Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Balkrishna Industries - The Tyres Roll Faster From JainMatrix Investments

Caricato da

Punit JainTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Balkrishna Industries - The Tyres Roll Faster From JainMatrix Investments

Caricato da

Punit JainCopyright:

Formati disponibili

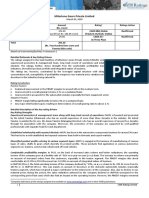

A quality report by JainMatrix Investments

Balkrishna Industries The Tyres Roll Faster

Small Cap Mkt Cap 2,300 crores. Advice: Buy (the target is for Subscribers Only).

06 Sept 2013 CMP: Rs 238

BKT is a fast growing tyre manufacturer with Revenues, EBITDA and PAT up 25%, 28% and 44% CAGR in 6 years. It is poised to double capacity by FY15. The tyres sell to a very large global market, are a high quality products. BKT can maintain its margins, and will gain from the INR weakness. Today with the PE of 6.6 times, it is available at the lowest valuations in the last 6 years. BKT is a Buy. Risks to this investment are: Global conflicts and economic uncertainties, Natural rubber price rise and a Promoter group restructuring.

Business Snapshot:

Balkrishna Industries (BKT) is a Mumbai based firm that makes off-highway tyres (OHT) for agriculture, mining and earth moving vehicles. It derives 90% of revenues from exports. The consolidated Revenues are 3,394 cr with Profits 350 cr (FY13). These tyres are manufactured at four mfg units (Bhiwadi & Chaupanki in Raj., Aurangabad, Mah., and Dombivili, Mumbai. The new greenfield unit at Bhuj, Guj. is partially operational. BKT currently has a capacity of 1,44,000 tonnes a year. The company is on an expansion program for both de-bottlenecking the existing facilities, as well as a Rs 1,800-crore greenfield factory at Bhuj, which will expand the companys capacity to 2,70,000 tonnes by FY15.

Fig 1 Business Segments at BKT, in % (JainMatrix Investments) Tyres are exported from Mundra Port through 200 distributors to 120 countries, see Fig 1. It supplies to companies such as Volvo, John Deere, Ferrari and JCB across the world. Around 90% of revenue is exports. BKT imports some raw materials (Rubber), but is a net exporter. It has about 4% market share globally in the OHT business. The Promoter/ CMD is Arvind Poddar, who has been at the helm of BKT since 2006.

JainMatrix Investments BKT

Sept 2013

BKT makes a range of Off-Highway Specialty tyres for Agricultural, Industrial, Material Handling, Construction, Earthmoving (OTR), Forestry & Garden Equipment and All-Terrain Vehicles (ATV). Current shareholding is of Promoters 58.3%, MF/ DII/ FII 30.3%, Individuals 8% and Others 3.4%.

Pricing Snapshot

(Content for Subscribers Only) Fig 2 Price History The available 6-year view of the share price of BKT in Fig 3 shows us: BKT share has been somewhat volatile. Today it is at 25% below the Jan 2013 high of 317. Investors have been rewarded with steady dividends and a stock split in 2010 (FV10 to FV2). At CMP, it has given shareholders 15% annual appreciation so far.

Annual Revenues in Crores 4,000

3,500 3,000 2,500

20.6 30.8 Revenues EBITDA % PAT % EPS P/E 20.1 27.8

Balakrishna Ind. Financials

36.2

EBITDA, PAT in (margin %), EPS in Rs and P/E 40 35 30 25 20

22.7

2,000 1,500 1,000 500 0 FY08 FY09 FY10 FY11 FY12 FY13

11.6 7.7 10.5 11.8 8.6 6.6

15 10 5 0

Fig 3 Consolidated Financials Snapshot

Financial Snapshot

Growth has been steady with Revenues, EBITDA and PAT up by 25%, 28% and 44% CAGR in 6 years. In FY11, there was a compression in margins due to an increase in international Rubber prices. Even though this was handled well by the firm, and profits increased, the P/E (ttm) has rapidly fallen from 30.8 times (FY09) to 6.6 times currently, see Fig 3. The firm is in an investment phase for the Bhuj plant, but the D/E is at a fair 1.49 times. The capital investments are from a combination of debt and internal cash flows. Return on Capital Employed is 15.63% while Return on Net Worth is 24.24%. Equity Share Capital has remained unchanged for 7 years at 19.33 cr., indicating corporate stability. Dividend yield is a low 0.6%. PEG based on 1 year projection is at 0.22 indicates a very undervalued stock.

Cash Flow

(Content for Subscribers Only) Fig 4 Free Cash Flow

Report by JainMatrix Investments

Page | 2

www.jainmatrix.com

JainMatrix Investments BKT Financial Projections

(Content for Subscribers Only) The financials for BKT are projected till FY15. Fig 5 Two year Financial Projections

Sept 2013

Strengths and Opportunities

BKT is in a business segment that requires the production of a large range but low volumes of tyres. This makes BKT somewhat insulated from the competition, which focuses on high volumes. BKT focuses on the tyre replacement market (80% of sales) rather than on direct sale to manufacturers. This is a steadier market than OEM. The margins here are also higher. BKT hedges its forex receivables, to reduce fluctuations. Thus the recent rupee depreciation against the USD by 20% may not immediately benefit it, but this benefit should kick in over the next 1 year. The Bhuj factory is already partially commissioned, so it is already boosting production. The Bhuj location will help BKT reduce on logistics costs with its proximity to Mundra Port for raw materials imports as well as exports. With market-share at a low 4% of global OHT segment, there exists large room to grow volumes. BKT develops over 150-160 new tyre sizes every year, with a very fast turnaround time of 8-10 weeks for new product development. This is a powerful competitive edge. In FY13 it had net forex earnings of >1000cr in USD & Euros. BKT will gain from rupee depreciation. BKT has a low cost structure, compared to global competition/ peers. Radialisation is gaining momentum in the OHT industry, and BKT has allocated a large proportion of the new capacity at Bhuj plant for Radials, to ride this trend.

Risks and Concerns

(Content for Subscribers Only)

Opinion, Outlook and Recommendation

BKT has been a steady performer in the last few years in terms of Revenues, Margins and Profits. It is poised to double capacity by FY15. It is catering to a very large global market, and is seen as a high quality product, and can maintain its margins. In addition it will gain from the INR weakness. Today the BKT valuations are very low. With the PE of 6.6 times, it is available at the lowest valuations in the last 6 years. BKT is a Buy. (The target is for Subscribers Only).

Disclaimer

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Also see: http://jainmatrix.wordpress.com/disclaimer/

Report by JainMatrix Investments

Page | 3

www.jainmatrix.com

Potrebbero piacerti anche

- Balkrishna Industries: Growth On Track, Not RatedDocumento4 pagineBalkrishna Industries: Growth On Track, Not Ratedarunvenk89Nessuna valutazione finora

- Capital Goods: Gujarat Apollo Industries LTDDocumento20 pagineCapital Goods: Gujarat Apollo Industries LTDcos.secNessuna valutazione finora

- Balkrishna Industries: Business Analysis and ValuationDocumento10 pagineBalkrishna Industries: Business Analysis and ValuationindianequityinvestorNessuna valutazione finora

- Milestone Gears Private Limited-03-09-2020Documento4 pagineMilestone Gears Private Limited-03-09-2020Puneet367Nessuna valutazione finora

- Balkrishna Inds Initial (Key Note)Documento20 pagineBalkrishna Inds Initial (Key Note)beza manojNessuna valutazione finora

- Group1 - Balkrishna Industries TyresDocumento6 pagineGroup1 - Balkrishna Industries TyresparthkosadaNessuna valutazione finora

- Balkrishna Industries LTD - Group 9Documento31 pagineBalkrishna Industries LTD - Group 9Yogesh Sopan NivanguneNessuna valutazione finora

- Stock Report On Baja Auto in India Ma 23 2020Documento12 pagineStock Report On Baja Auto in India Ma 23 2020PranavPillaiNessuna valutazione finora

- Tata Motors: Q1FY11 Results Review - Press Meet 19 August 2010Documento18 pagineTata Motors: Q1FY11 Results Review - Press Meet 19 August 2010karthikeyan un reclusNessuna valutazione finora

- Stimulus 12 IssueDocumento8 pagineStimulus 12 Issuecapdash2002Nessuna valutazione finora

- BKT b2b Project ReportDocumento17 pagineBKT b2b Project ReportAshok Kumar0% (1)

- 10062019042502blend - AIF - May - 2019Documento7 pagine10062019042502blend - AIF - May - 2019Shyam P SharmaNessuna valutazione finora

- Balkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?Documento9 pagineBalkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?drsivaprasad7Nessuna valutazione finora

- Balkrishn A Industrie S: Business Analysis and ValuationDocumento12 pagineBalkrishn A Industrie S: Business Analysis and ValuationindianequityinvestorNessuna valutazione finora

- HMT Limited 2010Documento91 pagineHMT Limited 2010Sandeep PatilNessuna valutazione finora

- Industry Analysis of Ceat Lt1Documento9 pagineIndustry Analysis of Ceat Lt1santosh panditNessuna valutazione finora

- Bajaj Auto: FY10 Annual Report AnalysisDocumento10 pagineBajaj Auto: FY10 Annual Report Analysisvijay_maheshwariNessuna valutazione finora

- Press Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1Documento4 paginePress Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNessuna valutazione finora

- AP Moderate Portfolio 040219Documento20 pagineAP Moderate Portfolio 040219sujeet panditNessuna valutazione finora

- BKT ReportDocumento18 pagineBKT Reportneelakanta srikarNessuna valutazione finora

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocumento5 pagine354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNessuna valutazione finora

- Bajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFDocumento5 pagineBajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNessuna valutazione finora

- Bajaj Auto FSADocumento20 pagineBajaj Auto FSAVandit BhuratNessuna valutazione finora

- Initiating Coverage:: Radialisation Demand To Push The GrowthDocumento17 pagineInitiating Coverage:: Radialisation Demand To Push The GrowthrulzeeeNessuna valutazione finora

- 15 Stocks Oct15th2018Documento4 pagine15 Stocks Oct15th2018ShanmugamNessuna valutazione finora

- Cosmo Films Q4FY20 - Conference - Call - TranscriptDocumento14 pagineCosmo Films Q4FY20 - Conference - Call - TranscriptSam vermNessuna valutazione finora

- Adavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Documento20 pagineAdavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Suyash KumarNessuna valutazione finora

- Annual Budget 2012Documento14 pagineAnnual Budget 2012luv9211Nessuna valutazione finora

- Jyoti Structures 4Q FY 2013Documento10 pagineJyoti Structures 4Q FY 2013Angel BrokingNessuna valutazione finora

- Ultratech Cement Annual Report2017 18Documento264 pagineUltratech Cement Annual Report2017 18rajan10_kumar_805053Nessuna valutazione finora

- A Great Valuation Play Where Commodity Business Is A Cash CowDocumento29 pagineA Great Valuation Play Where Commodity Business Is A Cash Cowgullapalli123Nessuna valutazione finora

- Star Cement Limited - Q3FY24 Result Update - 09022024 - 09!02!2024 - 11Documento9 pagineStar Cement Limited - Q3FY24 Result Update - 09022024 - 09!02!2024 - 11varunkul2337Nessuna valutazione finora

- LGB Q4FY12Update 05may2012Documento4 pagineLGB Q4FY12Update 05may2012equityanalystinvestorNessuna valutazione finora

- Atul Auto 1QFY20 Result Update - 190813 - Antique ResearchDocumento4 pagineAtul Auto 1QFY20 Result Update - 190813 - Antique ResearchdarshanmadeNessuna valutazione finora

- Bajaj Auto LTD - An AnalysisDocumento25 pagineBajaj Auto LTD - An AnalysisDevi YesodharanNessuna valutazione finora

- Ginni Filaments Limited-09!07!2020Documento4 pagineGinni Filaments Limited-09!07!2020Saurabh AgarwalNessuna valutazione finora

- Internship at Rosy Blue SecuritiesDocumento12 pagineInternship at Rosy Blue SecuritiesKrish JoganiNessuna valutazione finora

- Bhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREDocumento4 pagineBhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREPuneet367Nessuna valutazione finora

- Good Bearing Ahead For The IndustryDocumento7 pagineGood Bearing Ahead For The IndustryAbhishek MaakarNessuna valutazione finora

- Mahindra & Mahindra (MM IN) : Analyst Meet UpdateDocumento9 pagineMahindra & Mahindra (MM IN) : Analyst Meet UpdateanjugaduNessuna valutazione finora

- Sintex Industries: Topline Beats, Margins in Line - BuyDocumento6 pagineSintex Industries: Topline Beats, Margins in Line - Buyred cornerNessuna valutazione finora

- One Stock That Will Repeat History and Turn Multibagger: 30 December 2008Documento6 pagineOne Stock That Will Repeat History and Turn Multibagger: 30 December 2008Pradeep MagudeswaranNessuna valutazione finora

- London School of Commerce: Name: Student Id: 0661Swsw1109 Mba (Ii) Tutor: SubjectDocumento13 pagineLondon School of Commerce: Name: Student Id: 0661Swsw1109 Mba (Ii) Tutor: SubjectNikunj PatelNessuna valutazione finora

- BKTInvestor Presentation Nov 10Documento25 pagineBKTInvestor Presentation Nov 10Gaurav AggarwalNessuna valutazione finora

- HSIE Results Daily - 15 Feb 24-202402150648003692167Documento8 pagineHSIE Results Daily - 15 Feb 24-202402150648003692167Sanjeedeep Mishra , 315Nessuna valutazione finora

- Endurance Technologies LTDDocumento15 pagineEndurance Technologies LTDUNKNOWN PersonNessuna valutazione finora

- Mayur Uniquotors Analyst ReportDocumento50 pagineMayur Uniquotors Analyst ReportS SohNessuna valutazione finora

- Tata Motors Company 1QFY23 Under Review 28 July 2022Documento9 pagineTata Motors Company 1QFY23 Under Review 28 July 2022Rojalin SwainNessuna valutazione finora

- CFRA Project PDFDocumento14 pagineCFRA Project PDFSYKAM KRISHNA PRASADNessuna valutazione finora

- Top Picks Sep 2012Documento15 pagineTop Picks Sep 2012kulvir singNessuna valutazione finora

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocumento25 pagineInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNessuna valutazione finora

- Tyre Industry AnalysisDocumento5 pagineTyre Industry AnalysisVaibhav Shah100% (1)

- Balkrishna IndustriesDocumento11 pagineBalkrishna IndustriesRohit KhannaNessuna valutazione finora

- Project ReportDocumento80 pagineProject ReportVimal KatiyarNessuna valutazione finora

- VRL L L (VRL) : Ogistics TDDocumento6 pagineVRL L L (VRL) : Ogistics TDjagadish madiwalarNessuna valutazione finora

- Sharekhan Top Picks: April 03, 2010Documento6 pagineSharekhan Top Picks: April 03, 2010Kripansh GroverNessuna valutazione finora

- Tab India Granites Private Limited-02-07-2020Documento6 pagineTab India Granites Private Limited-02-07-2020Puneet367Nessuna valutazione finora

- Nse Bse LetterDocumento29 pagineNse Bse Lettergmatmat200Nessuna valutazione finora

- IDirect Auto SectorUpdate 27mar20 PDFDocumento13 pagineIDirect Auto SectorUpdate 27mar20 PDFSuryansh SinghNessuna valutazione finora

- A Vision For The Indian EconomyDocumento2 pagineA Vision For The Indian EconomyPunit JainNessuna valutazione finora

- Petronet LNG - A Recovery in KochiDocumento6 paginePetronet LNG - A Recovery in KochiPunit JainNessuna valutazione finora

- VST Tillers Tractors - Agressive Agro GrowthDocumento3 pagineVST Tillers Tractors - Agressive Agro GrowthPunit JainNessuna valutazione finora

- KEC International - JainMatrix Investments - Feb2012Documento7 pagineKEC International - JainMatrix Investments - Feb2012Punit JainNessuna valutazione finora

- Eclerx - JainMatrix Investments - Nov2011Documento6 pagineEclerx - JainMatrix Investments - Nov2011Punit JainNessuna valutazione finora

- Investments in 2012Documento11 pagineInvestments in 2012Punit JainNessuna valutazione finora

- JainMatrix Investments Bajaj Finance Jan2012Documento6 pagineJainMatrix Investments Bajaj Finance Jan2012Punit JainNessuna valutazione finora

- Shipping Corporation of India FPO Dec 2010Documento3 pagineShipping Corporation of India FPO Dec 2010Punit JainNessuna valutazione finora

- PunjabandSind IPO JainMatrixInvestmentsDocumento1 paginaPunjabandSind IPO JainMatrixInvestmentsPunit JainNessuna valutazione finora

- Indicators XDDocumento17 pagineIndicators XDAniket jaiswalNessuna valutazione finora

- #Financial Management and Debt Control in Public EnterprisesDocumento54 pagine#Financial Management and Debt Control in Public EnterprisesD J Ben Uzee100% (2)

- Unit 14Documento28 pagineUnit 14Ajeet KumarNessuna valutazione finora

- Kedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanDocumento15 pagineKedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanVictor TumbelNessuna valutazione finora

- Payroll AccountinDocumento2 paginePayroll AccountinIvy Veronica SandagonNessuna valutazione finora

- Becamex Presentation - Full Version 4Documento34 pagineBecamex Presentation - Full Version 4Trường Hoàng XuânNessuna valutazione finora

- Hill Gbt6e PPT Chapter07Documento17 pagineHill Gbt6e PPT Chapter07Pardis SiamiNessuna valutazione finora

- Final Soft Copy of Grant-in-Aid SchemeDocumento14 pagineFinal Soft Copy of Grant-in-Aid SchemeTender infoNessuna valutazione finora

- 99503-Tsa Oxford Section 1 2010Documento32 pagine99503-Tsa Oxford Section 1 2010Liviu NeaguNessuna valutazione finora

- Winding Up of The Company by The TribunalDocumento5 pagineWinding Up of The Company by The Tribunalshishir2730Nessuna valutazione finora

- Company Basic Concept MCQ'sDocumento3 pagineCompany Basic Concept MCQ'sFaizan ChNessuna valutazione finora

- Himalayan Bank LTD Nepal Introduction (Essay)Documento2 pagineHimalayan Bank LTD Nepal Introduction (Essay)Chiran KandelNessuna valutazione finora

- Santander 219-432-Informe Anual ENG ACCE PDFDocumento296 pagineSantander 219-432-Informe Anual ENG ACCE PDFvhsodaNessuna valutazione finora

- Nikl Metals WeeklyDocumento7 pagineNikl Metals WeeklybodaiNessuna valutazione finora

- Liquidity Management in Banks Treasury Risk ManagementDocumento11 pagineLiquidity Management in Banks Treasury Risk Managementashoo khoslaNessuna valutazione finora

- QTN FreonDocumento1 paginaQTN Freonsanad alsoulimanNessuna valutazione finora

- Curriculam Vitae: Working With NEW TALENT PRO India PVT Ltd. in in Casa Since FEB 2016 To 30, Nov. 2016Documento3 pagineCurriculam Vitae: Working With NEW TALENT PRO India PVT Ltd. in in Casa Since FEB 2016 To 30, Nov. 2016vkumar_345287Nessuna valutazione finora

- Merger ReportDocumento9 pagineMerger ReportArisha KhanNessuna valutazione finora

- Final Report On Mutual Fund - Fm1vimal14Documento71 pagineFinal Report On Mutual Fund - Fm1vimal14Raksha ThakurNessuna valutazione finora

- Brain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountryDocumento3 pagineBrain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountrydivyanshNessuna valutazione finora

- Pitfalls Tips of Dealing With Subcontract Nomination Under Fidic Uaecivil LawDocumento36 paginePitfalls Tips of Dealing With Subcontract Nomination Under Fidic Uaecivil LawWael LotfyNessuna valutazione finora

- UTA v. KassanDocumento13 pagineUTA v. KassanTHR100% (1)

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaDocumento22 pagineAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryNessuna valutazione finora

- Accommodation Party Crisologo Jose vs. CADocumento2 pagineAccommodation Party Crisologo Jose vs. CAMica GalvezNessuna valutazione finora

- 20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enDocumento2 pagine20230801052909-SABIC Agri-Nutrients Flash Note Q2-23 enPost PictureNessuna valutazione finora

- Responsibility Accounting ExcisesDocumento7 pagineResponsibility Accounting ExcisesRoy Mitz Aggabao Bautista V100% (1)

- PT Temas TBK Dan Entitas Anaknya/: and Its SubsidiariesDocumento121 paginePT Temas TBK Dan Entitas Anaknya/: and Its SubsidiariesHammad Muqtadirul ImadNessuna valutazione finora

- MBA-4th Sem. - 2013-14Documento25 pagineMBA-4th Sem. - 2013-14archana_anuragiNessuna valutazione finora

- Business Finance Week 5Documento5 pagineBusiness Finance Week 5cjNessuna valutazione finora

- Bir Ruling No. 015-18Documento2 pagineBir Ruling No. 015-18edong the greatNessuna valutazione finora