Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Great Gas Heist - Lola Nayar, Arindam Mukherjee, Madhavi Tata

Caricato da

mdanasazizTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Great Gas Heist - Lola Nayar, Arindam Mukherjee, Madhavi Tata

Caricato da

mdanasazizCopyright:

Formati disponibili

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

WEB

MAGAZINE

SECTIONS

INTERACTIVE

FEATURES

REGULARS

RESOURCES

RSS

WIRES

LAST TELEGRAM SENT TO RAHUL GANDHI

/

National

Cover Stories

MAGAZINE | JUL 15, 2013

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 1 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

PHOTOS WIRES BLOGS LATEST

Cong Hits Back at Modi Over 'Burqa of Secularism' Remark SC Rejects PIL Challenging CAG's Appointment IAF's MiG-21 Crashes in Rajasthan, Pilot Killed One Killed in WB Panchayat Poll Violence Inflation Rises to 4.86% in June Last Telegram Sent to Rahul Gandhi 15-Year-Old Allegedly Raped by Neighbour in Delhi The Telegram (1850-2013), R.I.P. Don't Believe Cong Until Telangana Bill is Passed: TRS Complaint Filed Against Modi For Godhra Riots Remark

FEATURED BLOGS & WIRES Its done PM Manmohan Singh with Mukesh Ambani. (Photograph by Jitender Gupta)

Amar Gopal Bose (1929-2013) Pran (1920 -2013) Gujarat Riots: Uproar Over Modi's 'Puppy' Analogy Bartoli Who Won't Ever Be a Sharapova First An Eyewitness, Now A Blogger

SHORT TAKES

RELIANCE

The Great Gas Heist

One beneficiary, clear and corporate. How the UPA played for political positioning.

LOLA NAYAR, ARINDAM MUKHERJEE, MADHAVI TATA Like 310 Send Tweet 111

COMMENTS

2 06 JUL 2013, 5:44:27 PM | BUZZ

TEXT SIZE ALSO IN THIS STORY

In the Niira Radia tapes, theres this one delicious conversation the PR lady has with lobbyist Ranjan Bhattacharya. It was May 2009, and UPA-II cabinet formation was in full swing. Bhattacharya quotes Reliance Industries Mukesh Ambani as telling him, Haan yaar, you know Ranjan, youre right, ab toh Congress apni dukaan hai. Apocryphal or not, that earthy expression of ownership is relevant in the aftermath of the UPAs recent decision to raise gas prices for five years, starting at a flexible $8.4/mmbtuconceding a long-standing demand by Indias most powerful business house and its global partner BP. This must be said because, apart from the Left parties and AIADMK, few even in the political establishment are raising obvious questions about this deal, of which Reliance, the countrys largest private sector gas producer, is the major beneficiary. The whole pricing exercise has been riddled with conflicts between the ministries of power, fertiliser, finance and petroleum; the formula has invited severe criticism; and theres an attempt by the UPA to airbrush the obvious negative impact of the hike on the common man and taxpayer. Nearly everything will become expensive; or, obviously, the taxpayer will bear these subsidies. Back-of-the-envelope calculations by Outlook show that the cost of this gas hike on just the power, fertiliser and lpg industries will be in the range of Rs 54,500 crore per annum. Also, the costs of industry in general will go up. It is a massive loss to the nation. Already, fertiliser prices are soaring. Now, they will be increased again. This is a clear case of placing profit above people, says Prof K. Nageshwar, an MLC from Andhra Pradesh. On the other hand, aided by a depreciating rupee, gas producers will rake it in. Every $1 increase in gas price means $73 million profit for Reliance, says Nageshwar. The irony: gas was meant to be a cheap, green fuel. Theres also a political brazenness to the timing. A decision slated for April 2014 has been announced a good ten months before, neatly sidestepping an election code of conduct and buying the support of a crucial corporate. Given that AIADMK has said that it would review the deal if a coalition it is part of comes to power, this pre-emptive pricing takes the decision out of the hands of (potentially, of course) an unreliable Third Front coalition. With elections around, whod want to upset a major source of funding? says a political analyst.

There is even more cofusion about the Headley interrogation report, as it turns out there had been an earlier allegation, on June 23 in the Sunday Guardian which put the number of these paragraphs as 158 and 159 (and not 168 and 169) as mentioned by Headlines Today which have now been rubbished by lawyer Mukul Sinha thus: Abhinandan Mishra, Senior Correspondent of Sunday Guardian on 22 June 2013 declared in his weekly that David Coleman Headley apparently answering to a question by NIA in June 2010 had said the following. 158. On being asked about Ishrat Jahaan, I (Headley) state that in late 2005 Zaki ur Rehman Lakhvi introduced Muzzammil to me. Having introduced Muzzammil, Zaki talked about the accomplishments of

ADVERTISEMENT

ELSEWHERE IN OUTLOOK

The Ottavio Quattrocchi Files 'Sensational Tokenism' Paris Diary An Arbitrary Blackness Gallops In Rags, Riches, Retro Pulp Undeserved End Bracket (Sir) Andrew Murray Lootera Anand Gandhi You Are Hereby A Terrorist

RECENT

Given the token response by the BJP (see box), it appears that the national interest will ignite in the principal opposition party only after 2014. Its no secret that, considering the growing (and open) corporate support for Narendra Modi, the UPA has made Somayajulu, Member, YSR Congress a political bargain by keeping Reliance happy. It is not just Governing Council political parties that are observing a measured silence. Industry chambers, normally eager to put their point across to the media, were also trying to avoid eye contact. Last week, Modi, who normally draws a full house in his meetings, saw only a handful of prominent industrialists attending his session at a CII conclave in Mumbai. Finance minister P. Chidambaram and petroleum minister Veerappa Moily have rightly pointed out that currently the public-sector ONGC and OIL dominate gas production. But what they have failed to clarify is who will bear the subsidy burden for the power and fertiliser sectors. Going by the track record of the government, the state-owned exploration companies may well have to pick up the tab. That leaves only Reliance. With global energy giant BP as its partner, there is no telling when the incentivised partners may reverse the drop in production to capitalise on the higher gas prices. They (Reliance) have been waiting for this announcement for a long time. Production will go up, says a person associated with Reliances D-6 block in

Bartering Indias interests to the corporate world, the damage they have done is unfathomable. D.A.

MOST VIEWED MOST COMMENTED

How Real-Life Tamil Love Stories End Go With The Swing You Are Hereby A Terrorist Were Building Fences, Protecting Our Race, Religion Buddha Mortified Top Engineering Colleges 'Sensational Tokenism' Anawrathas Battle-Axe Bullets Speak A Story Top 100 Engineering Colleges In India

Find us on Facebook

Outlookindia

Like

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 2 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

the Krishna-Godavari basin, declining to be quoted. The biggest beneficiary is going to be Relianceeyes closed. Against the committed production of over 70 million metric standard cubic metres per day (mmscmd) at the KG basin, output has been as low as 15 mmscmd. Reliance has been in a high-octane war with the CAG, which has said the company is to be faulted for not complying with agreed investment and development plans. Our production will go up only in mid 2017-18, an RIL spokesperson says, seeking to deflate the charge that the price revision was orchestrated to benefit Reliance. In some three years, when Reliance hopes to bring its R cluster and satellite fields in the KG basin block into production, the gas price in the country may well have reached $10/mmbtu. The company has made other finds of gas condensates in recent months. The indications are all in Reliances favour. It could well emerge as the biggest gas producer in the country unless ONGC can be stirred to monetise its discoveries, including in the KG basin. ONGC and OIL did not respond to Outlooks queries. The government habit of selective picking of recommendations, including from the Rangarajan committee report, has come in for criticism. The new formula (cherry-picked from the report, and approved for 2014-19) is, to put it simply, based on the average of European nbp, Henry Hub of US and Japans import gas price plus the average of Indian gas import price. The formula is unique to India: no other gas-producing country has devised such a convoluted way to reward exploration companies. Moreover, the government has deviated from the committees recommendation of a monthly review, instead opting for quarterly revisions. Thus, the revised price of $8.4 per mmbtu put out by the government is merely an indicative price.

The cost of power and fertiliser will go up, so the government will have to moderate the impact. B.K.

Chaturvedi, Member,

Planning Commission In another instance, the Rangarajan report spells out that the pricing policy should apply only for future investments. In that case, most of the gas being produced in the country currently should not see any change in price. But that distinction has not been kept. The UPAs selective adoption of proposals, totally ignoring the concerns of its own ministries, defies logic. The US economy has turned around essentially due to lower gas price. What is the window for India? asks Anil Razdan, former power secretary.

What is particularly upsetting is the decision to equate domestic gas price with that of imported LNG, which has additional cost burdens of liquefaction, transportation and regassification. This also goes against the panels recommendation. But petroleum minister Veerappa Moily has been persuaded to believe that the import lobby is behind alleged attempts to scuttle Indias chance to become self-sufficient in oil and gas production. B.K. Chaturvedi, a member of the Planning Commission, who was on the Rangarajan committee, defends the formula: As far as the committee is concerned, it stands by its recommendations. The committee was conscious that the governments contractual commitment under the exploration policy (NELP) had to be honoured; therefore the prices were accordingly recommended. He does admit that the higher gas price will have bearing on the power and fertiliser costs, so the government will have to find a way to moderate the impact. The state government-owned Gujarat State Petroleum Corporation (GSPC) is another likely beneficiaryit has also been seeking a higher price to make production from its K-G basin block viable. At the same time, D.J. Pandian, chairman of gspc says, Even though gspc stands to benefit as an upstream company, we will be put to great hardship as power producers, for it will add Rs 2 per unit to our cost. Given that a large chunk of power goes to agriculture and industry, the hike in power tariff will hurt end-users.

Experts are critical of the government assumption that higher gas prices will attract foreign investments, as in the last 10 years, despite pegging crude oil prices to import parity and deregulating all petroleum products, inflow of FDI has been Venkatesh, CA And Political Analyst, insignificant. The assumption is based on a false premise. Chennai What worries me is that the subsidy bill will be humungous if this price goes through, says CPI(M) Rajya Sabha member Tapan Sen, who feels let down by fellow parliamentarians. The opposition should have come a long time back. Unfortunately, gas price seems unlikely to be a major issue in the upcoming elections. So far, only Tamil Nadu chief minister Jayalalitha has spoken against the price hike. Says M.R. Venkatesh, a Chennai-based chartered accountant and political analyst, Like in the case of GST, this should have been discussed with the states, as they would be affected. The decision looks coarse and arbitrary and is likely to be challenged under Article 14 of the Constitution. Well, even if the deal is done, its the post-hike reluctance to discuss its fallout that is the most worrying. I dont see any political fallout caused by this decision because political parties in our country are not vigilant enough, says K. Keshav Rao, a former Congress Rajya Sabha member who recently joined the TRS. Thats when one wonders if a delay in decision-making is actually better than a wrong one being takenall in the name of reforms. *** Primer: Everything You Need To Know On The Gas Price Rip-Off What is the gas price all about? It is natural gas produced within the country; unlike imported liquefied natural gas (LNG). This is viewed as a cheaper and more environment friendly fuel compared to imported crude oil. Where is this natural gas found? Both onshore and offshore. Currently Bombay High produces the most gas; Assam, Andhra Pradesh, Gujarat, Rajasthan, Tamil Nadu, Tripura are other states where gas is being

Like with GST, this should have been discussed with the states. The decision seems coarse, arbitrary. M.R.

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 3 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

produced. How much gas does India have? In 2012-13 India produced 47,558 million cubic metres of gas, a drop of 14.5% from the previous year. Indias gas imports have been steadily rising, up to 30% of total consumption last year. Which companies produce this gas? The biggest players are state-owned ONGC and OIL, and Reliance Industries Limited (RIL). In addition, there are other players like BP, Niko, Cairn Energy working in various joint ventures. Who do they supply gas to? According to government allocation, the first priority is to power and fertiliser plants; then for production of LPG or cooking gas; up next is other industries and city gas including piped gas and CNG. How will you be affected? Households are obviously impacted as they are the end-users of power, piped gas and compressed natural gas (CNG); if fertiliser costs go up, agriculture produce is bound to reflect it. Who will benefit from price hike? Technically, both public and private sector explorers. As ONGC and OIL pay dividend to government and contribute to subsidy bill, the top beneficiary will be RIL, the biggest private producer. What impact will the gas price hike have every year on tax payers? Power plants: Rs 46,360 crore p.a. Urea production: Rs 3,155 crore p.a. LPG production: Rs 1,620 crore p.a. Total: Rs 51,135 crore p.a. At current $ prices: Rs 54,500 crore* Sources: power, urea, LPG figures based on estimations made by concerned ministries in the CCEA note on gas price hike. Total cost arrived at $ value at Rs 59. *** Inverted Logic Why the gas price hike doesnt make sense Government View Counter View

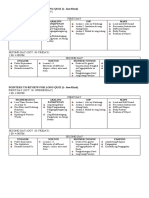

Need to attract foreign investment Will help to improve domestic production of oil and gas Public sector companies like ONGC and Oil India Limited will be bigger beneficiaries Will subsidise gas for power and fertiliser sector. Government will earn more through profit and royalties

Import parity price for crude oil in past 10 years has failed to woo big foreign investors The hike with prospective effect comes even as gas production has been slipping in recent years PSUs pay government huge dividends, also share part of subsidies: moreover, PSU gas production has hit a plateau Reversing the efforts to cut down subsidies would put fiscal prudence at risk Sure it will earn more but only lose it through additional subsidy burden ***

How UPAs Four Petroleum Ministers Have Dealt With The Gas Issue Mani Shankar Aiyar, May Murli Deora, Jan 2006-Jan 2004-Jan 2006 Shunted out for 2011 Known as Uncle to the keeping the Ambani brothers, then Ambani brothers, he pitched together, at arms length. Aiyar, for Mukesh in the legal fight however, also did his best to get with brother Anil. In the ONGC to focus more on improving process, he changed the domestic oil and gas production. provision for market-determined gas prices. S. Jaipal Reddy, Jan 2011-Oct 2012 Took unprecedented decision of not allowing Reliance to recover $1bn cost incurred on unutilised infrastructure. Paid for not permitting early review of gas price: he was unceremoniously moved. M. Veerappa Moily, Since Oct 2012 After famously blaming import lobbies, the minister granted Reliances demand for high gas prices, ignoring the concerns of power, fertiliser industries and impact on consumers.

By Lola Nayar and Arindam Mukherjee in Delhi, Madhavi Tata in Hyderabad

Like

310

Send

Tweet

111

COMMENTS

TEXT SIZE FILED IN: AUTHORS: LOLA NAYAR | ARINDAM MUKHERJEE | MADHAVI TATA PEOPLE: MUKESH AMBANI TAGS: OIL-GAS-FUEL | OIL-GAS-FUEL PRICES | RELIANCE INDUSTRIES | UPA SECTION: NATIONAL SUBSECTION: COVER STORIES

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 4 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

Follow us on Twitter for all updates, like us on Facebook for important and fun stuff

TRANSLATE INTO: Powered by

Translate

ALSO IN THIS STORY

RELIANCE

Lips And Purse-strings

Money talks; it also gags. A 2014-fixated BJPs muteness on the gas-pricing issue proves that.

ANURADHA RAMAN, PRARTHNA GAHILOTE

JUMP CUT

A Wellhead Of Blunders

Why did our market-friendly policymakers revert to the much-maligned administered price only for gas, while batting for market prices for all else?

T.N.R. RAO

RELIANCE

Reliable Attitudes

YSRs long fight for a share of KG basin gas

MADHAVI TATA

JUMP CUT

Self-Reliance, Not Reliance

What we see now is a new and indigenous form of McCarthyism.

MOHAN GURUSWAMY

11 comments Add a comment...

Sandeep Kathe Norwalk, Connecticut Seems UPA ( with help from BJP) have now started open loot instead of hidden scandals . Reply Like Saturday at 11:34am Lenin Kispotta KIIT +2 SCIENCE COLLEGE MAN ! how is this possible...and where is BJP....??? looting Reply Like Saturday at 9:50am View 5 more

Facebook social plugin

Post a Comment

You are not logged in, please log in or register If you wish your letter to be considered for publication in the print magazine, we request you to use a proper name, with full postal address - you could still maintain your anonymity, but please desist from using unpublishable sobriquets and handles

DAILY MAIL HAVE YOUR SAY | READ ALL 56 COMMENTS

56/D-43

JUL 13, 2013 09:10 AM

Reliance refines oil in the largest refinery in the world. The more oil that it refines, the more economical is the price which is afforded to O. N. G. C., the distributor. The amount of crude oil to be imported by India, to be refined at the Reliance Refinery, is increasing at a great pace. It seems, we are paying not for the refining, but for Crude Oil. It appears, that the oil producing nations, will have no choice, but to increase much cheaper imports and at a much lower price. Not that their profits will not increase, and greatly, and I think the Reliance revenues are also increasing. The great unhappiness in politics is, that our govt. within, also has a constituency, and the opposition is as vocal as the govt., in voicing increasing oil cost. For instance, if the C. P. I. (M) was in govt., they would have discontinued, in the govt., also because of the unfair situation that they would have been seen to be less represented in the parliament, and they would be obliged to resign. There must be people in the cabinet, who are more vocal about oil prices, than any other issue.

ADITYA MOOKERJEE BELGAUM, INDIA PERMALINK | LIKE (0) | DISLIKE (0) | REPORT ABUSE

55/D-20

JUL 12, 2013 05:10 AM

>>As I say its a tough place to do business. Indian politicians are famous for taking a bribe but offering nothing in return. Reliance is probably old fashioned anyway. What politicians are now interested in is real estate. I know, sometimes Indian businessmen just wish they made their

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 5 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

own Antilla flipping burgers at MacDonalds so politicians won't be able to get their hands on it. no worries, let's have Peace Tea by Coca Cola :) http://www.bevreview.com/2013/03/18/review-peacetea-razzleberry-tea/

HITESH BRAHMBHATT SAN DIEGO, UNITED STATES PERMALINK | LIKE (0) | DISLIKE (0) | REPORT ABUSE

54/D-145

JUL 11, 2013 10:56 PM

:lol: all problems are now solved. The Iranians are getting desparate. Iran asks India to settle all oil payment in rupees: Govt sources http://timesofindia.indiatimes.com/business/india-business/Iranasks-India-to-settle-all-oil-payment-in-rupees-Govt-sources /articleshow/21023851.cms

MK SAINI DELHI, INDIA PERMALINK | LIKE (0) | DISLIKE (2) | REPORT ABUSE

53/D-143

JUL 11, 2013 10:32 PM

#52 >>>So, are you now saying that "money for lobbying" is what is holding the interest of the pols or you are saying pols don't have any interest in Reliance? they take corporate money but their primary interest is getting re-elected. If corporates can help them that is fine. But that doesn't mean the corporate always gets its way. Indian politicians are famous for taking a bribe but offering nothing in return. Reliance is probably old fashioned anyway. What politicians are now interested in is real estate. The Indian politician is also feudal in nature. Say if a corporation offers to fund all the free laptops that the politician is promising. So it happens once, but do you think the politician wants to beholden to the corporation? Not likely As I say its a tough place to do business. It would be much easier if it was a corporate sponsored oligarchy (like China), as many here seem to believe

MK SAINI DELHI, INDIA PERMALINK | LIKE (0) | DISLIKE (1) | REPORT ABUSE

52/D-141

JUL 11, 2013 10:15 PM

#50 >>Their goal is to get elected by pandering to their constituency, who certainly don't care about Reliance. I did not say they are in love with Reliance but divorce is hard when so much money is involved. >>Only the state can pay for that, not Reliance. Oh the loss-making PSUs? >>Reliance can go bankrupt as far as any politician cares. If they don't have money for lobbying then the pols will lose interest anyway So, are you now saying that "money for lobbying" is what is holding the interest of the pols or you are saying pols don't have any interest in Reliance? Former seems to be self-evident and latter is less believable than next bollywood blockbuster about Yeti in Himalayan foothills.

HITESH BRAHMBHATT SAN DIEGO, UNITED STATES PERMALINK | LIKE (0) | DISLIKE (0) | REPORT ABUSE

HAVE YOUR SAY | READ ALL 56 COMMENTS Comments Policy

AB OUT US | CONTA CT US | SUB SCRIB E | ADV ERTI SI NG RATES | COP YRIG HT & DIS CLAI MER | CO MME NTS P OLICY

OUTLOOK TOPICS:

ABCDEFGHIJKLMNOPQRSTUVWXYZ 0123456789

Or just type in a few initial letters of a topic:

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 6 of 7

15-07-2013 13:04

The Great Gas Heist | Lola Nayar, Arindam Mukherjee, Madhavi Tata

http://www.outlookindia.com/article.aspx?286692

Print to PDF without this message by purchasing novaPDF (http://www.novapdf.com/) 7 of 7

15-07-2013 13:04

Potrebbero piacerti anche

- The Midway Battle: Modi's Rollercoaster Second TermDa EverandThe Midway Battle: Modi's Rollercoaster Second TermNessuna valutazione finora

- Future Prospects of Energy Firms in India: Financial Management AssignmentDocumento13 pagineFuture Prospects of Energy Firms in India: Financial Management AssignmentKenanNessuna valutazione finora

- Report On Summer Placement Project (2010 - 2012 Batch) : ResearchDocumento4 pagineReport On Summer Placement Project (2010 - 2012 Batch) : ResearchPrerna GillNessuna valutazione finora

- 20BSP0127 - Akanksha EcoDocumento46 pagine20BSP0127 - Akanksha EcoNeha SarayanNessuna valutazione finora

- Oil and Gas SKN Haryana City Gas DistributionDocumento15 pagineOil and Gas SKN Haryana City Gas DistributionBalaji MNessuna valutazione finora

- Epaper 16 June 2013Documento24 pagineEpaper 16 June 2013UConnecttNessuna valutazione finora

- Porter 5 and PestDocumento16 paginePorter 5 and Pestvaibhav chaurasiaNessuna valutazione finora

- Sluggish Power Sector Could Hit Economic GrowthDocumento1 paginaSluggish Power Sector Could Hit Economic Growthlaloo01Nessuna valutazione finora

- Novel Industry Government Governance MecDocumento10 pagineNovel Industry Government Governance MecSriramNessuna valutazione finora

- India Power MArketDocumento3 pagineIndia Power MArketratishbalachandranNessuna valutazione finora

- Economic Reforms in India Finally Take OffDocumento3 pagineEconomic Reforms in India Finally Take OffvbhvarwlNessuna valutazione finora

- Shri Chimanbhai Patel Institutes, Ahmadabad: Arti Trivedi Jay Desai Nisarg A JoshiDocumento31 pagineShri Chimanbhai Patel Institutes, Ahmadabad: Arti Trivedi Jay Desai Nisarg A Joshinisarg_Nessuna valutazione finora

- 1 PBDocumento15 pagine1 PBPratik WANKHEDENessuna valutazione finora

- InfralinePlus July 2016Documento76 pagineInfralinePlus July 2016SurendranathNessuna valutazione finora

- Lips and Purse-StringsDocumento2 pagineLips and Purse-StringsselvamuthukumarNessuna valutazione finora

- Current Oil ND GasDocumento5 pagineCurrent Oil ND Gassaurav1131489Nessuna valutazione finora

- The Impact of Rise in LPG Prices On The Household Budget in IndiaDocumento11 pagineThe Impact of Rise in LPG Prices On The Household Budget in IndiadeveshNessuna valutazione finora

- CII Asks Finance Ministry Not To Raise Excise, Service TaxDocumento11 pagineCII Asks Finance Ministry Not To Raise Excise, Service TaxMohit GargNessuna valutazione finora

- BBA-MBA Integrated Semester V Individual Assignment Analyses of News ArticlesDocumento13 pagineBBA-MBA Integrated Semester V Individual Assignment Analyses of News ArticlesPunyak SatishNessuna valutazione finora

- Macro Economics SnapshotDocumento12 pagineMacro Economics SnapshotmanjeetsrccNessuna valutazione finora

- Ahmedabad 27 December 2011 1Documento1 paginaAhmedabad 27 December 2011 1Rishit DalsaniaNessuna valutazione finora

- India: CountriesDocumento26 pagineIndia: CountriesreachernieNessuna valutazione finora

- Review of Management Discussions & Analysis For Indian Natural Gas Trading & Distribution CompaniesDocumento3 pagineReview of Management Discussions & Analysis For Indian Natural Gas Trading & Distribution CompaniesAshish ChoudharyNessuna valutazione finora

- Lincoln's Expansion Into India - 2Documento11 pagineLincoln's Expansion Into India - 2Lu XiyunNessuna valutazione finora

- NewsLetter7 FinalDocumento4 pagineNewsLetter7 FinalRobert MillerNessuna valutazione finora

- Takeaways Apr 02Documento6 pagineTakeaways Apr 02Nimish VikramNessuna valutazione finora

- With India's Economy Growing at About 7%, Why The Auto Industry Is Hurting So Badly?Documento6 pagineWith India's Economy Growing at About 7%, Why The Auto Industry Is Hurting So Badly?JPNessuna valutazione finora

- Economy For InterviewDocumento54 pagineEconomy For InterviewprinceNessuna valutazione finora

- Startups Protecting PatentsDocumento1 paginaStartups Protecting PatentsshirdhiNessuna valutazione finora

- Me News ArticlesDocumento5 pagineMe News ArticlesCarla Pianz FampulmeNessuna valutazione finora

- It's Our Turn Now: E&P Partnership For India's Energy SecurityDocumento36 pagineIt's Our Turn Now: E&P Partnership For India's Energy SecurityAlbus SeverusNessuna valutazione finora

- Finsight 2012Documento11 pagineFinsight 2012Deepan FalconNessuna valutazione finora

- Economic Recession 2008-2009 Impact On Indian Auto Industry's Management PracticesDocumento14 pagineEconomic Recession 2008-2009 Impact On Indian Auto Industry's Management PracticesArjun Pratap Singh100% (2)

- Slowdown Creepsin Indian EconomyDocumento8 pagineSlowdown Creepsin Indian EconomySarthak ShuklaNessuna valutazione finora

- India's Structural Economic SlowdownDocumento7 pagineIndia's Structural Economic SlowdownNova MenteNessuna valutazione finora

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocumento6 pagineMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersRajasekhar Reddy AnekalluNessuna valutazione finora

- International Economics - Group 3Documento13 pagineInternational Economics - Group 3Shobha MukherjeeNessuna valutazione finora

- The Political Economy of Petrol and Diesel: Dr. N. Saravanakumar & R. SureshDocumento4 pagineThe Political Economy of Petrol and Diesel: Dr. N. Saravanakumar & R. SureshTJPRC PublicationsNessuna valutazione finora

- Toikm 2012 9 17 1Documento1 paginaToikm 2012 9 17 1Soumik DeNessuna valutazione finora

- Economic Agenda For The New Government - The Hindu Centre For Politics and Public PolicyDocumento6 pagineEconomic Agenda For The New Government - The Hindu Centre For Politics and Public Policyaharish_iitkNessuna valutazione finora

- Can A Single Budget Solve The Most Serious Problems of The Indian EconomyDocumento9 pagineCan A Single Budget Solve The Most Serious Problems of The Indian EconomyGlads SamsNessuna valutazione finora

- Demand For Electric Cars Is Booming, With Sales Expected To Leap 35% This Year After A Record-Breaking 2022 - News - IEADocumento3 pagineDemand For Electric Cars Is Booming, With Sales Expected To Leap 35% This Year After A Record-Breaking 2022 - News - IEAFranco LuminiNessuna valutazione finora

- 01.11.2023 - The Banking FrontlineDocumento8 pagine01.11.2023 - The Banking FrontlineSapta Swar 7Nessuna valutazione finora

- Indian Refinery IndustryDocumento19 pagineIndian Refinery IndustryNiju K ANessuna valutazione finora

- IE - Article ReviewDocumento8 pagineIE - Article Review541ANUDEEP VADLAKONDANessuna valutazione finora

- The Gas Price Conundrum - The Hindu 19 FebDocumento2 pagineThe Gas Price Conundrum - The Hindu 19 Febmossad86Nessuna valutazione finora

- FACTS OF CAG REPORT ON COAL - HOW THE BJP IS TAKING INDIA FOR A RIDE - Hamara CongressDocumento5 pagineFACTS OF CAG REPORT ON COAL - HOW THE BJP IS TAKING INDIA FOR A RIDE - Hamara CongressSuresh NNessuna valutazione finora

- Task-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing CompaniesDocumento17 pagineTask-7 Crude Oil: Impact of Crude Oil Fluctuations in Different Sectors Refiners and Oil Marketing Companiessnithisha chandranNessuna valutazione finora

- Oil Chase in Race For 25%: ONGC Eyes Exxon Stake in Angolan Field For $2 BDocumento4 pagineOil Chase in Race For 25%: ONGC Eyes Exxon Stake in Angolan Field For $2 Bshirishgoyal4Nessuna valutazione finora

- Hike in Fuel Price and Its Impact On Automobile IndustryDocumento18 pagineHike in Fuel Price and Its Impact On Automobile Industryarijit022Nessuna valutazione finora

- Norther Region Bigggest MarketDocumento1 paginaNorther Region Bigggest Marketdheeraj007_nitk3164Nessuna valutazione finora

- 28 July - Empower BschoolDocumento4 pagine28 July - Empower BschoolKapil SharmaNessuna valutazione finora

- Economic Issues: India'S Inflation Highest Among Developing NationsDocumento7 pagineEconomic Issues: India'S Inflation Highest Among Developing NationsReishabh SharmaNessuna valutazione finora

- France or Mittal, Who Will Blink First?Documento27 pagineFrance or Mittal, Who Will Blink First?subhrit10Nessuna valutazione finora

- Pocketpedia - 256 Edition 18 Feb, 2015Documento2 paginePocketpedia - 256 Edition 18 Feb, 2015Vikash Chander KhatkarNessuna valutazione finora

- Apr Jun12 PetrofedDocumento92 pagineApr Jun12 PetrofedUsman FaarooquiNessuna valutazione finora

- Self-Reliance, Not RelianceDocumento2 pagineSelf-Reliance, Not RelianceselvamuthukumarNessuna valutazione finora

- About CompanyDocumento13 pagineAbout CompanyDivya ChokNessuna valutazione finora

- Crisis in Our SkiesDocumento25 pagineCrisis in Our SkiesUpsc TargetNessuna valutazione finora

- Chemical Industry Snapshot: Indian Chemical Industry Set To Touch $304-bn by FY25: ReportDocumento3 pagineChemical Industry Snapshot: Indian Chemical Industry Set To Touch $304-bn by FY25: ReportHammadNessuna valutazione finora

- Life Style DiseasesDocumento5 pagineLife Style DiseasesmdanasazizNessuna valutazione finora

- Communism Vs SocialismDocumento5 pagineCommunism Vs SocialismmdanasazizNessuna valutazione finora

- Gramsci HegemonyDocumento3 pagineGramsci HegemonymdanasazizNessuna valutazione finora

- Water WarsDocumento2 pagineWater WarsmdanasazizNessuna valutazione finora

- Dental Care & Oral HygieneDocumento6 pagineDental Care & Oral HygienemdanasazizNessuna valutazione finora

- The Business of Climate ChangeDocumento2 pagineThe Business of Climate ChangemdanasazizNessuna valutazione finora

- Who Is Ex Service MenDocumento2 pagineWho Is Ex Service MenMor AnilNessuna valutazione finora

- Article - How Migrant Labourers Worked in Modis Favour 18052014012068Documento2 pagineArticle - How Migrant Labourers Worked in Modis Favour 18052014012068mdanasazizNessuna valutazione finora

- Ias New Syllabus Analysis by SynergyDocumento9 pagineIas New Syllabus Analysis by SynergymdanasazizNessuna valutazione finora

- Salient Features of Service Tax VCES Voluntary Compliance Encouragement Scheme 2013Documento2 pagineSalient Features of Service Tax VCES Voluntary Compliance Encouragement Scheme 2013mdanasazizNessuna valutazione finora

- Coming Water WarsDocumento2 pagineComing Water WarsmdanasazizNessuna valutazione finora

- The Chimera of Dalit Capitalism2 - The HinduDocumento2 pagineThe Chimera of Dalit Capitalism2 - The HindumdanasazizNessuna valutazione finora

- Estimating Self-Reliance in India's Defence ProductionDocumento3 pagineEstimating Self-Reliance in India's Defence ProductionmdanasazizNessuna valutazione finora

- Judicial Overreach - The HinduDocumento1 paginaJudicial Overreach - The HindumdanasazizNessuna valutazione finora

- Perpetuating Short-Termism - The HinduDocumento1 paginaPerpetuating Short-Termism - The HindumdanasazizNessuna valutazione finora

- A Wellhead of BlundersDocumento1 paginaA Wellhead of BlundersmdanasazizNessuna valutazione finora

- Self-Reliance, Not RelianceDocumento2 pagineSelf-Reliance, Not ReliancemdanasazizNessuna valutazione finora

- Crime, Caste and Judicial Restraint - The HinduDocumento2 pagineCrime, Caste and Judicial Restraint - The HindumdanasazizNessuna valutazione finora

- US Whistleblower Snowden - My Fear Is They Will Come After My Family - The HinduDocumento2 pagineUS Whistleblower Snowden - My Fear Is They Will Come After My Family - The HindumdanasazizNessuna valutazione finora

- A Blunt Regulatory KnifeDocumento8 pagineA Blunt Regulatory KnifemdanasazizNessuna valutazione finora

- Basic Structure of The Constitution Revisited - The Hindu - 2007!05!21Documento4 pagineBasic Structure of The Constitution Revisited - The Hindu - 2007!05!21mdanasazizNessuna valutazione finora

- Border, Water Disputes in Focus As Khurshid Heads For China - The HinduDocumento2 pagineBorder, Water Disputes in Focus As Khurshid Heads For China - The HindumdanasazizNessuna valutazione finora

- GM Crops Are No Way ForwardDocumento2 pagineGM Crops Are No Way ForwardmdanasazizNessuna valutazione finora

- Sports PsychologyDocumento9 pagineSports PsychologymdanasazizNessuna valutazione finora

- Chicken PoxDocumento9 pagineChicken PoxmdanasazizNessuna valutazione finora

- A Comparative Study On Financial Performance of Private and PublicDocumento17 pagineA Comparative Study On Financial Performance of Private and PublicaskmeeNessuna valutazione finora

- M Fitra Rezeqi - 30418007 - D3TgDocumento6 pagineM Fitra Rezeqi - 30418007 - D3TgNugi AshterNessuna valutazione finora

- Nursing Law and JurisprudenceDocumento9 pagineNursing Law and JurisprudenceKaren Mae Santiago AlcantaraNessuna valutazione finora

- The Melodramatic ImaginationDocumento254 pagineThe Melodramatic ImaginationMarcela MacedoNessuna valutazione finora

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Documento1 paginaStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- AsdsaDocumento47 pagineAsdsaColin McCulloughNessuna valutazione finora

- NO. Three (3) Instances Justify The Declaration of Failure of Election, To Wit: (A) TheDocumento2 pagineNO. Three (3) Instances Justify The Declaration of Failure of Election, To Wit: (A) TheMaria GarciaNessuna valutazione finora

- Jayant CVDocumento2 pagineJayant CVjayanttiwariNessuna valutazione finora

- Nepotism in NigeriaDocumento3 pagineNepotism in NigeriaUgoStan100% (2)

- Pointers To Review For Long QuizDocumento1 paginaPointers To Review For Long QuizJoice Ann PolinarNessuna valutazione finora

- Advantages and Disadvantages of Free HealthcareDocumento1 paginaAdvantages and Disadvantages of Free HealthcareJames DayritNessuna valutazione finora

- Chernobyl Disaster: The Worst Man-Made Disaster in Human HistoryDocumento13 pagineChernobyl Disaster: The Worst Man-Made Disaster in Human HistoryGowri ShankarNessuna valutazione finora

- Resort Operations ManagementDocumento15 pagineResort Operations Managementasif2022coursesNessuna valutazione finora

- Calendar PLS MCLE MAY - JULYDocumento1 paginaCalendar PLS MCLE MAY - JULYBernard LoloNessuna valutazione finora

- Type Approval Certificate: Rittal GMBH & Co. KGDocumento2 pagineType Approval Certificate: Rittal GMBH & Co. KGLorena OrtizNessuna valutazione finora

- 2016-17 Georgia Hunting RegulationsDocumento76 pagine2016-17 Georgia Hunting RegulationsAmmoLand Shooting Sports NewsNessuna valutazione finora

- WT Unit IDocumento69 pagineWT Unit ISreenivasulu reddyNessuna valutazione finora

- Vera vs. AvelinoDocumento136 pagineVera vs. AvelinoPJ SLSRNessuna valutazione finora

- LDocumento408 pagineLvmarthyNessuna valutazione finora

- True West - April 2016Documento149 pagineTrue West - April 2016Rodrigo Moya100% (4)

- OPTEVA 522-562 - SETUP PC SIERRA REV Draft Version - STMIDocumento3 pagineOPTEVA 522-562 - SETUP PC SIERRA REV Draft Version - STMIJone AndreNessuna valutazione finora

- Mordheim - Cities of Gold Slann Warband: Tommy PunkDocumento5 pagineMordheim - Cities of Gold Slann Warband: Tommy PunkArgel_Tal100% (1)

- BHMCT 5TH Semester Industrial TrainingDocumento30 pagineBHMCT 5TH Semester Industrial Trainingmahesh kumarNessuna valutazione finora

- Survey ChecklistDocumento4 pagineSurvey ChecklistAngela Miles DizonNessuna valutazione finora

- Basic Survival Student's BookDocumento99 pagineBasic Survival Student's BookIgor Basquerotto de CarvalhoNessuna valutazione finora

- The Economic Burden of ObesityDocumento13 pagineThe Economic Burden of ObesityNasir Ali100% (1)

- THE-CLAT POST-March 2023 Final5284208Documento123 pagineTHE-CLAT POST-March 2023 Final5284208Vedangi JalanNessuna valutazione finora

- Seminar On HackingDocumento21 pagineSeminar On Hackingpandu16550% (2)

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDocumento10 pagineMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyNessuna valutazione finora

- Freemason's MonitorDocumento143 pagineFreemason's Monitorpopecahbet100% (1)