.1

5.1 5.2 5.3 5.4 5.5

1019.7 668 153.7 33.1 549.4 2423.58

1101.9 754.8 92.6 45.6 634.2 2628.7

6.1

2723.8 299 7.1 1883.3

2752.4 -123 2165.3

7.2

3879.5 5863.5

2688.7 5183.4

Dept. of Management, SKTRMCE.

72

Sujala Pipes Pvt. Ltd

2011 2012

BALANCE SHEET AS AT 31ST MARCH, 2009

(Rupees in Million)

Schedule SOURCES OF FUNDS SHAREHOLDER'S FUNDS Capital Reserves & Surplus LOAN FUNDS Secured Loans Unsecured Loans APPLICATION OF FUNDS FIXED ASSETS Gross Block Less: Depreciation Net Block Capital Work-in-Progress Machinery & Equipment in transit & Under inspection/erection INVESTMENT CURRENT ASSETS, LOANS AND ADVANCES Inventories Sundry Debtors Cash and Bank Balances Other Current Assets Loans and Advances Less: CURRENT LIABILITIES AND PROVISIONS Current Liabilities Provisions Net Current Assets MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) PROFIT & LOSS A/C

As at Year 2009

As at Year 2008

1.1 1.2 2.1 2.2 3 2121.3 1678.5 630.9 4445.4

107

107 1.2 643 4212.3

5076.3 5183.3

4855.3 4963.5

2127.9 1048.8 388.7 479.1 0.7 10.2

2.4 7.8

10.2 0.1

5.1 5.2 5.3 5.4 5.5

1101.9 754.8 92.6 45.6 634.2

2628.7

1342.2 850.8 64.1 52.2 755.6

3027.1

6.1

2752.4 -123 7.1 2165.3

2205 -822.1 1983.2

7.2

2688.7 5183.4

1668.2 4963.5

Dept. of Management, SKTRMCE.

73

Sujala Pipes Pvt. Ltd

2011 2012

BALANCE SHEET AS AT 31ST MARCH, 2008

(Rupees in Million)

Schedule SOURCES OF FUNDS SHAREHOLDER'S FUNDS Capital Reserves & Surplus LOAN FUNDS Secured Loans Unsecured Loans APPLICATION OF FUNDS FIXED ASSETS Gross Block Less: Depreciation Net Block Capital Work-in-Progress Machinery & Equipment in transit & under inspection/erection INVESTMENT CURRENT ASSETS, LOANS AND ADVANCES Inventories Sundry Debtors Cash and Bank Balances Other Current Assets Loans and Advances Less: CURRENT LIABILITIES AND PROVISIONS Current Liabilities Provisions Net Current Assets MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) PROFIT & LOSS A/C

As at Year 2008

As at Year 2007

1.1 1.2 2.1 2.2 3 2127.9 1048.8 643 4212.3

107 1.2 649 2595.6

107 1.2

4855.3 4963.5

3244.6 3352.8

2133.1 1608 479.1 0.7 10.2 525.1 0.4 10.6

5.1 5.2 5.3 5.4 5.5

1342.2 850.8 64.1 52.2 755.6 3027.1

1368.2 905.4 78.2 46.8 587.1 2985.7

6.1

2205 -822.1 7.1 7.2 1983.2 1668.2 4963.5

2345.6 640.1 1214.9 961.7 3352.8

Dept. of Management, SKTRMCE.

74

Sujala Pipes Pvt. Ltd

2011 2012

BIBLIOGRAPHY

IM Panday: Financial Management: eighth edition: Financial and Profit analysis: page no 25 to 59: published by Vikas publishers

M.Y. Khan

& P.K. Jain:

Financial Management

Prasanna Chandra Management

Fundamentals of Financial

WEBSITES www.Google.com: sujala pipes/financial statements www.sujalapipes.com:

Dept. of Management, SKTRMCE.

75

Potrebbero piacerti anche

- Pepsi Project ReportDocumento74 paginePepsi Project ReportShams SNessuna valutazione finora

- Data Analysis QWLDocumento40 pagineData Analysis QWLShams SNessuna valutazione finora

- Employee MotivationDocumento78 pagineEmployee MotivationShams SNessuna valutazione finora

- Recruitment QuestionnaireDocumento2 pagineRecruitment QuestionnaireShams SNessuna valutazione finora

- Questionnaire OlayDocumento1 paginaQuestionnaire OlayShams S100% (1)

- Ratio AnalysisDocumento64 pagineRatio AnalysisShams SNessuna valutazione finora

- DerivativesDocumento75 pagineDerivativesDowlathAhmedNessuna valutazione finora

- Employee Motivation QuestionnaireDocumento2 pagineEmployee Motivation QuestionnaireShams S89% (9)

- Samsung Galaxy Brand ImageDocumento63 pagineSamsung Galaxy Brand ImageShams SNessuna valutazione finora

- Loans and AdvancesDocumento64 pagineLoans and AdvancesShams SNessuna valutazione finora

- Review of LiteratureDocumento2 pagineReview of LiteratureShams SNessuna valutazione finora

- Employee Motivation QuestionnaireDocumento2 pagineEmployee Motivation QuestionnaireShams S89% (9)

- Mouryaa Inn ProfileDocumento9 pagineMouryaa Inn ProfileShams SNessuna valutazione finora

- A Questionnaire On Quality of Work Life Name: Designation: AgeDocumento3 pagineA Questionnaire On Quality of Work Life Name: Designation: AgeShams SNessuna valutazione finora

- Hero Satisfaction ProjDocumento59 pagineHero Satisfaction ProjShams S100% (2)

- Horlicks ProjectDocumento56 pagineHorlicks ProjectShams S82% (34)

- Cust Satisfaction ArielDocumento32 pagineCust Satisfaction ArielShams SNessuna valutazione finora

- Training Need AssessmentDocumento90 pagineTraining Need AssessmentShams S100% (1)

- Horlicks ProjectDocumento56 pagineHorlicks ProjectShams S82% (34)

- Findings and SuggestionsDocumento2 pagineFindings and SuggestionsShams SNessuna valutazione finora

- Base Form Simple Past Past ParticipleDocumento3 pagineBase Form Simple Past Past ParticipleShams SNessuna valutazione finora

- Pepsodent Proj Color PrintsDocumento13 paginePepsodent Proj Color PrintsShams SNessuna valutazione finora

- Literature Review Customer ServiceDocumento7 pagineLiterature Review Customer ServiceShams S83% (6)

- Theoretical Background of The Customer Satisfaction.Documento3 pagineTheoretical Background of The Customer Satisfaction.Shams S67% (6)

- Colgate Dental CreamDocumento3 pagineColgate Dental CreamShams SNessuna valutazione finora

- Use of Do and Have VerbsDocumento10 pagineUse of Do and Have VerbsShams SNessuna valutazione finora

- Cust Satisfaction ArielDocumento32 pagineCust Satisfaction ArielShams SNessuna valutazione finora

- History of Toothbrushes and ToothpastesDocumento15 pagineHistory of Toothbrushes and ToothpastesShams SNessuna valutazione finora

- QuestionnaireDocumento2 pagineQuestionnaireShams SNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Done BSBFIM501 Assessment Tasks Workbook2Documento40 pagineDone BSBFIM501 Assessment Tasks Workbook2babluanand100% (2)

- Week 1 Topic Tutorial Solutions CB2100 - 1920ADocumento6 pagineWeek 1 Topic Tutorial Solutions CB2100 - 1920ALily TsengNessuna valutazione finora

- FABM Q3 L1. SLeM 1 - IntroductionDocumento16 pagineFABM Q3 L1. SLeM 1 - IntroductionSophia MagdaraogNessuna valutazione finora

- IE103 Business Plan Outline & FormatDocumento5 pagineIE103 Business Plan Outline & FormatJoshua Roberto GrutaNessuna valutazione finora

- Akl Edisi TerbaruDocumento46 pagineAkl Edisi TerbaruemakNessuna valutazione finora

- TAX3761 - Test 3 28 July 2023Documento11 pagineTAX3761 - Test 3 28 July 2023themrmoonlightNessuna valutazione finora

- MR1 EMI - Business EnglishDocumento20 pagineMR1 EMI - Business EnglishfakerNessuna valutazione finora

- Model Contract Geothermal PPA PhilipineDocumento27 pagineModel Contract Geothermal PPA Philipinehendra_yuNessuna valutazione finora

- SunAccount Appreciation GuideDocumento273 pagineSunAccount Appreciation GuideRobertFabriNessuna valutazione finora

- Overhead Cost: Warunika N. HettiarachchiDocumento52 pagineOverhead Cost: Warunika N. HettiarachchiAnuruddha RajasuriyaNessuna valutazione finora