Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

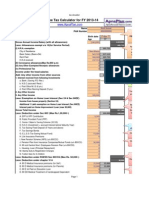

Income Tax Sheet Calculator

Caricato da

rincepTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Income Tax Sheet Calculator

Caricato da

rincepCopyright:

Formati disponibili

NAME ID

From To

1-Apr-12 31-Mar-13 :

Basic HRA m Exemption of HRA u/s 10(13A) M Transport Allownace Exemption of TA u/s 10(14) Special Allowance City Compensatary Allowance Refre,Allowance Arrears(of last year) Other payments : AIP/SIP/PIP/V.Pay Refferal Claim Taxable Reimb. Leave Encashment Notice Pay Recovery/reimb Tour LTA Any other income of the employee reported by him Prv employer income (after prof tax if any) Total Perquisites/Others Company leased Accomodation Less Borne by the Employee Medical Reimb Interest free loans Sweeper,Gardener & Watchman Car Perks Hard Furnishing

Days Attendance Structure -

Provisional Tax Calculation for the Financial Year 2012-2013 (business.mapsofindia.com) PAN DESIGNATION 30 31 30 31 31 30 31 30

30 April 31 May June 30 July 31 Aug 31 Sep 30 Oct 31 Nov 30 Dec

31

31 Jan -

31

31 Feb -

28

28 Mar -

31

31 -

TOTAL

12 -

Total Interest on Housing Loan Loss from house property Taxable Income Less : Deductions under Chapter VIA 80C Prv employer savings under 80C LIFE INSURANCE PREMIUM ULIP NSC PPF HOUSING LOAN PRINCIPAL MUTUAL FUNDS 5 yr F.D.POSTAL DEPOSIT SCHEME PENSION PLAN TUTION FEES FIXED DEPOSIT EPF (DEDUCTED) Total 80 D (Mediclaim) self 80 D (Mediclaim) parents 80 E (Interest Paid on Education Loan) 80 U Professional Tax (Deductd) Total Net Taxable Income Tax Education Cess Secondary Education Cess Net tax payable upto Deduction upto Balance Deduction => Deduction Per Month =>

31-Mar-13 31-Mar-13

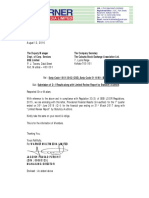

Registered Office: 33-35 Thyagraj Nagar,New Delhi-110 003 Corporate Office: A-39,Sector-62,NOIDA-201 307 Email:nsel@nucleussoftware.com Web:www.nucleussoftware.com

NUCLEUS SOFTWARE EXPORTS LTD

Provisional Tax Computation for the Financial Year 2011-2012

Name Pan No Period Name Basic Hra Transport Allownace Special Allawance City Compensatary Allowance Refreshment Allowance/ Food card AIP/SIP/PIP/V.Pay Refferal Claim Taxable Reimb. Leave Encashment Notice Pay Recovery/reimb Tour LTA Medical Reimb Arrears(of last year) Gross Income PERKS Company leased Accomodation Interest free loans Car Perks Hard Furnishing Gross salary HRA Exemption Conveyance Exemption Medical Exemption 0 0 1-Apr-12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Tax on Income Education Cess Secondary Education Cess Total Tax Tax Deducted Prev Emp TDS(included in above column) Tax Payable / Refundable HRA CALCULATION Metro Non Metro 0 0 0 0 0 0 To Deductor Pan AAACN5382P Deductor Tan DELN05326G 31-Mar-13 Gender

0 0 0 0 0 0 0 0

HRA Received Rent paid in excess of 10 % 50% OR 40% of Basic Minimum HRA Exemption INVESTMENT U/S 80C PREV EMPLOYER SAVINGS(80C) PF LIC ULIP NSC PPF HOUSING LOAN PRINCIPAL MUTUAL FUNDS POSTAL DEPOSIT SCHEME PENSION PLAN TUTION FEES FIXED DEPOSIT TOTAL INVESTMENTS U/S 80C

Salary After Exemption Previous Employer Income Total Income Professional Tax Taxable Salary Income H/P OR Loss H/P Interest on Housing Loan Income From other Sources

0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0

-

Total Deduction Tax Deducted Details

Total Income 80C 0 80CCF Notified additional infrastructure #REF! Bonds 80 D (Mediclaim-self) 0 80 D (Mediclaim-parents) 0 80 E (Interest Paid on Education Loan) 0 80 U 0 Total Deduction chapter VI A #REF! Total Income #REF! Other Tax Deduction Prv employer deduction Total Tax Deduction

APRIL MAY JUNE JULY AUGUST SEPTEMBER OCTOBER NOVEMBER DECEMBER JANUARY FEBRUARY MARCH

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Potrebbero piacerti anche

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawDa EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawValutazione: 3.5 su 5 stelle3.5/5 (4)

- Income Tax Calculator 2012-13Documento2 pagineIncome Tax Calculator 2012-13Cool Friend GksNessuna valutazione finora

- Company: 31 NameDocumento2 pagineCompany: 31 Namesenthilmask80Nessuna valutazione finora

- Pay SlipDocumento1 paginaPay SlipAnonymous QrLiISmpF100% (1)

- 11111HHDocumento6 pagine11111HHKelly Tan Xue LingNessuna valutazione finora

- Income Tax Calculator FY 2012 13Documento4 pagineIncome Tax Calculator FY 2012 13raattaiNessuna valutazione finora

- Verizon Data Services India Pvt. LTDDocumento2 pagineVerizon Data Services India Pvt. LTDabintmNessuna valutazione finora

- Income Tax Calculator For MaleDocumento19 pagineIncome Tax Calculator For MaleAlok SaxenaNessuna valutazione finora

- Income Tax Calculator 2016-17 v1804Documento2 pagineIncome Tax Calculator 2016-17 v1804Pankaj BatraNessuna valutazione finora

- Income Tax Calculator FY 2013 14Documento4 pagineIncome Tax Calculator FY 2013 14faiza17Nessuna valutazione finora

- V. N. Hari,: Sudhakar & Kumar AssociatesDocumento28 pagineV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNessuna valutazione finora

- Foundation Prelim Budget 2017-2019 Detailed - UpdatedDocumento5 pagineFoundation Prelim Budget 2017-2019 Detailed - UpdatedMichael LindenbergerNessuna valutazione finora

- CAclubindia News - Income Tax Sections at A GlanceDocumento3 pagineCAclubindia News - Income Tax Sections at A GlanceSmiju SukumarNessuna valutazione finora

- 56 Incom Tax CalculatorDocumento6 pagine56 Incom Tax Calculatorspecky123Nessuna valutazione finora

- Whichever Is Lower Is Exempt From Tax. For ExampleDocumento13 pagineWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNessuna valutazione finora

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocumento11 pagineITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNessuna valutazione finora

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Documento28 pagineModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNessuna valutazione finora

- Cost To The CompanyDocumento15 pagineCost To The CompanyrockNessuna valutazione finora

- Genpact Vs InfosysDocumento3 pagineGenpact Vs InfosysNidhi MishraNessuna valutazione finora

- Whichever Is Lower Is Exempt From Tax. For ExampleDocumento13 pagineWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNessuna valutazione finora

- Summary of Tax Deducted at Source: Part-ADocumento5 pagineSummary of Tax Deducted at Source: Part-Achakrala_sirishNessuna valutazione finora

- Tax CalculatorDocumento10 pagineTax Calculatorgsagar879Nessuna valutazione finora

- Nitin Jain Full & Final Clearance Monthly: (9 Working Days)Documento10 pagineNitin Jain Full & Final Clearance Monthly: (9 Working Days)intrax0Nessuna valutazione finora

- Delhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012Documento1 paginaDelhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012tippu09Nessuna valutazione finora

- UNIT 2 Income From SalaryDocumento146 pagineUNIT 2 Income From Salaryeasy mailNessuna valutazione finora

- Amount Credit Credits Items: 41580 Tax Payable Without Marginal ReliefDocumento4 pagineAmount Credit Credits Items: 41580 Tax Payable Without Marginal Reliefaqeelahmed1978Nessuna valutazione finora

- 261986Documento4 pagine261986Jaimin Mungalpara100% (1)

- FNDWRRDocumento1 paginaFNDWRRsreenidsNessuna valutazione finora

- Form 16 For AY 2015-16 CAknowledge - inDocumento16 pagineForm 16 For AY 2015-16 CAknowledge - inKiranNessuna valutazione finora

- Salary Structure CalculatorDocumento6 pagineSalary Structure CalculatorNisha_Yadav_6277Nessuna valutazione finora

- NMHD Template4Documento80 pagineNMHD Template4sur_ruhNessuna valutazione finora

- Serv Let Control Le 11 RDocumento2 pagineServ Let Control Le 11 Rgourav_bhardwajNessuna valutazione finora

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocumento2 pagineSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNessuna valutazione finora

- 1 - Form 16Documento5 pagine1 - Form 16premsccNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Gross Total Income (1+2c) 4: Import Previous VersionDocumento4 pagineGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNessuna valutazione finora

- Financial Projections TemplateDocumento66 pagineFinancial Projections TemplateVigneshwari VeeNessuna valutazione finora

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Documento2 pagineArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Nessuna valutazione finora

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocumento16 pagineIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNessuna valutazione finora

- IT Projection ToolDocumento7 pagineIT Projection ToolsaurabhmanitNessuna valutazione finora

- SL - No Employee Name Eligible Amount (Basic+DA & Others) Employee Contribution Employer ContributionDocumento3 pagineSL - No Employee Name Eligible Amount (Basic+DA & Others) Employee Contribution Employer ContributionAshwin Kannakotai GopalkrishnaNessuna valutazione finora

- 40 Income From Salary PDFDocumento12 pagine40 Income From Salary PDFkiranshingoteNessuna valutazione finora

- Enter Necessary Data For Income Tax CalculationDocumento15 pagineEnter Necessary Data For Income Tax Calculationsa_mishraNessuna valutazione finora

- Sebi MillionsDocumento3 pagineSebi MillionsShubham TrivediNessuna valutazione finora

- IT Calculator, Mohandas 2013Documento36 pagineIT Calculator, Mohandas 2013DEEPTHISAINessuna valutazione finora

- Revised Financial Results For June 30, 2015 (Result)Documento2 pagineRevised Financial Results For June 30, 2015 (Result)Shyam SunderNessuna valutazione finora

- Tax Return Filled 2014Documento1 paginaTax Return Filled 2014helloasd1Nessuna valutazione finora

- Employee Investment Declaration Form For The Financial Year 2019-2020Documento2 pagineEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNessuna valutazione finora

- Project Report UtilityDocumento29 pagineProject Report Utilitypriyankastore123100% (2)

- IT Calculator 14 15 Taxguru - inDocumento16 pagineIT Calculator 14 15 Taxguru - inanirbanpwd76Nessuna valutazione finora

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDocumento5 pagineNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Nessuna valutazione finora

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocumento6 pagineMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNessuna valutazione finora

- 21St Century Computer Solutions: A Manual Accounting SimulationDa Everand21St Century Computer Solutions: A Manual Accounting SimulationNessuna valutazione finora

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleDa EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleNessuna valutazione finora

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryDa EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryDa EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaDa EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNessuna valutazione finora

- TrainingDocumento1 paginaTrainingrincepNessuna valutazione finora

- Holiday List 2018Documento2 pagineHoliday List 2018rincepNessuna valutazione finora

- Holidays List: 2016 Month Date Day Holiday Bangalore Chennai Delhi Mumbai HyderabadDocumento2 pagineHolidays List: 2016 Month Date Day Holiday Bangalore Chennai Delhi Mumbai HyderabadrincepNessuna valutazione finora

- Mobile Phone Market SurveyDocumento50 pagineMobile Phone Market SurveyrincepNessuna valutazione finora

- Holidays in 2014 Calendar YearDocumento1 paginaHolidays in 2014 Calendar YearrincepNessuna valutazione finora

- Income Tax Sheet Bmoi 2012 13Documento2 pagineIncome Tax Sheet Bmoi 2012 13rincepNessuna valutazione finora

- Chinna Koundan Pudur Primary Agricultural Co-Operative Credit SocietyDocumento16 pagineChinna Koundan Pudur Primary Agricultural Co-Operative Credit SocietyrincepNessuna valutazione finora

- Holidays 2012Documento1 paginaHolidays 2012rincepNessuna valutazione finora

- Service Tax CalculatorDocumento1 paginaService Tax CalculatorrincepNessuna valutazione finora

- SRS KingfisherDocumento14 pagineSRS KingfisherrincepNessuna valutazione finora

- Netapp, Inc.: Form 10-KDocumento118 pagineNetapp, Inc.: Form 10-KrincepNessuna valutazione finora

- Seven Habits of Highly Effective People - Book ReviewDocumento2 pagineSeven Habits of Highly Effective People - Book ReviewrincepNessuna valutazione finora

- Marketing ResearchDocumento107 pagineMarketing ResearchrincepNessuna valutazione finora