Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Phil Customs Clearance Guidelines

Caricato da

Ronaldo HertezDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Phil Customs Clearance Guidelines

Caricato da

Ronaldo HertezCopyright:

Formati disponibili

PHILIPPINE CUSTOMS CLE AR ANCE GUIDELINES GENERAL PROVISIONS All articles, when imported from any foreign country

into the Philippines, shall be subject to duty and tax upon each importation, even though previously exported from the Philippines, except as otherwise specifically provided in the Customs Code or in other laws. (Section 100, Tariff and Customs Code, as amended) PROHIBTED AND REGULATED ARTICLES The unlawful importation of prohibited articles (i.e. marijuana, cocaine or any other narcotics or synthetic drugs); firearms, ammunitions, gun replicas, explosives and parts thereof, obscene, pornographic and immoral articles; mislabeled, misbranded and adulterated articles of food and drugs; gambling outfits and paraphernalia; used clothing and rags (R.A. 4653); elephant tusks and their by-products; or those which violate the Intellectual Property Rights Act (i.e., DVDs, VCDs, other imitation products); and regulated Items (i.e., transceivers and communications equipment; controlled chemicals, substances and precursors, regardless of quantity constitutes a violation of tariff and Customs Code of the Philippines, as amended, and other special laws and may subject you to criminal prosecution and/or fines and penalties). AGRICULTURE AND QUARANTINE REGULATIONS Agriculture quarantine restricts the entry of animal, fish and plant products or their byproducts (such as meat, eggs, birds, fruits, etc.). Transport of endangered species and their by-products is also restricted/prohibited by CITES/DENR regulations. Likewise, export of such products/by-products must be referred to quarantine officers to ensure compliance with Philippine regulations and requirements of country of destination. Failure to obtain prior import and/or export permit from the Philippine Department of Agriculture together with corresponding health sanitary or phytosanitary certificate from country of origin and to declare the same may result to seizure, fines, and/or penalties. REGULATED ARTICLES THA REQUIRE IMPORT PERMIT/CLEARANCES: Articles that need import/export permits and/or clearances and government agencies that issue them: Live Animals and Meat Fruits and Plants Marine and Aquatic Products Medicines and the like Firearms, Parts, Ammunition, etc. VHS, Tapes, CDs, DVDs, etc. TV, Movie, Film Print and Negatives, etc. Transceivers, Communication Equipments, etc. Endangered Species Bureau of Animal Industry (BAI) Bureau of Plant Industry (BPI) Bureau of Fisheries and Aquatic resources (BFAR) Bureau of Food and Drugs (BFAD) Philippine National Police (PNP) Firearms and Explosives Office (FEO) Optical Media Board (OMB) Movie and Television Review and Classification Board (MTRCB) National Telecommunications Commission (NTC) Dept. of Environment and Natural Resources (DENR)

CURRENCY AND MONETARY INSTRUMENTS Philippine Currency No person may import or export or bring with him into or out of the country legal tender Philippine notes, coins, checks, money orders and other bill of exchange drawn in pesos against banks operating in the Philippines in an amount exceeding PHP10,000.00 without authorization by the Bangko Sentral ng Pilipinas 9BSP Circular No. 98, Series of. I, 995, amending Section 4 of CBP Circular No. 1389, Series of 1993, as amended)

Foreign Currency Any person bringing in or taking out of the Philippines foreign currency, or other foreign exchange-denominated bearer negotiable monetary instruments such as travelers check, other checks, drafts, notes, money order, bonds, deposit substitute instruments, trading orders, transaction tickets and confirmation of custodial receipts, trading orders, transaction tickets and confirmation of sale/investment, in excess of US10,000.00 or its equivalent must accomplish a Foreign Currency Declaration (FCD) Form which may be obtained from, and after accomplishment submitted to, a Customs Officers at the Customs Desk in the Arrival or Departure Areas. (BSP Circular No. 308, Series of 2001, as amended by BSP Circular No. 507, Series of 2006) Any violation thereof shall be subject to the sanctions provided for in Section 36 of Republic Act No. 7653 (New Central Bank Act, without prejudice to the application of remedies and sanctions provided for under customs laws and regulations. (BSP Circular No. 308, Series of 2001) BALIKBAYAN CATEGORIES 1. 2. 3. Filipino citizen who has been continuously out of the Philippines for a period of at least one (1) year from the date of last departure. A. Filipino Overseas Work (OFW); or Former Filipino with foreign passport and members of his family (i.e. spouse and children) who are traveling with him.

EXEMPTIONS/DUTY-FREE CONCESSIONS Adult Passengers: T wo (2) reams of cigarette or two (2) tins tobacco T wo (2) bottles of liquor or wine not exceeding one (1) liter per bottle. Balikbayan and Overseas Filipino Workers (OFWs) are entitled to a Ten Thousand (10,000.00) Pesos duty exemption on their USED personal and household effects. Any excess thereof is subject to an ad valorem duty (Executive Order 206). In addition, OFWs are entitled to duty and tax-free privileges on their USED appliances limited to one of every kind provided the value does not exceed PHP10,000.00. Any excess is subject to duty and tax. PHILIPPINE DUTY-FREE SHOPPING All passengers arriving from abroad can enjoy a one-time duty-free shopping privilege within the prescribed number of days from the date of arrival, upon presentation of a valid passport, flight ticket and boarding pass. Philippine duty-free shops are retail establishments licensed by the government to sell duty and tax-free merchandise to cater to travelers and balikbayans. Frequent travelers can enjoy up to US$10,000.00 worth of duty-free shopping privileges in a given calendar year. However, duty-free shopping is subject to certain conditions and limitations. Purchases must be made in US dollars or its equivalent in Philippine Peso and other acceptable foreign currencies. This privilege is not transferable (except for kabuhayan shopping). Balikbayan privileges can only be availed of once a year. Minors are not allowed to buy cigarettes, liquors, wines, electronics, and home appliances. Tourists buying home appliances and electronics are subject to duties and taxes. ACCOMPANIED BAGGAGED INTENDED AS DONATION Relief, charitable and/or humanitarian organizations intending to donate for free distribution or extend free medical, dental or any other services to the less privileged must coordinate with the Philippine Department of Social Welfare and Development, through the Philippine embassies and/or consulates abroad, for purposes of clearance, prior to actual departure. Donations must be covered by a Deed of Donation and Deed of Acceptance, approved by the Department of Finance. NON-RESIDENT FOREIGNERS

Passengers who intend to bring back to their place of residence abroad any dutiable article must inform the inspecting Customs Officer of said intention. In this case, the passenger may be required to accomplish a re-exportation commitment form duly secured by a cash abroad deposit equal to the ascertained duty and tax on the article, refundable upon departure of the passenger with the article, for which a corresponding Official Receipt will be issued. IMPORTANT NOTICE All arriving passengers are required to accomplish a Customs Declaration form (BC Form 117) given on board the carrying aircraft if traveling as one family, one declaration is sufficient. Arriving passengers are required to declare all articles purchased or acquired abroad, indicating the quantity and its total acquisition price. If unsure of what to declare, please consult any customs Officer on duty. THE AMOUNT OF DUTY AND TAX TO BE PAID shall be assessed by the Customs Officer. Rates of duty imposed depend on the articles imported. Please have all your receipts and/or supporting documents ready for inspection/verification by the Customs Officers. Demand Customs Official Receipts for any payment of duties and/or taxes made.

Potrebbero piacerti anche

- Trade of Metal Fabrication: Module 6: Fabrication Drawing Unit 12: Structural Drawing Phase 2Documento27 pagineTrade of Metal Fabrication: Module 6: Fabrication Drawing Unit 12: Structural Drawing Phase 2Ronaldo HertezNessuna valutazione finora

- Construction Site SafetyDocumento14 pagineConstruction Site SafetyRonaldo Hertez100% (1)

- Drawing Methods and Types: PipefittingDocumento15 pagineDrawing Methods and Types: PipefittingRonaldo HertezNessuna valutazione finora

- Retaining Wall Calculations 12Documento13 pagineRetaining Wall Calculations 12Ronaldo HertezNessuna valutazione finora

- Guide For Design of Jointed Concrete Pavements For Streets and Local RoadsDocumento32 pagineGuide For Design of Jointed Concrete Pavements For Streets and Local RoadsFelipe Alfredo Martinez Interiano100% (1)

- Safety Training and EducationDocumento13 pagineSafety Training and EducationRonaldo HertezNessuna valutazione finora

- 15 Minutes Guide To Winning PresentationDocumento16 pagine15 Minutes Guide To Winning Presentationakash1526Nessuna valutazione finora

- Employability SkillsDocumento19 pagineEmployability SkillsRonaldo HertezNessuna valutazione finora

- List of Ebook SitesDocumento5 pagineList of Ebook SitesChiraag ChouhanNessuna valutazione finora

- RCC93 Flat Slabs (Tables)Documento24 pagineRCC93 Flat Slabs (Tables)Gan Chin PhangNessuna valutazione finora

- Food From PlantDocumento17 pagineFood From PlantRonaldo HertezNessuna valutazione finora

- Simple Electric CircuitDocumento24 pagineSimple Electric CircuitRonaldo HertezNessuna valutazione finora

- RCC42 Post Tensioned Analysis & DesignDocumento9 pagineRCC42 Post Tensioned Analysis & DesignSherif M. Geb100% (1)

- Plants AdaptationDocumento20 paginePlants AdaptationRonaldo HertezNessuna valutazione finora

- Structural Analysis Chapter 12Documento47 pagineStructural Analysis Chapter 12Ronaldo Hertez100% (2)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Apuntes ContabilidadDocumento206 pagineApuntes ContabilidadclaudiazdeandresNessuna valutazione finora

- General Oil and GasDocumento10 pagineGeneral Oil and GasRizqullah RamadhanNessuna valutazione finora

- Periyar University: Periyar Palkalai Nagar SALEM - 636011Documento48 paginePeriyar University: Periyar Palkalai Nagar SALEM - 636011sureshkumarNessuna valutazione finora

- 2021 Problem MojakoeDocumento6 pagine2021 Problem Mojakoedara ibthiaNessuna valutazione finora

- 4HANA Treasury and Risk ManagementDocumento50 pagine4HANA Treasury and Risk Managementsaigramesh100% (1)

- Free Trade and Free ArtDocumento6 pagineFree Trade and Free ArtJulian StallabrassNessuna valutazione finora

- Civil Law Review Ii: Part One - Obligations and ContractsDocumento31 pagineCivil Law Review Ii: Part One - Obligations and ContractsLawrence Y. CapuchinoNessuna valutazione finora

- EthicsDocumento13 pagineEthicsRafael RetubisNessuna valutazione finora

- HQ - Sat - 13.03.21 - QuizDocumento2 pagineHQ - Sat - 13.03.21 - QuizArthasNessuna valutazione finora

- NMDC LTD: ESG Disclosure ScoreDocumento6 pagineNMDC LTD: ESG Disclosure ScoreVivek S MayinkarNessuna valutazione finora

- Priced Bill of Quantities-4 PDFDocumento187 paginePriced Bill of Quantities-4 PDFAdebayo Gent Thayaw100% (1)

- DDM Tutorial Questions 1Documento2 pagineDDM Tutorial Questions 1phuongfeoNessuna valutazione finora

- BNY Mellon Resolution PlanDocumento24 pagineBNY Mellon Resolution PlanMohan ArumugamNessuna valutazione finora

- MBE AssignmentDocumento4 pagineMBE AssignmentDeepanshu Arora100% (1)

- John Company Second Edition ReferenceDocumento2 pagineJohn Company Second Edition ReferenceJohn SeaslyNessuna valutazione finora

- Exide Battery - Price List May 2011Documento7 pagineExide Battery - Price List May 2011dipakishereNessuna valutazione finora

- What Is A Financial Intermediary (Final)Documento6 pagineWhat Is A Financial Intermediary (Final)Mark PlancaNessuna valutazione finora

- Restaurant Opening ChecklistDocumento47 pagineRestaurant Opening ChecklistAssemNessuna valutazione finora

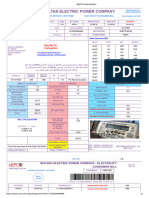

- Mepco Online BillDocumento1 paginaMepco Online Billhassan khanNessuna valutazione finora

- Programme: MBA: Teaching - Learning PlanDocumento8 pagineProgramme: MBA: Teaching - Learning PlanHarsh KandeleNessuna valutazione finora

- I Dont KnowDocumento84 pagineI Dont KnowSuraj PoptaniNessuna valutazione finora

- Sales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingDocumento67 pagineSales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingRishav Ch100% (1)

- "Land Investment at Its Best": Here's What Makes It A Rewarding InvestmentDocumento4 pagine"Land Investment at Its Best": Here's What Makes It A Rewarding InvestmentKetan BhanushaliNessuna valutazione finora

- Robot Book of KukaDocumento28 pagineRobot Book of KukaSumit MahajanNessuna valutazione finora

- Ensayos Sobre Politica Monetaria Inflacionaria y Politica EconomiaDocumento127 pagineEnsayos Sobre Politica Monetaria Inflacionaria y Politica EconomiacocoNessuna valutazione finora

- Tata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Documento54 pagineTata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Aman GuptaNessuna valutazione finora

- Costing Booster Batch: FOR MAY 2023Documento244 pagineCosting Booster Batch: FOR MAY 2023Vishal VermaNessuna valutazione finora

- Ƒ&$&Xuuhqw$VvhwDocumento20 pagineƑ&$&Xuuhqw$VvhwKawoser AhammadNessuna valutazione finora

- Pif 12 VoDocumento10 paginePif 12 VoJohn Lee PueyoNessuna valutazione finora

- ASSIGNMENT BBAW2103 - Financial AccountingDocumento13 pagineASSIGNMENT BBAW2103 - Financial AccountingMUHAMMAD NAJIB BIN HAMBALI STUDENTNessuna valutazione finora