Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Japanese Candlestick Patterns - Bearish

Caricato da

smksp1Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Japanese Candlestick Patterns - Bearish

Caricato da

smksp1Copyright:

Formati disponibili

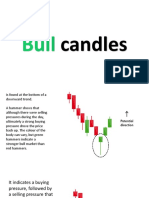

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Separating Lines

The bearish separating lines (iki chigai sen) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish separating lines candlestick consists of an upward candlestick (e.g. a green candlestick), that opens with a gap down, followed by a downward candlestick (e.g. a red candlestick) that opens at (or near) the open of the previous candlestick (i.e. a second gap down). In other words, the two candlesticks both open at (or near) the same price, but trade in opposite directions (hence the name separating lines) Use In Trading The bearish separating lines pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish separating lines pattern is a bearish pattern, and can be used as an indication of a downward trend, without requiring any further confirmation from a subsequent candlestick. The bearish separating lines pattern is one of the sightly more complicated two candlestick patterns, but once the separating concept is understo

Bearish Meeting Lines

The bearish meeting lines (deai sen) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish meeting lines candlestick consists of an upward candlestick (e.g. a green candlestick), followed by a downward candlestick (e.g. a red candlestick) that opens above the close of the previous candlestick (i.e. a gap up), and closes at (or near) the close of the previous candlestick (hence the name meeting lines). Use In Trading The bearish meeting lines pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish meeting lines pattern can be used as an indication of the end of an upward trend, and can be used as both a trade entry and a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade). Note that if the two candlesticks were compressed into a single candlestick, that they would create a long legged doji. Bearish Dark Cloud Cover The dark cloud cover (kabuse) candlestick pattern (view full size chart) is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish dark cloud cover candlestick consists of an upward candlestick (e.g. a green candlestick), followed by a downward candlestick (e.g. a red candlestick) that opens above the close of the previous candlestick (i.e. a gap up), and closes below the middle of the previous candlestick.

Use In Trading The bearish dark cloud cover pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish dark cloud cover can be used as an indication of the end of an upward trend, and therefore can be used as both a trade entry and a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade). Note that if the second candlestick does not close below the middle of the first candlestick, that a different (and bullish) pattern is created instead.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Harami

The bearish harami candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish harami candlestick consists of an upward candlestick (e.g. a green candlestick), followed by a downward candlestick (e.g. a red candlestick) that opens below the close of the previous candlestick, and closes above the open of the previous candlestick (i.e. is contained within the previous candlestick). Use In Trading The bearish harami pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish harami is often used as an indication of the end of an upward trend, and therefore can be used as both a trade entry and a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade).

Bearish Engulfing

The bearish engulfing (tsutsumi) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish engulfing candlestick consists of a upward candlestick (e.g. a green candlestick), followed by a downward candlestick (e.g. a red candlestick) that opens with a gap above the close of the previous candlestick, and closes below the open of the previous candlestick.

Use In Trading The bearish engulfing pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish engulfing is often used as an indication of the end of a upward trend, and therefore can be used as both a trade entry and a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade).

Bearish Three Outside Down

The bearish three outside down (tsutsumi sage) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish three outside down candlestick consists of an upward candlestick (i.e. a green candlestick), followed by a larger downward candlestick (i.e. a red candlestick) that contains the first candlestick (i.e. a bearish engulfing), followed by another downward candlestick (i.e. another red candlestick). Use In Trading The bearish three outside down pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish three outside down pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish three outside down pattern is a somewhat complicated candlestick pattern, but once the important elements of the pattern are understood (e.g. the second candlestick containing the first candlestick), the pattern is relatively easy to identify on a price chart, and the pattern can provide a useful indication of upcoming price movement.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Three Inside Down

The bearish three inside down (harami sage) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish three inside down candlestick consists of an upward candlestick (i.e. a green candlestick), followed by a smaller downward candlestick (i.e. a red candlestick), that is contained within the first candlestick (i.e. a bearish harami), followed by a larger downward candlestick (i.e. another red candlestick), that closes below the open of the first candlestick. Use In Trading The bearish three inside down pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish three inside down pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish three inside down pattern is a somewhat complicated candlestick pattern, but once the important elements of the pattern are understood (e.g. the third candlestick closing below the open of the first candlestick), the pattern is relatively easy to identify on a price chart, and the pattern can provide a useful indication of upcoming price movement.

Bearish Abandoned Baby

The bearish abandoned baby (sute go) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish abandoned baby candlestick consists of an upward candlestick (e.g. a green candlestick), followed by a smaller doji candlestick (e.g. a candlestick that opens and closes at the same price), followed by a downward candlestick (e.g. a red candlestick). The second candlestick (the doji) must be completely above both the first and third candlesticks (i.e. the open, high, low, and close, of the doji, must be above the highs of both the first and third candlesticks). Use In Trading The bearish abandoned baby pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish abandoned baby pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish abandoned baby pattern is somewhat similar to some of the other three candlestick patterns, but once the differentiating aspect is understood (e.g. the doji being completely above the other candlesticks), the pattern is relatively easy to identify on a price chart.

Bearish Evening Doji Star

The bearish evening doji star (yoi no myojyo doji bike) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish evening doji star candlestick consists of an upward candlestick (e.g. a green candlestick), followed by a smaller doji candlestick (e.g. a candlestick that opens and closes at the same price) that opens (and obviously closes) above the high of the previous candlestick (i.e. a gap up), followed by a downward candlestick (e.g. a red candlestick) that opens below the low of the previous candlestick (i.e. a gap down), and closes below the close, and above the open, of the first candlestick (i.e. in the middle of the first candlestick).

Use In Trading

The bearish evening doji star pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish evening doji star pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish evening doji star pattern is somewhat similar to some of the other three candlestick patterns, but once the differentiating aspects are understood, the pattern is relatively easy to identify on a price chart.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Tri Stars

The bearish tri stars (santen boshi) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish tri stars candlestick consists of a doji candlestick (i.e. a candlestick that opens and closes at the same price), followed by another doji candlestick, followed by another doji candlestick (i.e. three consecutive doji candlesticks). The second doji candlestick must be above both the first and third candlesticks (i.e. a gap up, followed by a gap down).

Use In Trading The bearish tri stars pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish tri stars pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish tri stars pattern is a rare candlestick pattern, but the pattern is relatively easy to identify on a price chart, and when it does occur, it can provide a useful indication of upcoming price movement.

Bearish Two Crows

The bearish two crows (niwa garasu) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish two crows candlestick consists of an upward candlestick (i.e. a green candlestick), followed by a smaller downward candlestick (i.e. a red candlestick), that opens and closes above the close of the first candlestick (i.e. a gap up that does not close), followed by a larger downward candlestick (i.e. another red candlestick), that opens above the close of the second candlestick (i.e. another gap up), and closes below the close of the first candlestick. Note that the third candlestick closing below the close of the first candlestick is the feature that differentiates the two crows from the upside gap two crows candlestick pattern. Use In Trading The bearish two crows pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish two crows pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish two crows pattern is a somewhat complicated candlestick pattern, but once the important elements of the pattern are understood (e.g. the third candlestick closing below the close of the first candlestick), the pattern is relatively easy to identify on a price chart, and the pattern can provide a useful indication of upcoming price movement.

Bearish Upside Gap Two Crows

The bearish upside gap two crows (shita banare niwa garasu) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish upside gap two crows candlestick consists of an upward candlestick (i.e. a green candlestick), followed by a smaller downward candlestick (i.e. a red candlestick), that opens and closes above the close of the first candlestick (i.e. a gap up that does not close), followed by a larger downward candlestick (i.e. another red candlestick), that opens above the close (and possibly the open) of the second candlestick (i.e. another gap up), and closes above the close of the first candlestick. Note that the third candlestick closing above the close of the first candlestick is the feature that differentiates the upside gap two crows from the two crows candlestick pattern. Use In Trading The bearish upside gap two crows pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish upside gap two crows pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish upside gap two crows pattern is a somewhat complicated candlestick pattern, but once the important elements of the pattern are understood (e.g. the third candlestick closing above the close of the first candlestick), the pattern is relatively easy to identify on a price chart, and the pattern can provide a useful indication of upcoming price movement.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Thrusting

The bearish thrusting (sashikomi) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish thrusting candlestick consists of a downward candlestick (e.g. a red candlestick), followed by an upward candlestick (e.g. a green candlestick) that opens below the close of the previous candlestick (i.e. a gap down), and closes above the close, but below the middle, of the previous candlestick.

Use In Trading The bearish thrusting pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish thrusting pattern is a bearish pattern, and can be used as an indication of the continuation of a downward trend. The bearish thrusting pattern is one of the sightly more complicated two candlestick patterns, but once the defining characteristic (the close above the close, but below the middle, of the previous candlestick) is understood, the pattern is relatively easy to identify on a price chart.

Bearish In Neck

The bearish in neck (iri kubi) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish in neck candlestick consists of a downward candlestick (e.g. a red candlestick), followed by an upward candlestick (e.g. a green candlestick) that opens below the close of the previous candlestick (i.e. a gap down), and closes at (or near) the close of the previous candlestick. Note that it is the second candlestick closing at (or near) the close of the previous candlestick that differentiates the in neck pattern from the on neck pattern.

Use In Trading The bearish in neck pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish in neck pattern is a bearish pattern, and can be used as an indication of the continuation of a downward trend. The bearish in neck pattern is one of the sightly more complicated two candlestick patterns, but once the defining characteristic (the close at (or near) the close of the previous candlestick) is understood, the pattern is relatively easy to identify on a price chart.

Bearish On Neck

The bearish on neck (ate kubi) candlestick pattern is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish on neck candlestick consists of a downward candlestick (e.g. a red candlestick), followed by an upward candlestick (e.g. a green candlestick) that opens below the close of the previous candlestick (i.e. a gap down), and closes at (or near) the low of the previous candlestick. Note that it is the second candlestick closing at (or near) the low of the previous candlestick that differentiates the on neck pattern from the in neck pattern.

Use In Trading The bearish on neck pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish on neck pattern is a bearish pattern, and can be used as an indication of the continuation of a downward trend. The bearish on neck pattern is one of the sightly more complicated two candlestick patterns, but once the defining characteristic (the close at (or near) the low of the previous candlestick) is understood, the pattern is relatively easy to identify on a price chart.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Deliberation

The bearish deliberation (aka sansei shian boshi) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish deliberation candlestick consists of three upward candlesticks (e.g. green candlesticks) in a row, with the third candlestick opening above the close of the previous candlestick (i.e. a gap up), and having a smaller range than the previous candlesticks.

Use In Trading The bearish deliberation pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish deliberation pattern is a bearish pattern, and can be used as an indication of the end of an upward trend, but it is recommended that a confirmation is required (e.g. bearish trading in a subsequent candlestick) before entering or exiting any trades. The bearish deliberation pattern is relatively easy to identify on a price chart.

Bearish Advance Block

The bearish advance block (saki zumari) candlestick pattern is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish advance block candlestick consists of three upward candlesticks (e.g. green candlesticks) in a row, with each candlestick opening below the close of the previous candlestick (i.e. a gap down), and having a smaller range between its open and close than the previous candlestick.

Use In Trading The bearish advance block pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish advance block pattern is a bearish pattern, and can be used as an indication of the end of an upward trend, but it is recommended that a confirmation is required (e.g. bearish trading in a subsequent candlestick) before entering or exiting any trades. The bearish advance block pattern is relatively easy to identify on a price chart.

Bearish Side By Side White Lines

The bearish side by side white lines (narabi aka) candlestick pattern (view full size chart) is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish side by side white lines candlestick consists of a downward candlestick (i.e. a red candlestick), followed by an upward candlestick (i.e. a green candlestick) that opens below the close of the first candlestick (i.e. a gap down), followed by another upward candlestick (i.e. another green candlestick) that opens below the close of the second candlestick (i.e. a gap down). Note that the gap down between the first and second candlesticks is not closed by either the second or third candlesticks.

Use In Trading The bearish side by side white lines pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish side by side white lines pattern is a bearish pattern, and can be used as an indication of the continuation of a downward trend. The bearish side by side white lines pattern is relatively easy to identify on a price chart, and as long as the important elements of the pattern are provided (e.g. the gap down that is not closed), the pattern can provide a useful indication of upcoming price movement.

Japanese candle sticks

[Type text]

(an indication of the continuation of a downward trend)

Bearish Pattern

Bearish Downside Tasuki Gap

The bearish downside tasuki gap (shita banare tasuki) candlestick pattern (view full size chart) is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish downside tasuki gap candlestick consists of a downward candlestick (i.e. a red candlestick), followed by another downward candlestick (i.e. another red candlestick) that opens below the close of the first candlestick (i.e. a gap down), followed by an upward candlestick (i.e. a green candlestick) that opens above the close of the second candlestick (i.e. a gap up). Note that the gap down between the first and second candlesticks is not closed by either the second or third candlesticks.

Use In Trading The bearish downside tasuki gap pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish downside tasuki gap pattern is a bearish pattern, and with a confirmation (e.g. bearish trading in a subsequent candlestick), the downside tasuki gap pattern can be used as an indication of the continuation of a downward trend. The bearish downside tasuki gap pattern is relatively easy to identify on a price chart, and as long as the important elements of the pattern are provided (e.g. the gap down that is not closed), the pattern can provide a useful indication of upcoming price movement.

Bearish Downside Gap Three Methods

The bearish downside gap three methods (uwa banare sanpoo ippon dachi) candlestick pattern (view full size chart) is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish downside gap three methods candlestick pattern consists of a downward candlestick (i.e. a red candlestick), followed by another downward candlestick (i.e. another red candlestick) that opens below the close of the first candlestick (i.e. a gap down), followed by an upward candlestick (i.e. a green candlestick) that opens above the close of the second candlestick (i.e. a gap up), and has a high above the close of the first candlestick (i.e. closes the gap between the first and second candlesticks).

Use In Trading The bearish downside gap three methods pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant downward trend. The bearish downside gap three methods pattern is a bearish pattern, and with a confirmation (e.g. bearish trading in a subsequent candlestick), the downside gap three methods pattern can be used as an indication of the continuation of a downward trend. The bearish downside gap three methods pattern is relatively easy to identify on a price chart, and as long as the important elements of the pattern are provided (e.g. the gap down that is closed by the third candlestick), the pattern can provide a useful indication of upcoming price movement.

Bearish Identical Three Crows

The bearish identical three crows (doji sanba garsu) candlestick pattern (view full size chart) is one of the triple candlestick patterns (i.e. it consists of three individual candlesticks), and it is a bearish pattern. The bearish identical three crows candlestick consists of three downward candlesticks (e.g. red candlesticks) in a row, with each candlestick opening at the close of the previous candlestick.

Use In Trading The bearish identical three crows pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish identical three crows pattern is a bearish pattern, and can be used as an indication of the end of an upward trend. The bearish identical three crows pattern is very easy to identify on a price chart.

Japanese candle sticks

[Type text]

Bearish Pattern

Bearish Engulfing

The bearish engulfing (tsutsumi) candlestick pattern (view full size chart) is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish engulfing candlestick consists of a upward candlestick (e.g. a green candlestick), followed by a downward candlestick (e.g. a red candlestick) that opens with a gap above the close of the previous candlestick, and closes below the open of the previous candlestick.

. Use In Trading The bearish engulfing pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. The bearish engulfing is often used as an indication of the end of a upward trend, and therefore can be used as both a trade entry and a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade).

Bearish Harami Cross

The bearish harami cross (harami yose sen) candlestick pattern (view full size chart) is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish harami cross candlestick consists of a downward candlestick (e.g. a red candlestick), followed by a doji candlestick (e.g. neither a red nor green candlestick) that opens below the close of, and is contained within, the previous candlestick.

Use In Trading Like the bearish harami pattern, the bearish harami cross pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant when it occurs during a significant upward trend. However, the bearish harami cross does not necessarily indicate the end of an upward trend, and therefore can not really be used as a trade entry or a trade exit pattern. The bearish harami cross indicates that the recent trading has been slightly bearish (due to the doji's gap down), but that neither bullish nor bearish trading has dominated.

Bearish Kicking

The bearish kicking (keri ashi) candlestick pattern (view full size chart) is one of the double candlestick patterns (i.e. it consists of two individual candlesticks), and it is a bearish pattern. The bearish kicking candlestick consists of an upward candlestick (specifically a bullish marubozu), followed by a downward candlestick (possibly a bearish marubozu) that opens and closes below the low of the previous candlestick (i.e. a gap down).

Use In Trading The bearish kicking pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is a somewhat rare pattern. The bearish kicking pattern is an extremely bearish pattern, but it is not necessarily suitable for use as a trade entry or a trade exit pattern (i.e. an exit from a long trade, and/or an entry into a short trade).

Japanese candle sticks

[Type text]

Bearish Pattern

Short Belt Hold

The short belt hold candlestick pattern (view full size chart) is one of the single candlestick patterns (i.e. it consists of only one candlestick), and it is a bearish pattern. The short belt hold candlestick opens with a gap up, and at its high, and closes near its low, showing that the time frame consisted of generally bearish trading.

. Use In Trading The short belt hold pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), but it is most relevant during an upwards trend. The short belt hold can indicate the end of an upwards trend and the beginning of a new downwards trend, and can therefore be used as both a trade exit and a trade entry. The short belt hold is also included in some of the two or three candlestick patterns, in which case it has the same bearish relevance, and provides the same indication of upcoming price movement.

Short Marubozu

The short marubozu candlestick pattern is one of the single candlestick patterns (i.e. it consists of only one candlestick), and it is a bearish pattern. The short marubozu candlestick opens at (or near) its high, and closes at (or near) its low, showing that the time frame consisted of generally bearish trading.

Use In Trading The short marubozu pattern can occur in a number of different contexts (e.g. at the beginning of a trend, during a trend, at the end of a trend, etc.), so by itself it only indicates that the time frame was extremely bearish. Therefore, the short marubozu is not often used as an trade entry pattern, but it is sometimes used as a trade exit pattern (depending upon the trade in question). The short marubozu is also included in some of the two or three candlestick patterns, in which case it has more relevance, and can provide an indication of upcoming price movement.

Potrebbero piacerti anche

- Japanese Candlestick Patterns - BullishDocumento7 pagineJapanese Candlestick Patterns - Bullishsmksp10% (1)

- Candlestick Charts ExplainedDocumento15 pagineCandlestick Charts Explainedchoysg11100% (4)

- CandlesticksDocumento5 pagineCandlesticksE McDonaldNessuna valutazione finora

- Group 13 (Candlestick)Documento17 pagineGroup 13 (Candlestick)Ruchika SinghNessuna valutazione finora

- Candlestick PatternsDocumento7 pagineCandlestick PatternsHemanthNessuna valutazione finora

- CandlestickDocumento37 pagineCandlestickLaxmi Dhakal100% (1)

- Candlestick 1Documento6 pagineCandlestick 1Hafizul Hisyam Maysih LuzifahNessuna valutazione finora

- Mastering Candlestick Charts (PDF) Free MT4 IndicatorsDocumento4 pagineMastering Candlestick Charts (PDF) Free MT4 IndicatorsSAGIR MUSA SANINessuna valutazione finora

- Candlestick PatternDocumento6 pagineCandlestick PatternGajanan HegdeNessuna valutazione finora

- Candlestick For The WiseDocumento6 pagineCandlestick For The WisepaoloNessuna valutazione finora

- Candlesticks For Support and ResistanceDocumento6 pagineCandlesticks For Support and ResistanceNorbert SanganoNessuna valutazione finora

- Stock Market Chart Technical AnalysisDocumento8 pagineStock Market Chart Technical AnalysisDilip SinghNessuna valutazione finora

- Candlestick MethodDocumento3 pagineCandlestick MethodMazlan IsmailNessuna valutazione finora

- Fib Markets Introduction To Fibonacci Trading TechniquesDocumento7 pagineFib Markets Introduction To Fibonacci Trading TechniquesAlex Farah DrazdaNessuna valutazione finora

- Backtesting and Trading JournalDocumento5 pagineBacktesting and Trading JournalLynnhNessuna valutazione finora

- Candlestick Patterns - Types of Candlestick Patterns - 5paisa - 5pschool PDFDocumento21 pagineCandlestick Patterns - Types of Candlestick Patterns - 5paisa - 5pschool PDFaaooprv100% (1)

- General Description: Practice and Technical Market Analysis. in 1948, Robert D. Edwards and John MageeDocumento1 paginaGeneral Description: Practice and Technical Market Analysis. in 1948, Robert D. Edwards and John MageeCynea ArquisolaNessuna valutazione finora

- Basic Japanese Candlestick PatternsDocumento36 pagineBasic Japanese Candlestick PatternsDevanshi ShahNessuna valutazione finora

- The 5 Most Powerful Candlestick PatternsDocumento12 pagineThe 5 Most Powerful Candlestick PatternsRandy Mar TagudarNessuna valutazione finora

- Candlestick PatternDocumento6 pagineCandlestick PatternEmmaly MarjanovNessuna valutazione finora

- Candle PatternsDocumento4 pagineCandle PatternsIlman IlmuNessuna valutazione finora

- 6 Lessons To Help You Find Trading Opportunities in Any MarketDocumento9 pagine6 Lessons To Help You Find Trading Opportunities in Any Marketgdm81Nessuna valutazione finora

- An Introduction To Japanese Candlestick ChartingDocumento14 pagineAn Introduction To Japanese Candlestick ChartingRomelu MartialNessuna valutazione finora

- Candlestick Forcaster ManualDocumento146 pagineCandlestick Forcaster ManualKuay Kean Lee100% (2)

- The Art of Candlestick ChartingDocumento11 pagineThe Art of Candlestick Chartinganeraz2719Nessuna valutazione finora

- 16 CandlestickDocumento9 pagine16 CandlestickRikNessuna valutazione finora

- (Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisDocumento4 pagine(Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisThie ChenNessuna valutazione finora

- Art of Japanese Candlestick ChartingDocumento82 pagineArt of Japanese Candlestick ChartingMizanNessuna valutazione finora

- Candlestick PatternsDocumento17 pagineCandlestick PatternsaaryinfoNessuna valutazione finora

- Candlesticks 1Documento11 pagineCandlesticks 1saied jaberNessuna valutazione finora

- G2-T5 Dual Candlestick PatternsDocumento3 pagineG2-T5 Dual Candlestick PatternsThe ShitNessuna valutazione finora

- The 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaDocumento6 pagineThe 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaMax Rene Velazquez GarciaNessuna valutazione finora

- Japanese Candlesticks: Strategy GuideDocumento3 pagineJapanese Candlesticks: Strategy GuideJean Claude DavidNessuna valutazione finora

- Bakery CompanyDocumento3 pagineBakery CompanyNeha DhuriNessuna valutazione finora

- Candlestick Cheat SheetDocumento1 paginaCandlestick Cheat SheetMarvin Luis Montilla100% (1)

- The Art of Japanese Candlestick Charting Summary PDFDocumento24 pagineThe Art of Japanese Candlestick Charting Summary PDFelbronNessuna valutazione finora

- Bullish Hammer: Reversal Candlestick Pattern: HammerDocumento23 pagineBullish Hammer: Reversal Candlestick Pattern: HammerCinaru CosminNessuna valutazione finora

- Candelsticks PatternDocumento9 pagineCandelsticks PatternNadia ShekhNessuna valutazione finora

- What Is A Japanese Candlestick?Documento16 pagineWhat Is A Japanese Candlestick?Bakres Btpn SabahNessuna valutazione finora

- 3 Candlestick Patterns - 3 White Soldiers - 3 Black CrowsDocumento3 pagine3 Candlestick Patterns - 3 White Soldiers - 3 Black CrowsskotteNessuna valutazione finora

- Candle TypesDocumento19 pagineCandle TypesMarcel ProustNessuna valutazione finora

- TA Secrets #4 - Basic Chart PatternsDocumento7 pagineTA Secrets #4 - Basic Chart PatternsBlueNessuna valutazione finora

- Candelstick PatternDocumento21 pagineCandelstick PatternIrosh Akalanka BandaraNessuna valutazione finora

- Candlesticks Vs Bar ChartsDocumento5 pagineCandlesticks Vs Bar Chartso.morenoNessuna valutazione finora

- Candlestick Charting: Quick Reference GuideDocumento24 pagineCandlestick Charting: Quick Reference GuideelisaNessuna valutazione finora

- The 5 Most Powerful Candlestick PatternsDocumento12 pagineThe 5 Most Powerful Candlestick PatternsfikeiNessuna valutazione finora

- CandleStick Patterns ListDocumento23 pagineCandleStick Patterns ListZaid Ahmed100% (1)

- Technical AnalysisDocumento69 pagineTechnical AnalysisNikhil KhandelwalNessuna valutazione finora

- Basic of Chart Reading and CandlestickDocumento10 pagineBasic of Chart Reading and CandlestickRobin WadhwaNessuna valutazione finora

- Candlestick Charts PDFDocumento48 pagineCandlestick Charts PDFChano MontyNessuna valutazione finora

- Doji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezDocumento6 pagineDoji Candlestick Pattern A Simple Candlestick Trading Strategy For Consistent Profits Kindle Edition by Erik CortezRodrigo OliveiraNessuna valutazione finora

- Japanese Candlestick Cheat SheetDocumento5 pagineJapanese Candlestick Cheat Sheetrhythm90Nessuna valutazione finora

- CandlestickDocumento58 pagineCandlestickzennsee100% (1)

- Candlestick Patterns Price Action Charting GuideDocumento14 pagineCandlestick Patterns Price Action Charting GuideAda Greenback100% (2)

- The Coming Stock Market Crash of 2015-2016: How to Profit from these Amazing Bible PredictionsDa EverandThe Coming Stock Market Crash of 2015-2016: How to Profit from these Amazing Bible PredictionsValutazione: 5 su 5 stelle5/5 (1)

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDa EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNessuna valutazione finora

- Cantilever Research MaterialsDocumento21 pagineCantilever Research Materialsbookdotcom7221Nessuna valutazione finora

- Physics Experiment 1 VectorDocumento6 paginePhysics Experiment 1 Vectorbookdotcom7221Nessuna valutazione finora

- MATH 1024 Precalculus August 2020Documento7 pagineMATH 1024 Precalculus August 2020bookdotcom7221Nessuna valutazione finora

- 8.2 Sukatan Serakan: Binasatu Plot Kotak Bagi Setiap Set Data BerikutDocumento3 pagine8.2 Sukatan Serakan: Binasatu Plot Kotak Bagi Setiap Set Data Berikutbookdotcom7221Nessuna valutazione finora

- Keenan YapDocumento10 pagineKeenan Yapbookdotcom7221Nessuna valutazione finora

- 4 Hour MACD Forex StrategyDocumento20 pagine4 Hour MACD Forex Strategyanzraina100% (8)

- Teknik Forex SebenarDocumento9 pagineTeknik Forex Sebenarbookdotcom7221Nessuna valutazione finora

- Lesson Plan For Ausmat ProgramDocumento22 pagineLesson Plan For Ausmat Programbookdotcom7221Nessuna valutazione finora

- Dynamic Zone RSI StrategyDocumento14 pagineDynamic Zone RSI Strategybookdotcom7221Nessuna valutazione finora

- 5-10 Binary MethodDocumento106 pagine5-10 Binary Methodbookdotcom7221Nessuna valutazione finora

- 22015MUF0122PhysicsUnit2Sol PDFDocumento24 pagine22015MUF0122PhysicsUnit2Sol PDFbookdotcom7221100% (1)

- Test 2 Physics QuestionsDocumento6 pagineTest 2 Physics Questionsbookdotcom7221Nessuna valutazione finora

- Koleksi Soalan SPM Paper 1Documento34 pagineKoleksi Soalan SPM Paper 1Basri JaafarNessuna valutazione finora

- Cara BersikologyDocumento10 pagineCara Bersikologybookdotcom7221Nessuna valutazione finora

- 2017 Trade PlanDocumento1 pagina2017 Trade Planbookdotcom7221Nessuna valutazione finora

- 2017 Trade PlanDocumento2 pagine2017 Trade Planbookdotcom7221Nessuna valutazione finora

- Horizontal Projectile Motion ExperimentDocumento3 pagineHorizontal Projectile Motion Experimentbookdotcom7221Nessuna valutazione finora

- Diffraction Interfernce PDFDocumento18 pagineDiffraction Interfernce PDFbookdotcom7221Nessuna valutazione finora

- MUFY Lesson Plan PhysicsDocumento15 pagineMUFY Lesson Plan Physicsbookdotcom7221100% (1)

- Work EnergyDocumento36 pagineWork Energybookdotcom7221Nessuna valutazione finora

- 60 Seconds Binary Options StrategyDocumento11 pagine60 Seconds Binary Options Strategybookdotcom722175% (8)

- 60secs Binary Options StrategyDocumento6 pagine60secs Binary Options Strategybookdotcom72210% (1)

- Addition of VectorsDocumento7 pagineAddition of Vectorsbookdotcom7221Nessuna valutazione finora

- Binary PhysicsDocumento12 pagineBinary Physicsbookdotcom7221Nessuna valutazione finora

- One-To-One Correspondence: Domain RangeDocumento3 pagineOne-To-One Correspondence: Domain Rangebookdotcom7221Nessuna valutazione finora

- Addition of VectorsDocumento7 pagineAddition of Vectorsbookdotcom7221Nessuna valutazione finora

- Relative Velocity: On Same LineDocumento3 pagineRelative Velocity: On Same Linebookdotcom7221Nessuna valutazione finora

- Relative Velocity: On Same LineDocumento3 pagineRelative Velocity: On Same Linebookdotcom7221Nessuna valutazione finora

- SUNWAY COLLEGE (KL) - Teachers/Lecturers Training Record: Subarmaniyam Chandran MufyDocumento1 paginaSUNWAY COLLEGE (KL) - Teachers/Lecturers Training Record: Subarmaniyam Chandran Mufybookdotcom7221Nessuna valutazione finora