Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

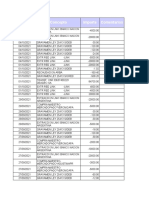

PSL Targets and Classification

Caricato da

Madhanmogan VenugopalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PSL Targets and Classification

Caricato da

Madhanmogan VenugopalCopyright:

Formati disponibili

______________________RESERVE BANK OF INDIA _______________________

www.rbi.org.in

RBI/2012-13/253

RPCD. CO. Plan. BC 37 /04.09.01/ 2012-13 October 17, 2012

The Chairman/ Managing Director/

Chief Executive Officer

[All scheduled commercial banks

(excluding Regional Rural Banks)]

Dear Sir,

PRIORITY SECTOR LENDING TARGETS AND CLASSIFICATION

Please refer to our circular No.RPCD.CO.Plan. BC 13/04.09.01/ 2012-13 dated J uly 20, 2012 on

the captioned subject. During the interaction Governor had with bankers on J uly 31, 2012 in

connection with the first quarter review of Monetary Policy Statement 2012-13, certain concerns

were raised by the banks on the revised priority sector guidelines. Accordingly, discussions were

held with CMD/CEOs of select banks and also with priority sector heads of select banks. Based

on the feedback received, it has been decided to make certain additions and amendments, as per

the Annex, in the guidelines on priority sector issued vide circular dated J uly 20, 2012.

The additions and amendments will be operational with effect from J uly 20, 2012.

Yours faithfully,

(T V Rao)

Deputy General Manager

, | , 10 , | , | , 4 . 10014, -400 001 ::022-

22601000 4 : +91-22-22621011/22610943/22610948 - : cgmincrpcd@rbi.org.in

Rural Planning & Credit Dept., Central Office, 10

th

Floor, Central Office Building, Shahid Bhagat Singh Marg, P.Box No. 10014, Mumbai 400 001

Tel : +91-22-22601000 Fax : +91-22-22621011/22610943/22610948 E-mail: cgmincrpcd@rbi.org.in

| ;

: - , | | , |

| | | |

Caution: RBI never sends mails, SMSs or makes calls asking for personal information like bank account details, passwords, etc. It never

keepsoroffersfundstoanyone.Pleasedonotrespondinanymannertosuchoffers.

Annex

1. Agriculture

1.1 Direct Agriculture

Bank loans to following entities would also qualify for lending to direct agriculture:-

Loans to corporates including farmers' producer companies of individual farmers, partnership

firms and co-operatives of farmers directly engaged in Agriculture and Allied Activities, viz.,

dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture (up to cocoon stage) up to

an aggregate limit of 2 crore per borrower for the following purposes.

(i) Short-term loans for raising crops, i.e. for crop loans.

This will include traditional/non-traditional plantations, horticulture and allied activities.

(ii) Medium & long-term loans for agriculture and allied activities (e.g. purchase of

agricultural implements and machinery, loans for irrigation and other developmental

activities undertaken in the farm, and development loans for allied activities).

(iii) Loans for pre-harvest and post-harvest activities, viz., spraying, weeding, harvesting,

grading and sorting.

(iv) Export credit for exporting their own farm produce.

[Effect on July 20, 2012 circular: A new sub paragraph under Paragraph (III) (1.1) gets added]

1.2 Indirect Agriculture

If the aggregate loan limit per borrower is more than 2 crore in respect of para 1.1 above, the

entire loan should be treated as indirect finance to agriculture.

[Effect on July 20, 2012 circular: Paragraphs (III) (1.2.1) (i), (ii), (iii), (v) and (vi) would stand

amended accordingly]

-1-

2. Micro and Small Enterprises (Service Sector)

Bank loans to Micro and Small Enterprises (MSE) engaged in providing or rendering of services

will be eligible for classification as direct finance to MSE Sector under priority sector upto an

aggregate loan limit of 2 croreper borrower/unit, provided they satisfy the investment criteria

for equipment as defined under MSMED Act, 2006.

[Effect on July 20, 2012 circular: Paragraph (III) (2) (2.1.2) would stand amended accordingly]

3. Housing

(i) Bank loans to any governmental agency for construction of dwelling units or for slum

clearance and rehabilitation of slum dwellers subject to a ceiling of 10 lakh per dwelling unit.

(ii) Loans sanctioned by banks for housing projects exclusively for the purpose of construction of

houses only to economically weaker sections and low income groups, the total cost of which

does not exceed 10 lakh per dwelling unit, will qualify for priority sector status. For the purpose

of identifying the economically weaker sections and low income groups, the family income limit

of 1,20,000 per annum, irrespective of location, is prescribed.

[Effect on July 20, 2012 circular: Paragraph (III) (4) (iii) & (iv) would stand amended

accordingly]

(iii) Bank loans to Housing Finance Companies (HFCs), approved by NHB for their refinance,

for on-lending for the purpose of purchase/construction/reconstruction of individual dwelling

units or for slum clearance and rehabilitation of slum dwellers, subject to an aggregate loan limit

of 10 lakh per borrower, provided the all inclusive interest rate charged to the ultimate borrower

is not exceeding lowest lending rate of the lending bank for housing loans plus two percent per

annum.

(iv) The eligibility under priority sector loans to HFCs is restricted to five percent of the

individual banks total priority sector lending, on an ongoing basis. The maturity of bank loans

should be co-terminus with average maturity of loans extended by HFCs. Banks should maintain

necessary borrower-wise details of the underlying portfolio.

[Effect on July 20, 2012 circular: A new sub paragraph under Paragraph (III) (4) gets added]

-2-

4. It is also clarified that:-

(i) The investments in non-SLR securities, under HTM category for computation of ANBC will

include only non-SLR bonds/debentures.

(ii) Off-balance sheet interbank exposures are excluded for computing Credit Equivalent of Off -

Balance Sheet Exposures for the priority sector targets.

(iii) The term all inclusive interest includes interest (effective annual interest), processing fees

and service charges.

(iv) Banks should ensure that loans extended under priority sector are for approved purposes and

the end use is continuously monitored. The banks should put in place proper internal controls and

systems in this regard.

--00--

-3-

Potrebbero piacerti anche

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsDa EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNessuna valutazione finora

- Master Circular MSME - RBIDocumento32 pagineMaster Circular MSME - RBIMadan MohanNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Reserve Bank of IndiaDocumento47 pagineReserve Bank of IndiaRitam PalNessuna valutazione finora

- Micro PPT PSLDocumento23 pagineMicro PPT PSLSONALI HIREKHANNessuna valutazione finora

- Excluding Regional Rural BanksDocumento33 pagineExcluding Regional Rural BanksBimal SahooNessuna valutazione finora

- Exposure Norms - RBI CircularDocumento38 pagineExposure Norms - RBI CircularAtul MittalNessuna valutazione finora

- Common Guidelines For Priority Sector AdvancesDocumento43 pagineCommon Guidelines For Priority Sector AdvancesKeval PatelNessuna valutazione finora

- Amendment & Additions in Unified Directives, 2077: Flash AlertDocumento3 pagineAmendment & Additions in Unified Directives, 2077: Flash AlertAnup KhanalNessuna valutazione finora

- Vidya Deepam Circ Gist Mar20 - Mar21Documento105 pagineVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- Non Performing Assets in Priority Sector Lending: Page NoDocumento24 pagineNon Performing Assets in Priority Sector Lending: Page NoYNessuna valutazione finora

- MASTERPRIORITYSECTORrbi80 2010Documento21 pagineMASTERPRIORITYSECTORrbi80 2010ANBUNessuna valutazione finora

- Reserve Bank of India: AppendixDocumento39 pagineReserve Bank of India: Appendixmithilesh tabhaneNessuna valutazione finora

- Ms Me PolicyDocumento13 pagineMs Me PolicyPrakash C RaavudiNessuna valutazione finora

- Reserve Bank of IndiaDocumento8 pagineReserve Bank of IndiaVasu Ram JayanthNessuna valutazione finora

- B BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateDocumento20 pagineB BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateGuruswami PrakashNessuna valutazione finora

- CAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020Documento15 pagineCAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020SATISHNessuna valutazione finora

- Financing Smes: The Nayak Committee Recommendations Appraisal, Monitoring and Nursing of SsisDocumento24 pagineFinancing Smes: The Nayak Committee Recommendations Appraisal, Monitoring and Nursing of SsisPrashant JoshiNessuna valutazione finora

- Priority Sector July 2012Documento16 paginePriority Sector July 2012Naveen ShettyNessuna valutazione finora

- Priority Sector Lending Norms by RBIDocumento4 paginePriority Sector Lending Norms by RBI9451893077Nessuna valutazione finora

- Master Circular - Lending To Micro, Small & Medium Enterprises (MSME) SectorDocumento24 pagineMaster Circular - Lending To Micro, Small & Medium Enterprises (MSME) SectorDeepakNessuna valutazione finora

- Micro Small & Medium EnterprisesDocumento33 pagineMicro Small & Medium EnterprisesTejaswi KarriNessuna valutazione finora

- Regional Rural Banks - Priority Sector Lending - Targets and ClassificationDocumento11 pagineRegional Rural Banks - Priority Sector Lending - Targets and ClassificationLangpi Dehangi Rural Bank P&DNessuna valutazione finora

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDocumento12 pagineIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNessuna valutazione finora

- CAIIB - Priority Sector LendingDocumento5 pagineCAIIB - Priority Sector LendingsharmilaNessuna valutazione finora

- Monthly Beepedia July 2022Documento132 pagineMonthly Beepedia July 2022not youNessuna valutazione finora

- Exposure NormsDocumento30 pagineExposure Normspadam_09Nessuna valutazione finora

- Study Materials of Banking LawDocumento8 pagineStudy Materials of Banking Lawsau kurNessuna valutazione finora

- Position of Weaker SectionsDocumento25 paginePosition of Weaker Sectionspulkit magoNessuna valutazione finora

- MSME Definition by RBIDocumento8 pagineMSME Definition by RBIRahul YadavNessuna valutazione finora

- 1 - Priority - Sector - LendingDocumento24 pagine1 - Priority - Sector - LendingMantu Kumar100% (1)

- Jun 232021 Smespd 06 eDocumento83 pagineJun 232021 Smespd 06 eSuman kunduNessuna valutazione finora

- Priority Sector LendingDocumento17 paginePriority Sector LendingRavi SankarNessuna valutazione finora

- Micro, Small and Medium EnterpricesDocumento7 pagineMicro, Small and Medium EnterpricesTarun BhatejaNessuna valutazione finora

- RBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Documento7 pagineRBI Master Circular Lending To Micro Small Medium Enterprises MSME Sector 2nd July 2012KALE LAW OFFICE CORPORATE LAWYER LAW FIR TAX CONSULTANTS COMPANY LAWYER 1Divya MewaraNessuna valutazione finora

- RBI Monetary Policy 5 Feb 2021Documento2 pagineRBI Monetary Policy 5 Feb 2021priyankaNessuna valutazione finora

- 229kyc Aml CFT Pmla1Documento7 pagine229kyc Aml CFT Pmla1skmlsrajNessuna valutazione finora

- Msepolciy DocumentDocumento27 pagineMsepolciy DocumentRupesh MoreNessuna valutazione finora

- Latest Recalled Questions - Bank Promotion - Oct 2022Documento50 pagineLatest Recalled Questions - Bank Promotion - Oct 2022kgaurav001Nessuna valutazione finora

- Rbi 1Documento27 pagineRbi 1Nishant ShahNessuna valutazione finora

- Msme Reserve Bank of India PDFDocumento6 pagineMsme Reserve Bank of India PDFAbhishek Singh ChauhanNessuna valutazione finora

- 'CC (CCC" CCC CCCCCCDocumento14 pagine'CC (CCC" CCC CCCCCCGopi KrishnaNessuna valutazione finora

- Study Material Updated (30.01.16) .Doc - 1541698900069Documento37 pagineStudy Material Updated (30.01.16) .Doc - 1541698900069vikasm4uNessuna valutazione finora

- Prime Minister Employment Generation Programme (PMEGP) : ObjectivesDocumento16 paginePrime Minister Employment Generation Programme (PMEGP) : ObjectivesPandhari SanapNessuna valutazione finora

- General Knowledge Today - 63Documento2 pagineGeneral Knowledge Today - 63niranjan_meharNessuna valutazione finora

- IASbabas 60 Day Plan 2017 Day 22 MinDocumento14 pagineIASbabas 60 Day Plan 2017 Day 22 MinsabirNessuna valutazione finora

- Small Scale Industries Finance: Credit FlowDocumento11 pagineSmall Scale Industries Finance: Credit FlowYuvarani GotturiNessuna valutazione finora

- Banking & Economy PDF - December 2022 by AffairsCloud 1Documento119 pagineBanking & Economy PDF - December 2022 by AffairsCloud 1Maahi ThakorNessuna valutazione finora

- 8-MM 8A-MSME FinancingDocumento42 pagine8-MM 8A-MSME Financingsenthamarai krishnan0% (1)

- PIB 2-14 MarchDocumento122 paginePIB 2-14 MarchgaganNessuna valutazione finora

- Weekly BeePedia 1st To 8th Aug 2020 PDFDocumento36 pagineWeekly BeePedia 1st To 8th Aug 2020 PDFSpringNessuna valutazione finora

- Rural Banking (Unit 13 - 15)Documento19 pagineRural Banking (Unit 13 - 15)dubakoor dubakoorNessuna valutazione finora

- Priority Sector LendingDocumento3 paginePriority Sector LendingSupriya ShrivastavNessuna valutazione finora

- Promotion Study Material I To II and II To III-1Documento131 paginePromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNessuna valutazione finora

- Master CircularDocumento41 pagineMaster Circularমেহেদী হাসানNessuna valutazione finora

- Small Scale Industries RahulDocumento12 pagineSmall Scale Industries RahulVaibhav RolihanNessuna valutazione finora

- PXV Update External Commercial BorrowingsDocumento7 paginePXV Update External Commercial BorrowingsSamar JhaNessuna valutazione finora

- Handbook On MSME Products 20210818110228Documento68 pagineHandbook On MSME Products 20210818110228omvir singhNessuna valutazione finora

- CSB. Session. 05 - 06. Credit Deployment - Priority SectorsDocumento24 pagineCSB. Session. 05 - 06. Credit Deployment - Priority SectorsSai KiranNessuna valutazione finora

- 14-Priority Sector Credit-Revised by Rbi On 20-7-2012Documento12 pagine14-Priority Sector Credit-Revised by Rbi On 20-7-2012sinha_rini80Nessuna valutazione finora

- Economics 2 XiiDocumento17 pagineEconomics 2 Xiiapi-3703686Nessuna valutazione finora

- Challan PDFDocumento1 paginaChallan PDFRAJESH KUMAR YADAVNessuna valutazione finora

- Church Street Health Management Bankruptcy Docket 3:12-bk-01573Documento62 pagineChurch Street Health Management Bankruptcy Docket 3:12-bk-01573Dentist The MenaceNessuna valutazione finora

- Customer Relationship ManagementDocumento88 pagineCustomer Relationship Managementphanindra_madasu0% (1)

- NGÀY 31 - ĐỀ TỰ LUYỆN SỐ 10Documento5 pagineNGÀY 31 - ĐỀ TỰ LUYỆN SỐ 1033.Trần Bích NgọcNessuna valutazione finora

- Economics Notes by AfreenMam PDFDocumento76 pagineEconomics Notes by AfreenMam PDFNitu KumariNessuna valutazione finora

- Securitisation of Financial AssetsDocumento27 pagineSecuritisation of Financial Assetsvahid100% (3)

- Deepak Mohanty: Implementation of Monetary Policy in IndiaDocumento11 pagineDeepak Mohanty: Implementation of Monetary Policy in Indianitin_panditNessuna valutazione finora

- First State Bank & Trust Company of Valdosta, Georgia, and Fidelity & Deposit Company of Maryland v. Bruce McIver, 893 F.2d 301, 1st Cir. (1990)Documento8 pagineFirst State Bank & Trust Company of Valdosta, Georgia, and Fidelity & Deposit Company of Maryland v. Bruce McIver, 893 F.2d 301, 1st Cir. (1990)Scribd Government DocsNessuna valutazione finora

- 1210 B C A T A (1071)Documento6 pagine1210 B C A T A (1071)rindah100% (2)

- Hold and ParkingDocumento2 pagineHold and Parkingjoy_dipdasNessuna valutazione finora

- CT Case AnalysisDocumento16 pagineCT Case AnalysisAchal Mittal0% (1)

- Assignment # 1: Very Important InstructionsDocumento5 pagineAssignment # 1: Very Important InstructionsFahad MuzafarNessuna valutazione finora

- For General Tax Questions Call Our Toll Free NumberDocumento2 pagineFor General Tax Questions Call Our Toll Free NumberManish PatelNessuna valutazione finora

- Auto Loan CalculatorDocumento13 pagineAuto Loan CalculatorLinkon PeterNessuna valutazione finora

- Bluedart Express LTD - Customs-Country Information-IndiaDocumento6 pagineBluedart Express LTD - Customs-Country Information-Indiaad2avNessuna valutazione finora

- SecuritizationDocumento146 pagineSecuritizationSaurabh ParasharNessuna valutazione finora

- Wells Fargo Everyday CheckingDocumento8 pagineWells Fargo Everyday CheckingJohn TurnerNessuna valutazione finora

- Movimientos HistoricosDocumento22 pagineMovimientos HistoricosVerónica RodNessuna valutazione finora

- IRM Sessional Test Notes - Introduction To Risk and InsuranceDocumento5 pagineIRM Sessional Test Notes - Introduction To Risk and InsuranceRupesh SharmaNessuna valutazione finora

- Banking Performance Management: Rajesh Shewani Presales Leader, BA Software IBM India/SADocumento20 pagineBanking Performance Management: Rajesh Shewani Presales Leader, BA Software IBM India/SARajesh Kumar100% (1)

- Citibank, N.A. V Sabeniano (Rivera) PDFDocumento2 pagineCitibank, N.A. V Sabeniano (Rivera) PDFKako Schulze CojuangcoNessuna valutazione finora

- Ed SyllaDocumento82 pagineEd SyllaDr.V.Bastin JeromeNessuna valutazione finora

- 1592827567uestions On Scale 0 To 1 Exam of UBGBDocumento16 pagine1592827567uestions On Scale 0 To 1 Exam of UBGBUmesh DewanganNessuna valutazione finora

- List of Common Violations and Applicable PenaltiesDocumento4 pagineList of Common Violations and Applicable PenaltiesMickin ShethNessuna valutazione finora

- Digital Lending For SMEsDocumento5 pagineDigital Lending For SMEsSatwika PutraNessuna valutazione finora

- FIN 401 Final Report BodyDocumento9 pagineFIN 401 Final Report Body1711........100% (1)

- EcbDocumento210 pagineEcbhnkyNessuna valutazione finora

- Department of Financial Institutions ESBMDocumento34 pagineDepartment of Financial Institutions ESBMAnu VanuNessuna valutazione finora

- Consultation Paper On The ITS On Supervisory ReportingDocumento69 pagineConsultation Paper On The ITS On Supervisory ReportingGeanina DavidNessuna valutazione finora

- Green Roofs, Facades, and Vegetative Systems: Safety Aspects in the StandardsDa EverandGreen Roofs, Facades, and Vegetative Systems: Safety Aspects in the StandardsNessuna valutazione finora

- To Engineer Is Human: The Role of Failure in Successful DesignDa EverandTo Engineer Is Human: The Role of Failure in Successful DesignValutazione: 4 su 5 stelle4/5 (137)

- Pocket Guide to Flanges, Fittings, and Piping DataDa EverandPocket Guide to Flanges, Fittings, and Piping DataValutazione: 3.5 su 5 stelle3.5/5 (22)

- Marine Structural Design CalculationsDa EverandMarine Structural Design CalculationsValutazione: 4.5 su 5 stelle4.5/5 (13)

- Carpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresDa EverandCarpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresValutazione: 1 su 5 stelle1/5 (2)

- Advanced Modelling Techniques in Structural DesignDa EverandAdvanced Modelling Techniques in Structural DesignValutazione: 5 su 5 stelle5/5 (3)

- Structural Cross Sections: Analysis and DesignDa EverandStructural Cross Sections: Analysis and DesignValutazione: 4.5 su 5 stelle4.5/5 (19)

- Structural Steel Design to Eurocode 3 and AISC SpecificationsDa EverandStructural Steel Design to Eurocode 3 and AISC SpecificationsNessuna valutazione finora

- Pile Design and Construction Rules of ThumbDa EverandPile Design and Construction Rules of ThumbValutazione: 4.5 su 5 stelle4.5/5 (15)

- Climate Adaptation Engineering: Risks and Economics for Infrastructure Decision-MakingDa EverandClimate Adaptation Engineering: Risks and Economics for Infrastructure Decision-MakingNessuna valutazione finora

- Predicting Lifetime for Concrete StructureDa EverandPredicting Lifetime for Concrete StructureNessuna valutazione finora

- Modeling and Dimensioning of Structures: An IntroductionDa EverandModeling and Dimensioning of Structures: An IntroductionNessuna valutazione finora

- Flow-Induced Vibrations: Classifications and Lessons from Practical ExperiencesDa EverandFlow-Induced Vibrations: Classifications and Lessons from Practical ExperiencesTomomichi NakamuraValutazione: 4.5 su 5 stelle4.5/5 (4)

- Bridge Engineering: Classifications, Design Loading, and Analysis MethodsDa EverandBridge Engineering: Classifications, Design Loading, and Analysis MethodsValutazione: 4 su 5 stelle4/5 (16)

- Engineering for Kids: Building and Construction Fun | Children's Engineering BooksDa EverandEngineering for Kids: Building and Construction Fun | Children's Engineering BooksValutazione: 3 su 5 stelle3/5 (2)

- Transmission Pipeline Calculations and Simulations ManualDa EverandTransmission Pipeline Calculations and Simulations ManualValutazione: 4.5 su 5 stelle4.5/5 (10)

- Advanced Design Examples of Seismic Retrofit of StructuresDa EverandAdvanced Design Examples of Seismic Retrofit of StructuresValutazione: 1 su 5 stelle1/5 (1)