Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Unit 1 - Introduction To Banking

Caricato da

c08Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Unit 1 - Introduction To Banking

Caricato da

c08Copyright:

Formati disponibili

UNIT1 INTRODUCTIONTOBANKING

STRUCTURE 1.1. Objectives 1.2. Meaninganddefinitionsofbank/banking 1.2.1. DefinitionofbankunderBritishLaw 1.2.2. DefinitionofbankunderIndianLaw 1.2.3. DefinitionofbankunderUSALaw 1.3. BasicPrinciplesofbanking 1.3.1. PrincipleofIntermediation 1.3.2. PrincipleofLiquidity 1.3.3. PrincipleofProfitability 1.3.4. PrincipleofSolvency 1.3.5. PrincipleofTrust 1.4. TypesofbankinggroupsinIndia 1.4.1. ScheduledandNonScheduledbanks 1.4.2. Publicsectorbanks 1.4.3. Privatesectorandforeignbanks 1.4.4. Cooperativebanks 1.4.5. MarketshareofbankingGroups 1.5. Functionsofbanks 1.5.1. Traditionalfunctions 1.5.2. Modernbankingfunctions 1.5.3. MerchantBanking 1.6. EmergingTrendsinbanking 1.6.1. Universalbanking 1.6.2. Electronicbanking 1.6.3. Globalisationofbanking

INTRODUCTIONTOBANKING

1.7. Letussumup 1.8. CheckyourProgress 1.9. Terminalquestions 1.10. AnswerstoCheckyourProgress

1.1.OBJECTIVES: ThisUnitwouldgiveyouanintroductiontotheBasicsofBankingbyexplaining: MeaninganddefinitionsofBanking/Bankunderdifferentsystems. Mainuniversalprinciplesofbanking Maintypes/groupsofbanksunderIndianbankingsystem Traditionalandmodernfunctionsofbanks TrendsinIndianbanking 1.2.MEANINGANDDEFINITIONSOFBANK/BANKING: Meaning of Bank The word bank means an organization where people and businesses can invest or borrow money, change it to foreign currency, etc. As against this word bankrupt in relation to an individual or a corporate entity signifies a status of being unable to pay what is owed as declared by a Court of Law,videCambridgeInternationalDictionaryofEnglish. The dictionary meaning of these two words indicates mutually opposite connotations bankrupt indicates an inability to pay ones obligation or debt owedtoothers,whilebankessentiallyconnotesanabilitytopayitsobligationsto others(itscustomers)alwaysintimethecasharedue. Another word bank on meaning depend on happening is derived from the intrinsic quality of a bank, viz. dependability. Therefore, in ordinary parlance, the financial soundness, inherent ability to meet ones financial obligations, honouringonescommitmentsordependability,arethedistinguishingfeaturesofa bank. 1.2.1. Definition of Bank under British Law Gerald Klein of University of Londonexplainsbankasabody,corporateornot,thathasbeenrecognized by BankofEnglandundertheBankingAct,1987,toacceptdepositsasdefinedbythat Act (Dictionary of Banking by Gerald Klein, 1994, page 13). In UK there is no statutory definition of a bank or banker. These concepts have been defined bythejuristsandsubjectexperts,basedonthedecisionsoftheCourtsofEngland, asfollows: A banker is one who in the ordinary course of his business, honours cheques drawn upon him by persons from and for whom he receives moneyoncurrentaccounts(Dr.HerbertL.Hart) A banker is an individual, partnership or corporation, whose sole pre dominant business is banking, that is the receipt of money on current or depositaccount;

INTRODUCTIONTOBANKING

andthepaymentofchequesdrawnbyandthecollectionofchequespaid inbyacustomer.(Halsbury) According to Sir John Paget, an authority on British banking law, a banker must perform at least four essential functions in order to do banking business. A personorcorporatebodycannotbeabankeriftheydonot: takedepositaccounts, takecurrentaccounts, issueandpaycheques,and collectcheques(crossedanduncrossed)forcustomers. Thus, a money lender would not qualify to be a banker as per the British banking law, as, even though he lends his own capital to others and charges interest in the course of lending business, he doesnt take deposits from the public and also doesnt issue/pay/collect customers cheques in the course of business. 1.2.2.DefinitionofBankunderIndianlawInIndiabankinghasbeendefinedby a statute, viz., the Banking Regulation Act, 1949 (vide Section 5 b, c) as follows: Accepting,forthepurposeoflendingorinvestment,ofdepositsofmoney from the public, repayable on demand or otherwise, and withdrawal by cheque,draft,andorderorotherwise(section5b) Abankingcompanyisacompanywhichtransactsthebusinessofbankingin India(section5c) Aspertheabovedefinitionthefollowingarethecorefunctionsofabank: Acceptance of deposits from the public (customers or members of the society). Making deposits of customers withdrawable by cheque or otherwise (withdrawal slip, letter, voucher) on demand, or repayable on maturity to thecustomers. Lending or investing funds collected from customers, subject to the obligation to repay the deposits to the customers on demand or other wiseasperthetermsofthedeposits. 1.2.3. Definition of Bank under USA lawInUnited StatesofAmerica (USA), the term banking has been defined, in one of the earliest Acts of the Congress, as follows (vide Tannans Banking Law and Practice, 20th Edition (2002), Ch. VII, page210): By banking, we mean the business of dealing in credits and by a bank weincludeeveryperson,firmorcompanyhavingaplaceofbusiness where credits are opened by the deposit or collection of money or currency, subject to be paid or remitted on draft, cheque or order; or moneyisadvancedorloanedonstocks,bonds,bullion,billsofexchange;or promissorynotesarereceivedfordiscountorsale.

INTRODUCTIONTOBANKING

banks collect deposits from public by way of demand deposits and term deposits and use these and their own funds, for making loans and advances for business and trade. Banks pay interest only on term deposits and follow the directions issued by the regulatory authorities Comptroller of the Currency, FederalReserveandStateBankingCommissioners. 1.3.BASICPRINCIPLESOFBANKING: ItwouldbeinterestingtoexaminedifferencesinthelegaldefinitionsofBank orBankingundertheBritish,IndianandUSAlaws. The British had framed the banking and regulatory laws much before 1947, when India became a democratic republic. Though the Indian model has been largely derived from the British one, there are certain inherent differences betweenthetwo.TheIndiancommercialbankingsystemwithbranchbankingand its regulation by Reserve Bank of India (Reserve Bank of India Act, 1934) as the apex banking authority in the country was patterned on the British banking systemhavingBankofEnglandasthebankingregulator. TheUSAbankingsystem,isaltogetherdifferentfromtheBritishandtheIndianones. Yet,certainbasictenetsofbankingarecommontothesethree,asalsothe other systemsofbankingacrosstheworld.For,thesetenetsaresofundamentalthatthe same would characterize almost all banking systems globally. These basic principlesofbankingarebrieflydescribedinthissection. 1.3.1. Principle of Intermediation The word intermediary means someone who carries messages between people who are unwilling or unable to meet personally(CambridgeInternationalDictionaryofEnglish). Banks are called financial intermediaries because they invest or lend funds of depositors who themselves are unable to lend their funds, due to risk and other factors involved in direct lending. Banks assume the credit risk (arising from defaultbytheborrower)involvedindirectlendingtothosewhoneedfunds. (borrowers). They have expertise and abilities to manage such risks. Thus, banksmediatebetweenthedepositors(saversofmoney)andborrowers(users of money) and earn interest spread as a reward for risk taking, meeting the administrativeexpensesandmakingprovisionforsomeportionsofloansthatmay turn bad or difficult to recover (termed as nonperforming assets orNPAs). 1.3.2. Principle of Liquidity The simultaneous operations of acceptance of deposits (repayable on demand or on certain maturity periods) and lending these funds to borrowers in a manner such that the bank would be able to arrangeforthefundsdemandedbyitsdepositorsatanypointoftime,iscalled liquiditymanagementorassetliabilitymanagement. In line with the liquidity principle, a bank must keep a certain portion of its deposit liabilities in liquid form so as to be able to repay the same on demand or maturity dates to the depositors. This principle is reinforced by the regula tory requirements of the Reserve Bank of India (RBI) that every bank has to maintain deposits with the RBI as cash reserve ratio (CRR), which currently

INTRODUCTIONTOBANKING

stands at 4.75% of the banks demand and time liabilities (DTL) and statutory liquidityratio(SLR),wherein,everybankhastoinvestingilts/governmentandother approved securities (currently 25% of its DTL). If a bank is cashstrapped, it can easily trade the SLR securities to generate cash, as the same the most liquid of all. It is only after meeting the minimum CRR and SLR requirements, that a bank can invest/lenditsremainingDTL,bywayofloans/advancesorotherkindsof lending business,toearnandmaximizeitsprofits. 1.3.3. Principle of Profitability Banking business, like any other, has to be profitableinordertosustaintherequiredgrowth. Interest income, which represents the interest differential (spread) between its loans and deposits rates, is the main source of profit for a bank. The interest earned by a bank on its lending operations should be higher than the interest paidbyitonitsdepositoperations.Theinterestspread,alongwiththevolumeof its deposits and loans determines the total net interest income of a bank. Interestincomealongwithnoninterestorfeebasedincome(e.g.commission on letters of credit, funds remittance; exchange on bank drafts, foreign ex change business)contributestothebulkofabanksprofits.Theabsolutesize ofabanks Gross/Operating/Net Profits considered with ratios like Return on Assets (ROA) andReturnonCapital(ROC)arethetruefinancialindicatorsofabanksprofits. 1.3.4.PrincipleofSolvencySolvencyconnoteslongtermfinancialsoundnessof a bank, achieved by adherence to prudent policies in lending, retention of some part of profits for business growth, implementation of professional management systems and following the mandatory rules and procedures inday todayoperations.Abanksfinancialsoundnessisjudgedbyanalyzingitsfinancial graph of a couple of years and comparing the relevant ratios (e.g. capital adequacy ratio, standard assets ratio and provisions to nonperforming assets ratio)withotherbanks. Theprincipleofsolvencyalsoembracesliquidityandprofitabilityattributes. 1.3.5. Principle of Trust The trust that customers existing and potential repose in a bank is its hallmark as it connotes dependability in the opinion of its customers.Trustworthinessisafunctionofabanksgoodtrackrecordoverafairly longperiodoftime,intermsofliquidity,profitability,financialsoundness, and its record of meeting its commitments to all concerned parties. It also reflects the governance quality of the bank. The magnitude of trust reposed in a bank by its customers,byotherbanksinthecountryandglobally,wouldvary,according to the parameters of evaluation applied by each. However, for customers andpublic, trust indicates dependability and safety as they perceive while lodging their deposits with a bank and it is reflected in the rate of growth of its deposits and profitsonasustainedbasis.

INTRODUCTIONTOBANKING

1.4.TYPESOFBANKINGGROUPSININDIA: 1.4.1.ScheduledandNonscheduledbanksBankscanbecategorizedaccord ing to their ownership patterns, functions and operational coverage. The Indian banking system regulated by the Reserve Bank of India (RBI) comprises scheduled and nonscheduled banks and these are classified in various sub categoriesasfollows. (a) Scheduledbanks:Thesearebankswhicharelistedinthe2ndschedule of theReserveBankofIndia Act,1934.Thesebankshavepaidup capital and reserves of not less than Rs. 5 lacs and they are successful in convincing the RBI that their affairs are not conducted in a manner detrimental to their depositors. These banks are required to maintain certainamountofreserves(CRRasmentionedinparagraph1.3.2)withRBI, against which these banks enjoy the facility of financial accommo dation andremittancefacilitiesatconcessionaryratesfromRBI.Scheduledbanks areclassifiedas: 1.1. Cooperativebanks[bothStateandUrbanCoopbanks] 1.2. Commercialbanks:Thesearesubclassifiedas: 1.2.1. Foreignscheduledbanks:38 1.2.2. Indianscheduledbanks:Furthersubclassifiedas: (a) privatesectorscheduledbanks:OldandNew:31 (b) publicsectorscheduledbanks:subclassifiedas: (i) StateBankanditssevenbankingsubsidiaries:8 (ii) Nationalizedbanks:19 (iii) RegionalRuralBanks:196 (b) Nonscheduled banks: Nonscheduled banks are those not included in the 2nd schedule of the Reserve Bank of India Act. Their number has progressivelydeclinedovertheyears. 1.4.2.PublicSectorbanks: (a) StateBankGroupandNationalizedbanks:Thisgroupof27bankshasthe largestnumberofbranchesinmetros/urbanandruralareasthroughoutthe country.TheGroupcontributesabout75%ofthetotaldepositsand about 70% of total advances of all commercial banks in India. Most of these banks have a countrywide branch network, alongwith a large deposits and assets base and perform all kinds of core and modern banking functions.Someofthesebankshavebranches/officesabroadtoo. TheerstwhileImperialBankofIndiawasnationalizedin1955tocreatethe StateBankofIndiainaccordancewiththeStateBankofIndiaAct, 1955.SBIisthelargestbankinIndiaintermsofbranchnetwork,assetssize, capital and profits. SBIs seven subsidiaries were created in 1959 by nationalizing the regional banks in the princely states as per the State

INTRODUCTIONTOBANKING

Bank of India (Subsidiary Banks) Act, 1959. The remaining 19 banks in the publicsectorwerenationalizedbytheBankingCompanies(Acquisitionand TransferofUndertakings)Act,1970. After 1994, most of these banks have made public issues of their shares, thus diluting the Government shareholdings much below 100%, but above51%. (b) RegionalRuralBanks(RRBs):Thesetooarescheduledbanks,but,unlike commercial banks, are small localized banks operating in rural areas limited to specified districts. About 196 RRBs operate exclusively in rural areasforprovidingcreditandbankingfacilitiestosmallfarmers,agricultural labour, artisans and small entrepreneurs. Each RRB operates in 1 to 5 allotted districts. Their ownership capital is provided jointly by Central Government (50%), the concerned State Government (15%) and the sponsor public sector bank (35%). There is no local participation in ownershiporadministrationofthesebanks. 1.4.3.Privatesectorandforeignbanks: (a) Indian private sector banks : These are incorporated in India and their shares/ownership is held by business houses and individuals (public). Majority of these banks are old generation private banks which have a smallbalancesheetsize,limitedregionaloperationsandtraditionalstyleof managementandbusinessactivities. New generation private sector banks, incorporated post1994, are tech nologydriven and have a modern style of functioning, thus achieving a level of parity with that of the foreign banks operating in India. Some of these have expanded to enable countrywide operations, on account of mergersandacquisitions. (b) Foreign banks: These are the banks incorporated abroad but granted license by RBI to conduct banking business in India through their Indian branches. While the foreign banks in India outnumber the private sector banks,thebranchnetworkoftheformerissmallerandconfinedmostly to the metropolis/big commercial centres. Their operations are techno logy drivenandagoodpartoftheirbusinesscomprisesforeignexchange, trade finance and merchant banking, which augments their income/ profitabilityperbranchandperworker. 1.4.4. Cooperative Banks The foregoing subgroups pertain to commercial banking sector, which principally meet the varied financial needs of industry, tradeandcommerce. CooperativebanksformanotherdistinctivebankingsectorinIndia.Cooperativebanks havetwomainsubgroupsruralandurban. Rural Cooperative banks primarily meet financial needs of agriculture and allied activities in the rural areas, whereas Urban Cooperative Banks meet financial needs of smallsize trade and commerce activities operating in the urbanareas.

INTRODUCTIONTOBANKING

Although, broadly speaking, the operational thrust of commercial banks is in urban areas, these banks also lend to the agricultural sector and the small businesses (for e.g. priority sector advances). Cooperative banks have opera tional thrust in the rural areas for agriculture, yet the banks also lend to tiny units, artisans, small businesses, etc. in the urban areas. Basically, there are legal, structural and sizewise differences between the two banking groups as follows: Cooperative banks are registered under the Registrar of Cooperatives and their main regulator is the State Government (or Central Govern ment in case of cooperative banks operating in more than one State). The commercial banks are registered under the Banking Regulation Act/ CompaniesActandareregulatedbyRBI. The organizational structure and management set up of cooperative banks is based on cooperative principles which are not as formal and professionalasinthecaseofcommercialbanks. Thesizeofassets/liabilitiesofthecooperativebanksaremuchsmallerin comparisontocommercialbanks. Cooperativebanksoperateonnoprofitnolossprincipleofcooperation asopposedtothecommercialbankswhichoperatewithprofitmotive (for the shareholders). However, commercial banks need to balance their profit objective with the mandatory 40% of their net bank credit given as priority sector advances (PSAs) to the agriculture, the small scale industries, the small businesses, the exporters, individual housing andeducationetc.,whichinvolveconcessionaryinterestandothertermsas prescribed by RBI. PSAs include 10% of commercial banks credit to weaker/disadvantaged section of the society for employment under the government sponsored schemes and 1% of net bank credit to the very poor persons under Differential Rate of Interest (DRI) Scheme at fixed interestrateof4%p.a. 1.4.5.MarketshareofBankingGroupsAsofendMarch2004,themarketsharein totaldepositsandtotaladvancesofvariousgroupsofscheduledcommercialbanks, indescendingorder,wasasfollows:

BankGroup

INTRODUCTIONTOBANKING

TABLE1.MARKETSHAREOFBANKS(in%) (AsofendMarch2004) Assets Deposits 2003 2004 2003 2004 (2) (3) (4) (5) (7)Scheduledcommercialbanks 100.0 100.0 100.0 100.0 75.6 74.5 79.6 77.9 46.5 29.1 17.5 6.2 11.3 6.9 46.7 27.8 18.6 6.1 12.5 6.9 50.8 28.8 15.3 6.7 8.5 5.1 50.4 27.5 17.0 6.7 10.4 5.1 Advances 2003 2004 (6) 100.0 100.0 74.2 73.2 48.6 25.6 18.8 6.7 12.1 7.1 47.7 25.5 19.8 6.5 13.3 7.0

(a) Publicsectorbanks Ofwhich, (i)Nationalizedbanks (ii)StateBankGroup Privatesectorbanks Ofwhich, Oldprivatesectorbanks Newprivatesectorbanks Foreignbanks

Source:RBIsTrendandProgressinBanking,200405 1.5.FUNCTIONSOFBANKS: Functionsofabankcanbeclassifiedas: (a) Traditional/Core functions: These are performed by almost every bank, irrespectiveofitssize,ownershippatternandoperationalarea. (b) Modern functions: These are mostly performed by large sized/modern banks,situatedincommercialcentresormetros. Whileeachofthetraditionalandmodernfunctionofbanksisdiscussedindetail in the Courseware elsewhere in the book, we would, in the section ahead, like to giveanoverviewofthebankingfunctionstofacilitateunderstandingofthebasics ofbankingcoveredinthisCourseware. 1.5.1.TraditionalFunctions: (a) Accepting deposits: A bank accepts money from its customers (members of the public) and keeps the funds in noninterest bearing accounts (current accounts) or interestbearing accounts (savings, fixed deposits, recurring deposits) as per the choice/preference of customer while opening the account. Deposits constitute the largest portion of a banks funds (liabilities), apart from its own capital. Deposits are repayable on demand(likecurrentandsavingsaccounts)oronspecificmaturitydates (fixedandrecurringdeposits).Inadditiontoearninginterestcustomersget several benefits in maintaining deposit accounts with banks (viz., safety, liquidity, interest earning, transactions record/statement of account,chequebookfacilityetc.).

10

INTRODUCTIONTOBANKING

(b) Lending: Another traditional function is lending money to businesses/ customers by way of loans and advances of various kinds. Funds mobilized through deposits are deployed by a bank in making loans and advances to earn profits by way of interest spreads, i.e. the differential between the average interest rates on loans and on deposits. The interest income from loans and advances forms a sizeable chunk of a banks operating profit. Undoubtedly, some portion of loans do turn into non performingassets(NPAs)whichcauselossofincomeand,insomecases,also of capital to the bank. Hence, lending requires adequate care, caution and supervision/monitoring by the banks management at various levels,whichhelpstoactasabufferagainsterosionofprofits/ capitaldue toNPAs.TherecentexampleoffailureofGlobalTrustBank (GTB), a new generation private sector bank in India, shows how the banks net worth got substantially eroded due to indiscriminate lending, eventually leading to a temporary moratorium (on withdrawals by the banks depositors) declared by the RBI in 2004. GTB eventually was merged with Oriental Bank of Commerce, a strong public sector bank. The Bank of Credit and Commerce (BCCI), an international Bank, and Barings BankofUKalsofailedandbecamebankruptduring1990sdueto indiscreet lending by the banks, coupled with poor managementcontrols. (c) Funds remittance: Banks have branch network spread in various cities/ regions/States in the country of their incorporation/operations. Some banks have branches and correspondent banks overseas, as well. Banks remit customers funds from one place to another in the same country or overseas through their branches and correspondent banks by mail/ telegraphic/electronic funds transfer or by issuing bank drafts for which a small commission or fee is charged from the remitting person. This mode offundtransferisfast,safe,secureandeconomicalascomparedtoothers, likepostofficemoneyorderandphysicaltransferofmoney. (d) Miscellaneous services: In addition to the above, banks also render other services, which are useful to businesses and members of the society. Theseservicesincludeissueofcredit/debitcards,safedepositlockers,safe custody of valuables; issuance of travellers cheques, letters of credit and guarantees; collection of outstation cheques/bills/hundies; furnish ing opinion reports on their customers; acting as agency services for government business, correspondents; trusteeship and executors busi ness. These services are selectively performed by banks through their normalorspecializedbranchesasperthecustomerneedsattherespective places.(Bankschargeacommissionorfeeonsuchservices,whichprovides the bank with noninterest income and help to augmentsprofits). 1.5.2.ModernbankingfunctionsModernbankingisaboutprovidinganarray of services to customers, under one roof, so as to enable banking with convenience.

INTRODUCTIONTOBANKING

11

The modern commercial banking function mainly comprises of activities such as crossborder banking, merchant banking, credit cards, factoring, leasing, and insuranceandotherfinancialservicesundertakenbythebanks. Onemaynotehowever,thatthoughthisisreferredtoasUniversalBanking (vide paragraph 1.6.1), all these services do not necessarily come within the ambitofcommercialbanking.Crossborderbankingreferstobankingbetweentwo individuals or business entities residing in two different countries on account of funds remittance or deposit or business dealings. It necessarily involves conversion of at least two foreign currencies belonging to the coun tries where thetwotransactingpartiesareresident.Thetransactionsincrossborderbanking, therefore, involve foreign exchange. In India, foreign exchange transactions are doneonlybybanksdesignatedasAuthorizedDealers(ADs)by the RBI and these banks designate some of their branches to do foreign exchange business of specified kind. Crossborder banking is classified asfollows: (i) Crossborderfundraisingservices Externalcommercialborrowing(ECB) Globaldepositoryreceipts(GDRs)/Americandepositoryreceipts (ADRs)/Internationaldepositoryreceipts(IDRs) Nonresident external (NRE)/Foreign currency Nonresident (FCNR)Accounts Syndicationofforeigncurrencyloans (ii) CrossborderBankingServices importfinancing/leasing exportfinancing/forfeiting/leasing 1.5.3. Merchant banking Merchant banking refers to dealing with securities on feebasiswithoutoutlayoffundstotheclients.Commercialbanking,onthe other hand,mostlyinvolvesfundbasedfunctionsandthesearereflectedonthe assets side (loans and investments) and liabilities side (deposits and other borrowings apart from owned capital) of a banks balance sheet. Commercial bankinginvolvesintermediaryrolebetweendepositorsandborrowers,imply ing risktaking by a bank and earning interest spread. On the contrary, mer chant banking involves disintermediation, as it helps savers to invest directly in the shares of companies, instead of depositing their savings with banks. Merchant bankingprovideslucrativefeebasedbusinessformodernbanks,butisdonemainly byspecializedsubsidiariesofbanks. 1.6.EMERGINGTRENDSINBANKING: Ever since the banking sector in India was deregulated and opened to global competition and investment under the New Economic Policy (1991), it has undergoneagreatmetamorphosis.Theoverallperformanceandproductivity has spiralledupwardswithmajorattentiongiventoimprovementofcustomerservice. The banks are becoming competitive and technology driven. An

12

INTRODUCTIONTOBANKING

outcomeofthesefactorshasbeenanexpansionoftheirproductrangecoupledwith improvements in product delivery and pricing. Banks are also increasing their balance sheet size with mergers and acquisitions and fresh capital issues with a view to reaping economies of scale and achieving larger penetration amongst the target customer segments. Some of these developments have crystallized intobroadtrends,assummarizedinthefollowingparagraphs. 1.6.1 Universal Banking It refers to the provision of a wide range of financial services by an organization, under one roof e.g. commercial banking, merchant banking (or investment banking), mutual funds and insurance all by one bank. Universalbankinghasresultedintheblurringofdistinctivefunctionalboundaries that once existed between the providers of these financial services viz. commercial banks (short/mediumterm credit providers), development banks or financial institutions (longterm credit providers), merchant banks (dealing in securities), insurance companies (dealing with risk to the insured). Universal banking usually takes one of three forms inhouse, or through separately capitalized subsidiaries, or through a holding company. Citibank and HSBC are examples of Universal banks in USA and UK respectively and both these banks have global operations in a wide range of modern banking services. In India, examples of Universal Banks are State Bank of India (through its several non banking subsidiaries/affiliates dealing in longterm project finances, leasing, factoring, securities, credit cards, life insurance etc., apart from commercialbanking)andICICIBank.ICICI,afteritsreversemergerin 2002, has become a Universal Bank providing commercial banking, longterm projectfinance,merchantbanking,creditcard,insuranceetc. 1.6.2.ElectronicBankingInthewakeofrecentdevelopmentsininformationand communication technologies, majority of banking operations have been computerized by most of the commercial banks, both in the private and the public sectors especially in the last ten years and the process is still on for extension and upgradation of computerization by banks in India. The comput erizationisdoneforfrontofficeoperationsinvolvinginterfacewithcustomers as well as backoffice operations involving internal house keeping (accounting and books balancing), external accounting and settlement with other branches and banks/institutions. Electronic banking provides a bouquet of new channels like internetbanking,telephonebanking,ATMbanking whicharedifferentfromthe traditional brick and mortar branch banking and which have made possible anywhere and any time banking and contributed to speed, accuracy and confidentiality of customers transactions while enhancing customers convenience. Funds transfer, cheques clearing and collection of bills of ex change are also done electronically with accuracy, speed and safety. Internal house keeping is done accurately and much faster through programmed packages/software at the branch and also at centralized platforms involving severalbranchesofaregionorzone. 1.6.3. Globalisation of Banking In addition to universal banking and electronic banking, globalisation has emerged as a prime mover in the Indian banking

INTRODUCTIONTOBANKING

13

system. This has come about as a result of the policy of liberalization and opening up of banking and other sectors pursued after 1991 in India. Foreign banks that wish to setup their offices/branches in India have been granted licenses by RBI on liberal and on reciprocal basis. Their business in India has increased manifold, due to scores of Multinational Corporations setting up their manufacturing/trading bases in India and also due to Indias increased foreign trade. Similarly, Indian banks are also opening their offices/branches abroad, parti cularlyincountrieswhosebankshaveopenedofficesinIndia. 1.7.LETUSSUMUP: There is no statutory definition of bank or banking under British law. British jurists have defined a banker as one who in the ordinary course of his business honours cheques drawn upon him by persons from and for whom he receives money on current accounts. According to them keeping of deposits, current account and issue/payment/collection of cheques are the prerequisites of banking.InIndia,theBankingRegulationAct,1949definesbankingasaccepting for the purpose of lending or investment, of deposits of money from the public, repayableondemandorotherwise,andwithdrawalbycheque,draftandorder or otherwise. The basic universal principles of banking which typically characterize banks are principles of intermediation, liquidity, profitability, solvency and trust. The principle of intermediation refers to banks acting as intermediary between the depositors or savers of money and borrowers or users of money, by lending the depositorsmoneytothebusinessesandtherebyearninginterestdifferen tial as a reward for risk taking on such lending, which the depositors are not ready to undertake (liquidity principle means managing their assets and liabilities in suchamannerthatthedepositorscanbepaidbacktheirmoneywithintereston theirdemand.Thisisaveryspecializedtask.) Profitability principle refers to earning interest income mainly by way of interestdifferentialbetweenlending/investmentsanddepositratesasarewardfor risk taking, and also fee based income for various services rendered bybanks. Banksploughbackagoodportionoftheirprofitsintothebusinesstoenhancetheir reserves and financial strength, in addition to adhering to regulatory guidelinesregardingcapitaladequacyratio,assetclassificationandprovision ing for nonperforming assets, etc. This is referred as the principle of solvency. The principle of trust connotes confidence or dependability as perceived by customers and public in relation to a bank. The public confidence in a bank arises from the cumulative result of the policies of liquidity, profitability, and solvency and governance quality followed by each bank over a fairly long period. The Indian banking system classifies banks into scheduled and nonscheduled banks,publicsectorandprivatesectorbanks,Indianbanksandforeignbanks,

14

INTRODUCTIONTOBANKING

and commercial and cooperative banks. Scheduled banks satisfy the pre scribed rules by RBI. RBI regulates the banking sector. Public sector banks are owned(over51%)bytheCentralGovernment/theRBIorotherpublicauthorities and comprise three groups nationalized banks, SBI group of banks, Regional Rural Banks (RRBs). Private sector banks are owned by private entities and are either Indian banks or foreign banks. Indian private sector banks are further classified in two subgroups old generation (established prior to 1993) and new generation private sector banks (established after 1993). Cooperative banks are small size banks operating mainly for agriculture and alliedactivitiesin rural areas and small and tiny businesses in urban. Commercial banks generally concentrate on industry, trade, commerce in the urban centres and they also lend to agricultural and small businesses in the ruralareas. Banking functions are classified as traditional functions and modern functions. Traditionalorcorefunctionsrelatetodeposittaking,lending,fundsremittanceand miscellaneous services, like safe deposit lockers, agency and trustee business. Modern functions of banks encompass a wide range of financial services to meet the customers varied requirements under one umbrella e.g. crossborderbanking,merchantbanking,creditcardbusiness,factoring,leasingand insurance. Some of these services are outside the ambit of commercial banking andfallunderUniversalBanking. AmongtheemergingtrendsintheIndianbankingsystem,themaintrendsthatcan beidentifiedare:universalbankingandelectronicbanking.Asmentioned above, universal banking seeks to converge all kinds of financial services under one umbrella of an organization. ICICI Bank, SBI Group are instances of Universal banks registered in India and HSBC Bank, Citibank are among the foreign banks thatareofferinguniversalbankingservicesinIndia.Internationalizationofbanking is another major trend in India in the wake of opening up ofbankingandfinance sector for direct foreign investment since 1991. Indian banks are also becoming more global gradually by conducting more international banking business and openingtheirofficesoverseas. 1.8.CHECKYOURPROGRESS: (A) StatewhetherthefollowingstatementsareTrueorFalse: (i) ThereisnostatutorydefinitionofbankorbankerunderUKlaw. (ii) According to Banking Regulation Act, 1949, a banking company is onewhichtransactsthebusinessofbankingoutsideIndia. (iii) Interest differential between the interest rates of time deposits andsavingsbankdepositsistermedasinterestspread. (iv) Solvencyconnoteslongtermfinancialsoundnessofabank. (v) Regional Rural Banks are included in the category of scheduled publicsectorbanks.

INTRODUCTIONTOBANKING

15

(vi) ICICI Bank Ltd. is the largest bank in the private sector in India in termsofassetssize. (vii) Cooperativebanksoperateonprofitmotiveinruralareas. (viii) Foreign banks in India are outside the regulatory control of RBI as theseareincorporatedoutsideIndia. (ix) Nationalized banks group has the largest market share of total bankdepositsandadvancesinIndia. (x) Traditionalfunctionsofbanksincludemerchantbanking. (xi) NREdepositsareakindofdomesticbankinginIndia. (B) (i) According to Sir John Paget, an authority on British Banking, a banker must take deposits by way of ..............................account and issue/pay/collect........................... (ii) Banking Regulation Act defines banking as accepting for the purposeoflendingorinvestment,of......................ofmoneyfromthe public, repayable on .................................... or otherwise, and withdrawalby...........................,draft,orderorotherwise (iii) Intermediation principle means that banks mediate between............................... who are savers of money and ....................................whoareusersofmoney. (iv) .............................................Management means the ability of a bank to meet the demand of its depositors and other creditors in time. (v) A banks interest income arises from the interest differential betweenits.............and...........................ratesofinterest. (vi) Solvencyofabankindicatesits...............................soundness. (vii) The principle of trust shows the ........................... of a bank in the perceptionofits..................................... (viii) PublicsectorbanksinIndiacomprise......................,...........................and ................................ (ix) SBIwascreatedin...........................byanActof..................................... (x) Merchant banking involves .............based services connected with capitalmarket................................ (xi) SBIisthelargest...........................sectorbankinIndia. (C) Writefullformofthefollowingacronyms: (i) RBI (ii) SBI (iii) IDBI (iv) RRB

16 (v) ROA (vi) ROC (vii) NPA

INTRODUCTIONTOBANKING

1.9.TERMINALQUESTIONS: (i) Explain the essentials of the definition of banking under Indian law. DoestheprincipleofIntermediationhasanyrelevancetothisdefinitionand ifso,how? (ii) Explain the principles of liquidity, profitability, solvency and trust. Do these principles show any inter connection/inter se? If so, explain the interrelationships. (iii) Distinguishbetween: commercialandcooperativebanks, oldandnewgenerationprivatesectorbanks, commercialbankingandmerchantbanking,and domesticandcrossborderbanking. (iv) What do you understand by universal banking? Give some examples of universalbanksinIndia. (v) Whatdoyouunderstandbyelectronicbanking?Whatareasofbankingare coveredbyinformationandcommunicationtechnologies? 1.10.ANSWERSTOCHECKYOURPROGRESS: (A) (i) True (ii) False (iii) False (iv) True (v) True (vi) True (vii) False (viii) False (ix) True (x) False (xi) False (B) (i) currentcheques (ii) deposits,demand,cheques

INTRODUCTIONTOBANKING (iii) depositors,borrowers (iv) liquidity (v) loansdeposits (vi) financial (vii) dependability,customers (viii) nationalizedbanks,SBIGroupandRRBs (ix) 1955,Parliament (x) fee,securities (xi) publicsector (C) (i) ReserveBankofIndia (ii) StateBankofIndia (iii) IndustrialDevelopmentBankofIndia (iv) RegionalRuralBank (v) ReturnonAssets (vi) ReturnonCapital (vii) NonPerformingAsset

17

Potrebbero piacerti anche

- Pindyck TestBank 7eDocumento17 paginePindyck TestBank 7eVictor Firmana100% (5)

- Study Notes Banking and Finance Law - University of Technology JamaicaDocumento19 pagineStudy Notes Banking and Finance Law - University of Technology JamaicaPersephone West100% (3)

- CHAPTER 3 Social Responsibility and EthicsDocumento54 pagineCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- HSBC in A Nut ShellDocumento190 pagineHSBC in A Nut Shelllanpham19842003Nessuna valutazione finora

- Momentum 101 ConceptsDocumento13 pagineMomentum 101 ConceptsExpose SunriseNessuna valutazione finora

- MVR Homeowner Benefit AgreementDocumento24 pagineMVR Homeowner Benefit AgreementWPXI StaffNessuna valutazione finora

- DB - Ocwen-Serviced Trusts - Notice Re Regulatory Actions 7.21.17Documento147 pagineDB - Ocwen-Serviced Trusts - Notice Re Regulatory Actions 7.21.17Nye Lavalle100% (1)

- SPOG-5-1002 Cease and Desist LTRDocumento6 pagineSPOG-5-1002 Cease and Desist LTRpmocekNessuna valutazione finora

- Banking and Finance LawDocumento4 pagineBanking and Finance LawDinh VinhNessuna valutazione finora

- 20200418-Mr G. H. Schorel-Hlavka O.W.B. To Independent Broad-Based Anti-Corruption Commission Ex C-VO 20-6752Documento26 pagine20200418-Mr G. H. Schorel-Hlavka O.W.B. To Independent Broad-Based Anti-Corruption Commission Ex C-VO 20-6752Gerrit Hendrik Schorel-HlavkaNessuna valutazione finora

- TTMYGHDocumento37 pagineTTMYGHZerohedgeNessuna valutazione finora

- Obama China and LawyersDocumento2 pagineObama China and LawyersFreeman LawyerNessuna valutazione finora

- Steps Toward British Union, A World State, and International StrifeDocumento38 pagineSteps Toward British Union, A World State, and International StrifeEheyehAsherEheyehNessuna valutazione finora

- If Not Silver, What? by Bookwalter, John W.Documento48 pagineIf Not Silver, What? by Bookwalter, John W.Gutenberg.org100% (1)

- 1811 1823 Statutes at Large I-150Documento191 pagine1811 1823 Statutes at Large I-150ncwazzyNessuna valutazione finora

- Wisconsin ConstitutionDocumento65 pagineWisconsin ConstitutionMaria ShankNessuna valutazione finora

- Banking Working Capital & Term Loan Water Case StudyDocumento2 pagineBanking Working Capital & Term Loan Water Case Studyanon_652192649Nessuna valutazione finora

- The 1994 EbsworthDocumento15 pagineThe 1994 Ebsworthbustal100% (1)

- Household Balance Sheet Q2 2009Documento6 pagineHousehold Balance Sheet Q2 2009DvNetNessuna valutazione finora

- Bills 116hr133sa RCP 116 68Documento5.593 pagineBills 116hr133sa RCP 116 68MaurA DowlingNessuna valutazione finora

- Response To LOR and Order Curtailment-RedactedDocumento18 pagineResponse To LOR and Order Curtailment-RedactedTim BrownNessuna valutazione finora

- Not A Valid AssignmentDocumento3 pagineNot A Valid AssignmentSam FisherNessuna valutazione finora

- ASIO, Australian Federal Police Corrupt - CompromisedDocumento57 pagineASIO, Australian Federal Police Corrupt - CompromisedLloyd T VanceNessuna valutazione finora

- Caudle StatementDocumento9 pagineCaudle StatementThereseApelNessuna valutazione finora

- Fiduciary DeedDocumento1 paginaFiduciary Deedapi-224104463Nessuna valutazione finora

- Federal Reserve BankDocumento17 pagineFederal Reserve BankpackagingwizNessuna valutazione finora

- Blackstone Volume 1 - A Sys. and Hist. Expo. of Rom. LawDocumento1.153 pagineBlackstone Volume 1 - A Sys. and Hist. Expo. of Rom. LawSteveManning100% (1)

- Norman F. Dacey and Norman F. Dacey, Doing Business As National Estate Planning Council v. New York County Lawyers' Association, 423 F.2d 188, 2d Cir. (1970)Documento18 pagineNorman F. Dacey and Norman F. Dacey, Doing Business As National Estate Planning Council v. New York County Lawyers' Association, 423 F.2d 188, 2d Cir. (1970)Scribd Government DocsNessuna valutazione finora

- DOJ Overview of Issues Under Privacy Act 1974 - 2015 EditionDocumento318 pagineDOJ Overview of Issues Under Privacy Act 1974 - 2015 EditionRobert BarkerNessuna valutazione finora

- We Are All in This Together in The Global Currency ResetDocumento10 pagineWe Are All in This Together in The Global Currency Resetkaren hudesNessuna valutazione finora

- Breton Wood AgreementDocumento4 pagineBreton Wood Agreementyasser lucman100% (1)

- Jeff Anderson and SlaveryDocumento2 pagineJeff Anderson and SlaveryMarkus OdeNessuna valutazione finora

- Rhode Island Public Pension Reform-Wall Street's License To StealDocumento106 pagineRhode Island Public Pension Reform-Wall Street's License To StealGoLocal100% (2)

- Episode 111 Full Show Transcript: Crrow777 Radio Podcast Transcript Recorded 06/28/18Documento47 pagineEpisode 111 Full Show Transcript: Crrow777 Radio Podcast Transcript Recorded 06/28/18liz knightNessuna valutazione finora

- Fission Card Reader User Manual 105x142!06!04Documento13 pagineFission Card Reader User Manual 105x142!06!04cozcatecatlian100% (1)

- Rxi Pharmaceuticals Corporation: Form 8-KDocumento3 pagineRxi Pharmaceuticals Corporation: Form 8-KAnonymous Feglbx5Nessuna valutazione finora

- 12-CV-00379 Document 5Documento19 pagine12-CV-00379 Document 5A Better Dumont (NJ, USA)Nessuna valutazione finora

- Criminal Breach of TrustDocumento2 pagineCriminal Breach of TrustAFANessuna valutazione finora

- 100 Ways International LawDocumento41 pagine100 Ways International LawSamantha BlancoNessuna valutazione finora

- Devvy Kidd - Seventeenth AmendmentDocumento7 pagineDevvy Kidd - Seventeenth AmendmentJohn Sutherland100% (1)

- Nlienclaim WJDF 9apr2012Documento5 pagineNlienclaim WJDF 9apr2012sovcomnet100% (1)

- House Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramDocumento260 pagineHouse Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramScribd Government DocsNessuna valutazione finora

- Banking Crisis Memos 250209Documento262 pagineBanking Crisis Memos 250209mainman1010100% (1)

- YouTube Letter - May 16 2018Documento1 paginaYouTube Letter - May 16 2018MineHQNessuna valutazione finora

- Grem - The Liberty Amendment Money Trap (Analysis of Central Banking) (1979) PDFDocumento74 pagineGrem - The Liberty Amendment Money Trap (Analysis of Central Banking) (1979) PDFwroueaweNessuna valutazione finora

- IMF Special Drawing RightsDocumento3 pagineIMF Special Drawing RightsJialu LiuNessuna valutazione finora

- Common Sense in LawDocumento12 pagineCommon Sense in LawJosie Jones BercesNessuna valutazione finora

- 1066 and All ThatDocumento47 pagine1066 and All ThatIbrahim AhmedNessuna valutazione finora

- May 2020 GAO Report On Postal ServiceDocumento85 pagineMay 2020 GAO Report On Postal ServiceFox News100% (1)

- DictionaryDocumento380 pagineDictionarypremanandcNessuna valutazione finora

- F 13551Documento2 pagineF 13551IRSNessuna valutazione finora

- Exemption of Utah Safety and Emission Requirements For Vehicles Not in UtahDocumento2 pagineExemption of Utah Safety and Emission Requirements For Vehicles Not in Utahtrustkonan100% (1)

- Christopher Proe Criminal ComplaintDocumento7 pagineChristopher Proe Criminal ComplaintWXYZ-TV Channel 7 DetroitNessuna valutazione finora

- West Virginia Inmate Search Department of Corrections LookupDocumento4 pagineWest Virginia Inmate Search Department of Corrections LookupinmatesearchinfoNessuna valutazione finora

- AkidoDocumento2 pagineAkidoapi-638999492100% (1)

- ZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFDocumento2 pagineZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFnujahm1639100% (1)

- Citizens United Department of Treasury FOIA Request (March 17, 2021)Documento1 paginaCitizens United Department of Treasury FOIA Request (March 17, 2021)Citizens UnitedNessuna valutazione finora

- Chapter - 11 To 14 PDFDocumento82 pagineChapter - 11 To 14 PDFRupinder kaurNessuna valutazione finora

- Bush 1992 Executive Order 12803 - Infrastructure Privatization PDFDocumento2 pagineBush 1992 Executive Order 12803 - Infrastructure Privatization PDFmichaelonlineNessuna valutazione finora

- Quasi-Contract - Recovery of Money Paid Under Mistake of FactDocumento2 pagineQuasi-Contract - Recovery of Money Paid Under Mistake of FactHenoAlambre100% (1)

- O T Public - PleaDocumento2 pagineO T Public - PleaoldeproNessuna valutazione finora

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryDa EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNessuna valutazione finora

- MORIGINADocumento7 pagineMORIGINAatishNessuna valutazione finora

- Data Sheet WD Blue PC Hard DrivesDocumento2 pagineData Sheet WD Blue PC Hard DrivesRodrigo TorresNessuna valutazione finora

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureDocumento7 paginePowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiNessuna valutazione finora

- IEC Blank ProformaDocumento10 pagineIEC Blank ProformaVanshika JainNessuna valutazione finora

- How To Control A DC Motor With An ArduinoDocumento7 pagineHow To Control A DC Motor With An Arduinothatchaphan norkhamNessuna valutazione finora

- Getting StartedDocumento45 pagineGetting StartedMuhammad Owais Bilal AwanNessuna valutazione finora

- 4109 CPC For ExamDocumento380 pagine4109 CPC For ExamMMM-2012Nessuna valutazione finora

- Process States in Operating SystemDocumento4 pagineProcess States in Operating SystemKushal Roy ChowdhuryNessuna valutazione finora

- Configuring Master Data Governance For Customer - SAP DocumentationDocumento17 pagineConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNessuna valutazione finora

- Cryo EnginesDocumento6 pagineCryo EnginesgdoninaNessuna valutazione finora

- Allan ToddDocumento28 pagineAllan ToddBilly SorianoNessuna valutazione finora

- Seminar On Despute Resolution & IPR Protection in PRCDocumento4 pagineSeminar On Despute Resolution & IPR Protection in PRCrishi000071985100% (2)

- ACIS - Auditing Computer Information SystemDocumento10 pagineACIS - Auditing Computer Information SystemErwin Labayog MedinaNessuna valutazione finora

- Simoreg ErrorDocumento30 pagineSimoreg Errorphth411Nessuna valutazione finora

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDocumento27 pagineSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNessuna valutazione finora

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDocumento16 pagineT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinNessuna valutazione finora

- Lending OperationsDocumento54 pagineLending OperationsFaraz Ahmed FarooqiNessuna valutazione finora

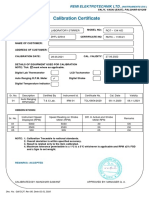

- Calibration CertificateDocumento1 paginaCalibration CertificateSales GoldClassNessuna valutazione finora

- General Field Definitions PlusDocumento9 pagineGeneral Field Definitions PlusOscar Alberto ZambranoNessuna valutazione finora

- Food and Beverage Department Job DescriptionDocumento21 pagineFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Wind Energy in MalaysiaDocumento17 pagineWind Energy in MalaysiaJia Le ChowNessuna valutazione finora

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocumento3 pagineArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarNessuna valutazione finora

- 004-PA-16 Technosheet ICP2 LRDocumento2 pagine004-PA-16 Technosheet ICP2 LRHossam Mostafa100% (1)

- BYJU's July PayslipDocumento2 pagineBYJU's July PayslipGopi ReddyNessuna valutazione finora

- Elastic Modulus SFRCDocumento9 pagineElastic Modulus SFRCRatul ChopraNessuna valutazione finora

- Specialty Arc Fusion Splicer: FSM-100 SeriesDocumento193 pagineSpecialty Arc Fusion Splicer: FSM-100 SeriesSFTB SoundsFromTheBirdsNessuna valutazione finora

- PeopleSoft Application Engine Program PDFDocumento17 paginePeopleSoft Application Engine Program PDFSaurabh MehtaNessuna valutazione finora