Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale Business

Caricato da

Impulsive collectorDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale Business

Caricato da

Impulsive collectorCopyright:

Formati disponibili

16 theSun | FRIDAY JUNE 19 2009

business KLCI

STI

1,054.41

2,237.20

16.49

34.25

Nikkei

TSEC

9,703.72

6,144.53

137.13

51.38

Hang Seng 17,776.66 307.94 KOSPI 1,375.76 15.41

SCI 2,853.90 43.78 S&P/ASX200 3,892.1 12.0

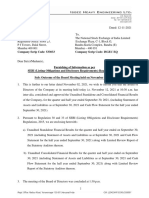

KL market summary

JUNE 18, 2009

INDICES

FBMEMAS

CHANGE

7,062.16 -138.15

CI sheds 16 points on profit taking

COMPOSITE 1,054.41 -16.49

INDUSTRIAL 2,328.23 -10.88 SHARE prices on Bursa Malaysia closed level will be at 1,030,” Phua said.

CONSUMER PROD 318.68 -2.62 lower yesterday as profit-taking contin- “As long as it maintains above the

INDUSTRIAL PROD 83.98 -2.36 ued with the selling of key heavyweights, 1,050 level, there is a good chance it will

CONSTRUCTION 201.14 -6.31

especially those in the banking sector, turn around,” he said.

TRADING SERVICES 139.36 - 2.32

FINANCE 8,411.45 -176.63 dealers said. Losers led gainers by 723 to 90 while

PROPERTIES 724.60 -36.21 The KLCI declined 16.49 points to 138 counters were unchanged, 304 un- EXCHANGE RATES June 18, 2009

PLANTATION 5,324.23 -66.31 1,054.41 after opening 0.01 of a point traded and 66 others suspended. Leading

MINING 275.60 -2.02 lower at 1,069.99 in the morning. the active counters were UEM Land which Foreign currency Bank sell Bank buy Bank buy

FBMSHA 7,301.55 -123.35 SJ Securities’ head of research Phua fell 24 sen to RM1.59 and KNM which

FBM2BRD 4,807.16 -206.62 TT/OD TT OD

Kwee Hock said the downtrend in the dropped 6.5 sen to 88.5 sen.

TECHNOLOGY 14.45 -0.42

market was expected but it was difficult Other active counters included Compu- 1 US DOLLAR 3.5590 3.4940 3.4840

to gauge the duration of the slide. gates which closed at seven sen, Iris which 1 AUSTRALIAN DOLLAR 2.8700 2.7440 2.7280

TURNOVER VALUE

1.919bil RM1.879bil “The market has hit the support level. If eased to 19 sen and Tebrau Teguh which 1 BRUNEI DOLLAR 2.4570 2.3970 2.3890

it goes down some more, the next support lost 12.5 sen to 81.5 sen. – Bernama 1 CANADIAN DOLLAR 3.1570 3.0790 3.0670

1 EURO 4.9840 4.8620 4.8420

1 NEW ZEALAND DOLLAR 2.2840 2.1850 2.1690

1 PAPUA N GUINEA KINA 1.4470 1.2070 1.1910

1 SINGAPORE DOLLAR 2.4565 2.3970 2.3890

TM expects 15% revenue 1 STERLING POUND

1 SWISS FRANC

100 ARAB EMIRATES DIRHAM

100 BANGLADESH TAKA

100 CHINESE RENMINBI

5.8570

3.3070

98.7000

5.5200

N/A

5.7150

3.2270

93.3900

5.2000

N/A

5.6950

3.2120

93.1900

5.0000

N/A

from wholesale business

100 DANISH KRONE 68.9300 63.3400 63.1400

100 HONGKONG DOLLAR 46.7400 44.2700 44.0700

Lefty wins 100 INDIAN RUPEE 7.6900 7.0700 6.8700

hearts but 100 INDONESIAN RUPIAH 0.0364 0.0310 0.0260

heads go 100 JAPANESE YEN 3.7270 3.6370 3.6270

100 NEW TAIWAN DOLLAR N/A N/A N/A

for Woods

SINGAPORE: Telekom Malaysia Iskandar Malaysia and key industrial Asian countries among the growth 100 NORWEGIAN KRONE 57.8000 53.1100 52.9100

Bhd (TM) expects revenue from the zones nationwide. leaders,” he said. pg 29 100 PAKISTAN RUPEE 4.5100 4.2000 4.0000

wholesale business to grow to 15% in TM’s wholesale offerings comprise A report released at Communi- 100 PHILIPPINE PESO 7.5400 7.0800 6.8800

the next two to three years from 10%. three HSBB services — transmission, cAsia 2009 said that broadband lines 100 QATAR RIYAL 99.2900 94.4500 94.2500

Its group chief executive officer access and connection. grew 16.6 million globally in the first

Datuk Zamzamzairani Mohd Isa said The HSBB project will cost RM11.3 quarter of 2009 alone, with over 429 100 SAUDI RIYAL 96.3900 91.6800 91.4800

the target would be driven by the billion. TM will invest RM8.9 billion million people worldwide now. 100 SOUTH AFRICAN RAND 45.7000 42.0400 41.8400

increase in demand for broadband, over a 10-year period, while the gov- Zamzamzairani said Malaysia 100 SRI LANKA RUPEE 3.2000 2.9400 2.7400

as and when TM rolled out its High- ernment will chip in RM2.4 billion. would become an attractive hub 100 SWEDISH KRONA 47.1500 42.8800 42.6800

Speed Broadband (HSBB) network. The project will offer speed of for content providers once the Asia 100 THAI BAHT 11.1800 9.4800 9.0800

“By year-end, 80-90% of the HSBB between 10 megabits per second America Gateway (AAG) cable was

Source: Malayan Banking Berhad/Bernama

will be ready and there will be a user (Mbps) and 1Gbps (billions of bits ready in August.

test. In the first quarter of next year, per second) to Internet users in the “This will make Malaysia attrac-

we would be able to commercialise Klang Valley and Iskandar Malaysia tive for content providers to host World Bank ups China 2009

the services,” he told Malaysian in Johor state, while up to 4Mbps will here to provide the services for their

reporters at the Singapore’s Com- be offered nationwide. customers in the region,” he said. growth forecast

municAsia 2009. For the HSBB retail service, it is AAG is a high-bandwidth optical BEIJING: The World Bank yesterday raised its forecast

CommunicAsia is a regional slated for launch in the fourth quarter fibre submarine cable system linking for economic growth in China this year to 7.2% from

information and communications this year. South-East Asia to the US. 6.5%, citing massive government spending as the main

technology (ICT) exhibition and a Zamzamzairani said mobile Among the operators in the AAG reason for the revised figure.

global platform to address current broadband users were increasing consortium are AT&T in the US, “Developments in the real economy have been

and emerging issues in the ICT and quickly both locally and aboard, Bharti in India, CAT Telekom in somewhat better than expected three months ago.

digital convergence landscape. hence there was a need to provide Thailand, Eastern Telecommunica- More importantly, bank lending in the first part of 2009

The HSBB project involves con- services to support the demand. tions in the Philippines, PT Indosat in has been much larger than expected,” the World Bank

necting 1.3 million premises within “More people worldwide are Indonesia, PCP in Cambodia, Saigon said.

the next two to three years. subscribing to high-speed Internet Postel Corporation in Vietnam, Telstra China, the world’s third-largest economy, started to

The areas that will be served by connections despite the economic in Australia and Telkom Indonesia. be heavily impacted by the global financial crisis in the

HSBB include the inner Klang Valley, downturn, with China and other – Bernama second half of last year, and unveiled an unprecedented

US$580billion package as an antidote. — AFP

Obama regulatory plan is

ambitious gambit

WASHINGTON: The fi- a measure that would allow could cause a systemic shock

nancial regulation overhaul the Federal Reserve to inter- and stronger consumer

proposed by President Barack vene in firms that could pose protection from dangerous

Obama offers much-needed a threat to financial stability, financial products.

reforms to troubled markets even those that don’t own Others attacked the pro-

but could prove difficult to banks. posal as being too aggressive,

enact because it is so ambi- Douglas Elliott, an saying it could send a chill

tious, analysts say. economist at the Brookings through the financial system

Even staunch free-market Institution, said the measures and discourage investment

advocates agree on the need are “all sensible, necessary and innovation.

for streamlining the patch- reforms” but fall short of the Diana Furchtgott-Roth,

work US regulatory system major overhaul that could a senior fellow at the con-

for financial institutions, but have been accomplished. servative Hudson Institute,

views on other aspects of the “On the whole, it follows said consolidating regulators

plan are more divergent. the broad principles of what “definitely does make sense”

In unveiling the wide- most of us would like to see, but that putting the govern-

ranging plan on Wednesday, but there were some aspects ment in change of monitor-

Obama called it the most that were missed opportuni- ing companies for systemic

sweeping overhaul since the ties,” Elliot said. risk “is very dangerous.”

1930s, vowing to stop future Elliott said the notion of a “The idea of the govern-

meltdowns in a financial single financial market regu- ment taking over companies

system humbled by lax over- lator was scrapped, leaving that have problems because

sight, greed and huge debts. the system with five instead it decides they are too big to

But because the plan of six agencies. fail invites political cronyism

contains so many elements, it “Having this many regula- as we saw with Chrysler and

sparked criticism from a va- tors opens up the system to General Motors,” she said.

riety of quarters. Some said it financial arbitrage” or “mak- “If this happened in Ven-

did not go far enough, while ing it easier to allow firms to ezuela or Russia we would

others argued it will give the find the weakest link.” be decrying this. If these

government too much power But he said the most sig- proposals are passed it would

in the private sector. nificant elements are tougher discourage investment in

Especially contentious is regulation of companies that these large firms.” — AFP

Potrebbero piacerti anche

- HayGroup Job Measurement: An IntroductionDocumento17 pagineHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Credit Decision ManagementDocumento14 pagineCredit Decision ManagementSat50% (2)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocumento27 pagineHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocumento4 pagineHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- IBM - Using Workforce Analytics To Drive Business ResultsDocumento24 pagineIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNessuna valutazione finora

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocumento117 pagineCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Strategy+Business - Winter 2014Documento108 pagineStrategy+Business - Winter 2014GustavoLopezGNessuna valutazione finora

- Phraud Car Parts Co. Received Order For Universal Joint (Auto Part) From ABC Corp. Presented Below Are The Requested Volume and PriceDocumento2 paginePhraud Car Parts Co. Received Order For Universal Joint (Auto Part) From ABC Corp. Presented Below Are The Requested Volume and PriceKrystel Joie Caraig Chang100% (1)

- DF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogDocumento255 pagineDF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogLifan Cinaautoparts Autoparts100% (1)

- Developing An Enterprise Leadership MindsetDocumento36 pagineDeveloping An Enterprise Leadership MindsetImpulsive collectorNessuna valutazione finora

- HBR - HR Joins The Analytics RevolutionDocumento12 pagineHBR - HR Joins The Analytics RevolutionImpulsive collectorNessuna valutazione finora

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocumento15 pagineHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNessuna valutazione finora

- 2015 Summer Strategy+business PDFDocumento104 pagine2015 Summer Strategy+business PDFImpulsive collectorNessuna valutazione finora

- Futuretrends in Leadership DevelopmentDocumento36 pagineFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Compensation Fundamentals - Towers WatsonDocumento31 pagineCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- 2016 Summer Strategy+business PDFDocumento116 pagine2016 Summer Strategy+business PDFImpulsive collectorNessuna valutazione finora

- Coaching in OrganisationsDocumento18 pagineCoaching in OrganisationsImpulsive collectorNessuna valutazione finora

- Deloitte Analytics Analytics Advantage Report 061913Documento21 pagineDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNessuna valutazione finora

- Islamic Financial Services Act 2013Documento177 pagineIslamic Financial Services Act 2013Impulsive collectorNessuna valutazione finora

- Talent Analytics and Big DataDocumento28 pagineTalent Analytics and Big DataImpulsive collectorNessuna valutazione finora

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocumento1 paginaTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocumento1 paginaThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNessuna valutazione finora

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocumento1 paginaThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNessuna valutazione finora

- Thesun 2009-07-17 Page13 Chinas Economy Grows 7Documento1 paginaThesun 2009-07-17 Page13 Chinas Economy Grows 7Impulsive collectorNessuna valutazione finora

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocumento1 paginaTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNessuna valutazione finora

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocumento1 paginaTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNessuna valutazione finora

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocumento1 paginaTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesDocumento1 paginaThesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocumento1 paginaThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeDocumento1 paginaThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorNessuna valutazione finora

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocumento1 paginaTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocumento1 paginaThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Thesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingDocumento1 paginaThesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocumento1 paginaThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocumento1 paginaThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearDocumento1 paginaThesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedDocumento1 paginaThesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedImpulsive collectorNessuna valutazione finora

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocumento1 paginaThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNessuna valutazione finora

- Thesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerDocumento1 paginaThesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerImpulsive collector100% (2)

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocumento1 paginaThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- Thesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBDocumento1 paginaThesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBImpulsive collectorNessuna valutazione finora

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocumento1 paginaTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocumento1 paginaThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNessuna valutazione finora

- TheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Documento1 paginaTheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Impulsive collector100% (2)

- Thesun 2009-08-25 Page17 Market SummaryDocumento1 paginaThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocumento1 paginaThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocumento1 paginaThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNessuna valutazione finora

- TheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsDocumento1 paginaTheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocumento1 paginaThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNessuna valutazione finora

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Documento1 paginaTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocumento1 paginaTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNessuna valutazione finora

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocumento1 paginaThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNessuna valutazione finora

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDocumento1 paginaThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocumento1 paginaThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocumento1 paginaThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocumento1 paginaThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNessuna valutazione finora

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocumento1 paginaThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNessuna valutazione finora

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocumento1 paginaTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNessuna valutazione finora

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocumento1 paginaTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocumento1 paginaThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyDocumento1 paginaThesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyImpulsive collectorNessuna valutazione finora

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocumento1 paginaTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyDocumento1 paginaThesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyImpulsive collector100% (2)

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocumento1 paginaThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocumento1 paginaThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-26 Page15 Market SummaryDocumento1 paginaThesun 2009-08-26 Page15 Market SummaryImpulsive collectorNessuna valutazione finora

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocumento1 paginaTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDocumento1 paginaThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNessuna valutazione finora

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinDocumento1 paginaThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- TheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelDocumento1 paginaTheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelImpulsive collector100% (2)

- Thesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderDocumento1 paginaThesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderImpulsive collectorNessuna valutazione finora

- TheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityDocumento1 paginaTheSun 2009-05-14 Page16 Mas Eads To Start Regional Aircraft Repair FacilityImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocumento1 paginaThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNessuna valutazione finora

- Thesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMDocumento1 paginaThesun 2009-10-29 Page14 Skypark Subang Can Help Transform Nation PMImpulsive collectorNessuna valutazione finora

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocumento1 paginaThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNessuna valutazione finora

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaDocumento1 paginaTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDocumento1 paginaThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNessuna valutazione finora

- Thesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingDocumento1 paginaThesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingImpulsive collectorNessuna valutazione finora

- Thesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionDocumento1 paginaThesun 2009-05-27 Page15 Asian Shares Hit by North Korea TensionImpulsive collectorNessuna valutazione finora

- KPMG CEO StudyDocumento32 pagineKPMG CEO StudyImpulsive collectorNessuna valutazione finora

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocumento5 pagineIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNessuna valutazione finora

- HayGroup Rewarding Malaysia July 2010Documento8 pagineHayGroup Rewarding Malaysia July 2010Impulsive collectorNessuna valutazione finora

- Global Added Value of Flexible BenefitsDocumento4 pagineGlobal Added Value of Flexible BenefitsImpulsive collectorNessuna valutazione finora

- Global Talent 2021Documento21 pagineGlobal Talent 2021rsrobinsuarezNessuna valutazione finora

- Emotional or Transactional Engagement CIPD 2012Documento36 pagineEmotional or Transactional Engagement CIPD 2012Impulsive collectorNessuna valutazione finora

- Stanford Business Magazine 2013 AutumnDocumento68 pagineStanford Business Magazine 2013 AutumnImpulsive collectorNessuna valutazione finora

- Flexible Working Good Business - How Small Firms Are Doing ItDocumento20 pagineFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNessuna valutazione finora

- Megatrends Report 2015Documento56 pagineMegatrends Report 2015Cleverson TabajaraNessuna valutazione finora

- 2012 Metrics and Analytics - Patterns of Use and ValueDocumento19 pagine2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNessuna valutazione finora

- Managing Conflict at Work - A Guide For Line ManagersDocumento22 pagineManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNessuna valutazione finora

- Strategy+Business Magazine 2016 AutumnDocumento132 pagineStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- TalentoDocumento28 pagineTalentogeopicNessuna valutazione finora

- Calculate Savings, Loans, Annuities and Present/Future ValuesDocumento1 paginaCalculate Savings, Loans, Annuities and Present/Future ValuesNaveed NawazNessuna valutazione finora

- TPS and ERPDocumento21 pagineTPS and ERPTriscia QuiñonesNessuna valutazione finora

- López Quispe Alejandro MagnoDocumento91 pagineLópez Quispe Alejandro MagnoAssasin WildNessuna valutazione finora

- The Role of Ideology in International RelationsDocumento8 pagineThe Role of Ideology in International RelationsVinay JohnNessuna valutazione finora

- Local Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoDocumento2 pagineLocal Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoPR.comNessuna valutazione finora

- Dgcis Report Kolkata PDFDocumento12 pagineDgcis Report Kolkata PDFABCDNessuna valutazione finora

- The Illinois QTIP Election To The RescueDocumento5 pagineThe Illinois QTIP Election To The RescuerobertkolasaNessuna valutazione finora

- Understanding Consumer Equilibrium with Indifference CurvesDocumento6 pagineUnderstanding Consumer Equilibrium with Indifference CurvesJK CloudTechNessuna valutazione finora

- Project Report SSIDocumento140 pagineProject Report SSIharsh358Nessuna valutazione finora

- PRQNP 11 FBND 275 HXDocumento2 paginePRQNP 11 FBND 275 HXjeevan gowdaNessuna valutazione finora

- Company Scrip Code: 533033Documento17 pagineCompany Scrip Code: 533033Lazy SoldierNessuna valutazione finora

- Enactus ProposalDocumento5 pagineEnactus Proposalhana alkurdi0% (1)

- Pro Forma Invoice for Visa Processing FeesDocumento1 paginaPro Forma Invoice for Visa Processing FeesShakeel AbbasiNessuna valutazione finora

- Weekly business quiz roundup from 2011Documento8 pagineWeekly business quiz roundup from 2011Muthu KumarNessuna valutazione finora

- Suburban Nation: The Rise of Sprawl and The Decline of The American DreamDocumento30 pagineSuburban Nation: The Rise of Sprawl and The Decline of The American DreamFernando Abad100% (1)

- Tax Invoice: Smart Lifts & ElectricalsDocumento1 paginaTax Invoice: Smart Lifts & ElectricalsYours PharmacyNessuna valutazione finora

- Biblioteca Ingenieria Petrolera 2015Documento54 pagineBiblioteca Ingenieria Petrolera 2015margaritaNessuna valutazione finora

- Lavanya Industries Tool Manufacturing Facility ProfileDocumento11 pagineLavanya Industries Tool Manufacturing Facility ProfilepmlmkpNessuna valutazione finora

- Schmitt NF JumpDocumento1 paginaSchmitt NF JumpKim PalmieroNessuna valutazione finora

- Indian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryDocumento5 pagineIndian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryRounak BasuNessuna valutazione finora

- Income Measurement and Reporting Numerical Questions SolvedDocumento2 pagineIncome Measurement and Reporting Numerical Questions SolvedKBA AMIR100% (2)

- Sample MC QuestionsDocumento6 pagineSample MC QuestionsJoshua OhNessuna valutazione finora

- ISO 14001 Certification Woodward ControlsDocumento3 pagineISO 14001 Certification Woodward ControlsErick MoraNessuna valutazione finora

- Spring Homes Subdivision Co Inc, Sps. Pedro Lumbres and Roaring Vs Sps TabladaDocumento1 paginaSpring Homes Subdivision Co Inc, Sps. Pedro Lumbres and Roaring Vs Sps TabladaSaji JimenoNessuna valutazione finora

- Money and Monetary StandardsDocumento40 pagineMoney and Monetary StandardsZenedel De JesusNessuna valutazione finora

- Fair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDDocumento3 pagineFair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDNarendra KumarNessuna valutazione finora

- (Topic 6) Decision TreeDocumento2 pagine(Topic 6) Decision TreePusat Tuisyen MahajayaNessuna valutazione finora